Alerian MLP ETF

Latest Alerian MLP ETF News and Updates

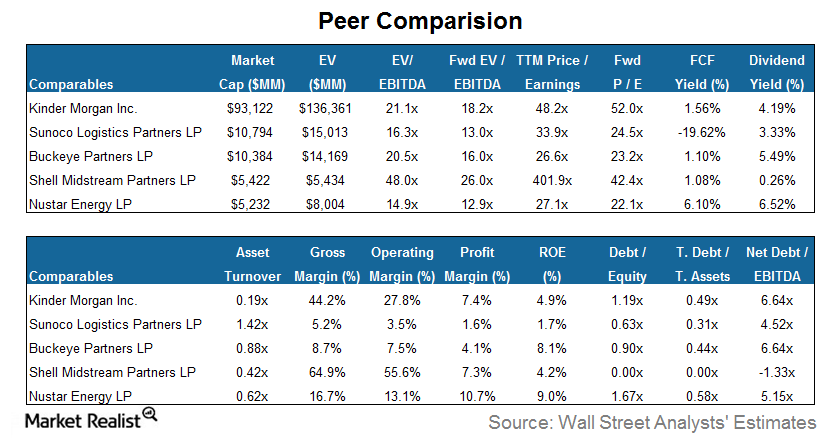

Why Sunoco Logistics Has the Lowest Profit Margins

Sunoco Logistics has the lowest profit margin and ROE among its peers. Its profit margin and ROE of 1.6% and 1.7%, respectively, are well below the group average.

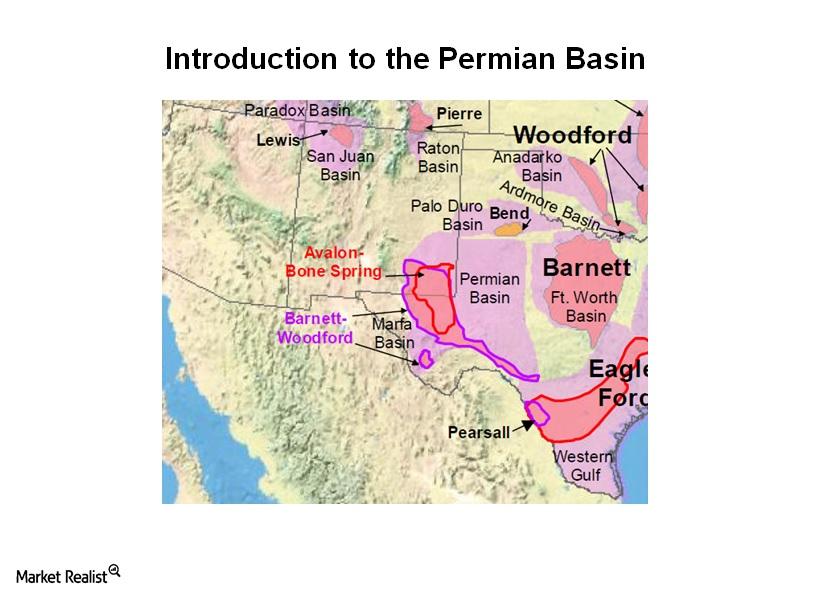

Introduction to the Permian Basin — Part 2: Geography of the Permian Basin

The Permian Basin is one of the US’s primary drivers of oil production growth. Market Realist provides an overview of this prolific hydrocarbon asset with a primer piece: “Introduction to the Permian Basin”.

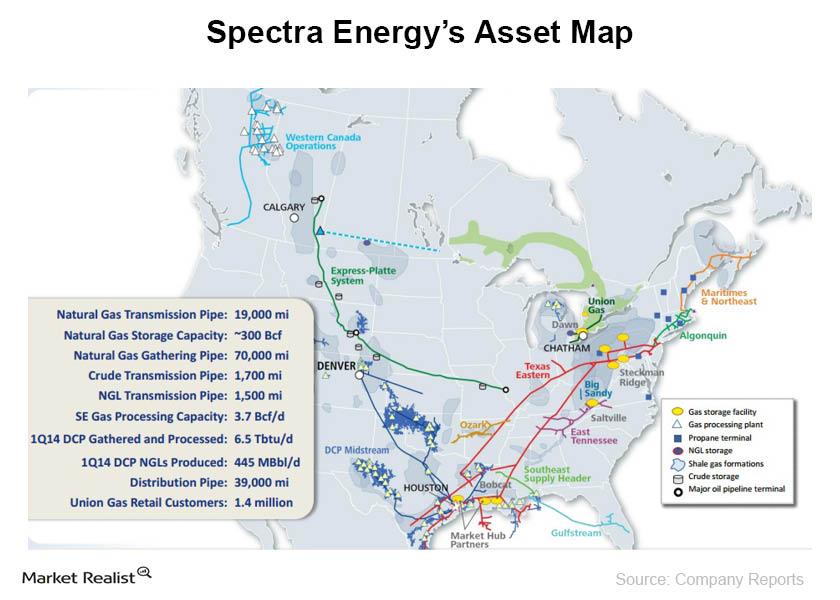

An investor’s guide to Spectra Energy Corp. and its earnings

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

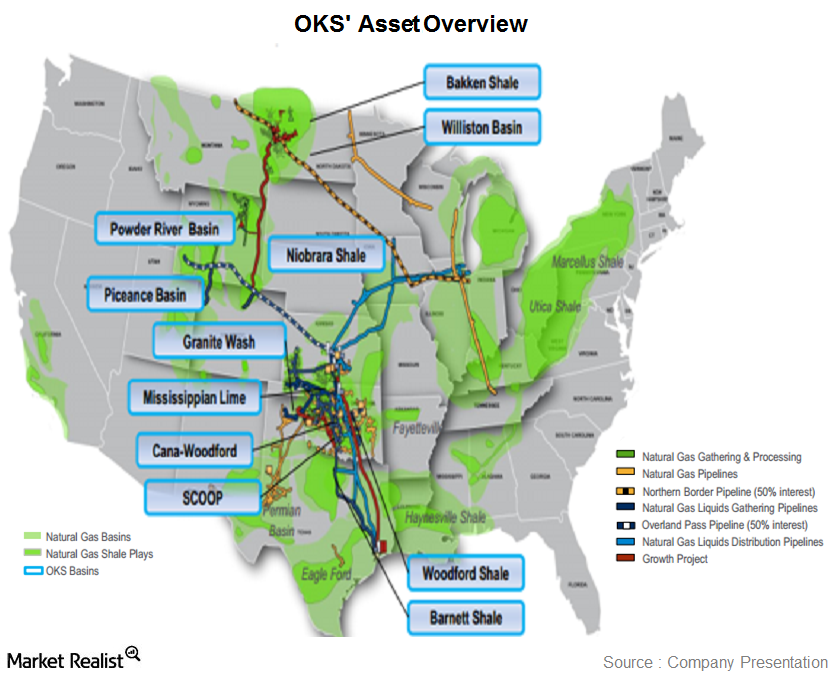

Overview: ONEOK Partners and its 3 operating segments

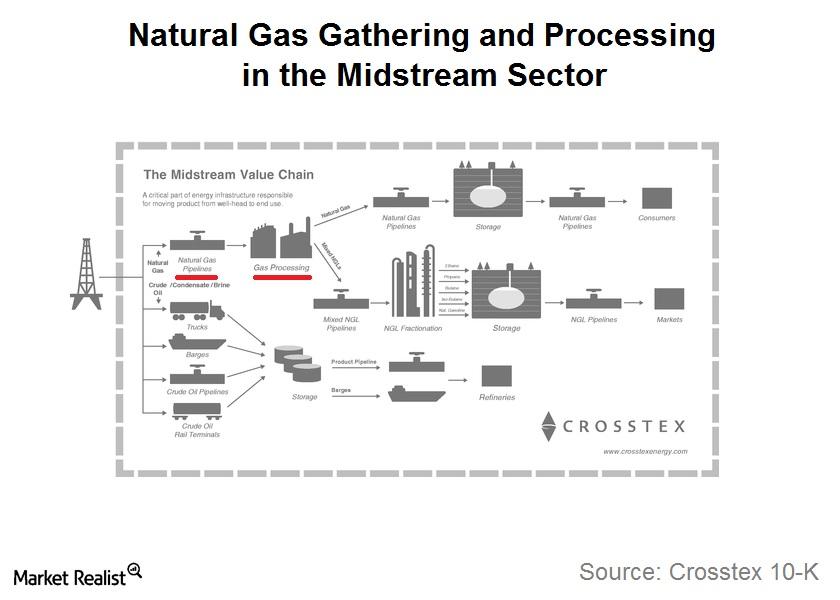

ONEOK Partners (OKS) is a master limited partnership (or MLP) engaged in gathering, processing, storing, and transporting natural gas and natural gas liquids (or NGLs) in the U.S.

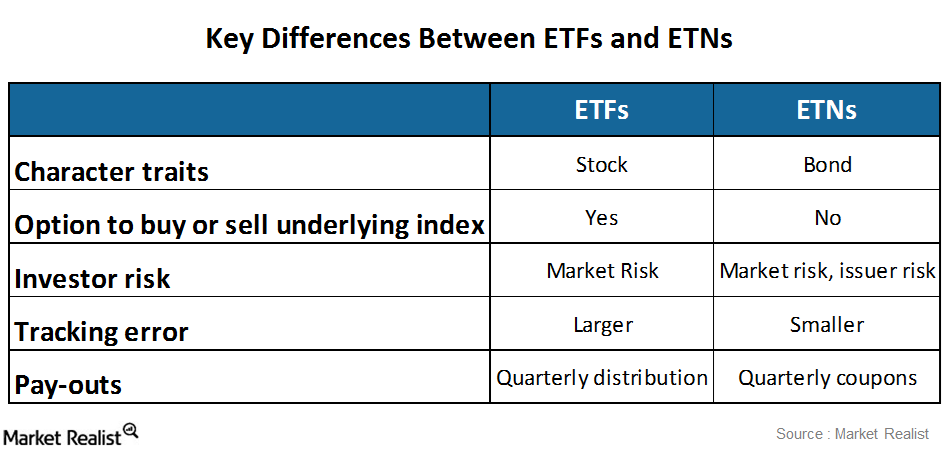

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

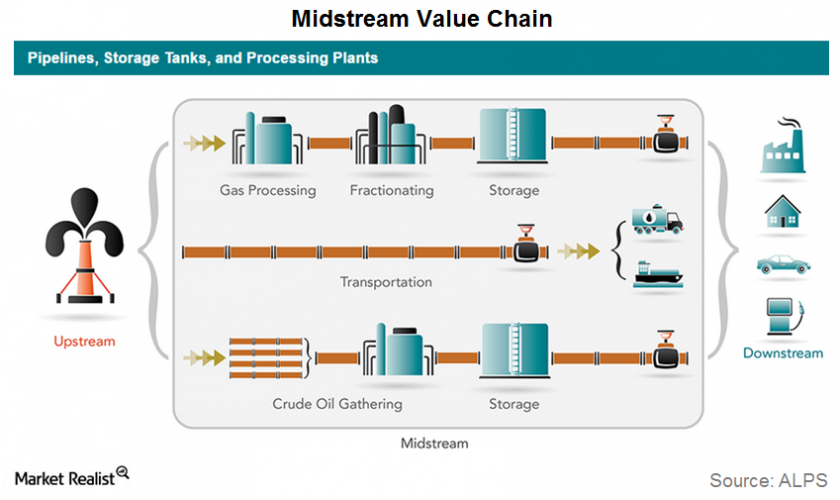

MLPs: How They Operate in the Midstream Energy Industry

Most MLPs operate in the midstream energy industry. They’re mainly involved in gathering, processing, storing, and transporting energy commodities.

