Express Scripts

Latest Express Scripts News and Updates

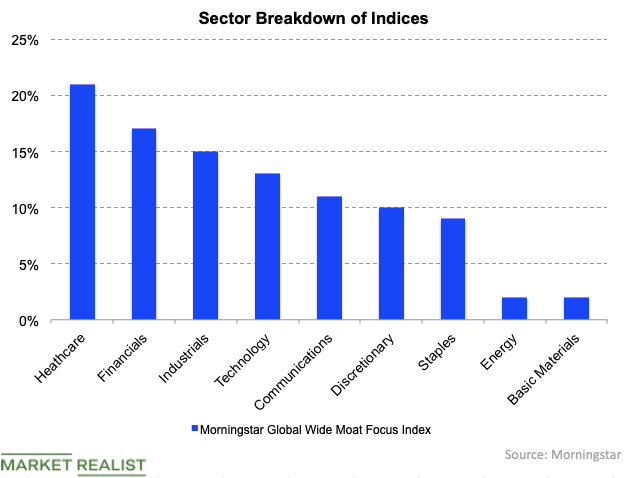

How to Invest in Global Wide Moat Stocks

The Morningstar Global Wide Moat Focus Index has global exposure, unlike the Morningstar International Moat Index (MOTI).

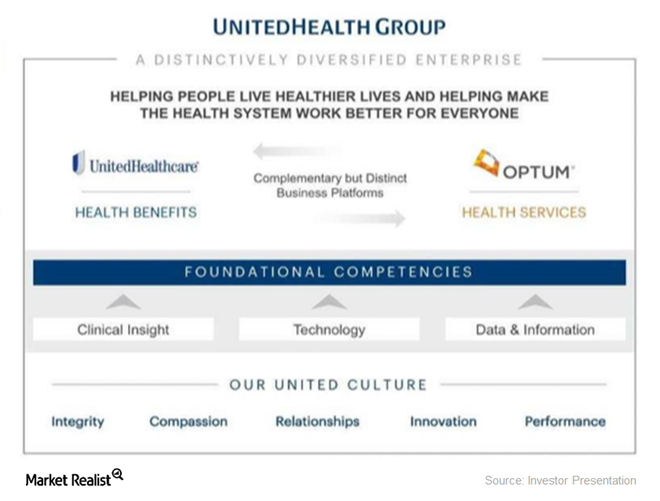

How Is UNH’s Optum Business Positioned in the Industry?

UnitedHealth Group is, by revenue, the largest healthcare company in the world.

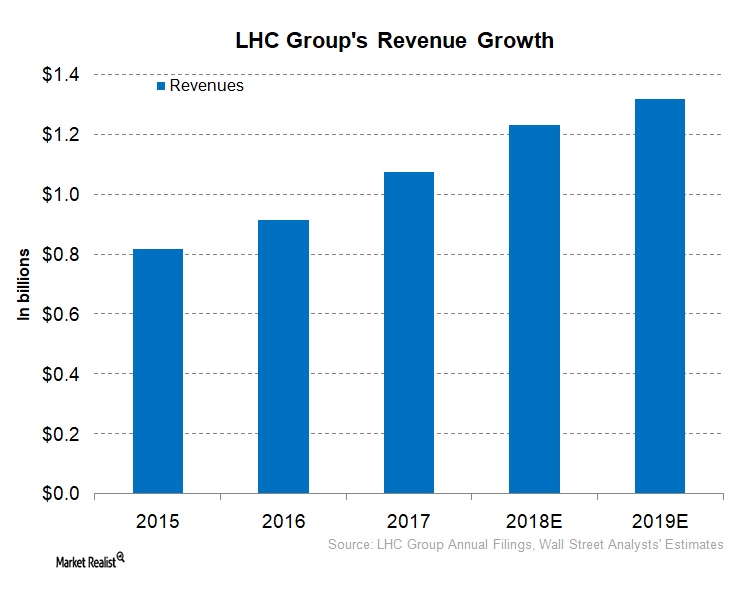

What’s LHC Group’s Business Strategy?

In 2018, LHC Group is expected to report revenue of $1.2 billion. What about its peers?

