Global X MLP ETF

Latest Global X MLP ETF News and Updates

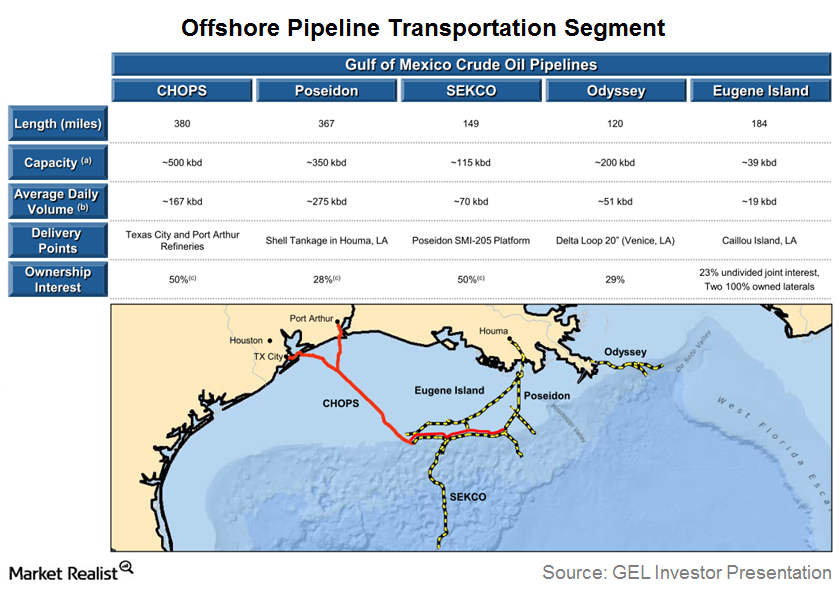

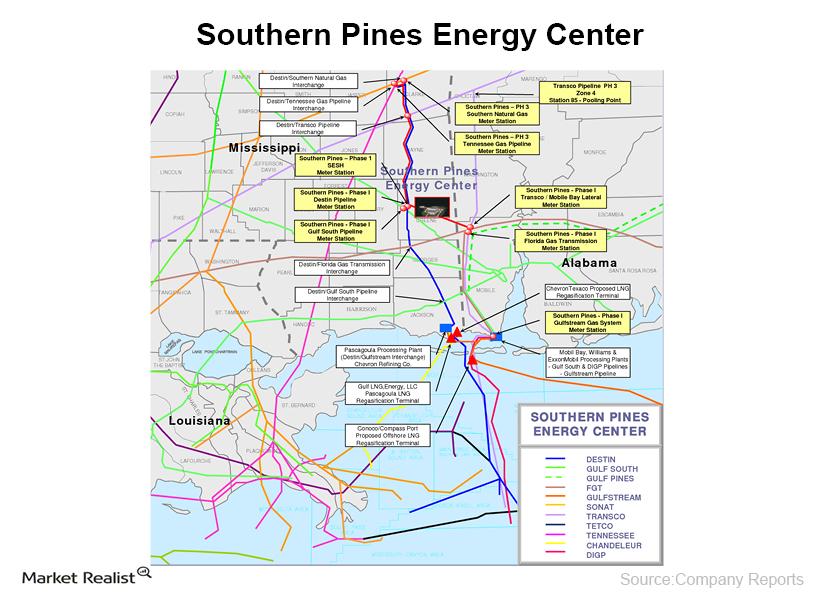

An Overview of Genesis Energy’s Offshore Pipeline Segment

Until recently, Genesis Energy’s Offshore Pipeline segment owned interest in ~1200 miles of offshore pipelines spread across five pipeline systems.

Overview: How Suburban measures up among its competitors

Over the past 12 months the group has had mixed results.

