PowerShares QQQ ETF

Latest PowerShares QQQ ETF News and Updates

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Kudlow Doesn’t See a Recession, Trump Might Fear One

White House economic advisor Larry Kudlow doesn’t see a looming recession. However, recession fears grew as the yield curve inverted last week.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Ackman Makes Berkshire Bet: What It Means for Investors

According to the regulatory filing from Bill Ackman’s Pershing Square Capital, the fund has taken a new stake in Berkshire Hathaway (BRK.B).

Dow Jones, Boeing, and GE Fall: Hard Landing Ahead?

On Wednesday, US stock indexes fell due to recession signals. The Dow Jones Industrial Average (DIA) was the worst performer with a 3.05% fall.

US Economy: Is It as ‘Great’ as Trump’s Touting?

On multiple occasions, Trump has said the US economy is doing phenomenally well, calling it “the greatest economy in the HISTORY of America.”

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

Morgan Stanley Is Skeptical about the S&P 500’s Upside

Morgan Stanley doesn’t believe the S&P 500’s current breakout above 3,000 will last. It also doesn’t expect Fed rate cuts to rekindle growth.

Why Ray Dalio’s Bridgewater Is Underperforming in 2019

Pure Alpha, the flagship fund of Ray Dalio’s Bridgewater Associates, fell 4.9% in the first half, the Financial Times reported.

Why Wall Street Fell in Love with Electronic Arts Stock

Electronic Arts (EA) gained 6.8% today as of 10:45 AM EST.

Should You Have Taken President Trump’s Advice in December?

Today, US President Donald Trump tweeted, “Best January for the DOW in over 30 years.”

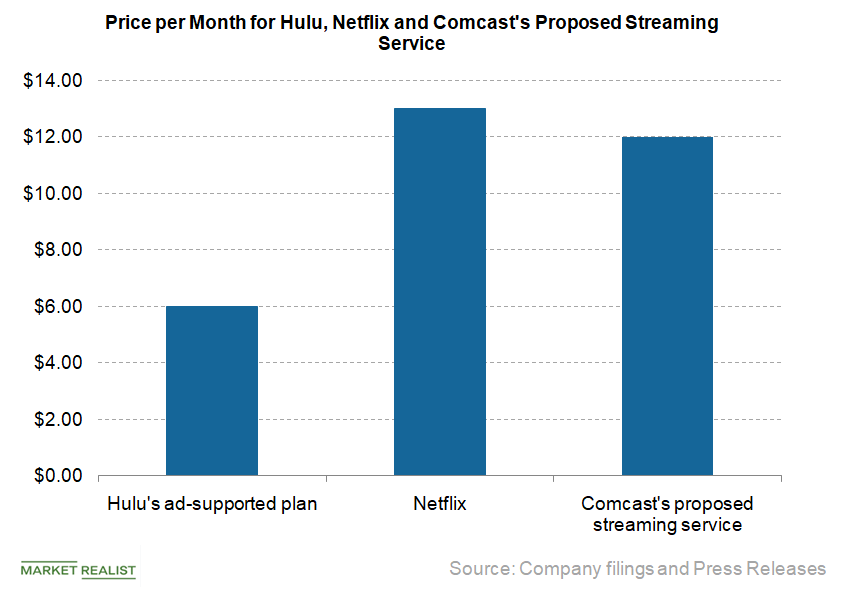

Why Hulu Changed Its Pricing Strategy

According to a Variety report from January 23, Hulu lowered the price of its ad-supported streaming plan from $7.99 per month to $5.99 per month.

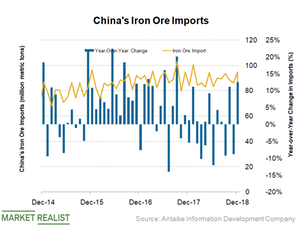

Why China’s Iron Ore Demand Could Soon Weaken

As China consumes more than 70% of seaborne-traded iron ore, it’s imperative for iron ore investors to track the country’s demand and outlook.

Investing Defensively Can Lose You a Fortune

I bet you may have heard a lot about investing defensively while the market faded.

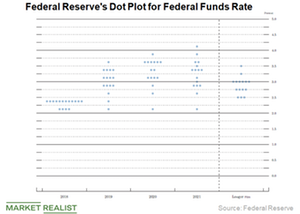

Powell’s Speech Ignites a Rally in Equities and Metals

Markets had been worried about the Fed’s continued aggressive stance on rate hikes, which could shorten economic expansion.

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Why George Soros Bought Amazon and Netflix

Legendary billionaire investor George Soros made some changes in his firm, Soros Fund Management LLC’s, portfolio in the first quarter.

