Jillian Dabney

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Jillian Dabney

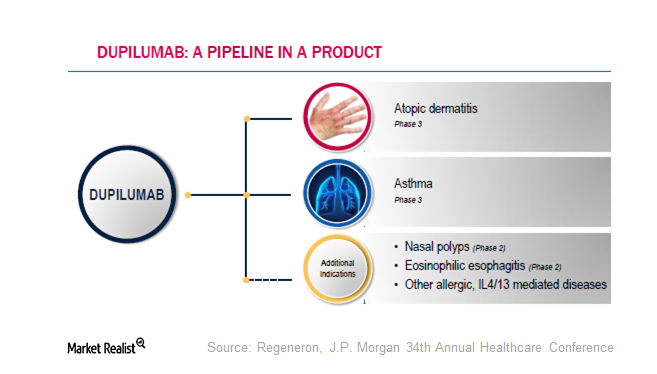

Regeneron’s Dupilumab: How Much Potential Does It Hold?

Dupilumab has a breakthrough therapy designation from the FDA for the indication of moderate-to-severe atopic dermatitis in adults.

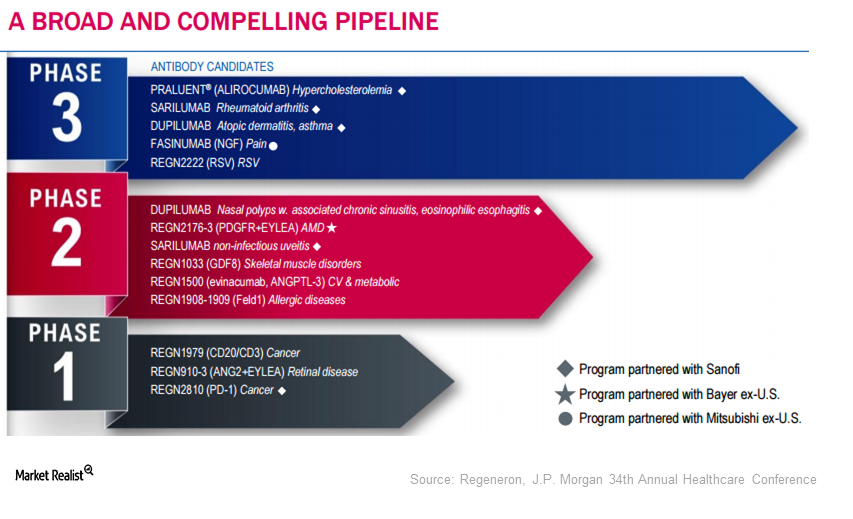

Regeneron’s Robust Pipeline

Regeneron’s (REGN) robust pipeline consists of 13 molecules in various phases of development. Sarilumab is under review with the FDA.

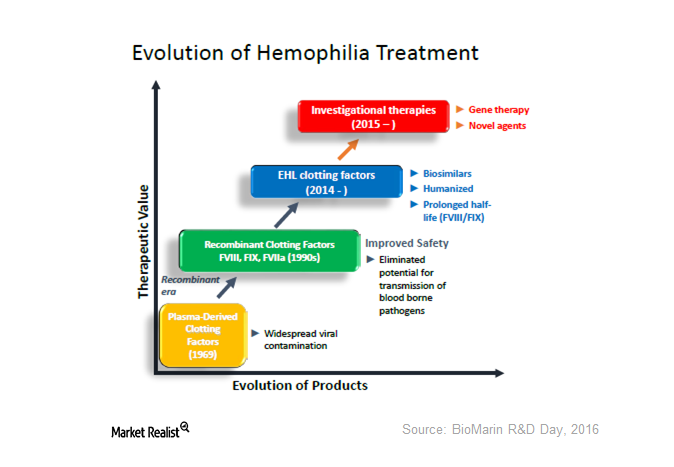

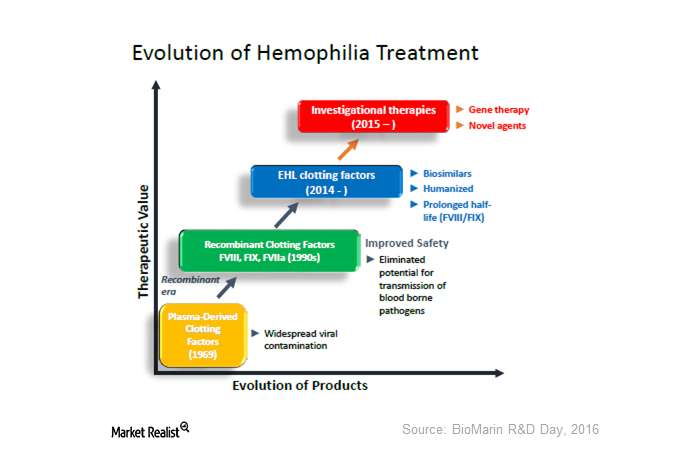

The Evolution of Hemophilia Treatment—And What It Means for BioMarin

BioMarin’s BMN 270 is a gene therapy being investigated for hemophilia A. On April 20, it announced early data of the phase-1 and phase-2 study of BMN 270.

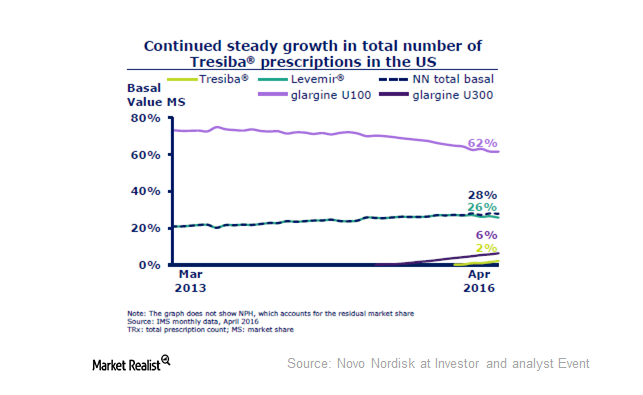

Why Market Share for Novo Nordisk’s Tresiba Is Set to Grow

Tresiba prescriptions in the United States are rising continually. In April 2016, Tresiba’s monthly volume market share increased to 1.4%.

