BTC iShares Core High Dividend ETF

Latest BTC iShares Core High Dividend ETF News and Updates

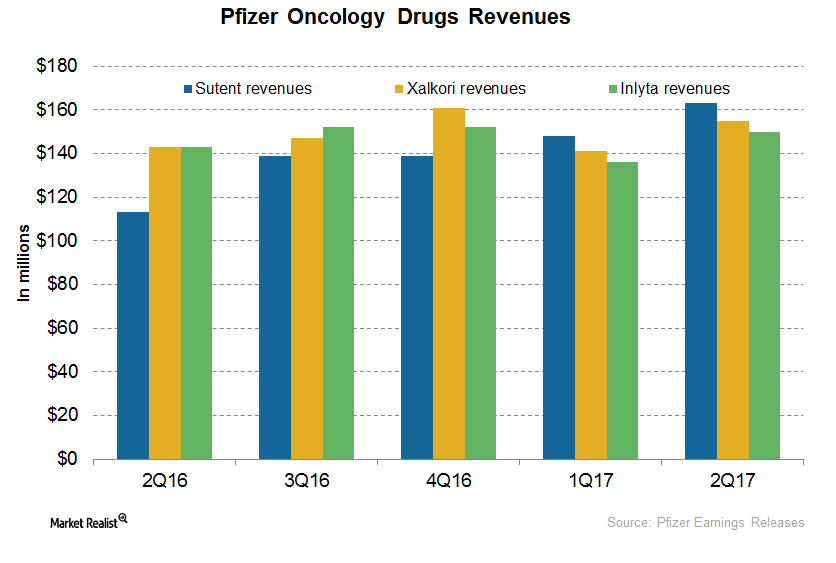

A Post-2Q17 Update on Pfizer’s Oncology Drugs: Sutent, Xalkori, and Inlyta

In 2Q17, Inlyta generated revenues of ~$88 million, which represents an ~19% decline on a YoY basis and ~4% growth on a quarter-over-quarter basis.

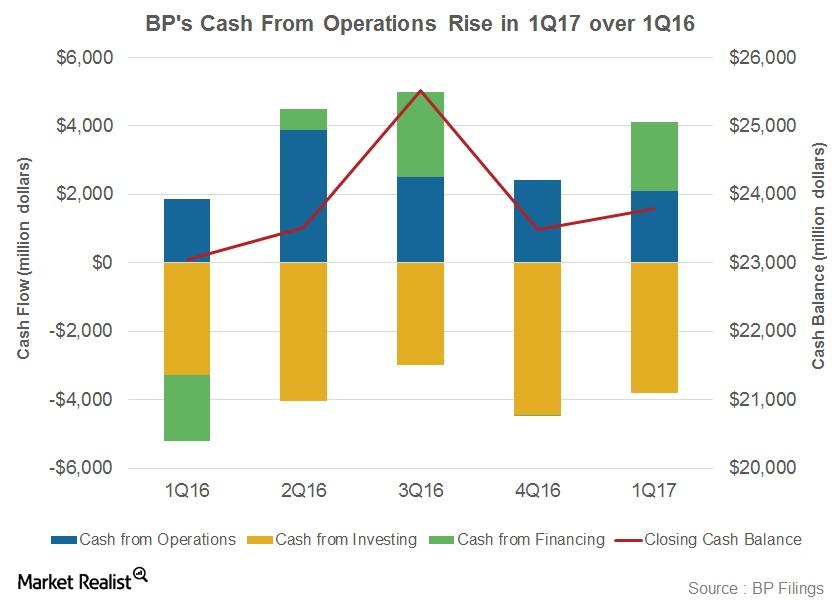

Is BP’s Cash Flow Slated for Growth?

Rising oil prices have given BP some hope that its cash flows could improve. The robust upstream project pipeline is also likely to result in higher production.

How Johnson & Johnson’s Partnerships Enhance Customer Value

Johnson & Johnson’s key innovation strategies include creating value through strategic customer partnerships and solutions.

