Alphabet: What Is XXVI?

Google parent Alphabet (GOOGL) has formed a new holding company to complete its evolution. The new entity is called XXVI Holdings.

Sept. 13 2017, Updated 1:06 p.m. ET

Separating Google from Other Bets

Google parent Alphabet (GOOGL) has formed a new holding company to complete its evolution. The new entity is called XXVI Holdings, which captures the 26 letters in the Alphabet in Roman numerals.

The creation of XXVI Holdings puts a legal separation between Google and Alphabet’s Other Bets such as Waymo (autonomous driving) and Verily (life sciences).

The rise of XXVI Holdings in the Alphabet corporate structure doesn’t change shareholder control or management of Alphabet. Instead, the reorganization is designed to ensure that each operating unit within Alphabet carries its own responsibilities.

Before forming the new holding entity, the Other Bets ventures were technically subsidiaries of Google, so a challenge in any of these businesses could spread to Google.

Protecting Google from potential challenges

XXVI Holdings will own equity in each Alphabet company. Google is the largest company in the Alphabet organization. In 2016, Google contributed 99.0% of Alphabet’s overall revenue. Google is also the source of Alphabet’s profits, making it a crucial member of the Alphabet family.

Perhaps Google’s important role in the Alphabet organization was part of what led to the creation of XXVI Holdings in order to reduce its exposure to potential challenges.

Revenue diversification

The legal separation of the various Alphabet companies will give them greater control of their destinies and potentially speed up efforts to diversify Alphabet’s revenue sources.

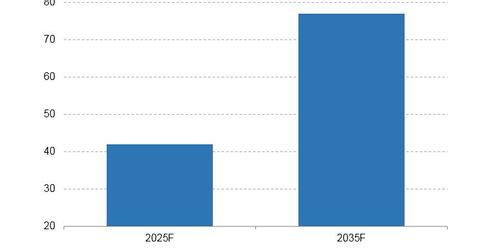

Waymo, one of Alphabet’s closely watched businesses, is competing with Tesla (TSLA), Apple (AAPL), Baidu (BIDU), and Uber (QQQ) for control of the autonomous driving industry. According to Boston Consulting Group, the market for autonomous vehicles could be worth $42.0 billion by 2025 and could grow further to $77.0 billion by 2035, as depicted in the above chart.