PowerShares QQQ ETF

Latest PowerShares QQQ ETF News and Updates

Consumer Must-know: Why did Amazon launch a mobile credit card reader?

For example, Amazon (AMZN) recently launched a credit card reader. Merchants can use it to conduct payments through a smartphone or tablet.

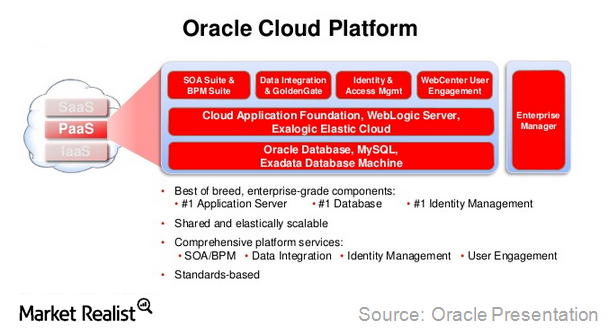

Oracle Unveils a Range of Cloud Offerings

Oracle’s newly launched cloud offerings are a step forward in Oracle’s strategy to shift its database and CRM business to the cloud.

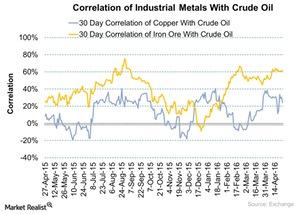

Analyzing the Correlation of Crude Oil and Industrial Metals

In the past year, US crude oil was more correlated with iron ore than copper. In August 2015, the correlation between crude oil and iron ore touched 75.5%.

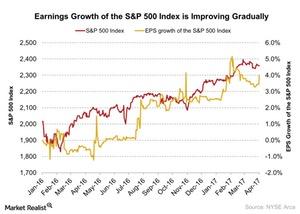

Jurrien Timmer’s Take on What Will Drive Markets the Most in 2017

When asked in a recent interview his thoughts about the short-term and medium-term investment story, Jurrien Timmer said that the main issue for the market other than geopolitical risks is its valuation.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

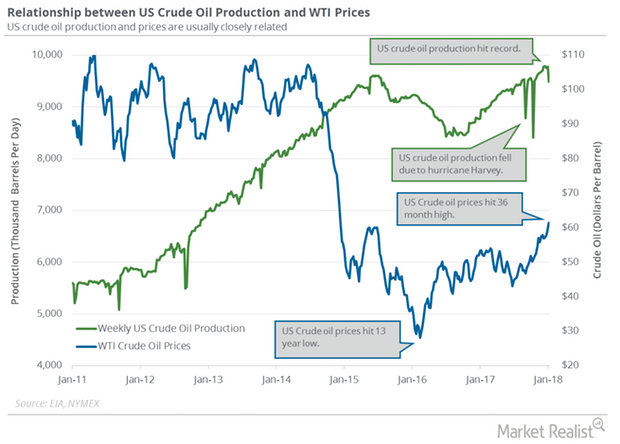

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

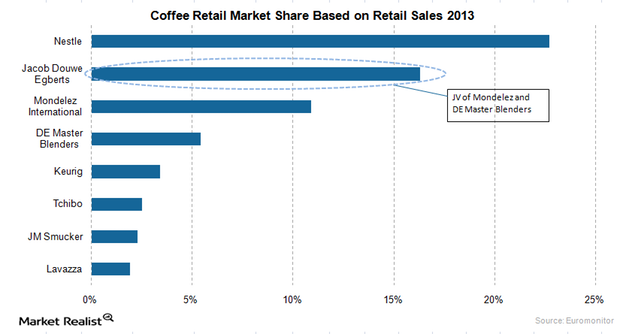

JAB to Challenge Nestle, Global Leader of Portioned Coffee Market

JAB’s share in the global coffee market is estimated to reach approximately 20% with the addition of Keurig’s brands and products to its portfolio.

Tesla Institutional Investors: Who All Sold Too Early?

In 2019, Tesla (TSLA) rose 29.3%. The S&P 500 Index gained 29.2%. The top institutional investors were bullish on the electric car manufacturer in Q3 2019.

