PowerShares QQQ ETF

Latest PowerShares QQQ ETF News and Updates

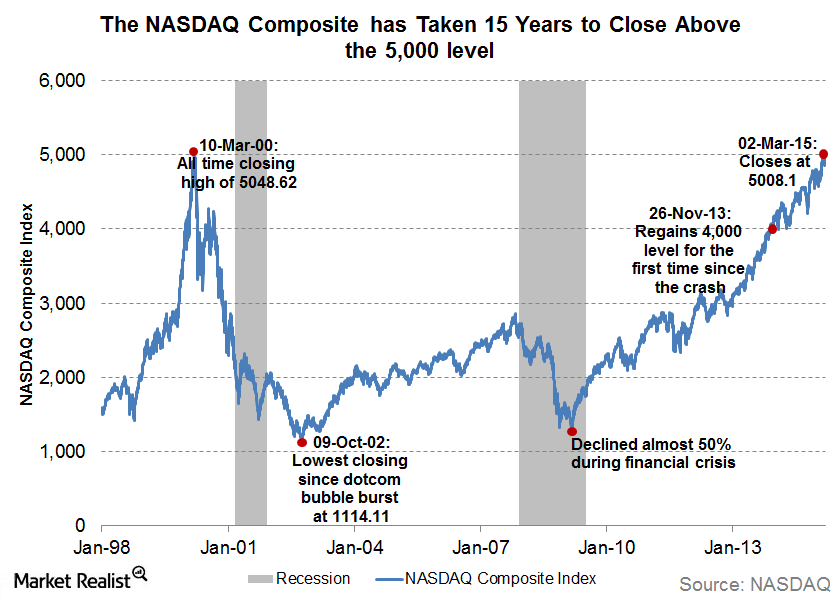

Why the NASDAQ’s 5,000 Level Is Not Like the Dot Com Bubble

The NASDAQ hit the all-important 5,000 level on March 2, 2015, for the first time after the dot com bubble burst of 2000.

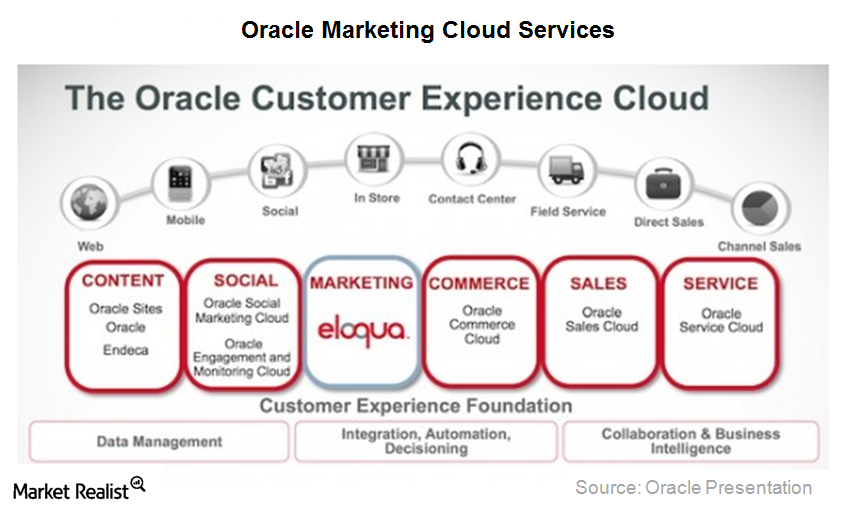

Why Oracle’s Marketing Cloud is integral to its growth

Oracle’s Marketing Cloud allows customers to run marketing campaigns and manage data related to those campaigns on web, social, mobile, and email.

Could the Model Y Change Tesla’s Profit Game?

This year, Tesla (TSLA) stock has fallen 21.3%, underperforming broader markets. Let’s look at how Tesla’s Model Y could turn things around.

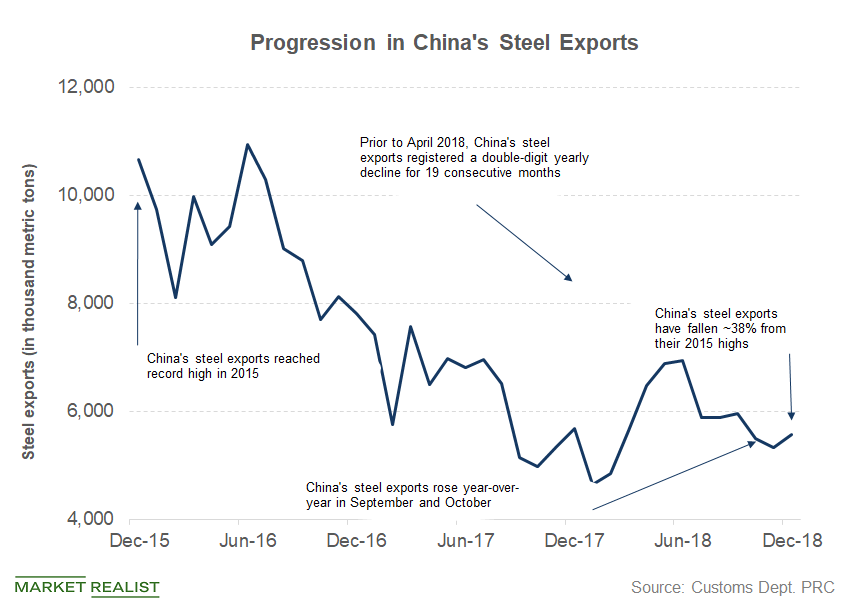

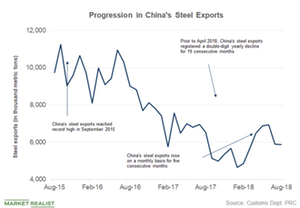

How to Counter China: Steel Could Show the Way

China (FXI) exported 5.56 million metric tons of steel in December, a yearly fall of 1.9%.