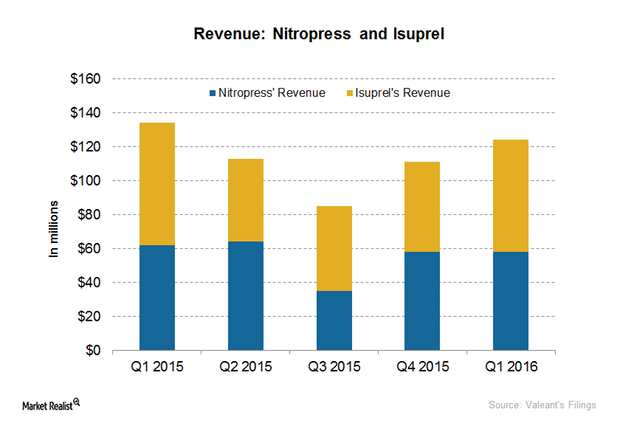

The Facts behind the Valeant Drug Pricing Controversy

Valeant Pharmaceuticals International (VRX) significantly raised the prices of two of its heart drugs—Nitropress and Isuprel—which caused a controversy and an outrage.

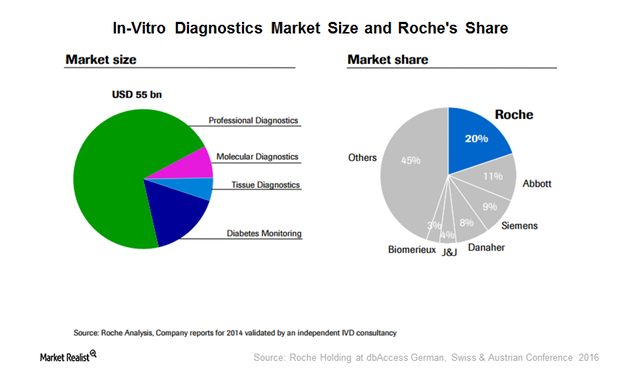

How Did Roche’s Diagnostics Division Perform?

Roche Holding (RHHBY) operates in the pharmaceuticals and diagnostics business units. The diagnostics unit comprises of professional, molecular, tissue diagnostics, and diabetes care.

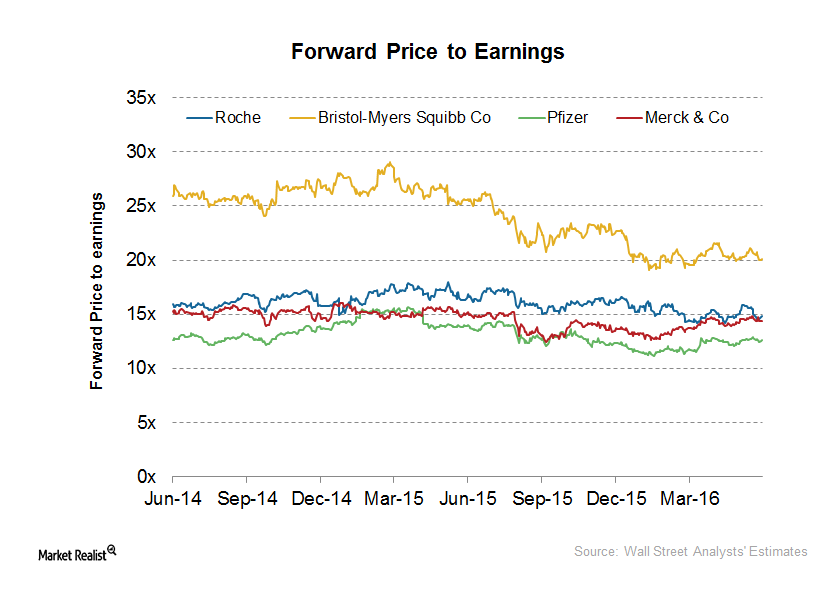

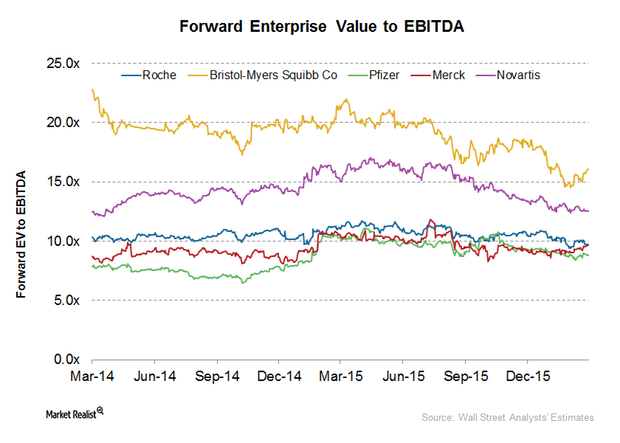

What Does Roche’s Valuation Indicate?

On June 21, 2016, Roche Holding (RHHBY) was trading at a forward PE (price-to-earnings) multiple of 14.8x.

