CVS Health Corp

Latest CVS Health Corp News and Updates

Small Window Open for Signify Stock Before CVS Acquisition

Signify Health stock is trending upwards amid news of an official acquisition by major drugstore chain CVS Health. Is it a buy or should you hold out?

CVS Wants to Acquire Signify—The Potential Deal, Explained

CVS reportedly has plans to put in a bid to acquire Signify Health. What are the expected terms of the deal, and will it go through?

Walmart and CVS Will Stop Filling Certain Controlled Substance Prescriptions

CVS and Walmart have decided to longer fill prescriptions for controlled substances issued by Cerebral and Done. We'll see why and what it means for some customers.

CVS Is Closing Some Stores Amid Market and Industry Changes

Some CVS stores are closing across the U.S. and customers are being directed to alternative outlets. What stores are closing and why is the company making changes?

CVS Will Close 900 Stores Starting in 2022—Closures Will Span 3 Years

On Nov. 18, CVS announced that it will be closing 900 stores across the U.S. Why will there be store closures?

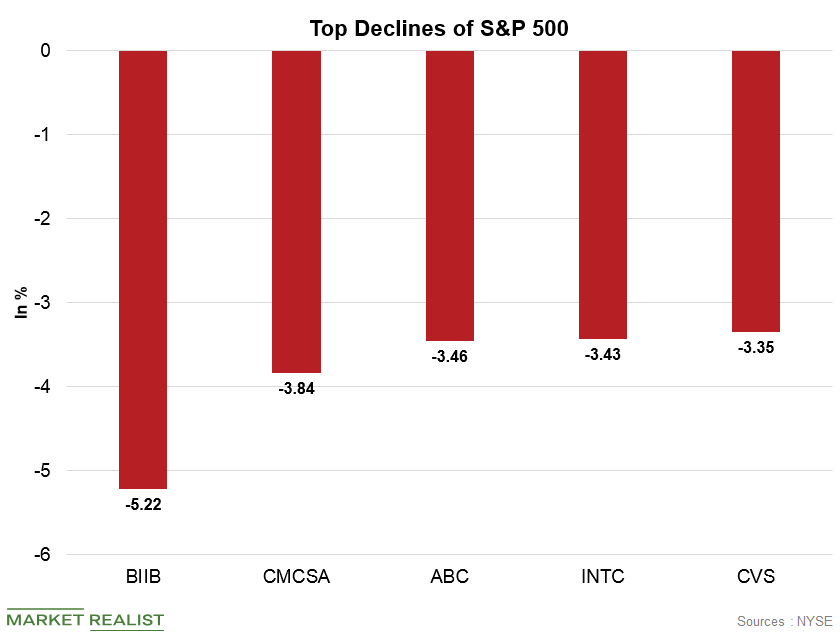

S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

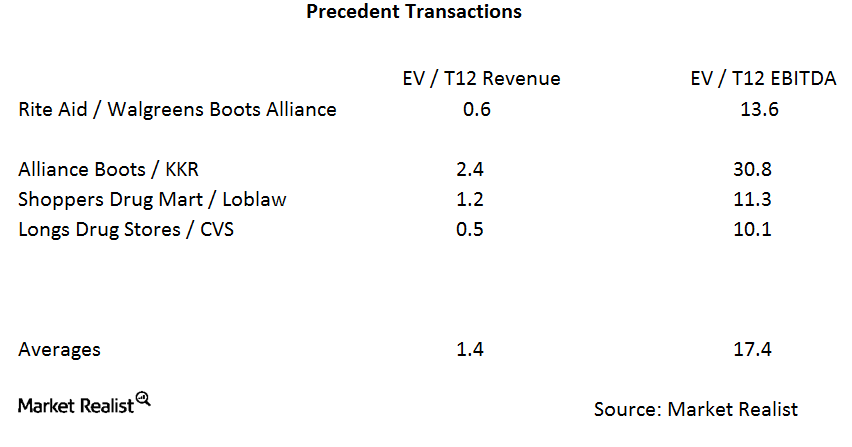

Could the Rite Aid–Walgreens Merger Get Competitive?

In the Rite Aid–Walgreens merger, Walgreens is paying about 0.6x trailing-12-month revenues and 13.6x trailing-12-month EBITDA.

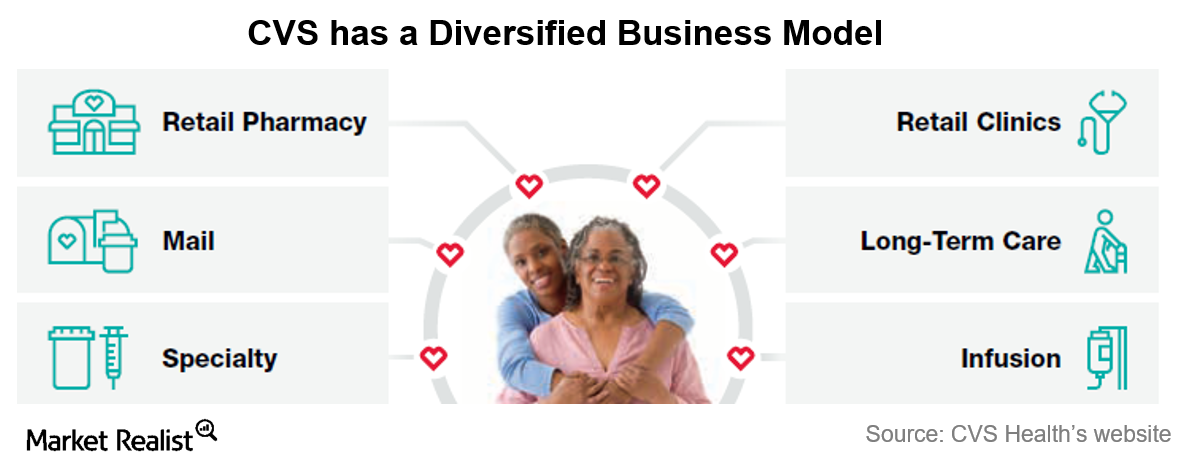

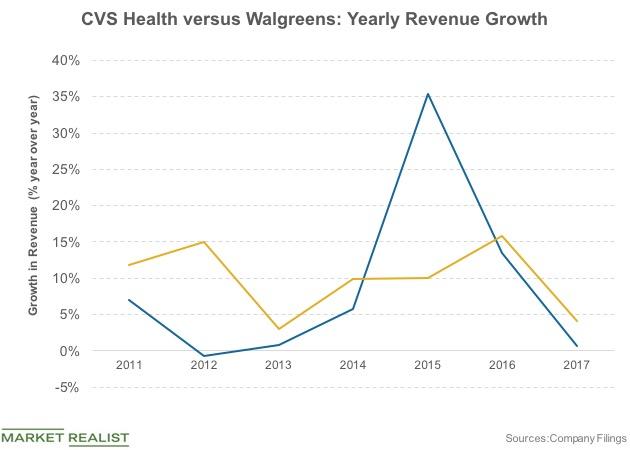

CVS versus Walgreens: Which Has a More Diversified Business Model?

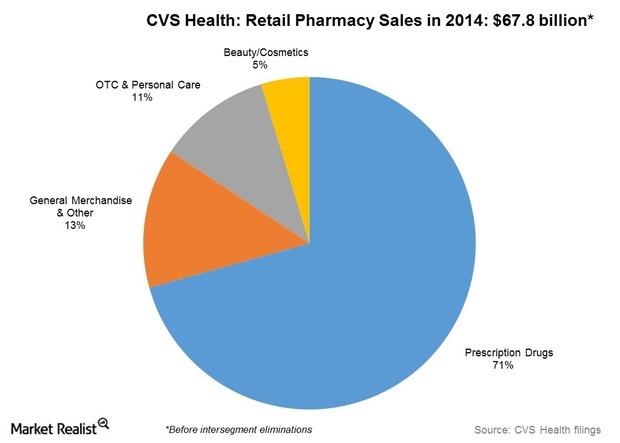

CVS generates close to 70% of its annual sales by offering a full range of pharmacy benefit management services.

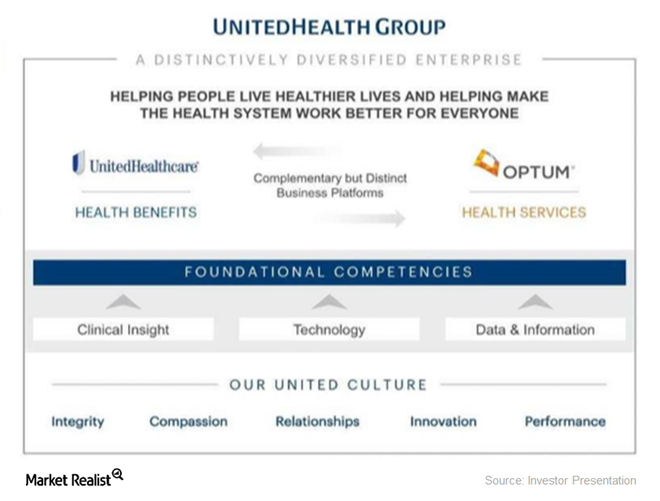

How Is UNH’s Optum Business Positioned in the Industry?