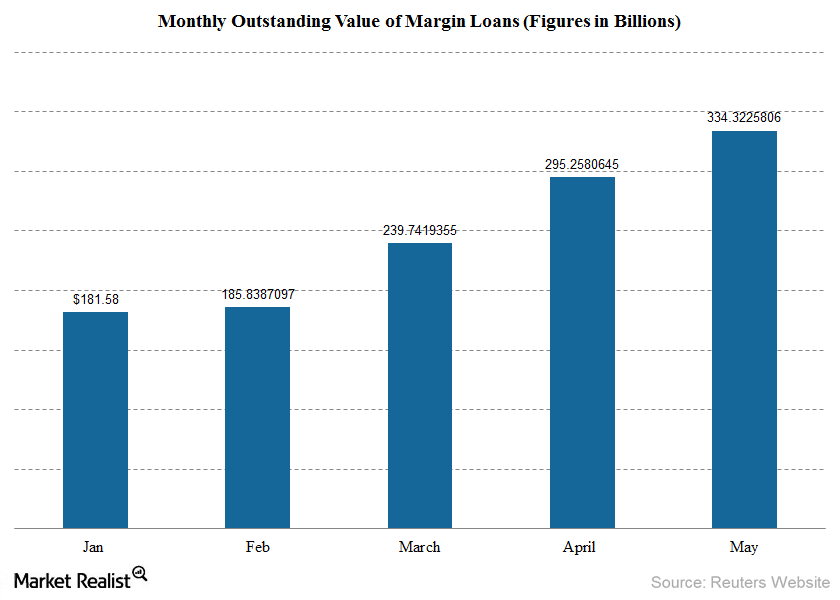

Is the Worst Over in the Chinese Stock Market?

The Chinese stock market rose by 150% 15 months before June 2015. Approximately 12 million Chinese citizens opened trading accounts in May 2015 alone.

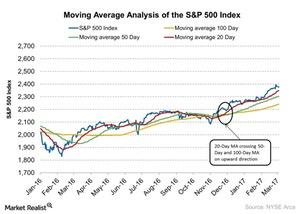

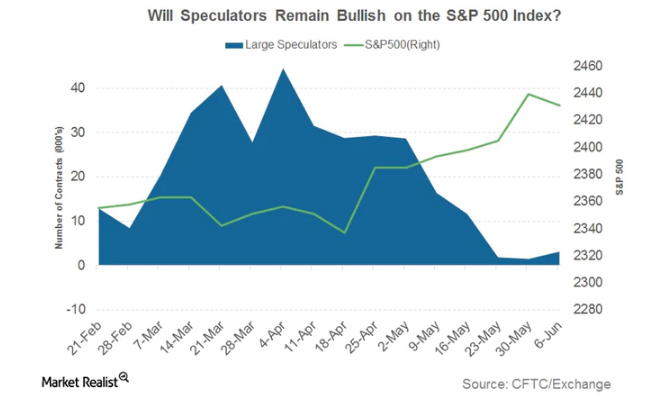

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

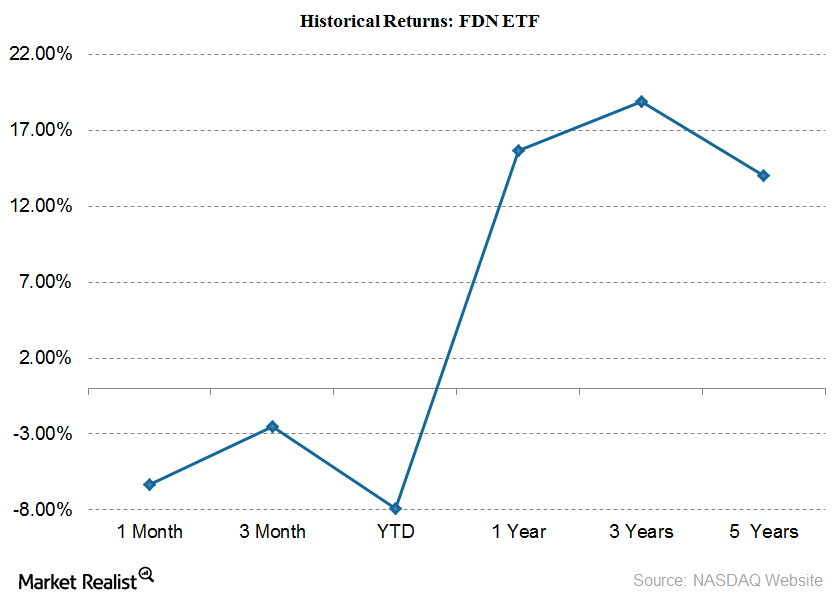

FDN Sees Huge Fund Inflows in Trailing 12-Month Period

In the trailing 12-month period, net fund inflows were $2.3 billion. FDN’s fund flows in the trailing one week and trailing three months were -$105.7 million and $719.3 million, respectively.

Trump Thinks Fed’s ‘Ridiculously Timed’ Rate Hikes Hurt GDP

Last Friday, President Donald Trump in a tweet called the Federal Reserve’s interest rate hikes a mistake.

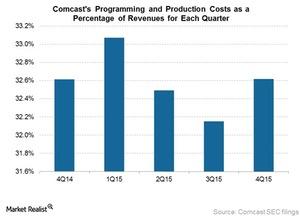

Why Does Comcast Expect Programming Costs to Rise in Fiscal 2016?

On March 8, 2016, the Wall Street Journal reported that Comcast and the YES Network were locked in a dispute regarding the carriage fee for the YES Network.