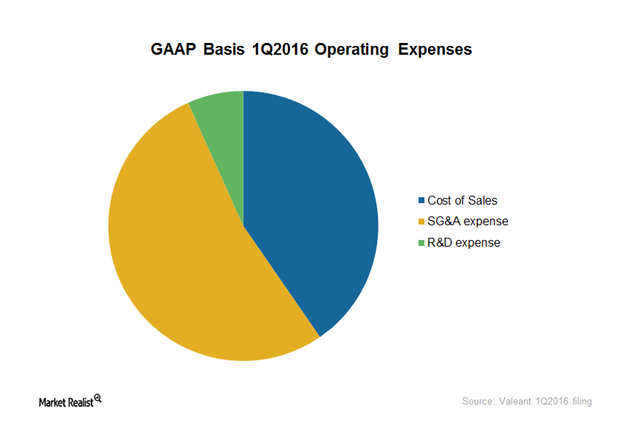

What’s behind Valeant’s Operating Expenses?

Valeant’s major operating expenses include cost of sales, SG&A (selling, general, and administrative) expenses, and R&D (research and development) costs.

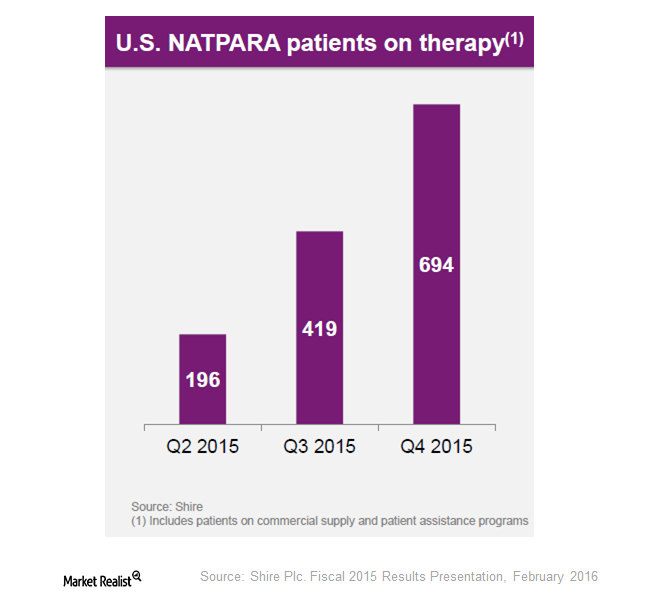

What Are Shire’s Flagship Products?

Shire’s (SHPG) portfolio spans across diversified areas such as neuroscience, hematology, immunology, genetic diseases, internal medicine, and ophthalmics.

What Happened in the Valeant-Philidor Controversy?

Valeant’s (VRX) controversies started with Philidor, a specialty pharmacy company that was accused of altering doctor’s prescriptions so it could sell more of Valeant’s costly drugs.

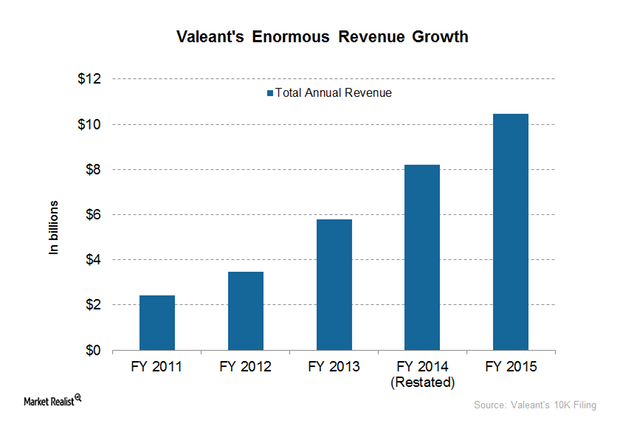

Valeant: The Rise and Fall of a Giant Specialty Pharmaceutical

Much of Valeant’s growth was coming from price increases rather than volume gains, and that wasn’t sustainable. The company’s steep price increases came under regulator scrutiny.

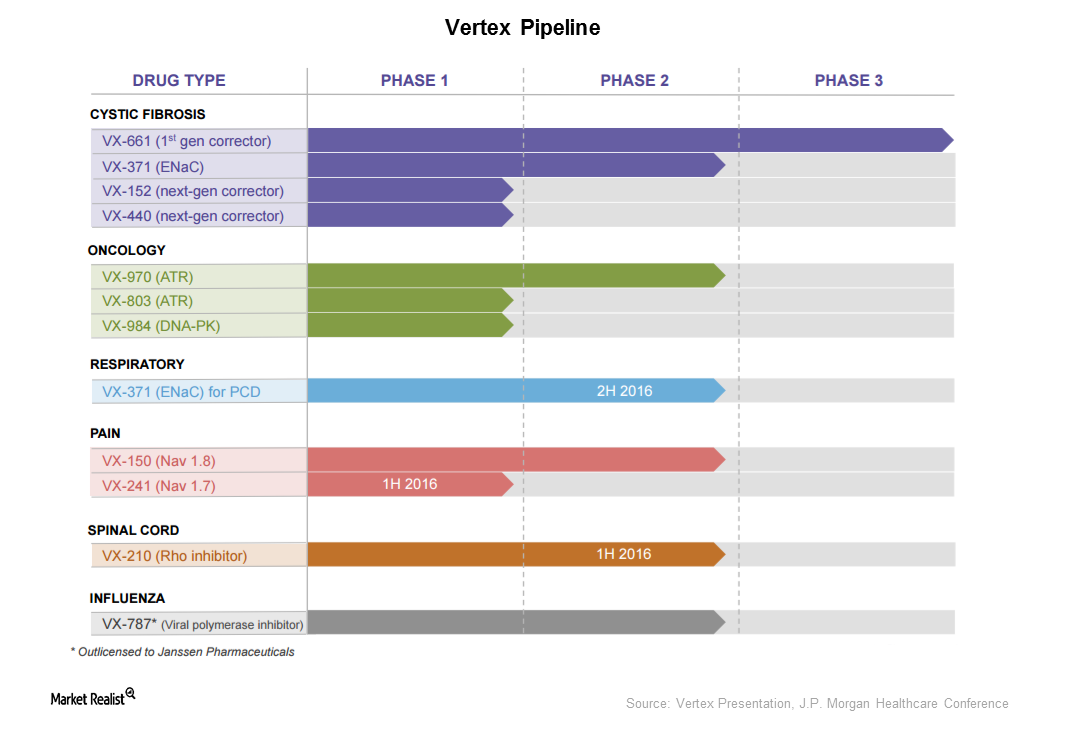

How Does Vertex Plan to Expand Beyond Cystic Fibrosis?