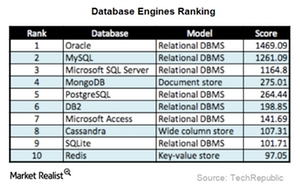

Oracle’s Database Cost Is Its Best Defense in Open Source Space

Except for Oracle’s relational databases, all other databases—especially MySQL—are losing to NoSQL databases.

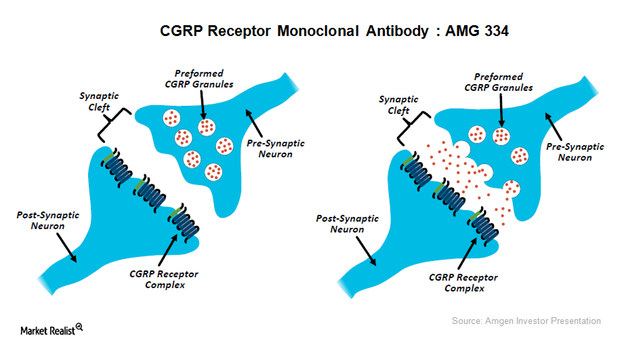

Entering Migraine Market Won’t Be Easy for Novartis, Amgen

Novartis (NVS) and Amgen (AMGN) recently announced that the CGRP inhibitor therapy, AMG 334, reported positive results in a Phase 2 clinical trial as a therapy for preventing chronic migraine.

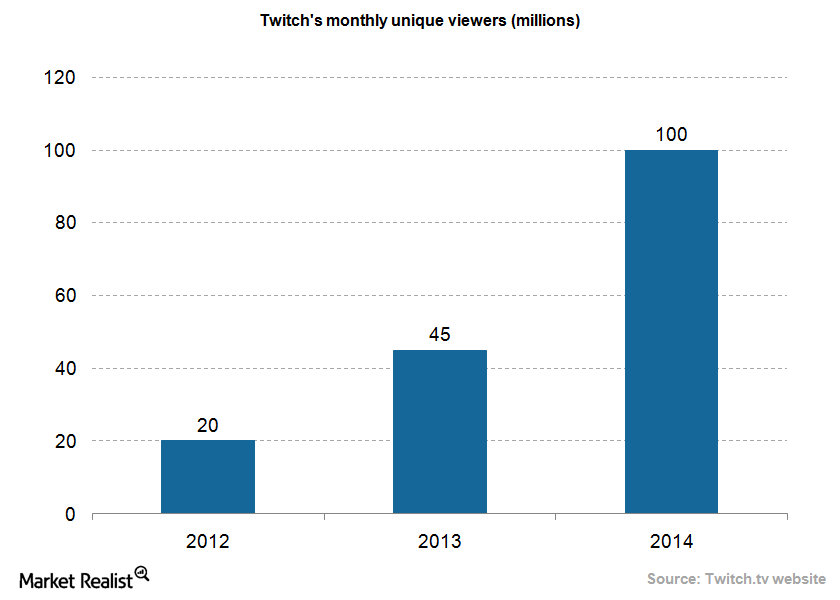

Twitch More than Doubled Its Monthly Active Users in 2013 and 2014

Tthe number of monthly unique visitors on Twitch’s platform has increased from 20 million in 2012 to 45 million in 2013 to 100 million in 2014.

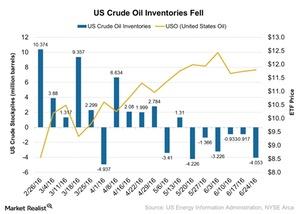

US Crude Oil Inventories Fall Again: How Is Crude Oil Reacting?

According to the U.S. Energy Information Administration’s report on June 29, 2016, US crude oil inventories fell by 4.1 MMbbls in the week ended June 24, 2016.

