iShares Nasdaq Biotechnology ETF

Latest iShares Nasdaq Biotechnology ETF News and Updates

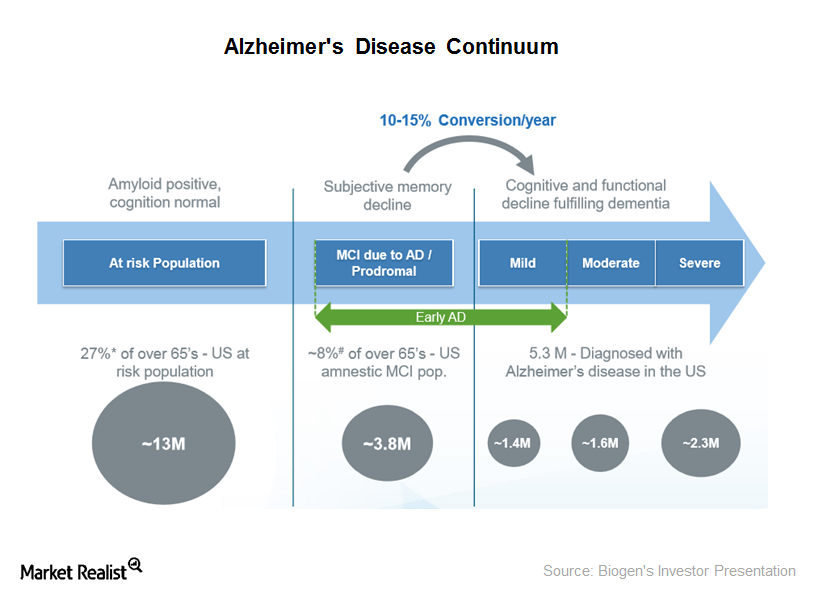

Biogen’s Experimental Alzheimer Therapy: Limited 2Q15 Success

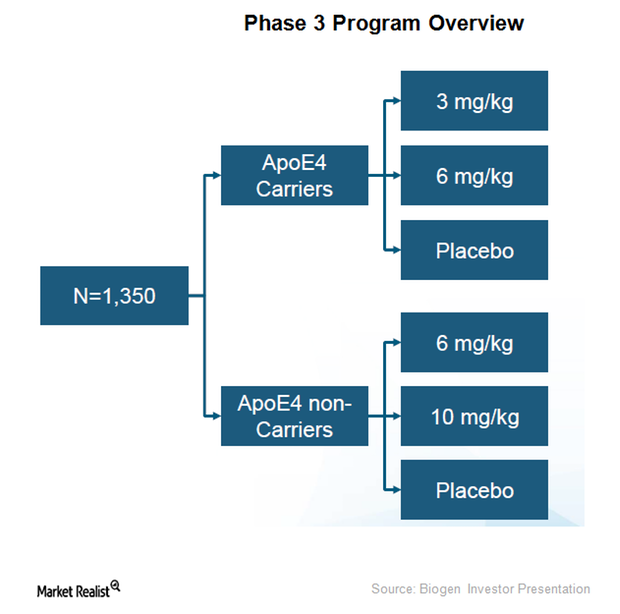

On July 22, 2015, Biogen (BIIB) released data from a Phase 1b study, also called the PRIME Study, that looked at the effectiveness of its investigational Alzheimer’s drug, BIIB037.

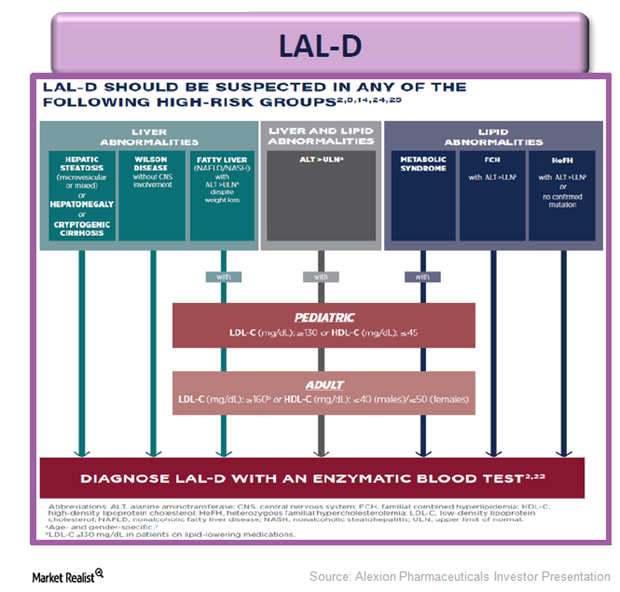

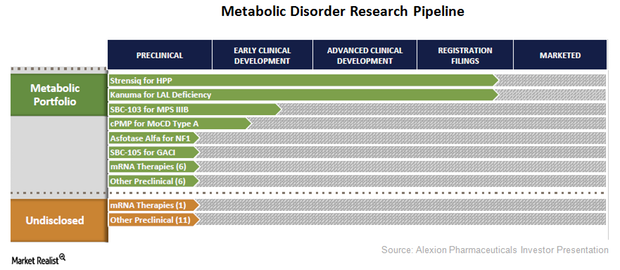

Alexion Pharmaceuticals Adds Metabolic Drug Kanuma to Portfolio

Kanuma was acquired by Alexion Pharmaceuticals on completion of the acquisition of Synageva Pharmaceuticals in June 2015.

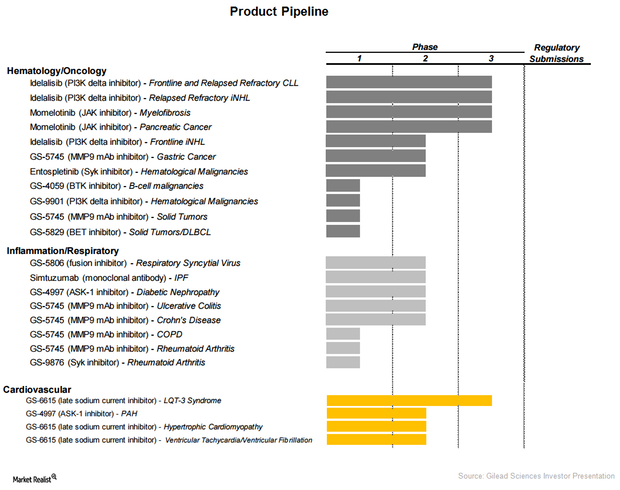

Gilead Sciences’ Product Line Extension

As part of its significant product line extension, Gilead Sciences (GILD) is entering therapeutic areas such as oncology, pulmonology, and cardiology.

What’s behind Biogen Buyout Rumors?