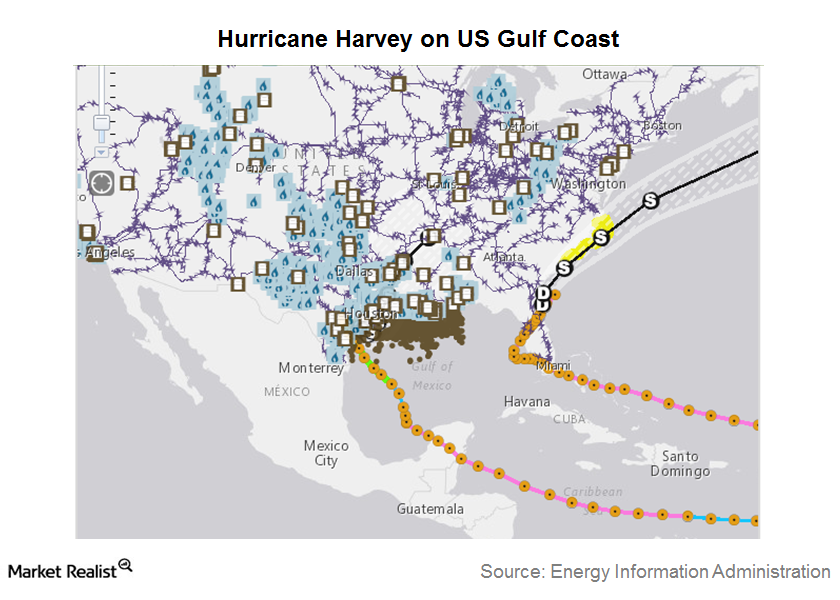

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

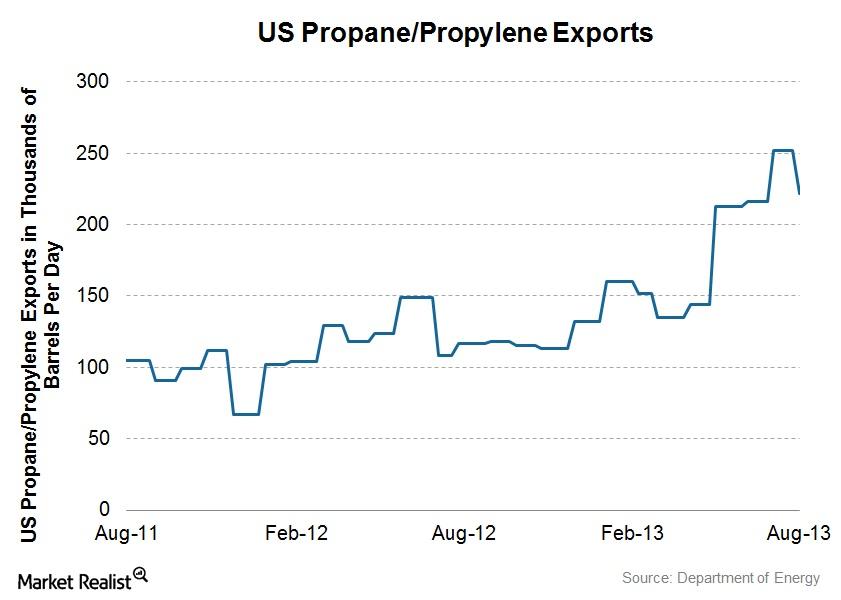

Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.Energy & Utilities Why Targa Resources’ segment operating margins changed in 1Q14

In 2013, the company processed an average of 780.1 million cubic feet per day of natural gas and produced an average of 91.9 thousand barrels per day of NGLs.

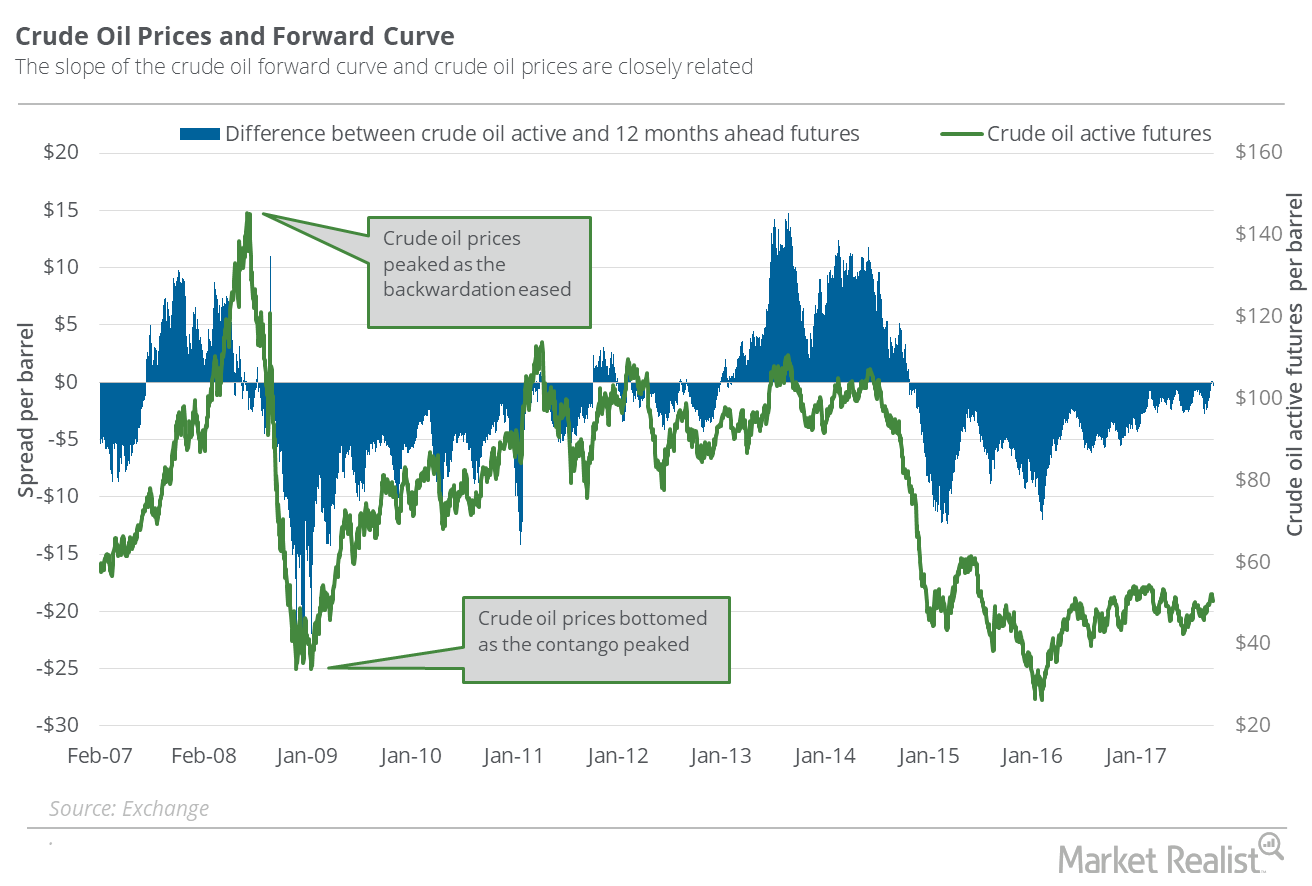

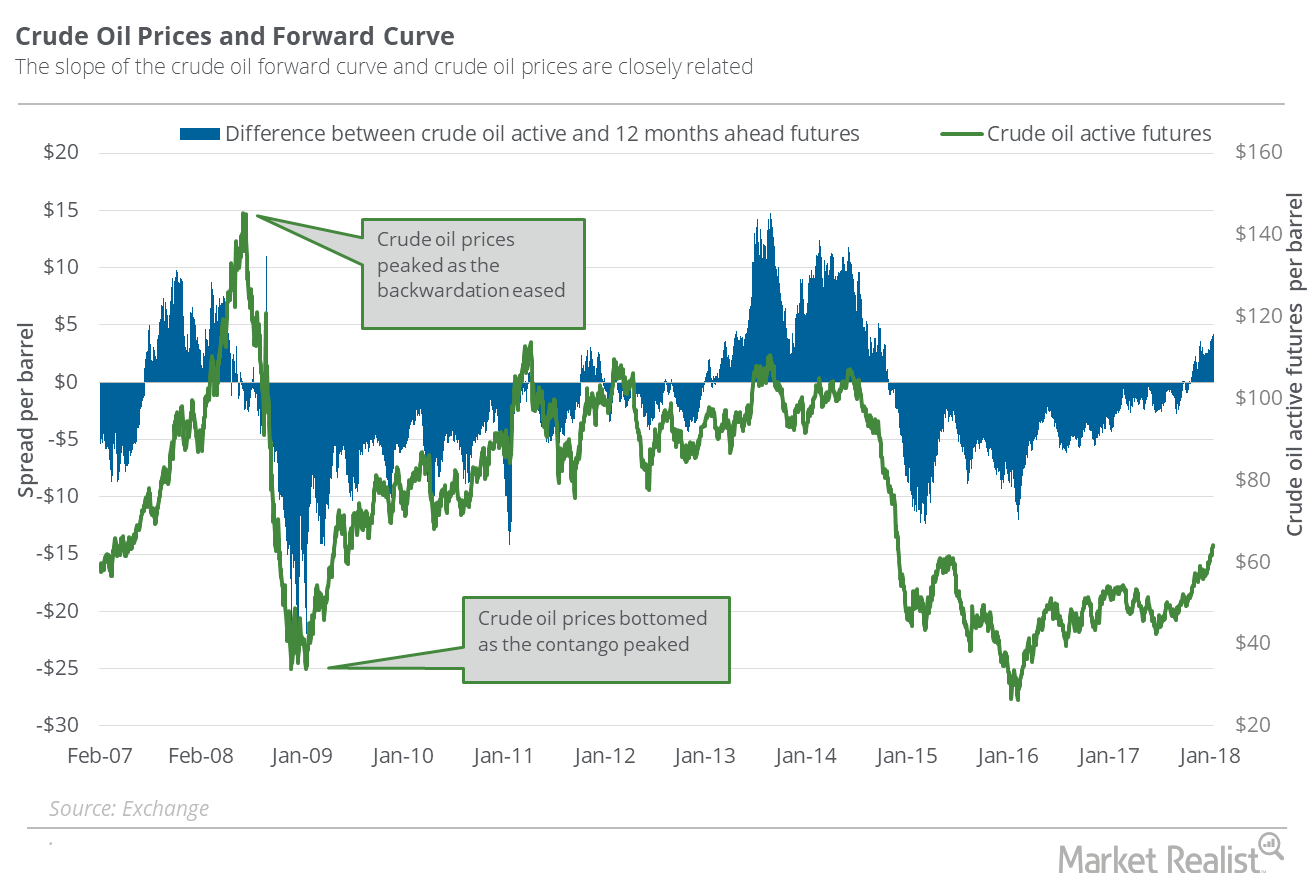

Oil’s Contango: Supply–Demand Fears Could Impact the Market

On October 3, 2017, US crude oil (USL) (OIIL) November 2018 futures settled $0.33 higher than the November 2017 futures.

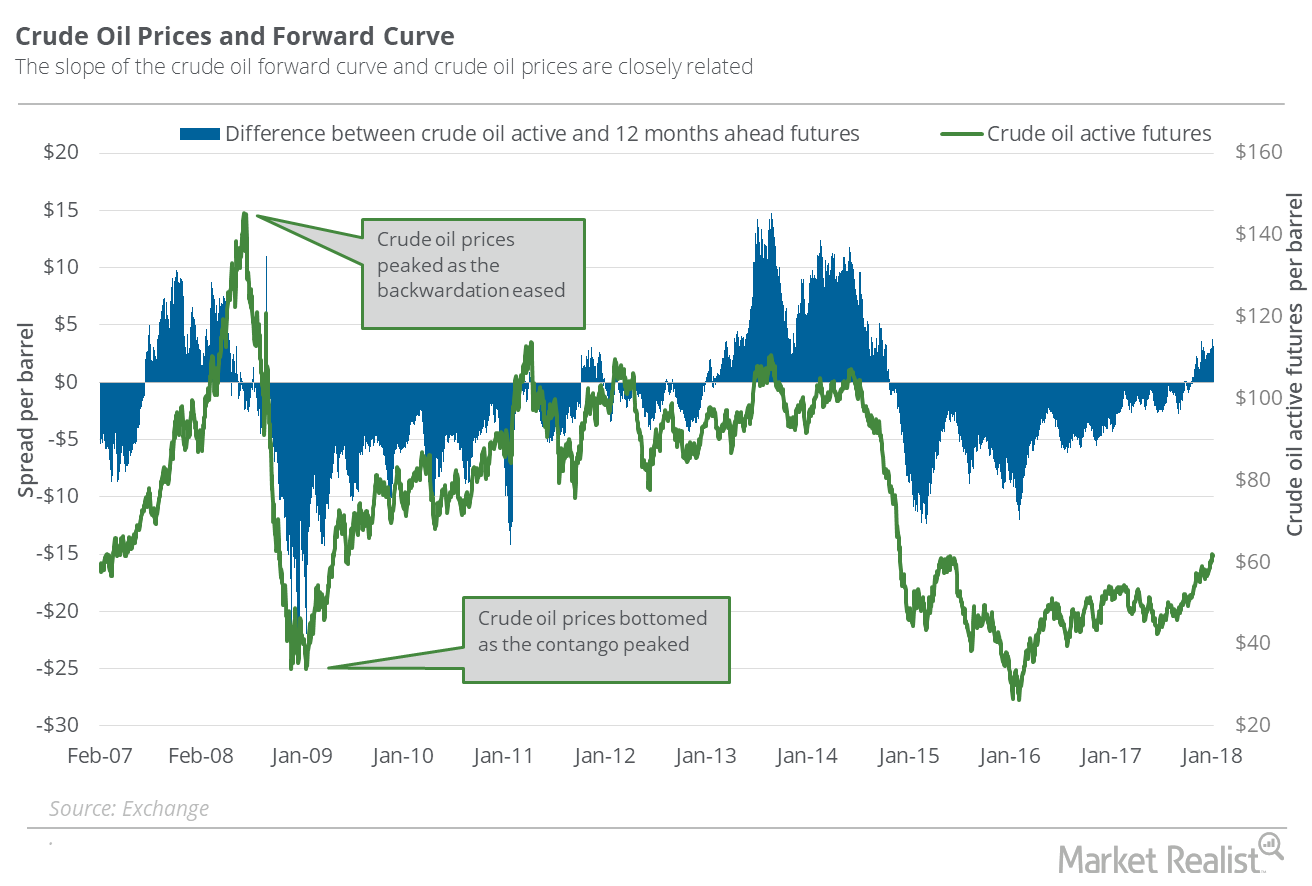

Are Traders Confident about the Oil Supply-Demand Balance?