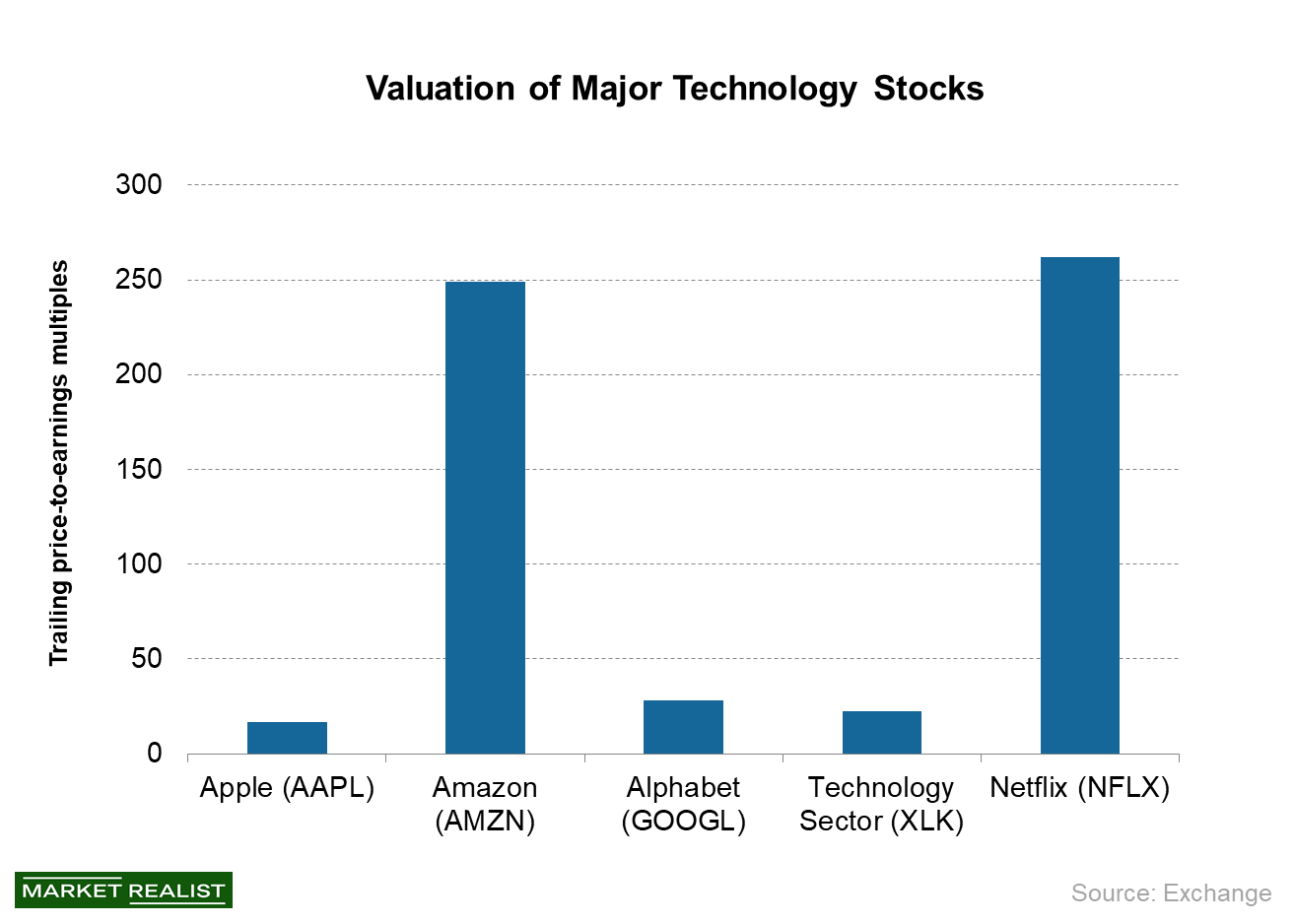

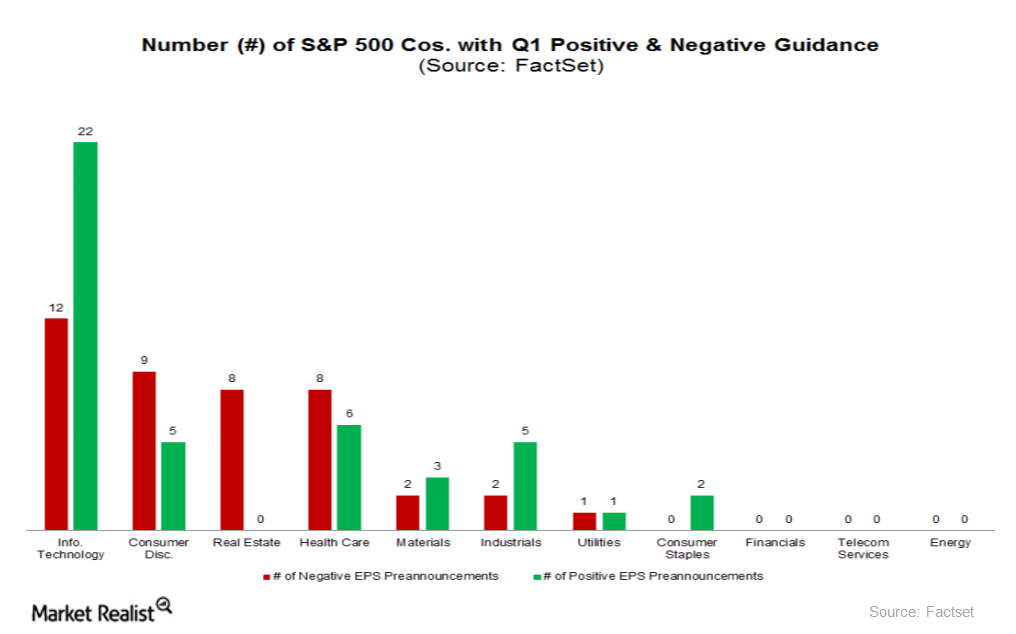

Why Tech Stocks Have High Price-to-Earnings Ratios

Tech stocks with good growth prospects usually trade at a higher PE (price-to-earnings) ratio than the broader S&P 500, which is why they are considered relatively expensive.

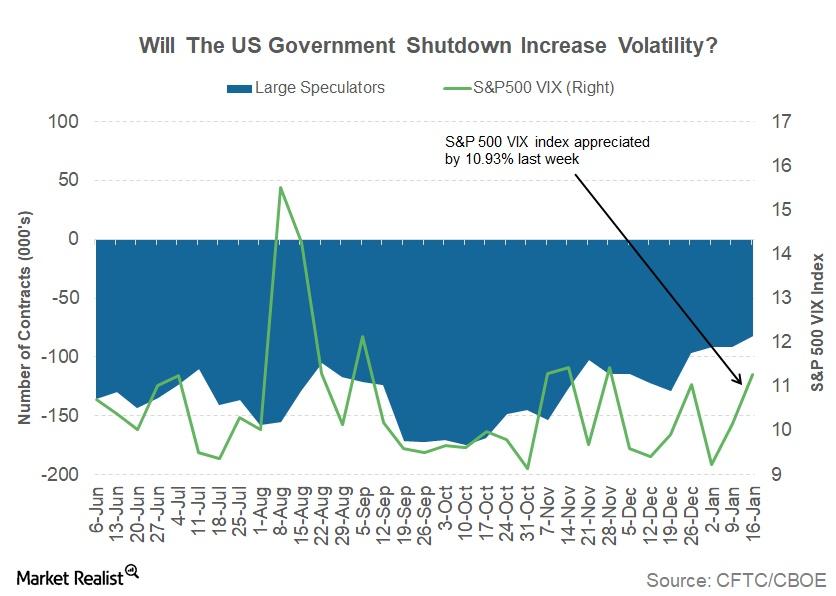

Could the US Government Shutdown Impact Market Volatility?

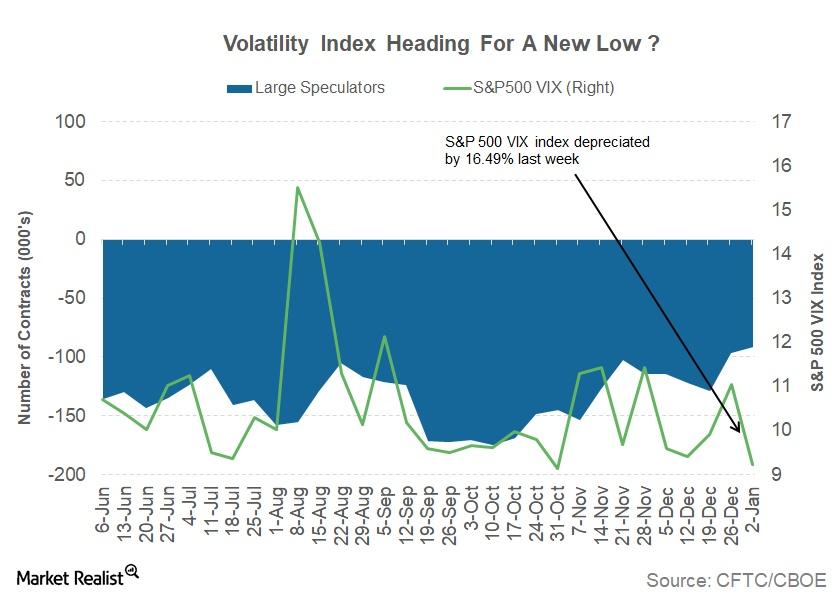

During the week ended January 19, 2018, global markets trended higher despite the possibility of a US government shutdown. The potential shutdown pushed volatility up.

Could the Threat of a US Government Shutdown Spike Volatility?