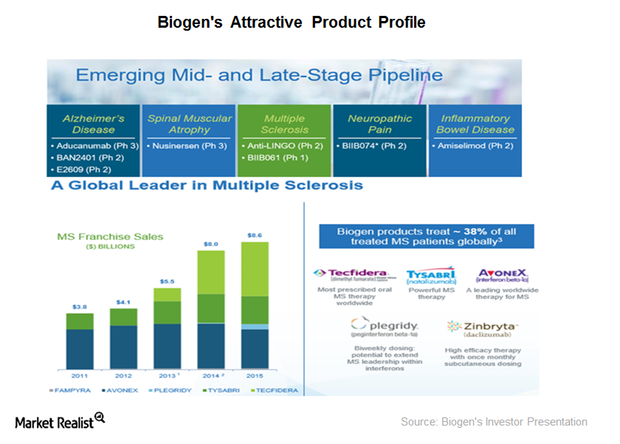

Since early August 2016, there have been rumors of a likely buyout of Biogen (BIIB) by one of the many interested suitors in the biotechnology industry.

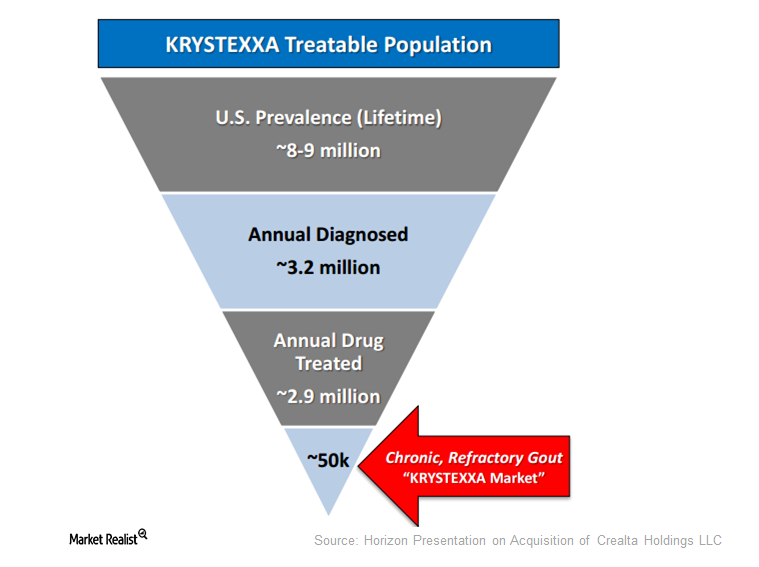

Introducing Krystexxa, the Latest Addition to Horizon’s Orphan Portfolio

In January 2016, Horizon acquired Krystexxa from Crealta Holdings. The drug has been approved by the FDA for the treatment of chronic refractory gout.

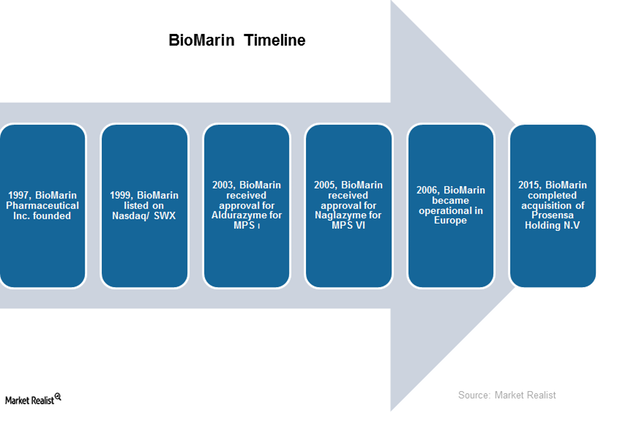

Overview of BioMarin: History and Product Portfolio

Here we present an overview of BioMarin. It’s based in California and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases.

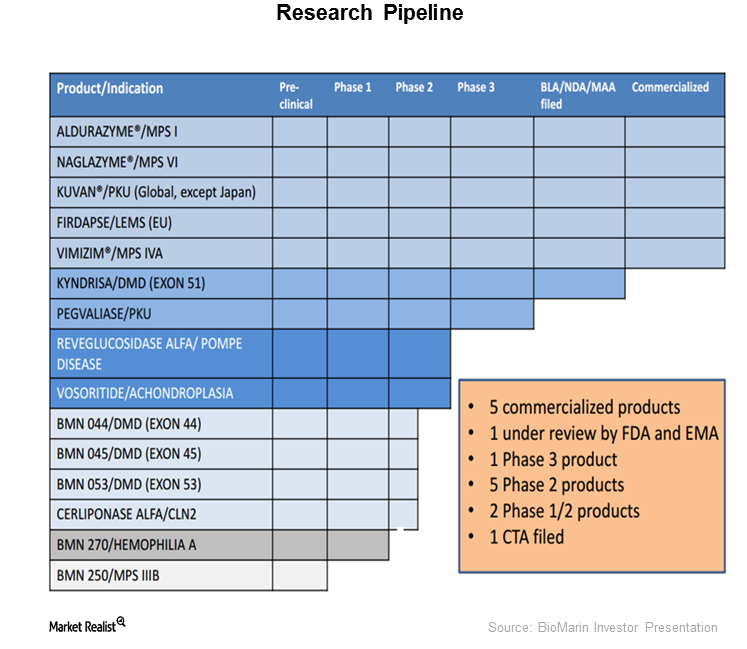

BMN 270: A Big Valuation Catalyst for BioMarin

On March 1, 2016, BioMarin received orphan drug designation for BMN 270 from the FDA. BioMarin’s stock jumped by about 6.96% the same day.

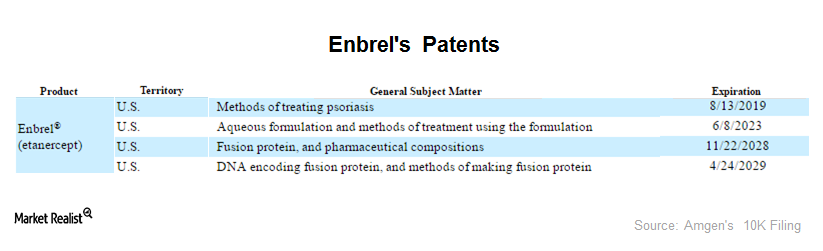

Why Is Enbrel So Important for Amgen?

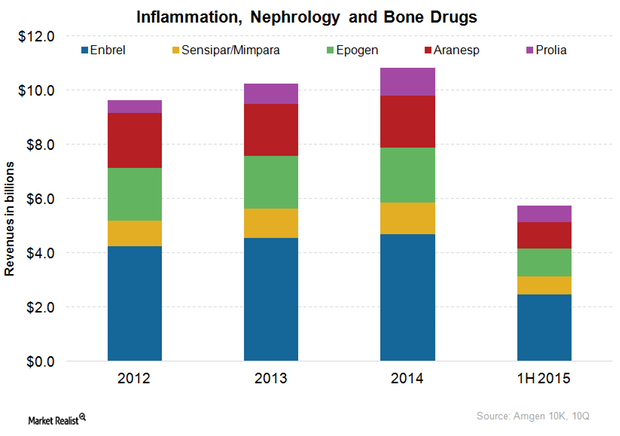

YTD, Amgen’s (AMGN) stock has already fallen 9%. Perhaps the pressure that Enbrel (etanercept) is seeing is to blame for the negative investor sentiment.