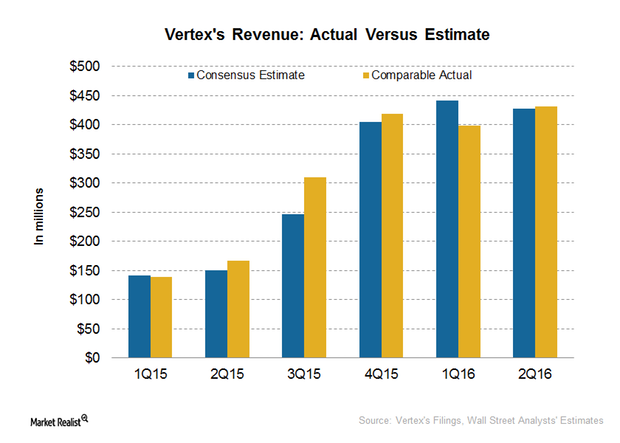

How Vertex’s Revenue and Earnings Surprised in 2Q16

Vertex Pharmaceuticals (VRTX) reported its 2Q16 earnings on July 27, 2016. VRTX surpassed Wall Street analysts’ projections and reported revenue of $431.6 million.

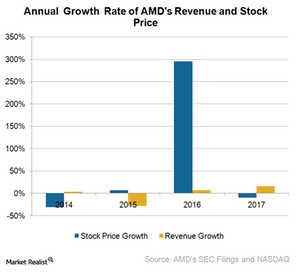

Where AMD Stands Today in the Tech Transition

Calendar 2017 was a turnaround year for Advanced Micro Devices (AMD) as it moved from losses to profits.

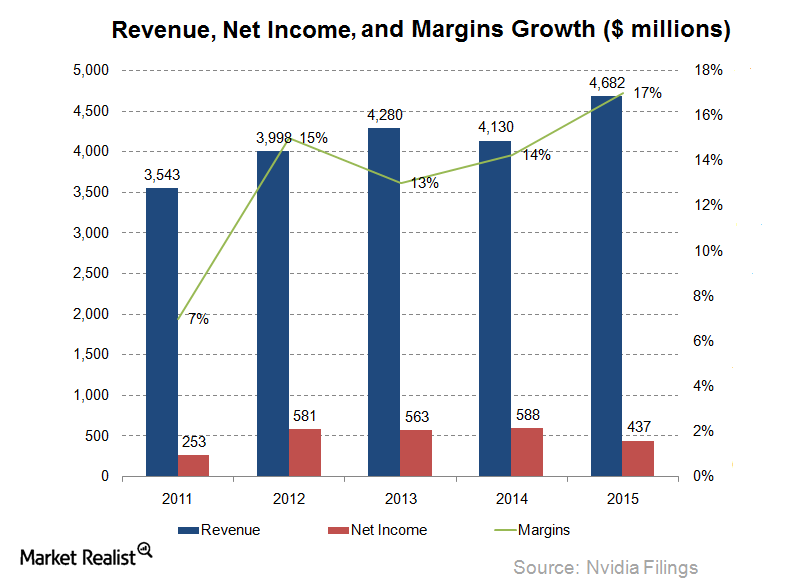

What margins, financials say about Nvidia’s growth prospects

PC gaming and accelerated computing played strong roles in the expansion of margins for Nvidia.

What’s Leon Cooperman’s Largest Position?

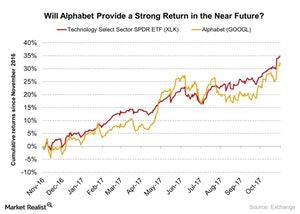

Alphabet reported its 3Q17 earnings on October 26, 2017. The company posted EPS (earnings per share) of $9.57, which beat analysts’ estimates of $8.33.

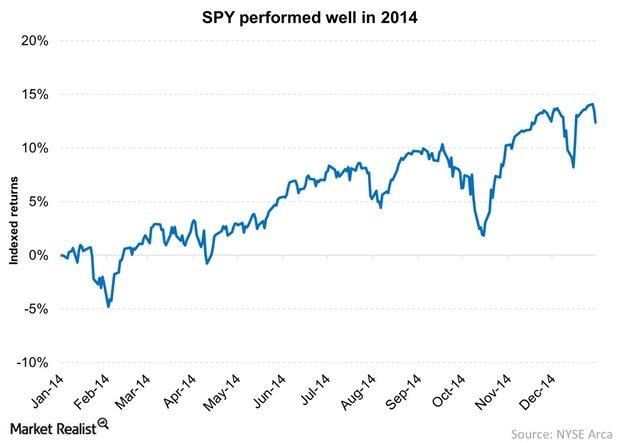

Why The US Saw Positive Fund Flows In 2014

The US saw positive fund flows in 2014 due to a relatively better economic position.

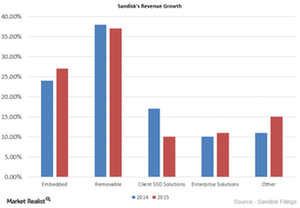

SanDisk Announced 3Q15 Earnings October 21: Reaction Is Positive

SanDisk (SNDK) announced its 3Q15 earnings on October 21, 2015. The market reaction was positive, which showed a marginal increase of 0.16% in after-hours trading.

US Businesses Push Back against Trump’s Tariffs

Farmers for Free Trade’s campaign was rolled out on September 12 with the slogan “Tariffs Hurt the Heartland.”

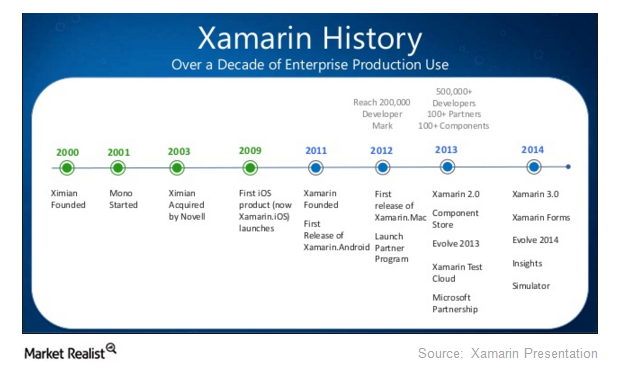

Microsoft Infiltrates the Mobile App Space: The Xamarin Acquisition

On February 24, Microsoft announced that it will acquire Xamarin, a mobile app platform provider. Financial details of the deal were not disclosed.

