Jillian Dabney

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Jillian Dabney

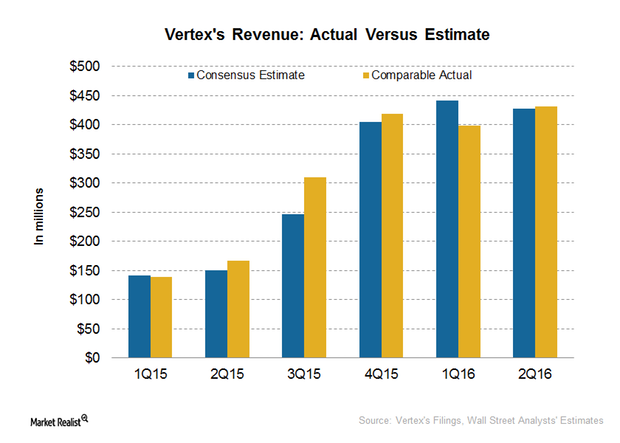

How Vertex’s Revenue and Earnings Surprised in 2Q16

Vertex Pharmaceuticals (VRTX) reported its 2Q16 earnings on July 27, 2016. VRTX surpassed Wall Street analysts’ projections and reported revenue of $431.6 million.

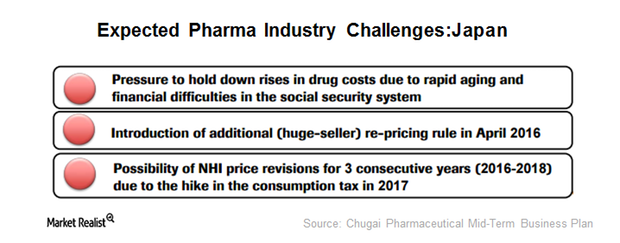

What Are the Challenges for the Pharmaceutical Industry in Japan?

Japan is the second-largest individual pharmaceutical market in the world. It accounts for less than 10% of the total global pharma market.

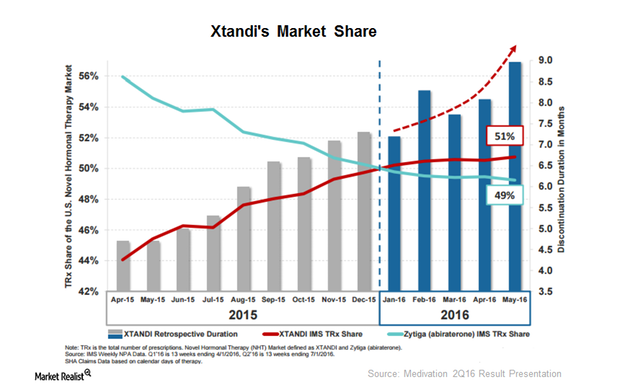

How Xtandi Fueled Big Pharmaceutical Interest in Medivation

Xtandi is the major factor behind Pfizer’s (PFE) interest in Medivation (MDVN). The drug, along with MDVN’s pipeline molecules, should strengthen Pfizer’s (PFE) oncology franchise.

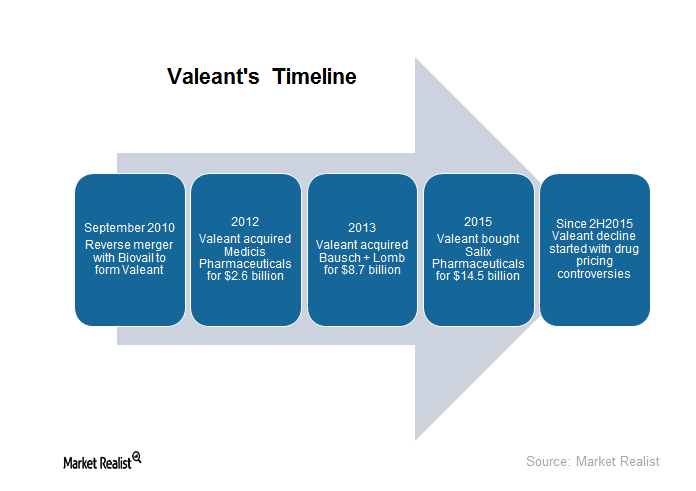

Valeant Pharmaceuticals: An Inorganic Growth Story

Valeant Pharmaceuticals International (VRX) has grown inorganically through highly leveraged acquisitions. From 2008 to 2015, it acquired more than 100 companies.

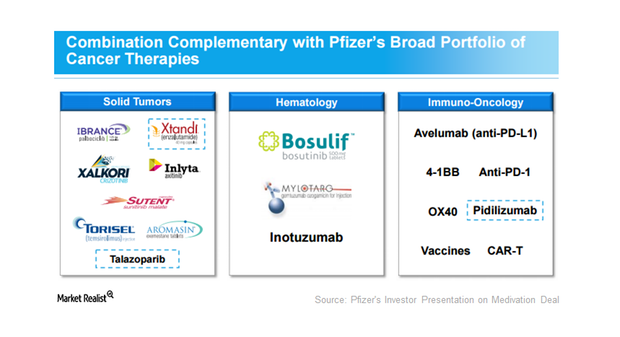

What’s the Story behind the Pfizer-Medivation Deal?

Medivation’s portfolio complements Pfizer’s existing oncology portfolio that includes solid tumors, hematology, and immunology-oncology.

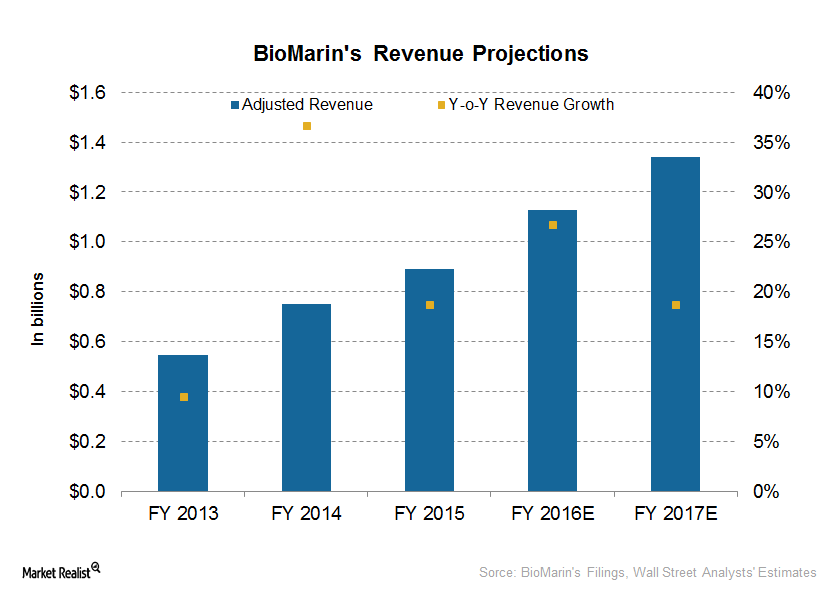

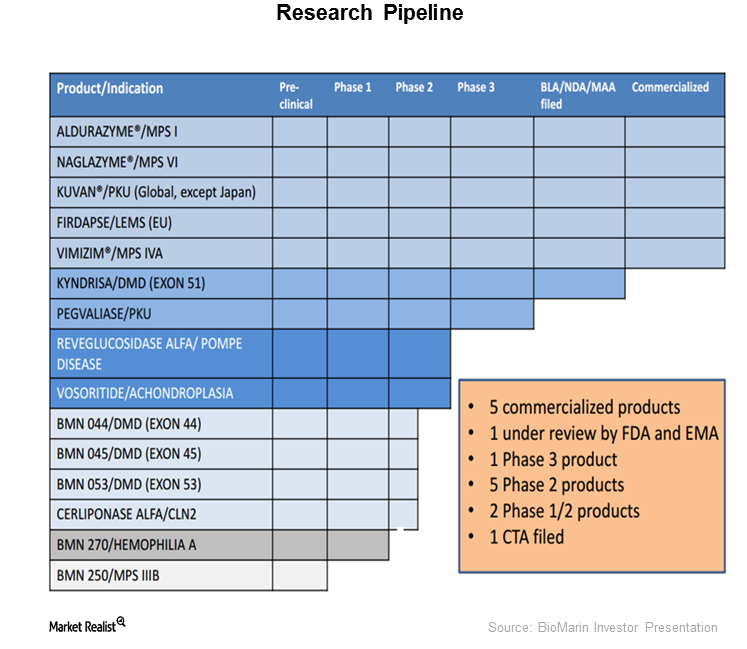

BioMarin to Cross $1 Billion Revenue in 2016

BioMarin Pharmaceutical (BMRN) expects its existing commercialized drugs to add $1.1 billion and $1.2 billion to its top line in 2016.