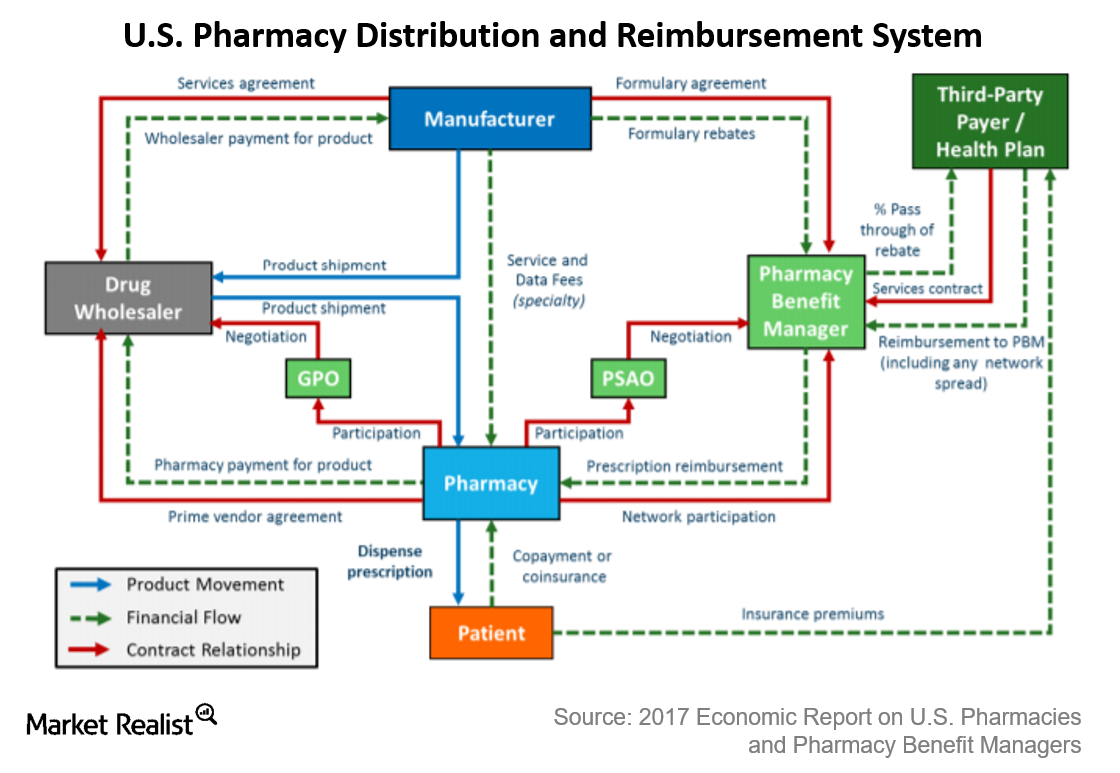

Walgreens versus CVS: Discussing PBM Strategies

In August 2016, Walgreens announced a long-term strategic alliance with Prime Therapeutics, America’s fourth-largest PBM.

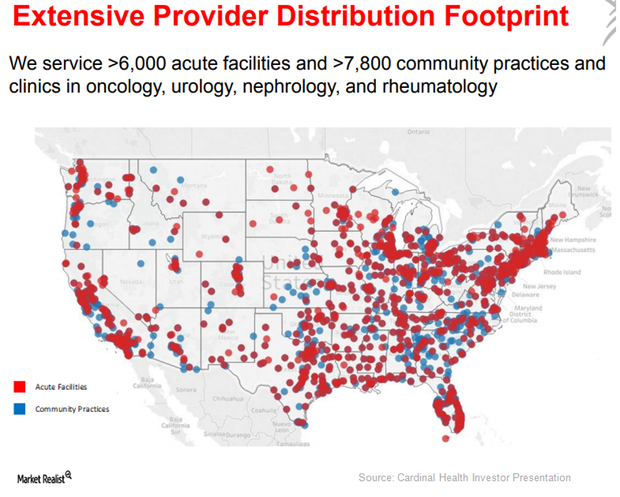

Robust Growth Expected for Cardinal Health’s Specialty Solutions

Cardinal Health’s (CAH) Specialty Solutions segment provides two types of services: upstream to pharmaceutical and biopharmaceutical manufacturers and downstream to healthcare providers.

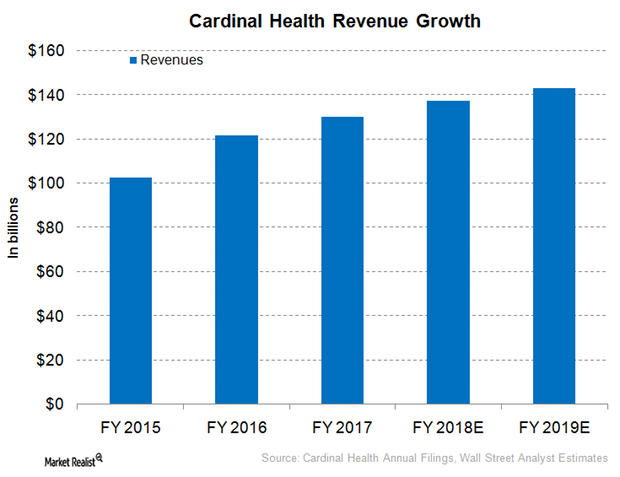

Cardinal Health Expected to Report Modest Revenue Growth

For fiscal 2018, Cardinal Health (CAH) has projected mid-single-digit revenue growth on a YoY basis, partially driven by the company’s high customer retention rates.

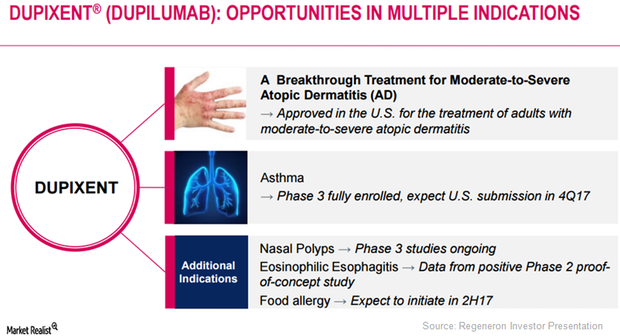

Eosinophilic Esophagitis: Major Market Opportunity for Dupixent?

Regeneron (REGN) has obtained positive results from its Phase 2 proof-of-concept study evaluating Dupixent in eosinophilic esophagitis.