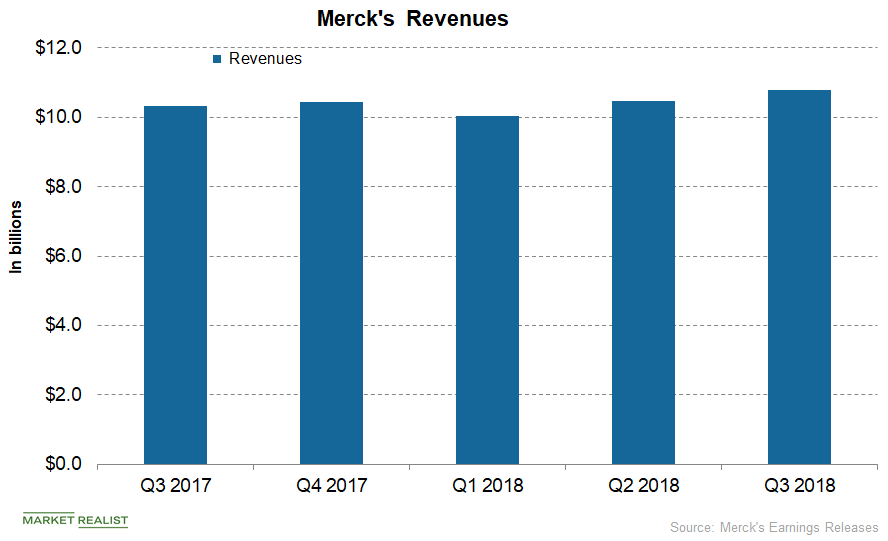

Merck’s Stock Price Has Increased ~34% in 2018

On November 16, Merck’s stock price closed at $76.06, which represents ~1.63% growth from its close of $74.84 on November 15.

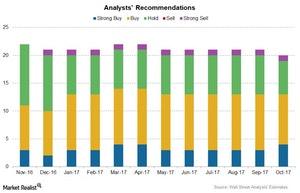

How Wall Street Analysts View Merck

On October 25, Merck (MRK) announced a dividend of $0.55 per share for its outstanding common stock in the fourth quarter of 2018.

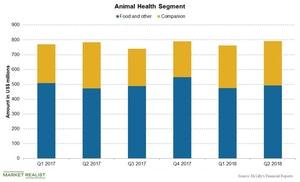

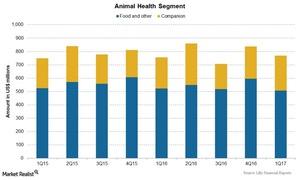

A Look at Elanco, Eli Lilly’s Animal Health Business

Eli Lilly’s Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter.

A Look at Pfizer’s Market Cap and Shareholding Pattern

The total number of Pfizer’s outstanding shares is ~5.862 billion. Of these, its free-floating shares total ~5.859 billion.

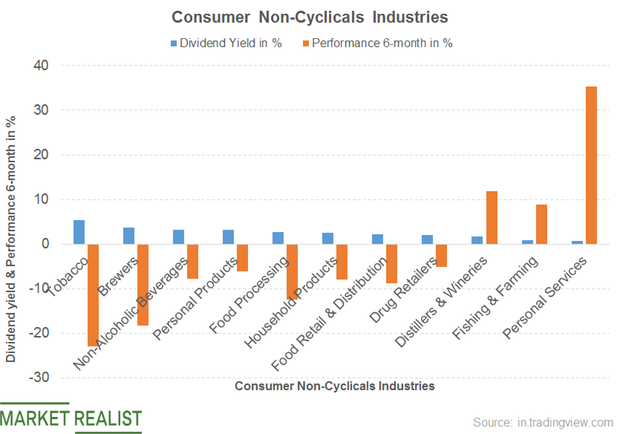

What’s the Dividend Yield of the Consumer Non-Cyclical Sector?

The consumer non-cyclical segment recorded a dividend yield of 3%.