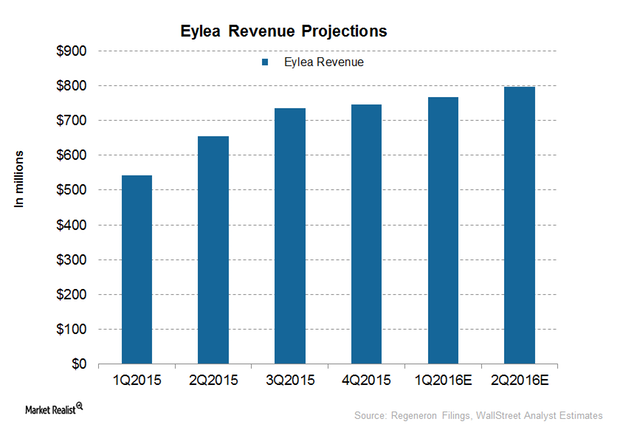

Worst-Case Scenario for Regeneron: What If Eylea Sales Slow Down by 2018?

Regeneron Pharmaceuticals (REGN) depends heavily upon its key drug, Eylea, which recorded global sales of $4.1 billion during fiscal 2015.

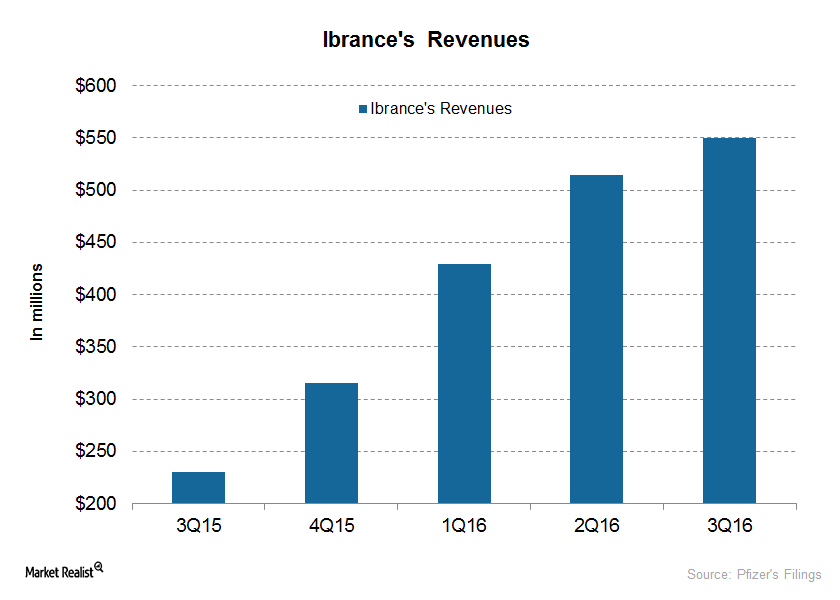

Ibrance Is the Only Registered CDK 4/6 Inhibitor for Breast Cancer

Since its launch in February 2015, Pfizer’s Ibrance has quickly captured the advanced breast cancer market and has reached more than 40,000 patients.

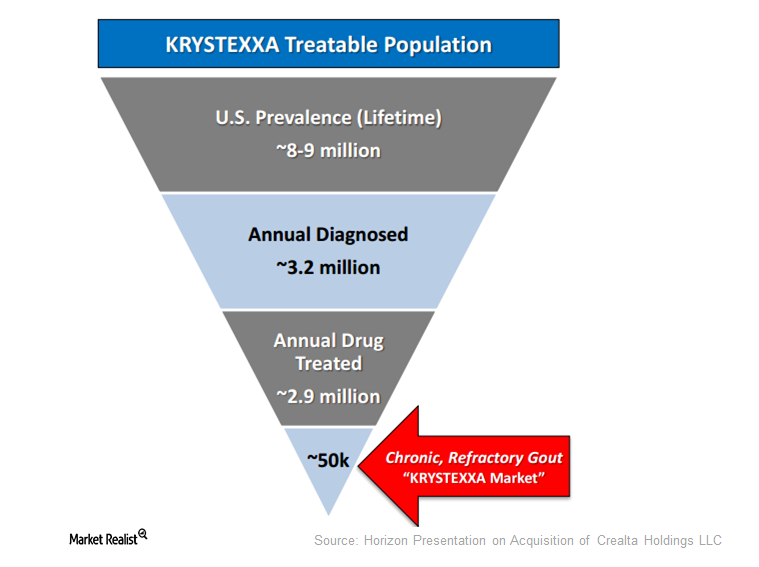

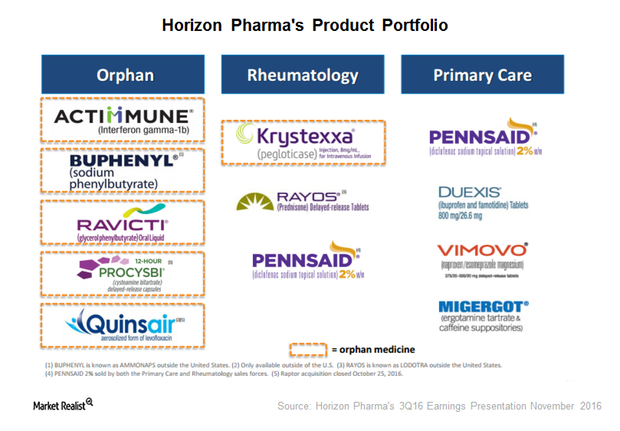

Introducing Krystexxa, the Latest Addition to Horizon’s Orphan Portfolio

In January 2016, Horizon acquired Krystexxa from Crealta Holdings. The drug has been approved by the FDA for the treatment of chronic refractory gout.

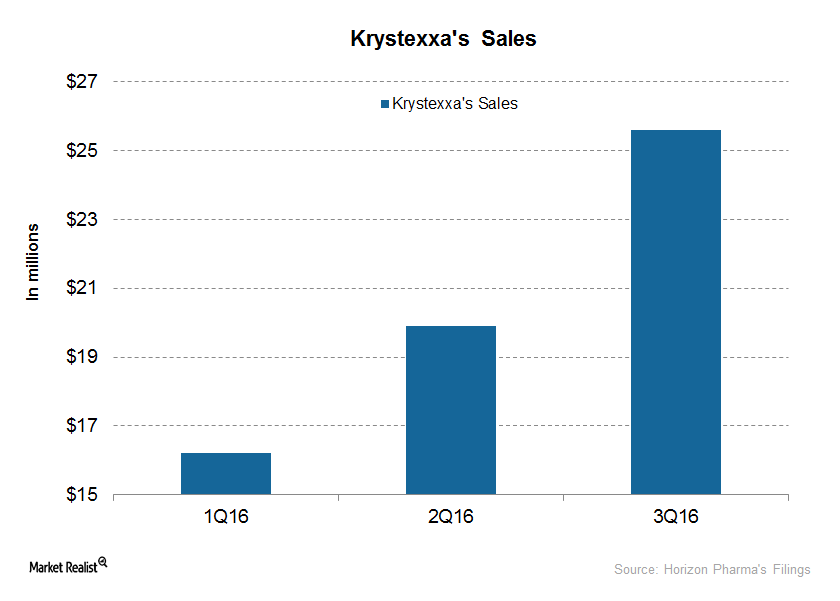

Revenue Drivers for Krystexxa, Horizon’s Orphan Biologic Drug

Horizon plans to drive Krystexxa through increased awareness and outreach, investing in its marketing and medical education as well as commercial infrastructure.