How Will the Fed Affect the Earnings Recovery Environment?

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

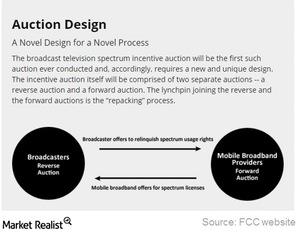

What Is Dish Network’s Wireless Spectrum Strategy ?

Dish Network (DISH) has filed an application with the FCC to participate as a potential spectrum bidder.

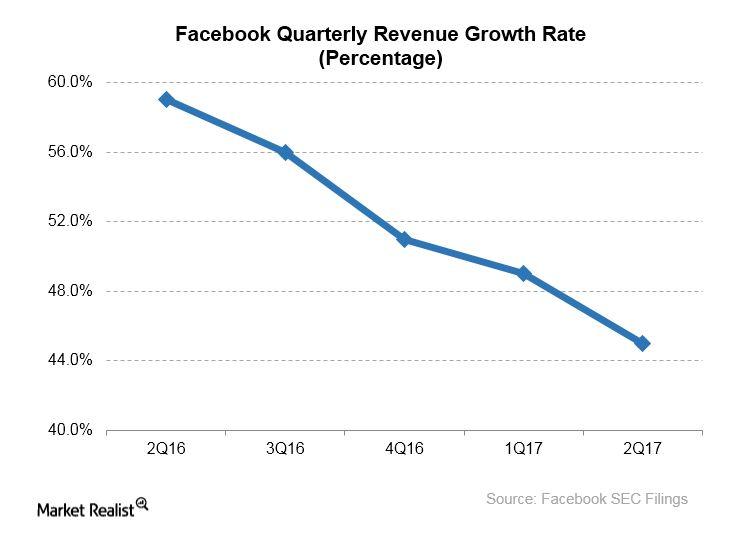

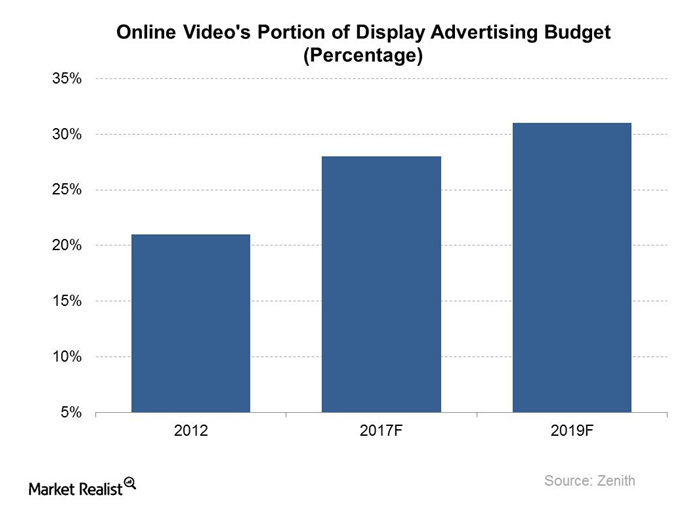

Music-Label Deals Could Also Help Facebook’s Video Ambitions

Facebook has been concentrating its efforts on video for a long time now. It has ambitions of becoming the number one player in the video ad market.

Will We See a Recession within the Next 2 Years?

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”

Why Larry Fink Thinks Markets Could See Some Setbacks

In a recent interview with CNBC, Larry Fink, CEO of BlackRock (BLK), shared his views on market movement, the US economy, and the dangerous impact of the lower interest rates.

What Facebook Was Aiming for with Its Stock Reclassification

In this series, we’ll review updates in the US Internet space and discuss some of the current issues faced by companies in the industry.

Will Oracle Continue to Outperform the S&P 500 Index?

Earlier in this series, we discussed the factors that might impede Oracle’s (ORCL) dominance in the database space, which is also the company’s cash cow.

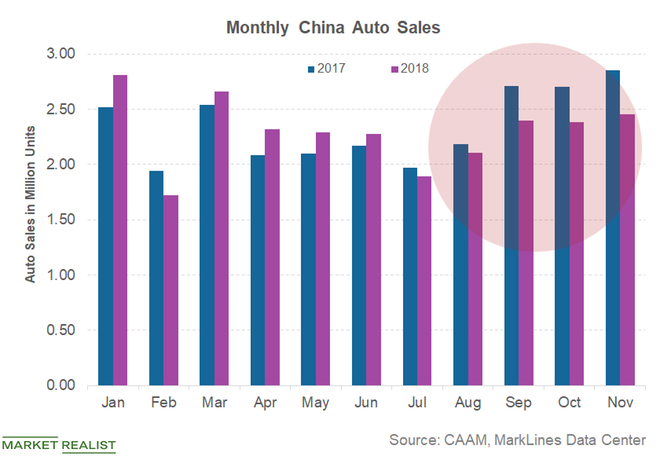

Can China Recover Like It Did in 2016?

In some aspects, 2018 looked like 2015 for investors. Like in 2015, China’s (BABA) slowdown spooked investors in 2018.

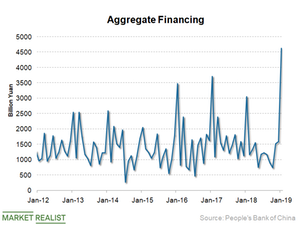

Can China Manage Growth without Fueling a Debt Crisis?

While there is no denying that China (FXI) needs stimulus measures to kickstart its slowing economy, any propping up needs to be done in a way to avoid another debt-fueled crisis.

