Monster Beverage Corp

Latest Monster Beverage Corp News and Updates

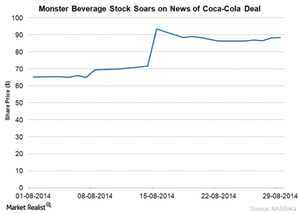

Monster Beverage and Coca-Cola: A landmark partnership

Under their strategic partnership, Coca-Cola will acquire 16.7% of Monster Beverage for $2.15 billion and transfer its energy business to Monster Beverage.

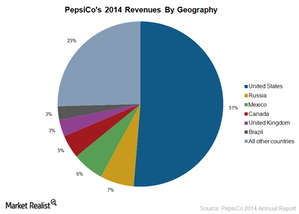

How PepsiCo is benefitting from complementary businesses

PepsiCo’s snack and beverage businesses are complementary in nature and derive a lot of synergies.

PepsiCo is a leader in the food and beverage spaces

PepsiCo (PEP) is the second largest non-alcoholic beverage maker and the market leader in the snack food space in the US.

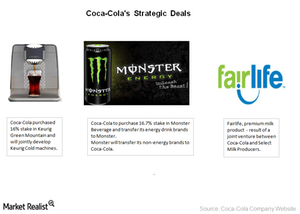

Coca-Cola’s joint ventures set the stage for future growth

The company is focused on expanding its product portfolio through strategic deals. Coca-Cola’s joint ventures will set the stage for future growth.

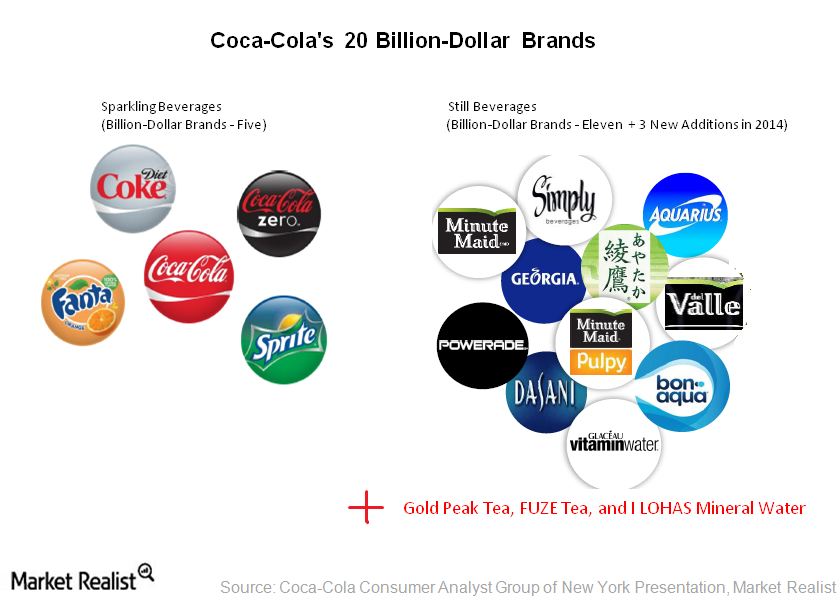

Coca-Cola’s still beverages brands meet growing demand

In 2014, Coca-Cola added three still beverage brands. Coca-Cola’s still beverages now include Gold Peak Tea, FUZE Tea, and I LOHAS mineral water.

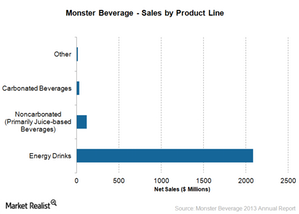

Why Monster Beverage extends its product line

Energy drinks witnessed impressive growth over the past five years. Monster Beverage and its peers—like Red Bull GmbH—are expanding their product lines to capture this growing demand.

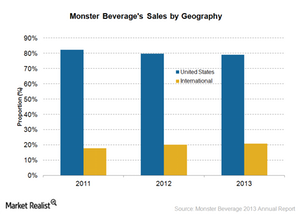

Why Monster Beverage’s international business is growing

Monster Beverage’s revenues from international regions increased over the years. Its international operations accounted for 21% of its 2013 revenues—up from 18% in 2011.