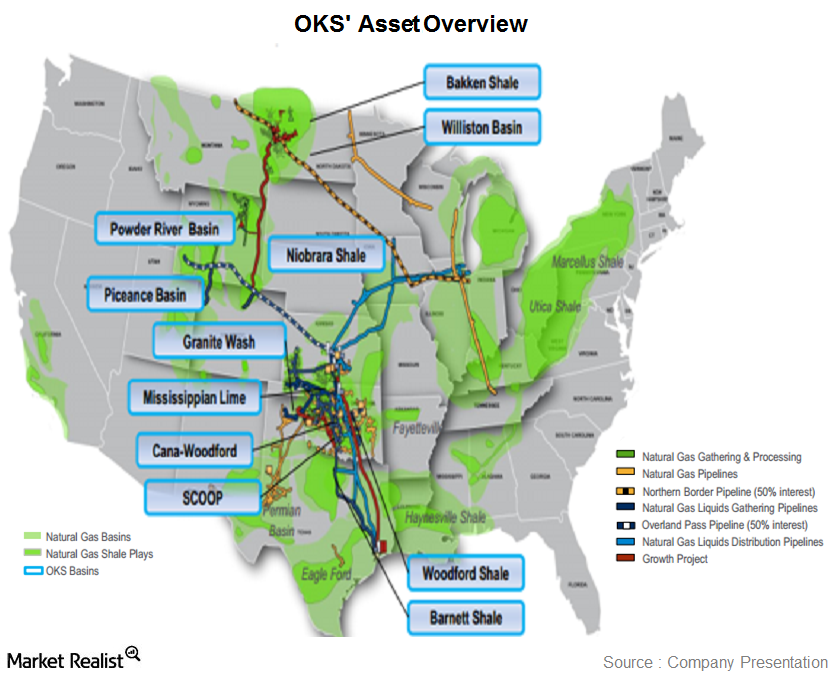

Overview: ONEOK Partners and its 3 operating segments

ONEOK Partners (OKS) is a master limited partnership (or MLP) engaged in gathering, processing, storing, and transporting natural gas and natural gas liquids (or NGLs) in the U.S.

