Monster Beverage Corp

Latest Monster Beverage Corp News and Updates

Monster Beverage Merger: Are Cannabis-Infused Energy Drinks Coming?

Monster Beverage Corporation is in talks with Constellation Brands Inc. for a possible merger. What would the merger mean for both beverage companies?

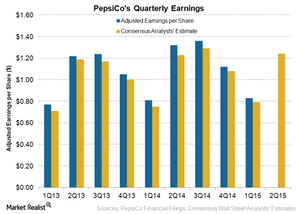

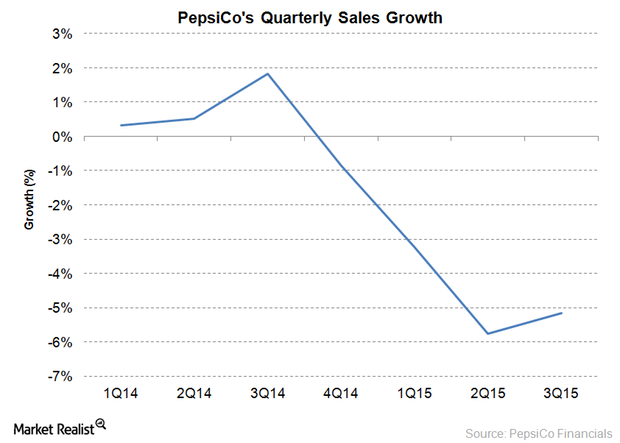

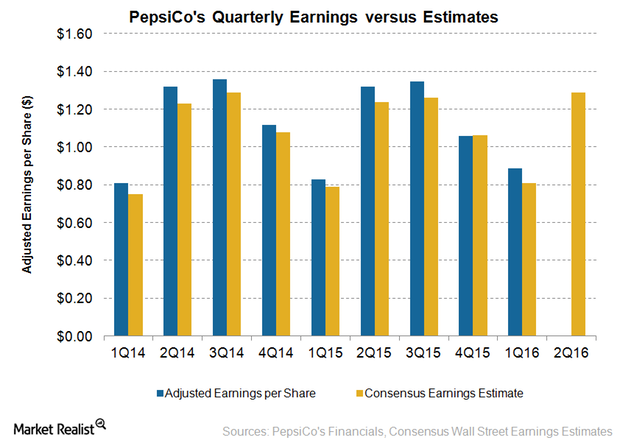

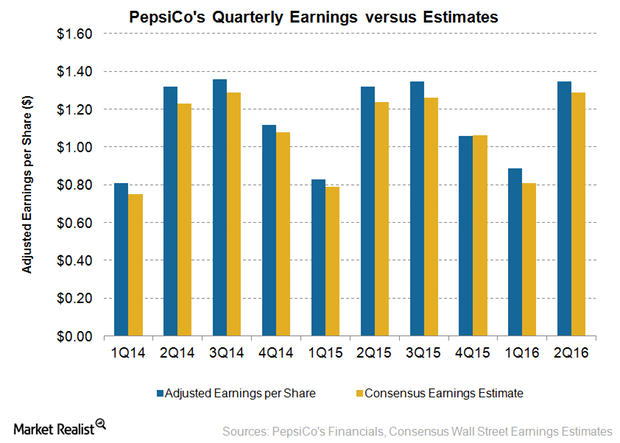

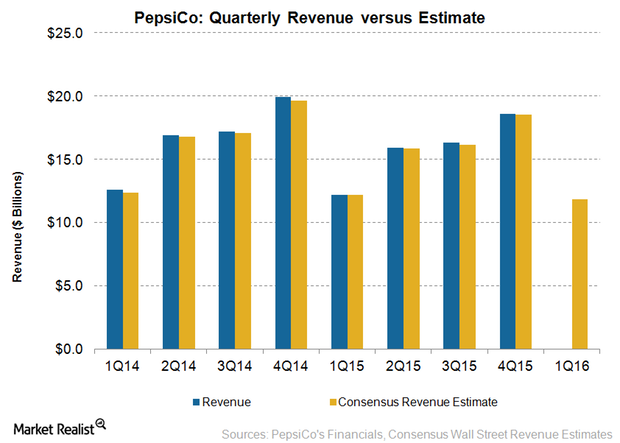

Will PepsiCo’s Earnings Stay Ahead of Wall Street in 2Q15?

PepsiCo expects currency headwinds to impact its fiscal 2015 core EPS by 11% compared to its previous estimate of 7%. It expects currency headwinds to drag down EPS in 2Q15 by 12%.

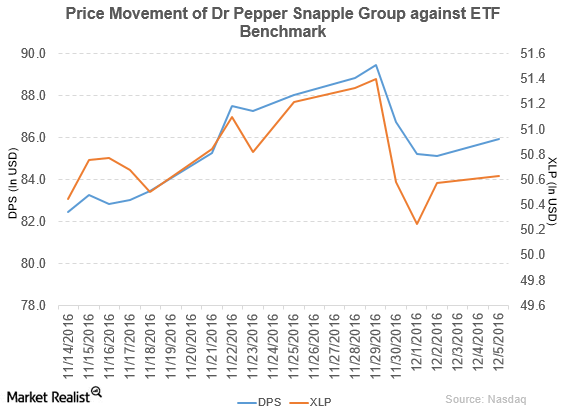

Why Did Moody’s Rate Dr Pepper Snapple Senior Notes as Baa1?

Dr Pepper Snapple Group (DPS) declared a quarterly dividend of $0.53 per share on its common stock. This dividend will be paid on January 5, 2017, to shareholders of record on December 13, 2016.

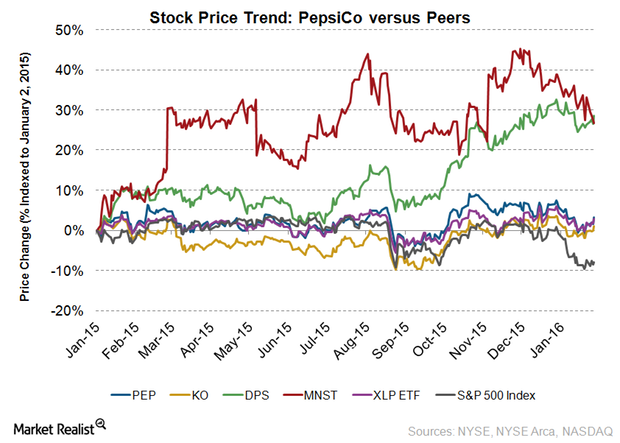

Can PepsiCo’s Stock Pick Up Momentum in 2016?