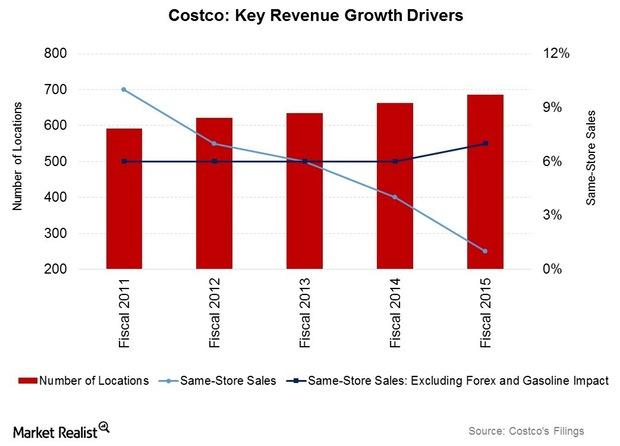

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

A Much-Needed Step towards an Eco-Friendly Ferrari

Ferrari (RACE) launched its ambitious first hybrid, LaFerrari, in 2013.

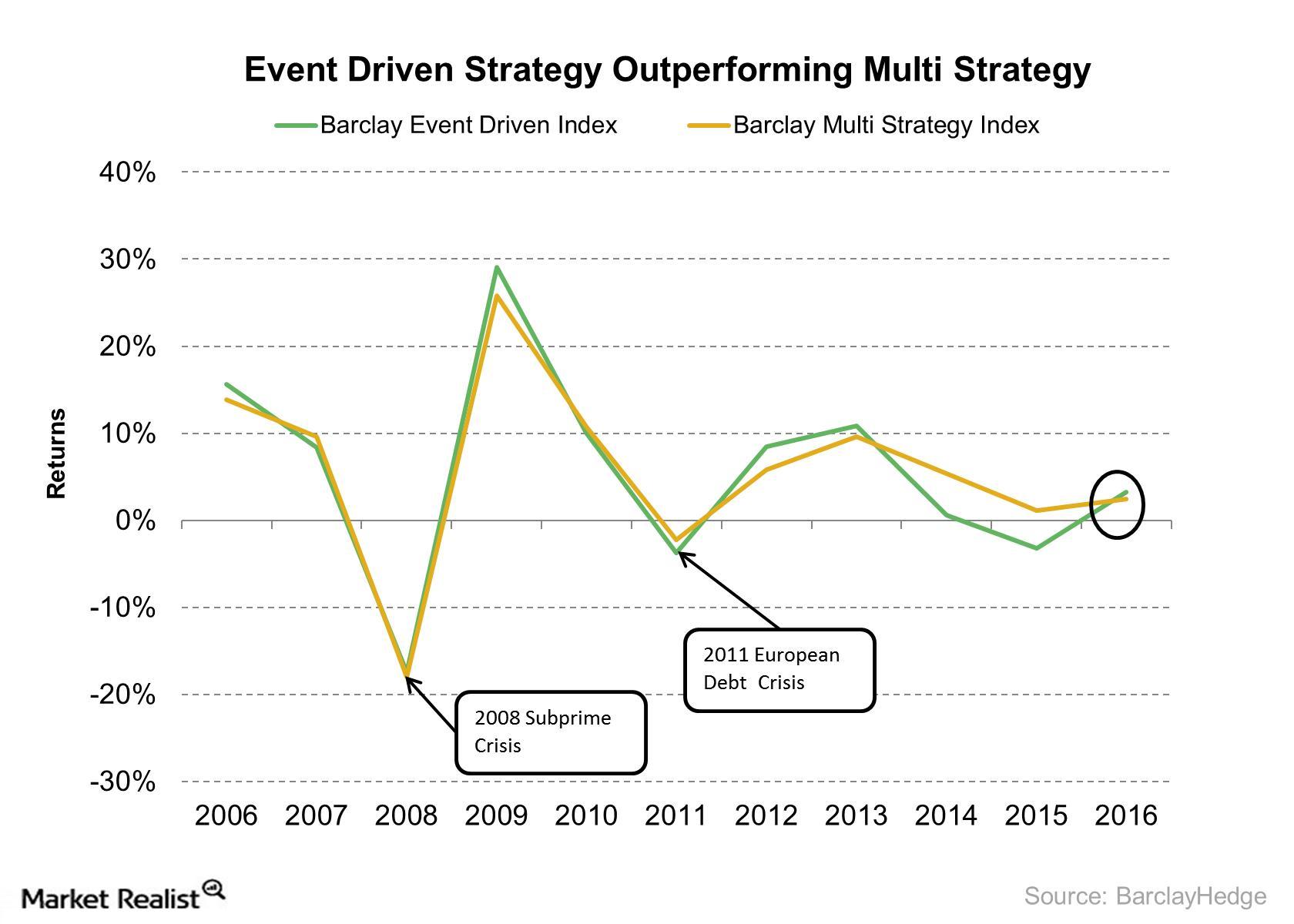

Event-Driven Strategy in a Volatile Market

Event-driven strategy is designed to make an investment in special situations, including mergers and acquisitions, restructuring, split-offs, bankruptcy, and other major events.

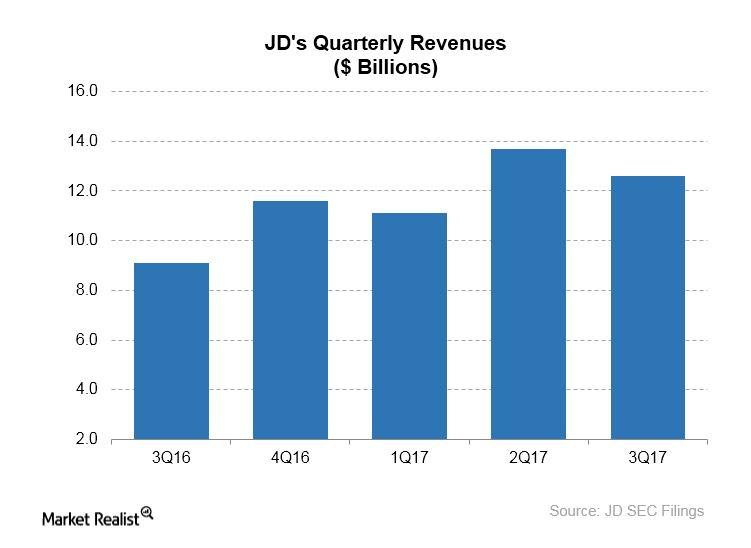