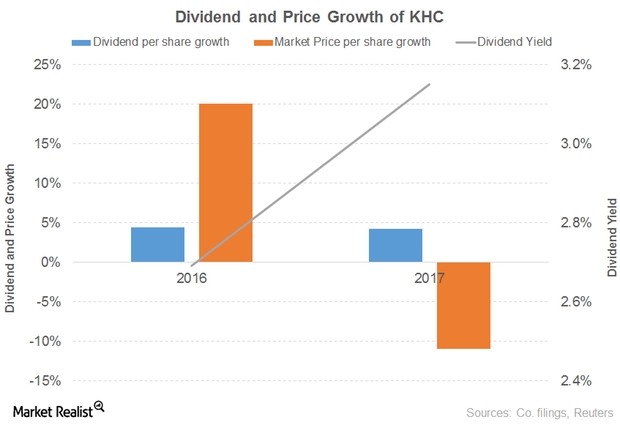

Why The Kraft Heinz Company’s Outlook Still Seems Promising

The Kraft Heinz Company’s (KHC) net sales grew 44% in 2016 before falling 1% in 9M17. Every product category drove the growth in 2016, offset by a decline in the infant and nutrition segments.

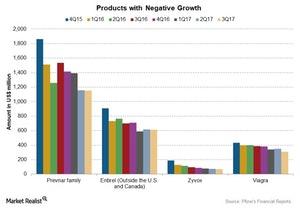

These Pfizer Products Lost Market Share in 3Q17

BeneFIX revenues fell 14% to $151 million during 3Q17, driven by a 16% fall in international sales to $87 million.

What Do Analysts Think about Merck?

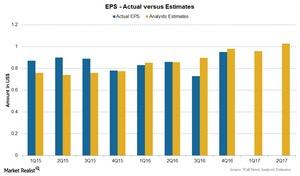

Wall Street analysts estimate Merck’s (MRK) top line will increase marginally by 0.1% to ~$10,546 million in 3Q17.

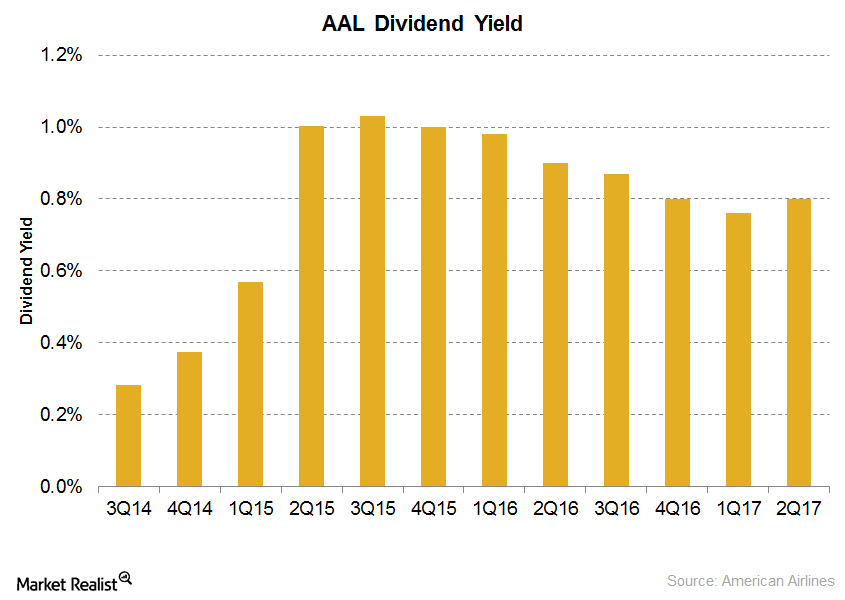

A Look at American Airlines’ Dividend Payouts

Only four airlines—Delta Air Lines (DAL), Southwest Airlines (LUV), American Airlines (AAL), and Alaska Air Group (ALK)—pay dividends to investors.