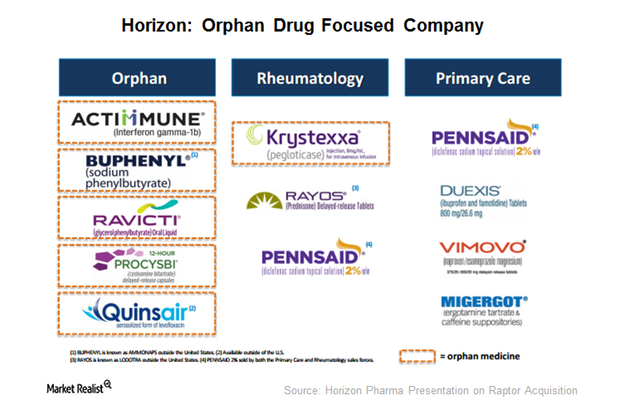

Buy Allows Horizon to Further Expand into Orphan Drug Space

Through the acquisition of Raptor Pharmaceuticals, Horizon Pharma (HZNP) will gain access to Procysbi and Quinsair and expand in the orphan drug space.

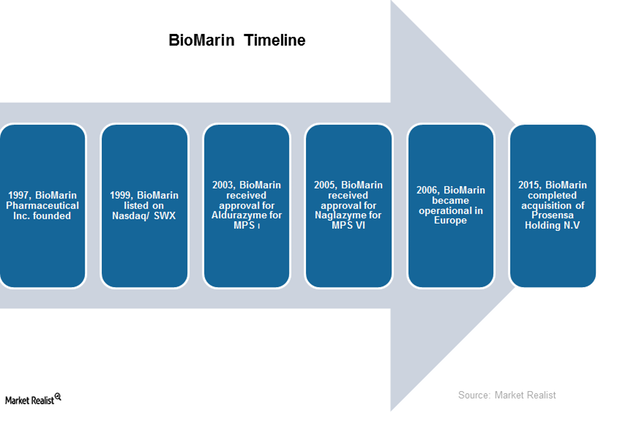

Overview of BioMarin: History and Product Portfolio

Here we present an overview of BioMarin. It’s based in California and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases.

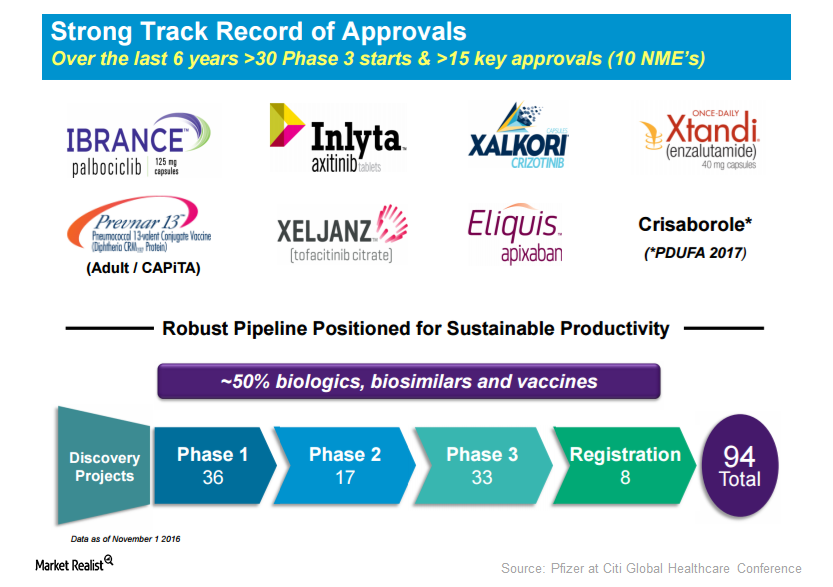

Pfizer Has Strong Track Record since 2010

As of November 1, Pfizer had ~94 projects in various development stages. More than 40% of these projects are in phase three or the registration phase.

Multinational and Japanese Pharmaceuticals Should Build Alliances

The Japanese pharmaceuticals market is not very welcoming to foreign companies. Similarly, the Japanese population is quite loyal to domestic manufacturers.

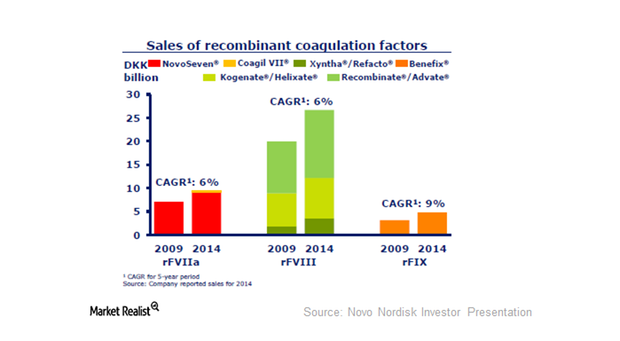

What Are the Current Treatment Options for Hemophilia?

Hemophilia treatment primarily includes factor replacement therapy and prolonged half-life therapy such as factor VIII or factor IX infusion.

BMN 270: A Big Valuation Catalyst for BioMarin

On March 1, 2016, BioMarin received orphan drug designation for BMN 270 from the FDA. BioMarin’s stock jumped by about 6.96% the same day.

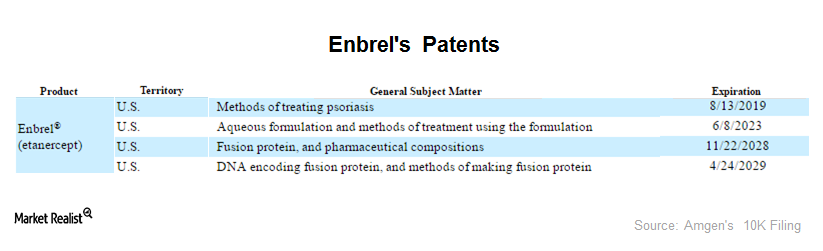

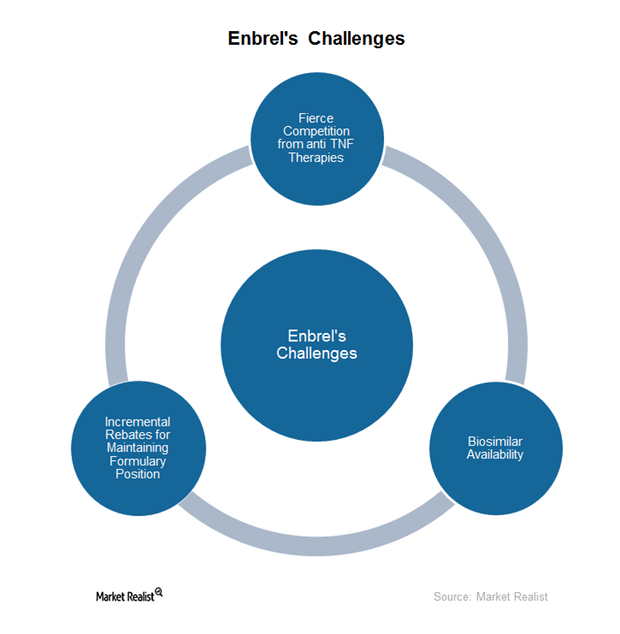

Why Is Enbrel So Important for Amgen?

YTD, Amgen’s (AMGN) stock has already fallen 9%. Perhaps the pressure that Enbrel (etanercept) is seeing is to blame for the negative investor sentiment.