Inside the Expanded JD-Tencent Partnership

China-based online retailer JD.com and social media and digital payments provider Tencent recently announced that they were expanding their partnership.

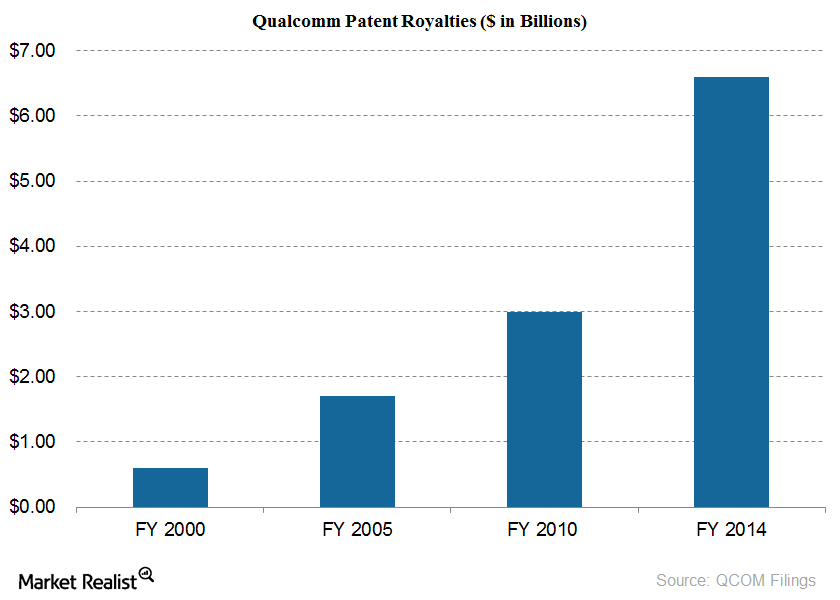

Fair Trade Commission Investigates Qualcomm’s Licensing Practices

According to the Korea Fair Trade Commission’s Case Examiner’s Report, Qualcomm’s practice of licensing its patents at the device level violates Korean competition law.Energy & Utilities Must-know: Is the utilities sector a bond market proxy?