As of January 28, about 59% (or 17) analysts out of 29 analysts, have a “buy” recommendation for PepsiCo and 12 analysts have a “hold” recommendation. None of the analysts have a sell recommendation.

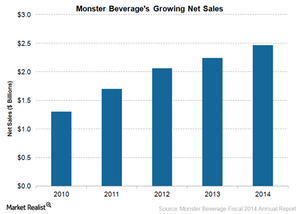

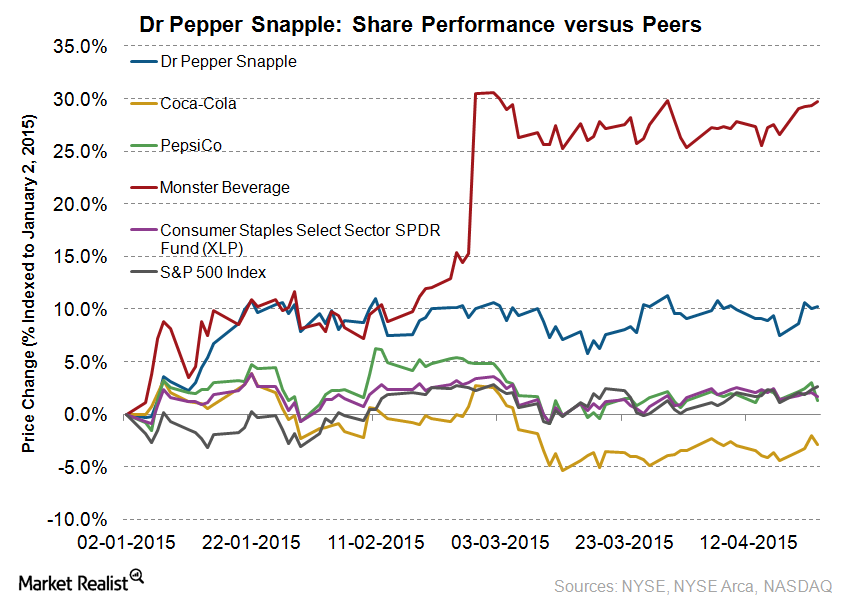

Coca-Cola Deal Gives Monster Beverage Yet Another Boost

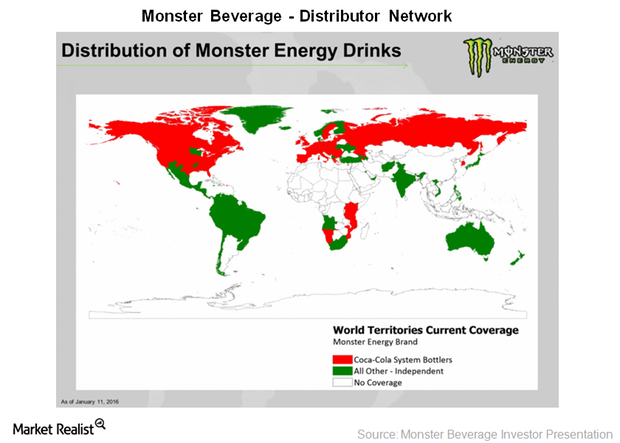

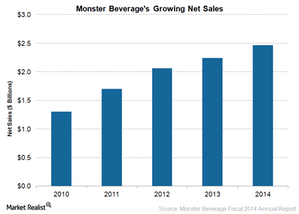

In 2014, Monster Beverage’s net sales increased by 9.7% to $2.5 billion, with 21.7% of its net sales from outside the United States.

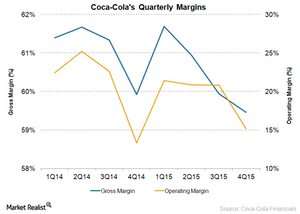

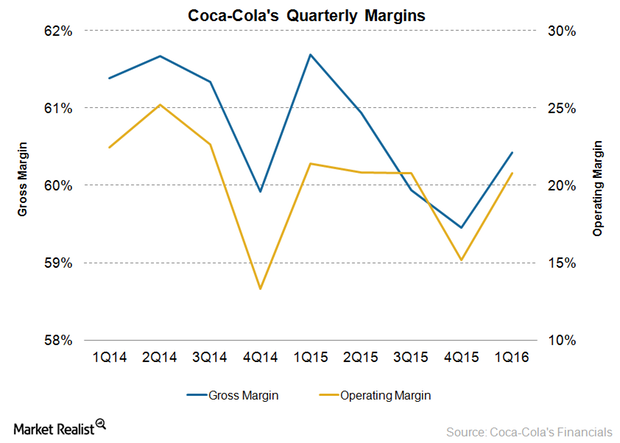

Coca-Cola’s 4Q15 Operating Margin Rose on Productivity Measures

Coca-Cola’s operating margin improved significantly to 15.2% in 4Q15 from 13.3% in the comparable quarter of the previous year.

Investing in CBD? Real Brands Is Making Big Moves

The CBD market is growing, and acquisitions are heating up. Real Brands is a top, under-the-radar investment candidate that should be on your radar.

