Taiwan Semiconductor Manufacturing Co Ltd

Latest Taiwan Semiconductor Manufacturing Co Ltd News and Updates

Semiconductor Startups Are Earning Big Bucks From Investors Amid Shortage

Semiconductor startups are raking in venture capital at super speed. What companies should you know about?

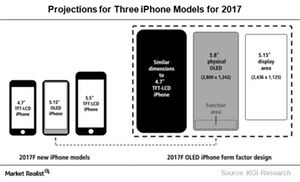

What’s All the Fuss about Apple’s iPhone 8?

Since 2017 marks the tenth anniversary of the iPhone, analysts and customers are expecting significant technology improvements in the iPhone 8.

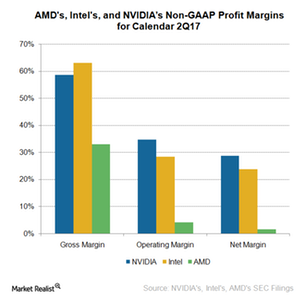

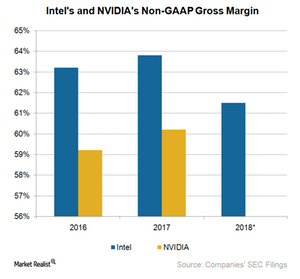

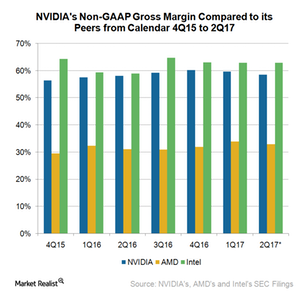

Where NVIDIA’s Margins Stand next to Those of Intel and AMD

NVIDIA’s profit margins NVIDIA (NVDA) has been increasing its revenue while controlling its expenses, resulting in improved profitability and a high free cash flow of up to 20% of its total revenues. Gross margin NVIDIA’s non-GAAP (generally accepted accounting principles) gross margin fell 90 basis points from 59.7% in fiscal 1Q18 to 58.6% in fiscal 2Q18 […]

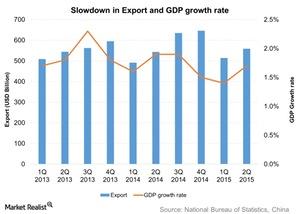

Analyzing China’s Leading Economic Index

China’s Leading Economic Index currently indicates that the country’s economy is facing a downturn. Its LEI remained unchanged at 98.71 points in July 2015.

Why AMD entered into a partnership with Synopsys

In September 2014, AMD (AMD) and Synopsys (SNPS) entered into a multi-year agreement. The partnership will give AMD access to a range of Synopsys’ intellectual property.

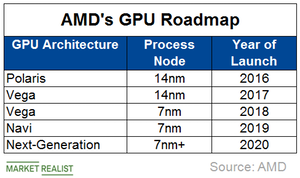

NVIDIA Unlikely to Compete with AMD on 7-nm Node

Advanced Micro Devices (AMD) is working on ray tracing technology and plans to introduce this technology in its future GPUs (graphics processing unit) in order to compete with NVIDIA’s (NVDA) RTX GPUs.

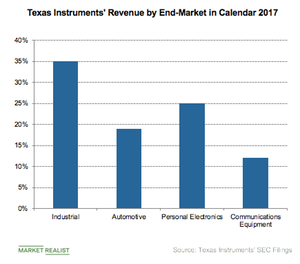

These Are Texas Instruments’ Future Growth Drivers

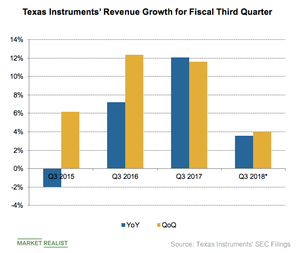

Texas Instruments (TXN) reported strong fiscal Q2 2018 revenue, and forecast slower-than-usual revenue growth for the third quarter as it increases its exposure to the more stable industrial and automotive markets.

