Cal-Maine Foods Inc

Latest Cal-Maine Foods Inc News and Updates

Analyzing the Expectations for Cal-Maine Foods in Fiscal 3Q16

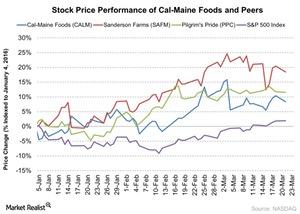

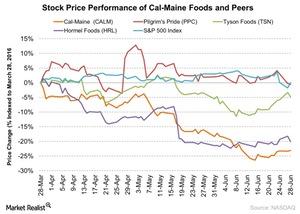

Cal-Maine Foods will report its fiscal 3Q16 results on March 28. Cal-Maine’s stock has gained 2% since its last quarter earnings release on December 23, 2015.

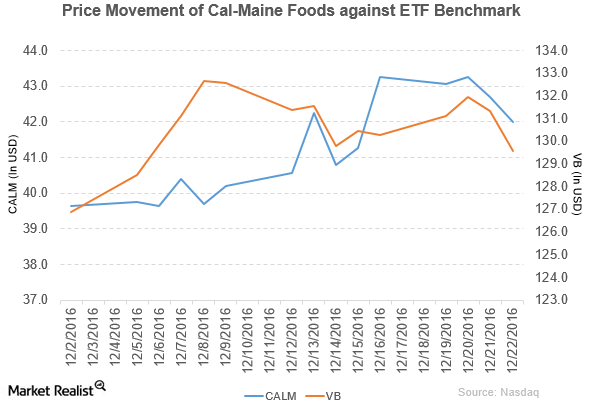

Understanding Cal-Maine Foods’ Performance in Fiscal 2Q17

Cal-Maine Foods (CALM) has a market cap of $1.9 billion. It fell 1.6% to close at $42.00 per share on December 22, 2016.

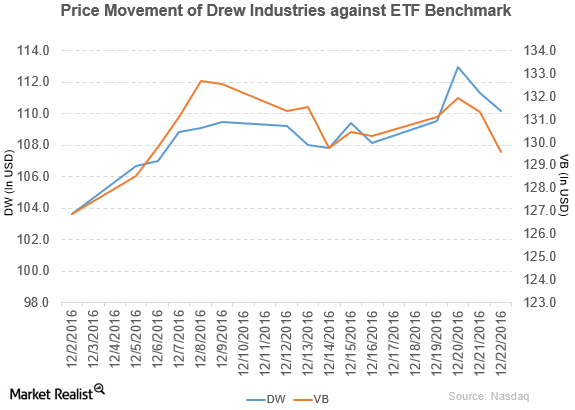

Why Sidoti Rated Drew Industries a ‘Buy’

Drew Industries (DW) has a market cap of $2.7 billion. It fell 1.0% to close at $110.15 per share on December 22, 2016.

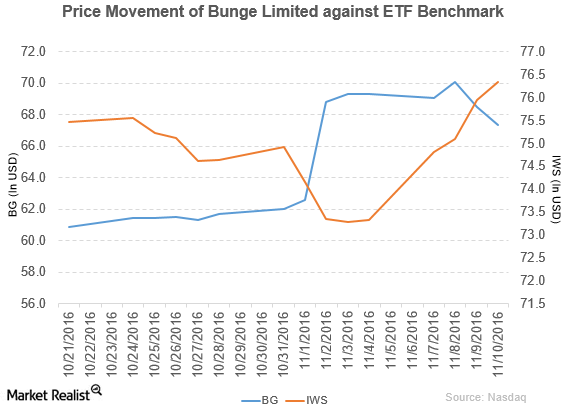

Why Did Bunge Limited Issue Senior Notes?

Bunge Limited (BG) has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

Goldman Sachs Rated Cal-Maine Foods as ‘Neutral’

Cal-Maine Foods (CALM) reported fiscal 1Q17 net sales of $239.8 million, a fall of 60.7% compared to its net sales of $609.9 million in fiscal 1Q16.

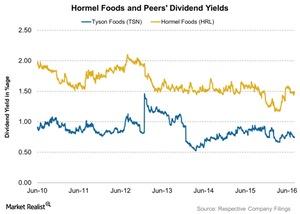

How Much Has Hormel Returned to Shareholders in Fiscal 2016?