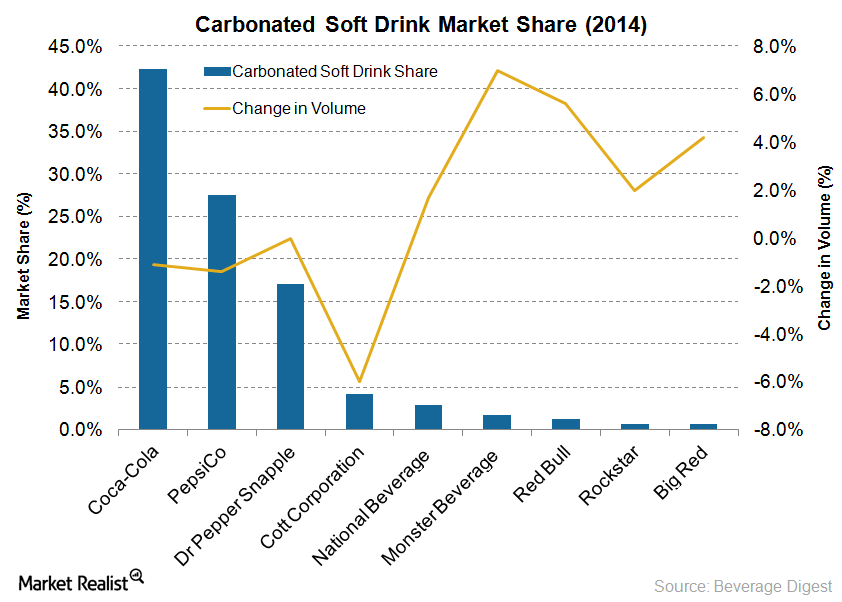

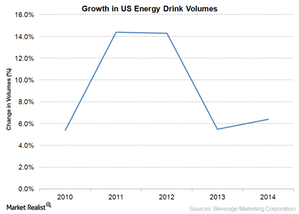

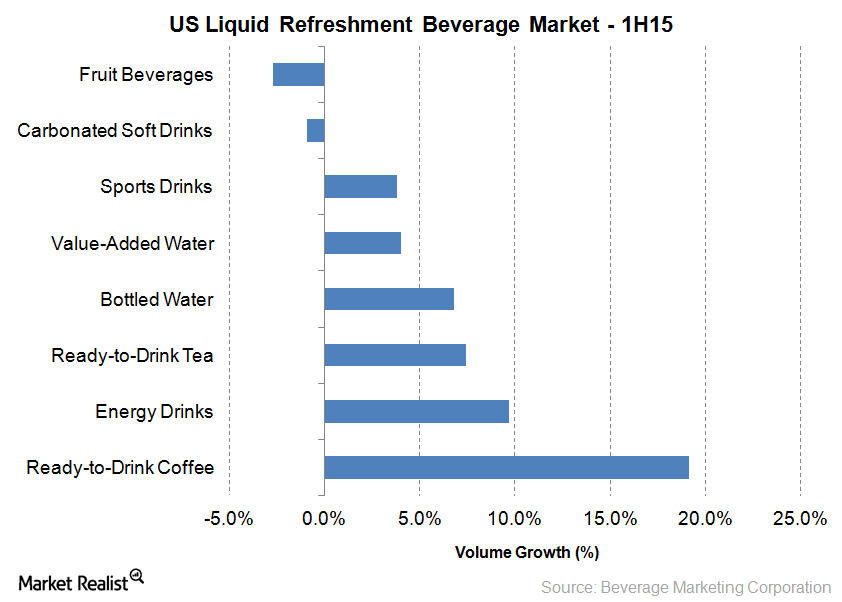

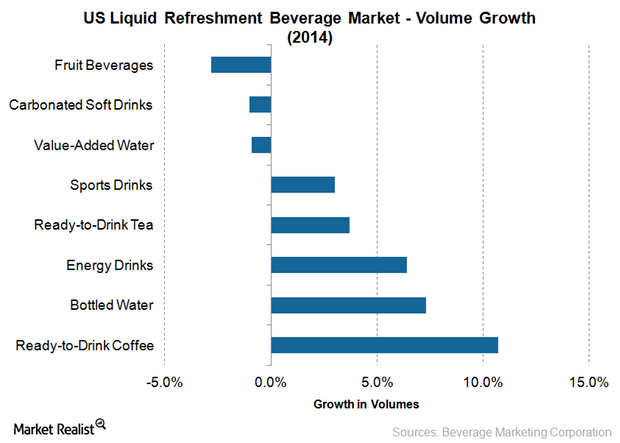

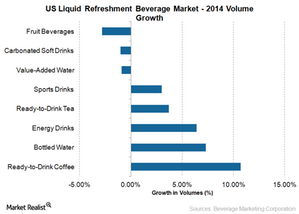

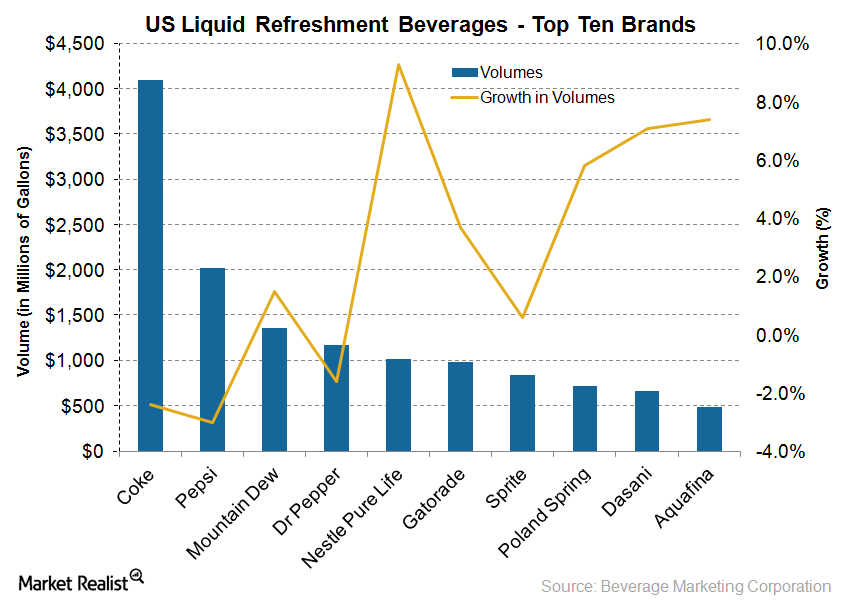

Energy Drinks Outperform Soda Drinks in Case-Volume Growth

An interesting development in the energy drinks industry is Monster Beverage’s strategic deal with Coca-Cola. The deal will expand Monster Beverage’s product line-up.