It’s important to note that higher real yields, not rising inflation, are driving today’s higher nominal yields as investors are demanding more compensation for holding bonds

JPMorgan Chase’s 2020 Market Outlook

On Wednesday, JPMorgan Chase’s strategists discussed the market’s 2020 outlook. These strategists expect stocks to rise next year, while gold could decline.

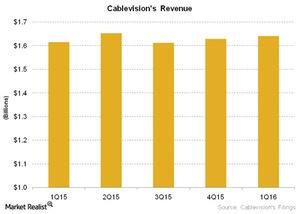

What Kind of Growth Does Altice Expect for Cablevision?

On a YoY (or year-over-year) basis, Suddenlink’s revenue rose ~6.7% to reach ~$0.63 billion in 1Q16.Financials Why unemployment data moves bond yields

Private and government construction both reported declines. The construction value chain has a multiplier effect on other sectors of the economy, and can significantly impact both stock and bond markets.

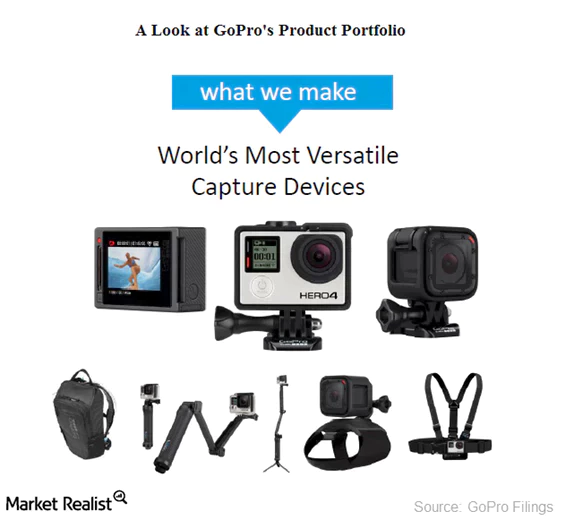

Why GoPro Is So Optimistic about HERO5

Although GoPro missed revenue estimates in 4Q16, it was still the firm’s second-best-performing quarter in revenue, primarily driven by HERO5 sales.

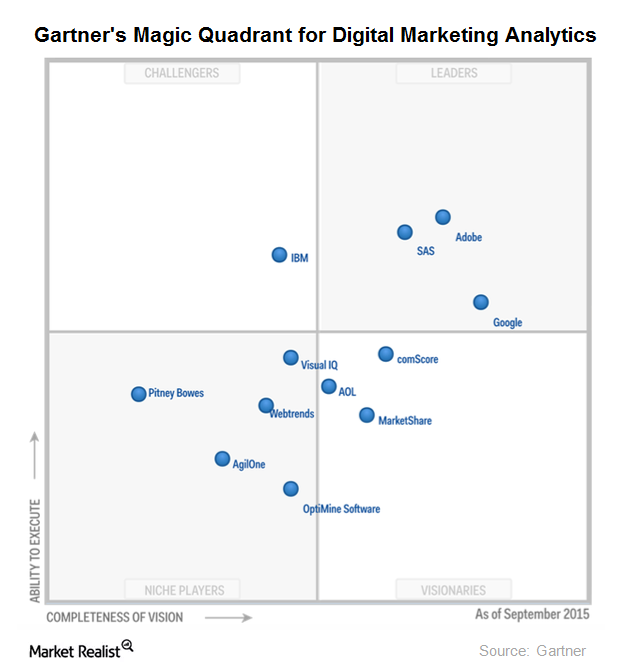

Competition Has Heated Up in the Marketing Cloud Space

Oracle has stated that Maxymiser—its recent acquisition in marketing cloud—will enhance its offering to manage marketing programs spanning digital channels and customer lifecycle.

