Alerian MLP ETF

Latest Alerian MLP ETF News and Updates

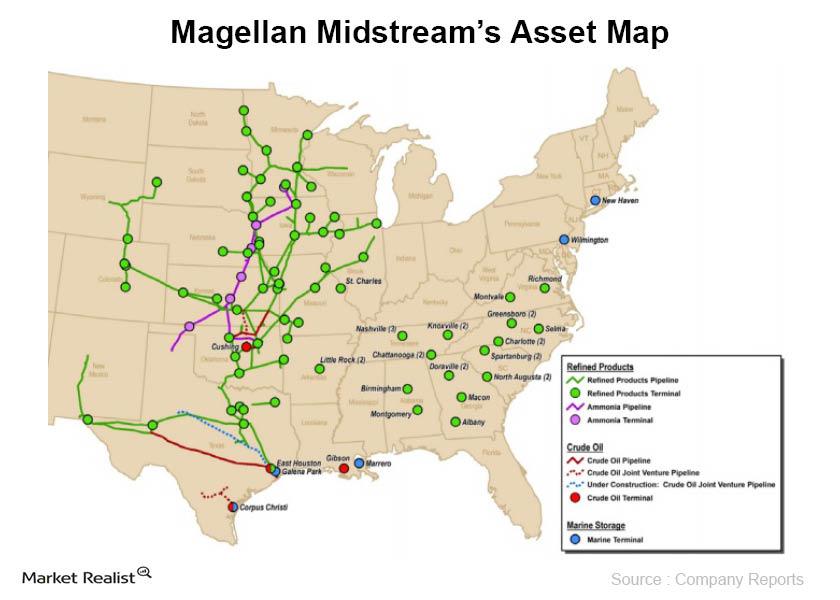

Overview: Magellan Midstream Partners L.P.

Magellan Midstream Partners L.P. (MMP), is a master limited partnership (or MLP) that owns and operates a diversified portfolio of energy infrastructure assets.

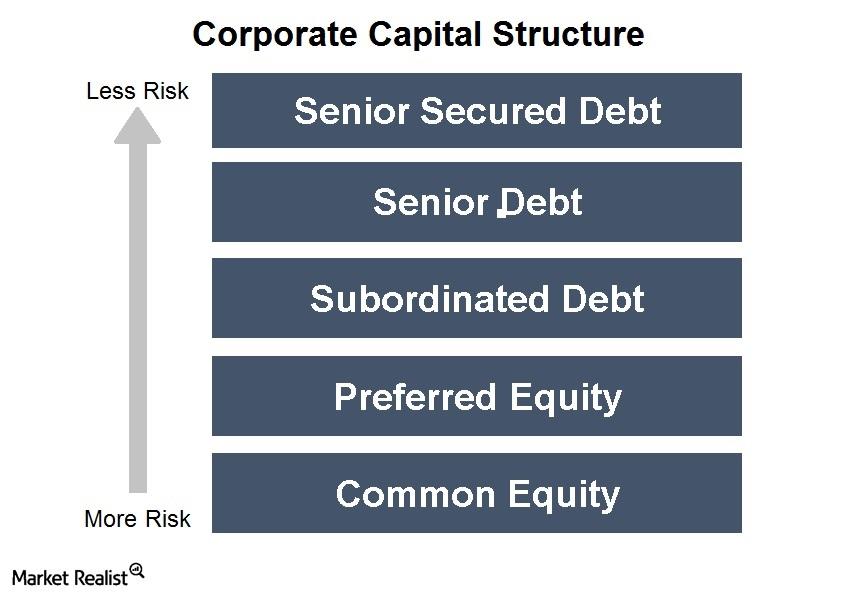

A guide to preferred equity and 2 MLPs that recently issued it

Preferred equity (also called “preferred stock”) is a class of security that has features of both common equity and debt. Preferred equity acts like stock.

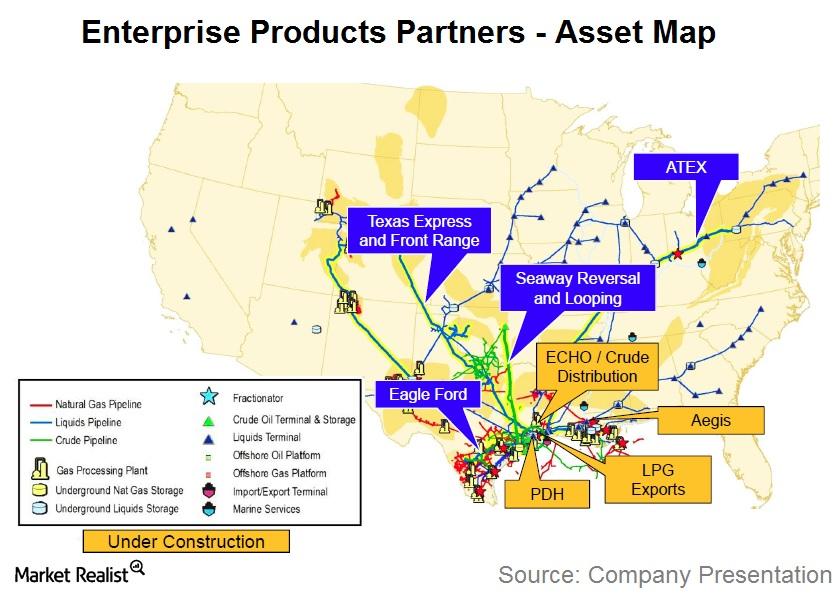

Key points from Enterprise Products Partners’ analyst day meeting

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space.