Vertex is trying to expand its product base beyond cystic fibrosis. It holds molecules in the oncology, respiratory, pain, spinal cord, and influenza spaces.

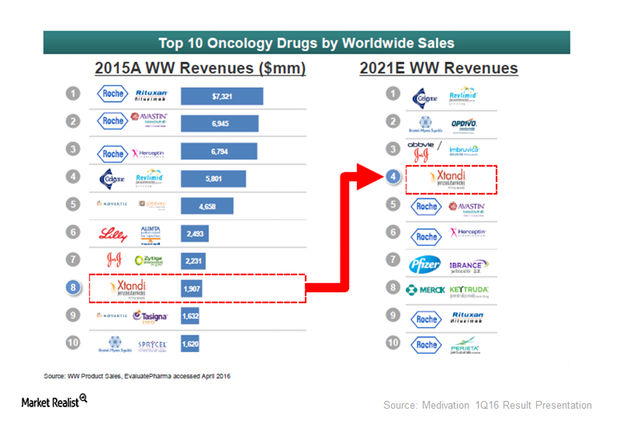

Medivation Sees Growth in Xtandi: A Major Oncology Drug

Medivation (MDVN) is an oncology-focused biopharmaceutical company, and Xtandi as its only approved drug.

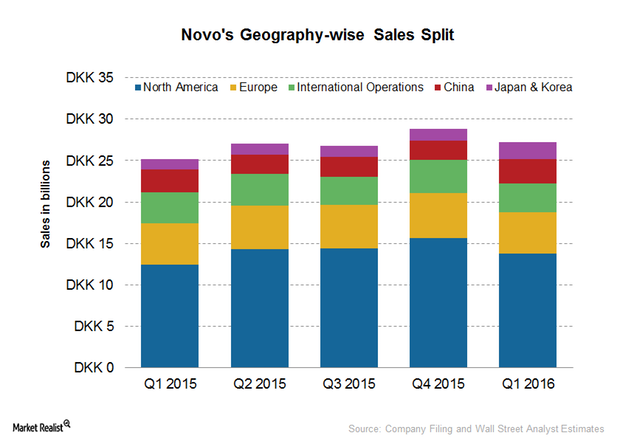

Novo’s Geographical Sales Split in 1Q16

Novo Nordisk’s US sales rose annually by 12% in local currency in 1Q16. North America remained its major market, constituting ~50% of its total revenue.

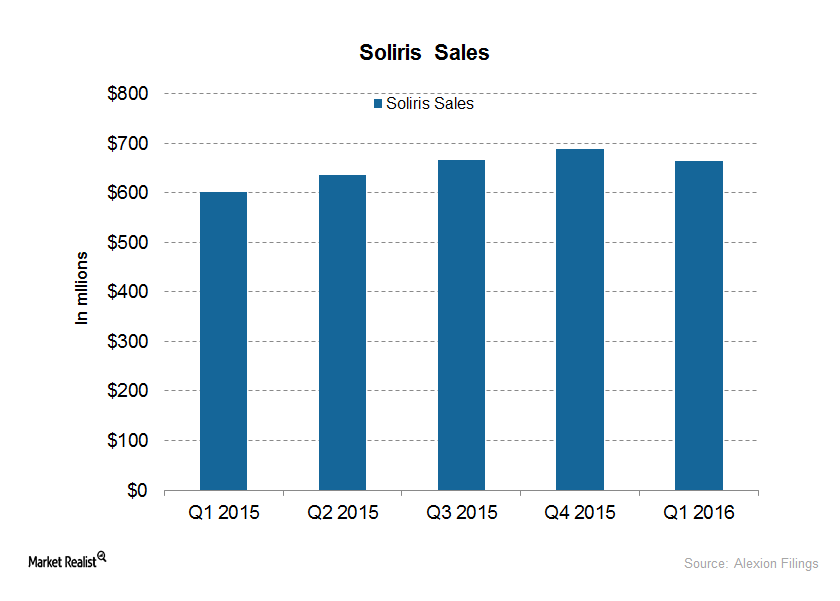

Inside Soliris’s Continued Growth Momentum

During the first quarter of 2016, Alexion Pharmaceuticals (ALXN) earned $664.7 million from the sale of its flagship drug, Soliris.

Could Gene Therapy Be a Next-Generation Treatment for Hemophilia?

Gene therapy is the emerging platform for hemophilia care. If approved, it would be a paradigm.

