Walgreens versus CVS: Discussing PBM Strategies

In August 2016, Walgreens announced a long-term strategic alliance with Prime Therapeutics, America’s fourth-largest PBM.

Oct. 16 2017, Updated 7:38 a.m. ET

Strategies of pharmacy giants

As we discussed in the previous article, CVS Health (CVS) acquired Caremark in 2007, which vertically integrated its supply chain. As a result, CVS Health generated savings as well as reduced customer costs.

So, what strategy has Walgreens Boot Alliance (WBA) been following to better compete with CVS? The company has gone for a horizontal integration, rather than a vertical one. What’s interesting is that its strategy recently cost rival CVS its prescription market share.

Recent business wins by Walgreens

Walgreens beat CVS Health to sign exclusive deals with a couple of pharmaceutical benefit managers (or PBMs) last year, which negatively impacted the latter’s business.

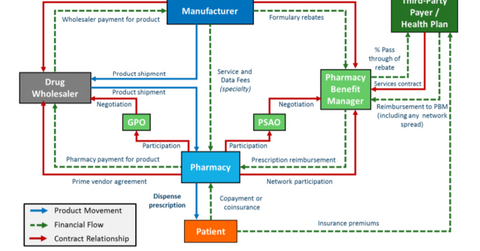

PBMs are third-party administrators that provide healthcare management and administration services to insurance companies, Medicare Part D plans, state government employee plans, and corporations.

In August 2016, Walgreens announced a long-term strategic alliance with Prime Therapeutics, America’s fourth-largest PBM. The two companies formed AllianceRx Walgreens Prime, which specializes in central specialty pharmacy and mail services.

A month later, Express Scripts Holdings took CVS out of the Tricare network, and Walgreens joined the network. Tricare is a healthcare program for military service members, retirees, and their families and is managed by Express Scripts (ESRX).

The deal added 9.4 million members to Walgreens’ network, while the Prime Therapeutics alliance added around 22 million members.

CVS ended up losing 40 million prescriptions due to the two above-mentioned deals, which resulted in a slowdown in the company’s retail pharmacy business. Please continue to the next article to learn about the performance of the two companies’ business segments.