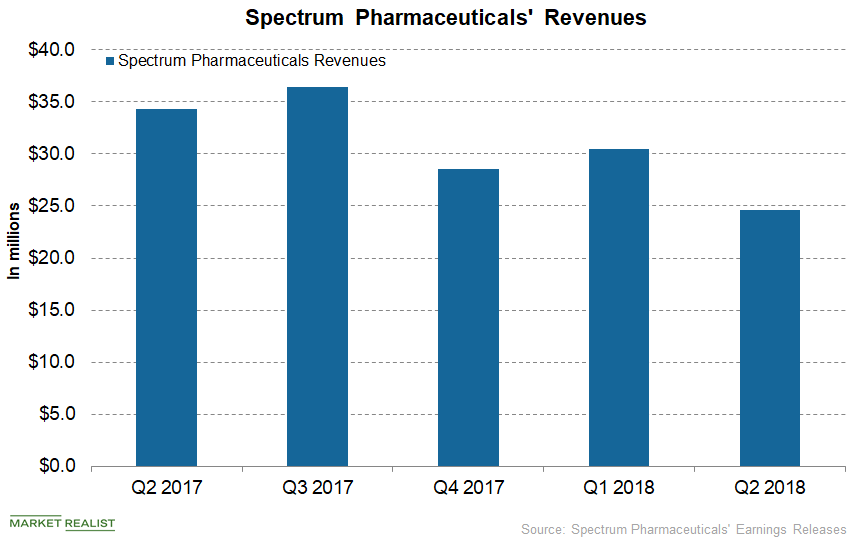

A Look at Spectrum’s Financial Position in September

In the second quarter, Spectrum Pharmaceuticals (SPPI) generated net revenues of $24.2 million compared to $34.3 million in Q2 2017.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

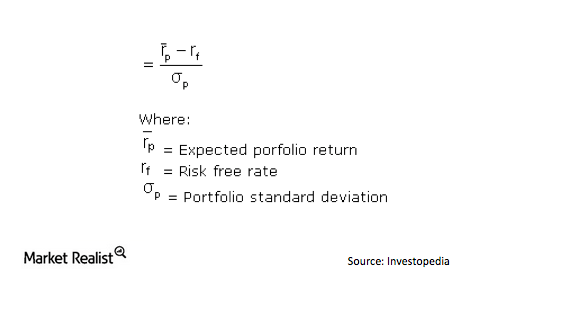

Why you should use the Sharpe ratio when investing in the medical device industry

What is a Sharpe ratio? A Sharpe ratio is a tool that measures the amount of returns for each unit of volatility that’s generated by a portfolio (higher returns and lower volatility equals more returns per unit of volatility). The measurement allows investors to analyze how much return they’re receiving from a portfolio in exchange for […]

Marijuana-Focused Biotech Companies in Q3: Are They Performing?

In this series, we’ll look at biotechnology companies focused on marijuana-based products and how they performed in the third quarter.

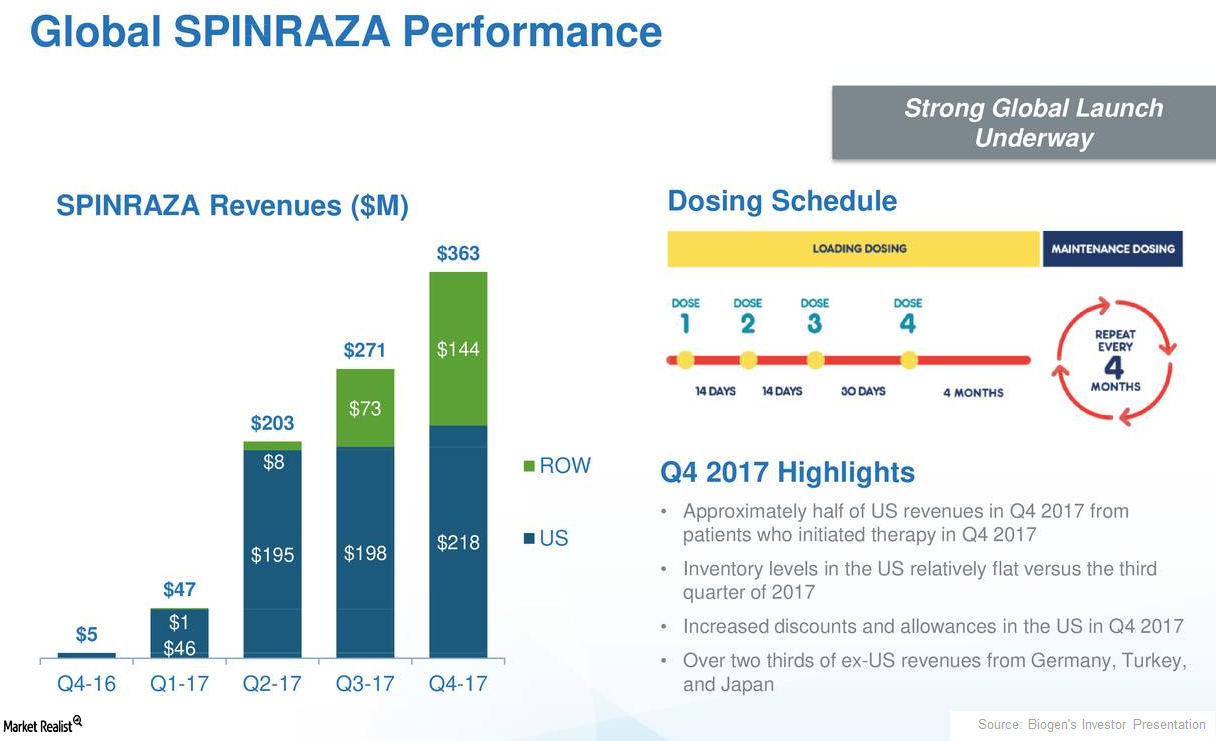

How Biogen’s Spinraza Is Positioned for 2018

In 4Q17, Biogen’s (BIIB) Spinraza generated revenues of $363 million, which reflected 34% quarter-over-quarter growth.

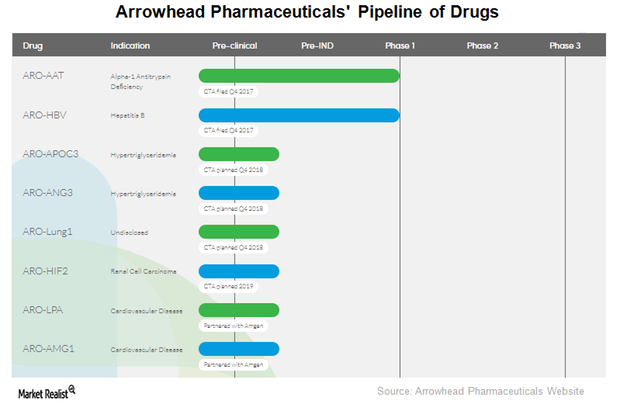

Taking a Closer Look at Arrowhead Pharmaceuticals’ TRIM Platform

Arrowhead Pharmaceuticals’ (ARWR) prior efforts were aimed at clinical programs that utilized the dynamic polyconjugate (or DPC), also called the EX1 delivery vehicle.