Between December 29, 2017, and January 8, 2018, the premium and the oil prices rose. The market expects a tightening supply-demand balance for oil in 2018.

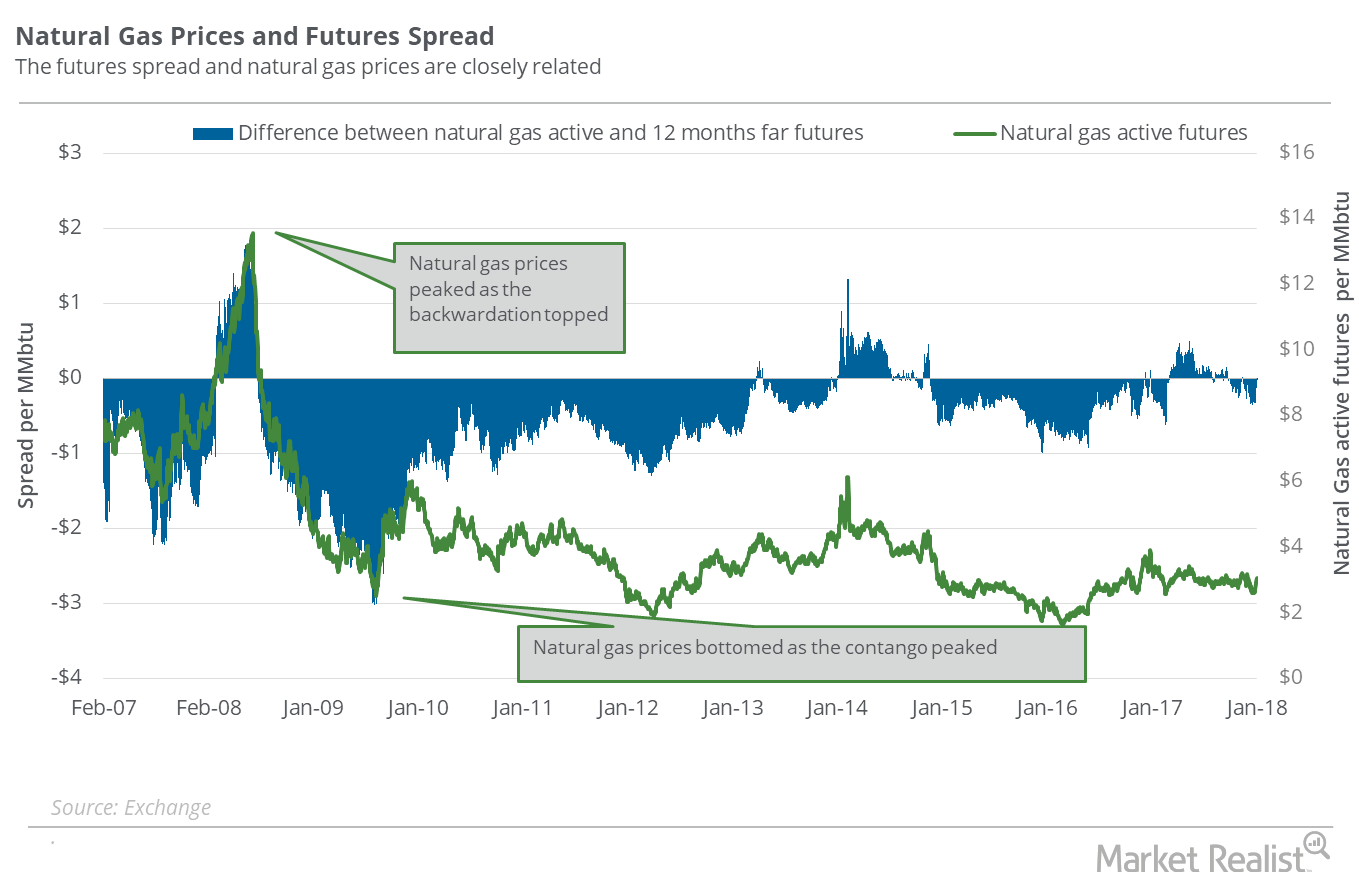

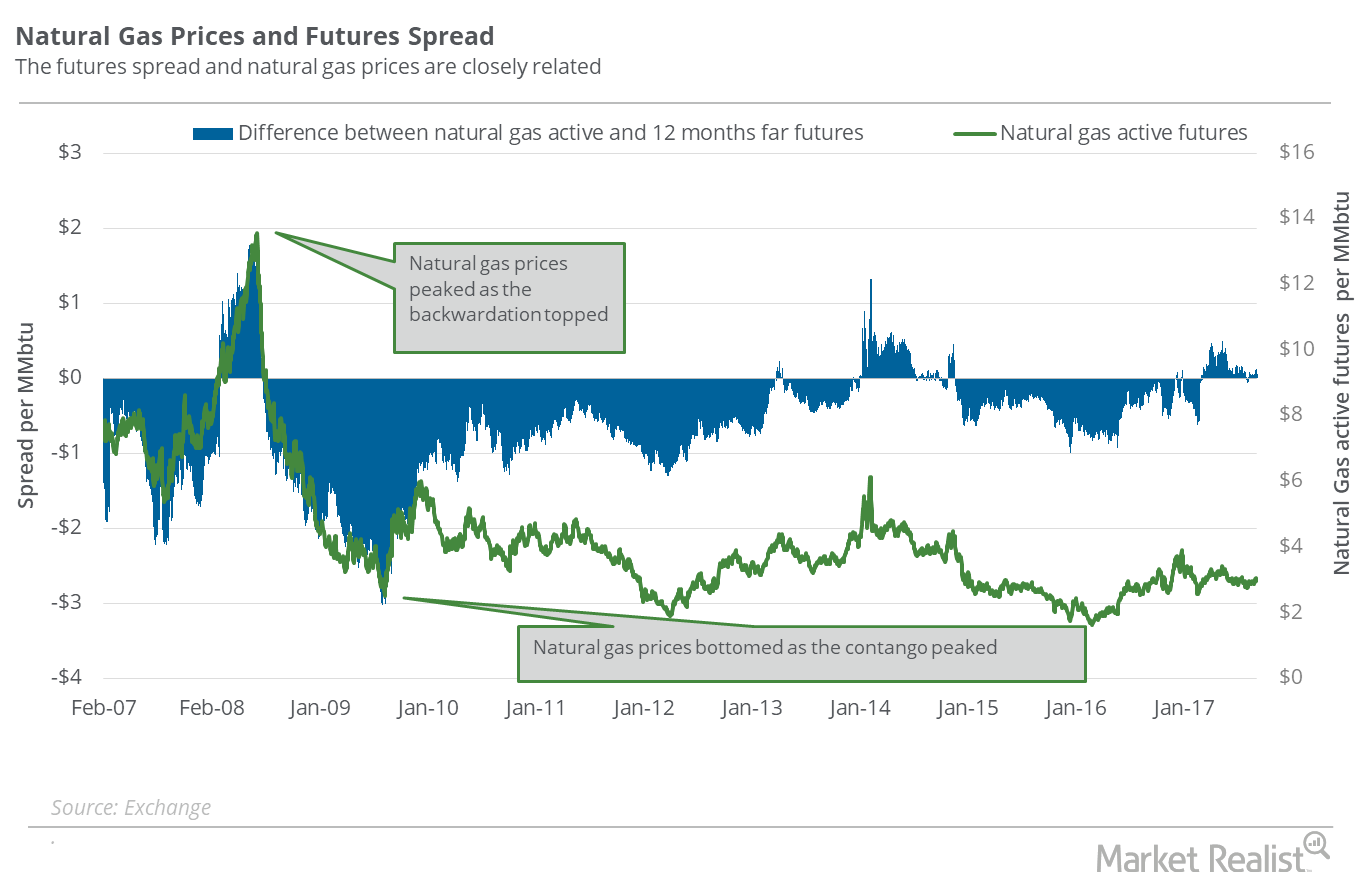

Natural Gas: Are Winter Demand Fears Rising?

On January 2, 2018, natural gas (UNG) (BOIL) (FCG) February 2018 futures settled $0.025 less than February 2019 futures.

Why Did Crude Oil Prices Rise?

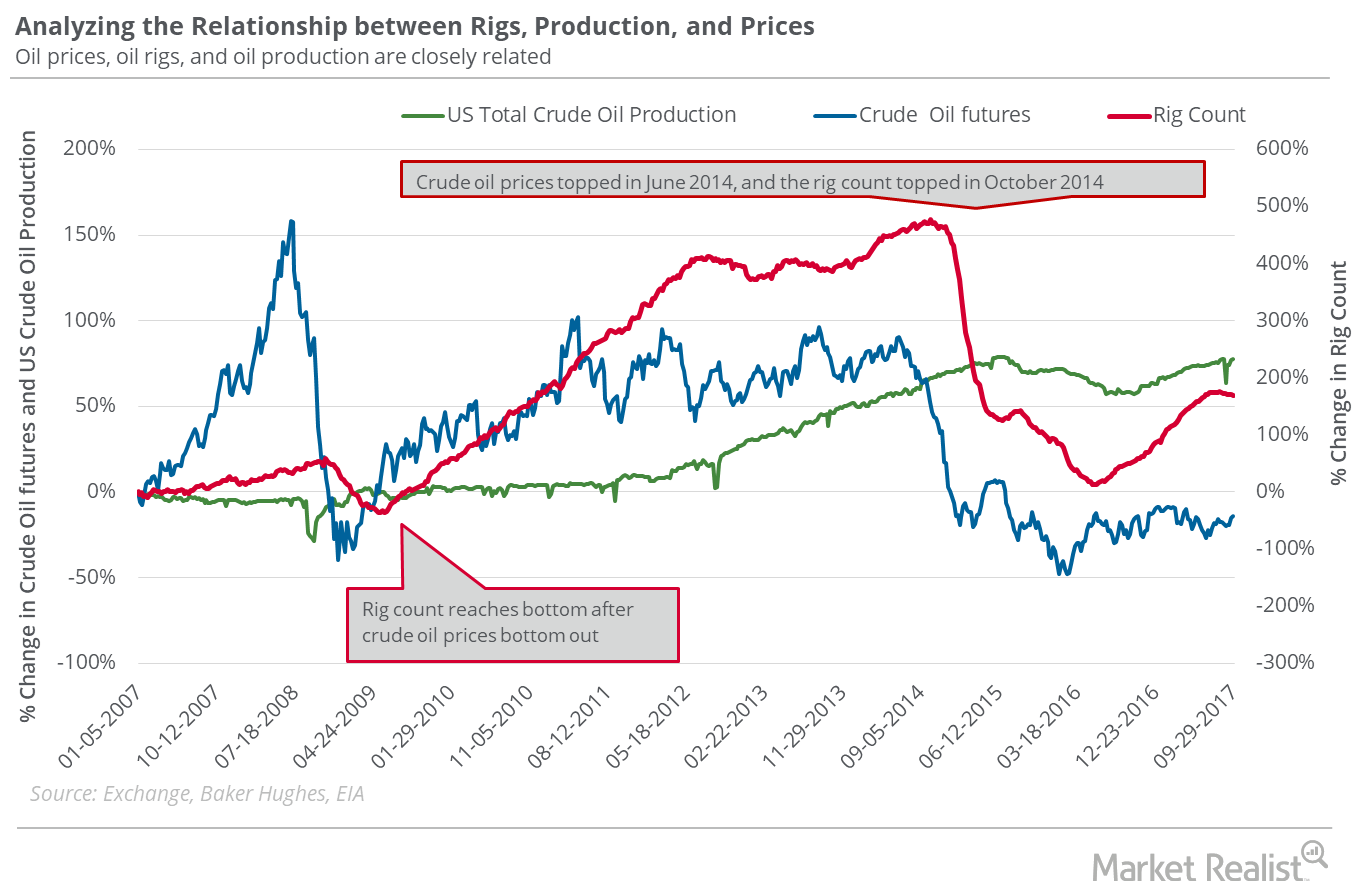

On February 9, 2017, US crude oil futures contracts for March delivery closed at $53.00 per barrel—an ~1.3% rise compared to the previous trading session.