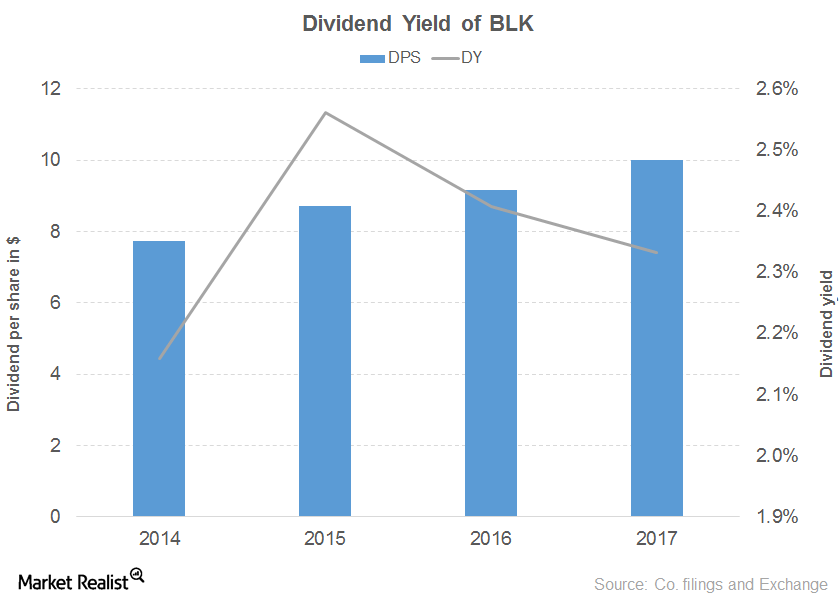

What Led to BlackRock’s Downward Sloping Dividend Yield Curve?

BlackRock posted a 7.0% revenue growth in the first half of 2017, driven by every segment except multi-asset and alternatives, which reported flat growth.

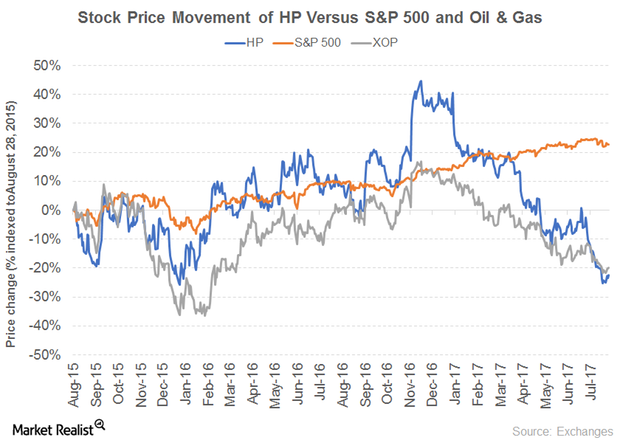

Decoding Helmerich & Payne’s Dividend Yield

What’s driving Helmerich & Payne’s high yield? Contract oil and gas well driller Helmerich & Payne (HP) recorded a sharp drop in its 2016 operating revenue due to declines in its US drilling, offshore, and international segments. Its revenue fell 19% in 2015, compared with 51% in 2016. Its operating income, as a result, ended […]

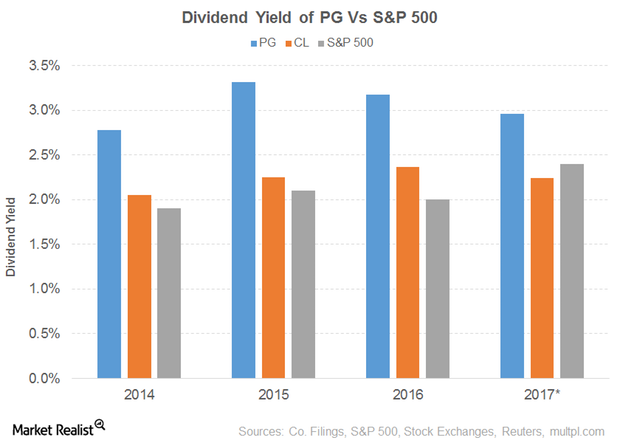

Dividend Yield of Procter & Gamble

Procter & Gamble’s (PG) PE ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%.