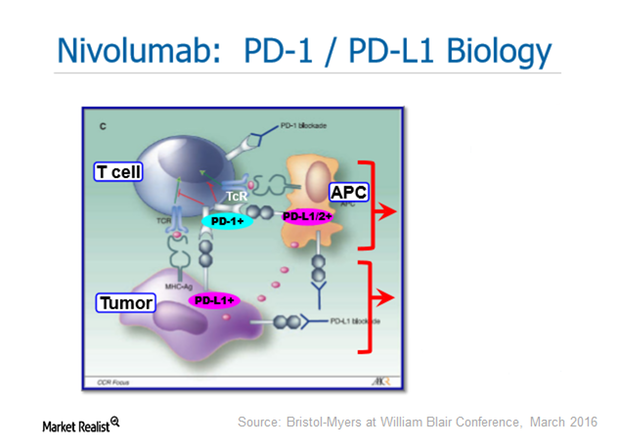

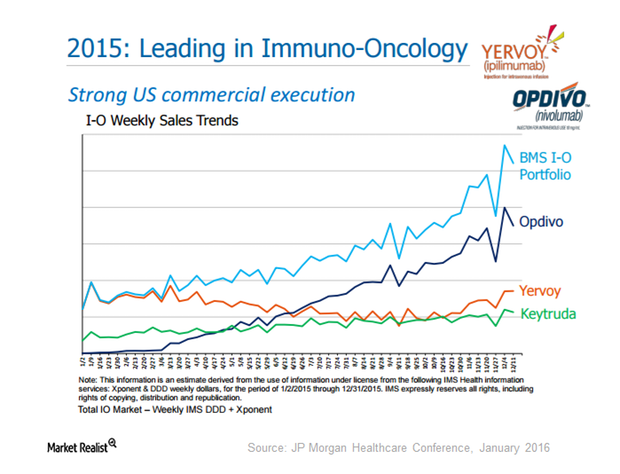

Brace Yourself: AstraZeneca Could Be a Fourth Entrant into the PD-1/PD-L1 Drug Class

The PD-1 (programmed death-1)/PD-L1 (programmed death-ligand 1) class consists of Bristol-Myers Squibb’s Opdivo, Merck’s Keytruda, and Roche’s Tecentriq.

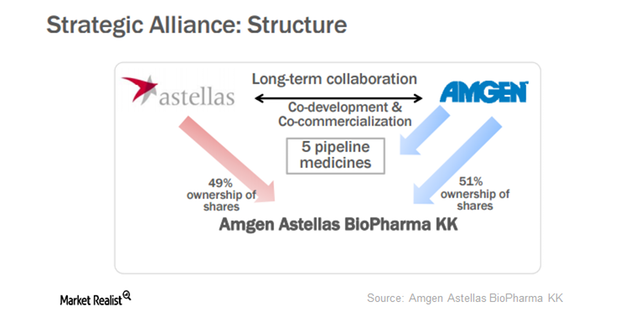

The Competitive Landscape for Enbrel

Amgen (AMGN) launched Enbrel in the US in 1998. It became a major success for Amgen in no time and recorded $5.4 billion sales in 2015.

Factors behind Horizon Pharma’s Volatility in December

With the Express Scripts agreement, Horizon Pharma’s net sales in 2017 are expected to rise. The probability of a top-line expansion has boosted investor sentiment.

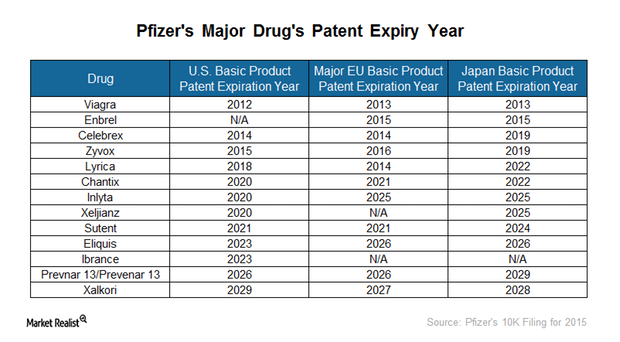

Loss of Patent Protection to Drag Pfizer’s Top Line

With the loss of patent protection for its flagship drug, Lipitor, Pfizer’s revenue fell to $48.8 billion in 2015, compared to $67 billion in 2010.

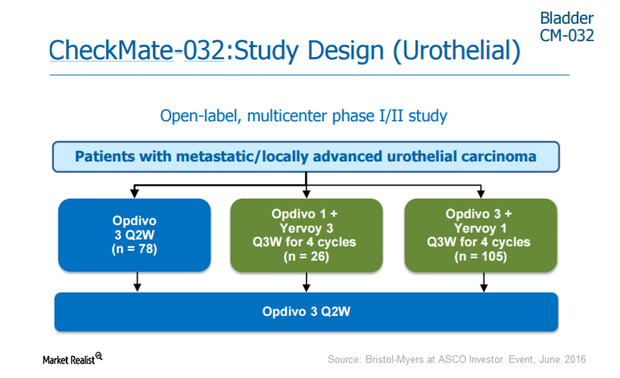

Bristol’s Opdivo Has One Eye on Advanced Bladder Cancer

After its 3Q16 earnings, there were multiple positive triggers for Bristol-Myers Squibb (BMY) stock.

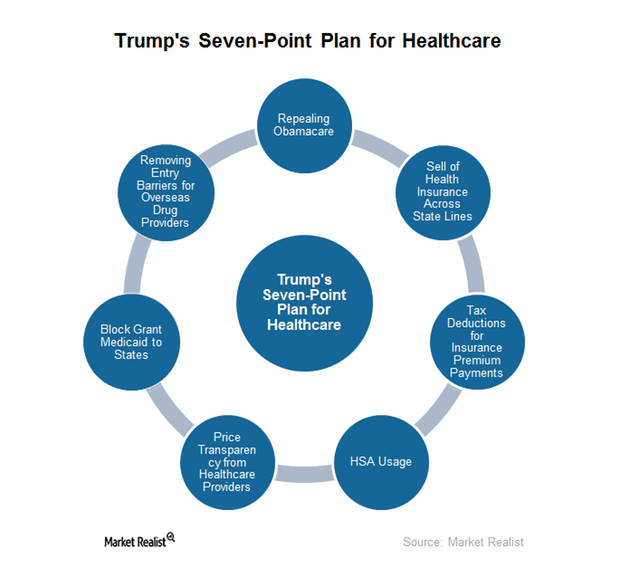

What Is Donald Trump’s Seven-Point Health Plan?

Trump’s healthcare agenda During his campaign, Trump came up with a seven-point plan for the healthcare industry. In this plan, he proposed to repeal the Affordable Care Act. Although a complete repeal doesn’t seem feasible, if applied, it would definitely take a toll on hospitals and insurance companies. In the next article, we’ll discuss the severity of […]

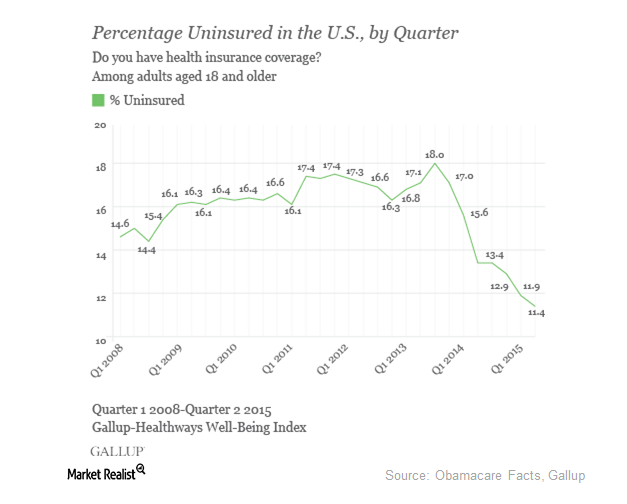

How Could Trump’s Presidency Affect Hospitals and Insurance?

The effects of repealing Obamacare Donald Trump is definitely not in favor of the Affordable Care Act, known as Obamacare. As he wants to repeal the act completely and replace it with another policy, the hospital sector fell on November 9, the day after the election. Trump believes that providing healthcare facilities to illegal immigrants costs […]

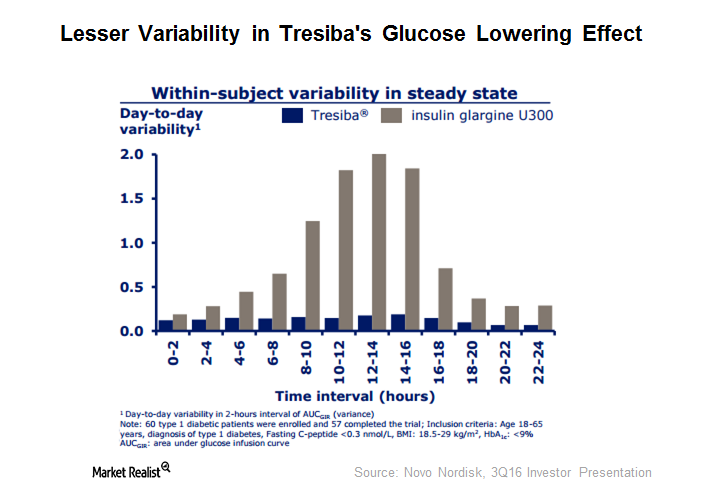

How Tresiba Helps Novo Achieve Its Growth Targets

During the first nine months of 2016, Novo’s (NVO) new generation portfolio garnered 2.8 billion Danish kroner.