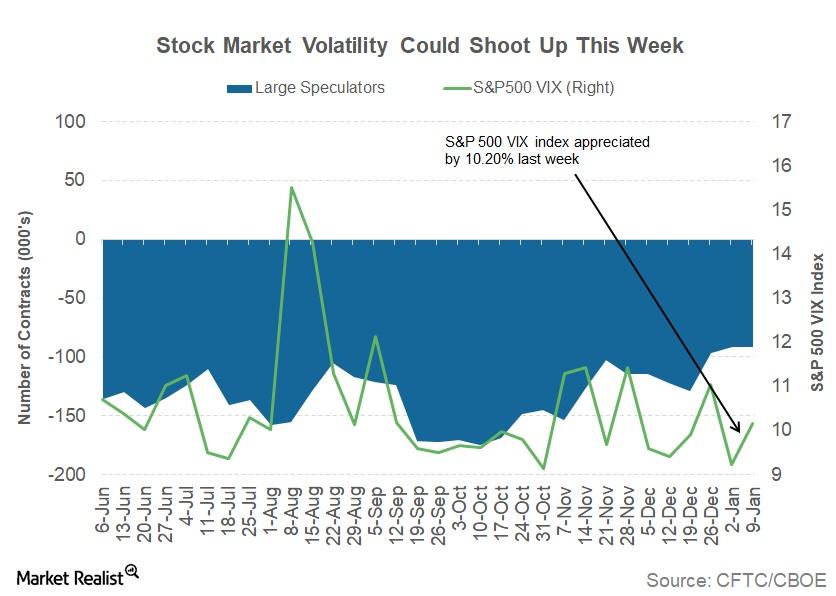

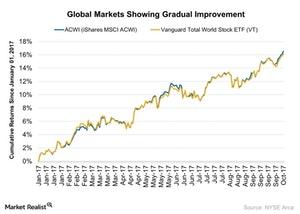

The Dow Jones Industrial Average appreciated ~1.6% for the week ended January 12, 2018, while the S&P 500 (SPY) returned ~1.3%. The tech-heavy NASDAQ (QQQ) posted a weekly gain of ~1.4%.

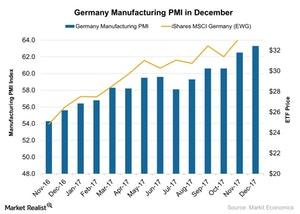

Germany’s Manufacturing Activity Reaches a Multidecade High

Germany’s manufacturing activity in December According to Markit Economics, Germany’s manufacturing PMI (purchasing managers’ index) showed a strong rise in December 2017, rising to 63.3 from 62.5 in November 2017. The index met the market estimate of 63.3, and marked the strongest expansion in German manufacturing activity since 1995. Germany’s strong manufacturing performance in December 2017 was […]

What Key Economic Indicators Say about the Economy

In this series, we’ll take a look at December 2017 manufacturing PMI reports for major developed regions, namely the United States (SPX-INDEX), Germany (DAX-INDEX), France, Spain, Europe, Japan, and the United Kingdom (UKX-INDEX).

Why Volatility Fell 16% in Week 1 of 2018

Every segment of the global financial markets began 2018 on a positive note. The global equity rally extended in the first week of the year.

Key Economic Indicators Released in the Past Week

In this series, we’ll analyze inflation for three key economies and look at retail sales in the United States and China. We’ll also look at some key economic sentiment indexes.

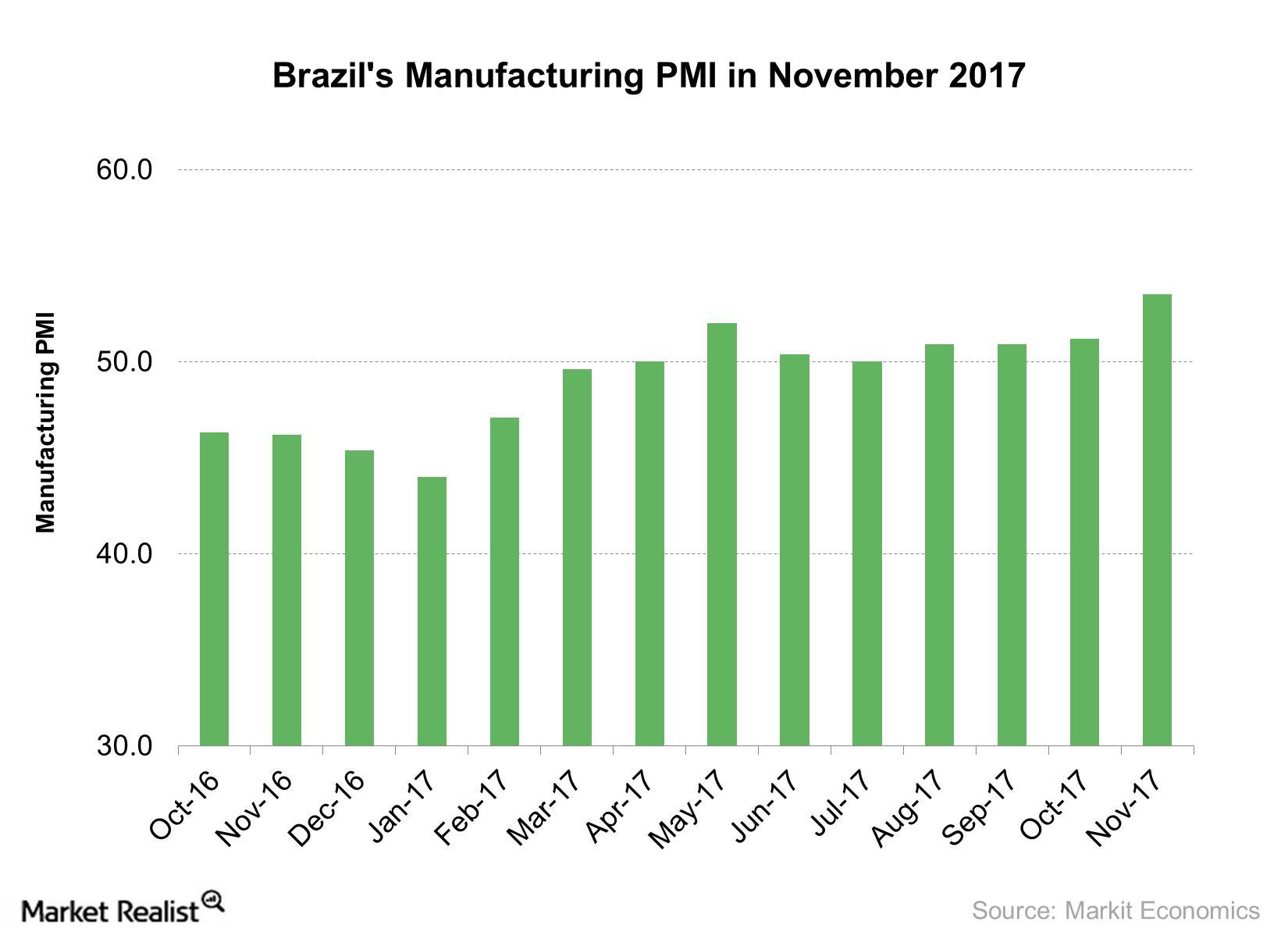

Brazil’s Manufacturing Activity Improves in November 2017

Brazil’s manufacturing activity in November According to data provided by Markit Economics, Brazil’s manufacturing PMI (purchasing managers’ index) rose to 53.5 in November from 51.2 in October, beating the estimate of 52.5 and marking the strongest rise in five years. November’s improvement in manufacturing activity was mainly due to the following factors: production output and volume […]