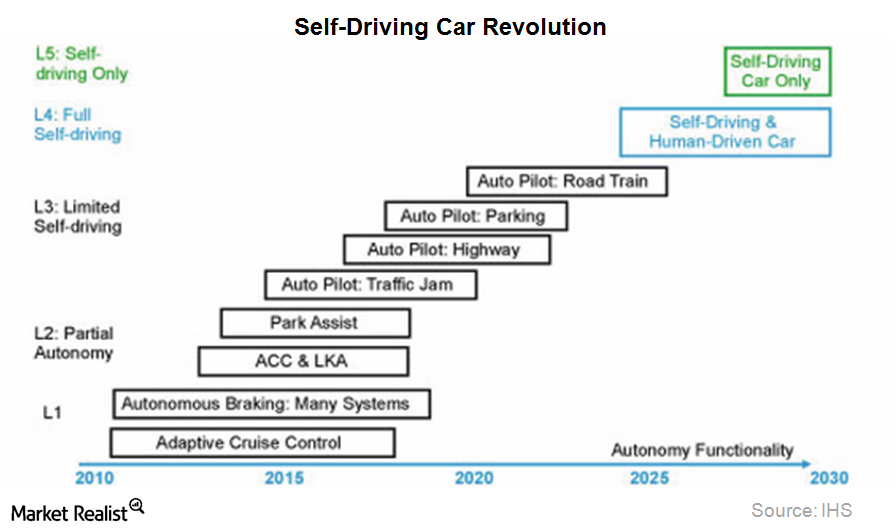

Google Could Put Self-Driving Cars on the Roads by Summer 2015

With a fleet of almost 20 self-driving cars, Google now averages ~10,000 self-driving miles per week. Google claims that its cars have 75 years of US adult driving experience.

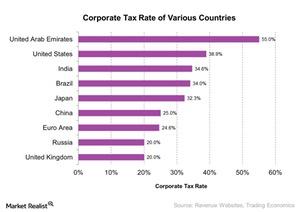

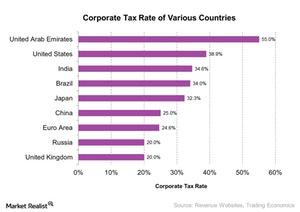

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

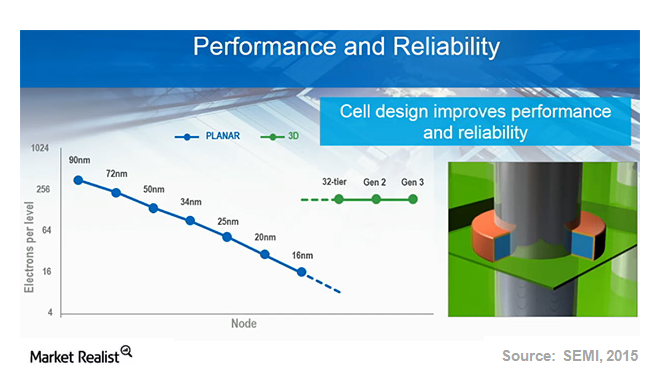

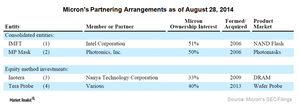

Micron Targets 3D NAND to Raise Its Visibility in the NAND Space

Micron (MU) in its fiscal 3Q15 presentation stated that it plans to start volume production of 3D NAND by the end of 2015.

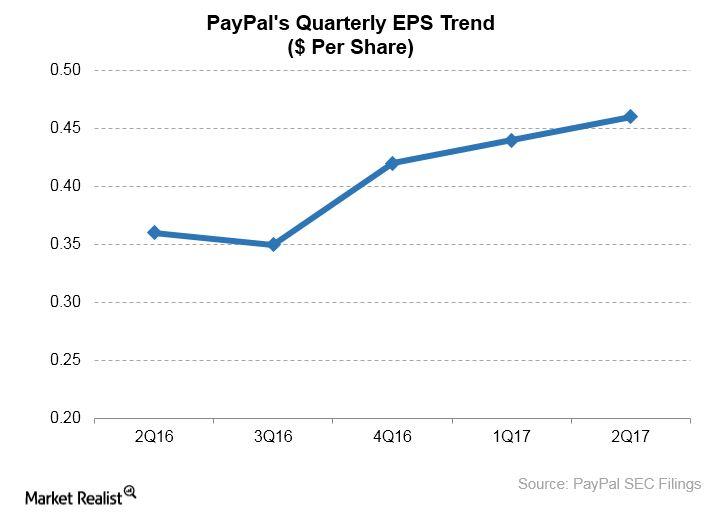

Why Investors Are Pleased with PayPal

PayPal (PYPL) has done very well since splitting from its parent, eBay (EBAY), two years ago.

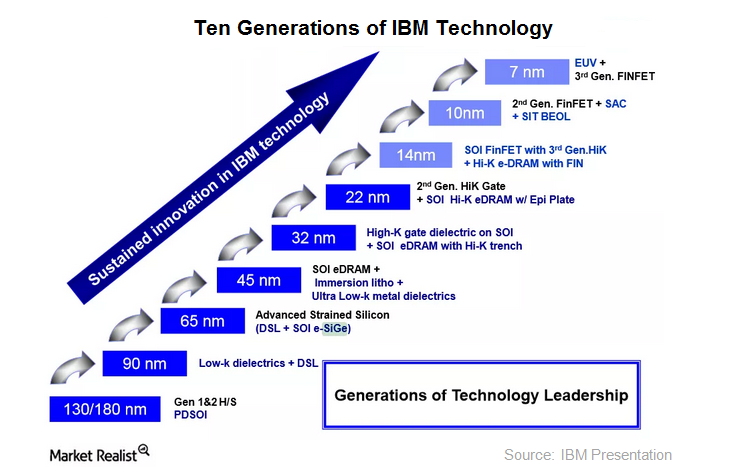

Why Have IBM’s 7-nm Chips Created Such Excitement?

With the development of 7-nm chips, IBM has surpassed Intel, which is still working on 10-nm chips.

