Global X Junior MLP ETF

Latest Global X Junior MLP ETF News and Updates

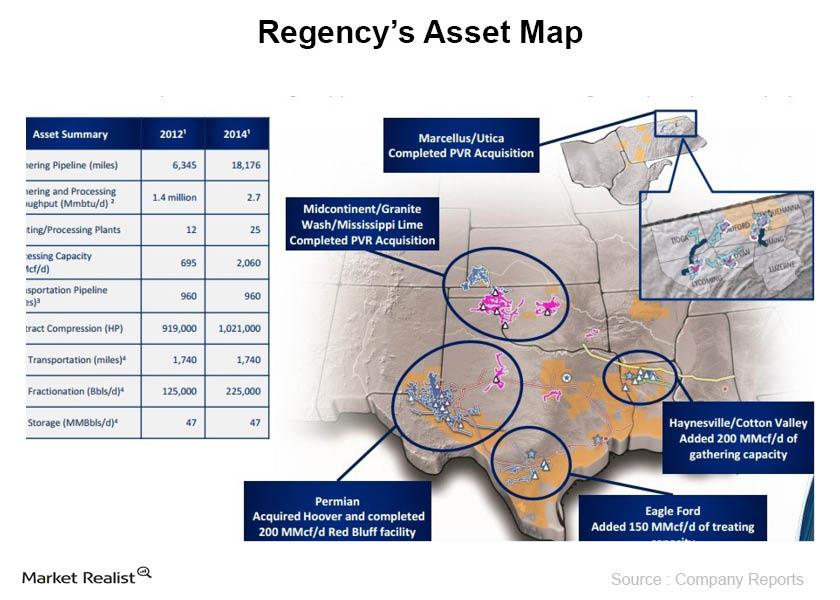

Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

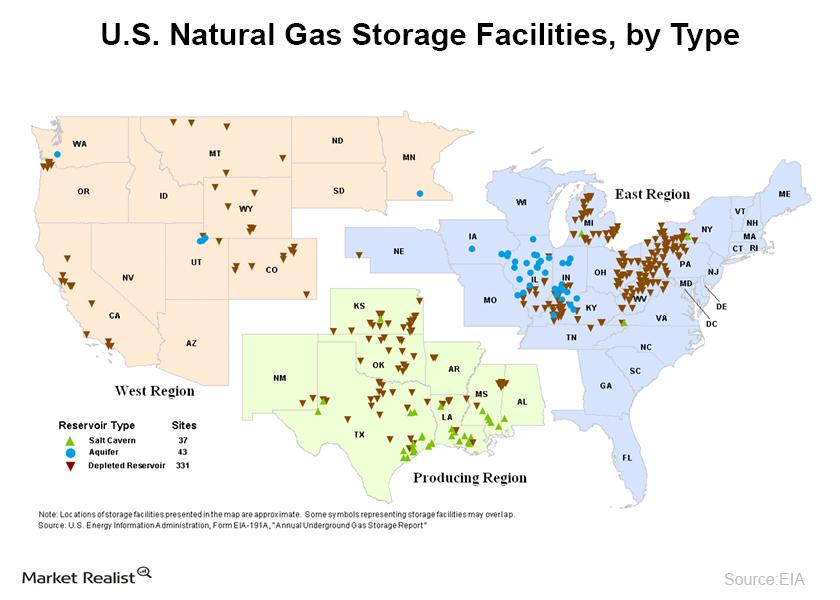

Must-know: Natural gas storage in the U.S.

Natural gas can be stored for an indefinite period of time for later consumption.

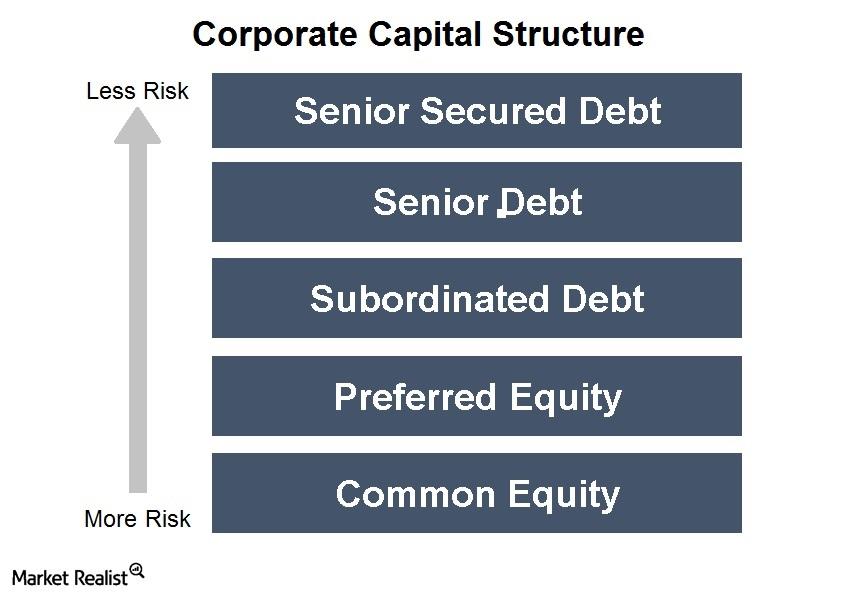

A guide to preferred equity and 2 MLPs that recently issued it

Preferred equity (also called “preferred stock”) is a class of security that has features of both common equity and debt. Preferred equity acts like stock.