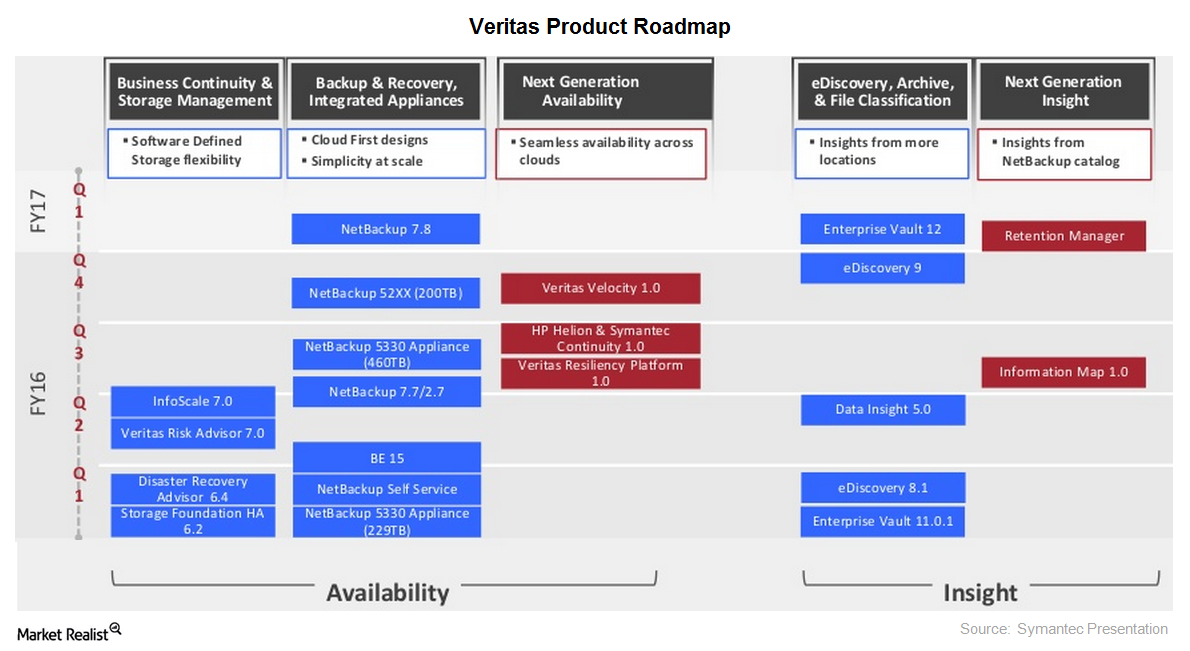

Symantec: Information Management Didn’t Grow in Fiscal 1Q16

In fiscal 1Q16, Symantec’s Information Management—Veritas—posted revenue of $587 million. This was a fall of 10% on YoY (year-over-year) basis.

Can NIO Stock Recover After Falling into Bear Territory?

NIO stock has closed with losses for two days now and is down 21.2 percent from its high of $16.44 on Monday. Can NIO get out of bear market territory?

Will Fox’s ‘Biggest Story of 2016’ Be Important Driver for 2017?

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about the “biggest business story of 2016.”Company & Industry Overviews Why NVIDIA’s GPU is an integral part of its growth

Since GPUs are installed into every system or PC before they’re shipped, they indicate the PC market’s health. The Gaming PC segment requires higher-end GPUs.

Will US Stock Markets Crash? IMF and Rogers Weigh In

Several analysts have said that US stock markets are ripe for a crash. They called out the disconnect between financial markets and the economy.

Goldman Sachs Warns about a US Stock Market Crash

Goldman Sachs expects the S&P 500 to crash to 2,400. However, the firm expects the S&P 500 to end the year at 3,000 level.

Options Traders Think AT&T Stock Will Climb Higher

AT&T stock (T) closed trading at $38.10 on December 4, rising 1.44% from the previous trading session, and I’m seeing more upside ahead.Financials Why you should pay attention to Scottish referendum opinion polls

As I write in my new weekly commentary, over the past two weeks, several polls have suggested a realistic chance that the people of Scotland will vote for independence in this week’s referendum.Financials Overview: Investment-grade bond ETFs

U.S. investment-grade bonds can provide investors with a safe and steady income stream. They’re issued by the U.S. Department of the Treasury and corporates. The issuers have a very high ability to service the debt issued. There’s little risk of default.