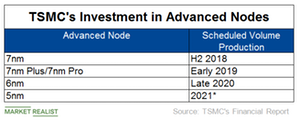

How Will Investment in Advanced Nodes Help TSMC?

TSMC’s technology lead helped it get several orders from Huawei, Advanced Micro Devices, and Qualcomm.

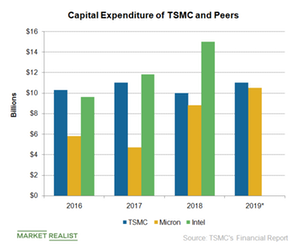

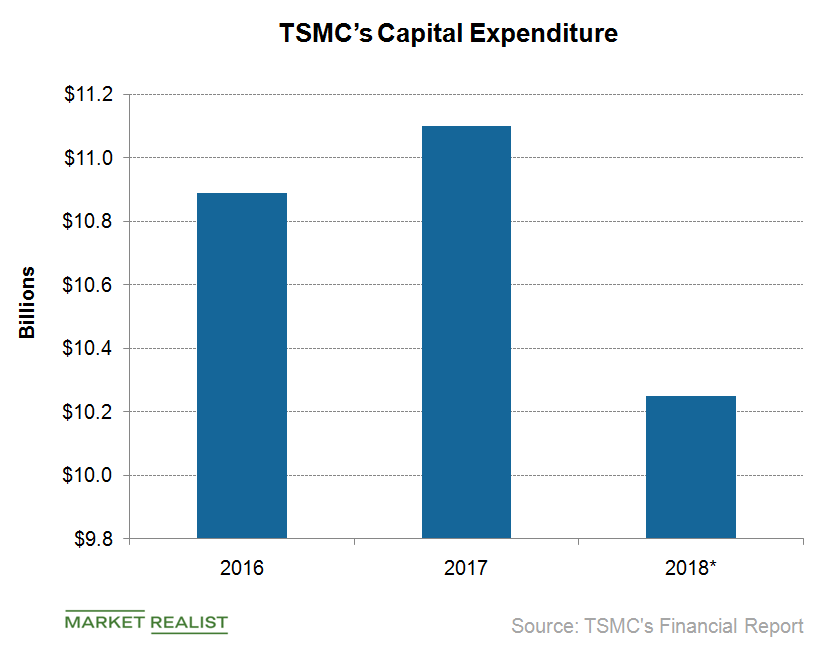

Advanced Nodes Increase TSMC’s Capital Expenditure

In the first three quarters of 2018, TSMC spent $6.7 billion in capital expenditure and is expected to spend $3.3 billion in the fourth quarter as it ramps up 7-nm production.

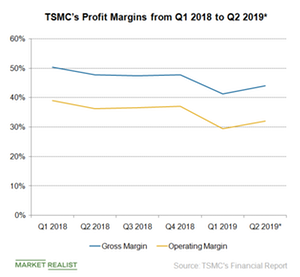

TSMC’s First-Quarter Profit Margins Fall to Seven-Year Low

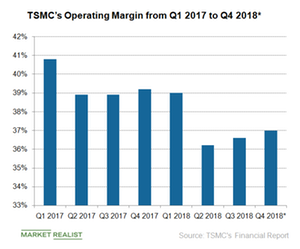

TSMC (TSM) is a third-party chip manufacturer and incurs a lot of fixed cost that goes into maintaining its fabrications facilities, or fabs.

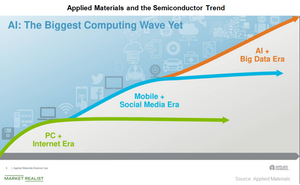

AMAT Feels the Impact of the Shift from Mobile Era to AI Era

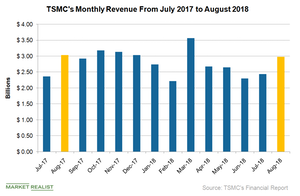

The guidance from Apple (AAPL) and its foundry partner TSMC (TSM) show that smartphone demand should pick up in the second half of 2018.