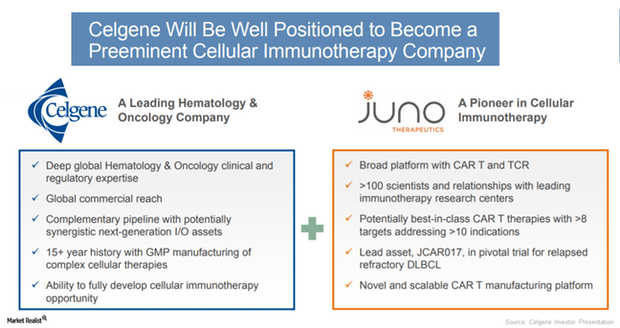

Celgene to Acquire Juno Therapeutics

On January 22, 2018, Celgene and Juno Therapeutics announced a merger agreement in which the former will acquire the latter’s business.

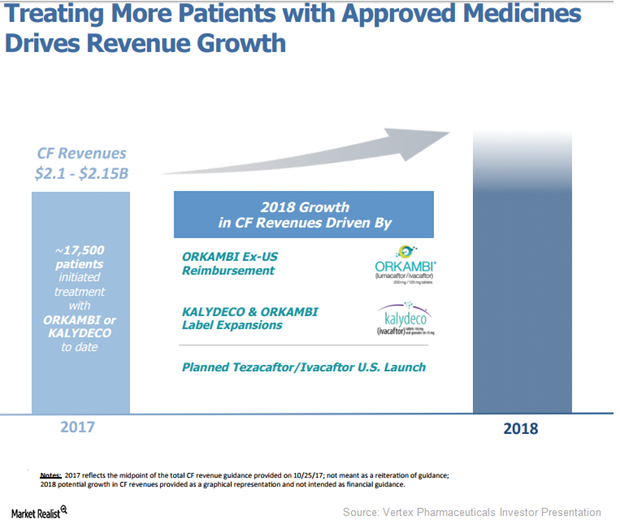

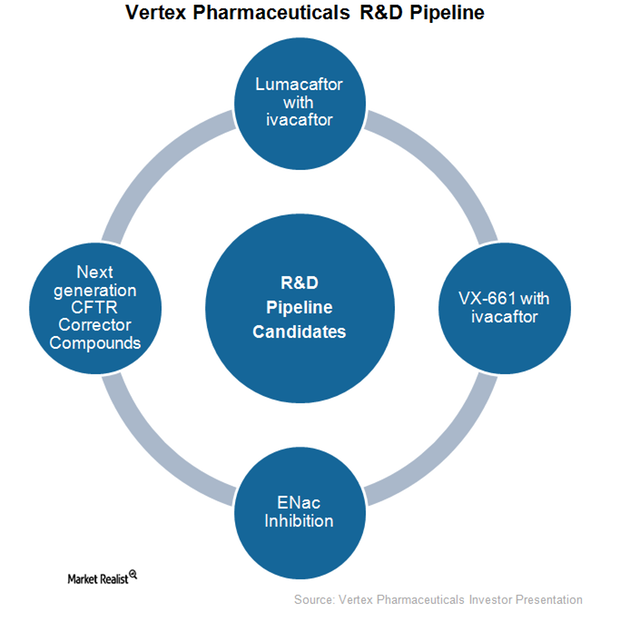

Vertex Pharmaceuticals Has Robust Late-Stage Research Pipeline

On January 10, 2018, Vertex Pharmaceuticals announced that Orkambi has secured regulatory approval from the European Commission to treat CF patients ages six to 11 years.

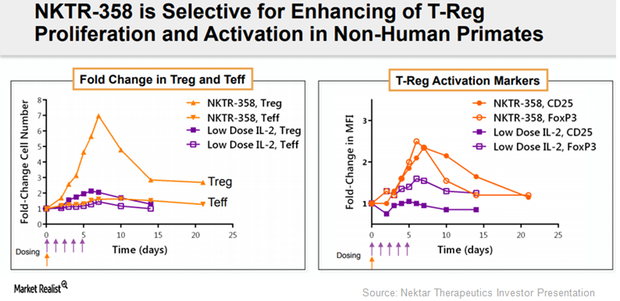

Nektar’s NKTR-358 Collaboration with Eli Lilly Boosted Revenues

Nektar Therapeutics (NKTR) recognized $128 million of the $150 million upfront payment from Eli Lilly (LLY) related to the development of investigational drug NKTR-358.

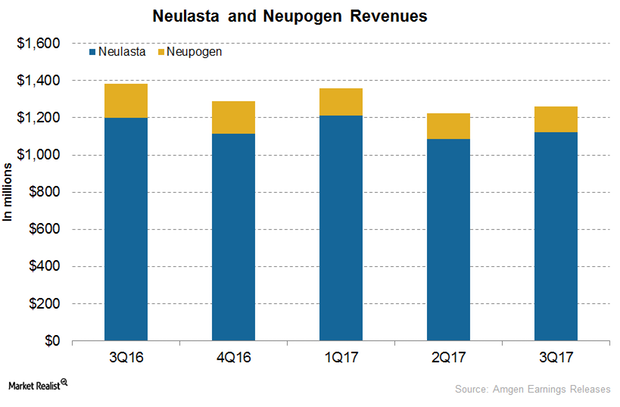

How Did Amgen’s Neulasta and Neupogen Perform in 3Q17?

In 3Q17, Amgen’s (AMGN) Neulasta generated revenues of around $1.1 billion, a ~6% decline on a year-over-year (or YoY) basis and ~3% growth on a quarter-over-quarter basis.

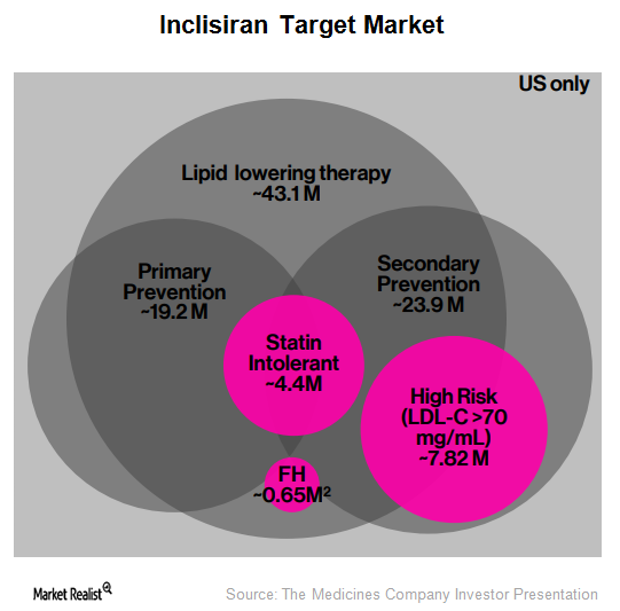

Inclisiran: Long-Term Growth Driver for The Medicines Company?

