What’s the Dividend Yield of the Consumer Non-Cyclical Sector?

The consumer non-cyclical segment recorded a dividend yield of 3%.

June 8 2018, Updated 4:30 p.m. ET

Consumer non-cyclical industries

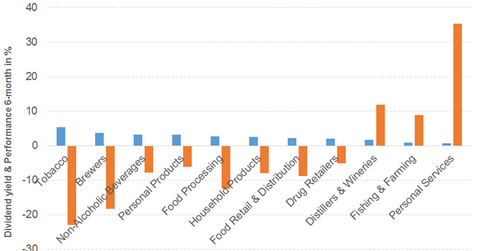

The consumer non-cyclical segment recorded a dividend yield of 3%. The tobacco segment noted the highest dividend yield. While tobacco, brewers, personal products, non-alcoholic beverages, food processing, and household products have beaten the broad-based indexes’ dividend yields.

Industries within this sector and top dividend payers under the respective industries include:

- tobacco with a dividend yield of 5.3% and Philip Morris International (PM)

- brewers with a dividend yield of 3.7% and Compañía Cervecerías Unidas (CCU)

- personal products with a dividend yield of 3.1% and Procter & Gamble (PG)

- non-alcoholic beverages with a dividend yield of 3.1% and Embotelladora Andina (AKO-A)

- food processing with a dividend yield of 2.7% and Kraft Heinz (KHC)

- household products with a dividend yield of 2.5% and Clorox (CLX)

- food retail and distribution with a dividend yield of 2.2% and Walmart (WMT)

- drug retailers with a dividend yield of 2% and CVS Health (CVS)

- distillers and wineries with a dividend yield of 1.7% and Diageo (DEO)

- fishing and farming with a dividend yield of 0.8% and BrasilAgro – Companhia Brasileira de Propriedades Agrícolas (LND)

- personal services with a dividend yield of 0.7% and H&R Block (HRB)

Tobacco, brewers, and distillers and wineries ended in the red on June 1. Every industry except distillers and wineries, fishing and farming, and personal services generated negative six-month returns.

Going forward

This sector already includes necessities for consumers. In addition, rising income, lower unemployment, lower inflation, growing wealth, and consumer confidence are expected to drive the sector.

Dividend ETFs

The WisdomTree US SmallCap Dividend ETF (DES) offers a dividend yield of 5% at a PE of 20.7x. It has 22% and 6% exposure to the consumer cyclical and consumer non-cyclical sectors, respectively. The iShares Core High Dividend ETF (HDV) offers a dividend yield of 3.6% at a PE of 21x. It has 20% and 18% exposure to the energy and consumer non-cyclical sectors, respectively.