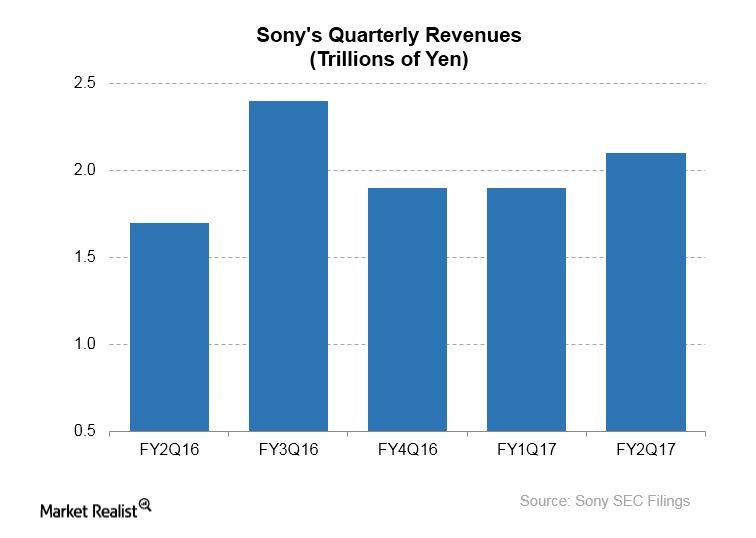

Tracing Sony’s Return to Its Aibo Robot Dog Business

Sony’s original Aibo sold for between $600 and over $2,000. The new Aibo starts at $1,700, a price that puts the product in the range of competitors.

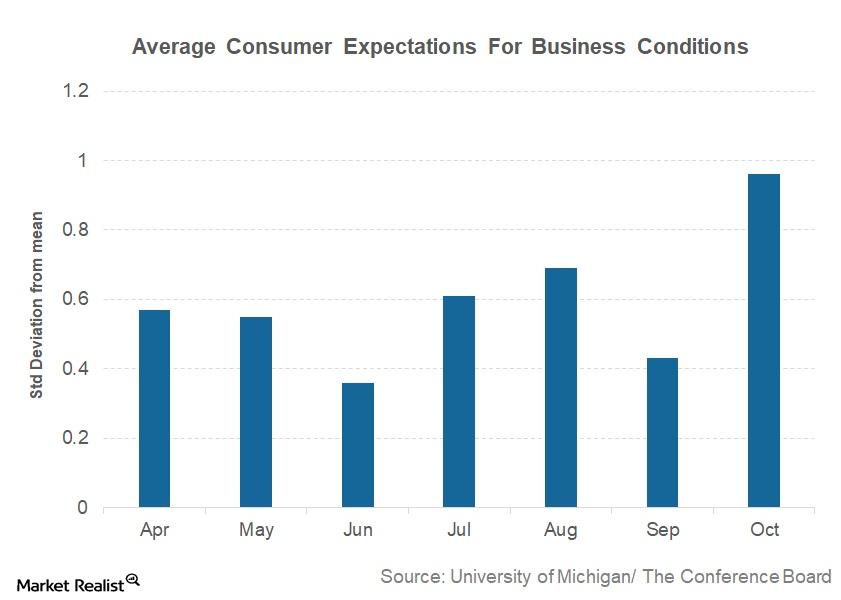

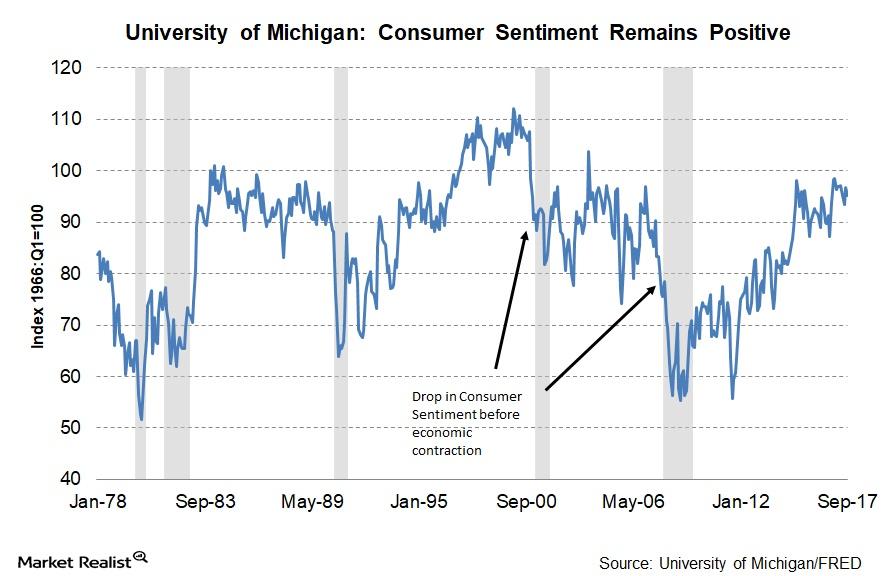

Understanding the Sharp Rise in Consumer Expectations in October

The November Conference Board LEI reported the average consumer expectations for business conditions for October at 0.96, a sharp increase from the September reading of 0.43.

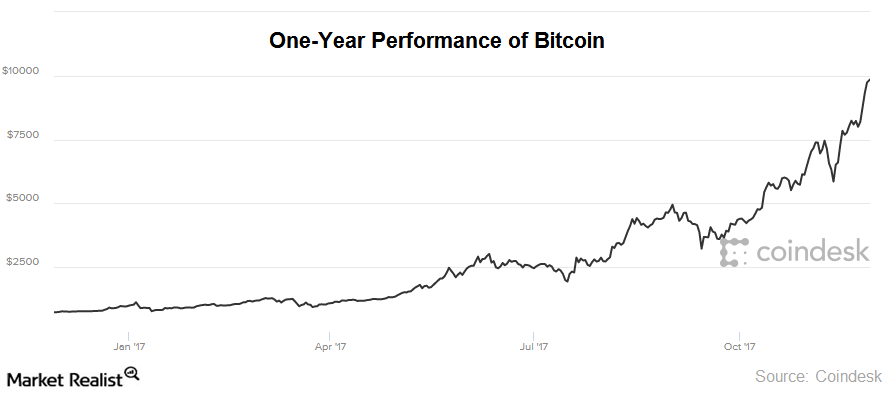

Why Gorman Doesn’t Think Bitcoin Deserves So Much Attention

James Gorman thinks that investment in bitcoin could be risky.