Would Intel Consider Outsourcing Its CPU Manufacturing to TSMC?

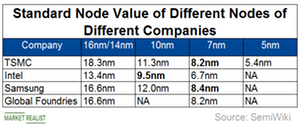

In 2018, AMD decided to divide the production of its 7nm products between TSMC and GlobalFoundries.

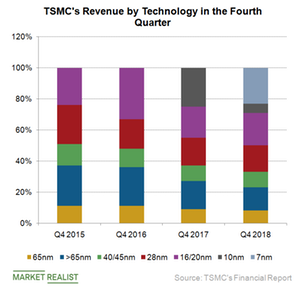

TSMC’s Process Node Strength Reflects in Its Q4 Revenue

A smaller node improves transistor density, thereby improving performance and power efficiency.

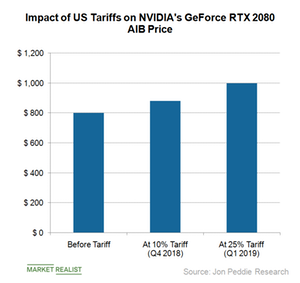

NVIDIA and AMD to See Higher GPU Prices Because of US Tariffs

According to Jon Peddie Research, NVIDIA’s new RTX 2080 AIB would cost gamers $800 in September, $880 in the fourth quarter, and $1,000 in the first quarter of 2019.

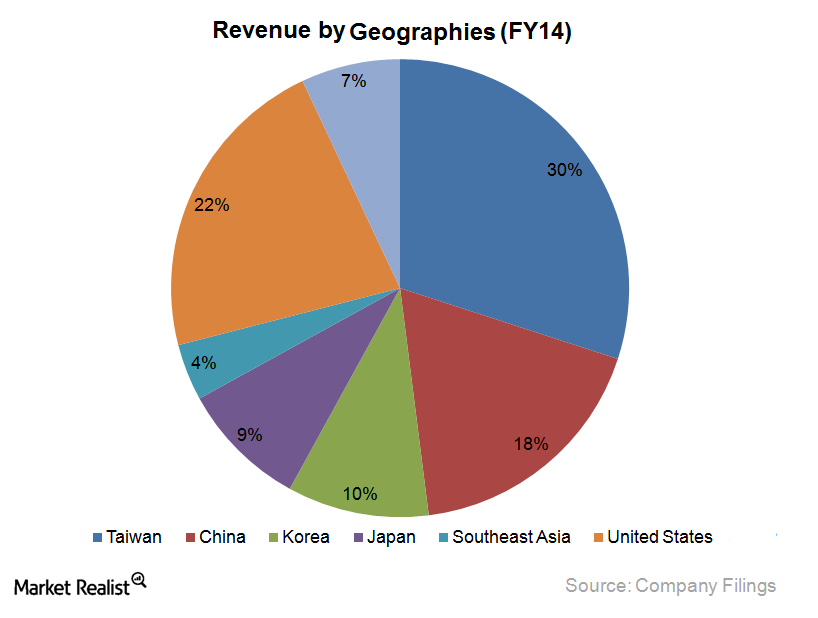

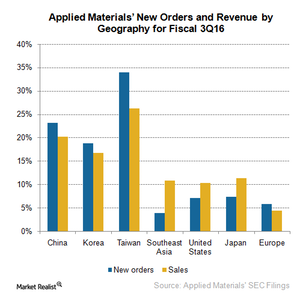

Applied Materials’s position in the semiconductor space

AMAT earns approximately 30% of its revenue from Taiwan, a share that has consistently risen in recent years.

Why AMAT’s Weak Guidance Alarmed Semiconductor Investors

Applied Materials’ (AMAT) performance is an indicator of the overall semiconductor industry’s outlook.