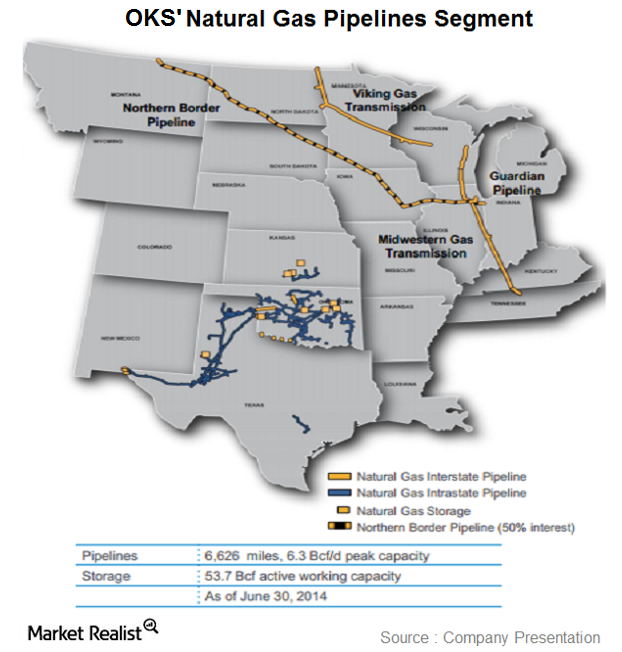

Overview: ONEOK Partners’ natural gas pipelines segment

ONEOK Partners’ (OKS) natural gas pipelines segment owns and operates regulated interstate and intrastate natural gas pipelines and natural gas storage facilities.

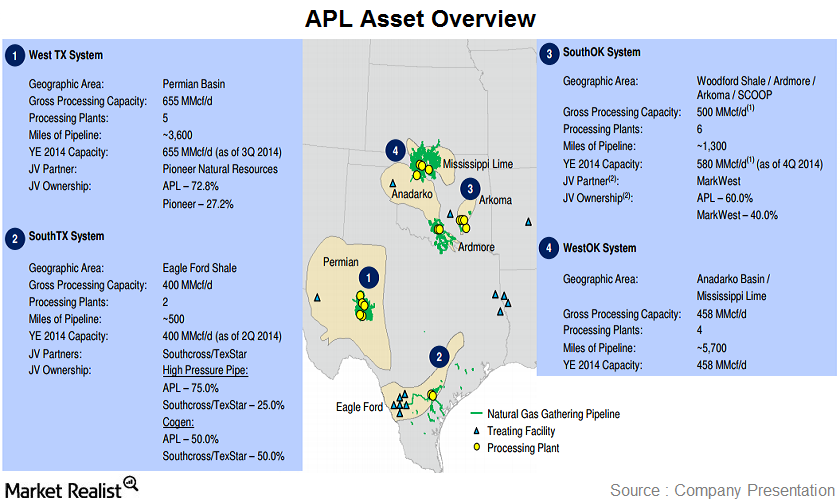

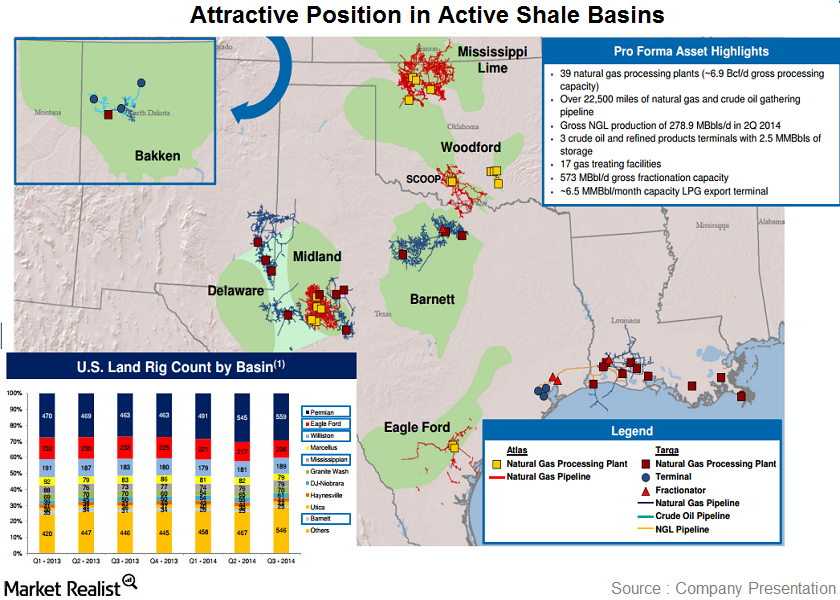

A brief overview on Atlas Pipeline Partners

The company provides natural gas gathering and processing services in the Eagle Ford Shale play in Texas, as well as in the Anadarko, Arkoma, and Permian basins.

Are Natural Gas Supplies Overtaking Demand?

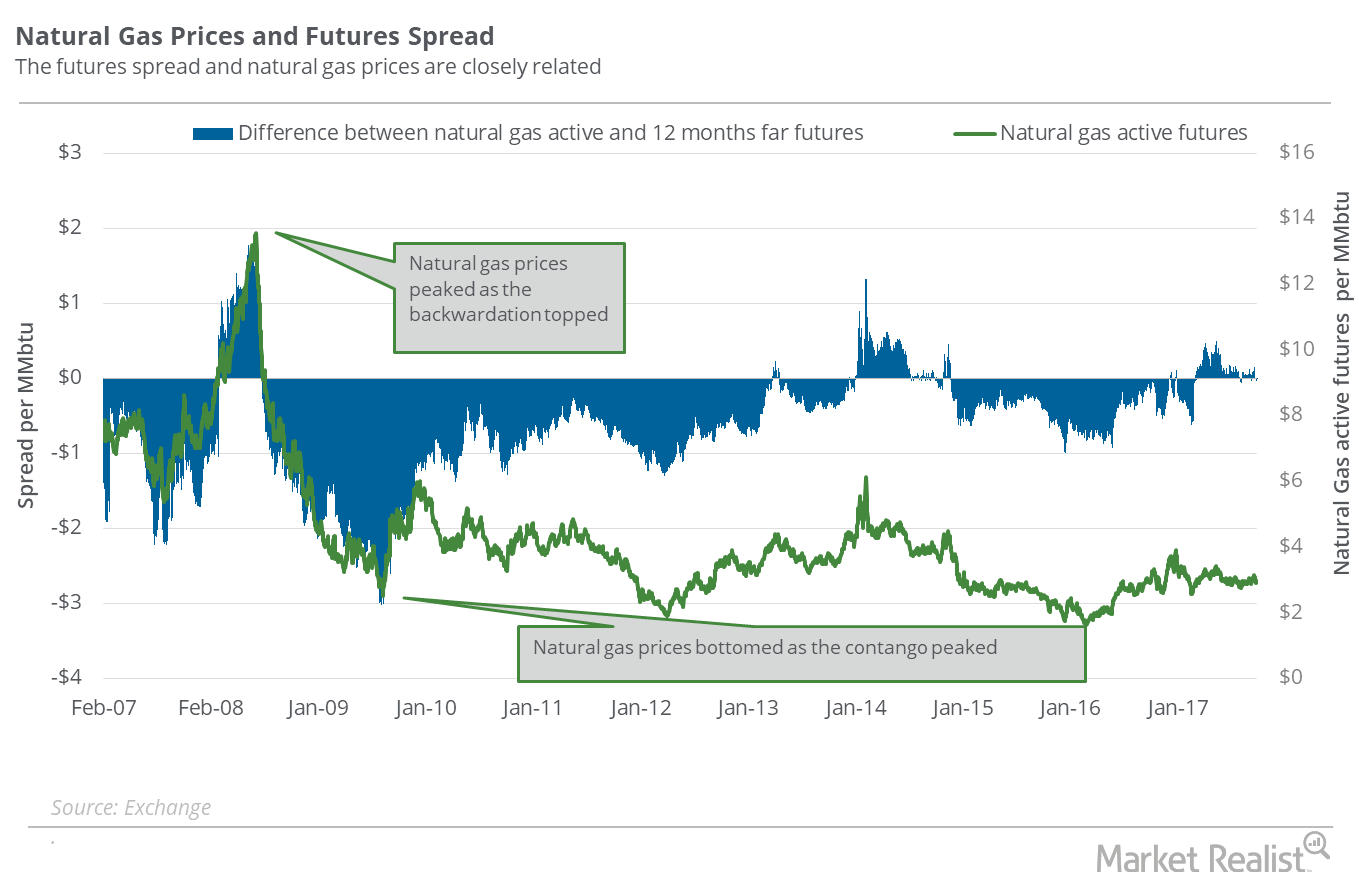

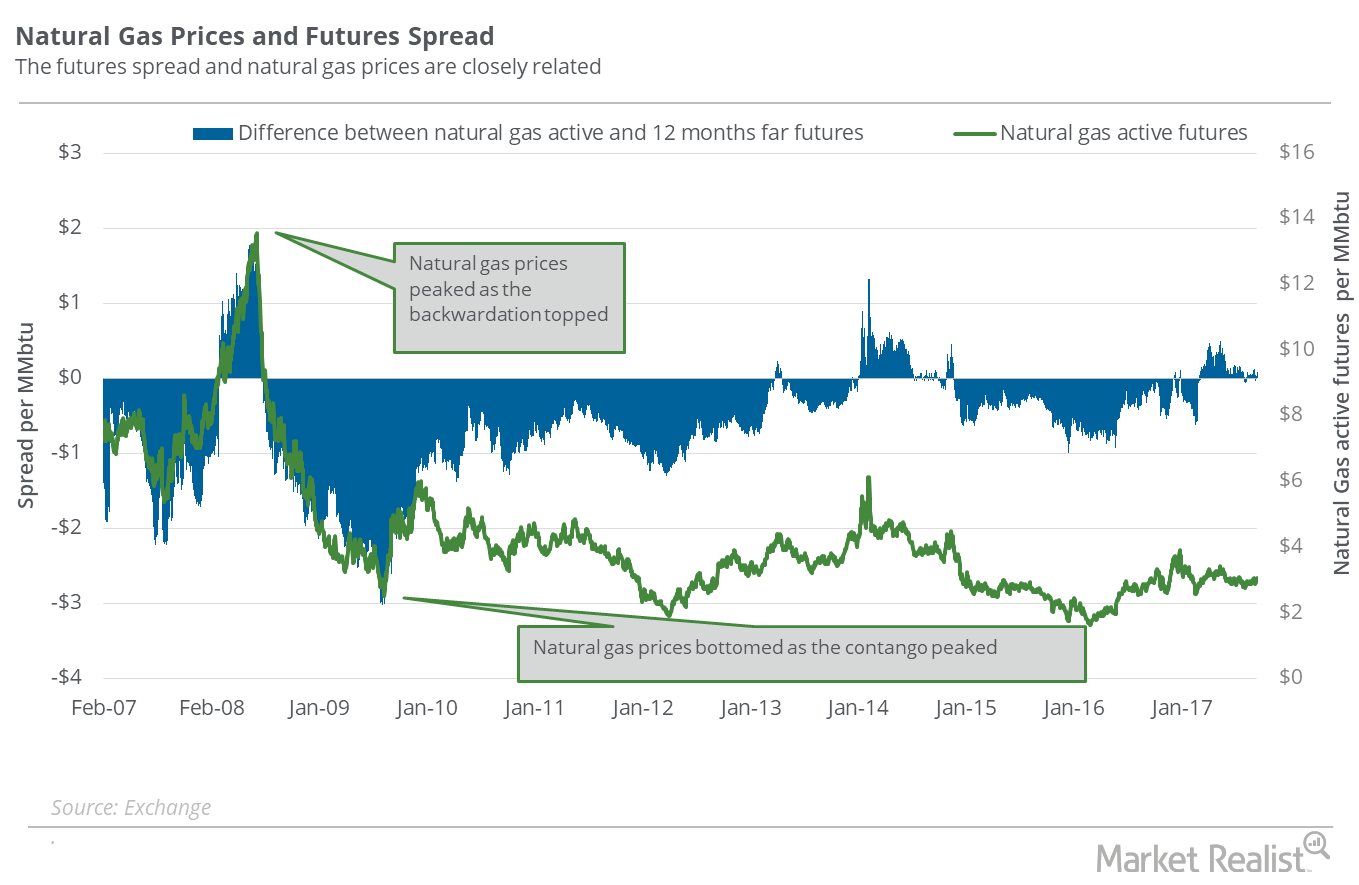

Futures spread On September 27, 2017, natural gas (FCG) (GASL) (BOIL) 2018 November futures traded $0.04 lower than November 2017 futures. That is, the futures spread was at a discount of $0.04. On September 20, 2017, the futures spread was at a discount of $0.10. Between September 20 and 27, 2017, natural gas November futures […]