According to a Monte Carlo simulation performed at Harvard, it’s estimated that 5.0 million patients in the United States stand to benefit from PCSK9 inhibitor therapy.

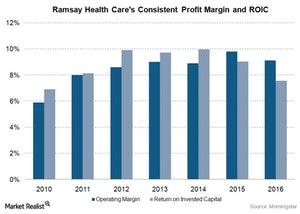

How Ramsay Health Care Became a Cost Leader

Ramsay Health Care is a market leader in private healthcare in Australia, treating almost 3 million patients each year.

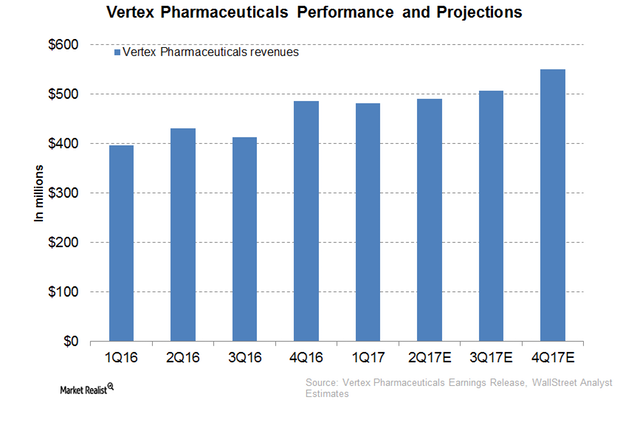

Inside Vertex Pharmaceuticals’ Revenue Trend

In 2016, Vertex Pharmaceuticals (VRTX) reported revenues of around ~$1.7 billion, which reflected a whopping 65% YoY (year-over-year) growth.

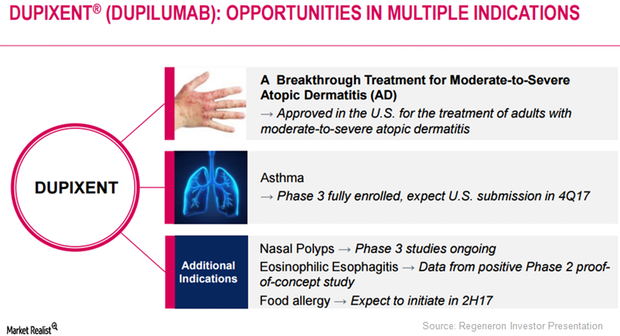

Dupixent May Prove Effective in Multiple Diseases

Regeneron plans to discuss Dupixent’s innovative mechanism-based treatment approach with regulatory authorities.

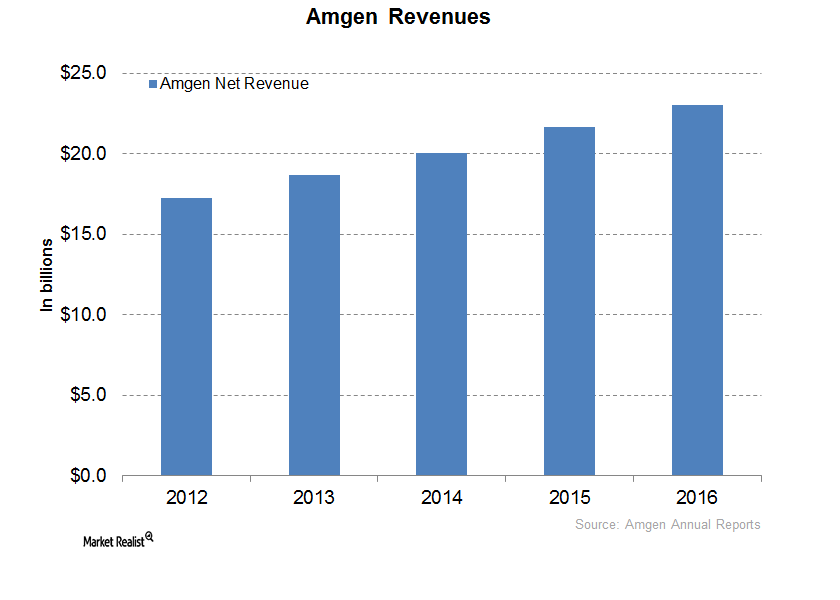

What Could Drive Amgen’s Growth in 2017?

Enbrel, Neulasta, and Epogen are among Amgen’s (AMGN) major revenue-generating drugs, each with annual sales in excess of $1 billion. Enbrel and Neulasta together accounted for ~46% of Amgen’s 2016 revenues.

Are Stock Returns during Summer Months That Bad?

The health care sector (IBB) (VHT) (XBI) has been the most challenged sector since Donald Trump’s presidential campaign.

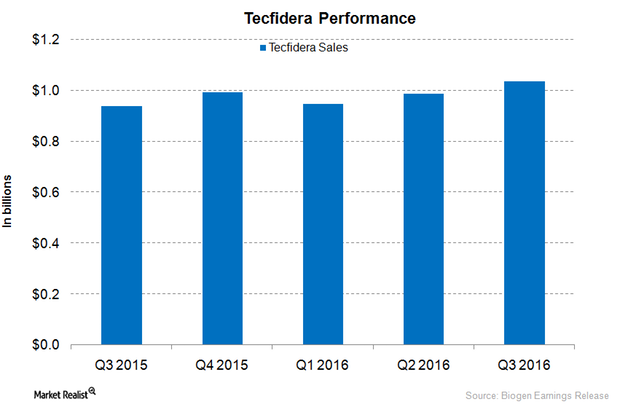

Tecfidera Continued to Lead in the Oral Multiple Sclerosis Market

In 3Q16, Biogen’s (BIIB) oral multiple sclerosis (or MS) drug, Tecfidera, managed to increase its global market share to ~15%, a year-over-year (or YoY) rise of about 1 point.

Market Cheers FDA’s Fast Tracking of BIIB’s Alzheimer’s Treatment

The U.S. Food and Drug Administration (or FDA) recently awarded the fast track status to aducanumab following the positive results of Biogen’s pre-clinical research.

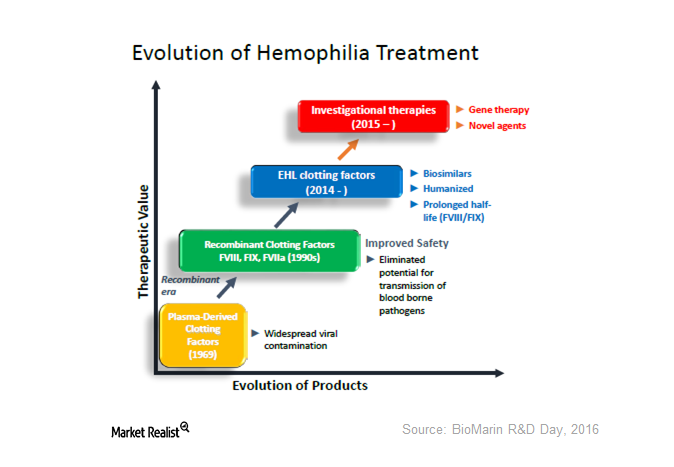

The Evolution of Hemophilia Treatment—And What It Means for BioMarin

BioMarin’s BMN 270 is a gene therapy being investigated for hemophilia A. On April 20, it announced early data of the phase-1 and phase-2 study of BMN 270.