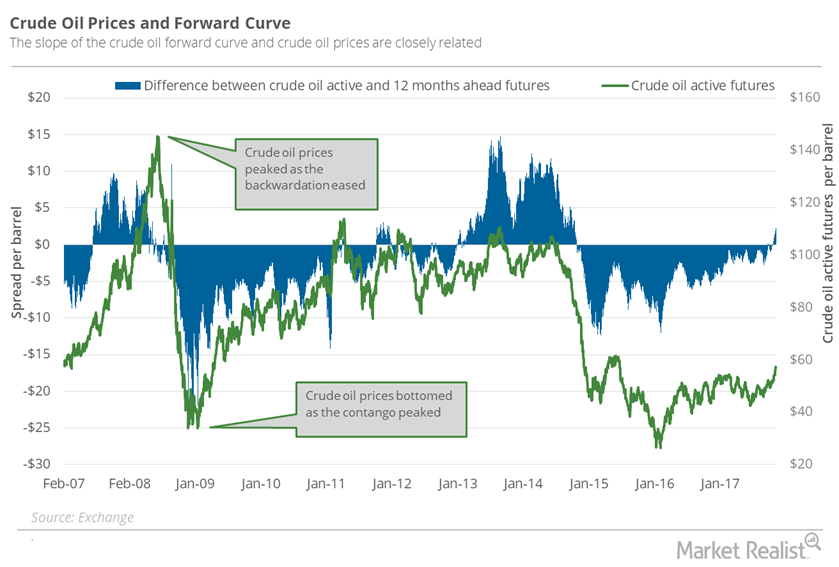

Where Is US Crude Oil Headed? An Energy Update

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

Rise in Oil Pushed Energy ETFs Higher

US crude oil active futures have risen 8.6% in the trailing week, which might have boosted or limited the downside in OIH, XOP, XLE, and AMLP. They have returned 5.8%, 5%, 3.7%, and -0.7%, respectively.

USAC, CCLP: Will the Outperformance Continue?

USA Compression Partners, CSI Compressco, and Archrock Partners are up 11%, 32%, and 4%.

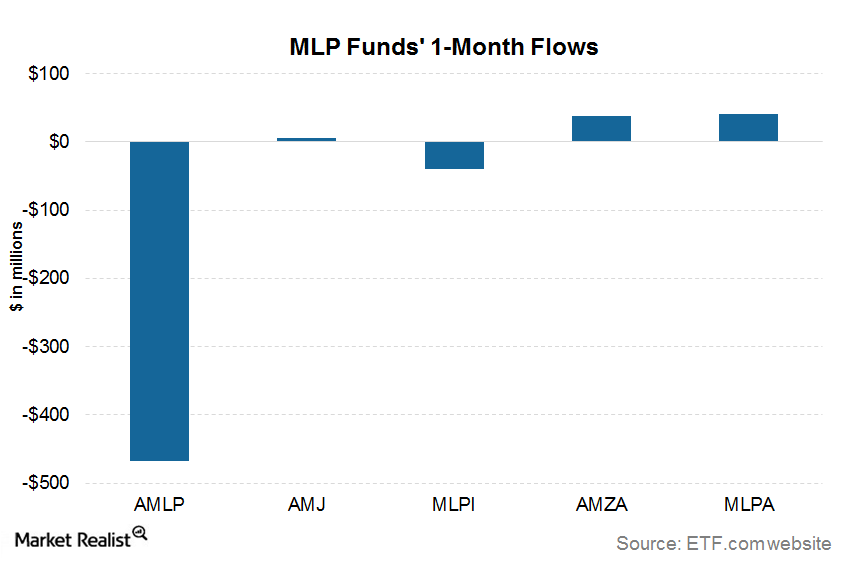

What Do the MLP Funds Flows Indicate?

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018.

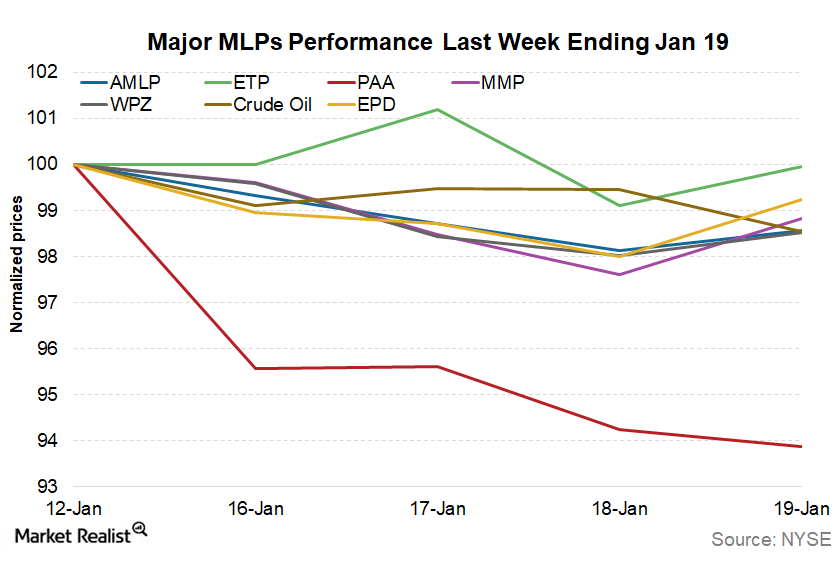

Why MLPs Underperformed the Energy Sector Last Week

MLPs underperformed the energy sector and the broader US markets last week. Let’s take a look.

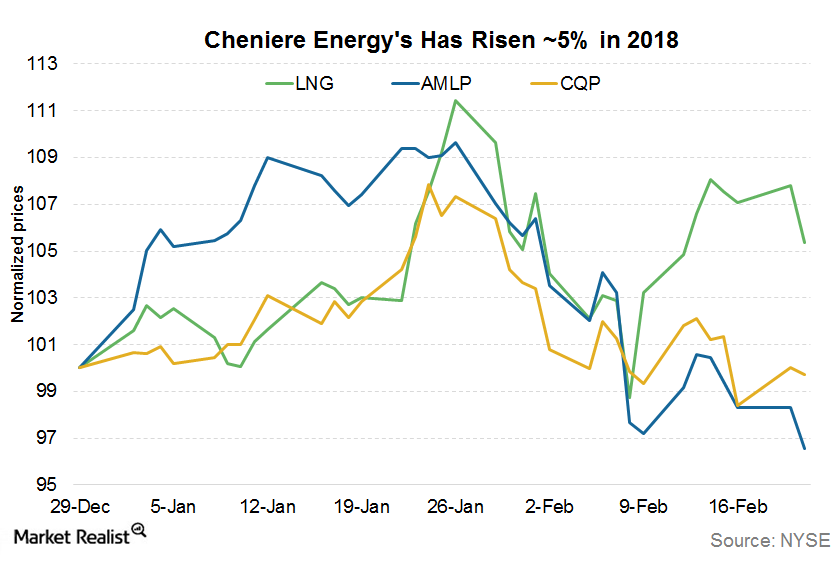

Cheniere Energy Stock after Its 4Q17 Earnings

Cheniere Energy is trading 4.4% above its 50-day simple moving average and 18.0% above its 200-day simple moving average.

Is Natural Gas Pricing in Colder Weather?