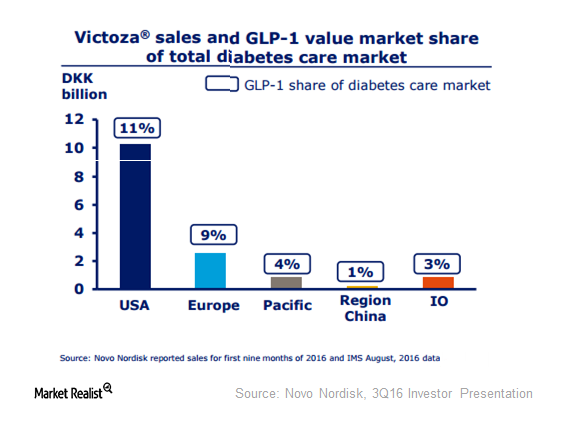

Victoza Dominates Global GLP-1 Class

Novo’s (NVO) Victoza is a glucagon-like peptide-1 (or GLP-1) therapy for type 2 Diabetes patients.

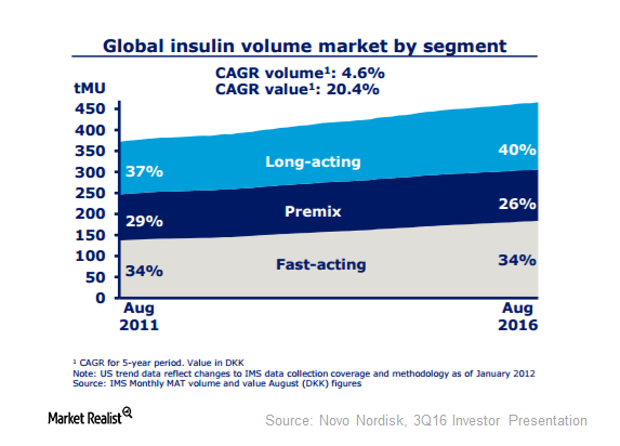

Reading Novo’s Insulin Portfolio to Find Clues about Its Growth

Novo Nordisk’s (NVO) diabetes and obesity care portfolio consists of modern insulin, Victoza, human insulin, new generation insulin, and other diabetes and obesity care products.

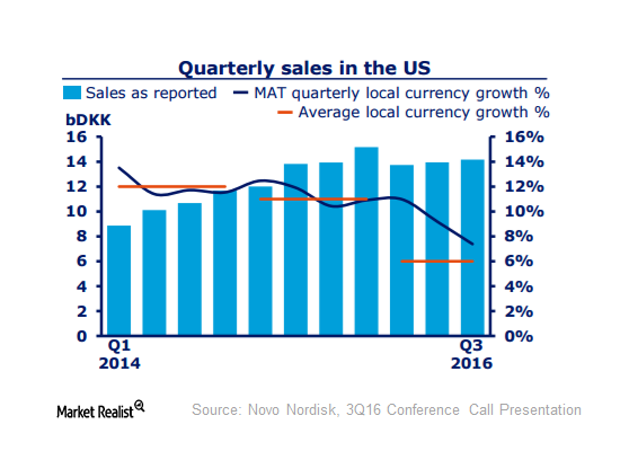

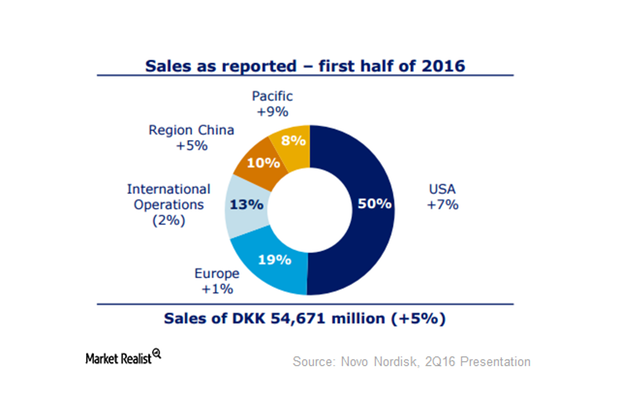

US Still the Largest Market for Novo Nordisk

During 3Q16, Novo’s sales in the US rose 2% in local currency terms to 14.2 billion Danish kroner.

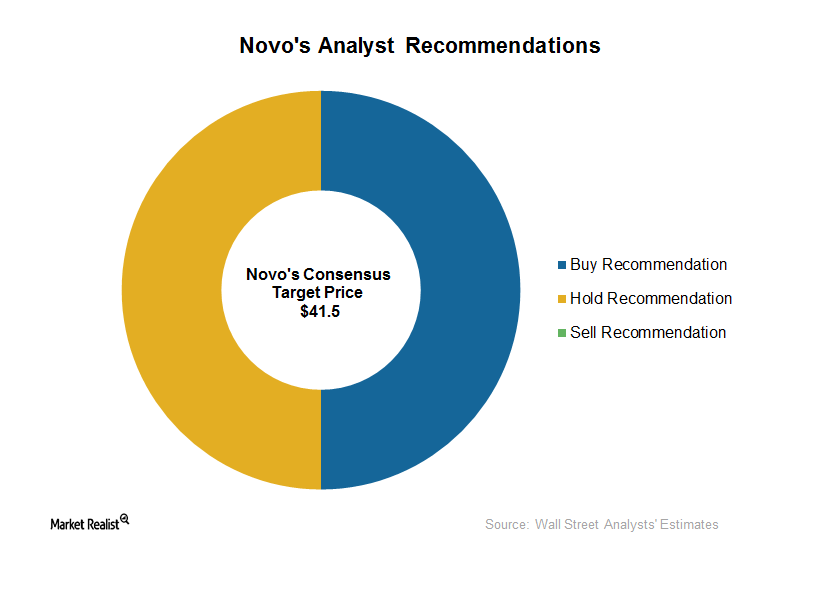

How Much Is the Return Opportunity for Novo Nordisk in 3Q16?

A Bloomberg survey of two brokerage houses on October 24, 2016, reflected a 50% “buy” rating and a 50% “hold” rating for the stock.

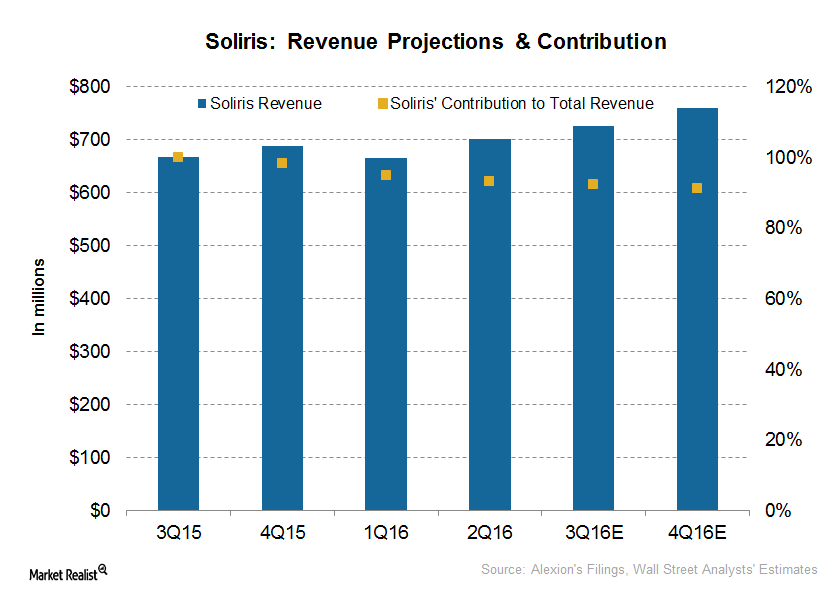

What Are the Drivers behind the Success of Soliris?