Along with its 3Q16 results, Hormel Foods (HRL) also announced the 352nd consecutive quarterly dividend at the annual rate of $0.58 per share.

Why Did Hormel Foods Increase Its Fiscal 2016 Guidance?

Hormel Foods (HRL) increased its fiscal 2016 EPS (earnings per share) guidance to $1.60–$1.64. The earlier EPS guidance range was $1.56–$1.60.

How Much Has Tyson Foods Returned to Shareholders in Fiscal 2016?

Tyson Foods bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16.

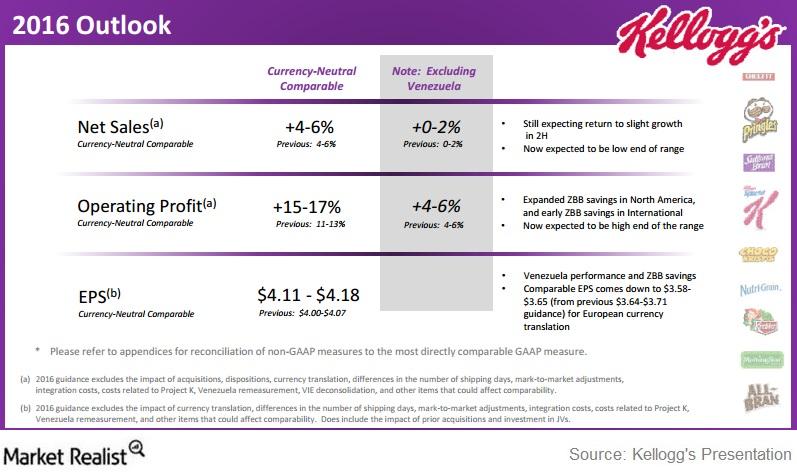

What Made Kellogg Update Its Fiscal 2016 Guidance?

In its fiscal 2Q16 earnings release, Kellogg stated that it expects its fiscal 2016 cash flow from operating activities to be ~$1.7 billion.

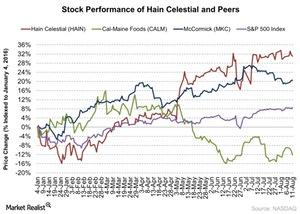

How Has Hain Celestial’s Stock Fared ahead of Fiscal 4Q16 Results?

So far, Hain Celestial’s stock has shown tremendous growth of 31% in 2016, led by an exceptional performance each quarter. The stock has gained 16% since its last quarterly earnings release on May 4.

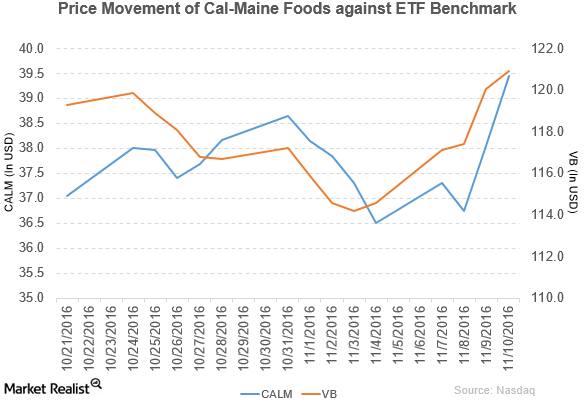

How’s Cal-Maine Trading Compared to Its Key Moving Averages?

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average and 0.7% below it 50-day moving average.

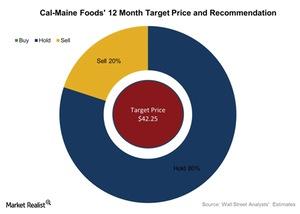

What Do Analysts Recommend for Cal-Maine Foods after 4Q16?

The average broker target price for Cal-Maine Foods rose slightly to $42.25 from $41.5—4.5% lower than the closing price of $44.18 on July 18, 2016.

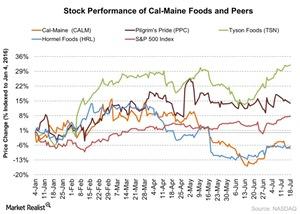

How Did Cal-Maine Foods Stock React to Its Fiscal 4Q16 Results?

Cal-Maine Foods reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter.

How Much Did Cal-Maine Return to Shareholders in Fiscal 2016?