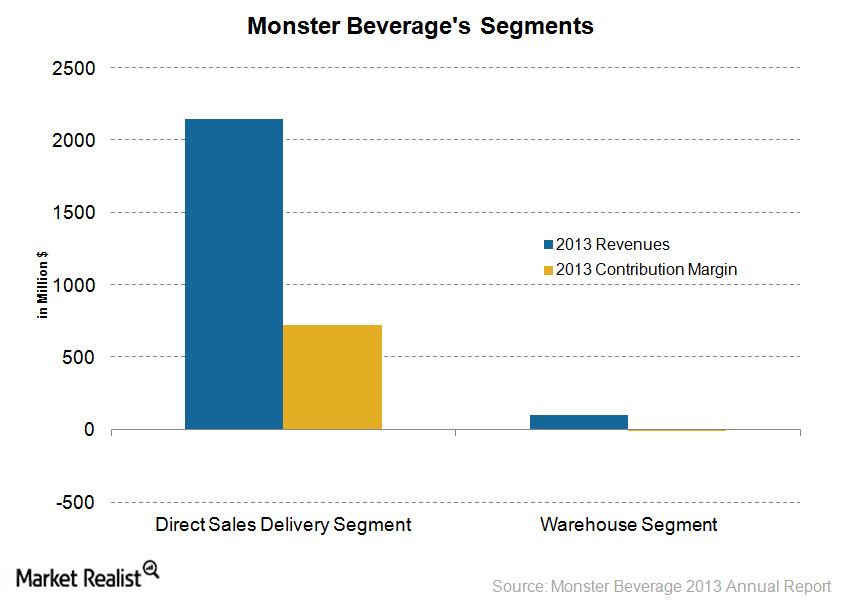

Analyzing Monster Beverage’s segments

Monster Beverage Corporation (MNST) conducts its business through two business segments—Direct Store Delivery, or DSD, and Warehouse. The DSD segment mainly sells energy drinks.

Monster Beverage’s bold marketing approach

Monster Beverage’s advertising and marketing efforts are associated with adventure sports and sports personalities. It sponsors extreme sporting events—like Motocross.

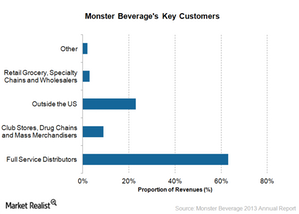

Monster Beverage’s distribution network

Coca-Cola purchased a 16.7% stake in Monster Beverage. Monster Beverage will be able to leverage Coca-Cola’s strong distribution network.

Monster Beverage’s extensive line of energy drinks

Monster Beverage Corporation (MNST) emerged as a leader in energy drinks. It has a 14% market share in the world’s energy drink market.

An overview of Monster Beverage Corporation

Monster Beverage Corporation (MNST) is based in California. It manufactures alternative beverages. It sold over 10 billion energy drinks in the past 12 years.

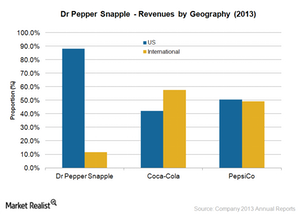

Why international expansion is vital for Dr Pepper Snapple

The carbonated soft drink volumes in North America have been continually declining. This makes it important for Dr Pepper Snapple to grow beyond its US operations.

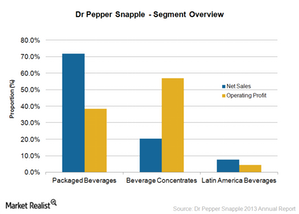

Understanding Dr Pepper Snapple’s revenue streams

Dr Pepper Snapple derives its revenues from the sale of carbonated soft drinks and noncarbonated beverages like ready-to-drink tea, juices, and mixers.

Dr Pepper Snapple targets key demographics in advertising campaigns

Dr Pepper Snapple is targeting Hispanics and Millennials in its advertising. By 2020, Hispanics will make up 19% of the US population. Millenials represents 24%.