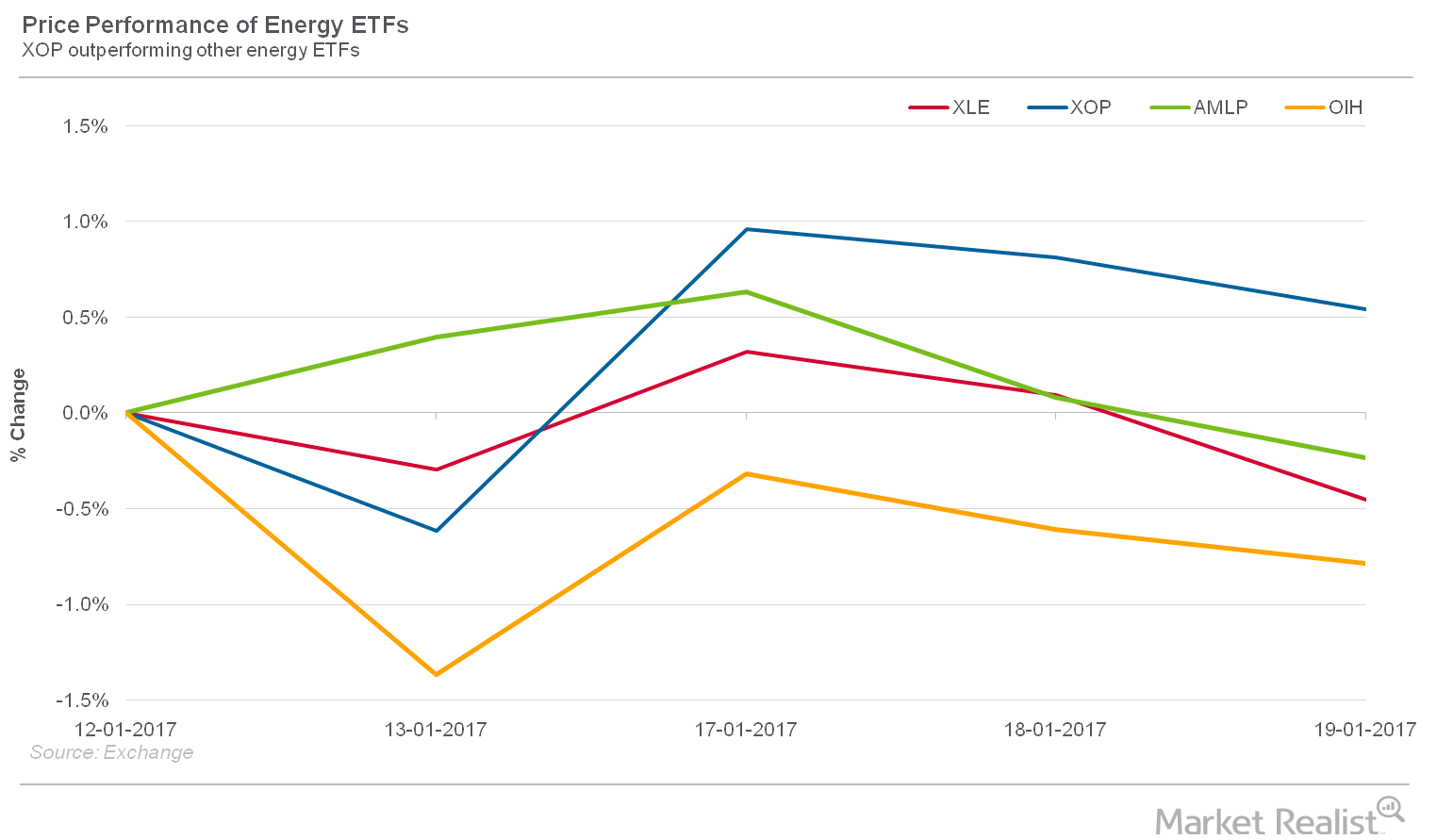

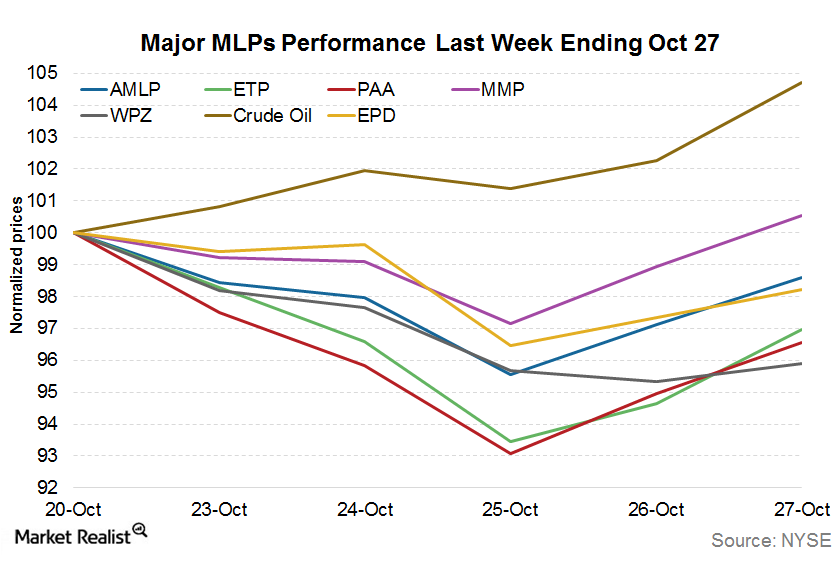

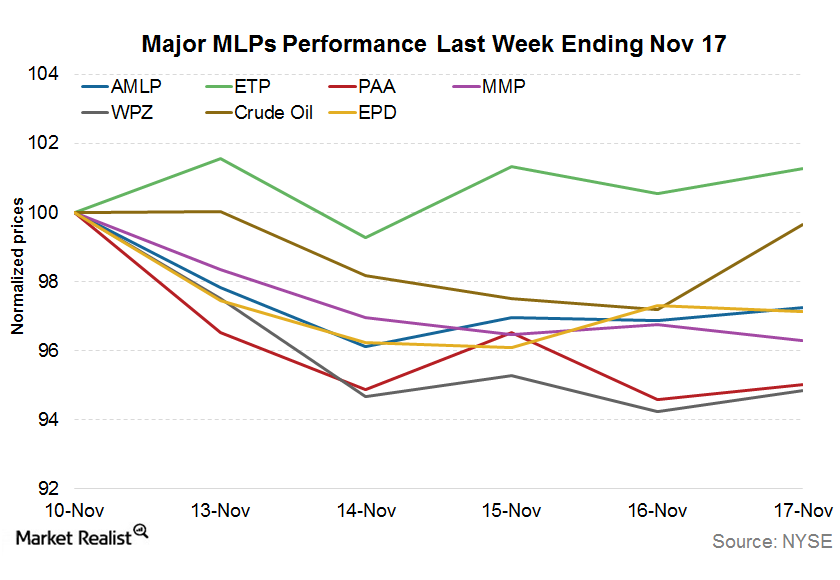

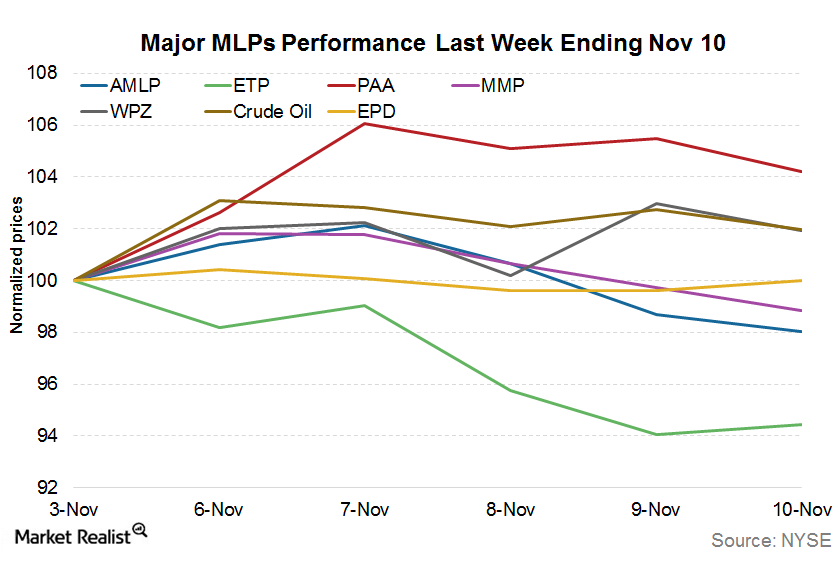

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

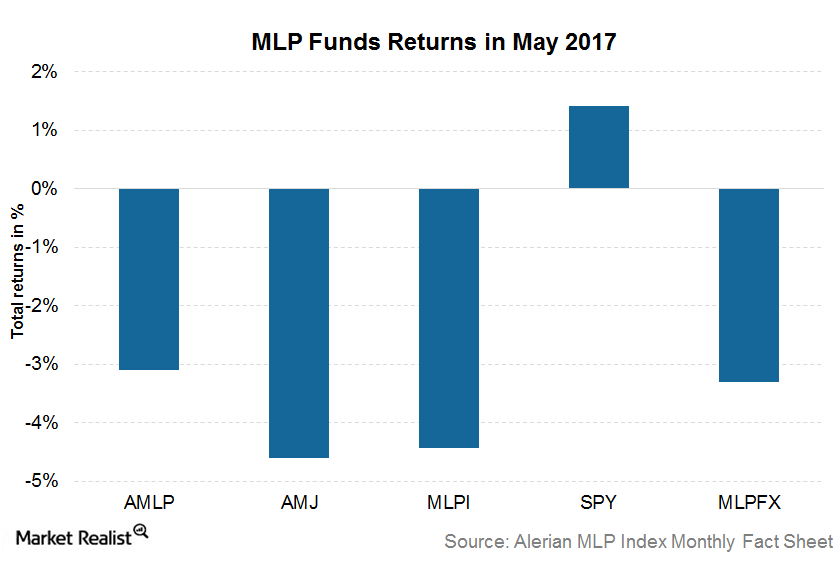

How MLP-Focused Funds Performed in May 2017

Among MLP funds, exchange-traded notes fell the most while the exchange-traded funds declined the least.

