PVR Partners LP

Latest PVR Partners LP News and Updates

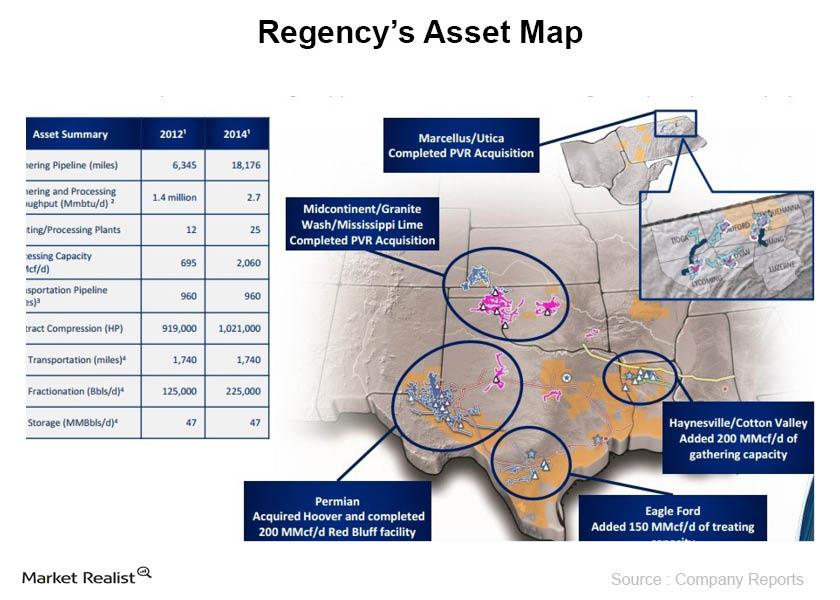

Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

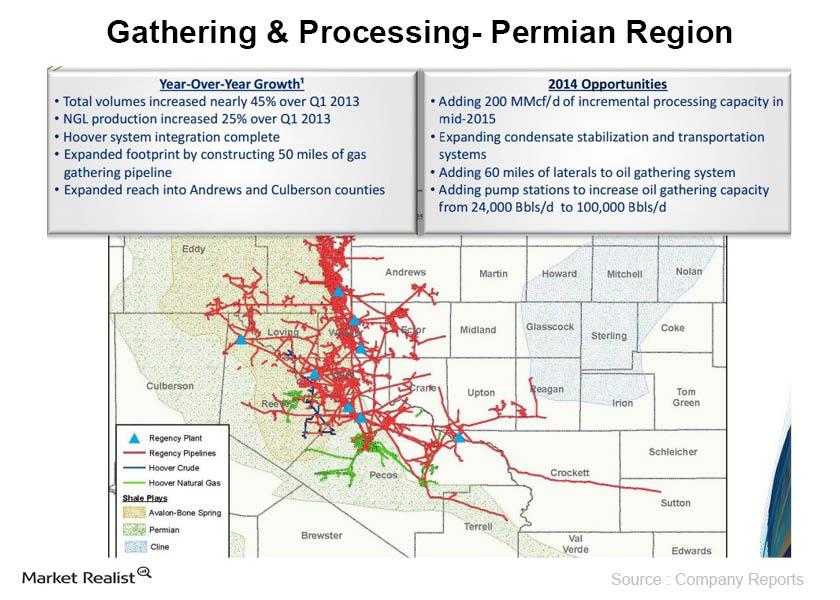

Overview: Regency’s growth projects in 2014

For the full year of 2014, Regency announced growth capex expenditures of $1.2 billion.