TSMC’s 2019 Guidance: Semiconductor Demand Should Recover

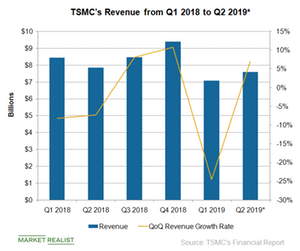

TSMC’s (TSM) revenue hit the bottom in the first quarter of 2019 due to weak economic demand, smartphone seasonality, and high inventory levels in the semiconductor industry.

Nov. 20 2020, Updated 11:02 a.m. ET

TSMC’s second-quarter revenue guidance

TSMC’s (TSM) revenue hit the bottom in the first quarter of 2019 due to weak economic demand, smartphone seasonality, and high inventory levels in the semiconductor industry. TSMC’s wafer output was also affected by a contaminated chemical from a supplier. The first two factors could continue to pressurize TSMC’s revenue, but improvement in the last two factors could bring sequential growth.

TSMC’s 2019 revenue growth drivers

For the second quarter, TSMC expects revenue to rise 7.1% sequentially to $7.6 billion at the midpoint. In the second quarter, the company will realize the $550 million revenue it lost in the first quarter because of the contaminated chemical. The company is also seeing stabilization in semiconductor inventory, which is gradually bringing orders to a normal level. Its customer NVIDIA (NVDA) claimed that it will sell all the excess graphics inventory by April.

TSMC expects growth to pick up in the second half as semiconductor inventory levels fall significantly and seasonal demand and new product launches in mobile and HPC (high-performance computing) markets boost order volume.

7-nm node

In 2019, TSMC’s lead in manufacturing technology node will help it leverage the 5G opportunity, which needs faster and smaller processors. TSMC has a first mover advantage in the 7-nm (nanometer) node. It is closely followed by Samsung (SSNLF). On the other hand, GlobalFoundaries has dropped from the 7-nm race. As a result, its customer Advanced Micro Devices (AMD) moved to TSMC. Intel (INTC) has delayed its 10-nm node to the end of the year. TSMC expects to earn a quarter of its 2019 revenue from 7-nm and 7nm+ node.

5G

The communications market is growing thanks to the early adoption of 5G (fifth generation). Xilinx (XLNX) is seeing increasing demand for its accelerators in 5G infrastructure, and Qualcomm is seeing increasing adoption of its 5G modems by Samsung and other Chinese handset makers. As the 5G rollout accelerates in the latter half of 2019, TSMC will likely see increasing orders from the above customers.

TSMC will also likely see orders from Apple (AAPL) in the third quarter. AMD will manufacture its next-generation CPUs (central processing units) and GPUs (graphics processing units) on TSMC’s 7-nm node driving orders in the second half. TSMC’s revenue is expected to grow faster than the overall semiconductor industry, excluding memory, in the second half of 2019.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!