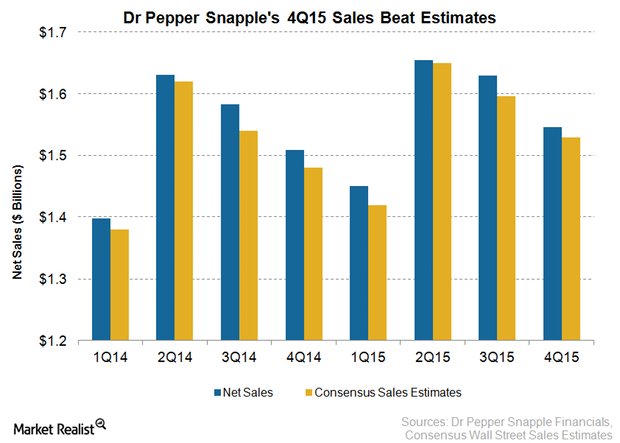

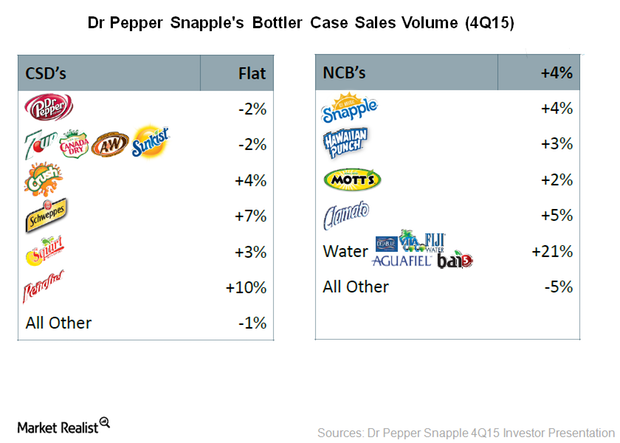

Key Drivers of Dr Pepper Snapple’s 4Q15 Sales

Dr Pepper Snapple reported sales of nearly $1.6 billion in 4Q15, beating the consensus Wall Street analyst estimate of $1.53 billion.

New York Is Gearing Up for PepsiCo’s Kola House this Spring

PepsiCo is getting ready to launch Kola House, its first hospitality venture, at its flagship location in New York City’s Meatpacking District. The first Kola House, which will operate as a kola bar, restaurant, lounge, and event space, is expected to open this spring.

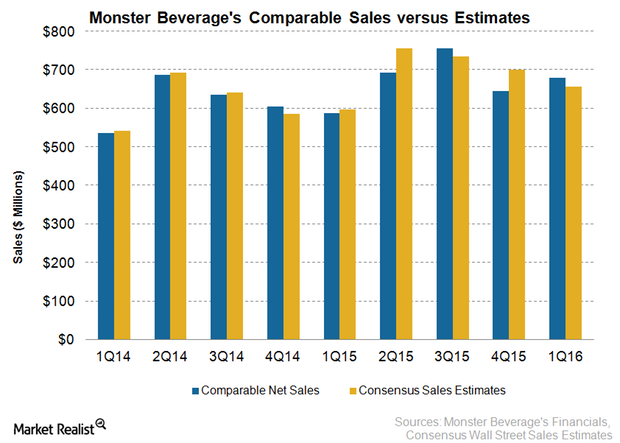

Monster’s 1Q16 Sales Benefit from Strategic Deal with Coca-Cola

Monster Beverage’s (MNST) net sales in 1Q16 ended March 31, 2016, were $680.2 million, ahead of the consensus analyst sales estimate of $656.9 million.

Mintel Forecasts Strong Growth in the US Energy Drink Market

The US energy drink and shots market grew by 56% between 2009 and 2014, even though the category was entangled in litigation and had negative publicity.

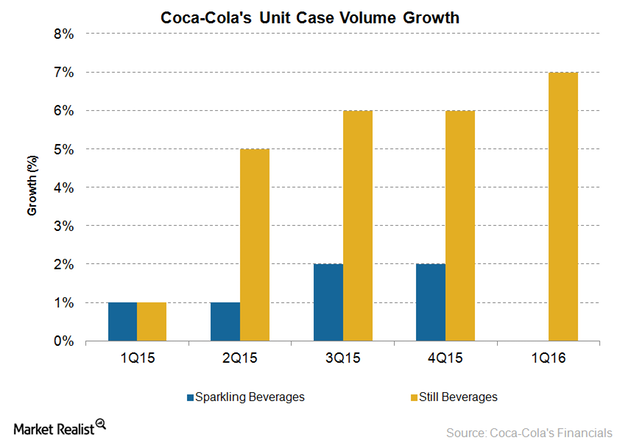

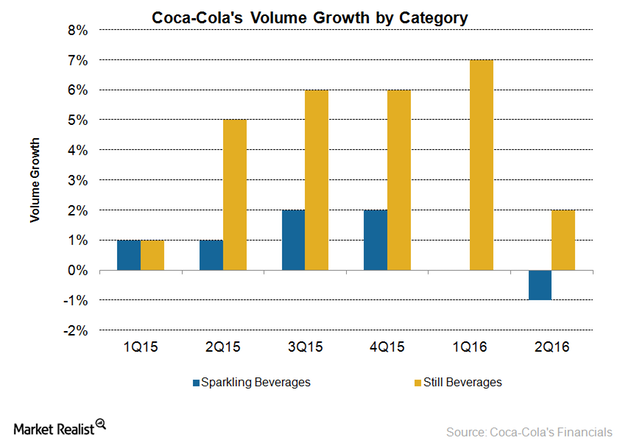

The Growing Emphasis of Coca-Cola and Peers on Still Beverages

Another plant-based beverage acquisition made by Coca-Cola was that of Xiamen Culiangwang Beverage Technology Company in 2015.

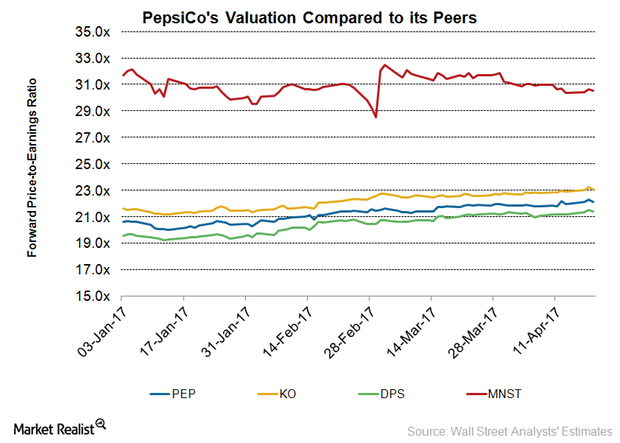

PepsiCo’s Valuation ahead of 1Q17 Results

As of April 19, PepsiCo (PEP) was trading at a 12-month forward PE (price-to-earnings) ratio of 22.1x.