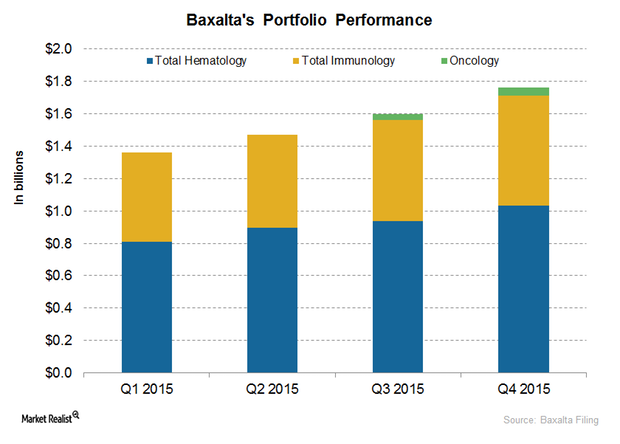

A Look at Baxalta’s Product Segments

Baxalta’s (BXLT) product portfolio can be divided into three parts: hematology, immunology, and oncology.

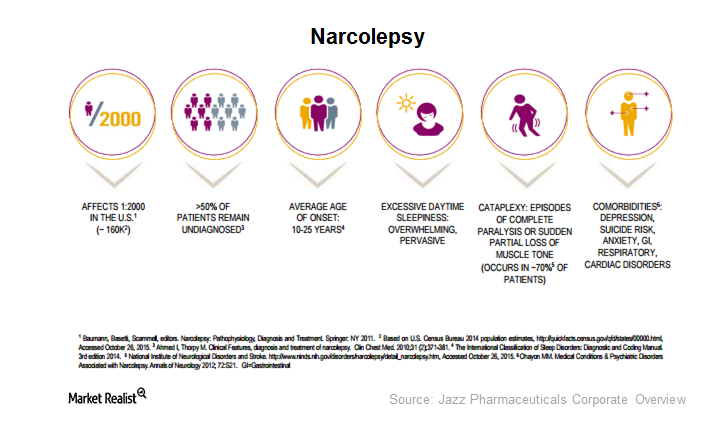

Can Xyrem Maintain Leadership in the Narcolepsy Space?

Jazz Pharmaceuticals’ (JAZZ) Xyrem is a drug for cataplexy and excessive daytime sleepiness occurring in patients with narcolepsy, a serious orphan disease.

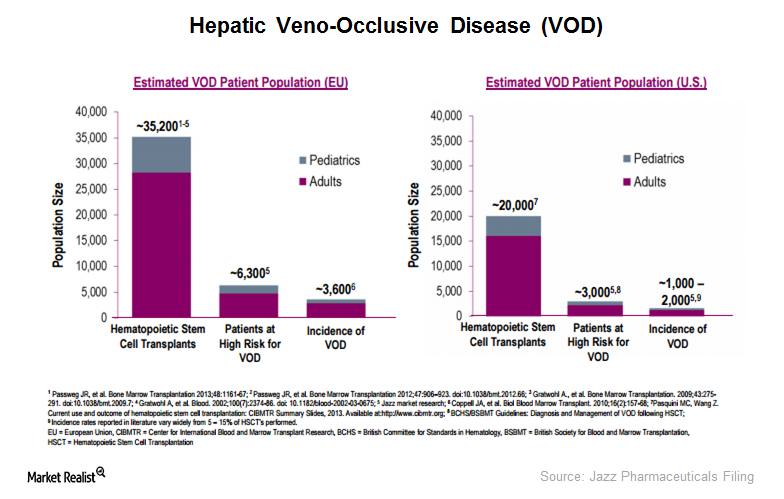

Defitelio: Volume and Pricing Challenges

Jazz Pharmaceuticals’ Defitelio is the first and only approved treatment that increases survival in VOD patients with multi-organ dysfunction (or MOD).

What’s Happening with a Generic Version of Vyvanse?

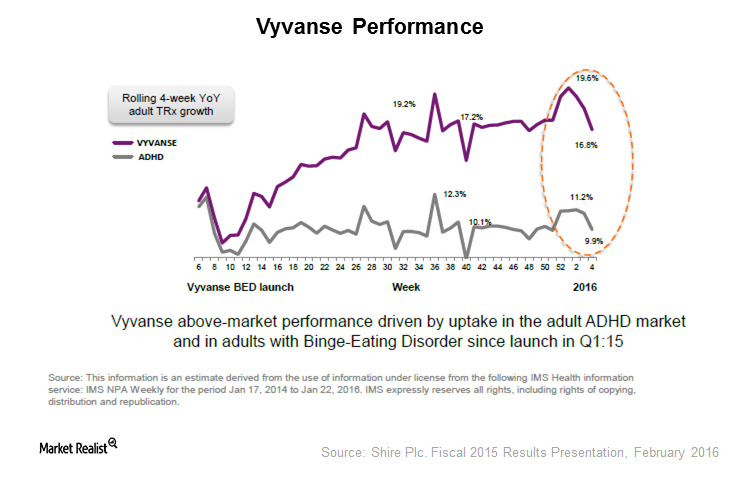

Vyvanse, Shire’s (SHPH) key drug, earned $1.7 billion in 2015, a 21% annual growth. Analysts expect Vyvanse to add $1.9 billion and $2.1 billion to Shire’s top line in 2016 and 2017.

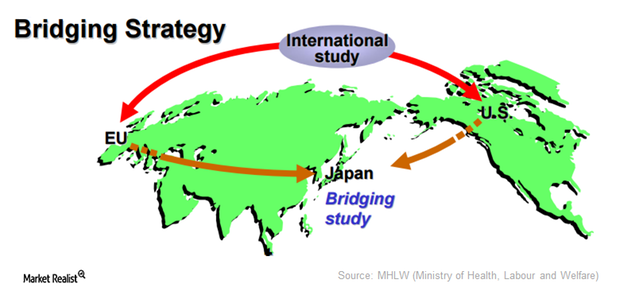

What Is a Bridging Study?

A bridging study on a drug is an additional study performed in a new region to provide clinical data on safety, efficacy, dosage, and dose regimen.