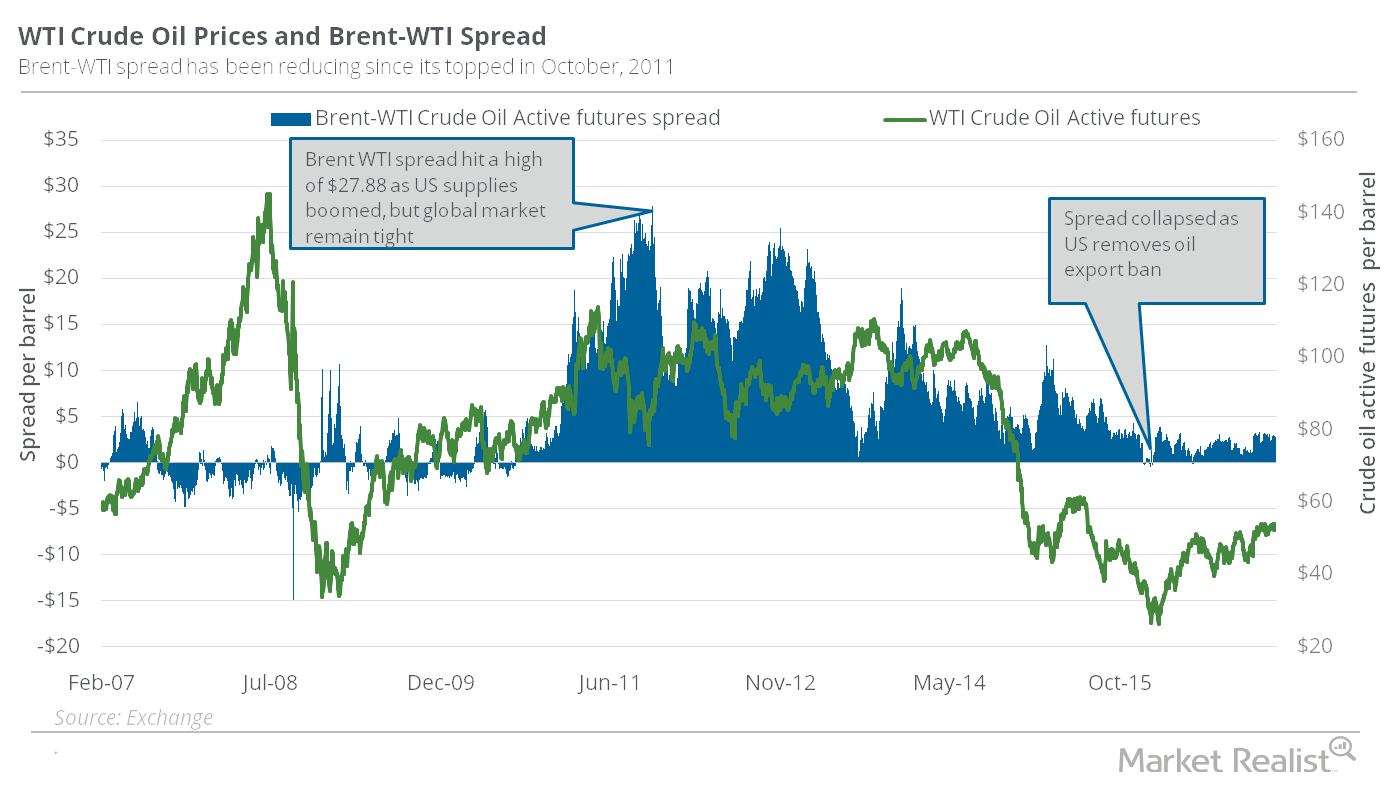

Brent-WTI Spread Impacts Your Oil-Related Investments

On February 14, WTI crude oil (USO) (USL) (OIIL) (SCO) active futures traded at a discount of $2.84 per barrel compared to Brent crude oil active futures.

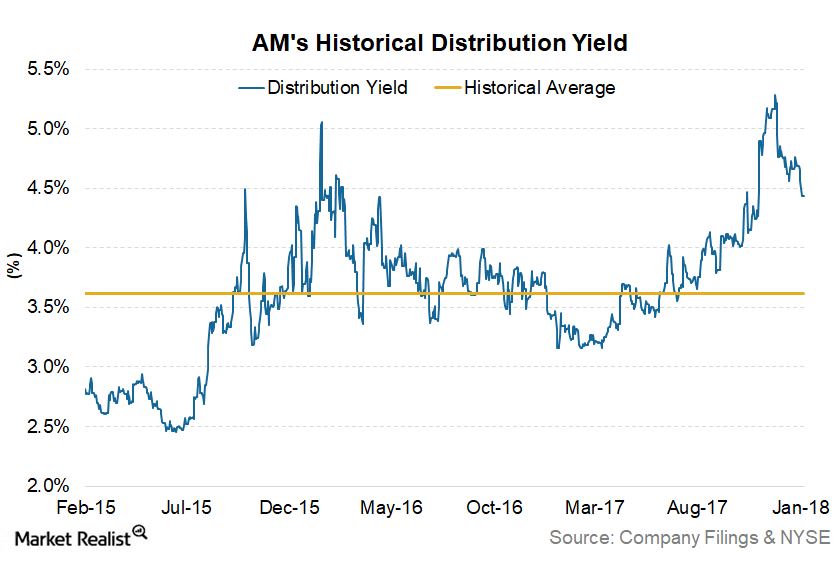

Could Antero Midstream Partners Benefit from Strong Earnings?

Antero Midstream Partners fell 6% last year. However, it had a strong start to the new year. It has risen 6.8% in 2018.

Oil Market Could Be Pricing in a Supply Deficit

The rise in the premium, along with the rise in oil prices in the trailing week, could mean that the market expects a supply deficit in the oil market.

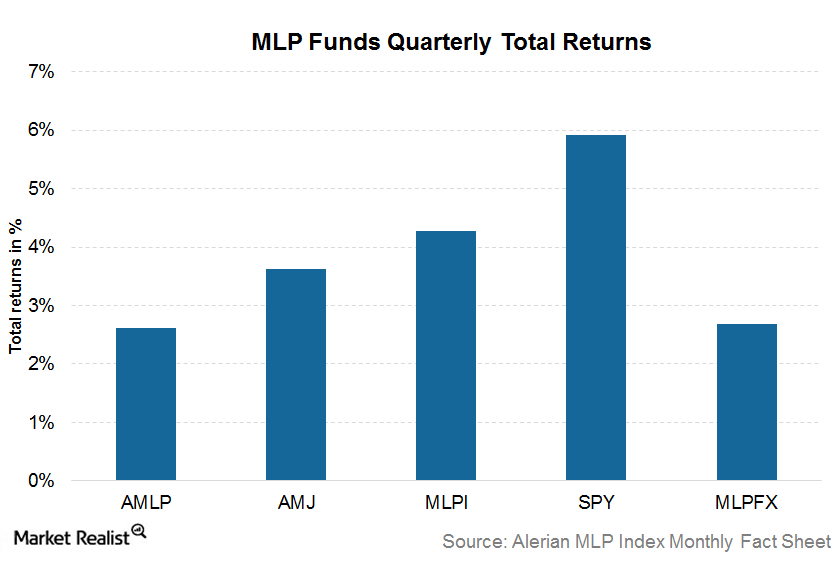

How MLP-Focused ETNs Performed in 1Q17

MLP-focused funds underperformed the SPDR S&P 500 ETF (SPY) in the recent quarter.

Why natural gas gathering and processing are important for MLPs

Natural gas gathering and processing is a significant part of the operations of many midstream master limited partnerships.

Futures Spread: Is the Natural Gas Market Turning Bullish?

On September 20, 2017, natural gas (FCG) (BOIL) October 2018 futures closed $0.10 below its October 2017 futures.

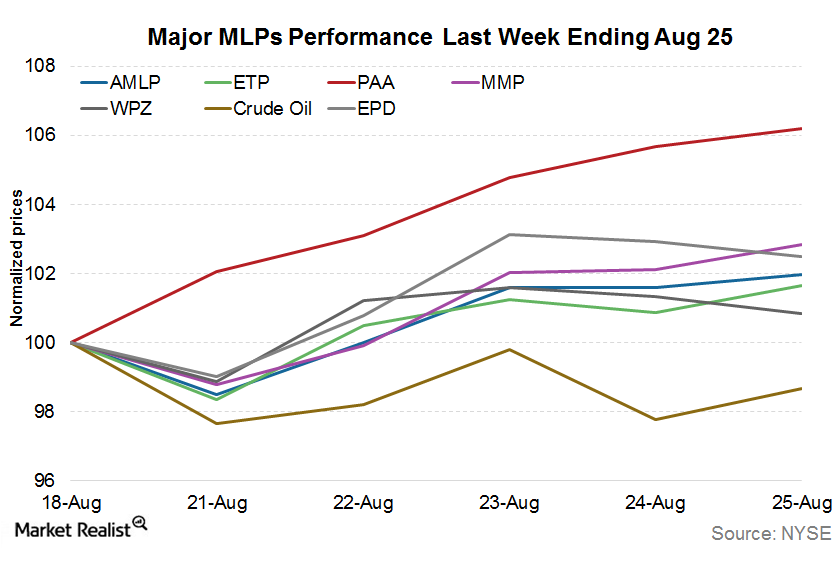

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

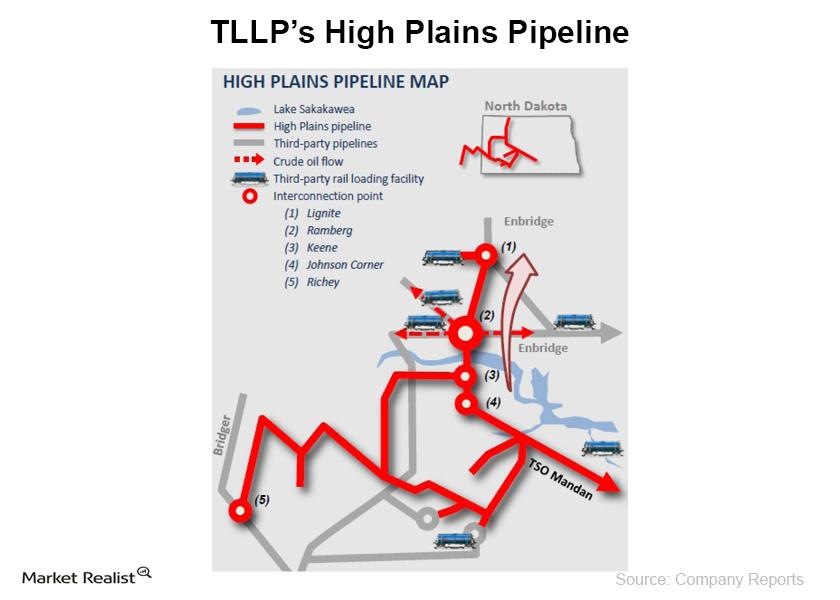

Why Tesoro’s crude oil gathering and pipeline segment is positive

Tesoro Logistics’ (TLLP) operations are organized into the Crude Oil Gathering segment and the Terminalling and Transportation segment.

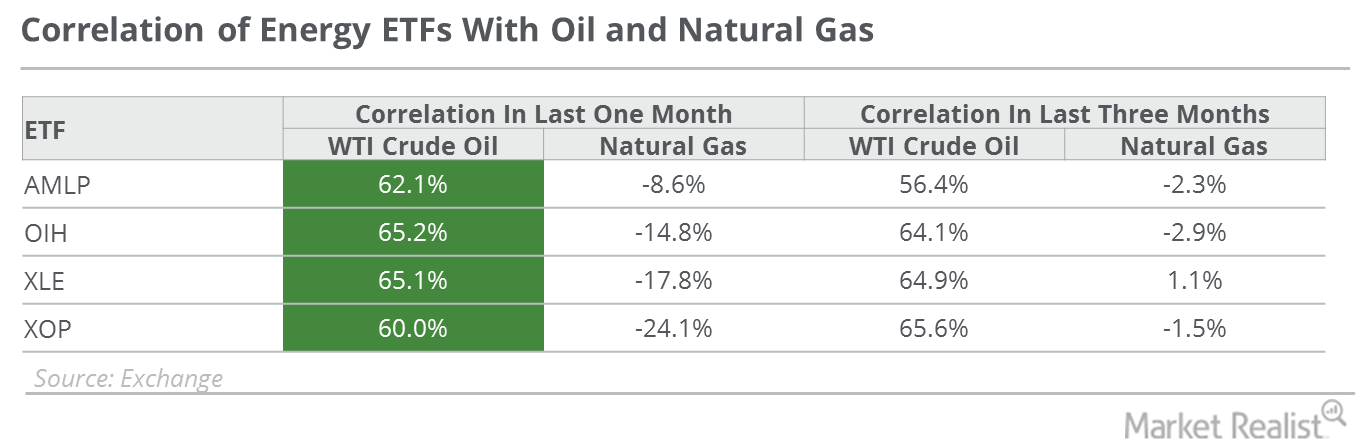

How Energy ETFs Are Correlated to Falling Oil Prices

At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017.

Why Frac Spreads Affect Some MLP Stocks

Companies in the natural gas processing space—many of which are MLPS—keep an eye on the fractionation or “frac” spread. Here’s why.

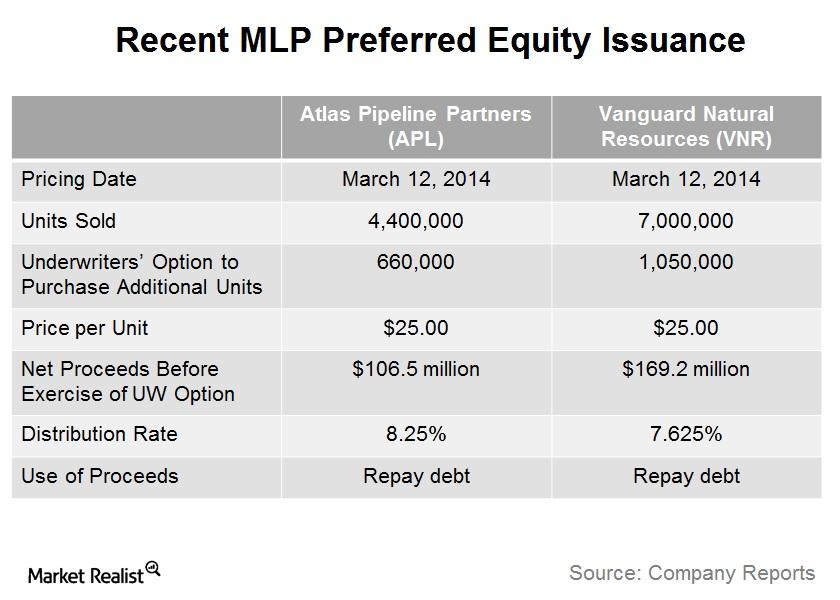

Is preferred equity a trend for master limited partnerships?