Innovation and Marketing Fuel Dr Pepper Snapple’s Future Growth

Dr Pepper Snapple is creating more visibility for its products by associating with popular movies. It expects its marketing spend to be ~7.6% of net sales in 2015.

Did Dr Pepper Snapple’s Non-Carbonated Beverages Call the Shots in 4Q15?

Dr Pepper Snapple (DPS) saw higher volume growth in non-carbonated beverages in all the quarters of fiscal 2015 compared to CSDs.

Coca-Cola Is Open to Inorganic Growth in Still Beverages

Coca-Cola has a dominant presence in the sparkling beverages market, but it’s the still beverage space that has huge growth prospects.

What Do Analysts Expect from PepsiCo’s 2Q16 Earnings?

PepsiCo’s (PEP) performance in recent quarters has been under pressure due to currency headwinds and weakness in carbonated soft drink volumes.

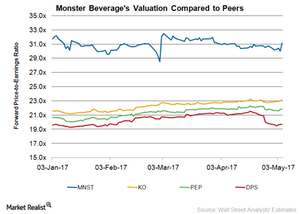

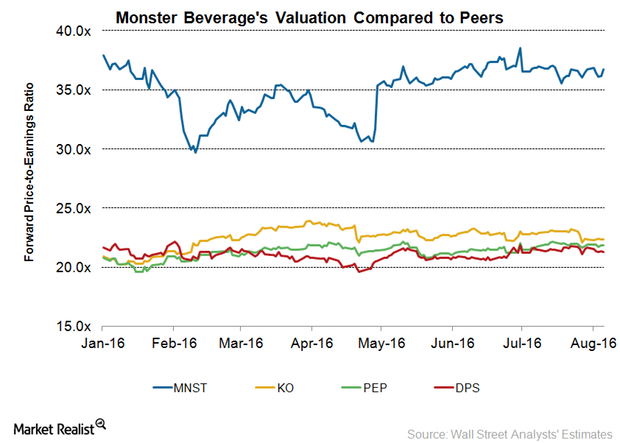

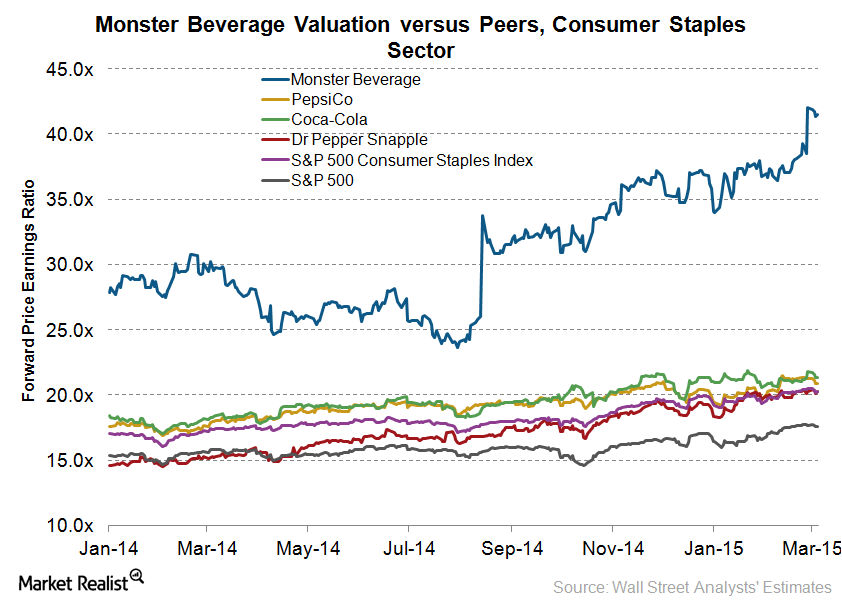

Monster Beverage’s Valuation: Impact of 1Q17 Results

On May 5, 2017, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings multiple) of 31.1x, up 3.7% in reaction to its 1Q17 results.

Dr Pepper’s Prospects in Other Non-Carbonated Beverages

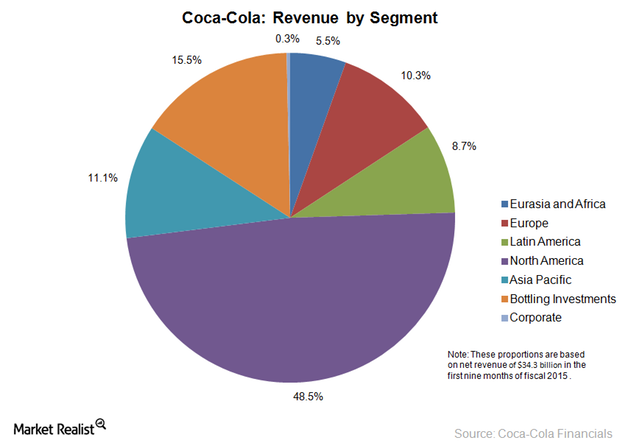

Dr Pepper Snapple adopted a strong strategy by acquiring an 11.7% stake in BodyArmor. But it could grow more in other non-carbonated beverage categories.Company & Industry Overviews Understanding Coca-Cola’s business segments

Overall, in 2013, still beverages performed better than sparkling beverages across all the segments except for Europe. Sparkling beverage volumes have been declining over the past few years.

PepsiCo Seeks Energy with Rockstar Acquisition

PepsiCo (NYSE:PEP) is gearing up to capture growth in the energy drinks market by acquiring Rockstar Energy Beverages for $3.85 billion.

Understanding PepsiCo’s Business Segments and More

PepsiCo (PEP) is one of two beverage-industry behemoths. We break down everything investors should know about the stock and the business.

Monster Beverage Beats Wall Street’s Q3 Estimates

Monster Beverage (MNST) stock was up 3% as of 1:48 PM ET today after the leading energy drink maker beat analysts’ earnings estimates.

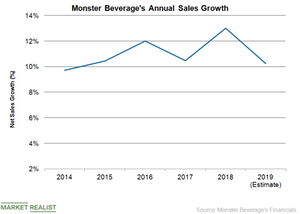

What Analysts Expect from Monster Beverage’s Sales in 2019

Monster Beverage’s (MNST) net sales grew 13.0% to $3.81 billion in 2018, mainly due to the performance of its Monster Energy Drinks segment.

