A Look at the Financial Details of the CVS-Aetna Deal

CVS is paying more than 11 times the trailing 12-month EBITDA for Aetna.

Dec. 4 2017, Updated 11:40 a.m. ET

A look at the CVS-Aetna deal valuations

CVS Health (CVS) has agreed to buy Aetna (AET) for $69 billion. The company is paying more than 11 times the trailing 12-month EBITDA for Aetna. CVS has agreed to take on $8 billion in net debt, which brings the total deal value to $77 billion. CVS is thus paying 1.3 times Aetna’s TTM revenue and 12.4 times its adjusted EBITDA.

The current transaction is in line with CVS Health’s previous purchases. The company acquired Caremark in 2007 for 11.8x its TTM EBITDA and Omnicare in 2015 for 22.0x its TTM EBITDA.

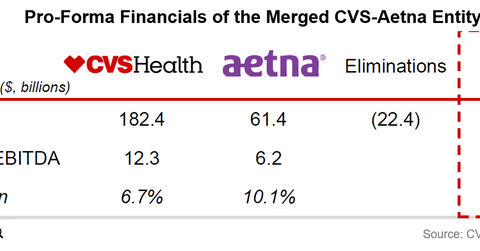

Looking at the pro forma numbers

The combined entity would form a pharmacy giant with more than $221 billion in total sales. It will have an EBITDA margin of 8.4%. The deal will likely boost CVS Health’s margins, which currently stand at 6.7% for the last 12 months.

Discussing synergies

CVS expects to realize around $750 million in near-term synergies, resulting mainly from internal efficiencies and the development of a better network. The company expects low-to-mid-single digit accretion in the second full year after the deal closure.

What does the deal mean to CVS Health’s balance sheet?

CVS will pay $145 per share in cash and $62 in stock to Aetna’s shareholders. The company will be issuing $21 billion of new equity for the deal.

The company plans to finance the cash portion of the transaction through a combination of cash at hand and debt. The company only has $4 billion of balance sheet cash and will thus raise $44.8 billion of new debt.

Investors looking for exposure to CVS can consider the First Trust Consumer Staples AlphaDEX Fund (FXG), which invests 4.2% of its portfolio in the company.