UnitedHealth Group is, by revenue, the largest healthcare company in the world.

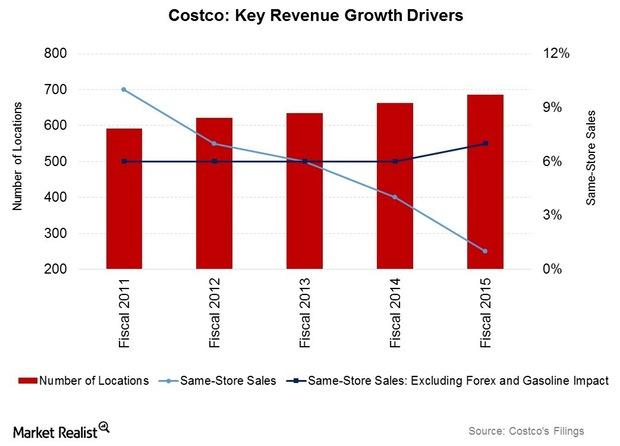

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Will Walgreens’ Q3 Results Beat Wall Street’s Forecast?

Unlike several other US companies, Walgreens didn’t suspend its dividends due to COVID-19. As of July 6, the company’s dividend yield was 4.2%.

Walmart to Boost Pharmacy Business with CareZone’s Tech Acquisition

Today, CNBC reported that Walmart (NYSE:WMT) has acquired prescription management technology from CareZone to boost its pharmacy space.

CVS Health Stock: What’s Fueling Growth and Will the Uptrend Last?

CVS Health stock is up about 13% in November. Strong financial performance is driving the stock higher, but low earnings growth could limit further upside.

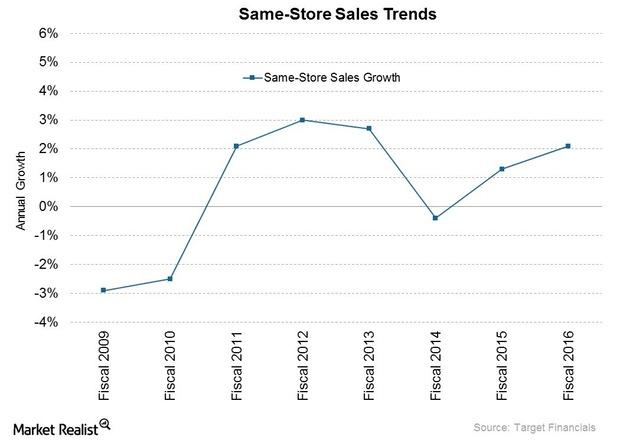

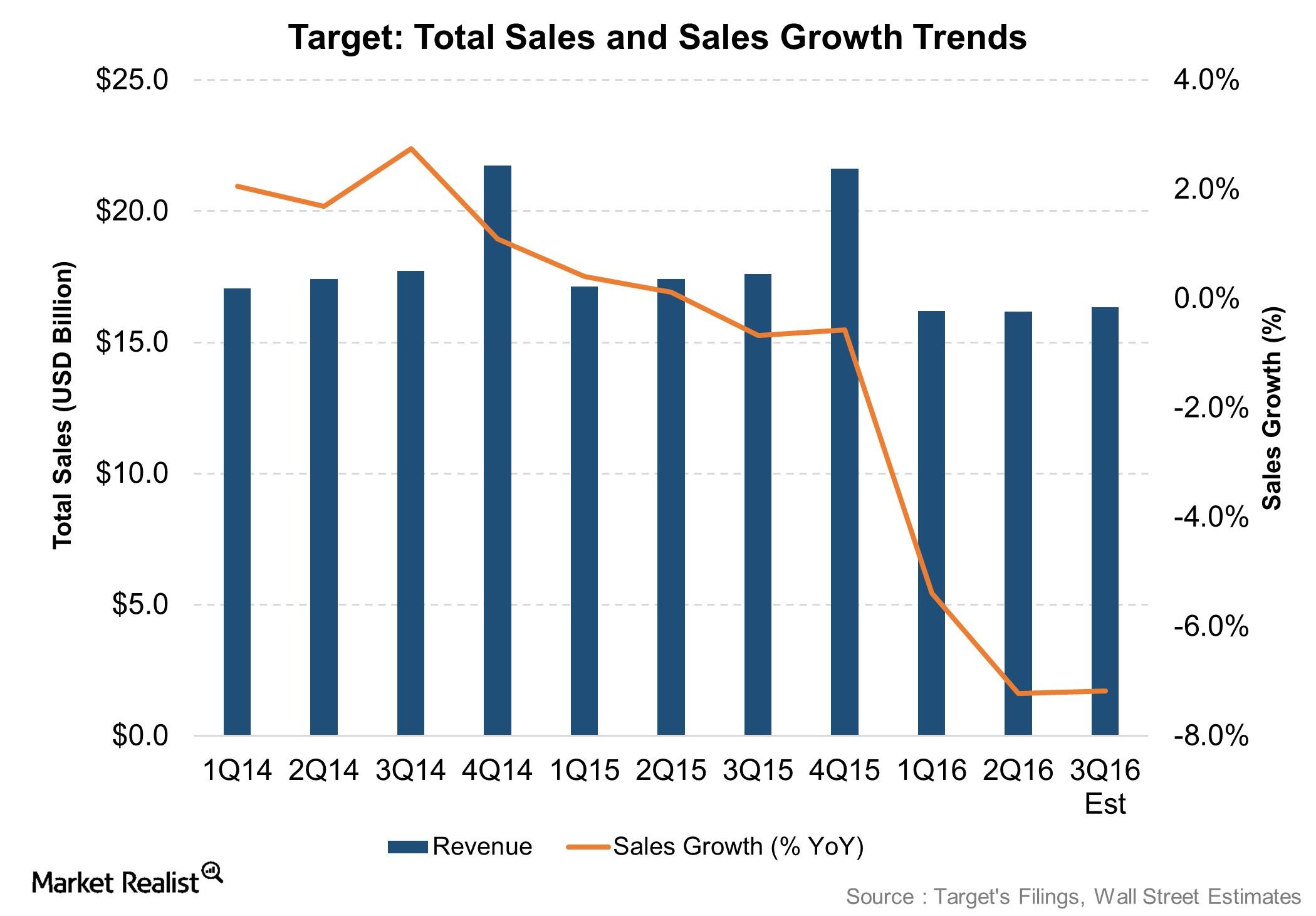

Analyzing Target’s Same-Store Sales Growth in Fiscal 2016

Target had upbeat revenue performance in fiscal 4Q16 and 2016. Store traffic was up by 1.3% YoY in fiscal 2016, trending in positive territory in all four quarters of the year.

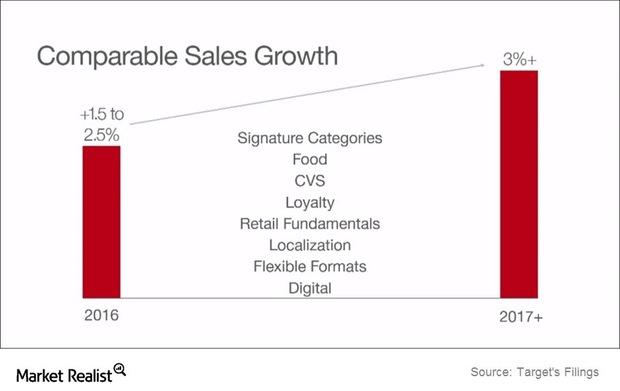

Why Target Is Focusing on Its Signature Categories to Drive Sales

Target has identified four signature categories it’s concentrating on to provide higher store and web traffic and sales: Baby, Style, Wellness, and Kids.

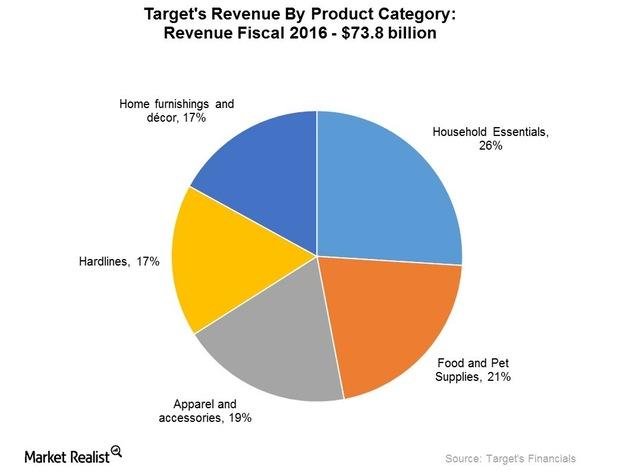

Merchandise Mix: Which Categories Are Performing Best at Target?