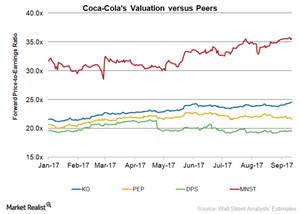

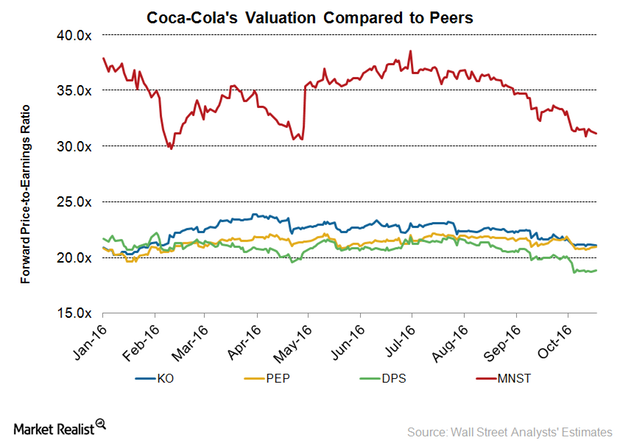

Where Coca-Cola’s Valuations Stand Compared to Its Peers

Coca-Cola’s valuation multiple is currently higher than PepsiCo (PEP) and Dr Pepper Snapple (DPS) but lower than Monster Beverage (MNST).

Analyzing Coca-Cola’s Valuation ahead of Q3 Earnings

12-month forward PE In this article, we’ll discuss Coca-Cola’s (KO) valuation using the 12-month forward PE (price-to-earnings) ratio. As of October 17, Coca-Cola was trading at a 12-month forward PE of 21.1x. The company is trading below its YTD (year-to-date) average forward PE of 22.4x. Peers’ valuation As of October 17, nonalcoholic beverage companies PepsiCo […]

Coca-Cola Keeps Its Focus on Still Beverages for Future Growth

Coca-Cola’s (KO) still beverage volumes have seen higher growth compared to sparkling or soda beverages.

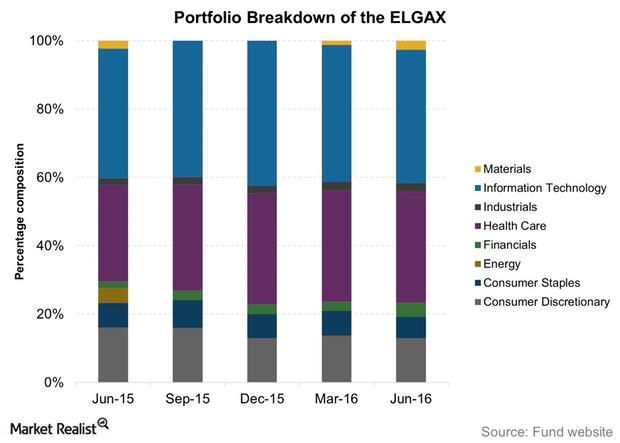

Columbia Select Large Cap Growth Fund: Sector Composition YTD 2016

The Columbia Select Large Cap Growth Fund (ELGAX) invests at least 80% of its assets in common stocks of US-based and foreign companies with market caps in the range of companies in the Russell 1000 Growth Index.

How 2Q16 Results Impacted Monster Beverage’s Valuation

As of August 5, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings) ratio of 36.8x.

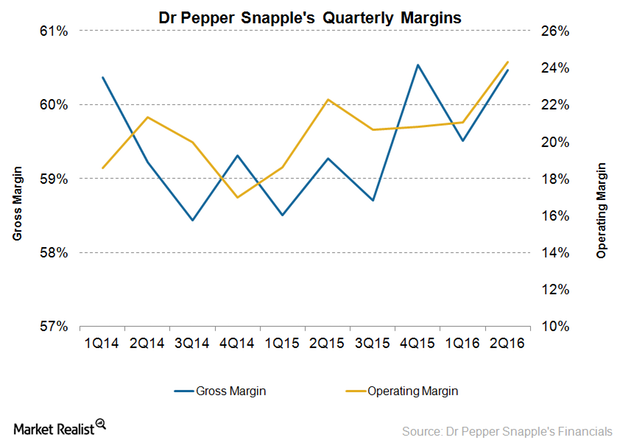

What Led Dr Pepper Snapple’s Margin Expansion in 2Q16?

Dr Pepper Snapple’s (DPS) gross margins increased by 120 basis points to 60.5% in 2Q16 on a YoY (year-over-year) basis.

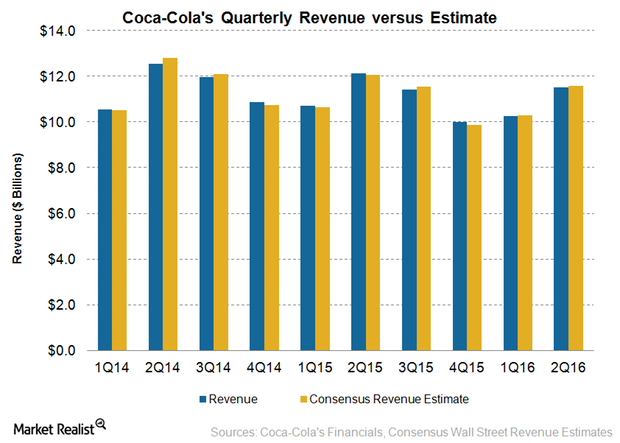

Coca-Cola’s 2Q16 Revenue Fell Due to Headwinds

Coca-Cola generated revenue of $11.5 billion in fiscal 2Q16 ending July 1, 2016. It missed analysts’ consensus revenue estimate of $11.6 billion.