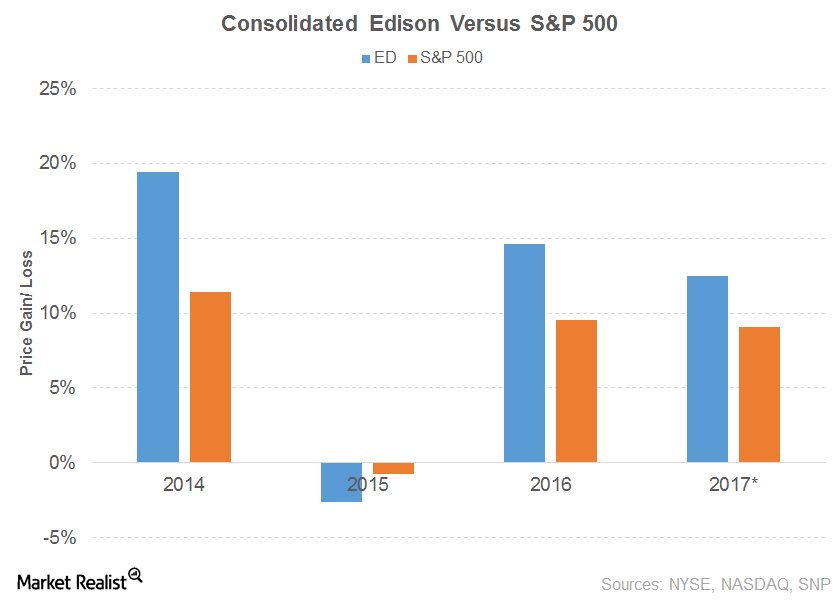

Consolidated Edison’s Dividend Trajectory

Consolidated Edison’s (ED) 2016 operating revenues fell 4.0% due to a decline in every segment; namely, electric, gas, steam, and non-utility.

Pfizer’s Corporate and Pipeline Developments in 2Q17

Apart from Pfizer’s (PFE) product developments, let’s take a look at some recent pipeline and corporate developments.

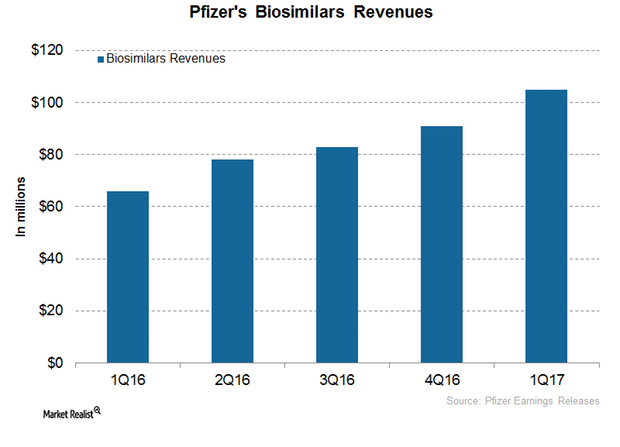

Pfizer Sees a Significant Opportunity in This for Revenue Growth

In 2016, Pfizer’s (PFE) biosimilar business reported revenues of ~$319 million, compared with $63 million in 2015.

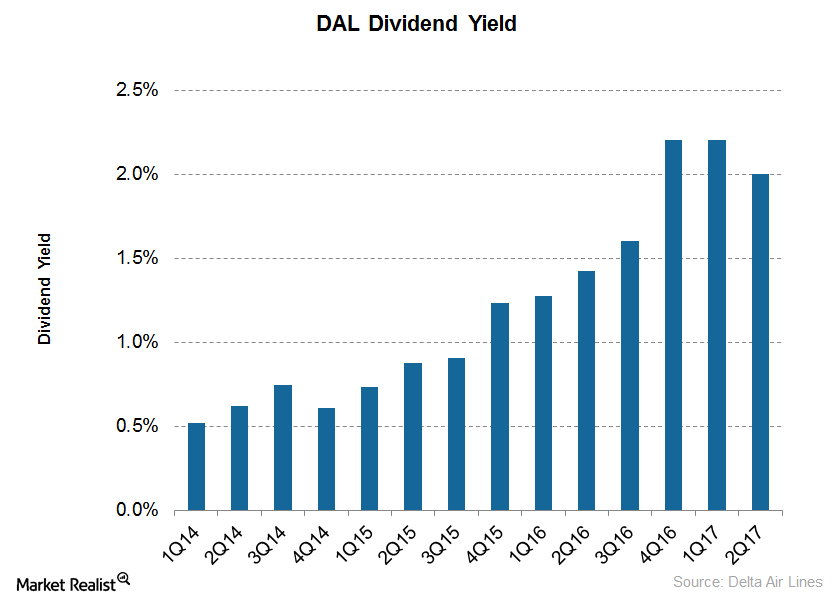

Can Delta Continue to Be the Best Airline Dividend Payer?

Delta Air Lines (DAL) has an indicated dividend yield of 2.0%, the highest among the four airlines that pay dividends.