In fiscal 2016, Target’s (TGT) performance was upbeat for all merchandise categories with the exception of hardlines.

Charlotte’s Web Holdings Stock Down after Earnings

Charlotte’s Web Holdings stock (CWBHF)(CWEB) was down 6.6% yesterday after the company reported lower-than-expected Q2 earning results.

Walgreens or CVS Stock: Which Is a Better Value Buy?

Walgreens and CVS Health shares are trading at a low valuation multiple. The stocks have fallen 22.3% and 8.7%, respectively, in 2019.

Walgreens Will Close 200 US Stores

In a regulatory filing on Tuesday, Walgreens Boots Alliance (WBA) announced that it will close 200 stores in the US to focus on store optimization.

What’s Hurting CVS and Walgreens Stocks?

Walgreens Boots Alliance stock (WBA) fell 6.4% on March 1 after Baird’s reduction in target price.

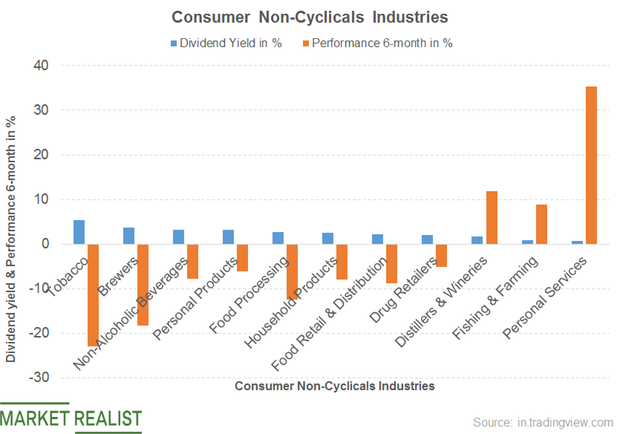

What’s the Dividend Yield of the Consumer Non-Cyclical Sector?

The consumer non-cyclical segment recorded a dividend yield of 3%.

CVS Health and Walgreens: Financial Health

CVS recorded total sales of $186 billion (+4% YoY) in the last 12 months. The Pharmacy Services segment was the company’s biggest moneymaker.

CVS Health versus Walgreens: Comparing Pharmacy Giants

Around 70% of the US population lives within three miles of a CVS store, while more than 75% of the population lives within five miles of a Walgreens store.

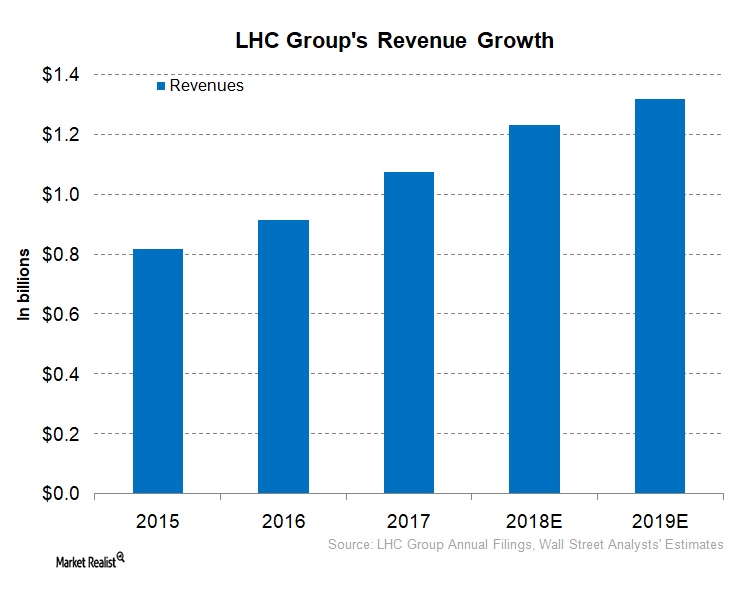

What’s LHC Group’s Business Strategy?

In 2018, LHC Group is expected to report revenue of $1.2 billion. What about its peers?

How the Drug Store Industry Is Changing

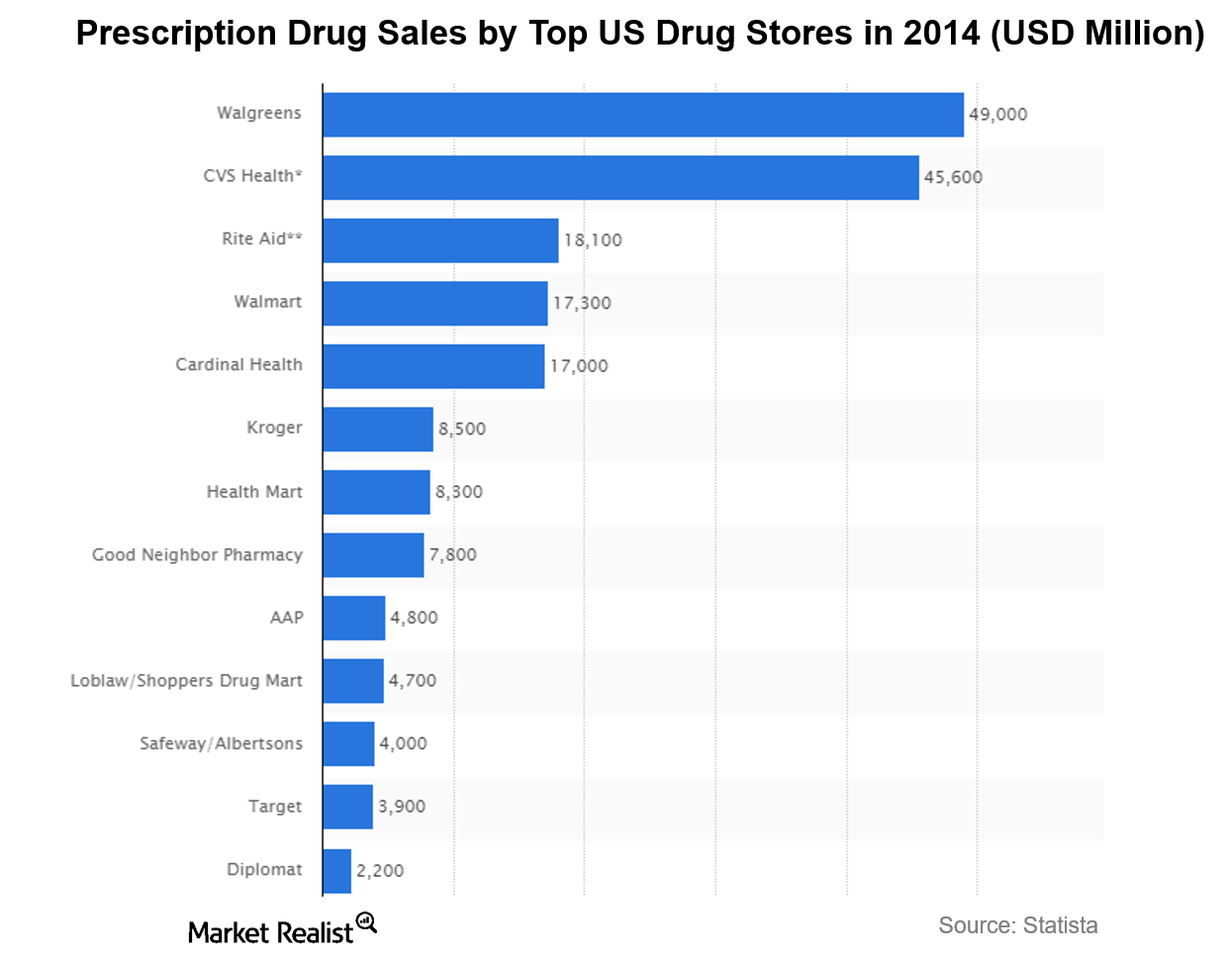

The top three drugstore chains in the US are in the process of forming new associations through mergers and acquisitions to create a more diversified portfolio and protect themselves from the growing online threat.

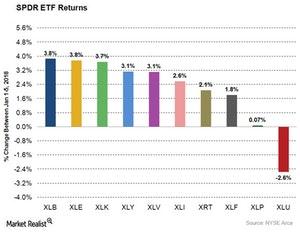

Consumer Sector Insights for the First Week of 2018

The consumer staples sector had a slight gain of 0.10% led by a stock increase in the stock price of CVS Health, Coty, Estee Lauder, and Walmart.