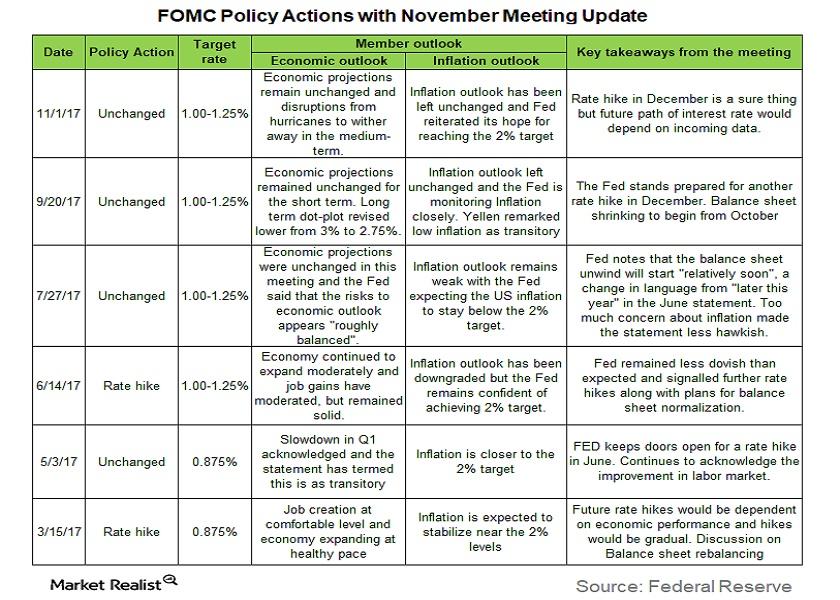

The November FOMC Meeting Minutes: Must-Knows

The last Federal Open Market Committee (or FOMC) meeting took place on October 31–November 1. The target range for the federal funds rate stayed unchanged at 1%–1.25%.

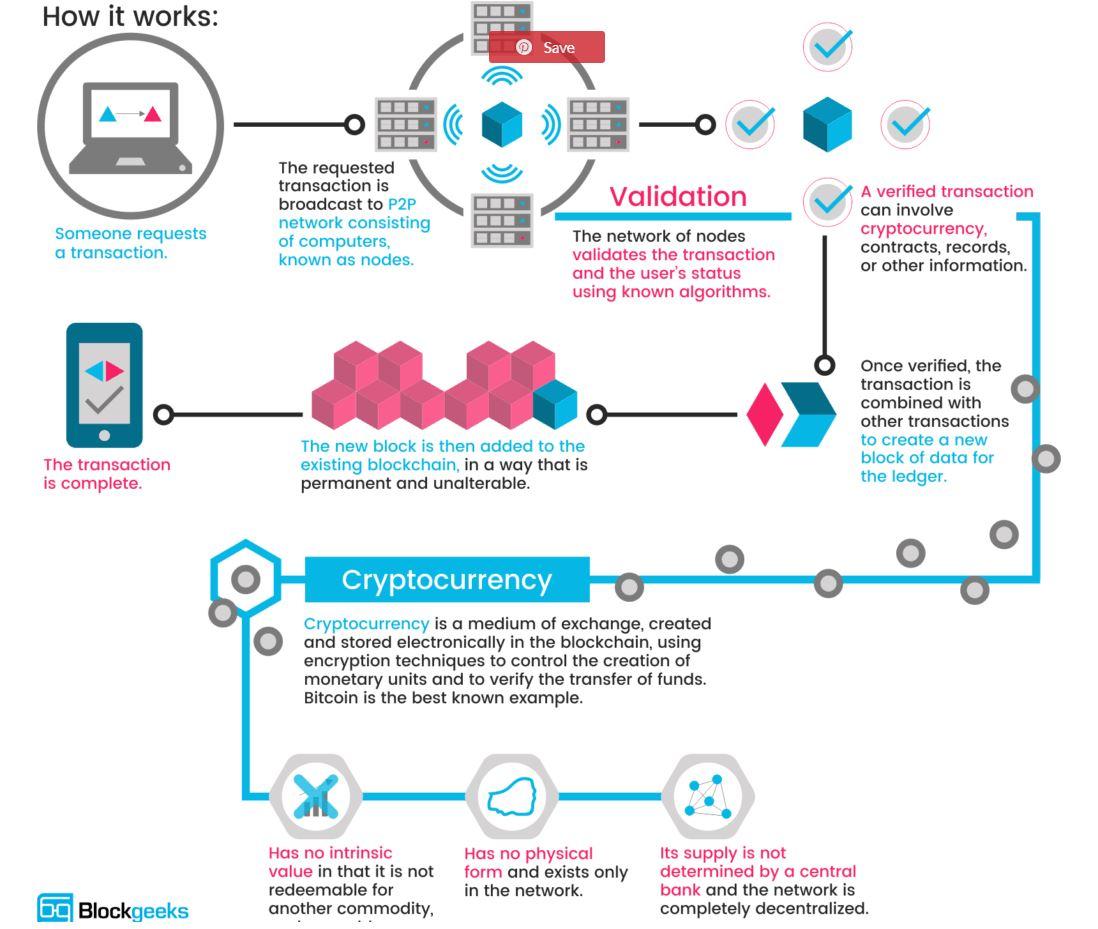

Is Blockchain Technology Really the New Internet?

It’s important that we understand the core technology behind cryptocurrencies if we want to appreciate the ingenuity of the bitcoin creation.

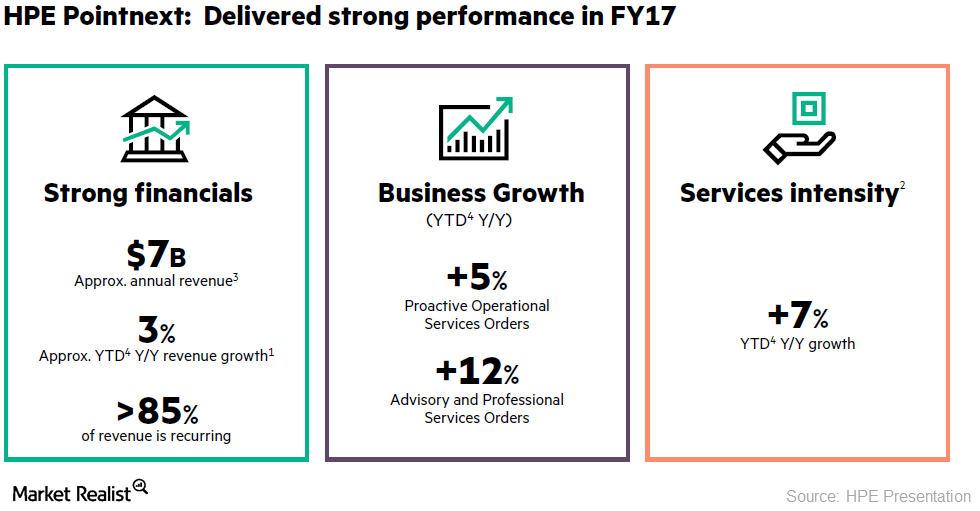

Why Hewlett Packard Enterprise Launched HPE Pointnext

HPE Pointnext launched in March 2017 In March 2017, hardware technology (QQQ) company Hewlett Packard Enterprise (HPE) launched HPE Pointnext, a technology service vertical aimed to drive digital transformation in companies. This business is also expected to deliver financial value to HPE, supporting its margins and revenue. HPE Pointnext will leverage the expertise of approximately 25,000 […]

These Key Economic Indicators Have Just Been Released

These economic indicators are important for global investors because they reflect the condition of the global economy.