The Top Dividend-Growing Financial Sector Stocks

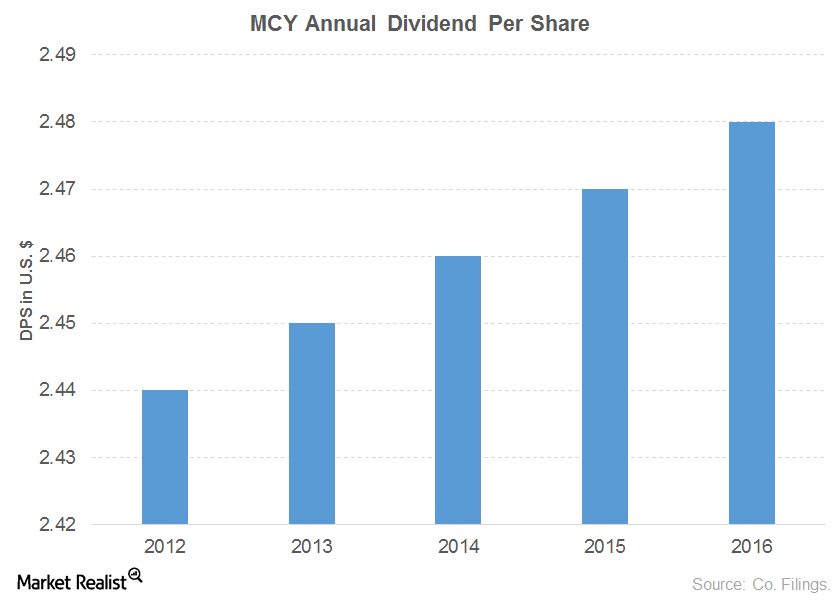

Mercury General (MCY) has consistently recorded revenue growth since fiscal 2011, except for a minor decline in fiscal 2015

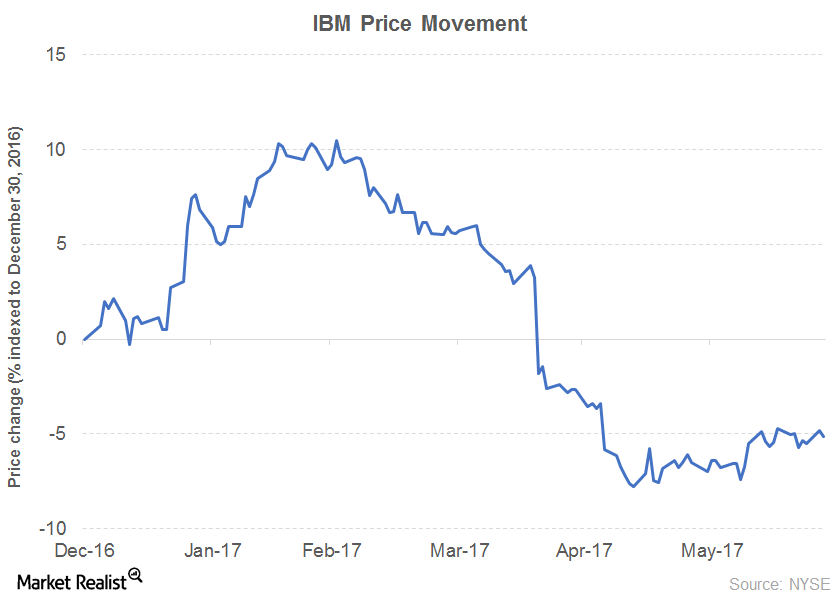

IBM’s Dividend Growth Curve

For IBM (IBM), 1Q17 marked the 22nd year of annual dividend growth despite being the 20th successive quarter with no revenue growth.

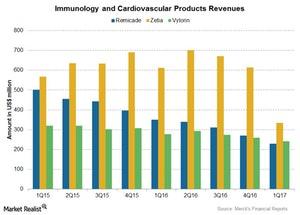

Merck’s Immunology and Cardiovascular Franchise in 1Q17

The combined revenues for Zetia and Vytorin fell 35% to $575 million in 1Q17, compared to $889 million in 1Q16.

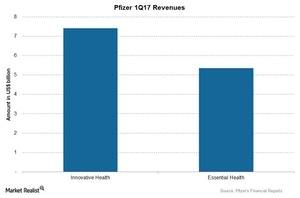

Pfizer’s Segment Performance in 1Q17

Pfizer Innovative Health contributed $7.4 billion, or about 58.0% of Pfizer’s total revenues in 1Q17.