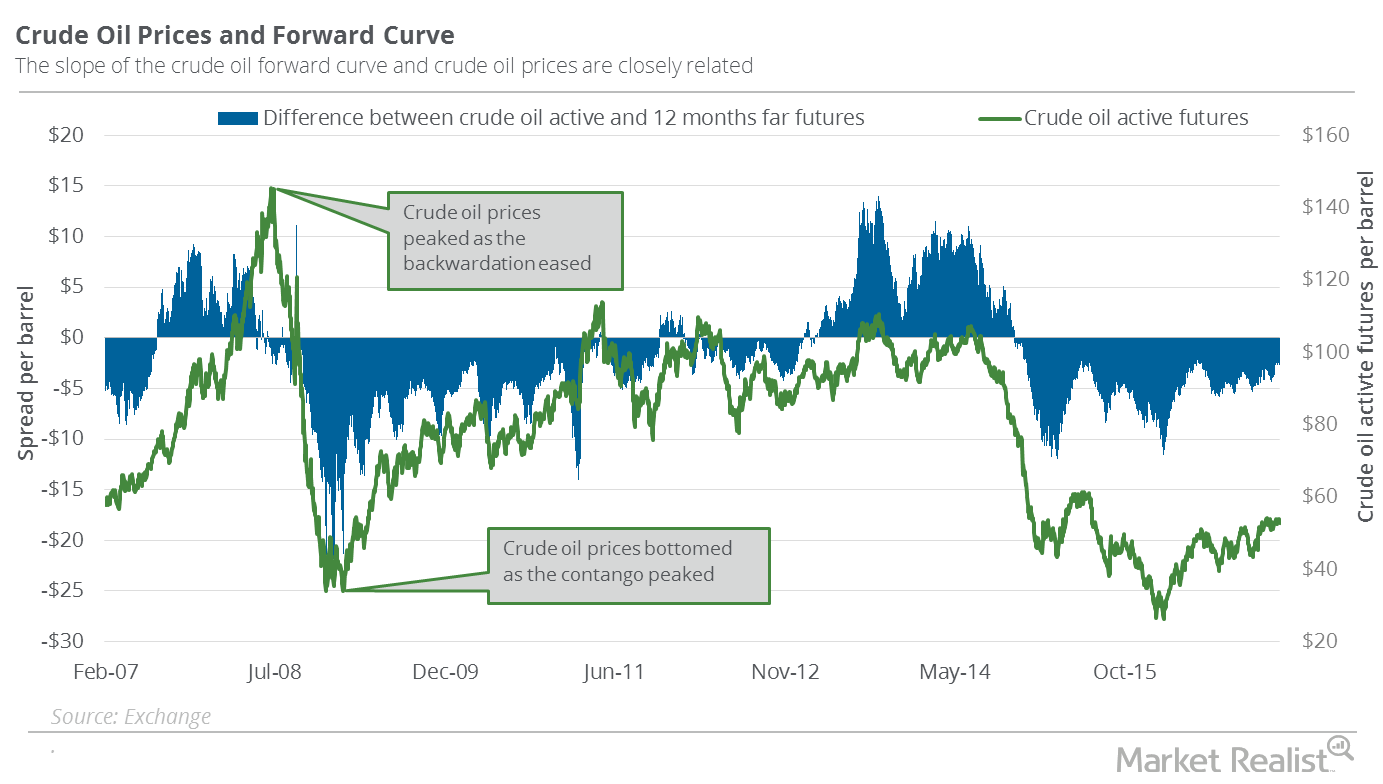

Backwardation: What It Could Mean for Crude Oil Prices

When the crude oil futures forward curve to slopes downwards, the situation in the crude oil futures market is called “backwardation.”

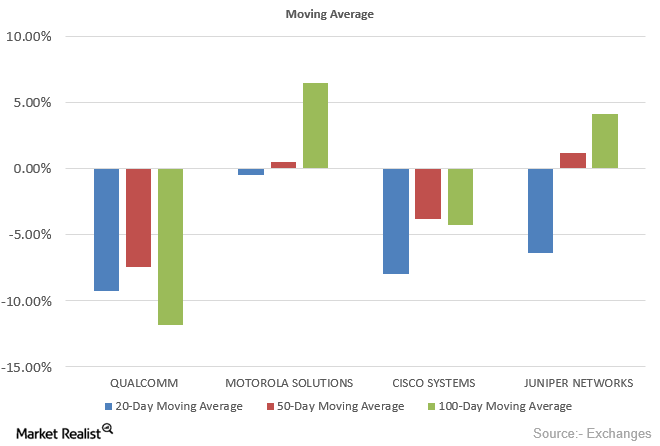

What Are Analyst Recommendations for Qualcomm?

Of the 35 analysts covering Qualcomm (QCOM), 18 have given it a “buy” recommendation, two a “sell” recommendation, and 15 a “hold” recommendation.

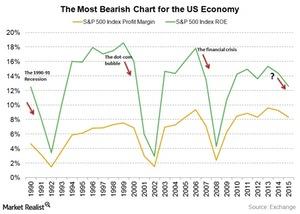

Why the S&P 500 Net Profit Margin May Predict a US Recession

Over a good four decades, the S&P 500’s net profit margin has fallen notably when the economy was on the verge of, or already into, a recession.

Inside Facebook’s Top 3 Priorities

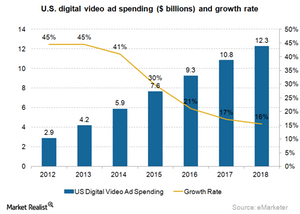

Investment research firm Zenith estimates that worldwide spending on online video ads rose 23.0% to $27.2 billion in 2017.

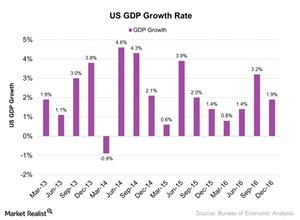

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

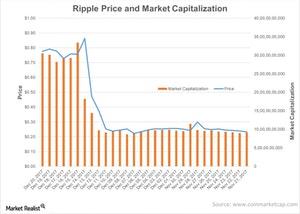

Ripple Crosses $1 for the First Time on December 21

For the first time in history, the price of ripple has surpassed $1.