These Major Economic Indicators Were Released Last Week

In this series, we’ll analyze the performance of the Eurozone Consumer Confidence Index and the ZEW Economic Sentiment Index in October 2017.

Why Expectations for Business Conditions Fell 50% in September

The October Conference Board LEI reported that average consumer expectations for business conditions for September are 0.37 above the mean.

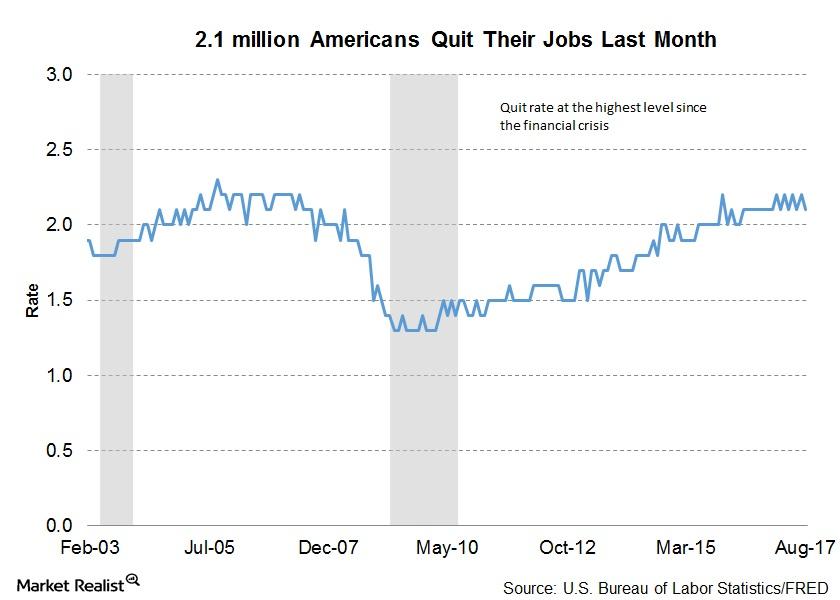

How Many Americans Quit Their Jobs in August?

As per the latest JOLTS report, about 2.1 million Americans quit their jobs voluntarily in August, which was a decrease of 70,000 from the previous reading.

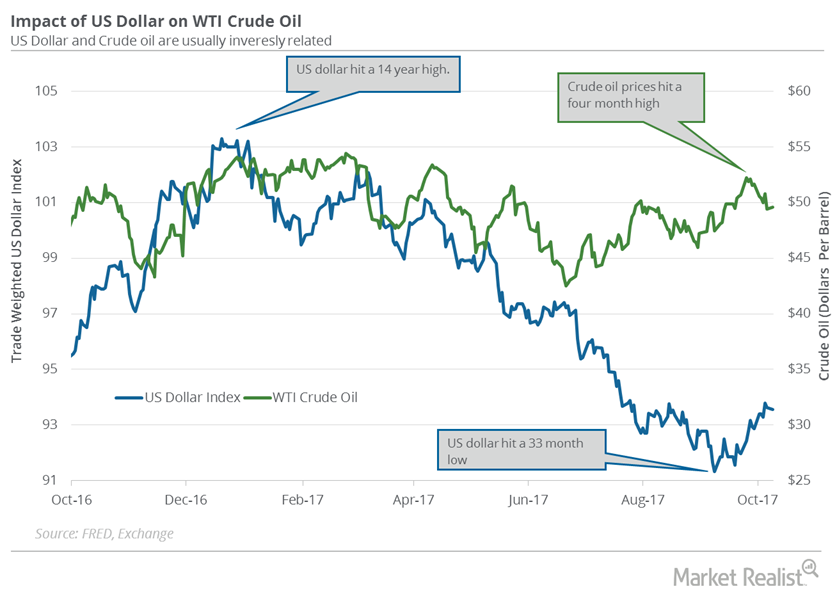

US Dollar Is near a 10-Week High, Could Upset Crude Oil Bulls

The US Dollar Index fell 0.1% to 93.55 on October 9, 2017. However, it rose almost 1.1% last week. The US dollar (UUP) is near a ten-week high.

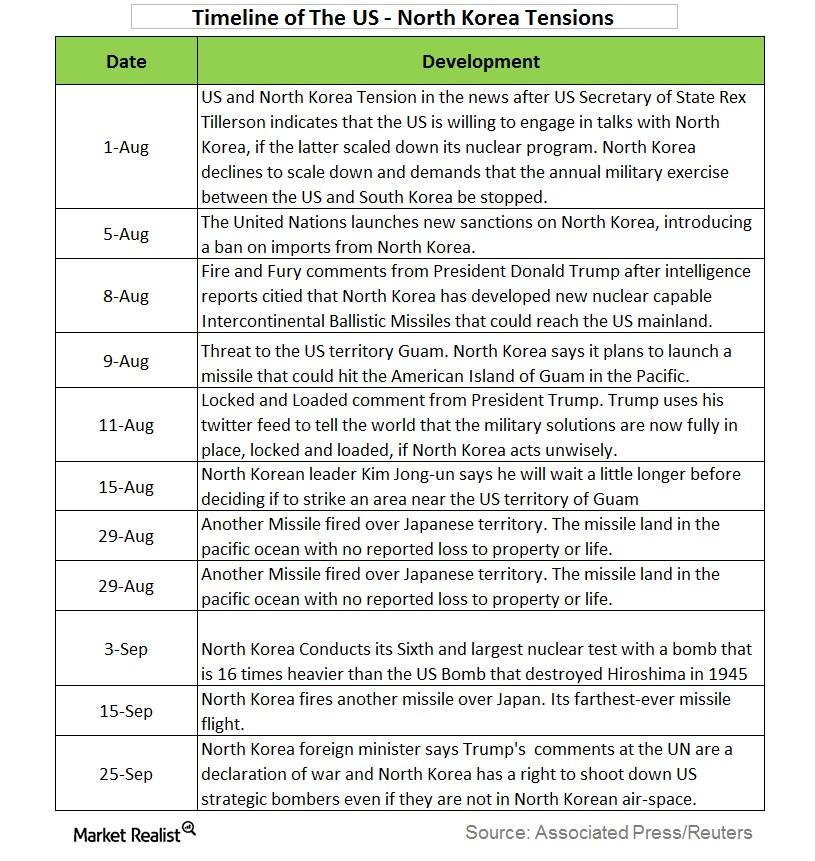

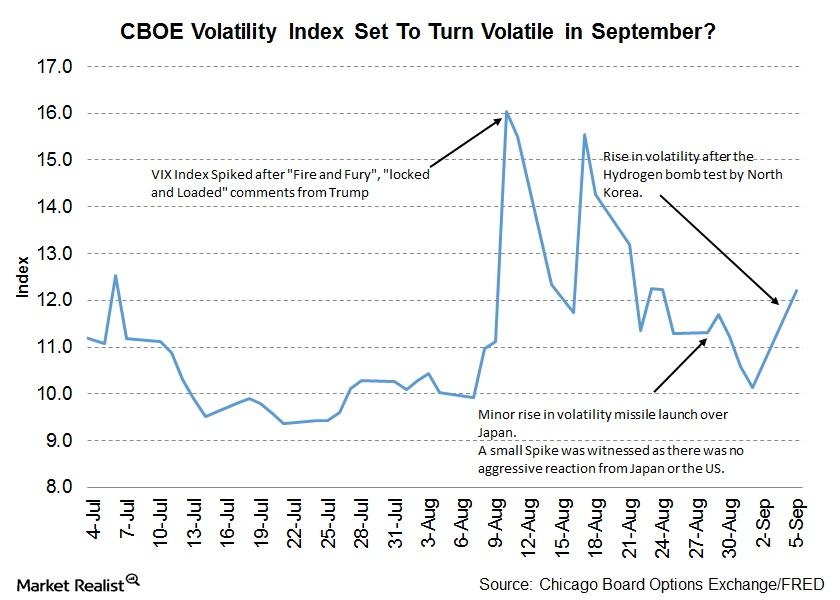

Effects of the North Korea–US Tension on Investors

Rising North Korea tensions In the last two months, tensions between the United and North Korea have continued to escalate, with both sides refusing to back down. North Korea has initiated a series of missile and nuclear tests, worsening tension in the region, and the US president has responded to these tests with strong warnings. […]