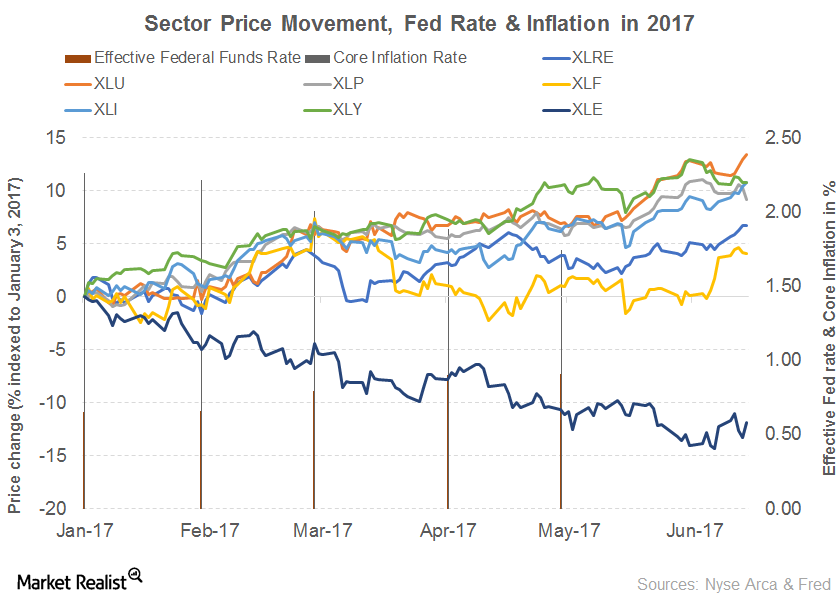

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

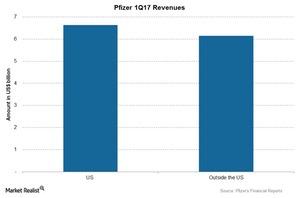

Understanding Pfizer’s 1Q17 Performance by Geography

Pfizer (PFE) reported a 2% decline in revenues to ~$12.8 billion for 1Q17, as compared to $13.0 billion in 1Q16.

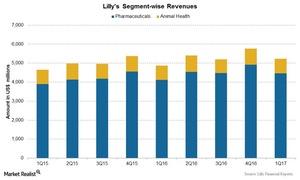

Eli Lilly’s Business Segments’ Performance in 1Q17

Elanco, Eli Lilly’s Animal Health business, reported growth of 2% to $769.4 million during 1Q17.

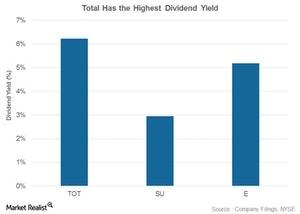

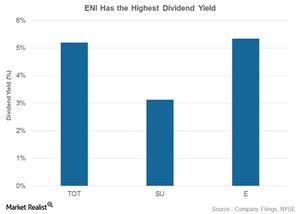

TOT, SU, E, and PBR: Comparing Their Dividend Yields

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have provided steady returns to their shareholders in the form of dividends.

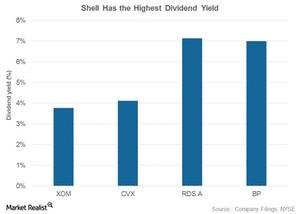

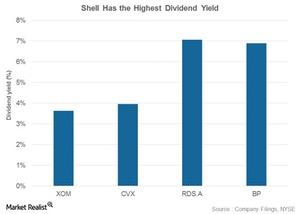

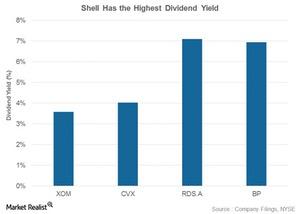

Who Has Higher Dividend Yields: RDS.A, XOM, CVX, or BP?

Shell has the highest dividend yield of 7.1% among the integrated energy stocks we’re covering in this series.

Performance of Eli Lilly & Co.’s Elanco in 1Q17

Eli Lilly & Co.’s (LLY) Animal Health company, Elanco, reported an increase of 2% in revenues to $769.4 million in 1Q17, compared to $754.6 million in 1Q16.

