Global X SuperDividend U.S. ETF

Latest Global X SuperDividend U.S. ETF News and Updates

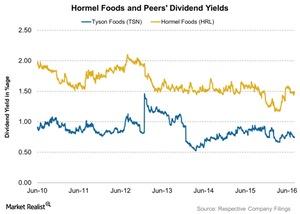

How Much Has Hormel Returned to Shareholders in Fiscal 2016?

Along with its 3Q16 results, Hormel Foods (HRL) also announced the 352nd consecutive quarterly dividend at the annual rate of $0.58 per share.

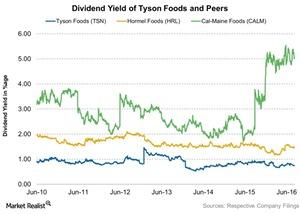

How Much Has Tyson Foods Returned to Shareholders in Fiscal 2016?

Tyson Foods bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16.

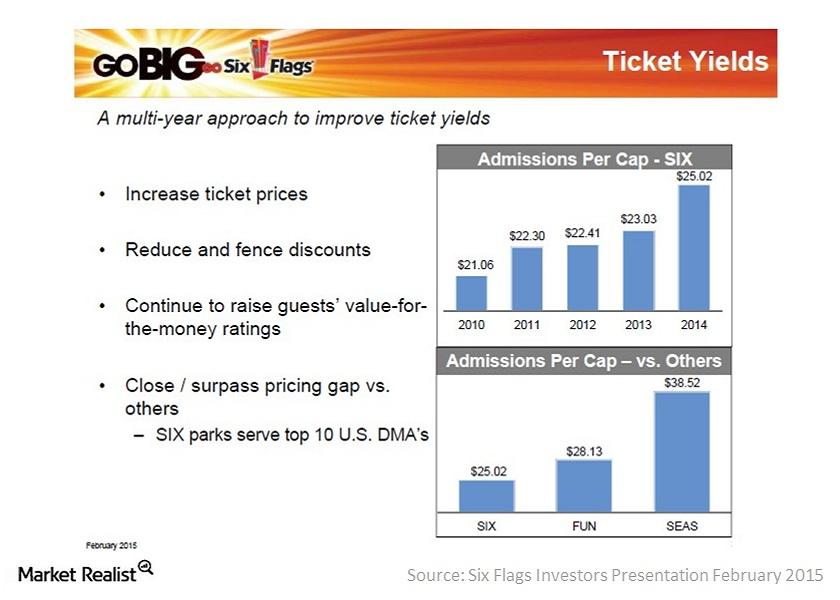

Ticket pricing pushes Six Flags’ admissions revenue up

Six Flags’ (SIX) admissions revenue per capita increased by 9% in 2014, primarily driven by pricing improvements on multi- and single-use ticket offerings.