Following analysts’ projections, Soliris revenues in 3Q16 and 4Q16 should rise 9.0% and 10.0%, respectively, YoY to reach $725.9 million and $760.6 million, respectively.

Keytruda Leads over Opdivo in Head and Neck Cancer Treatment

CheckMate-141 Bristol-Myers Squibb’s (BMY) CheckMate-141 evaluated Opdivo for the treatment of squamous cell carcinoma of the head and neck. The study was stopped after meeting the primary endpoint in January 2016. The drug is under priority review by the FDA with an action date set for November 11, 2016. With similar approved indications, Opdivo and Merck’s (MRK) […]

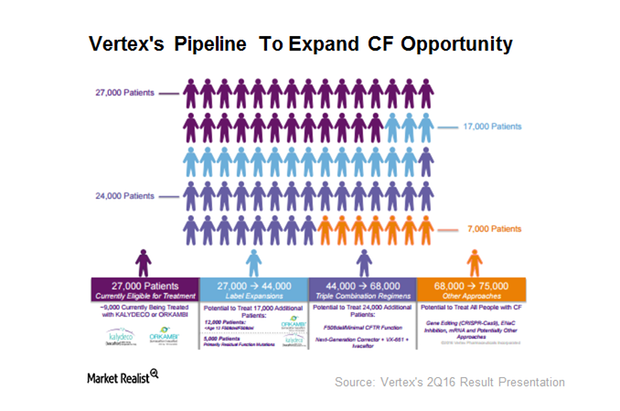

Cystic Fibrosis Treatment Is a Space Where Vertex Could Thrive

The addressable population for Vertex Pharmaceuticals’ (VRTX) two commercialized products Kalydeco and Orkambi is currently 27,000.

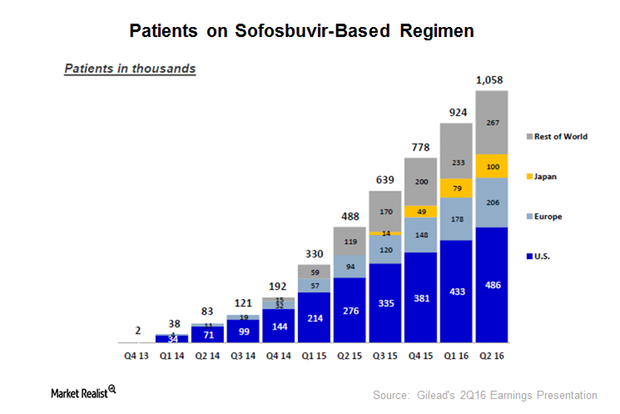

How Gilead Dominates the HCV Space

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. In December 2013, the FDA approved sofosbuvir under the brand name Sovaldi.

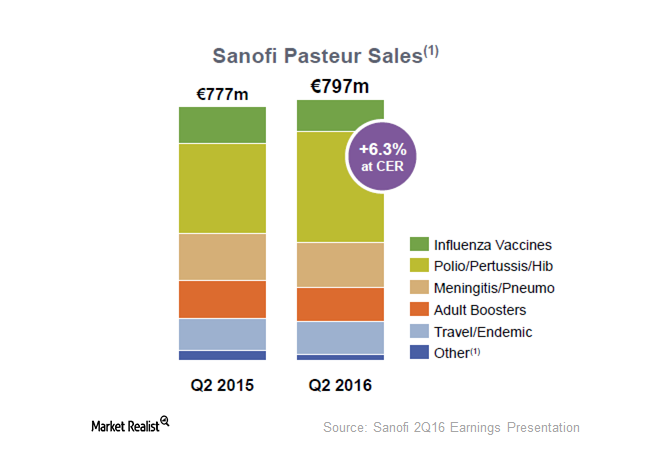

Sanofi’s Chase for Zika Virus Vaccine Could Drive Its Share Price

Sanofi’s Vaccine segment generated 1.4 billion euros, or about $1.6 billion, during the first half of 2016.

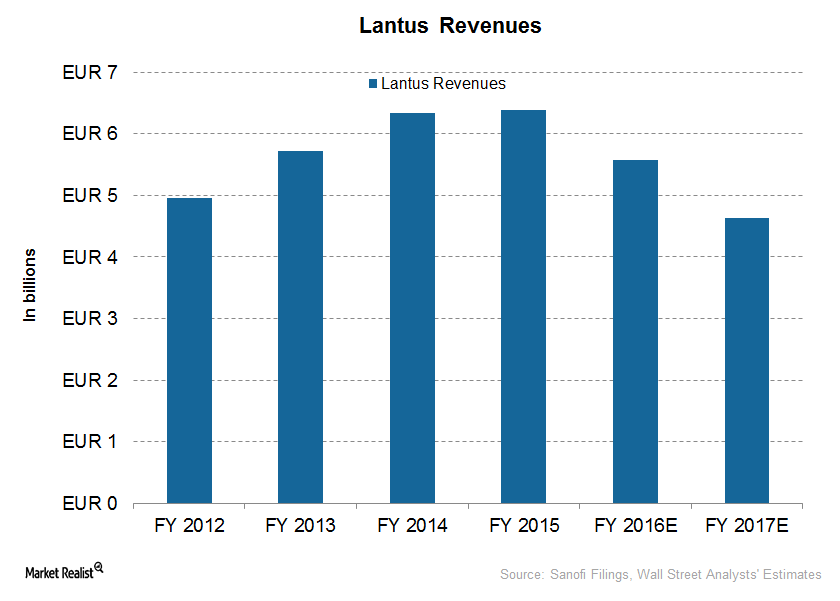

Will Sanofi See More Growth from Its Blockbuster Insulin Drug?

Sanofi’s diabetes franchise includes Lantus, Toujeo, Amaryl, and Apidra. Lantus, a glargine insulin, contributed 17% of total revenues in fiscal 2015.

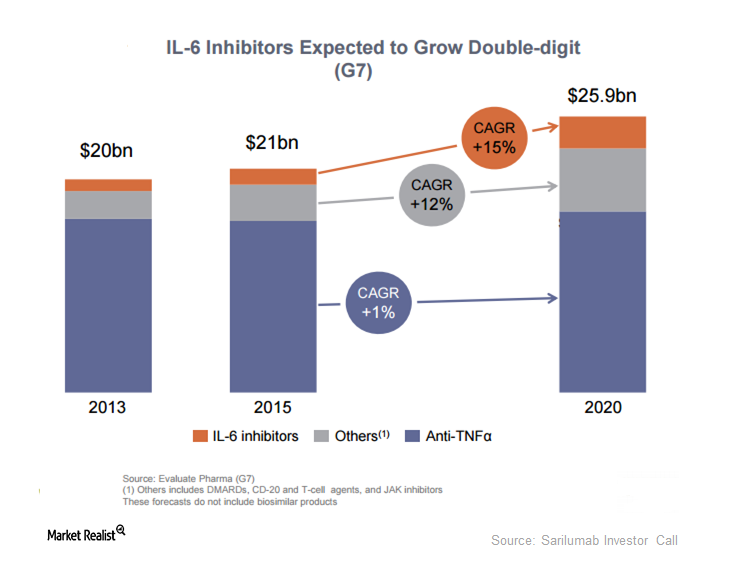

2016’s Estimated Product Launches: LixiLan, Sarilumab, Lixisenatide

LixiLan indicated for type 2 diabetes is a combination of Lantus and lixisenatide. Lantus is Sanofi’s most frequently prescribed diabetes drug.

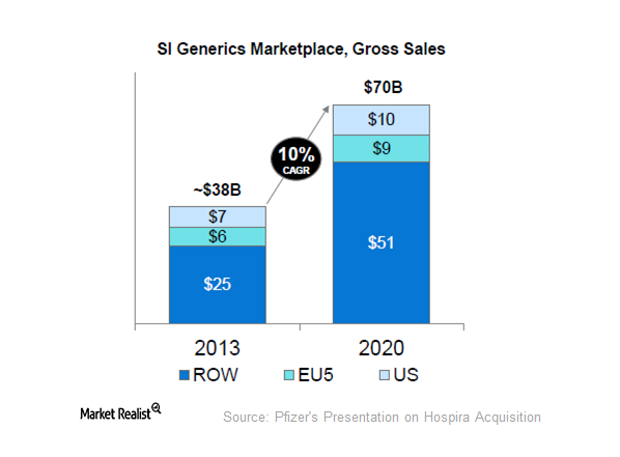

Pfizer’s Hospira Deal: Catching Up a Year Later

On September 13, 2015, Pfizer (PFE) completed its acquisition of Hospira for $17 billion.

