WisdomTree U.S. SmallCap Dividend Fund

Latest WisdomTree U.S. SmallCap Dividend Fund News and Updates

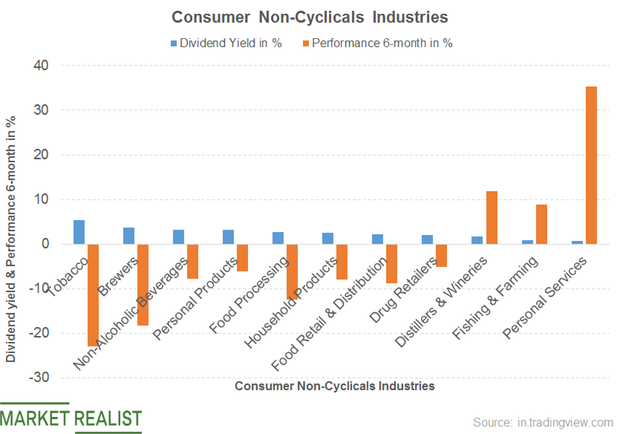

What’s the Dividend Yield of the Consumer Non-Cyclical Sector?

The consumer non-cyclical segment recorded a dividend yield of 3%.

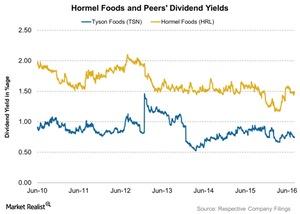

How Much Has Hormel Returned to Shareholders in Fiscal 2016?

Along with its 3Q16 results, Hormel Foods (HRL) also announced the 352nd consecutive quarterly dividend at the annual rate of $0.58 per share.

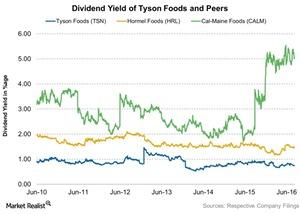

How Much Has Tyson Foods Returned to Shareholders in Fiscal 2016?

Tyson Foods bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16.

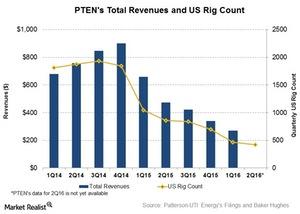

Will Rig Count Affect Patterson-UTI Energy in 2Q16?

In 1Q16, the US rig count declined by 56% over 1Q15. During this period, the international rig count decreased by only 21%.