Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

Nov. 20 2020, Updated 11:38 a.m. ET

Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities. It’s engaged in natural gas gathering and processing, compression, and transportation of natural gas, crude oil, and natural gas liquids (or NGLs). Energy Transfer Equity (ETE) is the general partner of Regency Energy (RGP), and it also holds ~9% of the limited partner units. ETE is a part of the First Trust North American Energy Infrastructure Fund (EMLP), while RGP is a constituent of the Alerian MLP ETF (AMLP) as well as the Global X MLP ETF (MLPA).

Regency divides its business into four business segments. These include Gathering and Processing, Natural Gas Transportation, NGL Services, and Contract Services.

The Gathering and Processing segment transports raw natural gas from the wellhead through gathering systems. Then the natural gas is processed to separate NGLs. Finally, it is sold or delivered to various markets and pipeline systems. The Natural Gas Transportation segment owns a 450-mile intrastate pipeline and two interstate pipelines of 500 miles and ten miles.The NGL Services segment owns midstream energy assets, including NGL pipelines, storage, fractionation, and processing facilities located in Texas, New Mexico, Mississippi, and Louisiana, through RGP’s 30% ownership in Lone Star LLC. RGP’s Contract Services segment owns and operates a fleet of compressors used to provide turn-key natural gas compression services for customer specific systems. It also owns and operates a fleet of equipment that provides treating services such as carbon dioxide and hydrogen sulfide removal, natural gas cooling, dehydration, and BTU management.

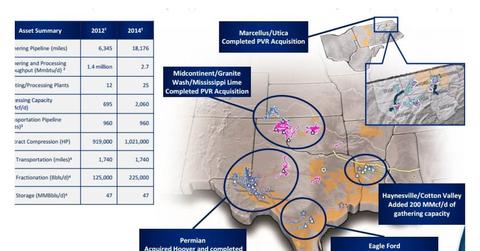

RGP also focuses on expanding its assets through strategic acquisitions and has acquired several businesses in 2013. These include the Southern Union Gas Services Ltd. (SUGS) acquisition from Southern Union Gas LLC, an affiliate of Energy Transfer Equity L.P. (ETE) and Energy Transfer Partners L.P. (ETP); the PVR acquisition from PVR Partners L.P. (PVR); and the Hoover Energy acquisition and the Eagle Rock acquisition from Eagle Rock Partners (EROC) midstream business. Many of these acquisitions have enabled RGP to expand its asset base in prolific basins such as the Permian Basin and the Marcellus Basin.

It is important to note that RGP and ETP are both a part of the Alerian MLP ETF (AMLP) while EROC is a part of the Global X Junior MLP ETF (MLPJ).

On May 8, Regency announced its earnings for the 1Q14 which ended March 31. To learn about how RGP performed during the quarter, continue reading the next part of this series.