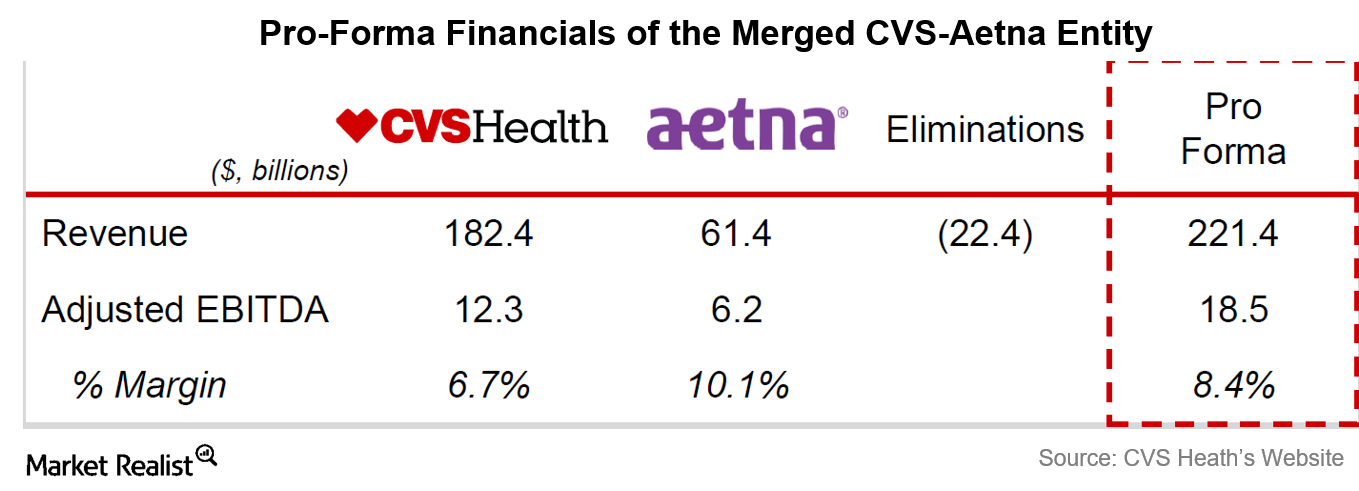

A Look at the Financial Details of the CVS-Aetna Deal

CVS is paying more than 11 times the trailing 12-month EBITDA for Aetna.

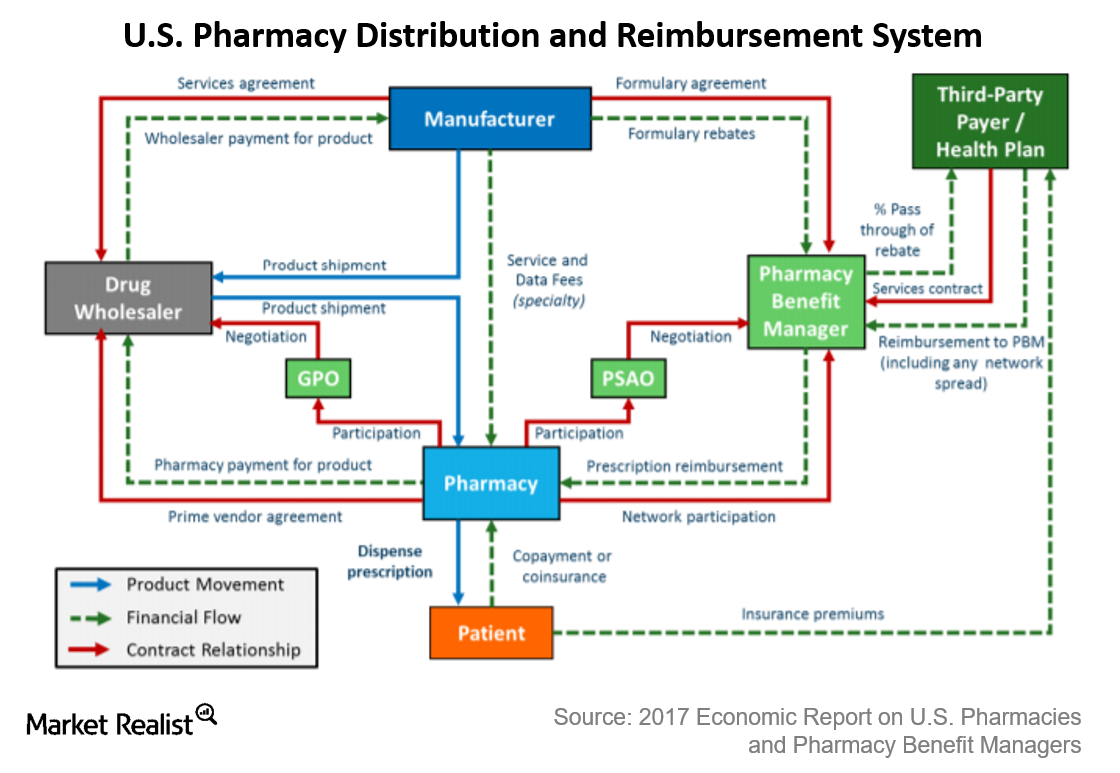

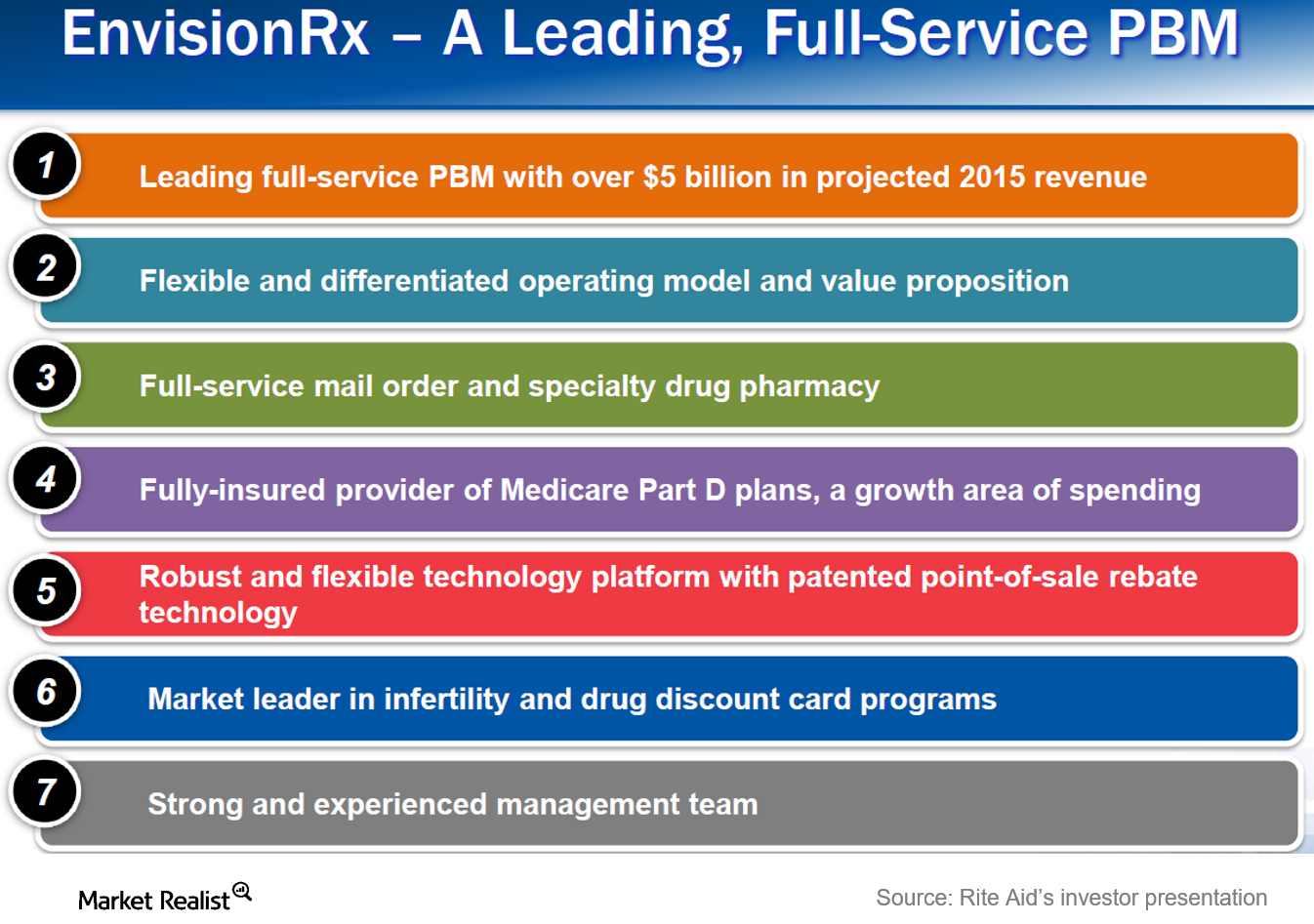

Walgreens versus CVS: Discussing PBM Strategies

In August 2016, Walgreens announced a long-term strategic alliance with Prime Therapeutics, America’s fourth-largest PBM.