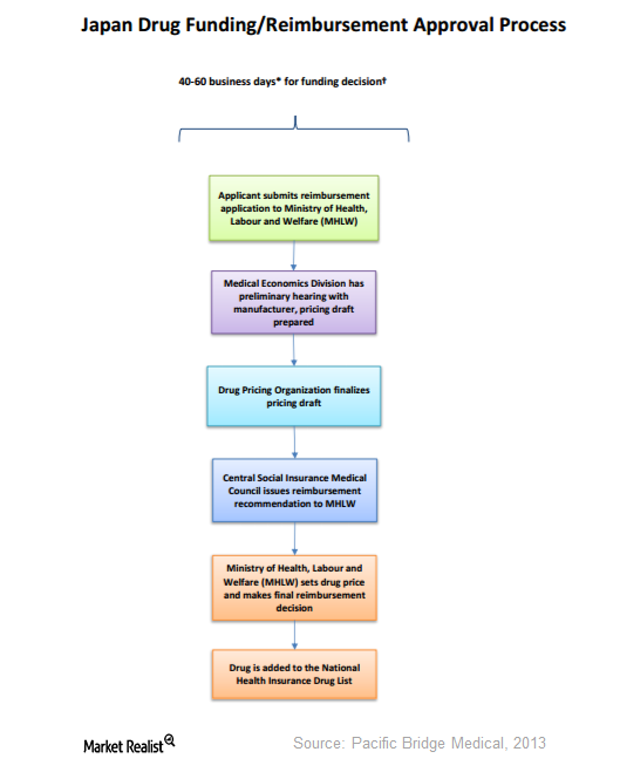

How Are Drugs Priced in Japan?

The NHI revises drug prices every two years. During fiscal 2016, a 6.8% reduction in drug prices is expected.

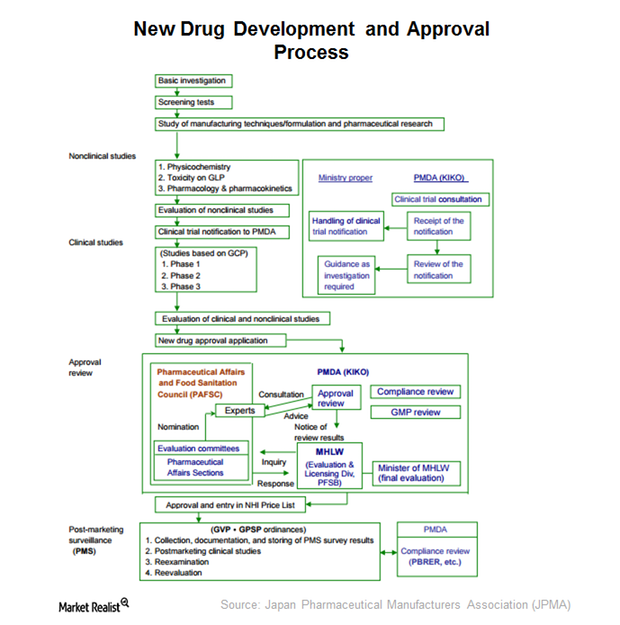

What’s the Drug Approval Process in Japan?

The drug approval process in Japan includes a sequence of non-clinical studies, clinical studies followed by approval review, and post-marketing surveillance.

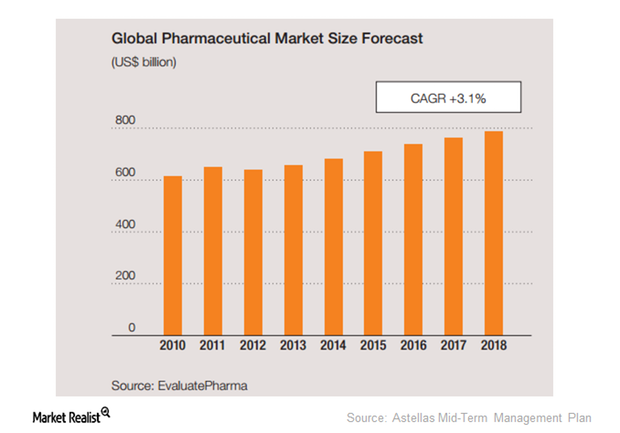

How Is the Global Pharmaceutical Industry Doing?

Some of the challenges the pharmaceutical industry faces include R&D failures, changes in regulatory procedures, litigation, patent expiries, and foreign currency movements.

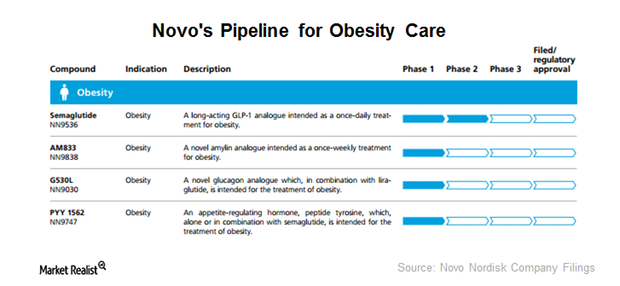

How Much Potential Does Saxenda Hold for Novo?

Saxenda, a glucagon-like peptide-1 (or GLP-1) analog therapy, holds 31% market share for branded anti-obesity drugs.

