Chicago Bridge & Iron Company

Latest Chicago Bridge & Iron Company News and Updates

Is VIX a Good Hedge? What to Know About the 'Fear Indicator'

Known colloquially as the fear indicator, is CBOE's Volatility Index, or VIX, a good hedge?

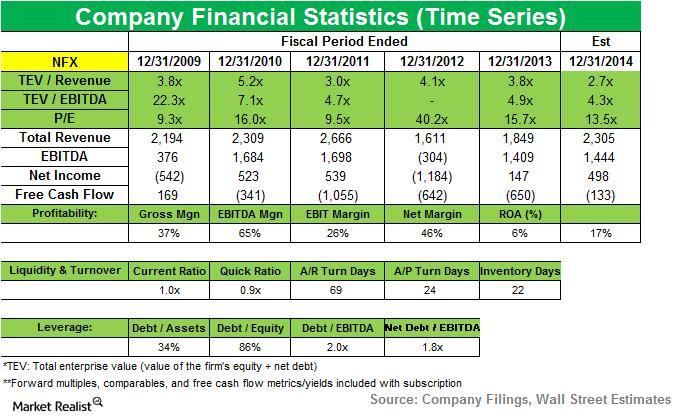

Balyasny exits position in Newfield Exploration Co.

BAM exited its position in Newfield Exploration Co. in 3Q14. It accounted for 1.31% of BAM’s second quarter portfolio. NFX is an energy company.

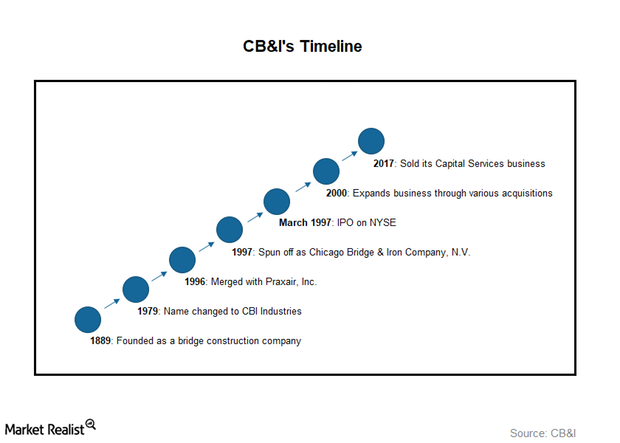

Chicago Bridge & Iron Company: An Introduction

In this series, we’ll analyze Chicago Bridge & Iron’s (CBI) business model. We’ll explore how it has expanded its business and evaluate its key operational metrics and financial position.