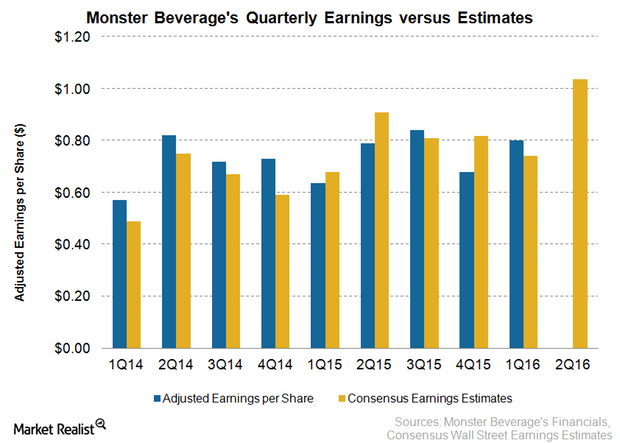

What Will Drive Monster Beverage’s 2Q16 Earnings Growth?

Monster Beverage (MNST) impressed its investors with a 26% growth in its 1Q16 EPS (earnings per share), excluding the impact of one-time items.

Can Productivity Measures Help Coca-Cola’s Margins in 2Q16?

Coca-Cola’s (KO) margins contracted in 1Q16 due to the impact of adverse currency fluctuations and structural headwinds.

PepsiCo’s 2Q16 Earnings Rise on Improved Margins

Leading snack and beverage maker PepsiCo (PEP) delivered adjusted EPS (earnings per share) of $1.35 in 2Q16 ended June 11, 2016.

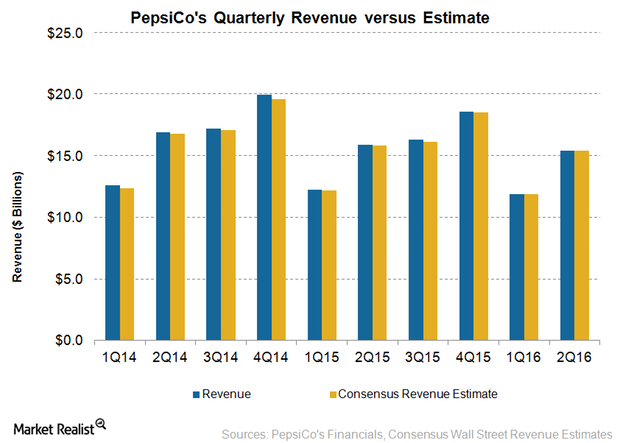

What Dragged down PepsiCo’s 2Q16 Revenue?

PepsiCo’s (PEP) revenue declined by 3.3% in 2Q16 ended June 11, 2016.

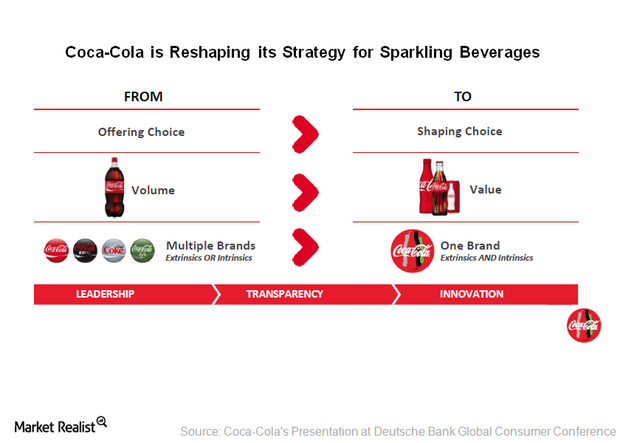

How Coca-Cola Is Reshaping Its Strategy for Sparkling Beverages

Coca-Cola is now changing its approach from offering beverage choices to consumers to shaping their choices.

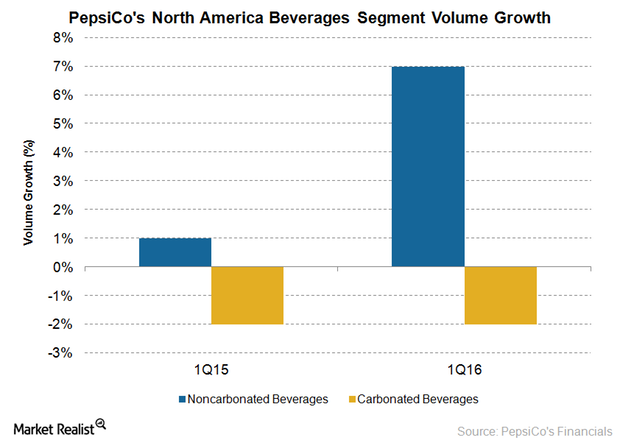

PepsiCo’s Non-Carbonated Beverages Sparkle in 1Q16

In 1Q16, PepsiCo’s North America Beverages segment accounted for 36.8% of the company’s net revenue and 27.5% of the division’s total operating profit.

Why Analysts Expect PepsiCo’s Revenue to Decline in Fiscal 1Q16

On April 18, PepsiCo is scheduled to announce its results for fiscal 1Q16. PepsiCo’s revenue has declined in each of the past five consecutive quarters.

Coca-Cola Strengthened Presence in Africa with Stake in Chi

Beverage giant Coca-Cola (KO) has expanded its presence in Africa with the acquisition of a minority stake in Chi Limited, Nigeria’s leading dairy, juice, and snacks company.

Are Strategic Brands Boosting Monster Beverage’s Sales?

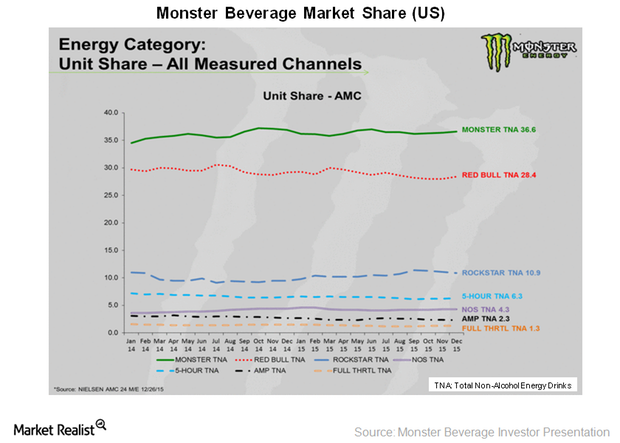

According to Nielsen’s data, for the period ending December 26, 2015, the Monster Beverage brand held a 36.6% share of the US energy drink market in terms of unit sales.