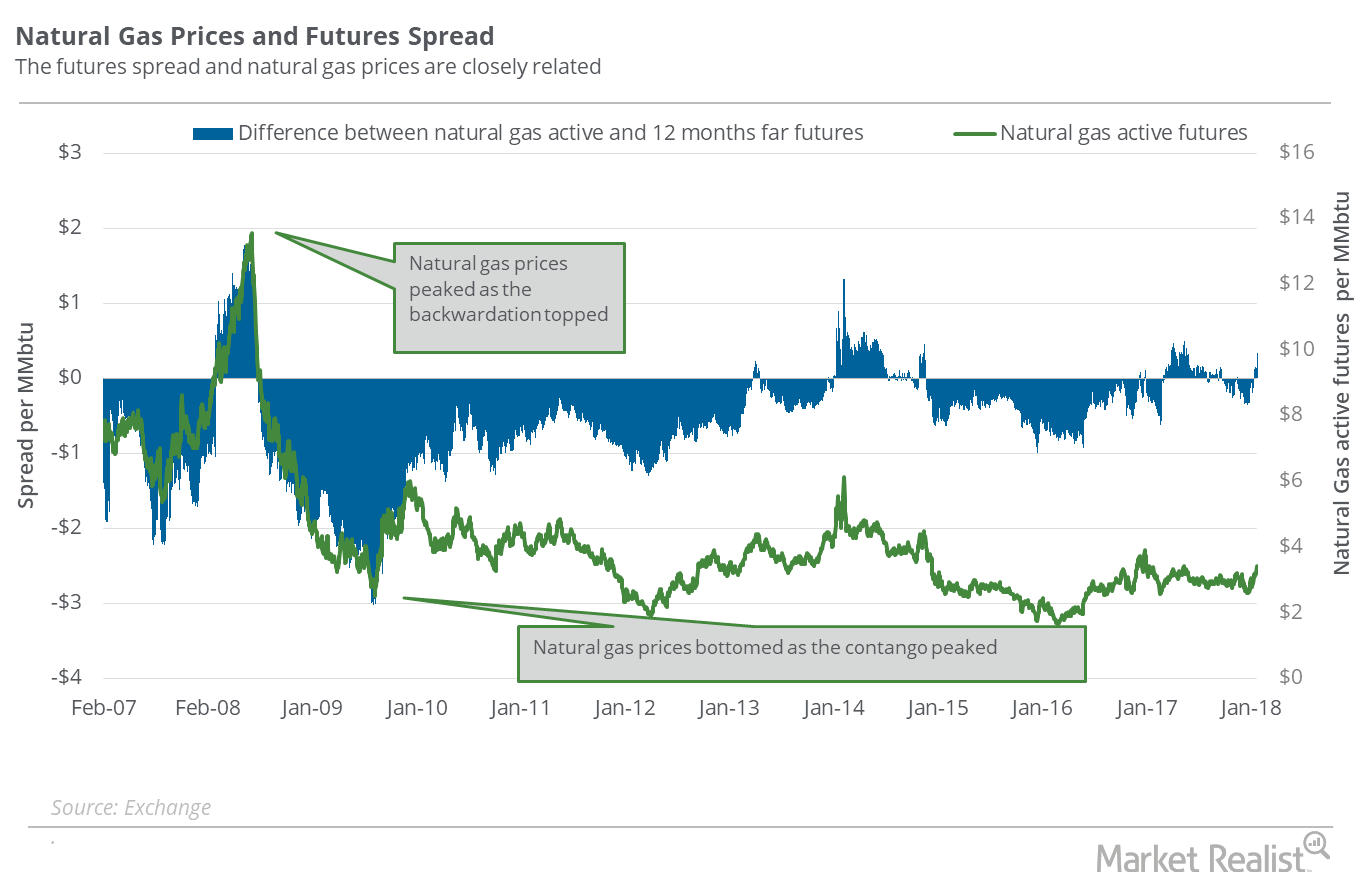

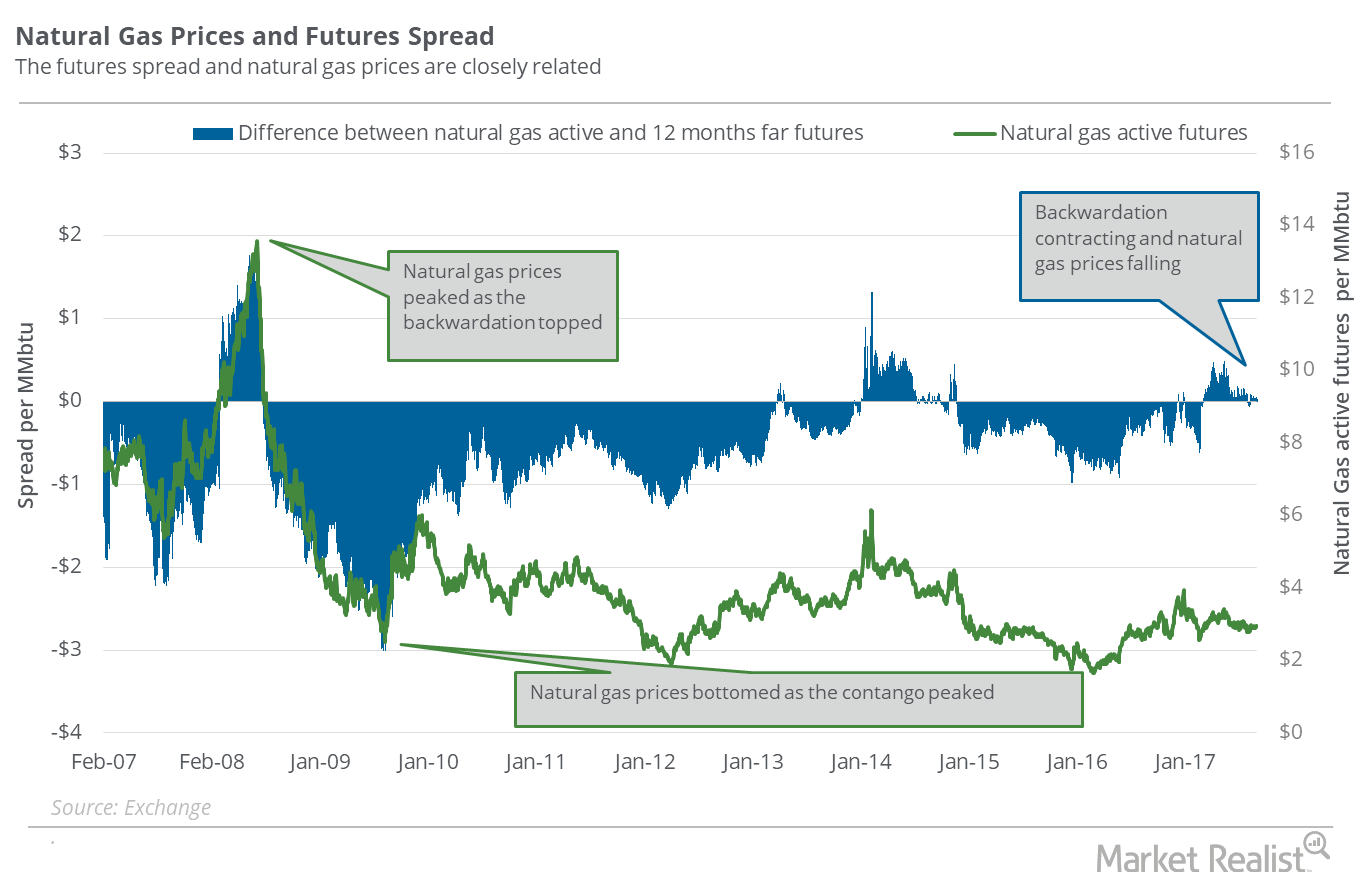

On January 23, 2018, natural gas February 2018 futures settled $0.34 above February 2019 futures.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

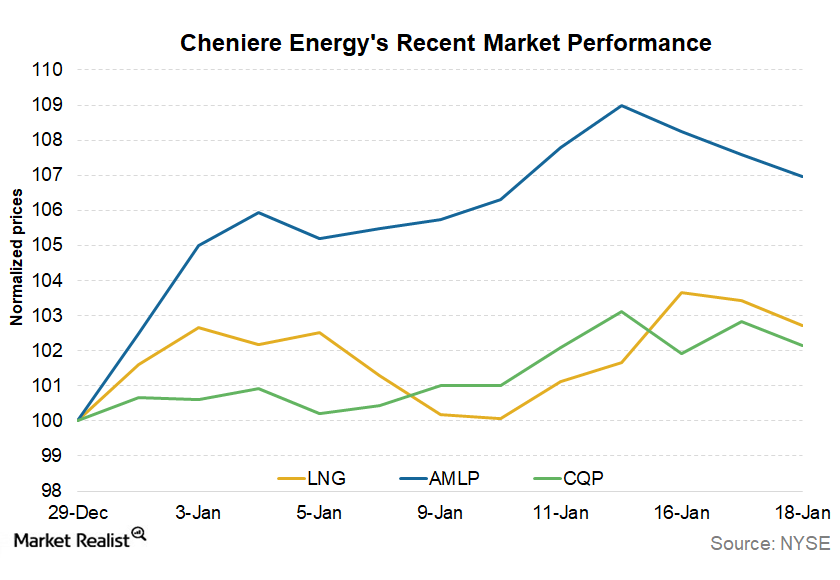

How the Recent Trafigura Deal Could Boost Cheniere Energy’s Stock

Cheniere Energy’s subsidiary, Cheniere Marketing, recently entered into a long-term SPA (sale and purchase agreement) with Trafigura.

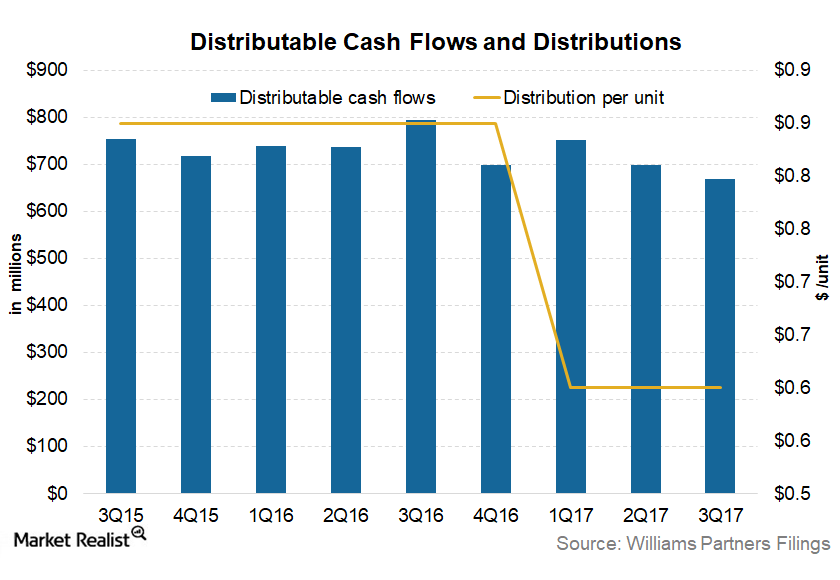

