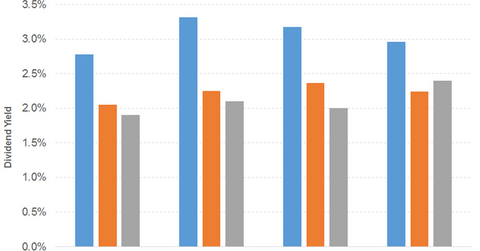

Dividend Yield of Procter & Gamble

Procter & Gamble’s (PG) PE ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%.

Aug. 23 2017, Published 12:43 p.m. ET

Procter & Gamble: Consumer goods sector, personal products industry

Procter & Gamble (PG) is a global consumer goods company dealing with branded products. Its sales have noted a declining trend throughout fiscal 2017. Sales for fiscal 2017 remained flat and were influenced by currency fluctuation. Organic sales posted a 2.0% growth. Operating income in fiscal 2017 recorded growth due to lower operating expenses. Earnings from the sale of Beauty Brands, share buybacks, and a decline in interest expenses further contributed to growth in EPS (earnings per share).

In the graph below, we can see Procter & Gamble’s dividend yield compared to the S&P 500 and Colgate-Palmolive (CL). (The asterisk in the graph denotes an approximation in calculating dividend yield.)

Increase in dividends for 61 years

Procter & Gamble has increased its dividends for 61 successive years. Free cash flow saw a growing trend before falling in fiscal 2017. The fall was driven by lower operating cash flow. The dividend yield has been impressive and is above the S&P 500.

The company’s PE (price-to-earnings) ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%. In the graph below, we can see Procter & Gamble’s price movement compared to the S&P 500 and Colgate-Palmolive.

Procter & Gamble has projected a sales growth of 3.0% in fiscal 2018. EPS for the period has been projected to fall 26.0%–28.0% compared to fiscal 2017 since the latter was influenced by a gain on the sale of a business.

The iShares Core High Dividend (HDV) offers a dividend yield of 3.3% at a PE ratio of 21.0x. The diversified ETF has a substantial exposure to consumer non-cyclical. The Global X SuperDividend ETF (SDIV) offers a dividend yield of 6.7% at a PE ratio of 11.6x. The geographically diversified ETF has a major exposure to real estate.