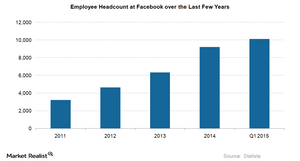

Where Is Facebook Investing Heavily?

Facebook has been hiring new talent and investing heavily in improving user experience on Instagram, WhatsApp Messenger, and Messenger. Instagram is expected to churn big money for Facebook.

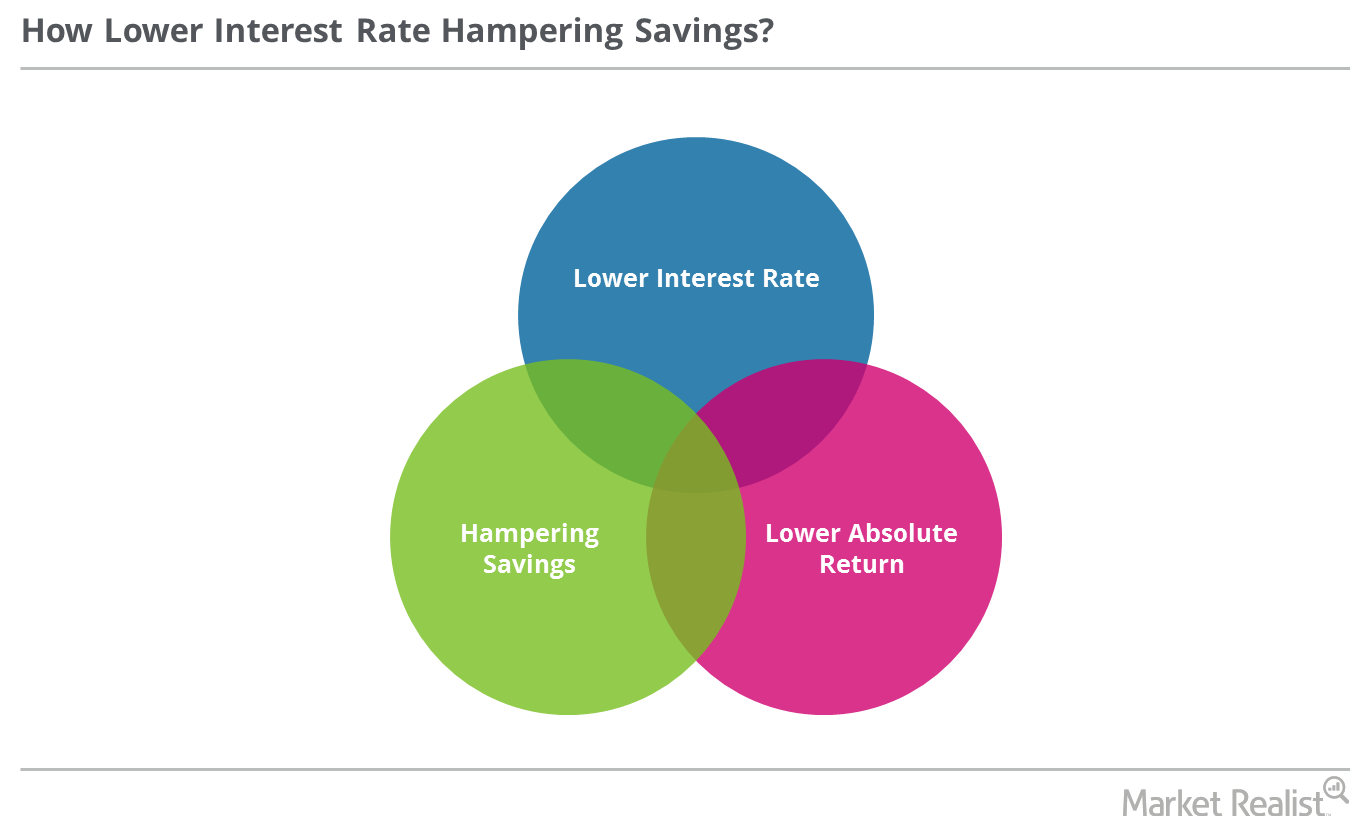

Larry Fink Says Lower Rates Hampered Savings around the World

Various central banks in developed nations (EFA) have lowered their key interest rates close to the zero level to revive their economies.

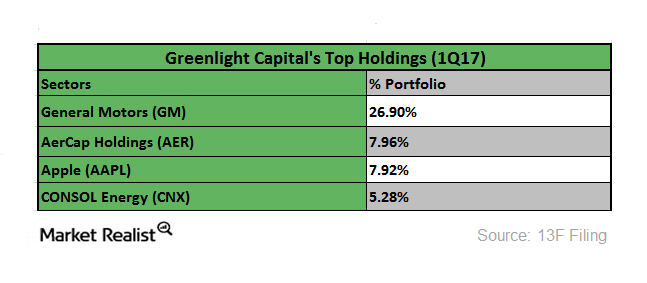

Inside Einhorn’s Greenlight Capital’s Top Holdings

Billionaire hedge fund manager David Einhorn is well known for his investment strategy, having advised long and short bets during different market scenarios.

An Instructive Rundown of Micron’s Business Strategies

Two business strategies that Micron can use to beat competition include innovating processes that reduce costs and developing next-generation products.

George Soros Buys Slack, Increases SPY Short Exposure

The 13F filing showed that George Soros bought almost 500,000 Slack (WORK) shares at an average price of $37.5 per share during the second quarter.