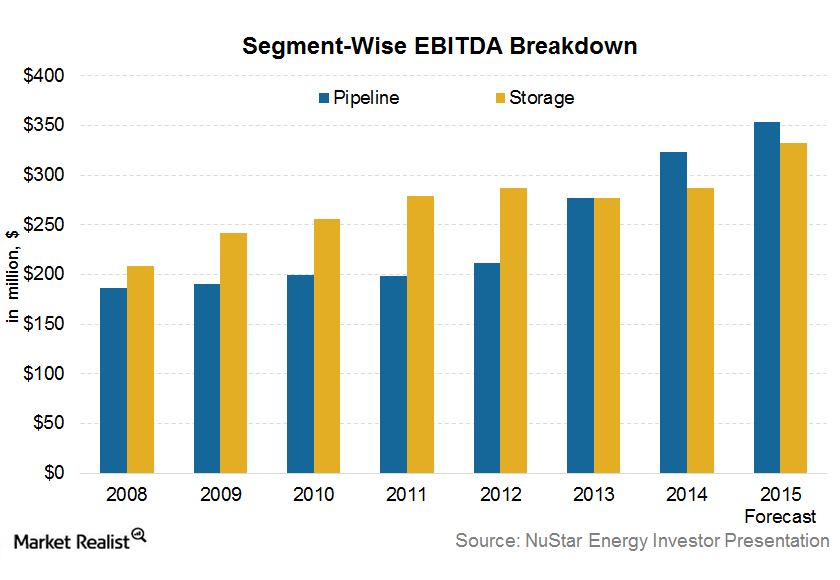

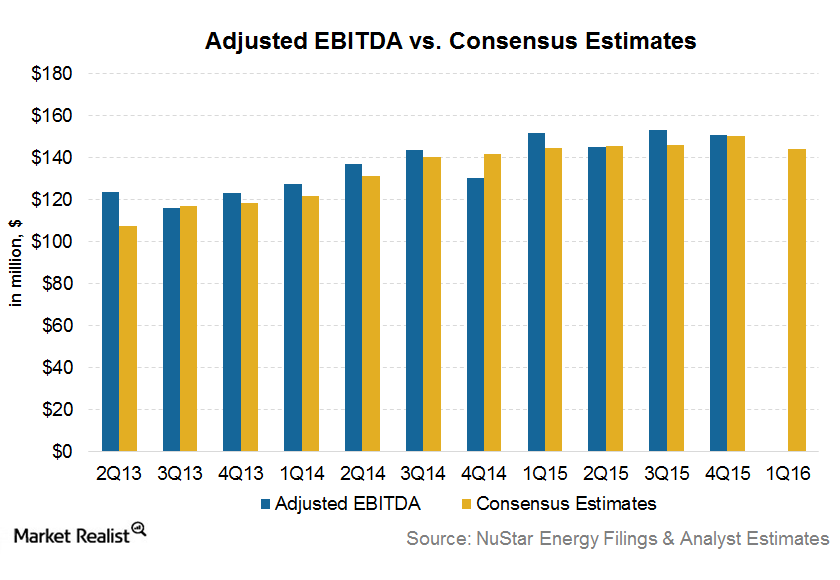

Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

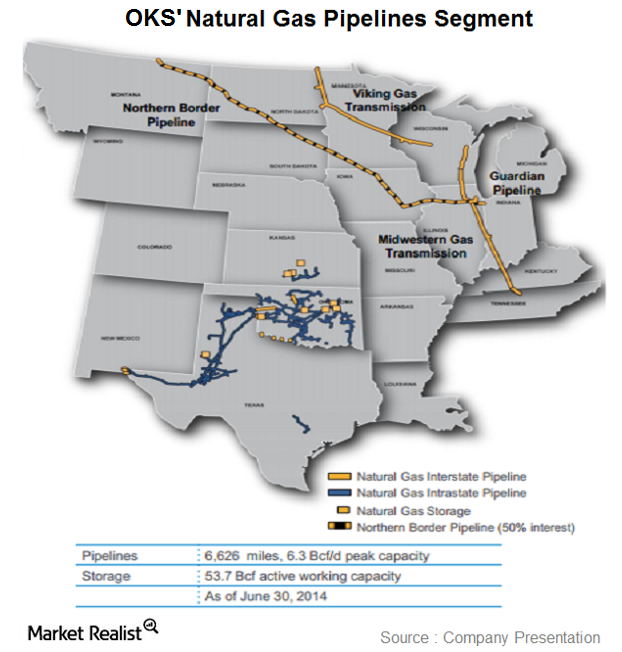

Overview: ONEOK Partners’ natural gas pipelines segment

ONEOK Partners’ (OKS) natural gas pipelines segment owns and operates regulated interstate and intrastate natural gas pipelines and natural gas storage facilities.

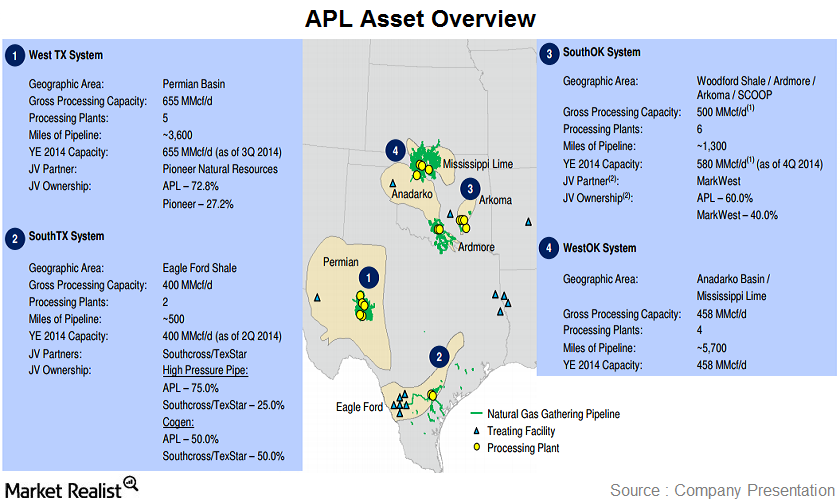

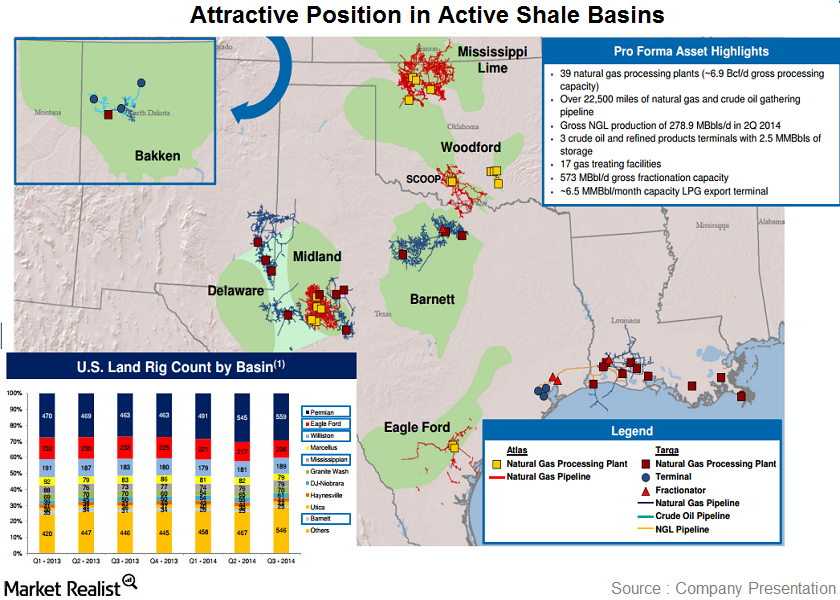

A brief overview on Atlas Pipeline Partners

The company provides natural gas gathering and processing services in the Eagle Ford Shale play in Texas, as well as in the Anadarko, Arkoma, and Permian basins.