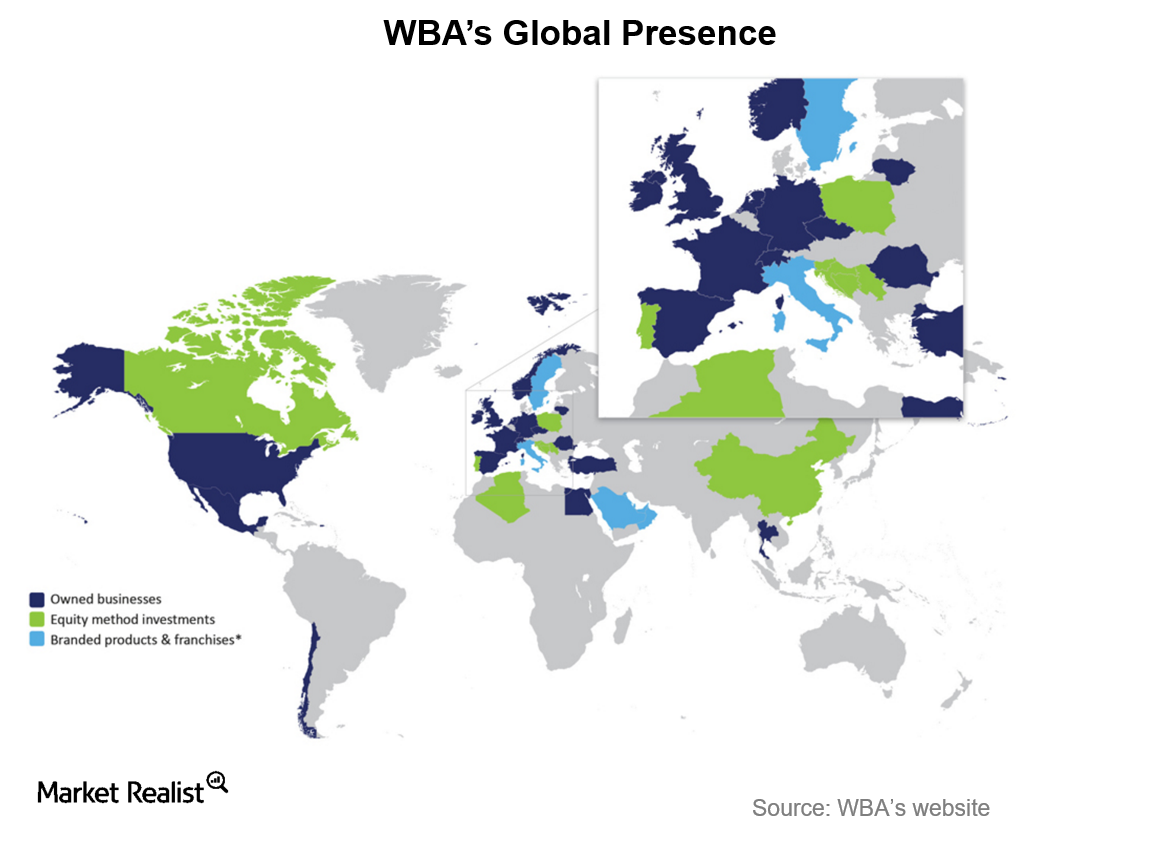

Walgreens versus CVS: Comparing International Presence

The US is Walgreens’ largest market and accounts for more than 70% of its total sales and operating income.

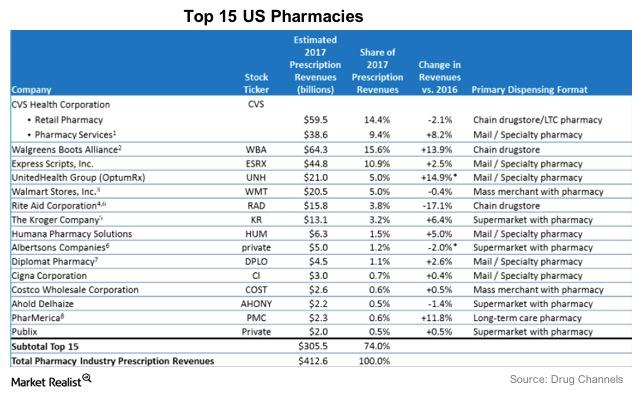

Walgreens versus CVS: Comparing Pharmacy Giants

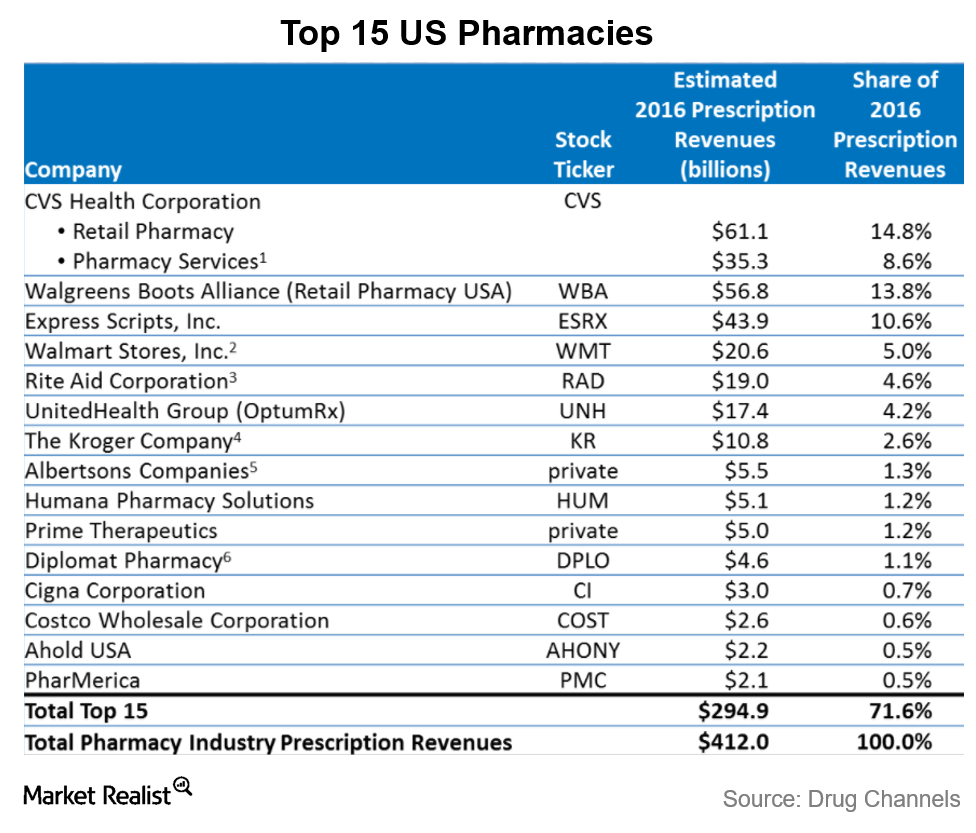

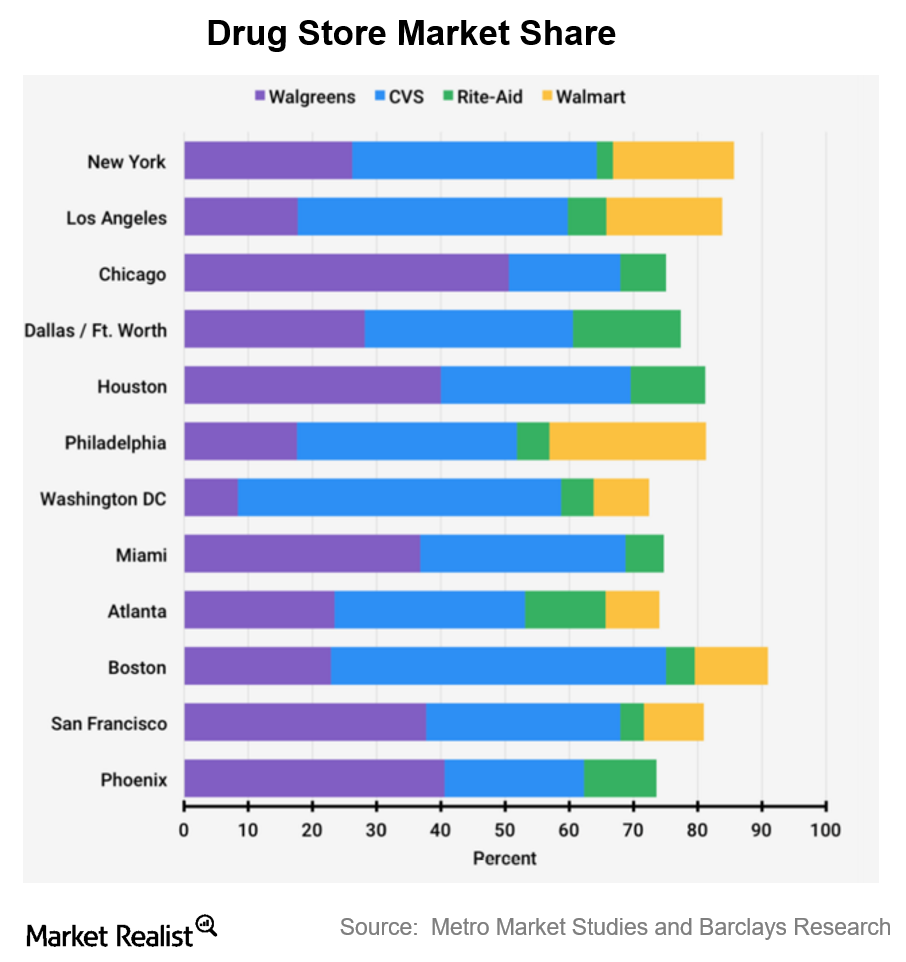

The US drugstore market is dominated by two major players—CVS Health (CVS) and Walgreens Boots Alliance (WBA). CVS and WBA accounted for ~29% of the country’s prescription dispensing revenues in 2016.