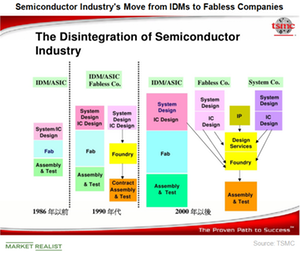

What Happened to Intel’s Foundry Business?

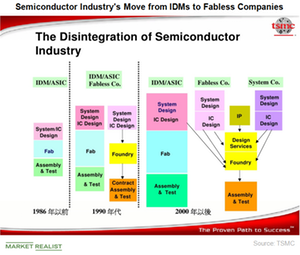

In 1986, Intel (INTC) adopted an integration model in which it invested in x86 chip designs and manufacturing nodes to attain technology leadership in the microprocessor market.

Texas Instruments Diversification Strategy Starts to Pay Off

Texas Instruments (TXN) has been reducing its exposure in the declining smartphone market and increasing its exposure in the growing automotive and industrial markets to reduce its seasonality.

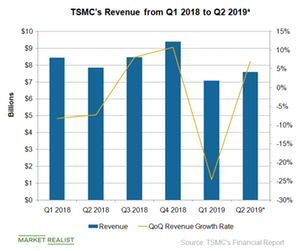

How TSMC Plans to Improve Its Profit Margin in 2019

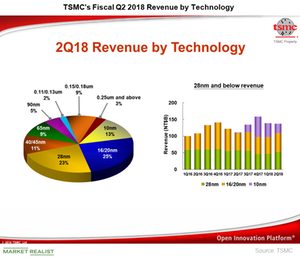

Another factor pulling down TSMC’s gross margin is the lower utilization rate of the 28-nm node due to faster-than-expected migration to the 7-nm node.

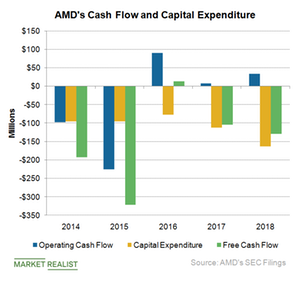

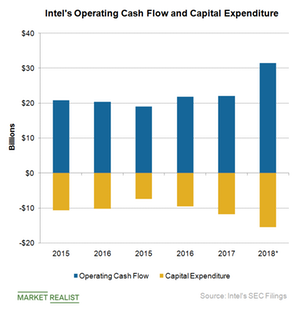

AMD Remains Free Cash Flow Negative

In full-year 2018, AMD earned operating cash of $34 million, but it was not sufficient to meet its capital requirements.

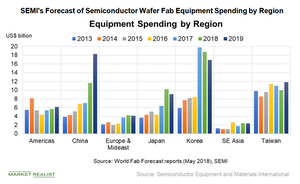

What TSMC’s Reduced Capital Spending Means for Applied Materials

Being the world’s largest foundry, TSMC is a key customer of foundry equipment suppliers Applied Materials (AMAT) and ASML (ASML).

What’s AMD’s Technology Strategy for High Performance Market?

AMD’s chief technology officer recently discussed the company’s technology strategy to enter the high-performance computing market.

TSMC’s 2019 Guidance: Semiconductor Demand Should Recover

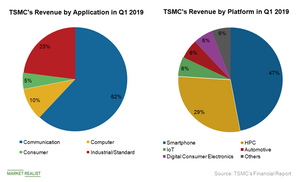

TSMC’s (TSM) revenue hit the bottom in the first quarter of 2019 due to weak economic demand, smartphone seasonality, and high inventory levels in the semiconductor industry.

Pros and Cons of Apple’s and TSMC’s Interdependence

TSMC started volume production on its new 7-nm (nanometer) node in H2 2018 but it suffered from a computer virus outbreak at the start of August 2018.

TSMC Banks on Mobile and High-Performance Computing for Growth

TSMC (TSM) is the world’s largest foundry and manufactures chips for all major end markets.