Monster Beverage Increases Its Advertising Efforts

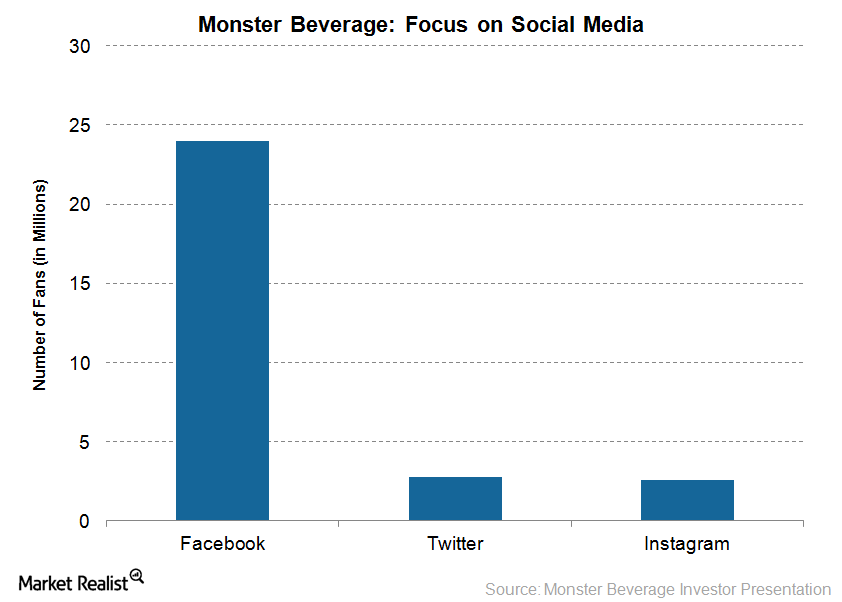

Monster Beverage enjoys huge popularity on social media. It has 24 million fans on Facebook (FB), 2.8 million fans on Twitter (TWTR), and 2.6 million fans on Instagram.

Monster Beverage Provides an Update on Distribution Transition

In its 3Q15 conference call, Monster Beverage disclosed an agreement with Coca-Cola HBC (Hellenic Bottling Company) that will apply across 28 countries.

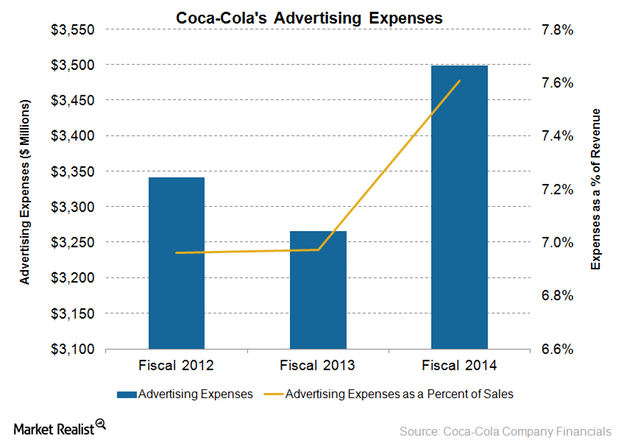

Understanding Coca-Cola’s New Marketing Efforts

Coca-Cola (KO) is using its productivity savings to ramp up its media investments.

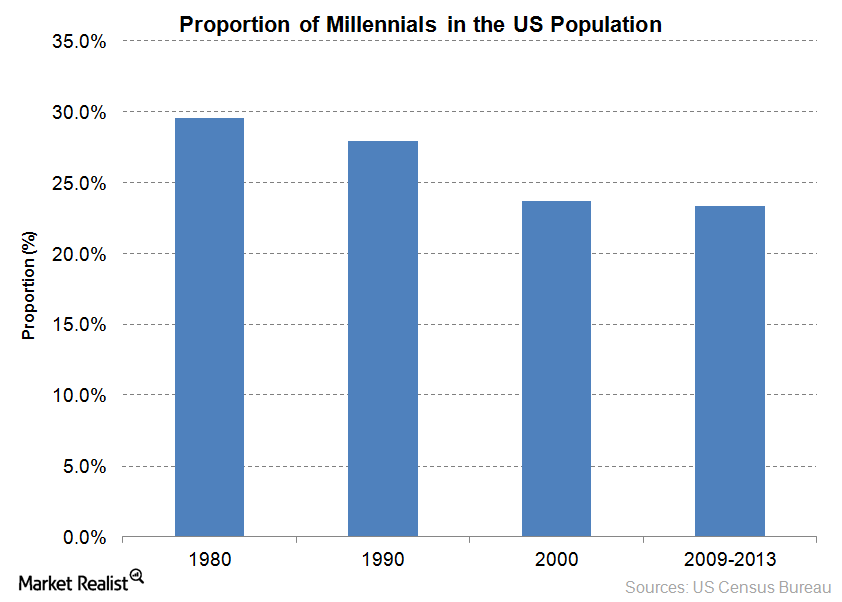

Why Are Millennials a Key Demographic for Monster Beverage?

Millennials are the key consumers of energy drinks and shots. Monster Beverage specifically targets this tech-savvy demographic in its advertisements.

Are Parents Driving Energy Drink Sales in the US?

As shocking as it may sound, a higher proportion of US households with children are consuming more energy drinks—compared to those without children.

Energy Drinks Continue to Thrive despite Controversies

Two-thirds of energy drink consumers are concerned about the negative effects of energy drinks and shots, but this doesn’t stop them from consuming the drinks.

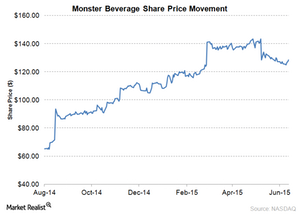

Monster Gets More Energy in Strategic Partnership with Coca-Cola

On June 12, Coca-Cola and Monster Beverage completed a strategic partnership. Coca-Cola purchased 16.7% in Monster for $2.2 billion. That day, Monster Beverage shares rose 1.0%, and Coca-Cola’s fell 0.3%.

Gatorade by PepsiCo: Still Athletic at 50

Gatorade is celebrating its 50th anniversary this year. It’s one of PepsiCo’s $22-billion brands, generating more than $1.0 billion in annual retail sales.

Monster Beverage’s stock outperforms peers

After transferring its non-energy drink brands to Coca-Cola, Monster Beverage can focus on its core energy business and expand its international presence.