Williams Partners’ Distribution Growth Plans

Williams Partners (WPZ) expects its 2017 distributable cash flow to lie between $2.6 and $2.8 billion. At the midpoint, this range represents a ~9.0% YoY (year-over-year) decline.

Natural Gas Market Could Be Pricing In a Supply Deficit

On January 16, 2018, the gap between natural gas’s February 2018 futures and February 2019 futures was $0.07, or the futures spread.

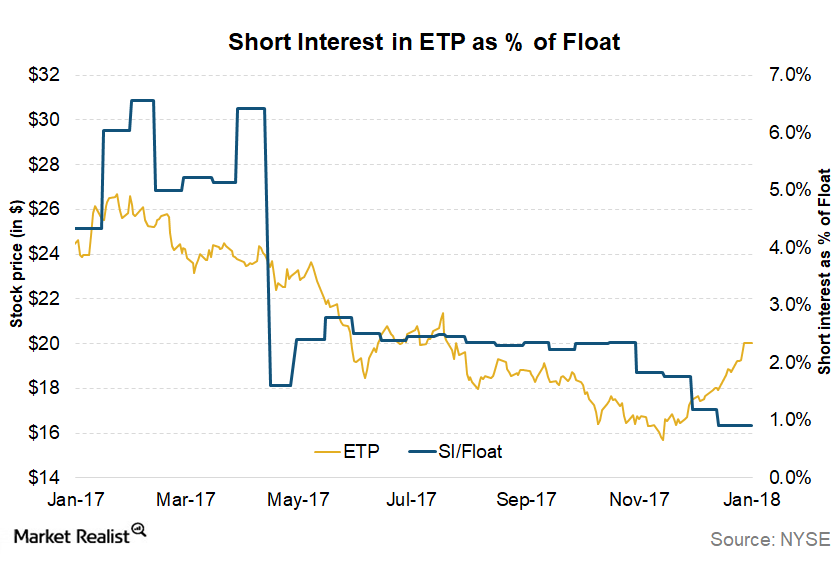

How USAC Deal Could Boost ETP’s Market Performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date).