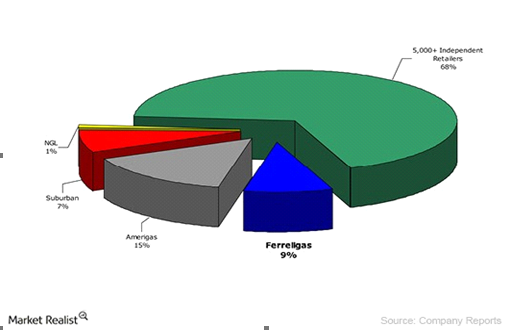

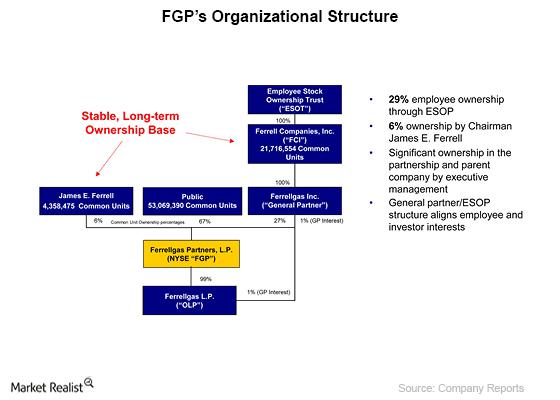

Ferrellgas Partners (FGP): An investor’s must-know overview

Ferrellgas Partners, L.P. (FGP), a master limited partnership (MLP), is the second largest retail propane distributor in the U.S. serving all 50 states, the District of Columbia and Puerto Rico, as measured by the volume of retail sales in fiscal 2013, and the largest national provider of propane by portable tank exchange.