How Does Vertex Plan to Expand Beyond Cystic Fibrosis?

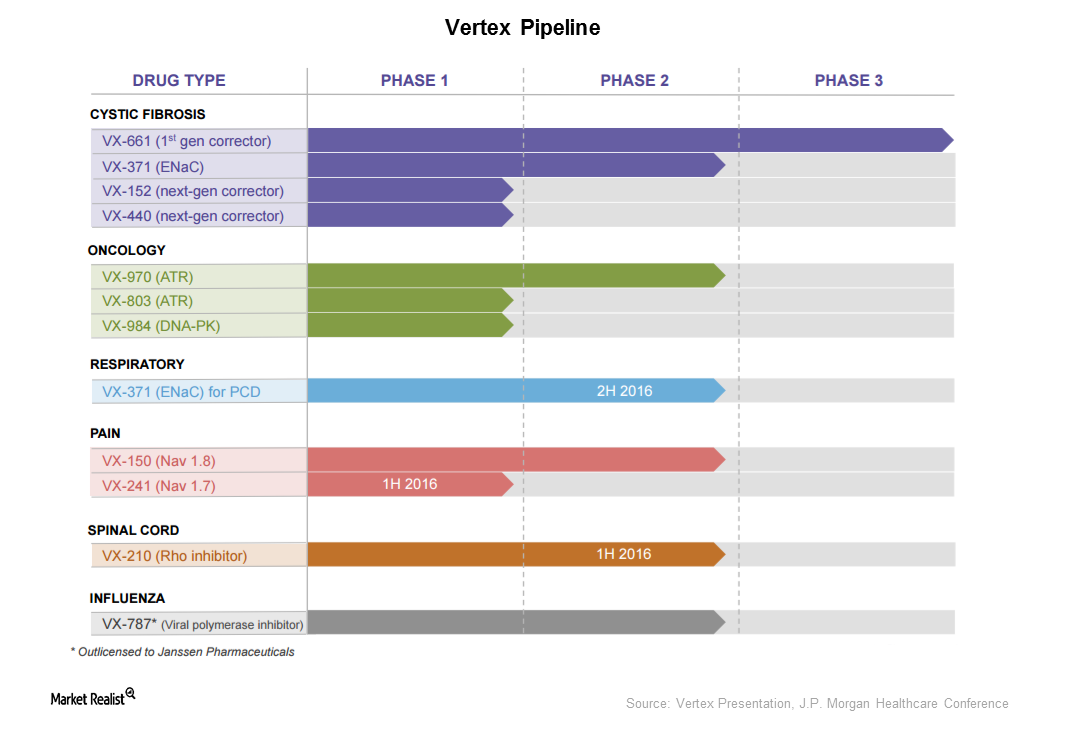

Vertex is trying to expand its product base beyond cystic fibrosis. It holds molecules in the oncology, respiratory, pain, spinal cord, and influenza spaces.

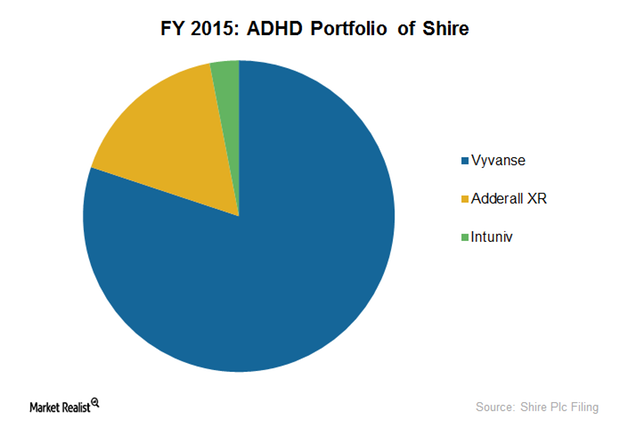

How Vyvanse Could Fuel Shire’s ADHD Portfolio Sales

Vyvanse is Shire’s leading ADHD drug, constituting 80% of the company’s ADHD portfolio. In fiscal 2015, Vyvanse earned the company $1.7 billion.

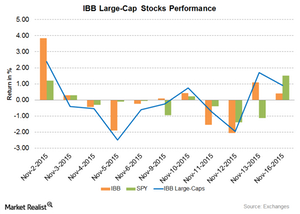

Illumina Continued to Rise, Led the Large-Cap Stocks

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period.

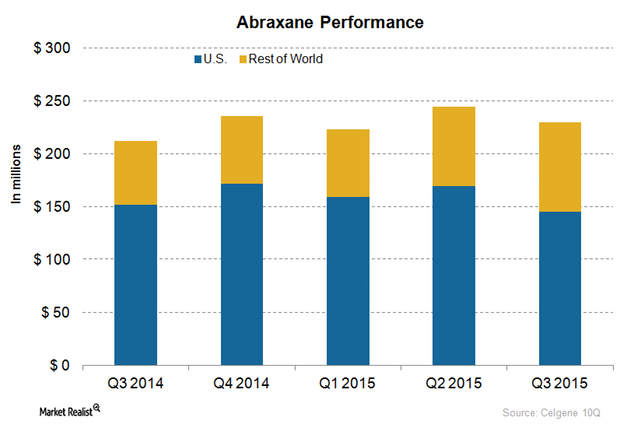

Abraxane Sales Are Lower than Expected in 3Q15

Abraxane’s sales in the US market fell by 4.2% from 3Q14 to 3Q15, while its sales in the rest of the world’s markets rose by 39.7% in the same time period.

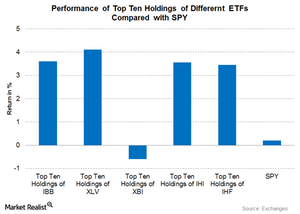

Allergan Drives the Performance of XLV’s Top Ten Holdings

Allergan gained 14.9% for the week ended October 30, 2015. The company’s stocks gained on the news of a possible merger with Pfizer.

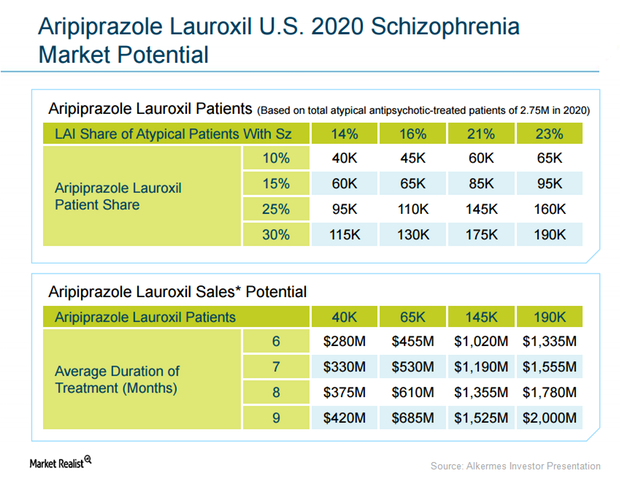

Alkermes’s Aristada and Its FDA Approval for Schizophrenia

Aristada was approved by the FDA and is projected to account for 10% to 30% of the LAI atypical antipsychotic market for schizophrenia patients in the US.