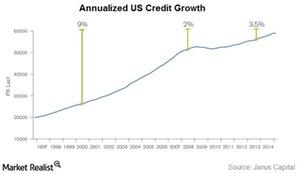

Bill Gross: Credit Is the Oil That Lubes the System

Currently, we’re in a highly levered system, especially the developed world. A levered economy depends on continued credit creation for stability and growth.

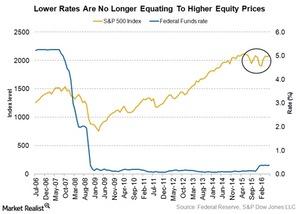

Lower Rates Aren’t Equating to Higher Equity Prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy. They have also lost their efficacy in raising equity prices.

Bill Gross: Possibility of Deglobalization in the Economy

Gross warned about deglobalization in the global economy. Trade between nations, exacerbating immigration issues, and stagnant economic growth formed his belief.

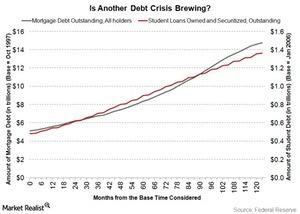

Is Student Debt the Next Bubble to Hit the US Economy?

Many are likening the current student debt situation in the United States to the mortgage debt situation that led to the 2009 financial meltdown in the US economy.

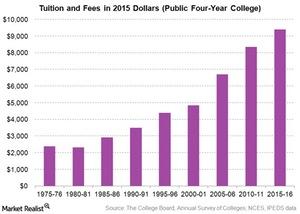

Why Is College Education So Expensive in the United States?

The rise in delinquencies on student loans in the United States (SPY) (IWM) (QQQ) can be partially attributed to the accelerated rise in college tuition and fees.

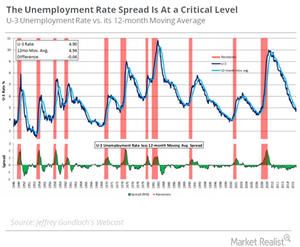

Gundlach Says This Chart Is ‘Early Warning Indicator’ of Recession

Jeffrey Gundlach seems quite bearish in his views about the US economy (IWM) (QQQ).

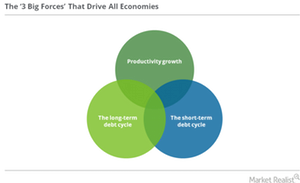

The ‘Three Big Forces’ That Drive All Economies

The “three big forces” Ray Dalio believes that “three big forces” drive all economies. These are: productivity growth the short-term debt cycle the long-term debt cycle An economy has to go through upturns and downturns Central bankers need to study the determinants of productivity for their economy. The determinants could include the costs of education, […]

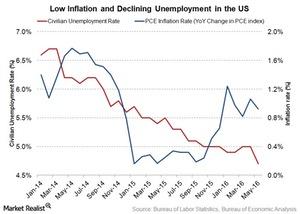

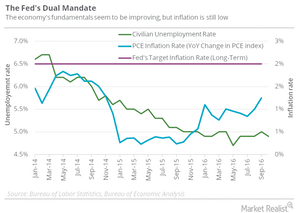

Paul Krugman to the Fed: Don’t Raise Rates

Inflation is moving up towards its target, but it still has a ways to go before it gets there. Paul Krugman believes raising rates could keep inflation from reaching that target.

How Are Citadel Advisors Hedging their Portfolio?

Kenneth Cordele Griffin is the CEO of investment management firm Citadel Advisors LLC. He is the hedge fund manager and he founded Citadel in 1990.