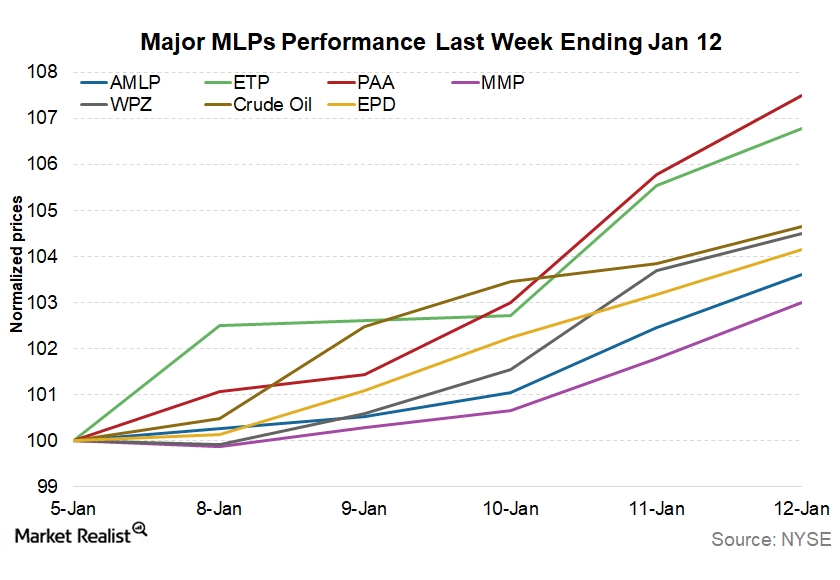

MLPs Continue to Outperform Broader US Markets in 2018

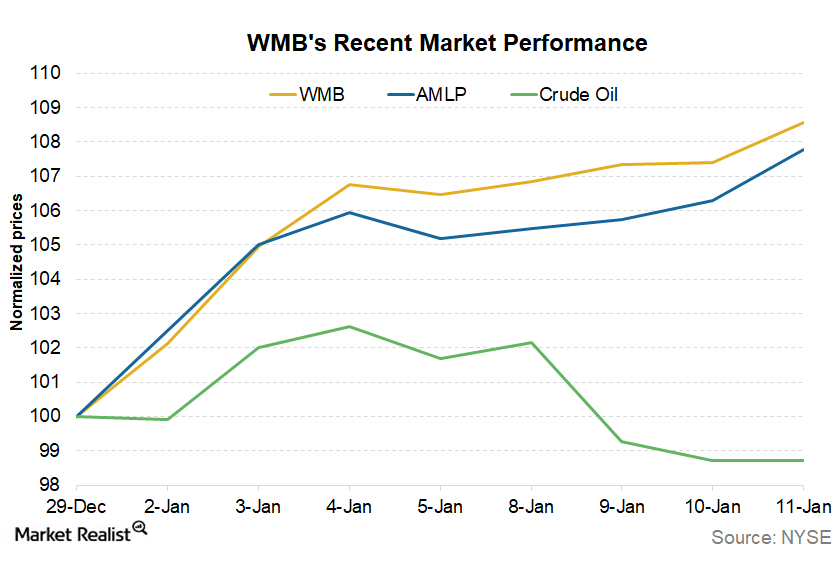

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

WMB Has Risen ~9% in 2018 So Far: Can the Gains Continue?

Williams Companies (WMB) has had a massive start to the year. It’s risen nearly 9% in seven trading sessions in 2018. Overall, the C corporation GP (general partner) has risen ~14% since the start of December 2017.

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

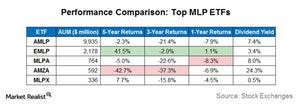

EMLP Generated the Highest Total Returns among the Top MLP ETFs

The First Trust North American Energy Infrastructure Fund (EMLP) generated total returns of 42% over a five-year period, the highest among the top five MLP ETFs that we are discussing in this series.

What’s Driving Cheniere Energy’s Recent Rally?

Cheniere Energy (LNG) has risen 9.7% in the last six trading sessions. It rose 12.1% in December 2017 alone.