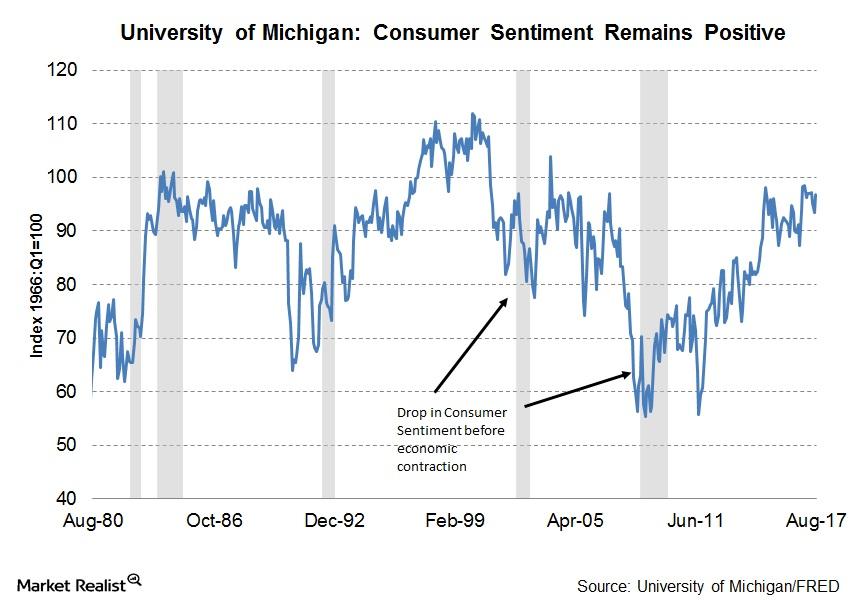

Consumers’ Business Condition Expectations Continue to Improve

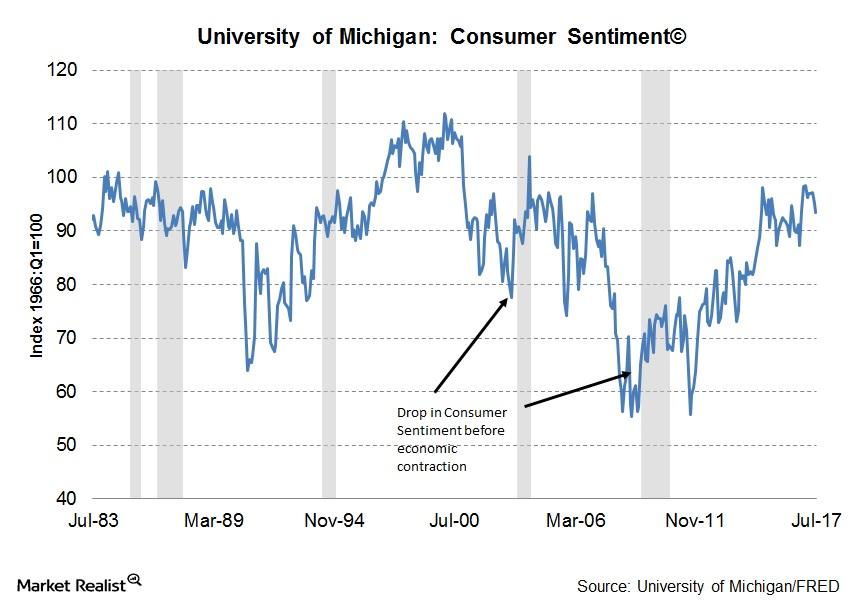

Consumer expectations for business conditions Consumer expectations data, which forms the only non-leading component of the Conference Board Leading Economic Index (or LEI), is collected through two different surveys. One of these surveys is conducted by the University of Michigan and Reuters, where consumer expectations for economic conditions in the next 12 months are collected, […]

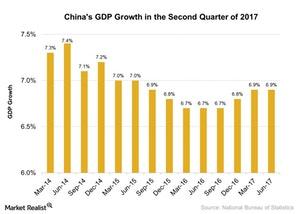

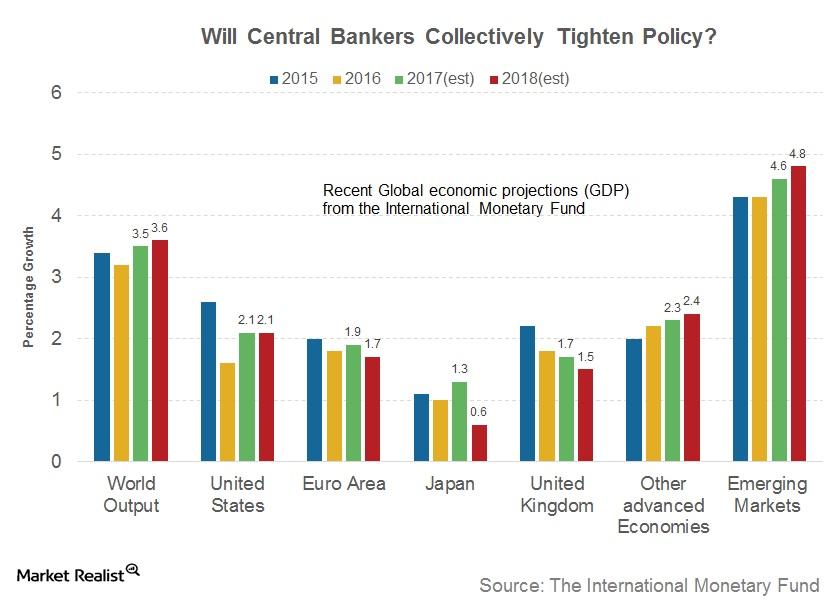

Does China’s Gradual Economic Growth Support Emerging Nations?

China (FXI) (YINN) is an important emerging nation. The gradual improvement in its economic growth is a positive sign both for emerging nations (EEM) and developed nations (EFA).

Stocks with High Dividend Yields in the Financial Sector

In this series, we’ll look at 11 S&P 500 companies offering high dividend yields.