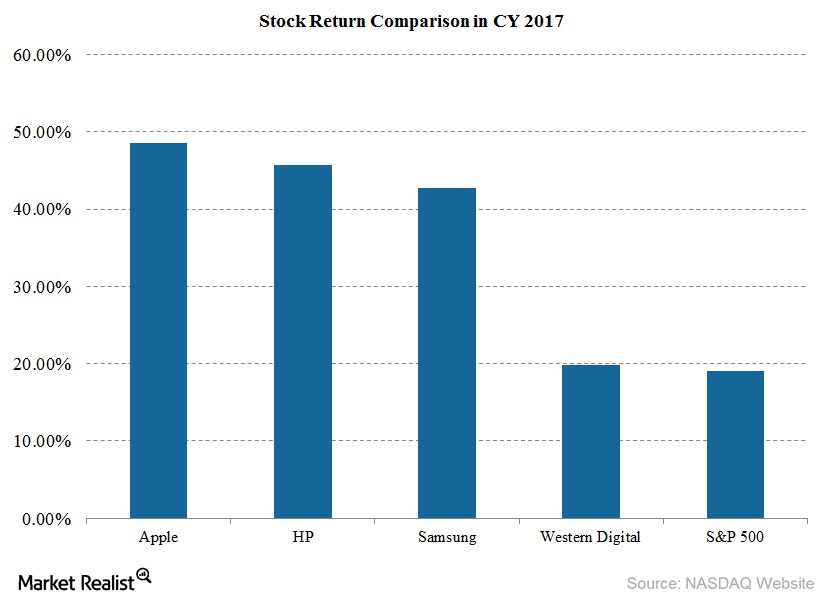

How Apple Stock Performed in 2017

Technology heavyweight Apple’s (AAPL) stock rose 48.5% in 2017 to close the year at $169.23. Its stock has fallen 3.3% in the last five trading days.

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

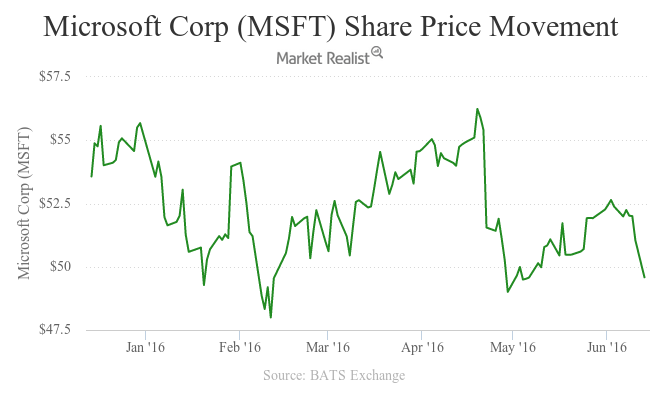

Why Did Microsoft’s Stock Fall after LinkedIn Offer?

After Microsoft’s announcement, LinkedIn’s stock rose 47% to $192.21 while Microsoft’s stock fell 2.6% to $50.14 on June 13, 2016.

How Tesla Plans to Lead in the EV Race in China

Citing Piper Jaffray, CNBC reported on September 26 that Tesla’s China deliveries were up more than 175% year-over-year in the third quarter.

Tesla V10: Do Other Cars Feel Like ‘Owning a Horse?’

On September 26, Tesla (TSLA) rolled out its version 10 software update—its biggest software update ever—which customers were eagerly awaiting.

Trade War Hits Consumer Confidence, Stocks Retreat

Today, the Consumer Confidence Index data fell sharply to 125.1 in September from August’s 134.2. The reading was below the expected 133.5.

Soros Exits, Buffet Increases: Who Is Right on Apple?

In Q4 2018, legendary investor George Soros sold all his holding in Apple (AAPL). In Q3 2018, Apple represented around 0.2% of his total portfolio.

Goldman Sachs: Expect Volatile October, Rising Gold

Yesterday, Goldman Sachs’ strategist warned of high volatility in October. Based on Goldman Sachs’ data, since 1928 volatility in October is 25% higher.

MS: Model Y, Pickup Truck to Drive Tesla’s Market Share

Yesterday, Morgan Stanley analyst Adam Jonas provided his thoughts on Tesla while maintaining his rating and target price on its stock.

Is Trump Hinting at a Currency War?

The currency can be weakened by the central bank or government intervention. If President Trump is reelected, a currency war seems obvious.