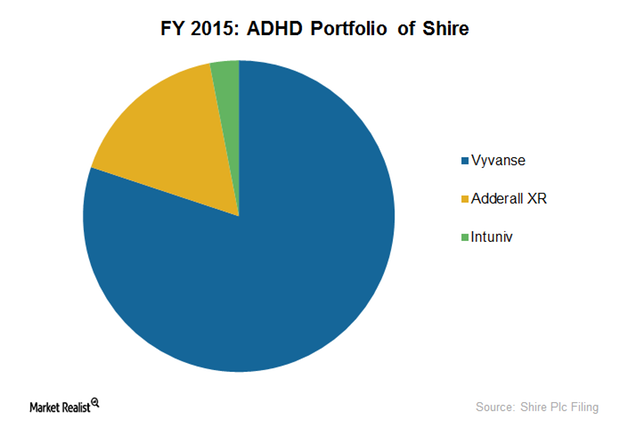

How Vyvanse Could Fuel Shire’s ADHD Portfolio Sales

Vyvanse is Shire’s leading ADHD drug, constituting 80% of the company’s ADHD portfolio. In fiscal 2015, Vyvanse earned the company $1.7 billion.

Shire’s Acquisition Gives It Natpara and Gattex

Gattex is the first and only analog of glucagon-like peptide-2 (or GLP-2) indicated for short bowel syndrome. The drug is known as Gattex in the United States and Revestive in Europe.

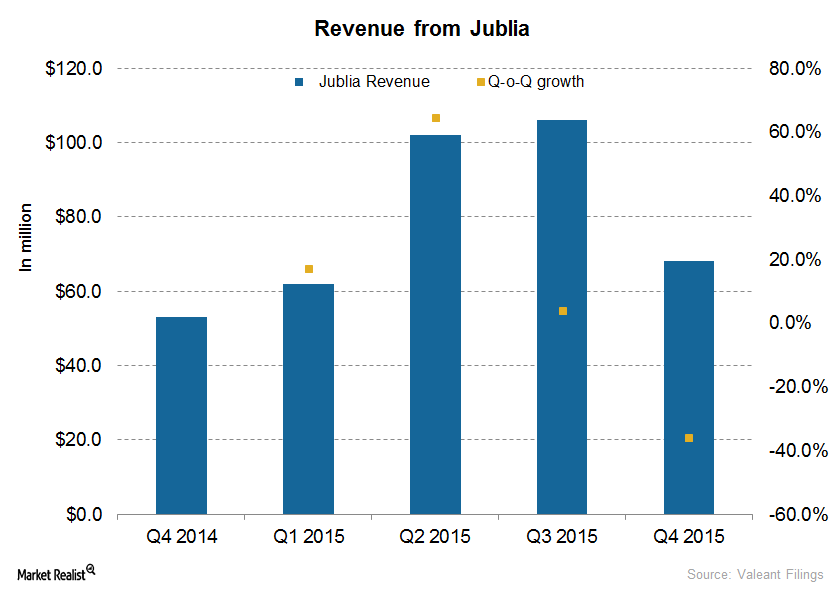

Behind Valeant’s Significant Drop in Jublia Sales

In 4Q15, Jublia added $68 million to the top line of Valeant—the sixth-largest revenue contributor in 4Q15, down from the second-largest in 3Q15.

Decoding Roche’s Performance on EV-to-EBITDA Basis

As of March 8, Roche Holding was trading at a forward EV-to-EBITDA multiple of 9.73x—a discount compared to Bristol-Myers Squibb’s 16.09x.

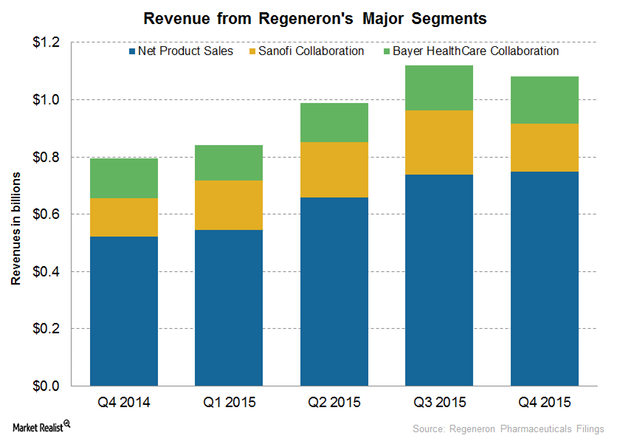

Regeneron Pharmaceuticals’ Major Revenue Sources in 4Q15

Regeneron Pharmaceuticals (REGN) earns revenue from net product sales, collaboration, and technology licenses.

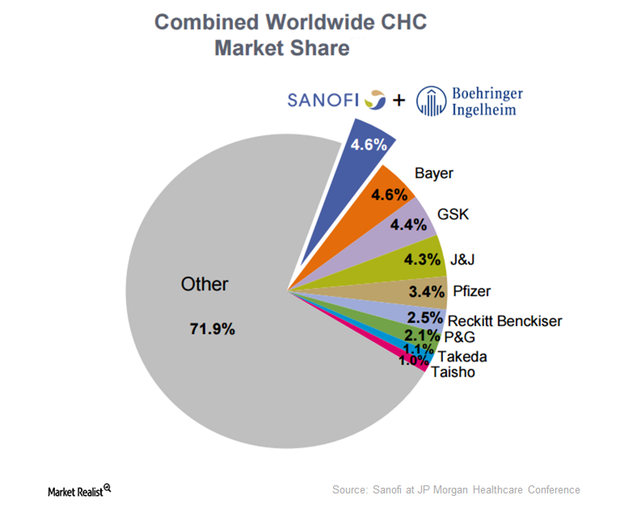

Can Consumer Healthcare Drive Sanofi’s Revenue?

The CHC (consumer healthcare) market forms a part of Sanofi’s (SNY) pharmaceutical segment.