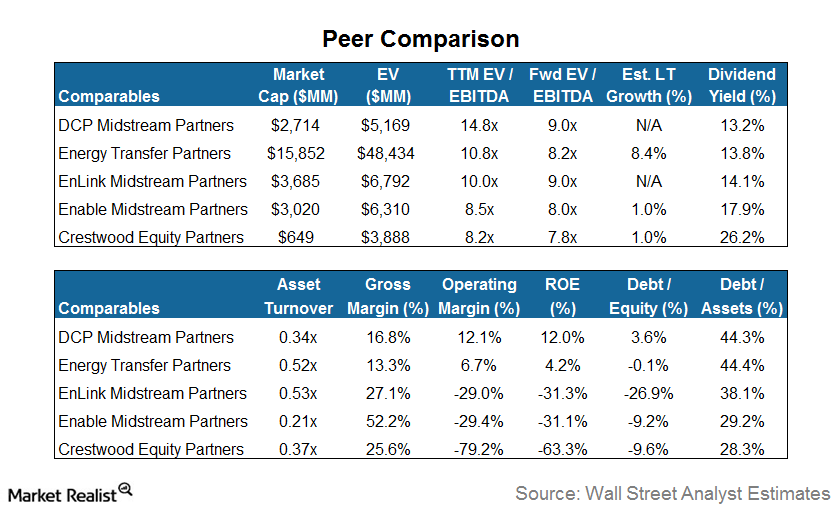

Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

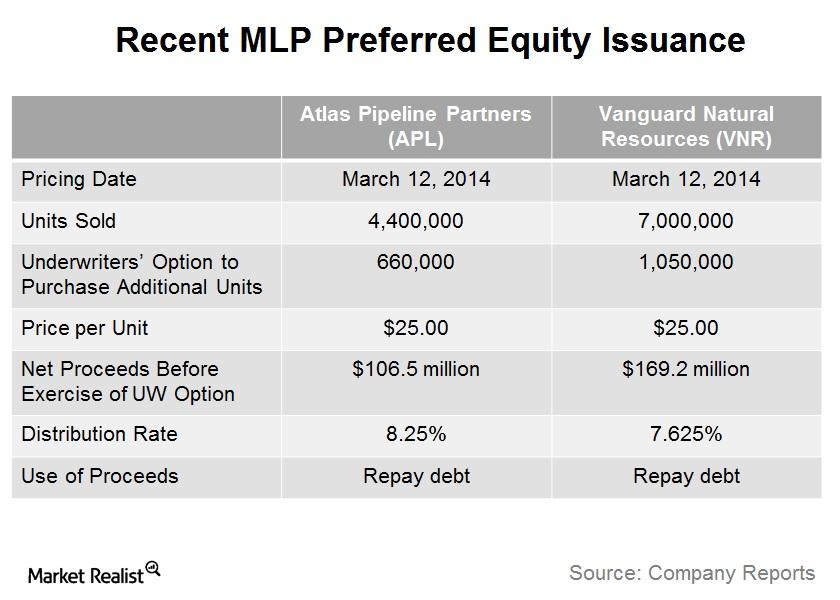

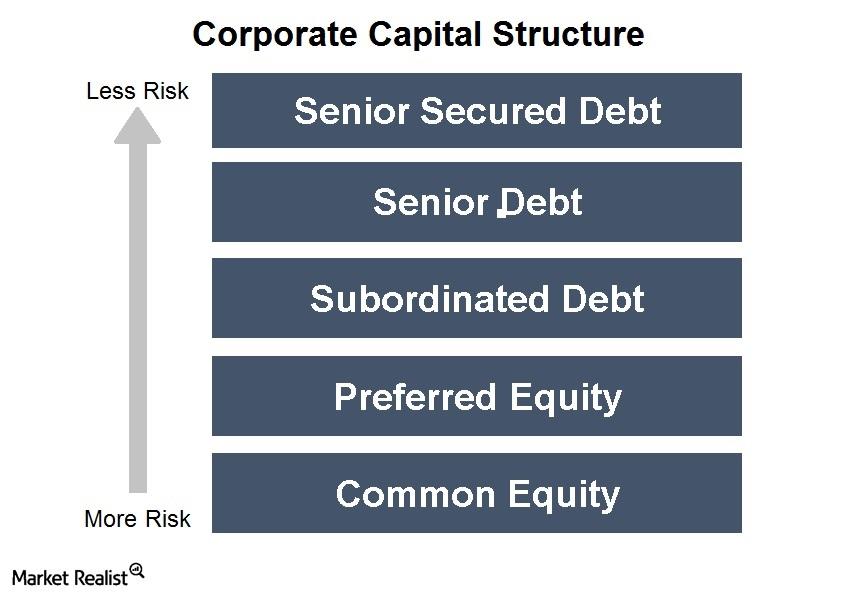

Is preferred equity a trend for master limited partnerships?

Recently, two master limited partnerships issued preferred equity, which is a relatively rare avenue of financing for MLPs.

An overview of the Targa Resources and Atlas Pipeline deal

The combined company will create a midstream enterprise with more than 22,500 miles of crude oil and natural gas pipelines across the U.S. The $7.7 billion deal is expected to close in the first quarter of 2015.

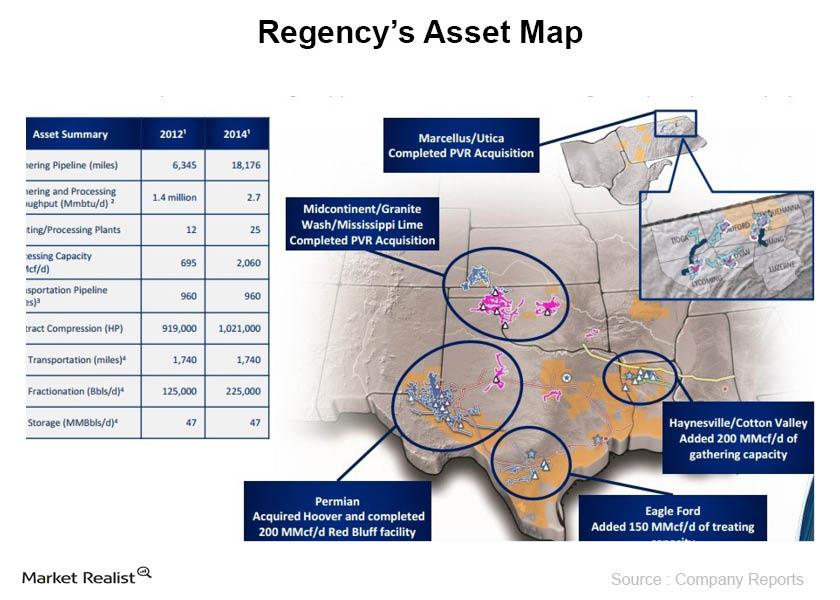

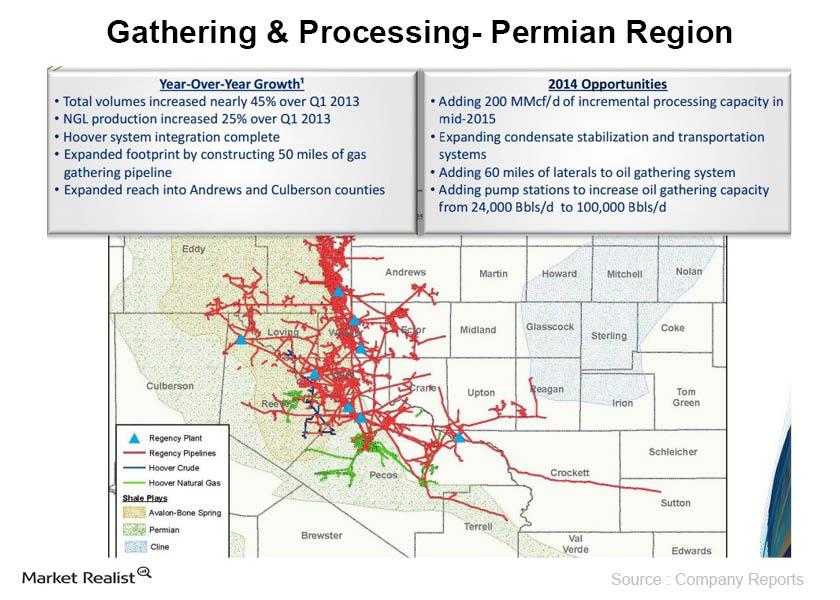

Overview: Regency Energy Partners

Regency Energy Partners L.P. (RGP) is a midstream operator of natural gas pipelines, gathering systems, and processing facilities.