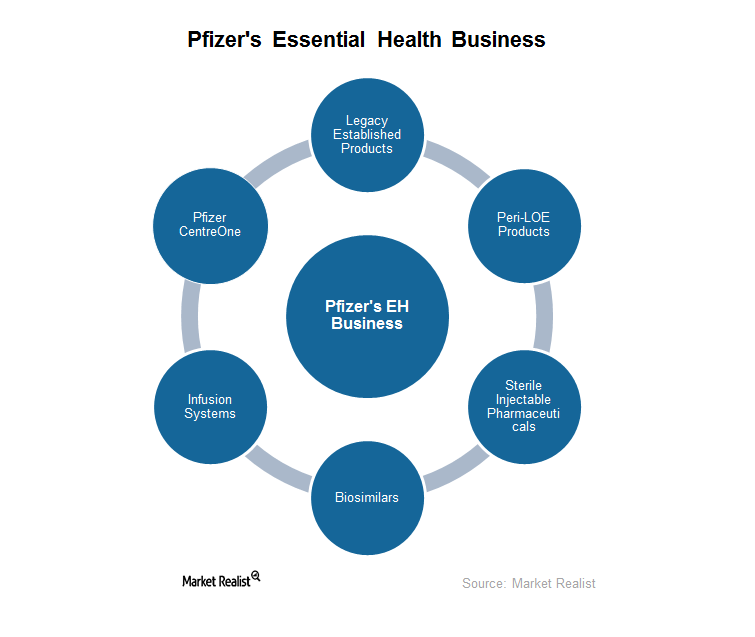

Pfizer’s Essential Health Business: What You Need to Know

In this series, we’ll discuss in detail how Pfizer plans to revive growth for the falling Essential Health business.

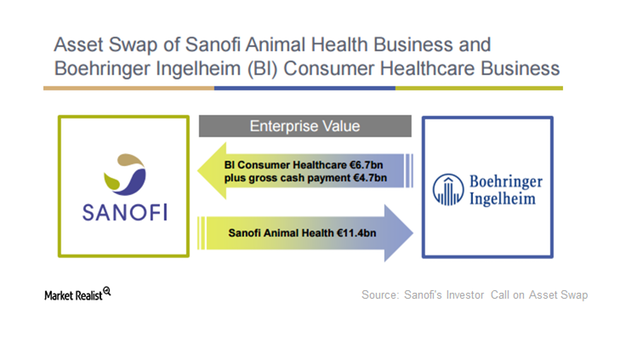

Why Is Sanofi Expanding in the CHC Space?

Sanofi (SNY) plans to become a leading company in the CHC business. The asset swap will exclude Boehringer Ingelheim’s CHC business in China.

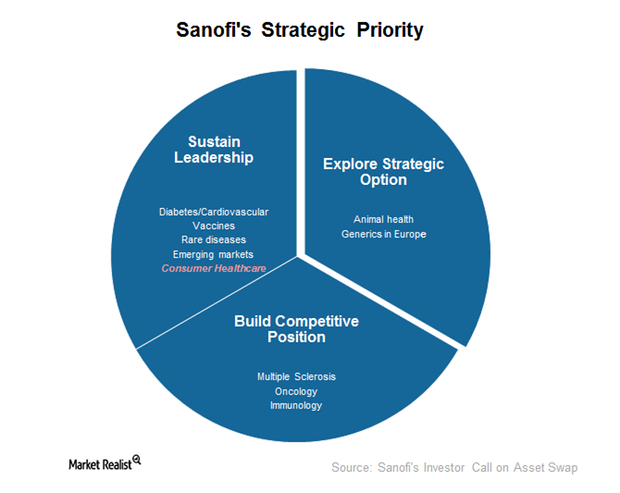

Understanding Sanofi’s Strategic Priority

As of June 30, 2016, the animal health business was Sanofi’s operating segment. It will remain an operating segment until the transaction closes.

Analyzing Sanofi’s Asset Swap Deal with Boehringer Ingelheim

Sanofi is swapping its animal health business with Boehringer Ingelheim’s consumer healthcare business. The asset swap deal was signed on June 27, 2016.

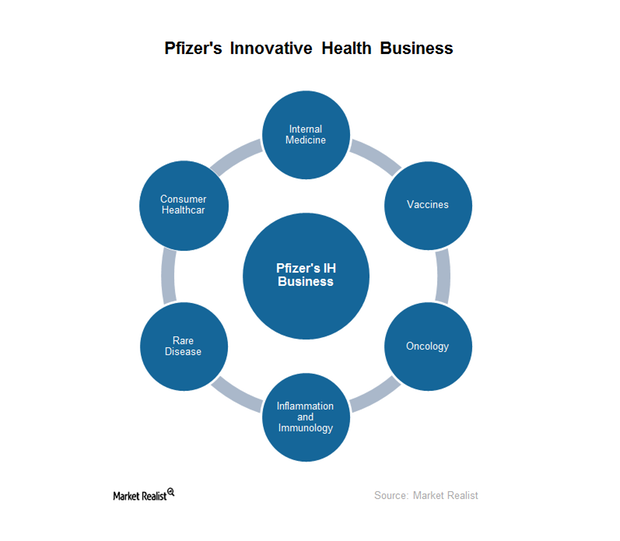

A Look at Pfizer’s Innovative Health Business

In the second quarter of 2016, Pfizer (PFE) reorganized its Innovative Pharmaceutical and Consumer Healthcare operations as the Innovative Health business segment.

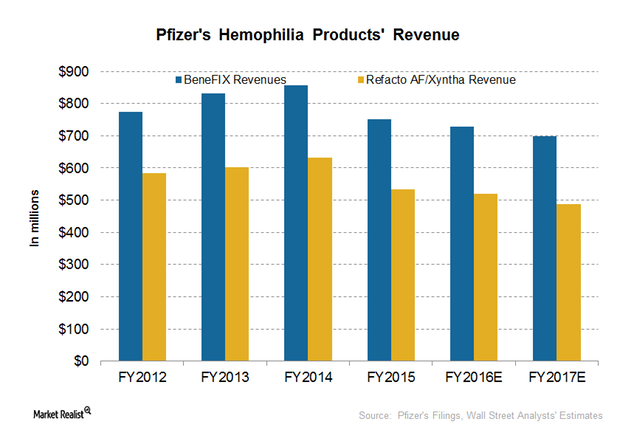

Why Are Revenues from Pfizer’s Rare Disease Portfolio Falling?

BeneFIX, the major contributor to Pfizer’s (PFE) Rare Disease portfolio, is indicated for hemophilia B. During the first six months, the drug earned $367 million.

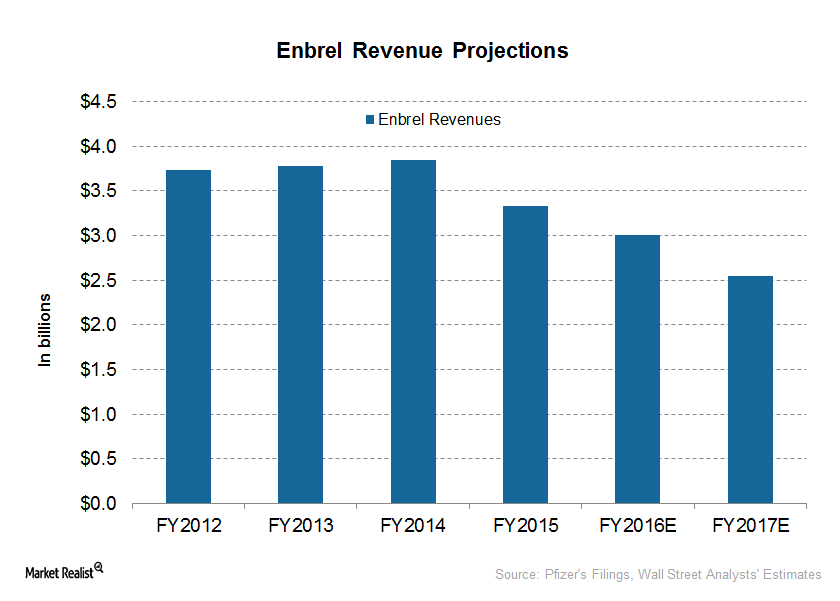

Why Pfizer’s Enbrel Faces a Sales Decline

Wall Street analysts expect Enbrel to earn $3 billion and $2.5 billion from the sale outside US and Canada in fiscal 2016 and 2017, respectively.

