Is Jeffrey Gundlach Long on the CBOE Volatility Index?

In the previous part of this series, we saw that Jeffrey Gundlach bought the put option of the S&P 500 index (SPY) and he expects that the index could fall 3% by the end of 2017.

Nov. 20 2020, Updated 4:48 p.m. ET

Jeffrey Gundlach on the volatility index

In the previous part of this series, we saw that Jeffrey Gundlach bought the put option of the S&P 500 index (SPY) and he expects that the index could fall 3% by the end of 2017. In this part, we’ll have a look at the volatility index. Gundlach is positive about the market volatility index (VIX).

Gundlach said, “I think going long the VIX is really sort of free money at a 9.80 VIX level today. I believe the market will drop 3 percent at a minimum sometime between now and December. And when it does I don’t think the VIX will be at 10.”

Performance of the volatility index

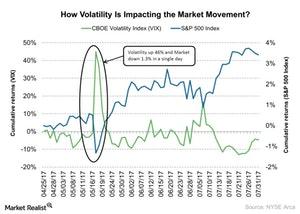

The CBOE Volatility Index (VIX), which measures volatility in the S&P 500 Index (QQQ)(IWM), also known as the “fear index,” rose suddenly by nearly 46.3% on May 17, mainly due to the political reasons. Again, on June 29, when the technology sector dragged down the performance of the S&P 500 index, the CBOE volatility index jumped to nearly $15.16 from $10.03 on June 28.

We’ve already seen in past events, China’s (FXI)(YINN) yuan devaluation and the Brexit referendum, that the VIX index rose nearly 143%, and 56%, respectively. Volatility generally picks up when stocks fall, and vice versa. As the volatility index remained near its historic lower level, taking a long position on the VIX index could provide a strong return in the near future.

In the next part of this series, we’ll analyze Gundlach’s view on the Trump administration.