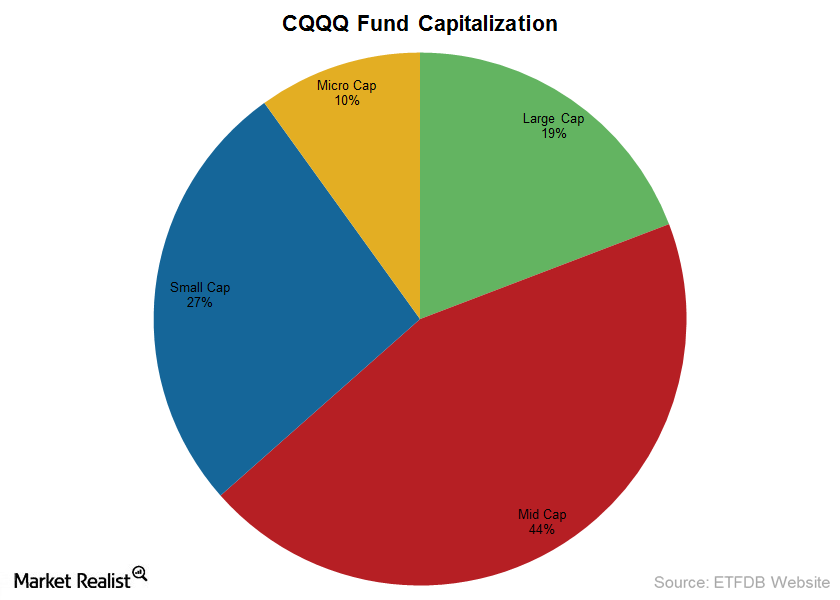

An Analysis of the Guggenheim China Technology ETF (CQQQ)

The Guggenheim China Technology ETF (CQQQ) is a passive fund that looks to replicate the AlphaShares China Technology Index.

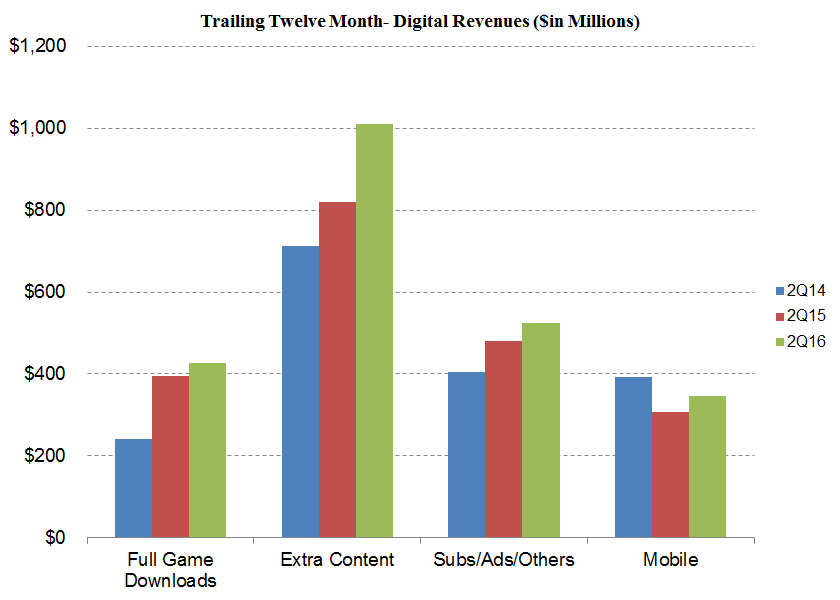

Micro-Transactions Are an Important Strategy for Electronic Arts

Accounting for over $200 million in revenues, micro-transactions present users with the opportunity to buy items that enhance their gameplay.

What Were the Top Holdings of Citadel Advisors in Q3?

In Q3 2019, Citadel Advisors’ portfolio of publicly traded securities was worth $212.04 billion. In Q2 2019, its portfolio was worth $155.1 billion.

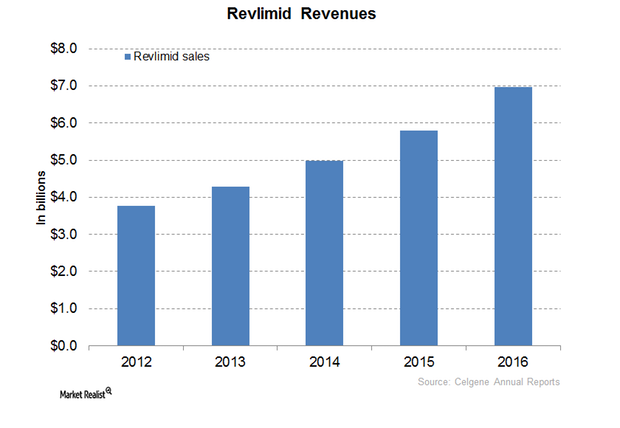

Revlimid Could Continue to Drive Celgene’s Revenue Growth in 2017

In 2016, Celgene’s (CELG) Revlimid generated revenues of around $6.9 billion, which reflected a ~20% year-over-year (or YOY) growth.

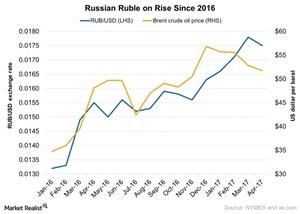

Why the Ruble Is on the Rise

The recovery of oil prices in the latter half of 2016 has helped the Russian ruble to appreciate along with improved exports.

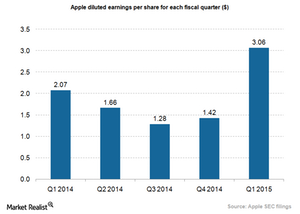

Apple beats all estimates to produce stellar fiscal 1Q15 results

In December 2014, the success of iPhone 6 and Plus helped Apple beat Google’s Android-based smartphones in terms of market share in the US.

Worried about a US Stock Market Crash? So Is Everyone!

Investors are concerned that US stock markets might crash. Notably, markets have staged a remarkable comeback from their March lows.

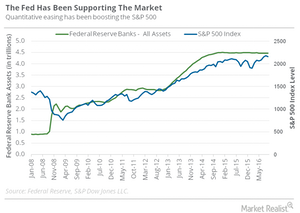

Jeffrey Gundlach: The Fed Has Been Supporting the S&P 500

Gundlach also believes it’s interesting to look at the correlation between the size of the Fed’s balance sheet and the S&P 500 (SPY) (SPXS) (SPXL) level.