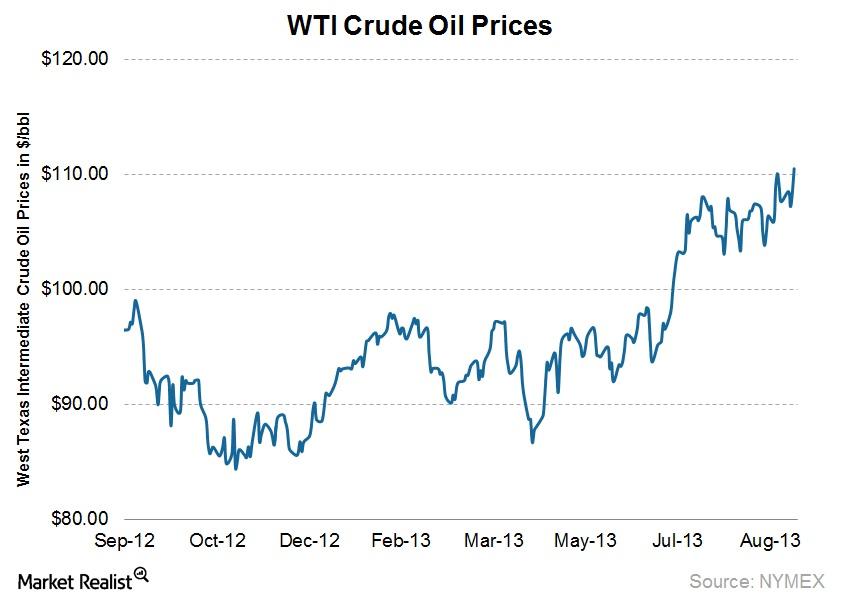

Higher oil prices are a potential double whammy for propane sales

Propane distributors such as Amerigas Partners (APU), Ferrellgas (FGP), and Suburban Propane (SPH) sell propane and related equipment to a variety of end markets. Find out what trends could hurt propane names this winter.

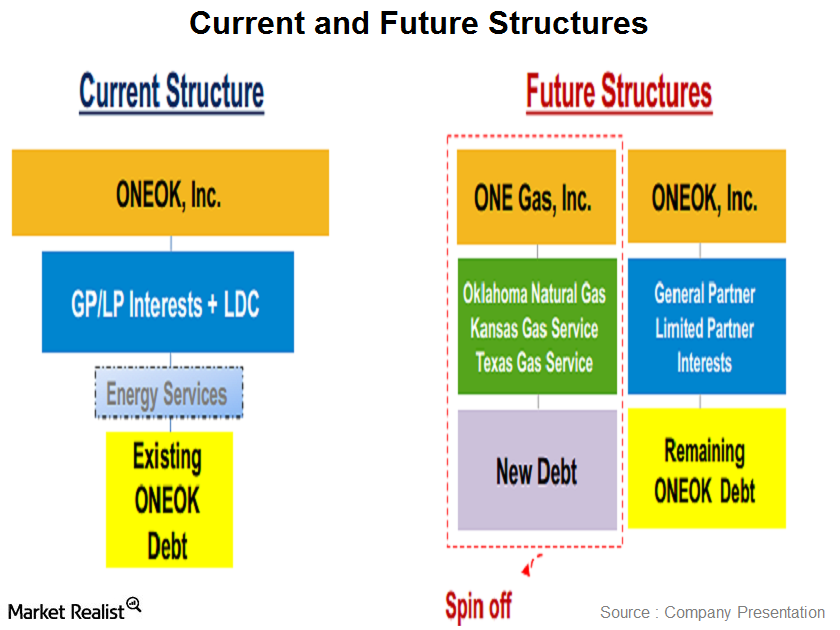

Must-know: Why ONEOK restructured its business, creating ONE Gas

Earlier this year, ONEOK (OKE) created a new stand-alone publicly traded company called ONE Gas (OGS), separating its natural gas distribution business into a separate dedicated company. The company believes that by having two separate companies, each of the companies will have a greater focus on its individual strategy, financial strength, and growth potential.

Overview: Regency’s growth projects in 2014

For the full year of 2014, Regency announced growth capex expenditures of $1.2 billion.

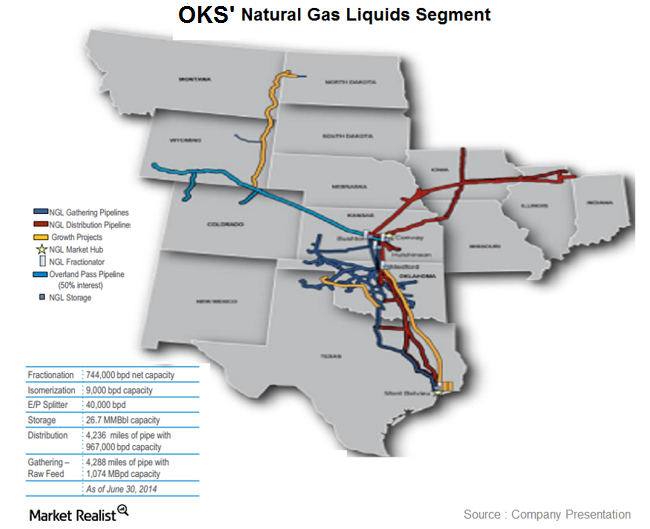

Overview: ONEOK Partners’ natural gas liquids segment

ONEOK Partners’ (OKS) natural gas liquids segment provides natural gas liquid gathering, fractionation, transportation, marketing, and storage services to its producers.