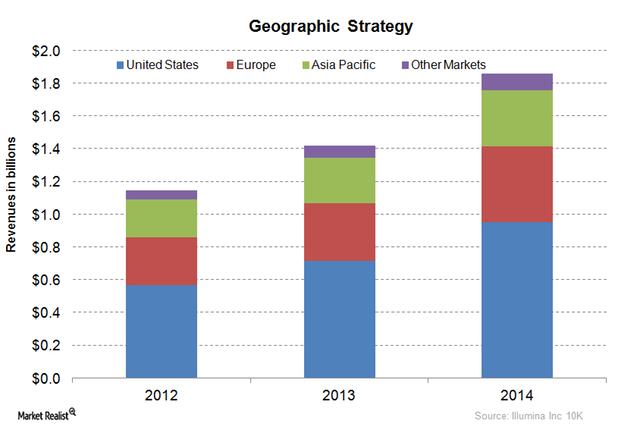

Illumina’s Market Expansion Strategy for Genome Sequencing

Illumina’s Market Expansion Strategy includes targeting the United States, Europe, and China for population sequencing projects.

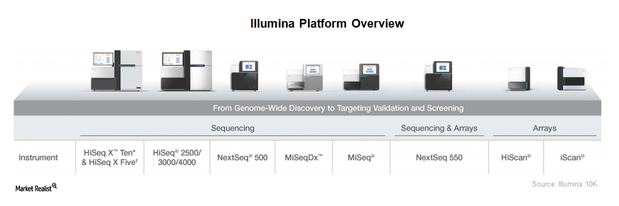

Illumina’s Key Products

Illumina’s key products are based on the company’s NGS (next-generation sequencing) technologies.

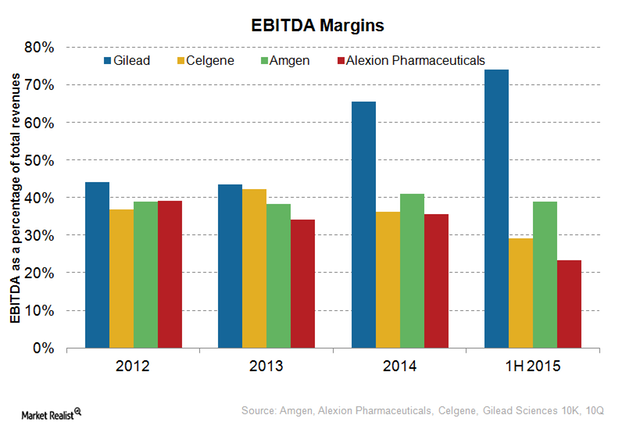

Alexion Pharmaceuticals’ Cost Structure and EBITDA Margins

Mature biotechnology companies generally earn EBITDA margins of about 30% to 40%.

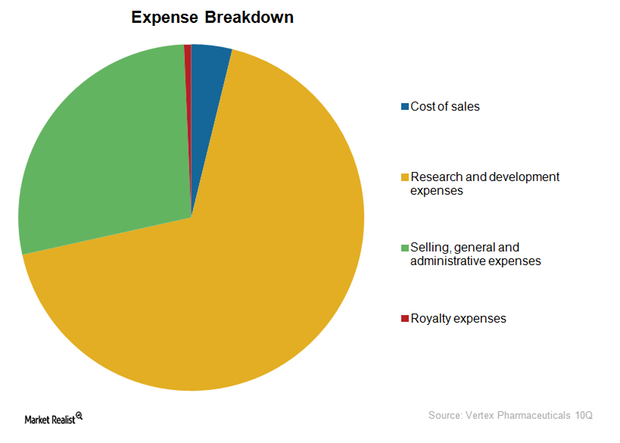

Vertex Pharmaceuticals’ Cost Structure and EBITDA Margins

While mature biotechnology companies with drugs in multiple disease segments earn an average of 30%–40% EBITDA, margins of companies targeting only rare diseases can vary due to unique business models.

Alexion Pharmaceuticals Diversifies Its Research Pipeline

Alexion Pharmaceuticals (ALXN) has strengthened its drug pipeline by diversifying its research programs across the metabolic disorder segment.

Vertex Has Strong Research and Development Pipeline

As part of its research and development, Vertex Pharmaceuticals (VRTX) has been actively exploring new cystic fibrosis (or CF) drugs as well as other indications for its existing drug Kalydeco.

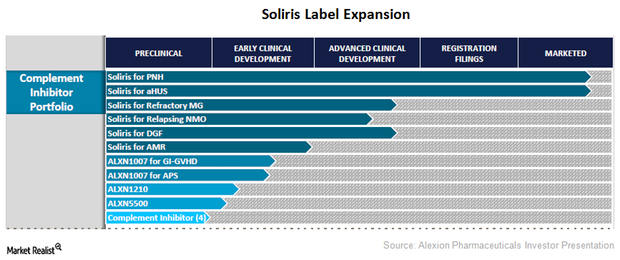

Alexion Pharmaceuticals Expands Soliris Labels

Alexion Pharmaceuticals is actively involved in expanding the approved labels for its flagship product Soliris.

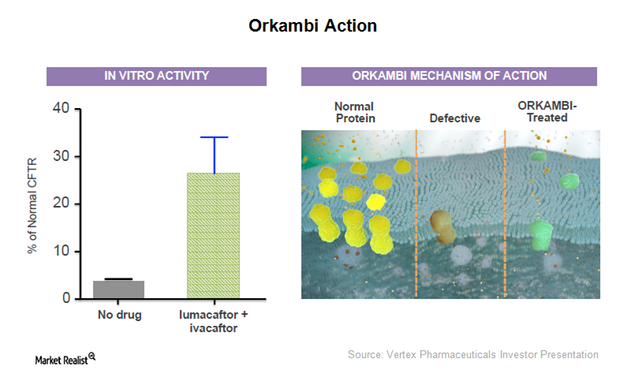

Vertex Pharmaceuticals’ New Drug Orkambi Receives FDA Approval

On July 2, 2015, the FDA (U.S. Food and Drug Administration) approved Orkambi, a combination drug of lumacaftor and ivacaftor, for treating cystic fibrosis (or CF) patients.

Dyax Traded above Its 100-Day Moving Average

Dyax (DYAX) gained 9.41% last week. The stock went up after Dyax presented at the Morgan Stanley global healthcare conference, which took place September 16-18 in New York.