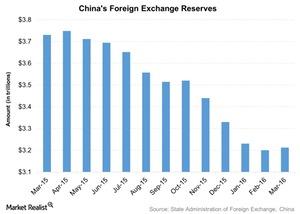

Did China End Its 4-Month Decline in Foreign Reserves in March?

China’s State Administration of Foreign Exchange, or SAFE, released foreign reserve data for March on April 7, 2016. China’s foreign reserves rose $10.3 billion to $3.2 trillion in March.

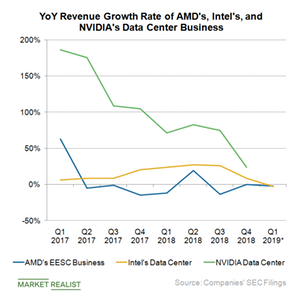

Can Intel Compete with NVIDIA in the AI Space?

For the last few years, Intel (INTC) has been shifting its focus away from PC to data-centric businesses. It’s looking to tap future technologies such as AI.

Why Is Intel Outsourcing Its 14-NM Chip Production?

Intel (INTC) has recently acknowledged that it has fallen short of providing 10-nm (nanometer) PC CPUs (central processing unit) due to a delay in production and rising CPU demand.

AMD’s Data Center Business Is Set to Take Market Share from Intel

AMD is currently working on bringing its second-generation EPYC server CPU, built on TSMC’s 7 nm node, to the market in mid-2019.

What Factors Could Influence Intel’s Capex in 2019?

Intel (INTC) is spending big on stock buybacks in 2018 driven by large cash flows coming from high PC and data center revenue.

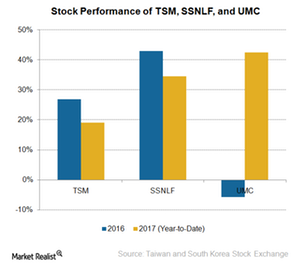

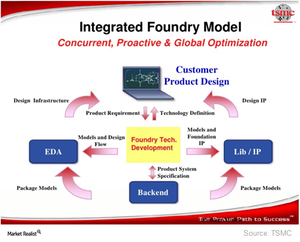

This Technology Gives TSMC the Advantage over Samsung and Intel

Taiwan Semiconductor Manufacturing Company (TSM) is ramping up the production of its 7 nm node ahead of Samsung (SSNLF).

Advanced Technology Nodes to Drive TSMC’s Future Revenue

TSMC focuses on manufacturing nodes to attract more chip designers to manufacture their chips at its foundry.

Behind Intel’s Gross Margin

Intel (INTC) is currently working on fixing the security flaws found in its chip designs. However, the nature of these threats is dynamic and evolving.

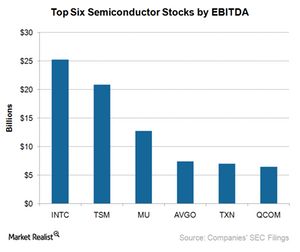

Reading the Most Profitable Semiconductor Companies

In calendar 3Q17, Intel (INTC) was the most profitable semiconductor company, with a last-12-month EBITDA of $25.3 billion.

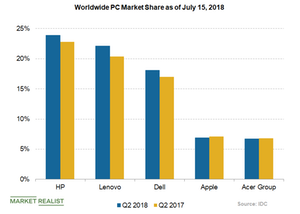

Can Intel Keep Its Footing in Technology’s Changing Landscape?

Intel (INTC) has been a dominant name in the technology industry for a long time, holding a strong position in the PC (personal computer) and data center processor markets.