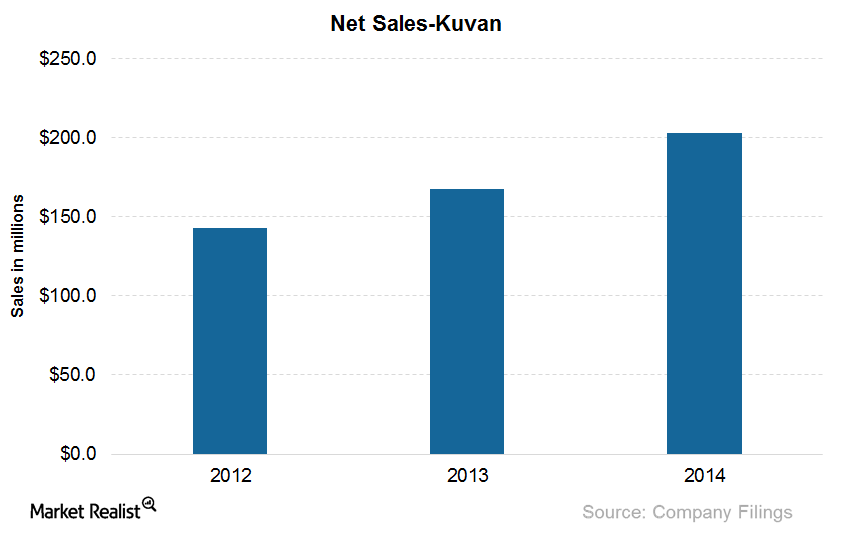

What Are BioMarin’s Products for Treating Phenylketonuria?

Kuvan, with the active ingredient sapropterin dihydrochloride, is effective in reducing blood phenylalanine levels in PKU (or phenylketonuria) patients.

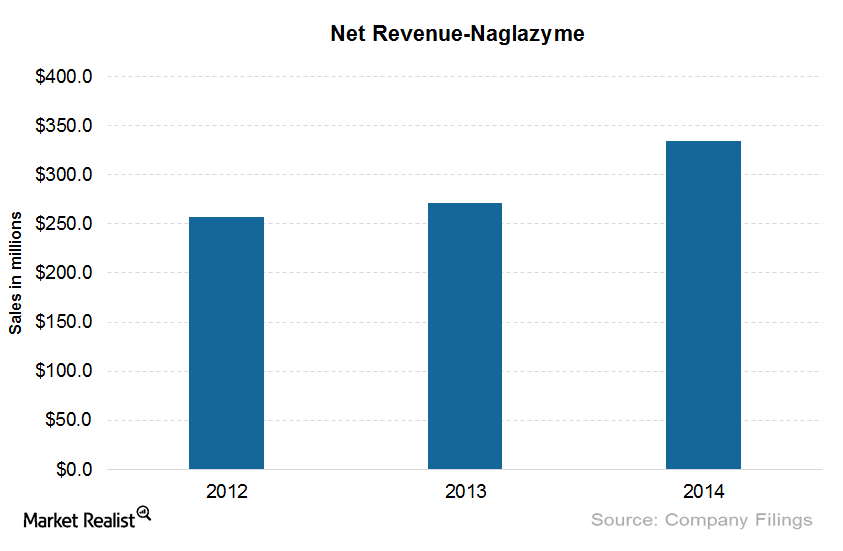

Naglazyme: One of the Costliest Drugs in the United States

The wholesale cost per patient for Naglazyme is around $485,747 per year. The drug has been effective in improving walking and stair-climbing capacity.

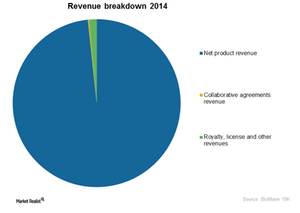

BioMarin’s Business Model and Its 3 Sources of Revenue

Let’s discuss BioMarin’s business model. It derives revenue from three sources, including product revenue. The latter accounts for ~98% of total revenue.

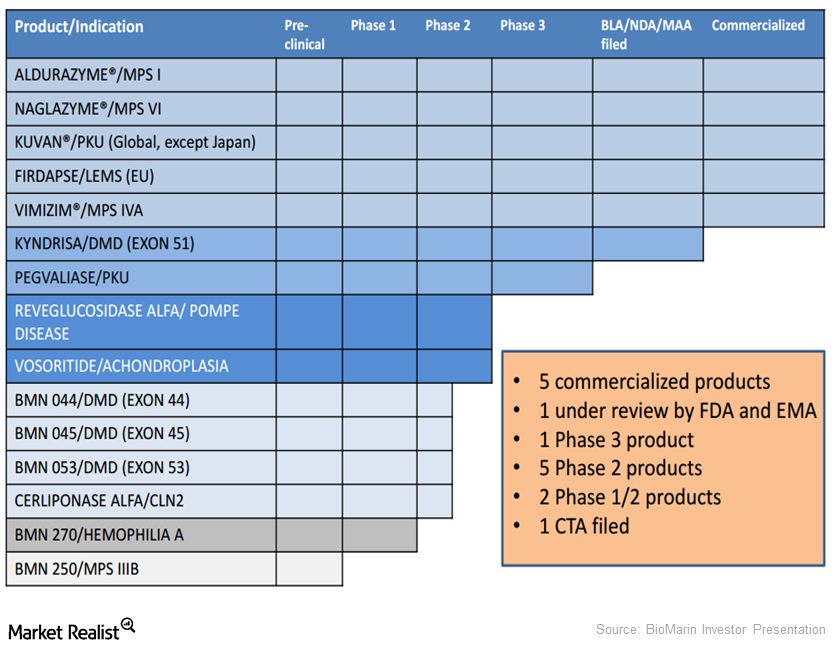

BioMarin’s Pipeline for Duchenne Muscular Dystrophy

There are four drugs in the pipeline targeting Duchenne muscular dystrophy. The company holds Kyndrisa, BMN044, BMN045, and BMN053 for the indication of DMD.