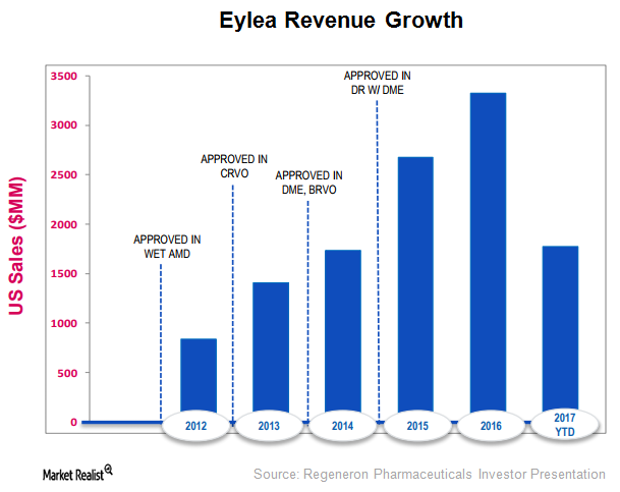

Eylea Leads the Retinal Diseases Sector

In 1H17, Eylea’s total sales rose 10% on a year-over-year basis.

Alphabet: What Is XXVI?

Google parent Alphabet (GOOGL) has formed a new holding company to complete its evolution. The new entity is called XXVI Holdings.

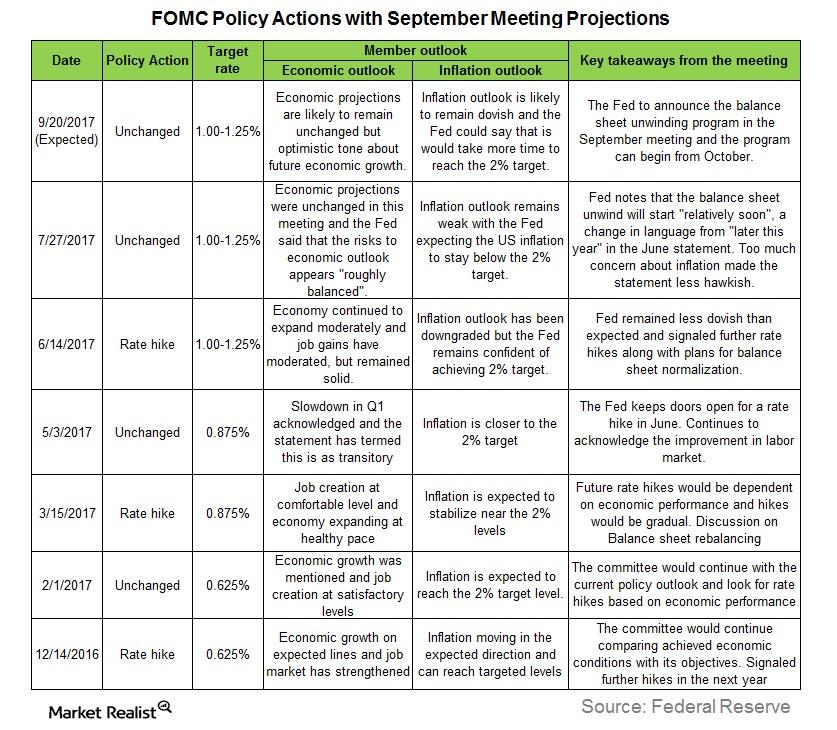

Could the Federal Reserve Surprise the Markets in September?

The US Federal Open Market Committee (or FOMC) is scheduled to meet on September 19 and 20 to discuss the current economic climate in the US and to decide whether any monetary policy adjustments are necessary.

Why September Could Be Volatile for Financial Markets

August was a volatile month, filled with economic, political, and geopolitical uncertainty. September could turn out to be another nail-biter for the financial markets.

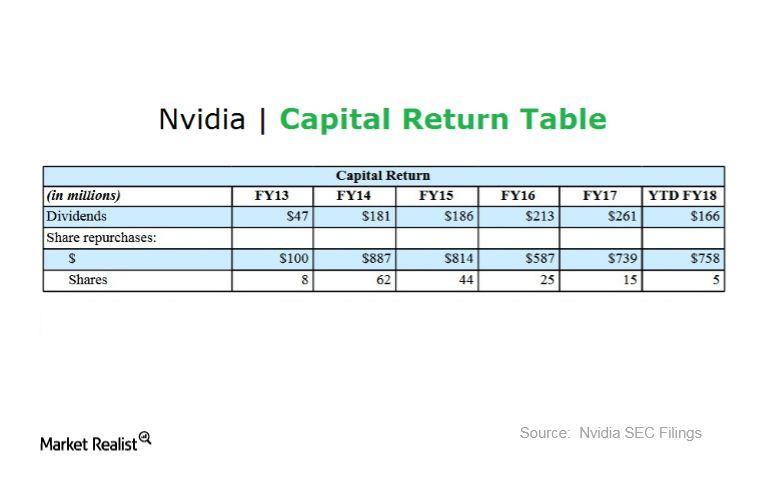

What It Means to Be a Nvidia Shareholder

In the first half of fiscal 2018 or fiscal 1H18, Nvidia distributed $166 million in dividends and repurchased shares worth $758 million.

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the flash manufacturing PMI for the US, Germany, France, and the Eurozone for August 2017.

A Look at Consumer Expectations amid Risk Aversion

Consumer expectations for business conditions Consumer expectations form the only component of the Conference Board Leading Economic Index (or LEI) based on business expectations. Referring to consumer expectations regarding future economic conditions, their measurement is an average of two surveys. One survey, conducted by the Conference Board, records consumer expectations for business conditions six months […]

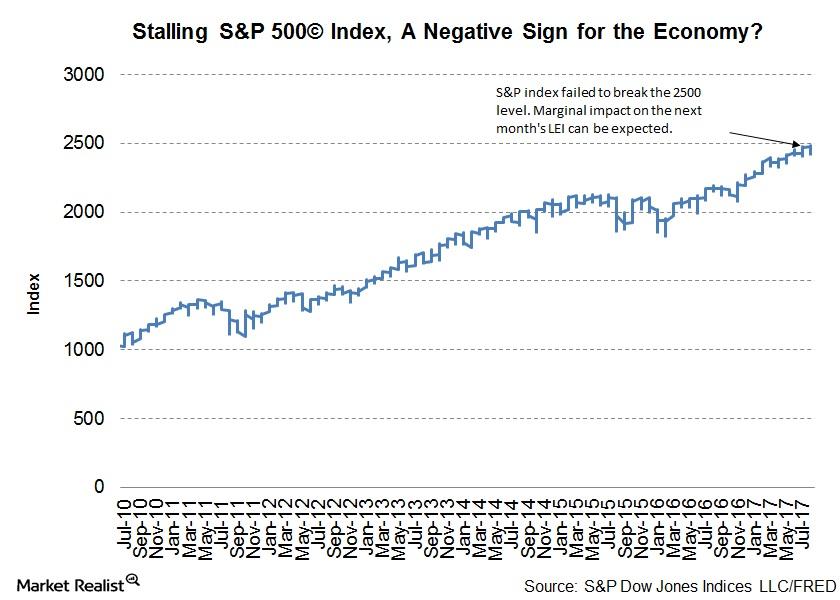

Could the S&P 500’s Stalled Ascent Derail Economic Expansion?

The risk scenario The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index […]

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”