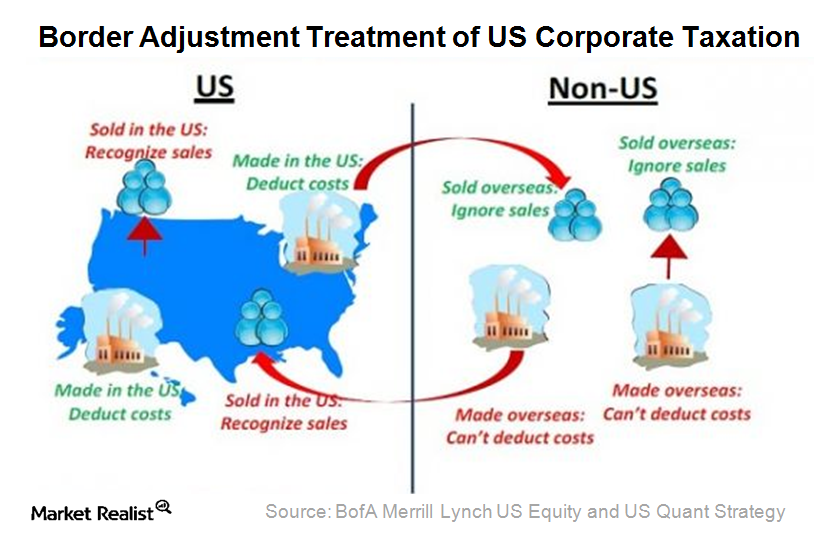

Why US Companies Have Concerns about the Corporate Tax Structure

Among the 35 OECD countries, the US has the highest corporate tax rate of 35%. This tax rate puts US companies at a disadvantage compared to their foreign rivals.

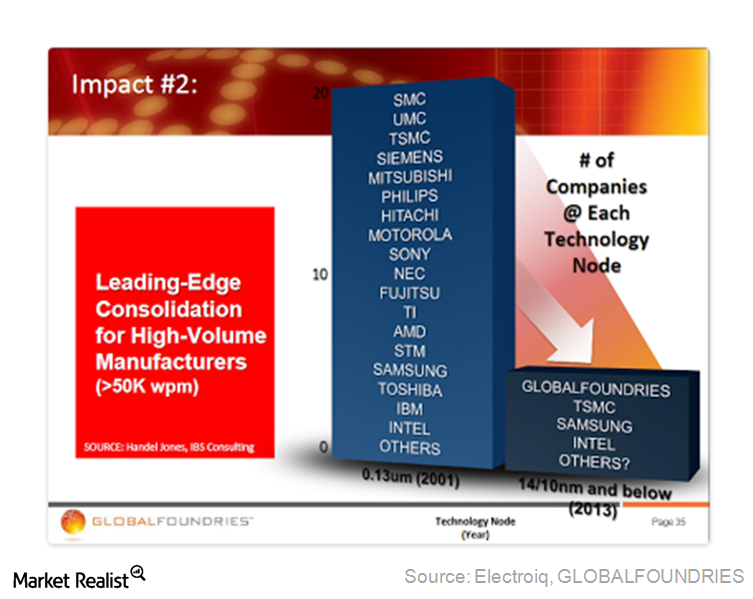

Who’s Betting on Foundries like TSM and SSNLF?

The performance of SME suppliers is a bellwether for the overall semiconductor industry’s outlook because these serve foundries and IDMs.

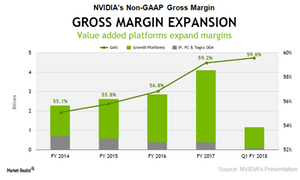

Could NVIDIA’s Revenue Growth Result in a Higher Profit Margin?

For fiscal 2Q18, analysts expect NVIDIA to report earnings per share of $0.78, which marks a sequential decline of 8.2%.