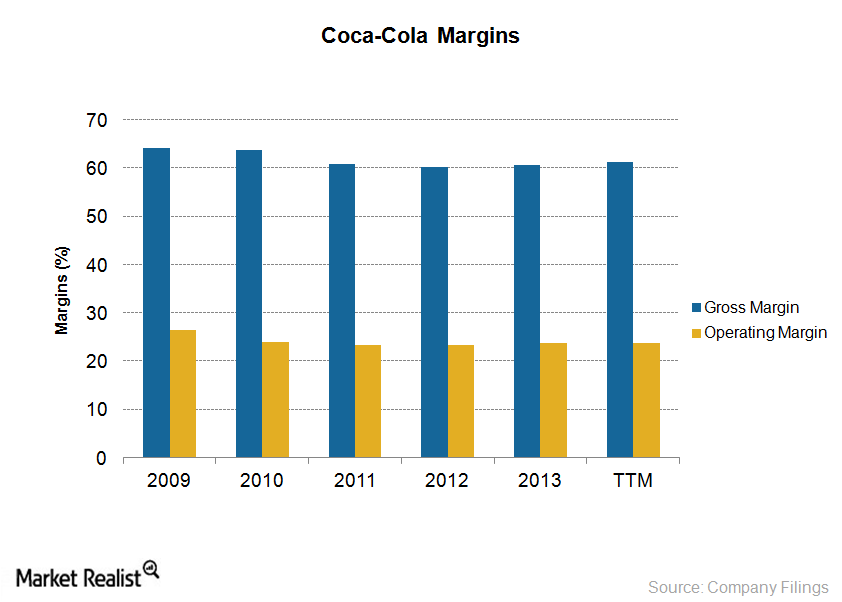

Advertising is a key strategy for Coca-Cola’s growth

In 2013, Coca-Cola spent $3.37 billion, or 7.0% of it’s 2013 revenues, on advertising—including in-store activations, loyalty points programs, and point-of-sale marketing.

Investing in Coca-Cola: The world’s largest soft drink company

The Coca-Cola Company (KO), founded in 1892, is the world’s largest soft drink maker. It sells more than 3,500 products worldwide.Company & Industry Overviews International growth opportunities for the soft drink industry

Growing populations and better standards of living in emerging markets will drive demand for beverages. The long-term prospects for growth in emerging economies are promising.Company & Industry Overviews Why growth is sluggish in the non-alcoholic beverage industry

The World Health Organization suggests that sugar should account for only 5% of total energy intake per day. A single soda can contains around 40 grams of sugar.Company & Industry Overviews The role of branding and advertising in the soft drink industry

Soft-drink makers continually invest in branding. In 2013, Coca-Cola and PepsiCo spent $3.3 billion and $3.9 billion, respectively, on advertising and marketing activities.Company & Industry Overviews Understanding the soft drink industry’s key markets

Market intelligence firm Euromonitor International estimates the middle class around the world will include 1.5 billion households by 2020, a 25% rise over 2012.Company & Industry Overviews Key indicators of the non-alcoholic beverage industry

US consumption spending accounts for over two-thirds of the country’s gross domestic product. A favorable trend in consumer spending on non-durable goods is a positive indicator for the non-alcoholic beverage industry.Company & Industry Overviews Understanding the value chain of the soft drink industry

Coca-Cola and PepsiCo’s wide distribution network gives them significant pricing power. Carbonated soft drinks have similar prices due to the intense competition in the industry.Company & Industry Overviews Understanding consumer craving for soft drinks

Soft drinks contain considerable amounts of sugar, which is a form of carbohydrate. Consumption of excess sugar releases a hormone called dopamine, which induces pleasure in the brain. Caffeine, another key ingredient, stimulates the nervous system.Company & Industry Overviews A guide to the non-alcoholic beverage industry

The non-alcoholic beverage industry broadly includes soft drinks and hot drinks. In the US, soft drinks, or liquid refreshment beverages, lead food and beverage retail sales. In this series, we’ll focus on the soft drinks market.