Recently, two master limited partnerships issued preferred equity, which is a relatively rare avenue of financing for MLPs.

An overview of the Targa Resources and Atlas Pipeline deal

The combined company will create a midstream enterprise with more than 22,500 miles of crude oil and natural gas pipelines across the U.S. The $7.7 billion deal is expected to close in the first quarter of 2015.

Futures Spread: Does It Signal End of Oil’s Oversupply Concern?

On October 17, 2017, US crude oil (USO) (OIIL) December 2018 futures traded $0.46 below the December 2017 futures.

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

What the Natural Gas Futures Spread Tells Us about the Current Sentiment

On September 6, 2017, the futures spread was at a discount of $0.06, but on September 8, 2017, the futures spread shifted to a premium.

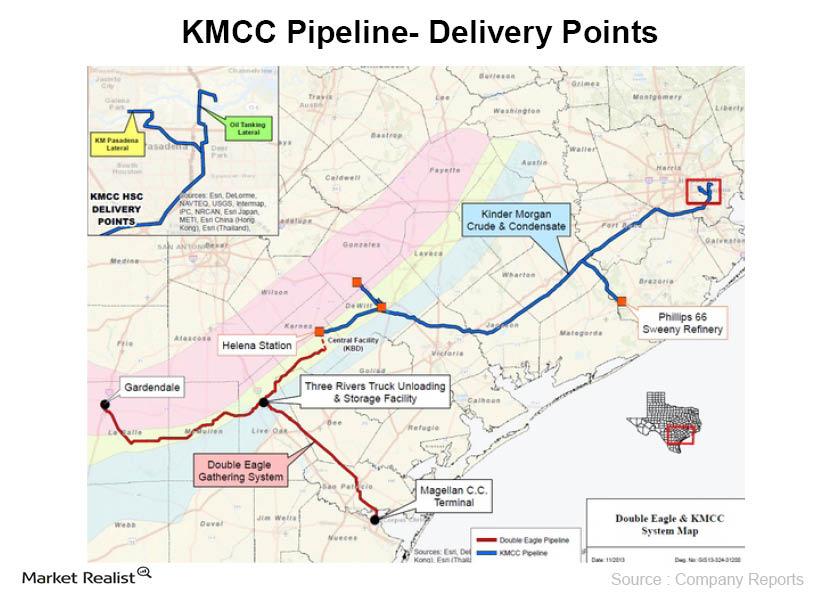

Must-know: Why the Kinder Morgan Eagle Ford expansion is positive

Kinder Morgan Energy Partners plans several major Eagle Ford joint ventures and projects that could reach almost $900 million in expenditures if company reports are to be believed.

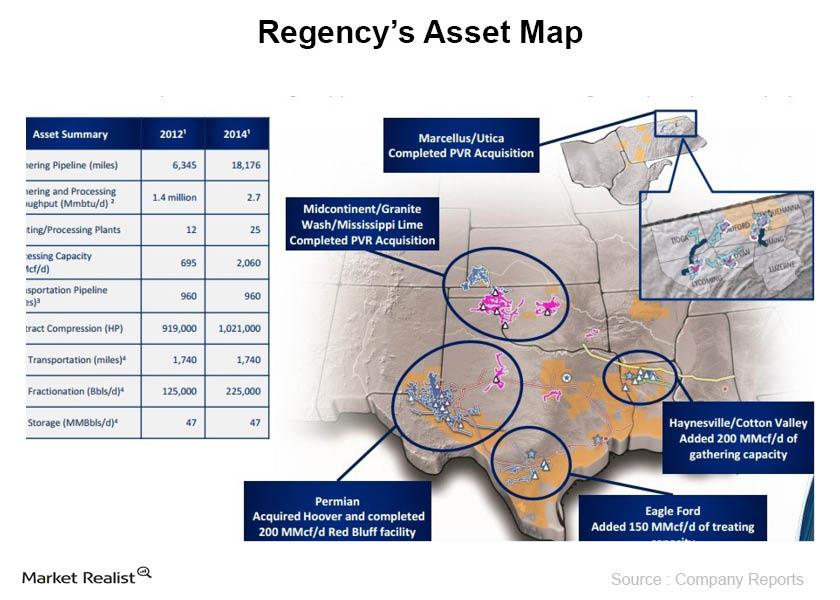

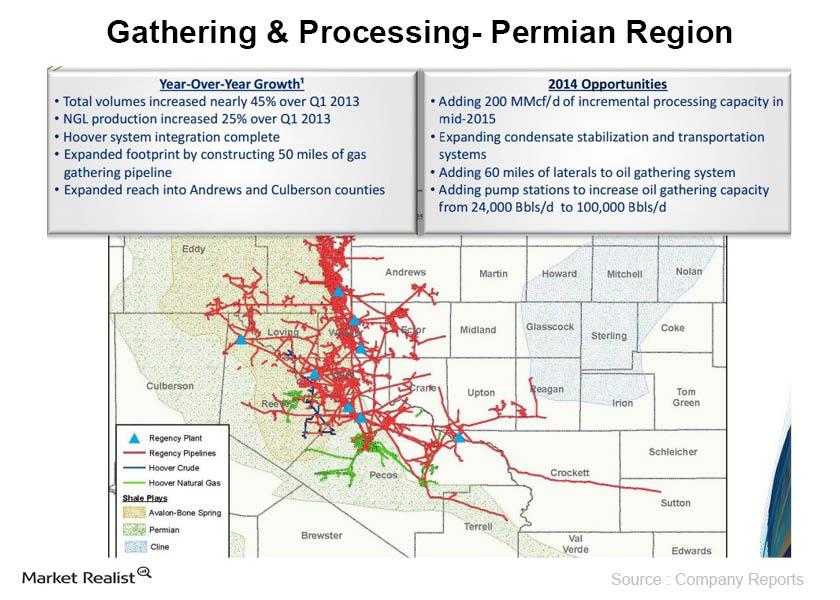

Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

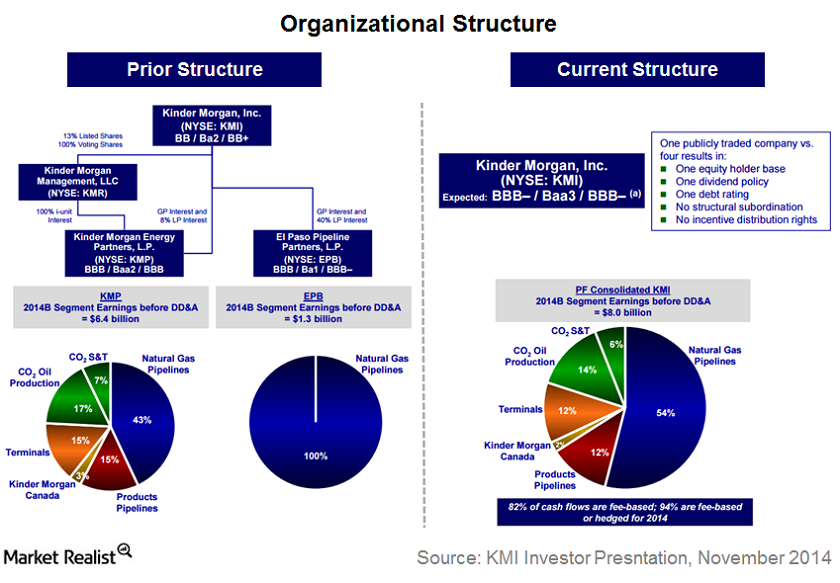

Kinder Morgan Consolidation: What It Means for the MLP Market

On November 26, 2014, Kinder Morgan acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

What’s behind MLP Performances for the Week Ended November 10?

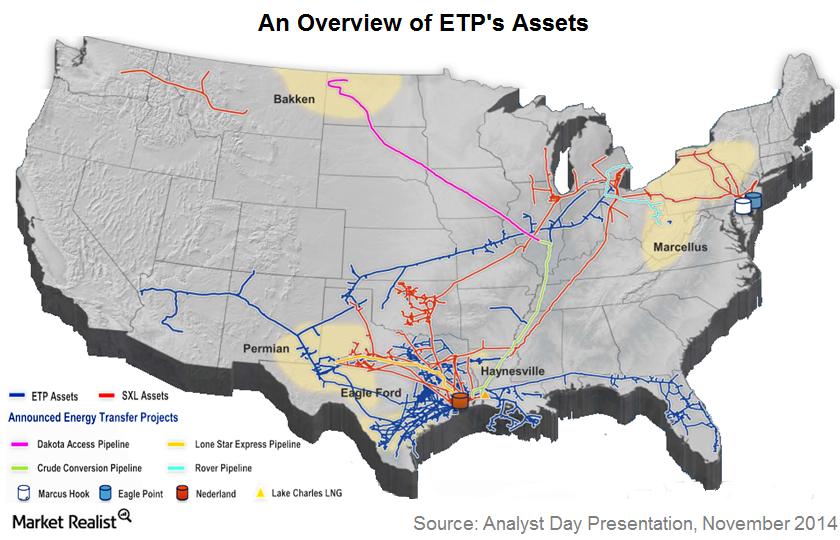

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

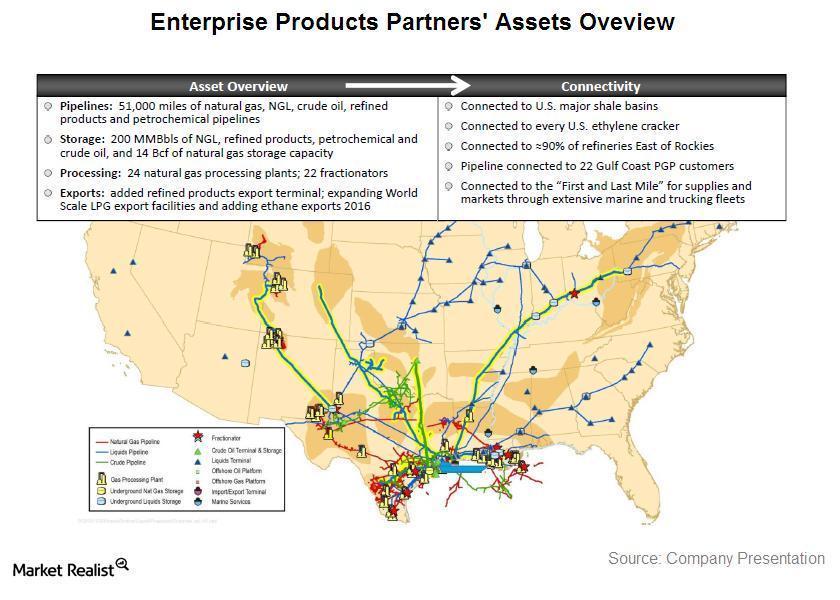

Why Enterprise Products Partners is important to investors

EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

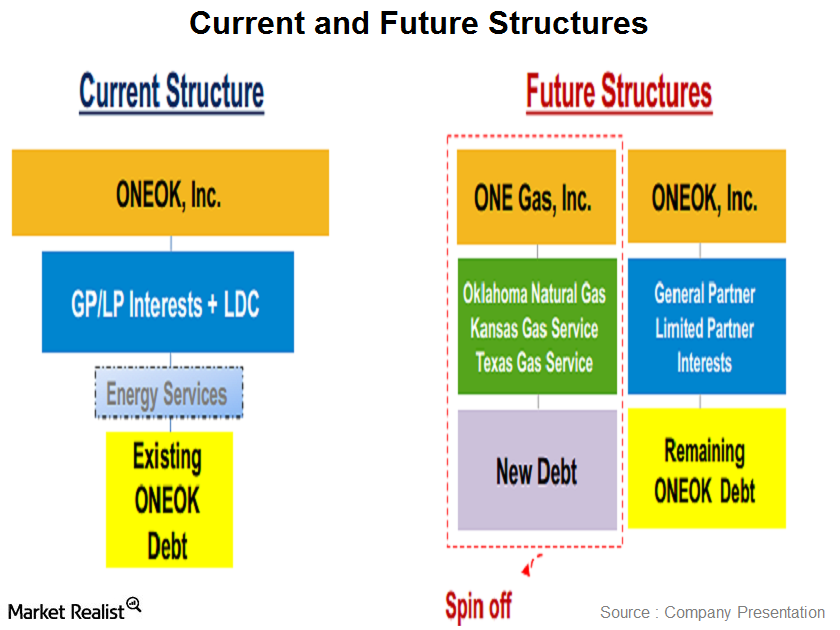

Must-know: Why ONEOK restructured its business, creating ONE Gas

Earlier this year, ONEOK (OKE) created a new stand-alone publicly traded company called ONE Gas (OGS), separating its natural gas distribution business into a separate dedicated company. The company believes that by having two separate companies, each of the companies will have a greater focus on its individual strategy, financial strength, and growth potential.