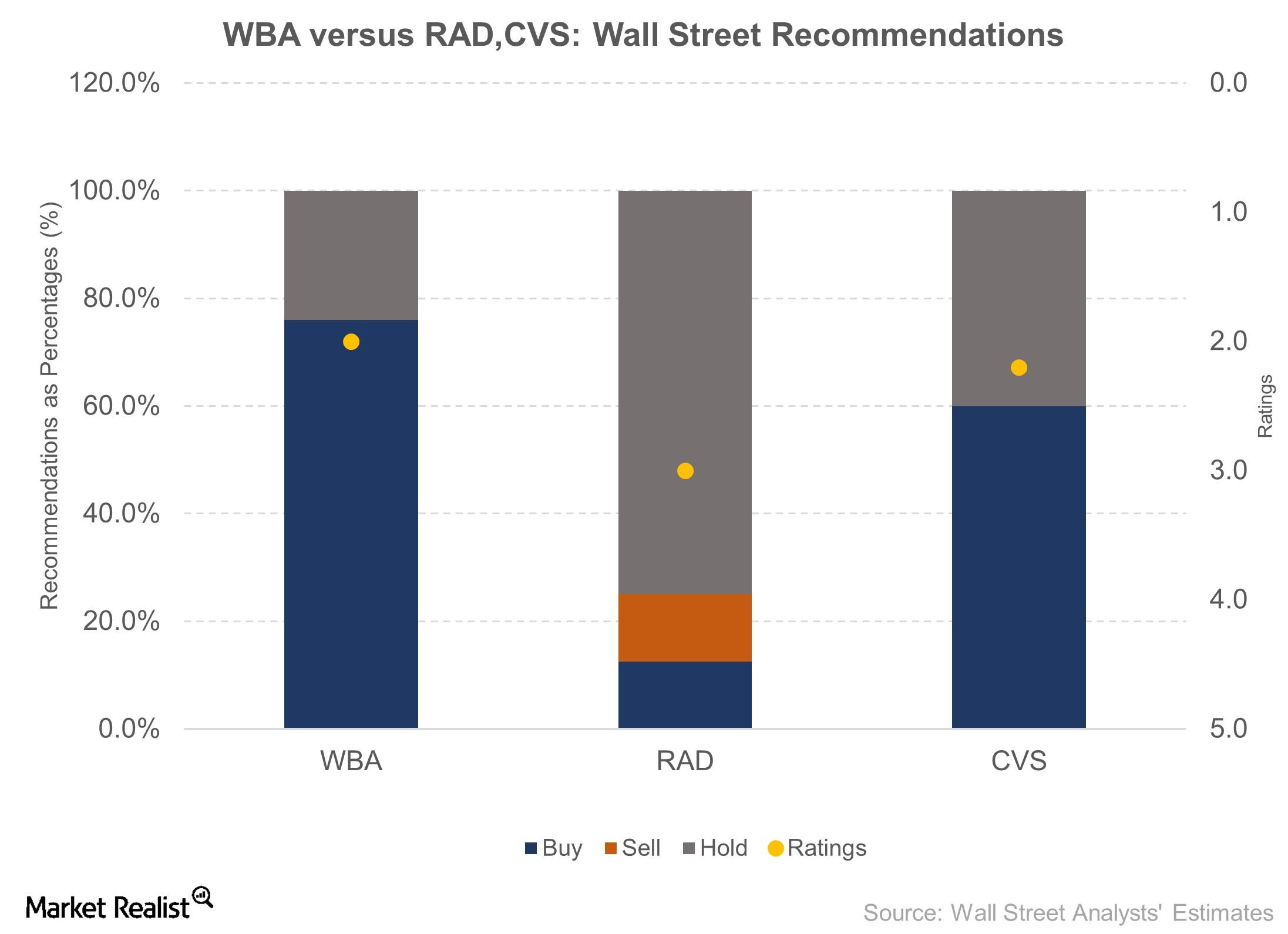

A Look at Rite Aid’s Stock Crash This Year

Rite Aid’s shareholders have been the real losers from the delay and eventual termination of the deal between Rite Aid (RAD) and Walgreens Boots Alliance (WBA) in October 2015.

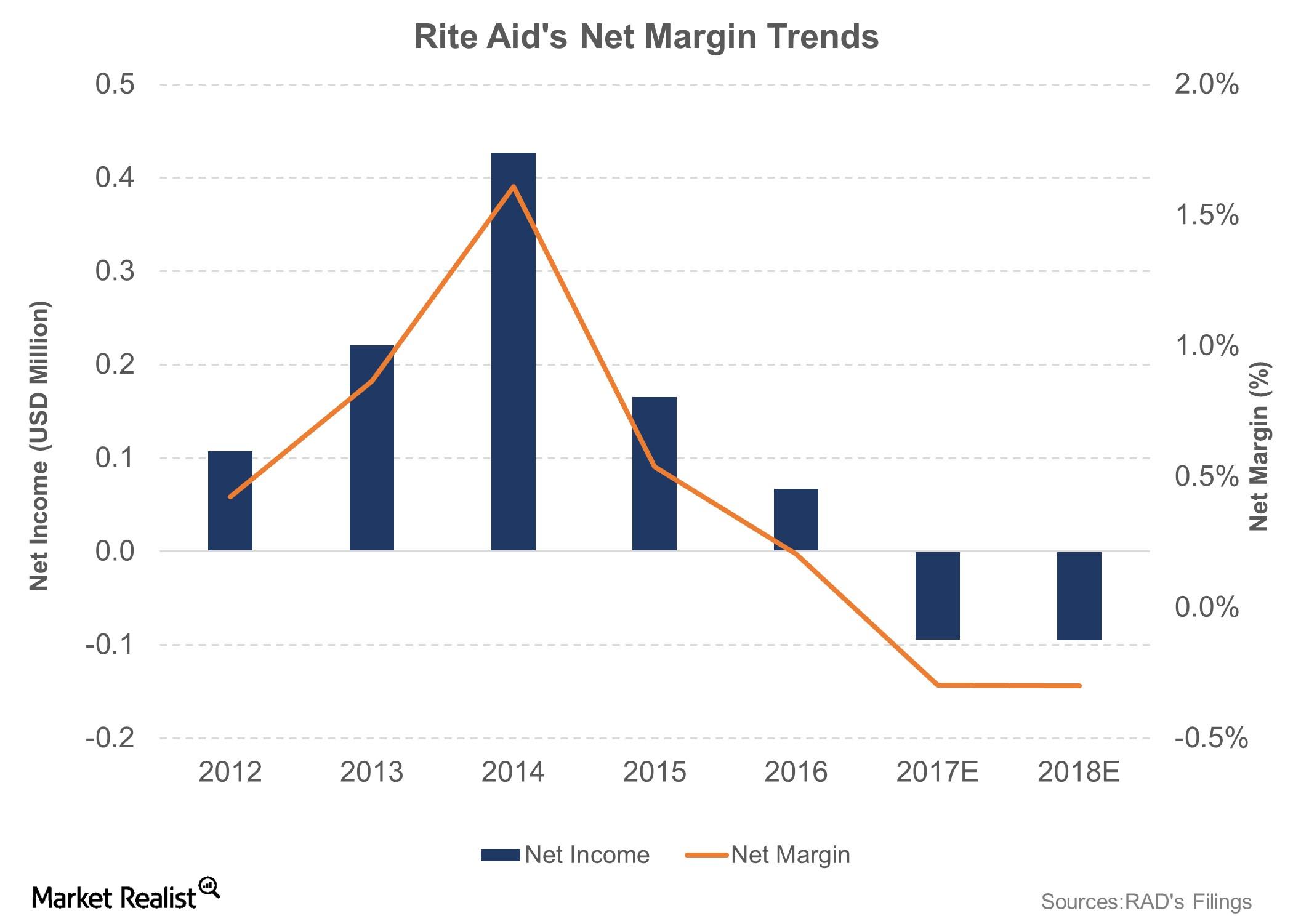

Here’s Why Rite Aid’s Margins Have Deteriorated over the Years

Rite Aid’s profitability has worsened over the years. Its gross margin has fallen from 29.0% in fiscal 2013 to just 22.6% in the first quarter of the current fiscal year.

Kao Corporation: What’s Sharpening Its Competitive Edge?