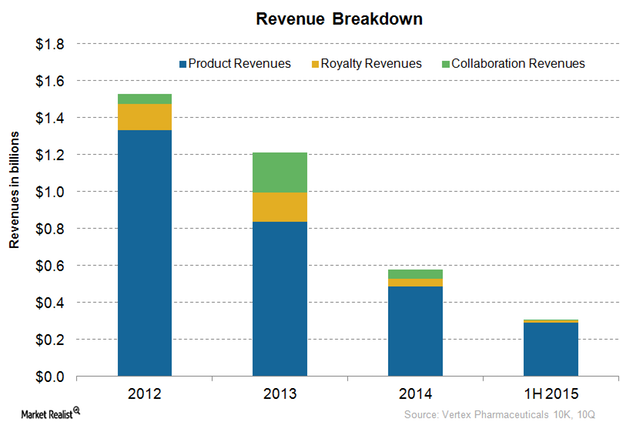

Vertex Pharmaceuticals’ 3-Pronged Business Model

Vertex Pharmaceuticals’ (VRTX) business model includes revenues in three areas: products, royalties, and collaboration. There’s significant variability in royalty and collaboration revenues.

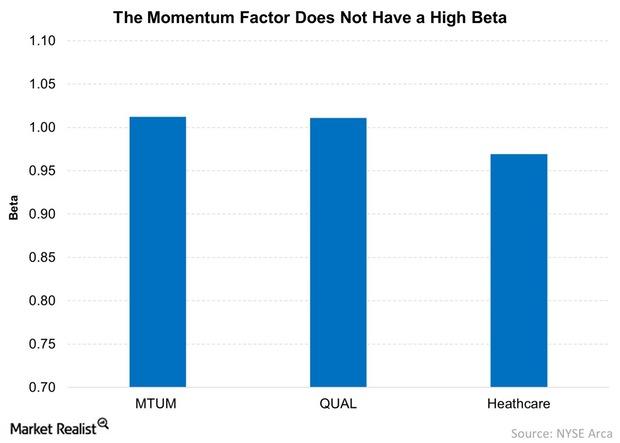

Momentum Stocks Don’t Have a High Beta

The healthcare sector, especially the biotech stocks, have garnered momentum over the last few years, as strong earnings growth has excited investors.

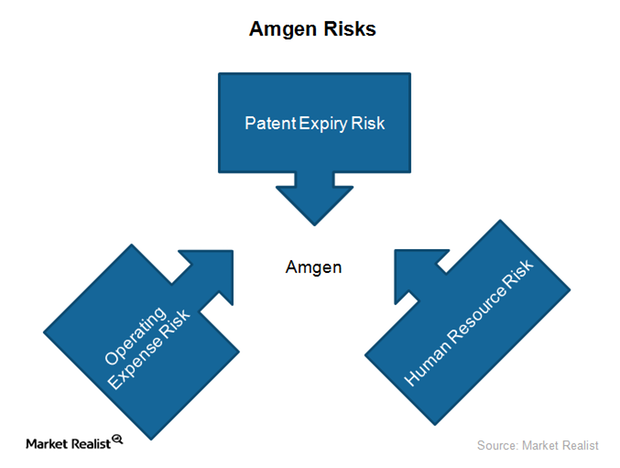

Amgen’s Key Risks

Amgen’s key risks include market erosion due to generic competition for Neulasta and Neupogen. Its restructuring also involves a reduction of about 3,500–4,000 employees.

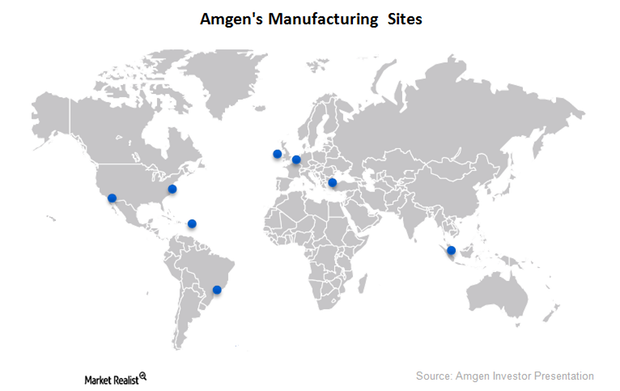

Amgen Develops World-Class Manufacturing Capability

Enhancing its manufacturing capability, Amgen has launched a next-generation bio-manufacturing facility in Singapore and plans to set up more in the coming years.

Amgen’s Presence in the Biosimilar Market

As it is still relatively difficult to introduce biosimilars, Amgen plans to enter the US market by leveraging experience of biosimilars in the European market.

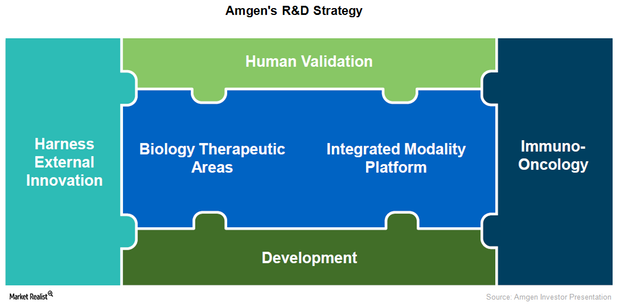

Amgen’s Research and Development Strategy

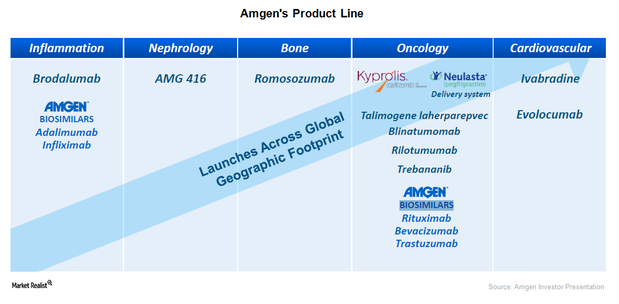

Amgen (AMGN) has adopted a well-structured research and development strategy focused on inflammation, metabolism, bone, and cardiovascular diseases.

Amgen’s Presence in Inflammation, Nephrology, and Bone Segments

Amgen offers various nephrology drugs such as Epogen, Aranesp, Sensipar, and Mimpara. Both Epogen and Aranesp have been facing squeezed profits from tight competition.

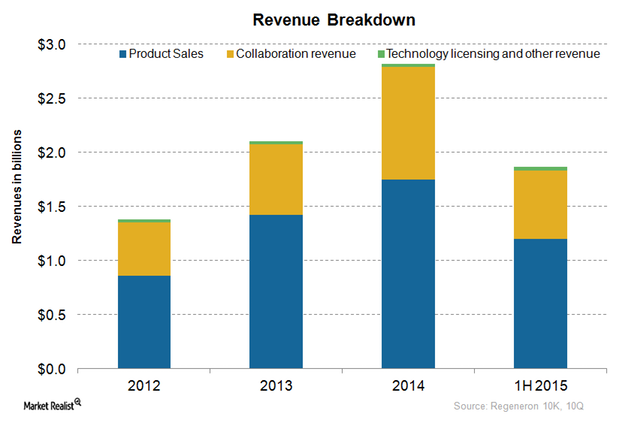

An Overview of Regeneron’s Business Model

Regeneron generates revenues in three ways: product sales, revenues earned through collaboration arrangements, and revenues earned from licensing proprietary technology.