How Much Has Tyson Foods Returned to Shareholders in Fiscal 2016?

Tyson Foods bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16.

Aug. 16 2016, Updated 9:04 a.m. ET

Capital allocation priorities

Tyson Foods’ (TSN) capital allocation priority is to focus on enhancing long-term shareholder value. It plans to execute this by deploying operating cash flow to invest in its consumer-preferred portfolio. Tyson Foods has utilized the strong cash flows of $2.8 billion generated in the past 12 months and has invested over $730 million in capital expenditure projects.

Tyson Foods aims for organic growth through capital expansion projects and operational efficiency. It also plans to acquire businesses that support strategic objectives and return cash to shareholders through dividends and share repurchases.

Recent dividends declared

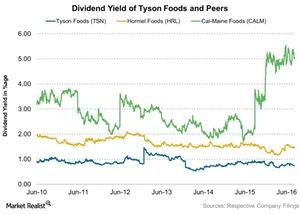

On the day of the 3Q16 earnings release, Tyson Foods announced quarterly dividends of $0.15 per share on its Class A common stock and $0.14 per share on its Class B common stock. These dividends will be paid on December 15, 2016, to shareholders of record at the close of business on December 1, 2016. Currently, the company has a dividend yield of 0.81%. The company’s management has been raising the dividend on a consistent basis for the last five years. The company’s dividend has increased by an average annual rate of 20% during this period.

Tyson Foods’ peers have the following dividend yields, as of August 9:

- Hormel Foods (HRL) has a dividend yield of 1.5%.

- Cal-Maine Foods (CALM) has a dividend yield of ~4.1%.

The WisdomTree SmallCap Dividend Fund (DES) and the Global X SuperDividend U.S. ETF (DIV) invest ~1.1% and 1.9% of their respective holdings in CALM.

Share repurchases

The company bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16. In the last 12 months, the company has purchased over 31 million shares for a little less than $1.8 billion and has paid ~$200 million in dividends.

The company expects to increase share repurchases under its share repurchase program for the remainder of fiscal 2016 and in fiscal 2017. Tyson Foods has repurchased over 5.0 million shares for $380 million so far in fiscal 4Q16.

In the next article in this series, we’ll look at Tyson Foods’ target price and recommendations.