Kao Corporation has become the largest branded and packaged goods company in Japan and the second-largest company in the cosmetics category.

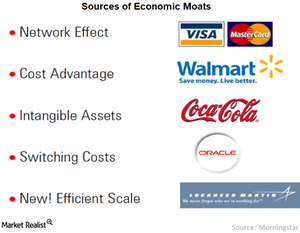

How to Identify Economic Moats

In this series, we’ll discuss how intangible assets can create long-term competitive advantages for companies.

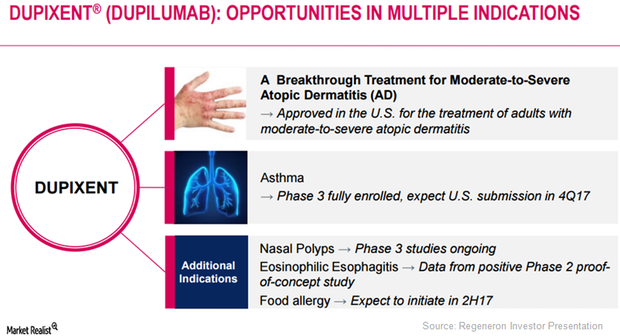

Eosinophilic Esophagitis: Major Market Opportunity for Dupixent?

Regeneron (REGN) has obtained positive results from its Phase 2 proof-of-concept study evaluating Dupixent in eosinophilic esophagitis.

Looking Back: What Drove Target’s Top Line in 2Q16?

In 2Q16, mass merchandiser Target (TGT) reported a 7.2% decline in its top line to $16.2 billion. Target’s 2Q16 revenues were affected by lower traffic and higher variability in sales patterns.

Upcoming Opportunities and Potential Threats for Walgreens Boots

In this part, we’ll discuss the company’s upcoming opportunities and potential threats.

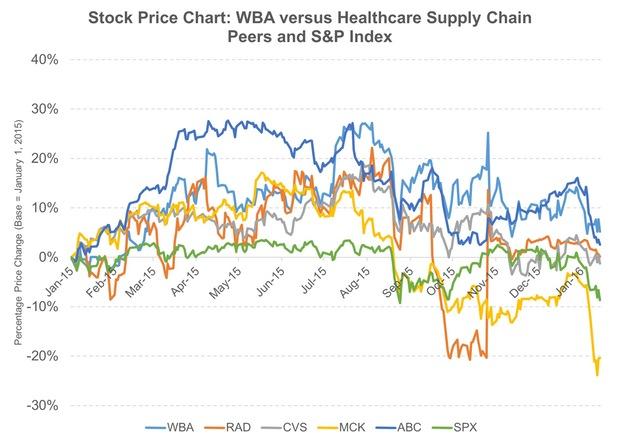

An Analysis of Walgreens Boots Alliance’s Stock Returns

Walgreen Boots Alliance’s (WBA) common stock trades on the NASDAQ under the symbol “WBA.”

Comparing the Pharmacy Giants: Walgreens versus CVS Health

Walgreens Boots Alliance (WBA) and CVS Health (CVS) largely dominate the US drug store market.

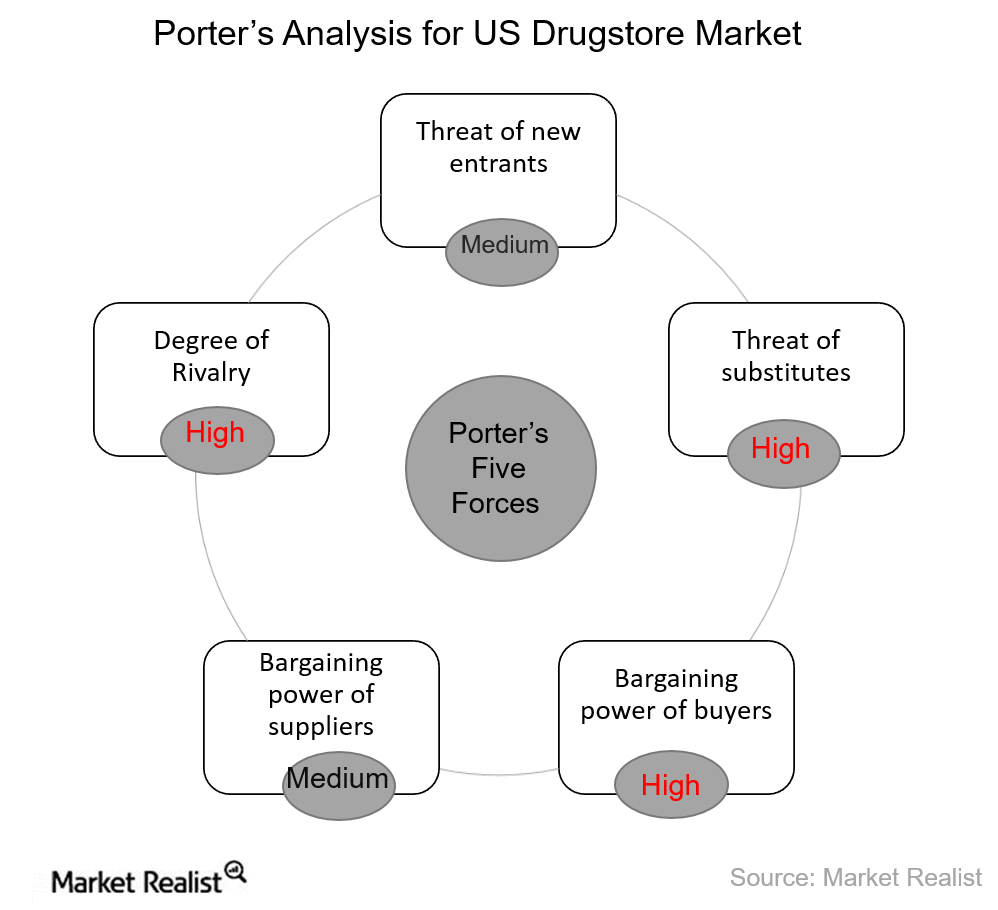

Porter’s Five Forces Analysis of the US Drugstore Industry

Porter’s five forces model is used to assess the nature of competition and attractiveness of an industry.

An Overview of the US Drugstore Industry

US drugstores typically generate revenues by selling prescription drugs, over-the-counter medications, health and beauty products, and general merchandise.