How Did Novo Nordisk Perform across Geographies in 1H16?

As of May 2016, Novo Nordisk (NVO) held a 46% share of the global total insulin market.

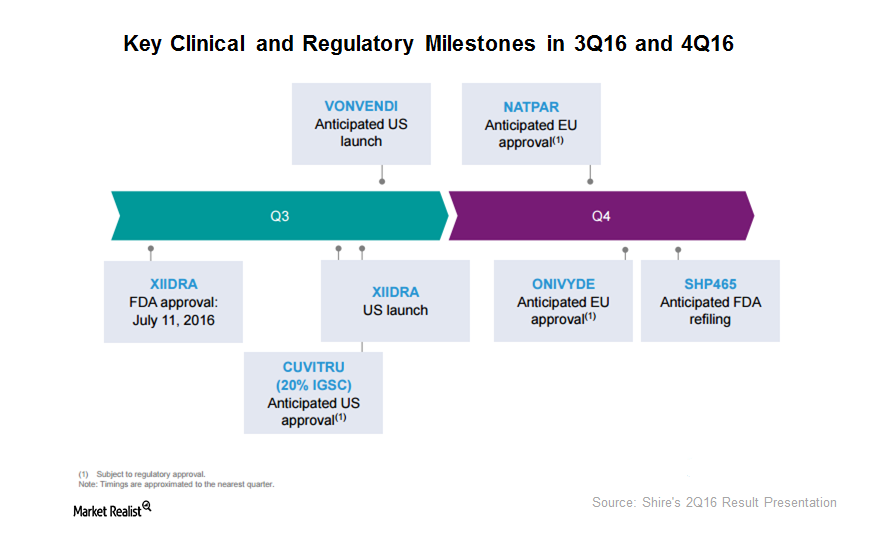

An Update on Shire’s Upcoming Milestones

Shire anticipates receiving European Union approval for Natpara for the indication of hyperparathyroidism in 4Q16.

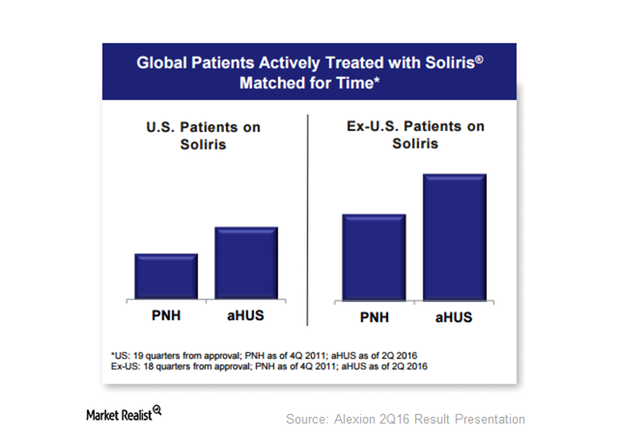

How Significant Is Alexion’s Opportunity with Soliris?

Alexion (ALXN) has been serving the atypical hemolytic uremic syndrome, or aHUS, market for the past five years.

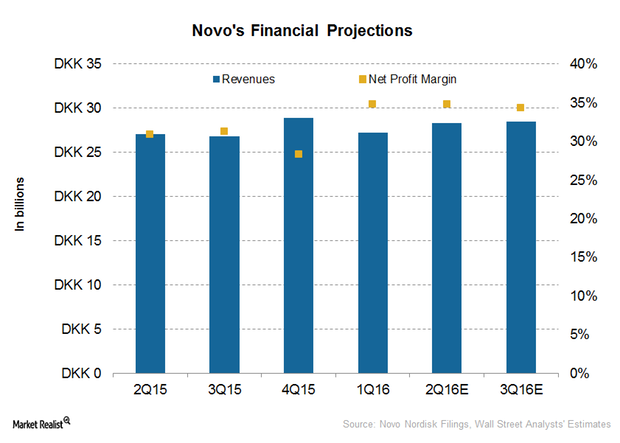

How Much Growth Will Novo See in 2Q16?

Following a company press release, Novo Nordisk (NVO) will announce earnings for the second quarter of 2016 on August 5, 2016.

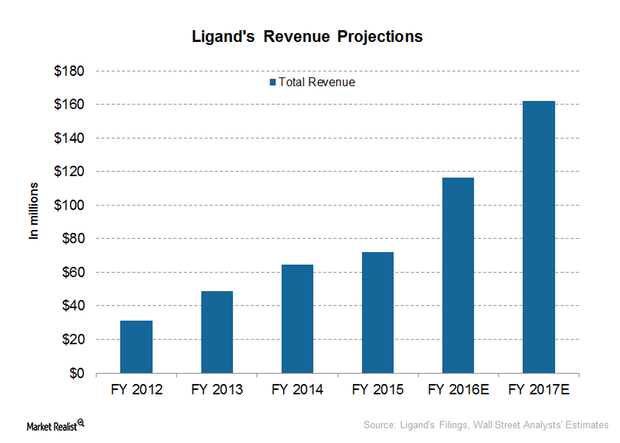

What Is Ligand Pharmaceuticals’s Expected Revenue Growth in 2016?

Ligand Pharmaceuticals (LGND) is a high-growth company with a comparatively low-risk business model. It earns most of its revenue from royalty and license fees.

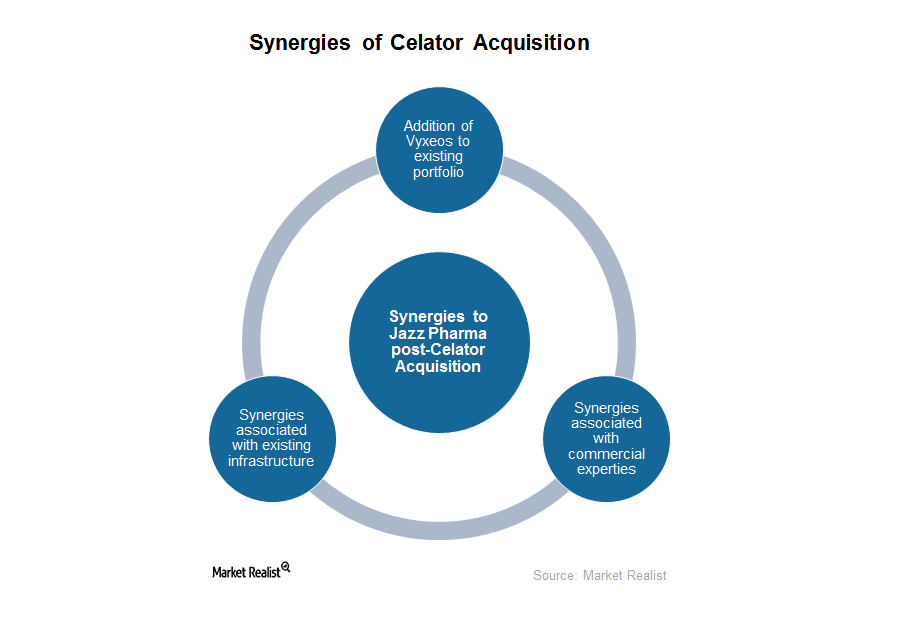

A Look at Jazz Pharmaceuticals’ Celator Acquisition Deal

On July 12, 2016, Jazz Pharmaceuticals announced the completion of the acquisition of Celator by its subsidiary Plex Merger Sub.