Overview: Regency’s growth projects in 2014

For the full year of 2014, Regency announced growth capex expenditures of $1.2 billion.

A Review of Energy Transfer Partners’ Business Segments

ETP operates primarily through its six business segments by leveraging its huge asset base.

How Will Energy Transfer Stock Perform in 2020?

Energy Transfer (ET) stock had a weak run despite strong earnings growth in 2019. Here’s a look into how analysts think ET will perform in 2020.

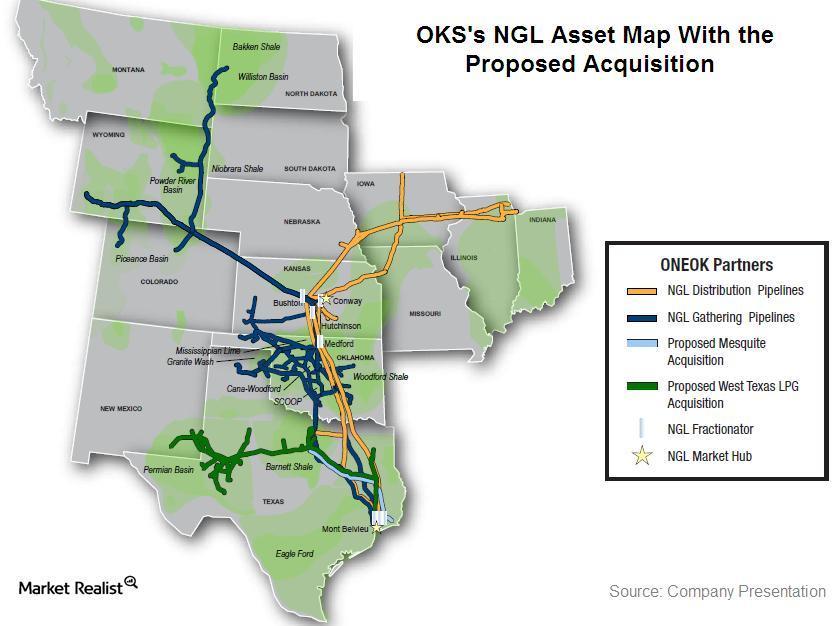

Why ONEOK Partners acquires Permian assets from Chevron

On October 27, ONEOK Partners (OKS) announced that it agreed to acquire Chevron Corporation’s (CVX) natural gas liquids (or NGLs) pipeline assets.

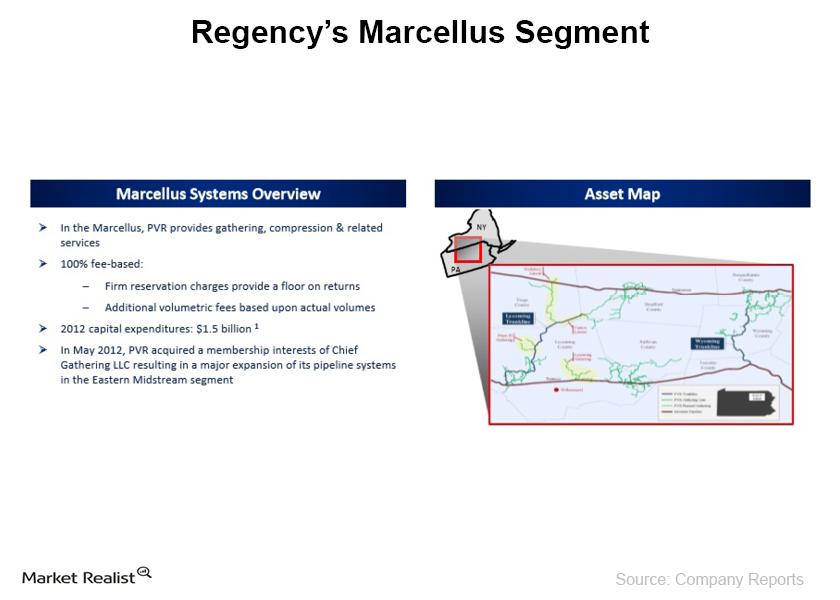

Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.

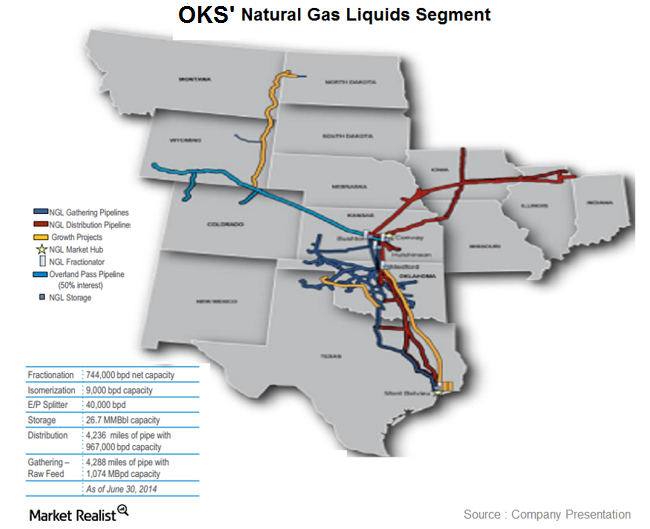

Overview: ONEOK Partners’ natural gas liquids segment

ONEOK Partners’ (OKS) natural gas liquids segment provides natural gas liquid gathering, fractionation, transportation, marketing, and storage services to its producers.

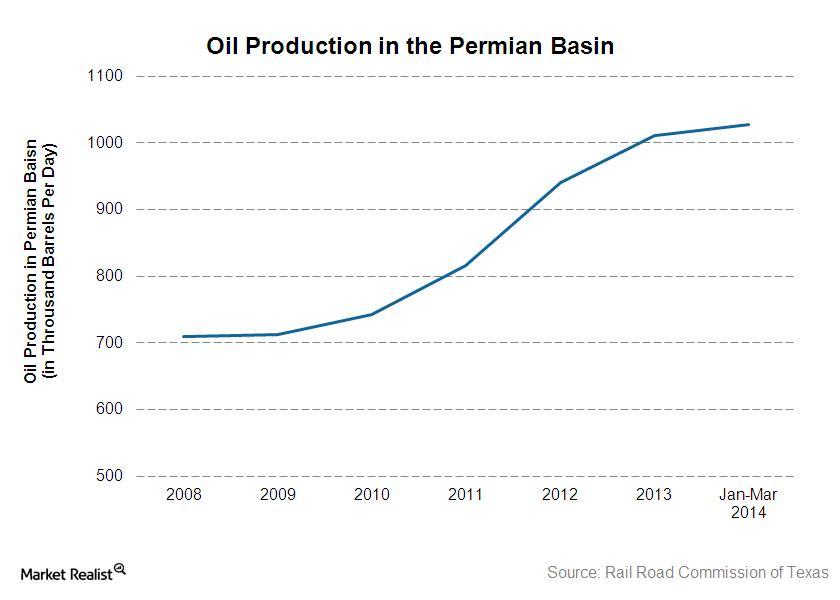

Why oil and natural gas production in the Permian should increase

According to the Energy Information Administration’s short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014.

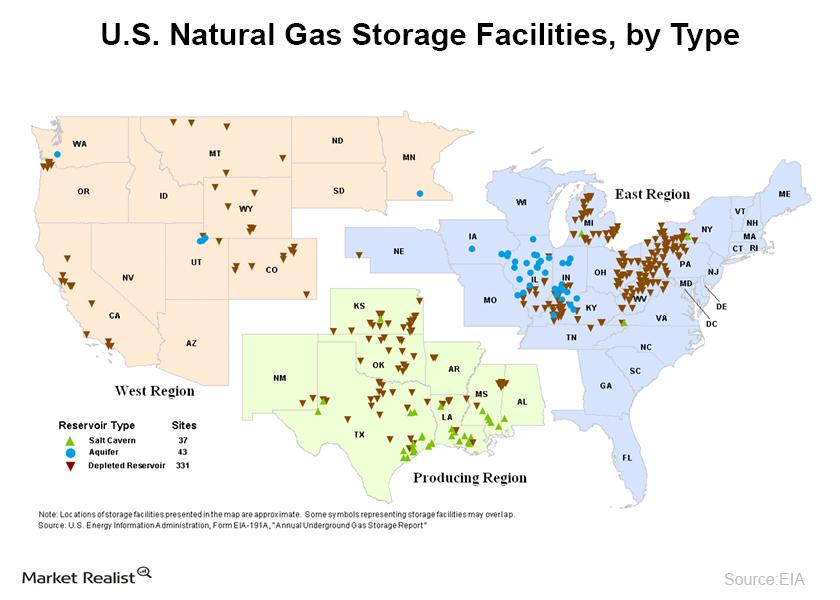

Must-know: Natural gas storage in the U.S.

Natural gas can be stored for an indefinite period of time for later consumption.

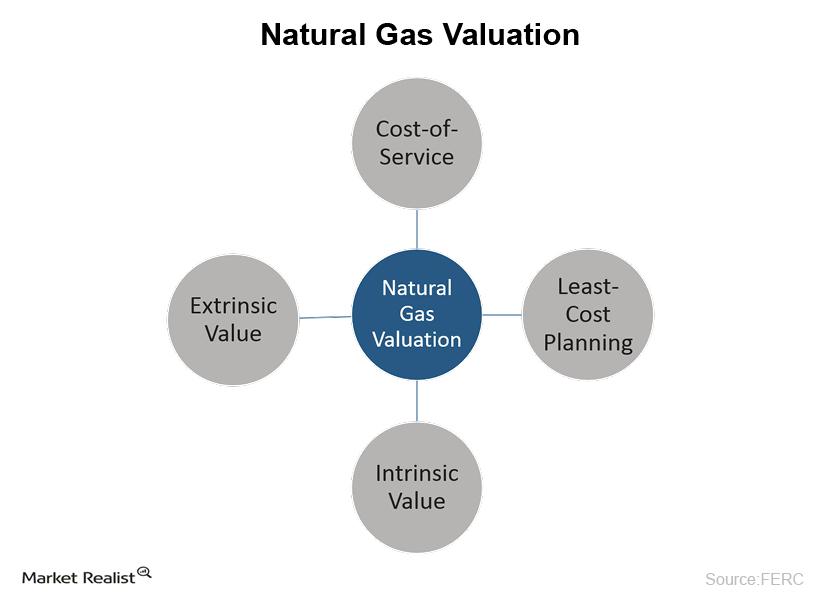

Must-know : A brief overview of natural gas storage contracts

High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

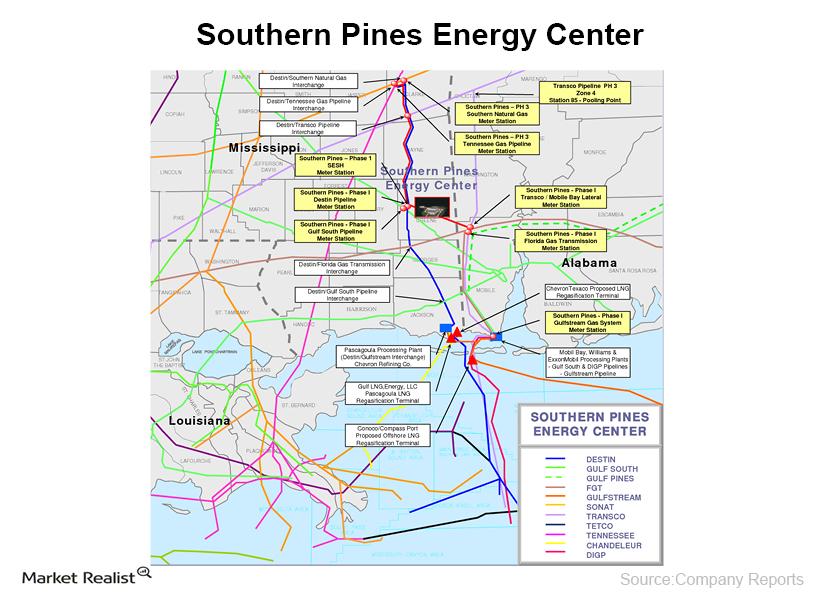

Overview: Plains All American Pipeline’s gas storage services

PAA’s storage facility falls under its supply and logistics segment, which is primarily a margin based segment, which makes it more volatile.