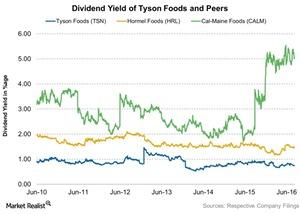

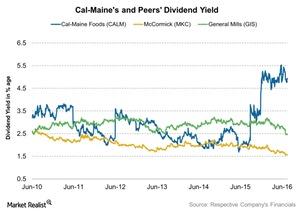

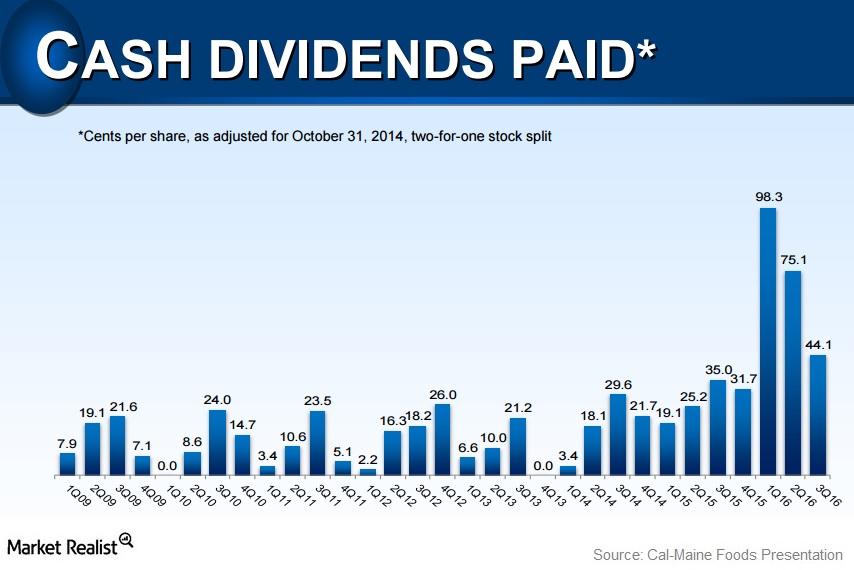

Cal-Maine Foods has a dividend yield of 4.0% as of July 18, 2016. Management raised the dividend at a CAGR (compound annual growth rate) of 15.3% over five years.

Analyzing Cal-Maine Foods’ Variable Dividend Policy

Cal-Maine has a variable dividend policy in place. It has a dividend yield of 5.8% as of June 28. Management raised the dividend at a CAGR of 15.3% over five years.

Cal-Maine Plans to Increase Its Value-Added Specialty Egg Business

Cal-Maine Foods (CALM) plans to grow its specialty egg business by meeting consumer demand in the rapidly growing segment.

Why Did Cal-Maine Shares Fall 23% in the Last 3 Months?

Cal-Maine Foods (CALM) saw declining growth in its shares in the last three months. The company’s shares are trading close to its 52-week low.

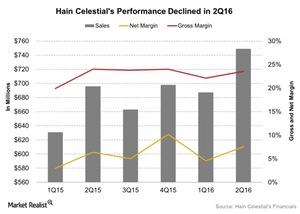

How Did Hain Celestial Perform in Fiscal 2Q16?

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million.

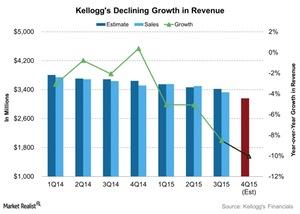

Kellogg Is Expected to Report a 10% Revenue Drop for Fiscal 4Q15

In its fiscal 4Q15 results, Kellogg is expected to report sales of $3,160 million, a fall of 10% YoY (year-over-year). For the full year, analysts expect revenue of $13.5 billion, a decline of ~7% YoY.

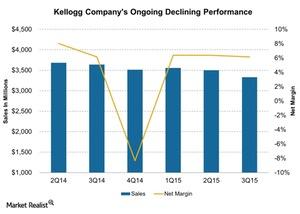

Kellogg Company’s Disappointing Performance in 3Q15

The Kellogg Company’s (K) net sales in 3Q15 fell 8.5% quarter-over-quarter to $3.3 billion due to the effect of currency translation. The company also missed analyst estimates of $3.4 billion in revenue.