Texas Instruments Diversification Strategy Starts to Pay Off

Texas Instruments (TXN) has been reducing its exposure in the declining smartphone market and increasing its exposure in the growing automotive and industrial markets to reduce its seasonality.

Nov. 20 2020, Updated 12:08 p.m. ET

Texas Instruments’ fiscal Q2 2018 revenue

Texas Instruments (TXN) has been reducing its exposure in the declining smartphone market and increasing its exposure in the growing automotive and industrial markets to reduce its seasonality. This shift is starting to reflect in the company’s earnings.

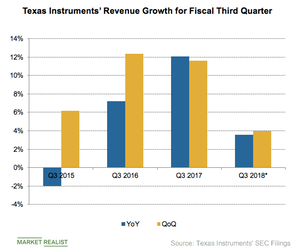

Fiscal Q2 and Q3 are traditionally strong quarters for Texas Instruments—the company has reported double-digit sequential growth in its past third quarters. This seasonality is linked to the company’s high exposure to Apple (AAPL), which traditionally launches its iPhones in Q3.

In fiscal Q2 2018, Texas Instruments’ revenue rose 8.2% sequentially and 11% YoY (year-over-year) to $4.0 billion, beating analysts’ estimate of $3.97 billion. This growth was driven by strong demand in the industrial and automotive segments, which together account for 54% of the company’s revenue. The growth in these segments was slightly offset by weakness in the communications segment.

Fiscal Q3 2018 revenue guidance

In fiscal Q3 2018, Texas Instruments expects its revenue to grow 4% sequentially to $4.27 billion (the midpoint of its guidance), driven by strength in the industrial and automotive spaces. This growth is lower than the double-digit growth the company has seen in the third quarter of the last two years, likely because it had reduced its exposure to Apple. Orders from the iPhone maker are strong for Q3 2018, and this is visible in TSMC’s (TSM) earnings guidance.

TSMC, Apple’s sole foundry supplier, expects sequential revenue growth of 8.3% in fiscal Q3 2018, lower than its normal double-digit seasonal growth. However, the foundry stated that strong smartphone demand is being offset by weakness in demand from cryptocurrency miners.

Revenue by business segment

Texas Instruments earns 67% of its revenue from its analog offerings and 24% from embedded processing. In fiscal Q2 2018, its analog revenue rose 5% sequentially, and embedded processing revenue rose 2%. In fiscal Q3 2018, analog and embedded processing revenues are expected to rise 8% and 9% sequentially. Next, we’ll look at Texas Instruments’ revenue by end market.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!