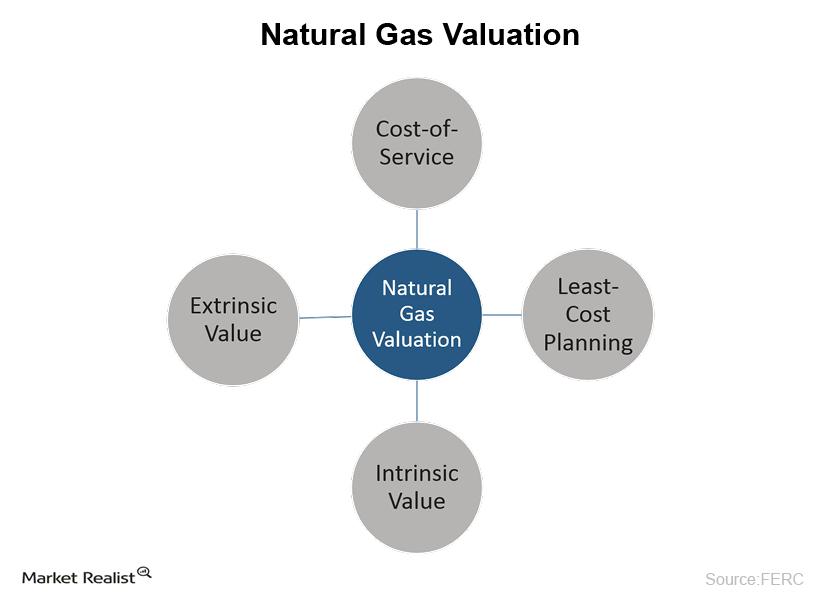

Must-know : A brief overview of natural gas storage contracts

High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

Overview: Plains All American Pipeline’s gas storage services

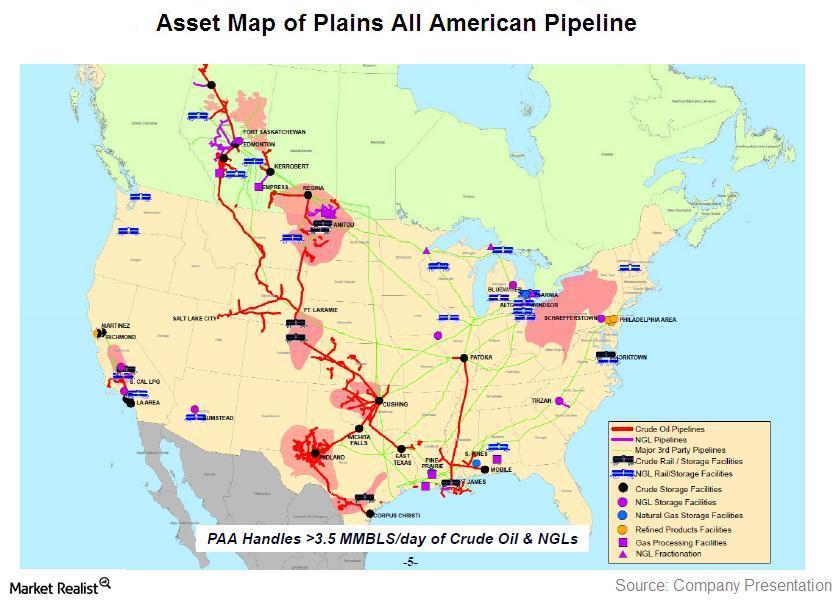

PAA’s storage facility falls under its supply and logistics segment, which is primarily a margin based segment, which makes it more volatile.