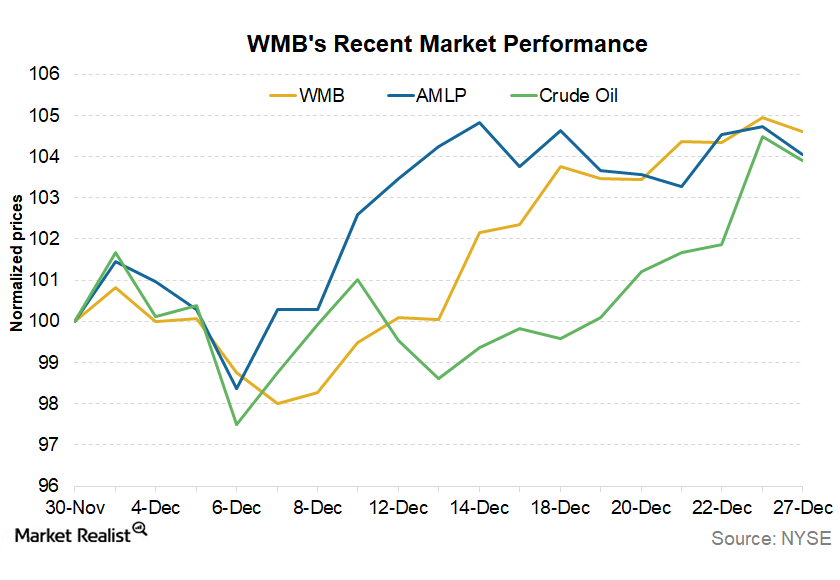

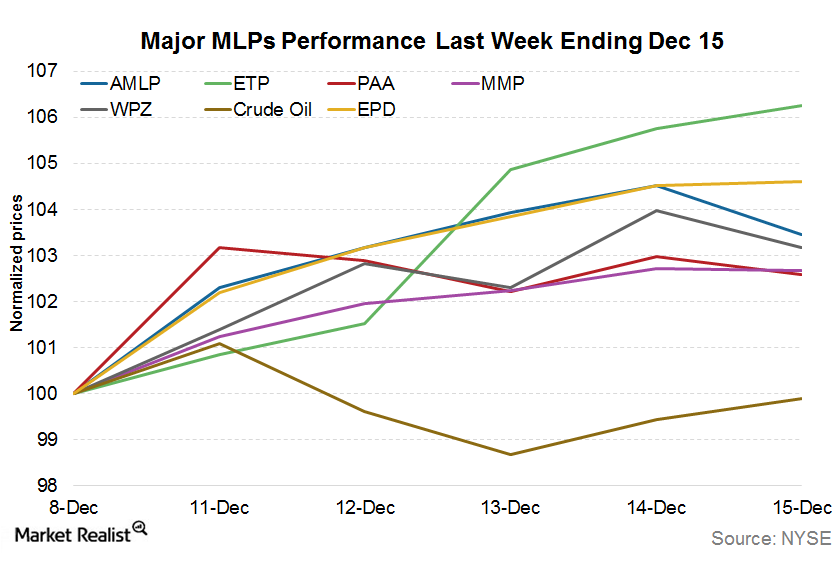

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

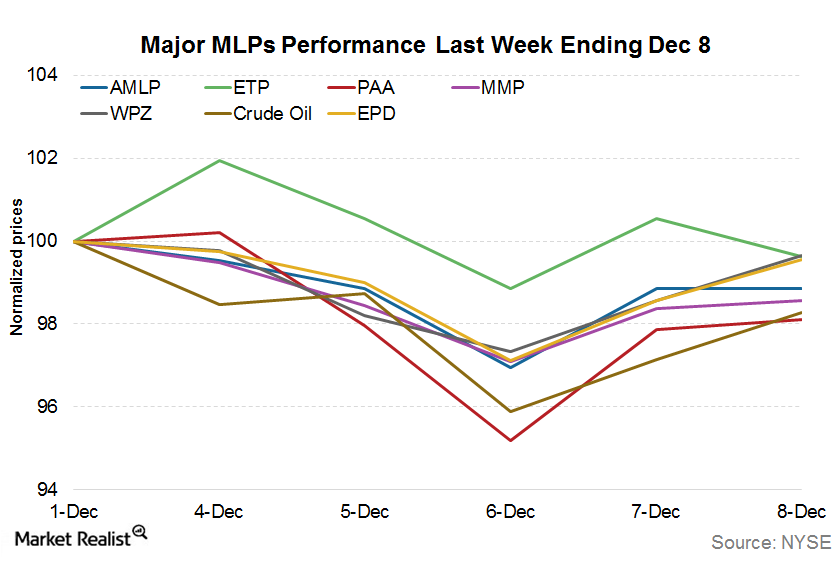

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

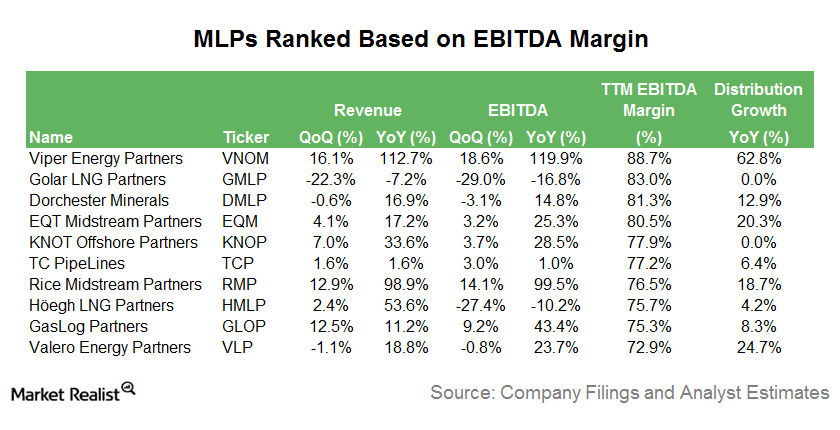

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

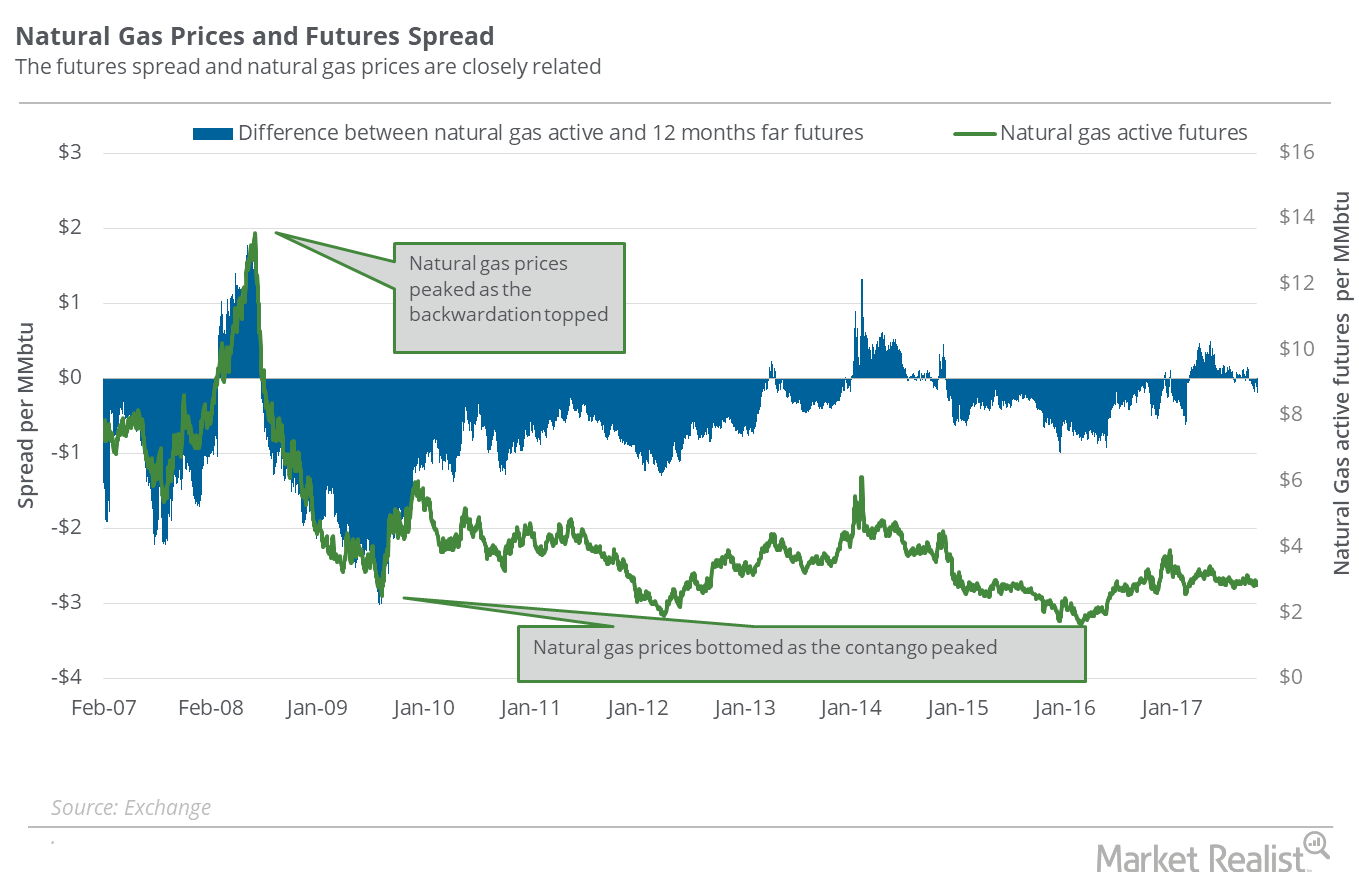

Are Natural Gas Supply Fears Rising?