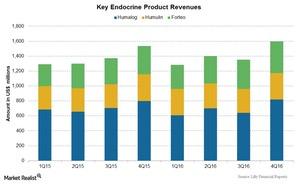

Eli Lilly’s 1Q17 Estimates for Humalog, Other Endocrine Products

Eli Lilly’s (LLY) human pharmaceutical segment contributes ~85.0% to Lilly’s total revenues.

Inside Integrated Energy’s Dividend Yields: Comparing XOM, CVX, RDS.A, and BP

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends.

TOT, SU, E, PBR: Who Has Highest Dividend Yield?

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have consistently given returns to shareholders in the form of dividends.

Integrated Energy Stocks: Who Stands Tall in Dividend Yield?

Shell’s dividend yield is 7.1%, the highest among the integrated energy stocks in this series.

What Wall Street Analysts Are Saying about Eli Lilly

Eli Lilly (LLY) reported EPS (earnings per share) of $2.58 on revenue of $21.2 billion in 2016, compared to EPS of $2.26 on revenue of $20.0 million in 2015.

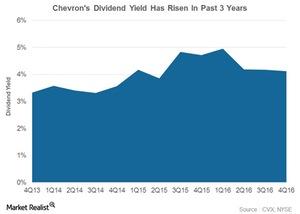

How Chevron’s Dividend Yield Has Trended

Chevron’s dividend yield Chevron (CVX) has consistently given returns to shareholders in the form of dividends. Therefore, we have evaluated its dividend yields. Yield is calculated as a ratio of the annualized dividend to stock price. Chevron’s dividend yield rose from 3.3% in 4Q13 to 4.1% in 4Q16, due to a dividend increase coupled with […]

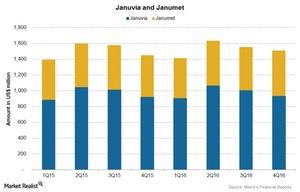

Januvia and Janumet: Merck & Co.’s Blockbuster Diabetes Products

Januvia and Janumet together contributed about 14.9% of Merck & Co.’s total revenues for 4Q16, an ~0.7% increase compared to 4Q15

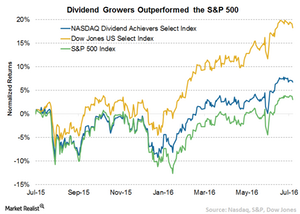

Do Dividend Growers Look Appealing?

Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility.

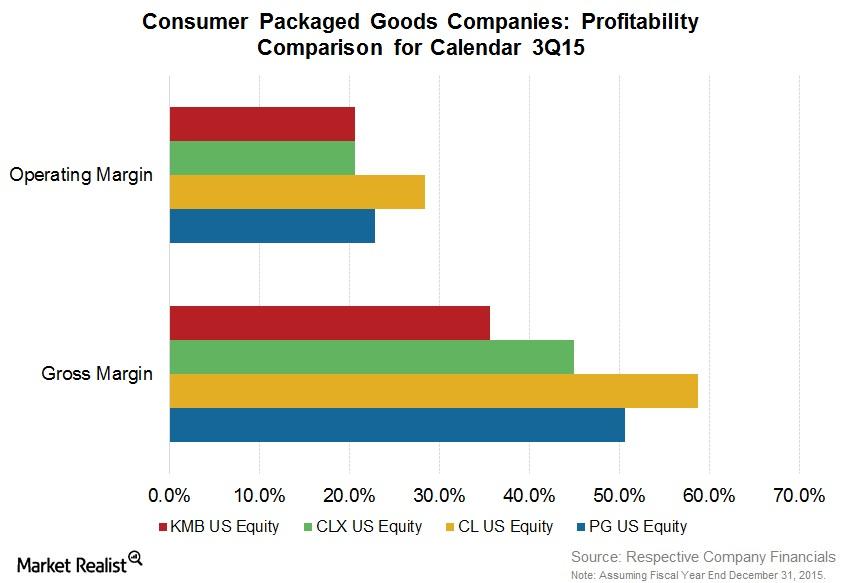

Consumer Packaged Goods Companies Saw Improved Margins

CPG companies’ 3Q15 margins sent strong signals. They have been investing in innovative products and other growth initiatives. This is impacting their margins.