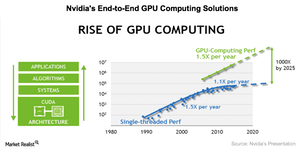

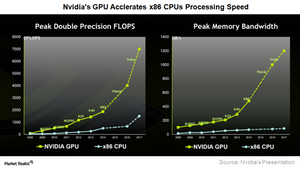

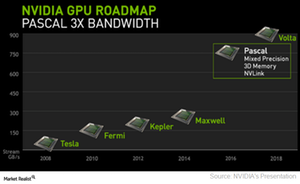

NVIDIA’s GPU-Accelerated Computing on the Rise

NVIDIA recently unveiled its unveiled its next-generation Volta GPU (graphics processing unit). In this series, we’ll look at the various growth opportunities NVIDIA is looking at to tap into GPU-accelerated computing.

What’s the Possibility of a Delay in Apple’s iPhone 8 Launch?

The early production ramp up for Apple’s (AAPL) iPhone 8 doesn’t seem to indicate an early launch of the smartphone.

Factors That Could Drive NVIDIA’s Gross Margin in Fiscal 2018

NVIDIA’s non-GAAP gross margin improved from 57.5% in fiscal 1Q17 to 59.6% in fiscal 1Q18.

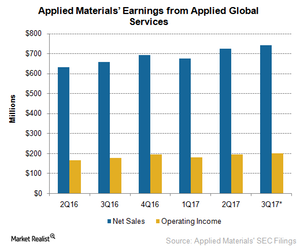

Applied Global Services Stabilizes Applied Materials’ Earnings

Applied Materials’ Applied Global Services segment Applied Materials’ (AMAT) Semiconductor Systems segment has seen strong growth as chipmakers transition to new material-intensive 3D NAND technology and 10-nm (nanometer) and 8-nm process nodes. The chipmakers may take some time to ramp up new technology and improve yield rates. Applied Materials’ AGS (Applied Global Services) team works in sync with […]

Rumor Has It NVIDIA’s Volta Will Arrive Later in 2017

Things are heating up in the GPU space as AMD looks to enter the high-end market with its Vega GPU. Vega will be priced competitively, likely creating a price war between AMD and NVIDIA.

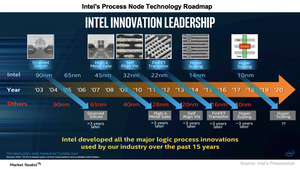

Behind Intel’s Foundry Business

Intel’s process leadership is seemingly unbeatable. Its upcoming 10nm (nanometer) node will contain double the number of transistors compared to Samsung’s and TSMC’s 10nm nodes.

Will Intel Continue to Benefit from Moore’s Law?

Intel’s (INTC) gross margin hasn’t improved much over the last two years because it’s been manufacturing chips on the same 14nm (nanometer) node since 2014.

What’s Nvidia’s GPU Strategy for 2017 and 2018?

Nvidia (NVDA) has reported strong growth in fiscal 2017, thanks to Pascal GPUs.

Xilinx Prepares Gears up with ARM’s IP

Xilinx (XLNX) is moving ahead of Intel (INTC), not only in FPGA (field programmable gate array) adoption but also in technology node.

How Will Donald Trump’s Victory Impact AMAT?

AMAT is the world’s largest manufacturer of SME (semiconductor manufacturing equipment) and supplies to chipmakers around the world.

Nvidia May Accelerate Its GPU Roadmap to Compete with AMD

Nvidia (NVDA) is rushing to launch Volta in early 2017, which is the timeframe when AMD could release its next-generation GPU Vega.

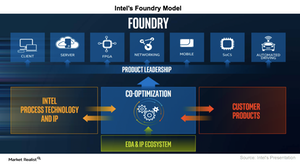

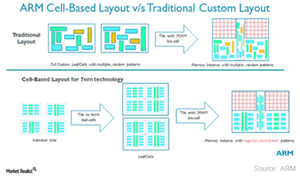

What Is Intel’s Strategy behind Its Foundry Model?

In fiscal 3Q16, Intel (INTC) partnered with ARM Holdings (ARMH) to provide foundry services for ARM-based chips. Intel announced another foundry partnership with Spreadtrum, but it did not identify the products that would be manufactured.