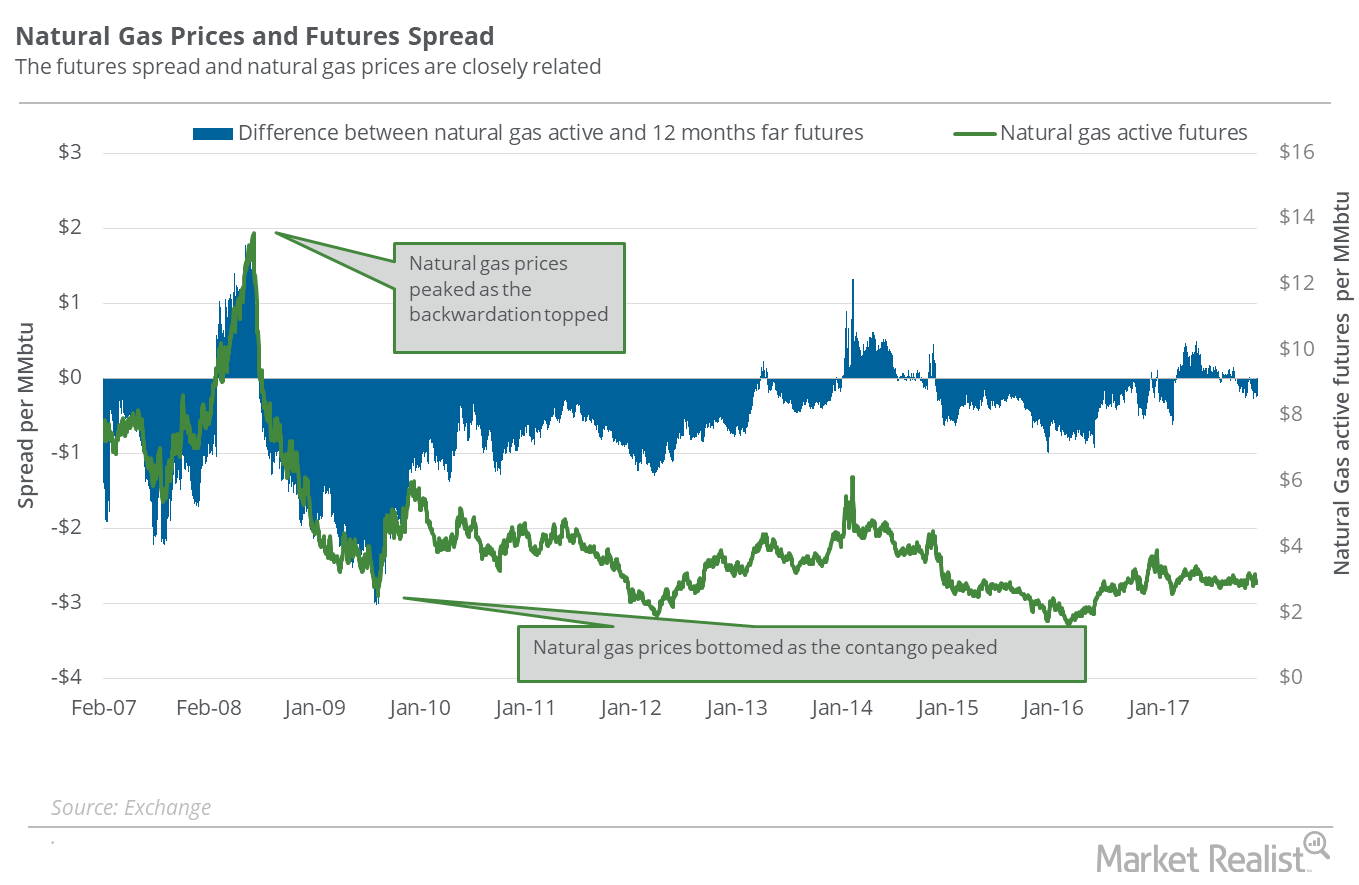

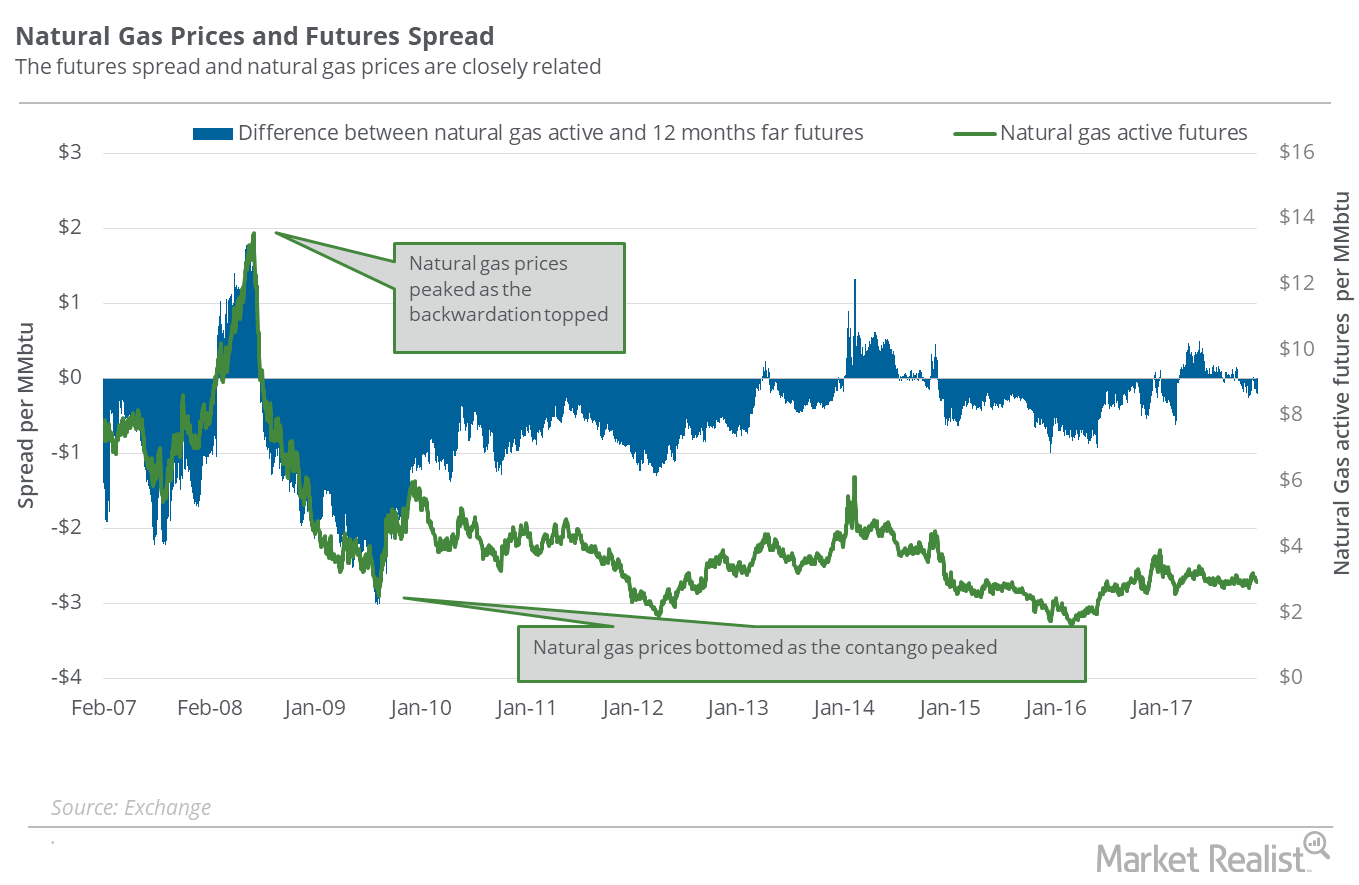