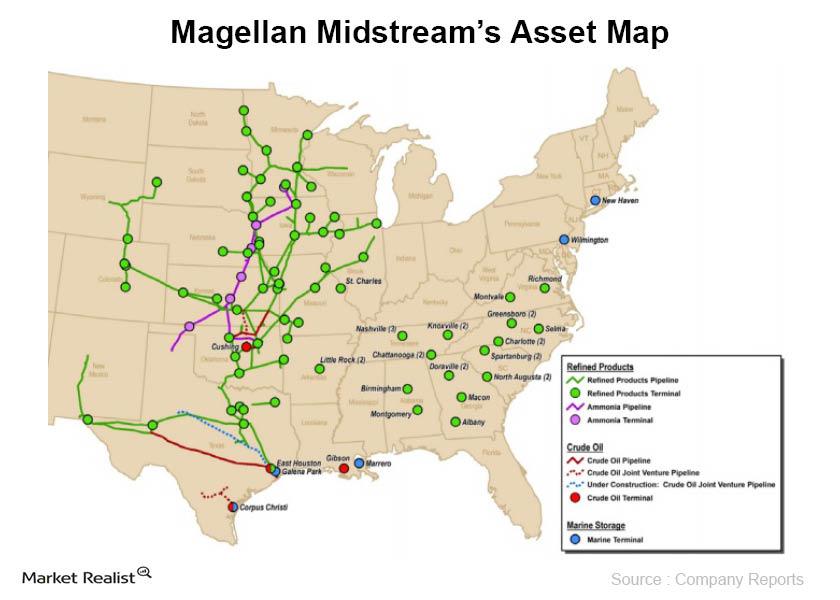

Overview: Magellan Midstream Partners L.P.

Magellan Midstream Partners L.P. (MMP), is a master limited partnership (or MLP) that owns and operates a diversified portfolio of energy infrastructure assets.

A guide to preferred equity and 2 MLPs that recently issued it

Preferred equity (also called “preferred stock”) is a class of security that has features of both common equity and debt. Preferred equity acts like stock.

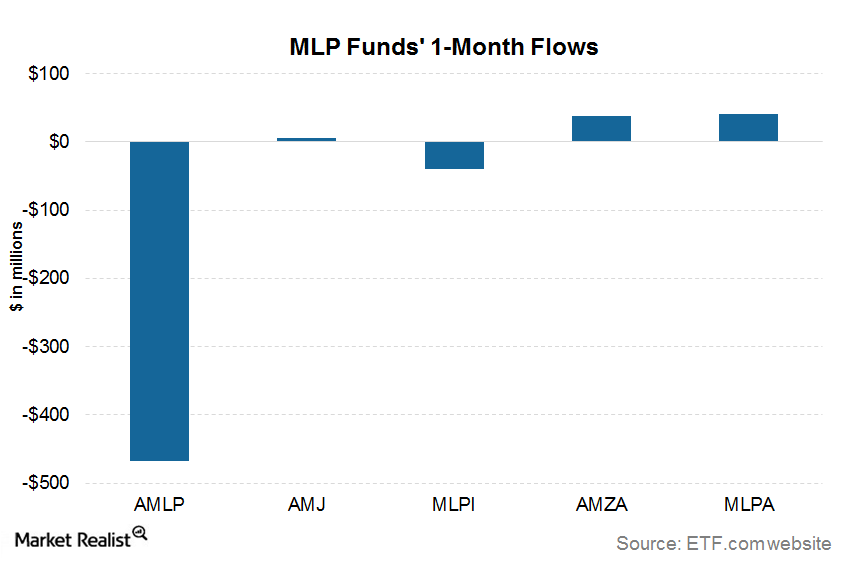

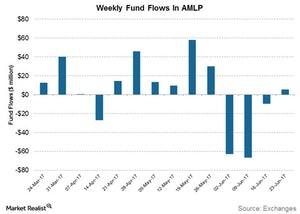

What Do the MLP Funds Flows Indicate?

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018.

Take a Look at Fund Flows in MLP ETFs Last Week

After three weeks of negative flows, the Alerian MLP ETF (AMLP) witnessed a net inflow of $5.6 million for the week ended June 23, 2017.

Analyzing NuStar Energy’s 1Q16 EBITDA Estimates

NuStar Energy is expected to release its 1Q16 earnings on April 27. Wall Street analysts’ 1Q16 consensus EBITDA estimate for NuStar Energy is $144.3 million.

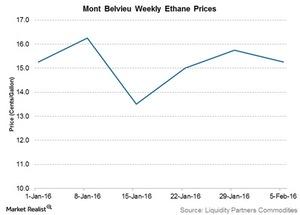

Ethane Prices Fall 3%: Impact on MLPs

Mont Belvieu ethane prices fell 3% to $0.15 per gallon in the week ending February 5, 2016. Ethane prices had risen 5% to $0.16 per gallon in the previous week.

Overview: Plains All American Pipeline’s gas storage facilities

Currently, there are three major publicly traded independent storage firms, Plains All American Pipeline’s (PAA) natural gas storage subsidiary (PAA Natural Gas Storage), Niska Gas Storage Partners (NKA), and Crestwood Equity Partners (CEQP). PAA is part of the Alerian MLP (or master limited partnership) ETF (AMLP), while CEQP is part of the Global X MLP ETF (MLPA).

Must-know: An introduction to Plains All American Pipeline

Plains All American Pipeline L.P. (PAA) is a master limited partnership that operates in the midstream energy business.