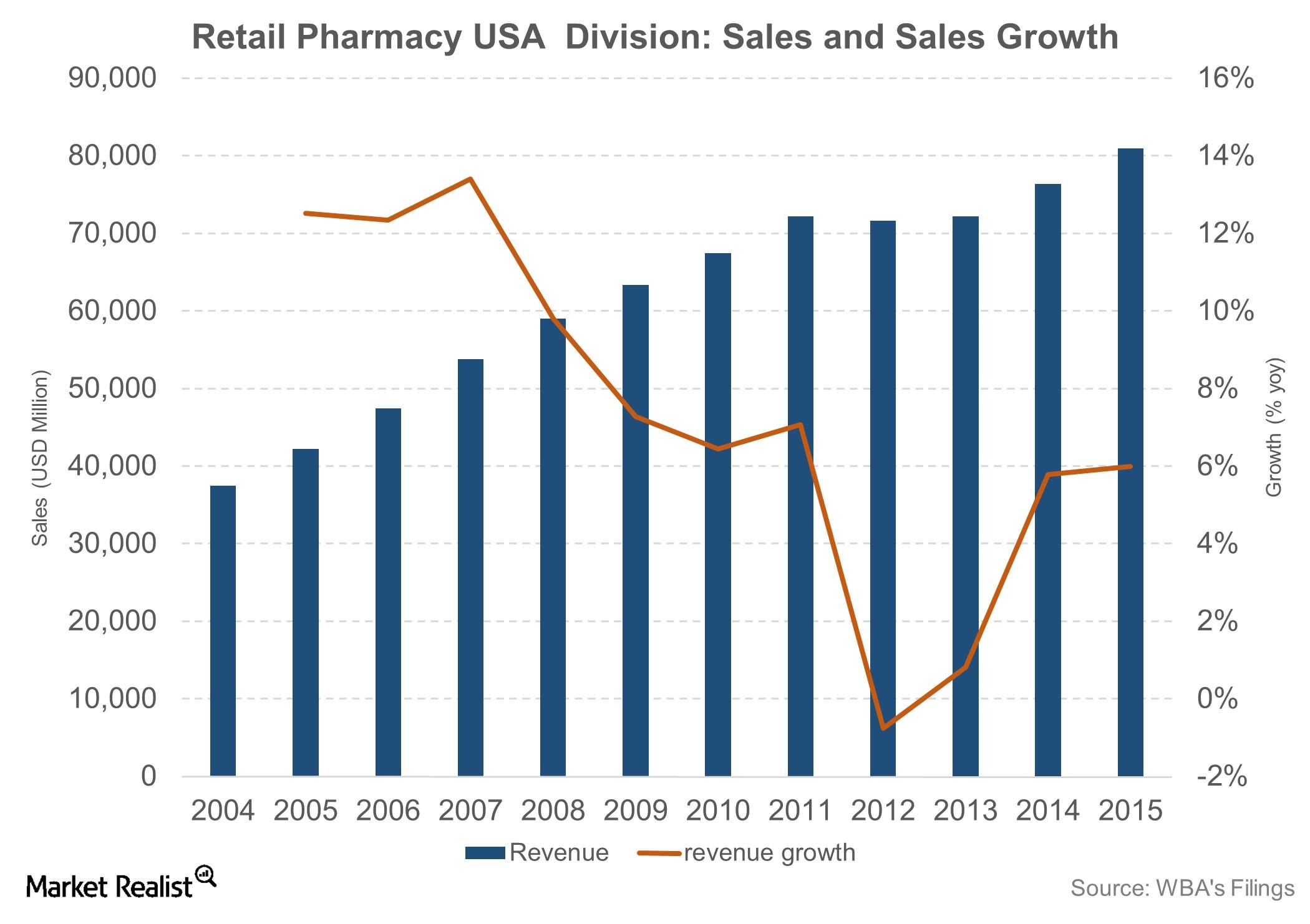

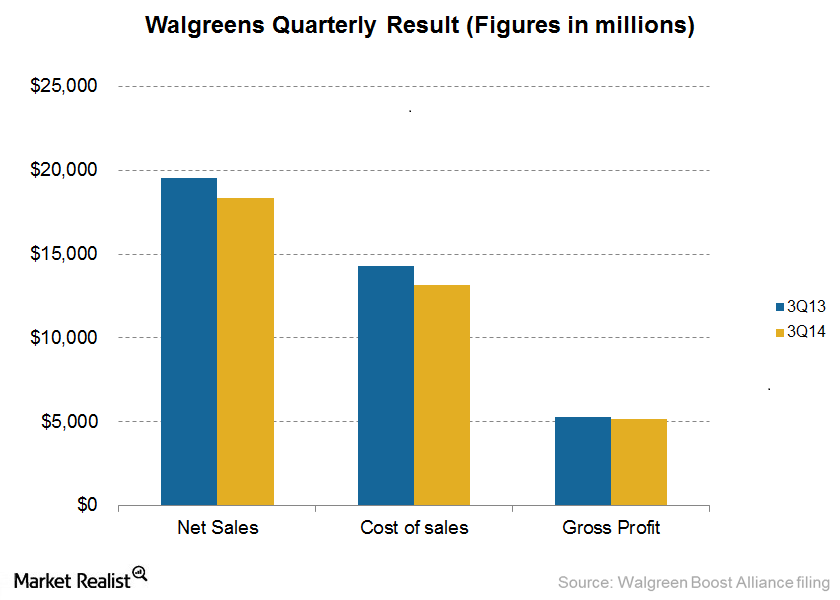

A Look at Walgreens Boots Alliance’s Retail Pharmacy USA Division

The Retail Pharmacy USA division is Walgreens Boots Alliance’s (WBA) largest revenue generator.

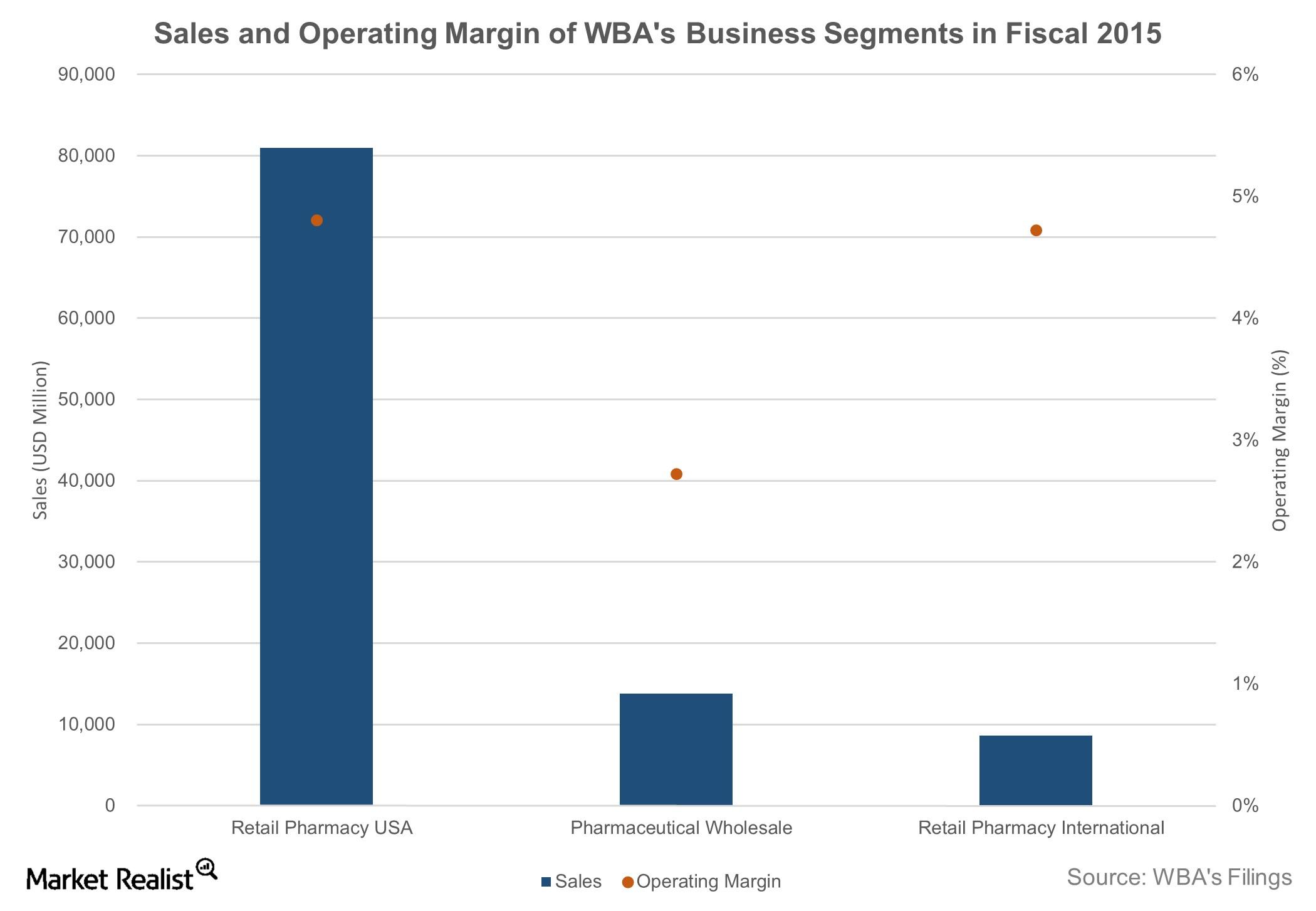

Walgreens Boots Alliance: Segments and Geographic Footprint

Following the completion of the second-step transaction on December 31, 2014, Walgreens Boots Alliance reorganized its operations into three segments.

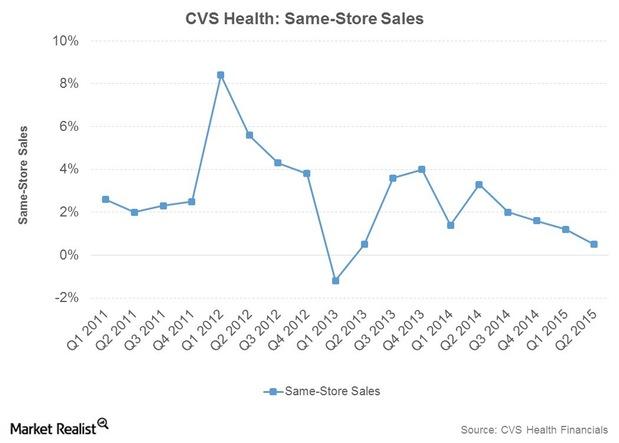

CVS’ Retail Pharmacy Market Share Rises in 2Q15 on Scripts Growth

CVS Health’s Retail Pharmacy segment reported sales of $17.2 billion in 2Q15, an increase of 2.2% over 2Q14. CVS boosted its share of the retail pharmacy market to 21.6% in 1Q15, from 21% in 2Q14.

Major Factors Driving CVS’s Retail Pharmacy Segment Growth

CVS Health (CVS) expects Retail Pharmacy sales growth between 0.5% and 2% year-over-year in 2Q15. Total same-store sales are expected to be in the range of -1.25% to 0.25%.

Leading Indicators that Help Identify the Current Business Cycle

The business cycle, which reflects fluctuations of activity in an economy, can be a critical determinant of equity sector performance over the intermediate term.

Blue Ridge Capital Opens New Position in Walgreens Boots Alliance

Walgreens Boots Alliance is a firm created by the merger of Walgreens and Alliance Boots in December 2014.