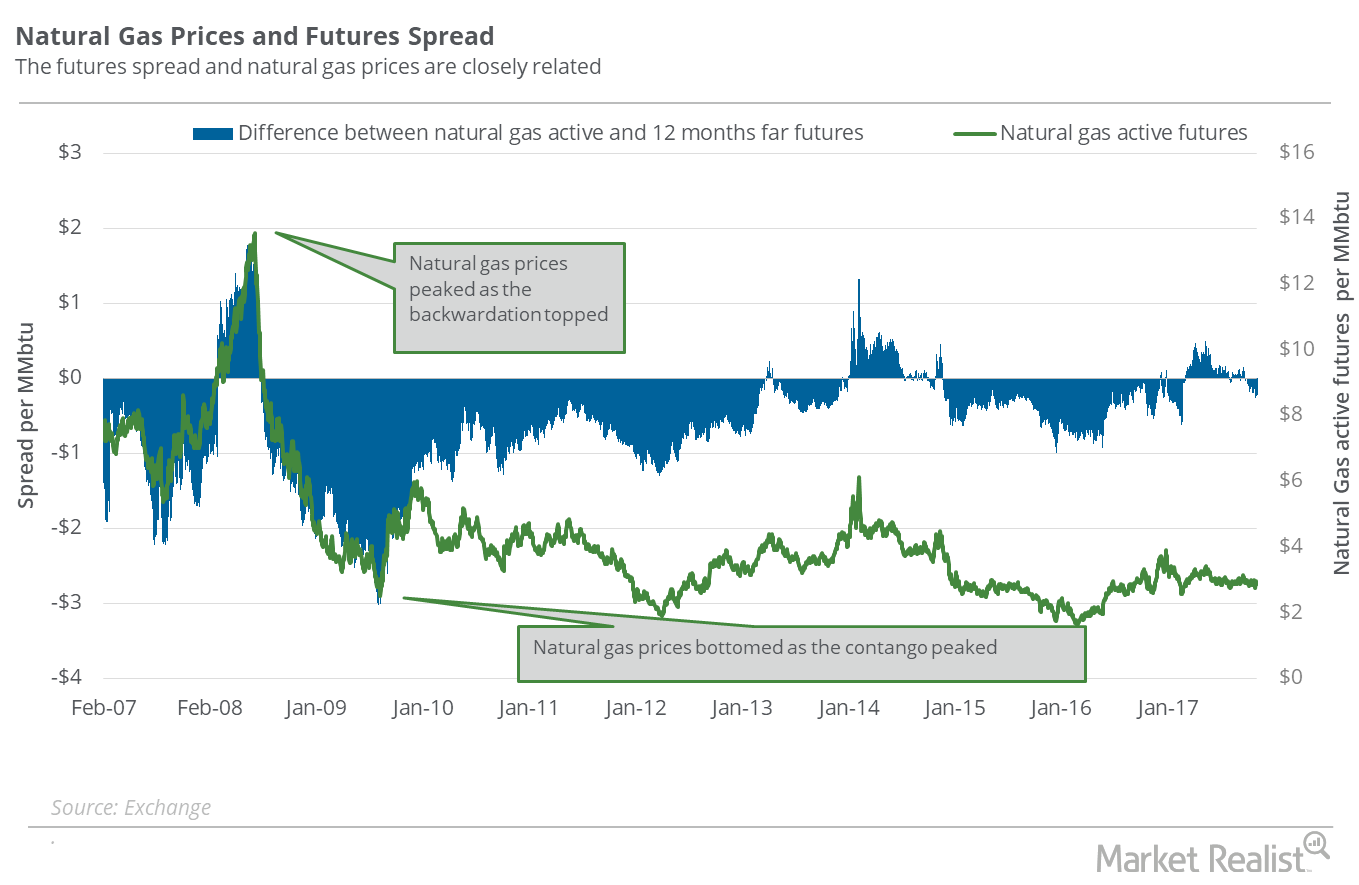

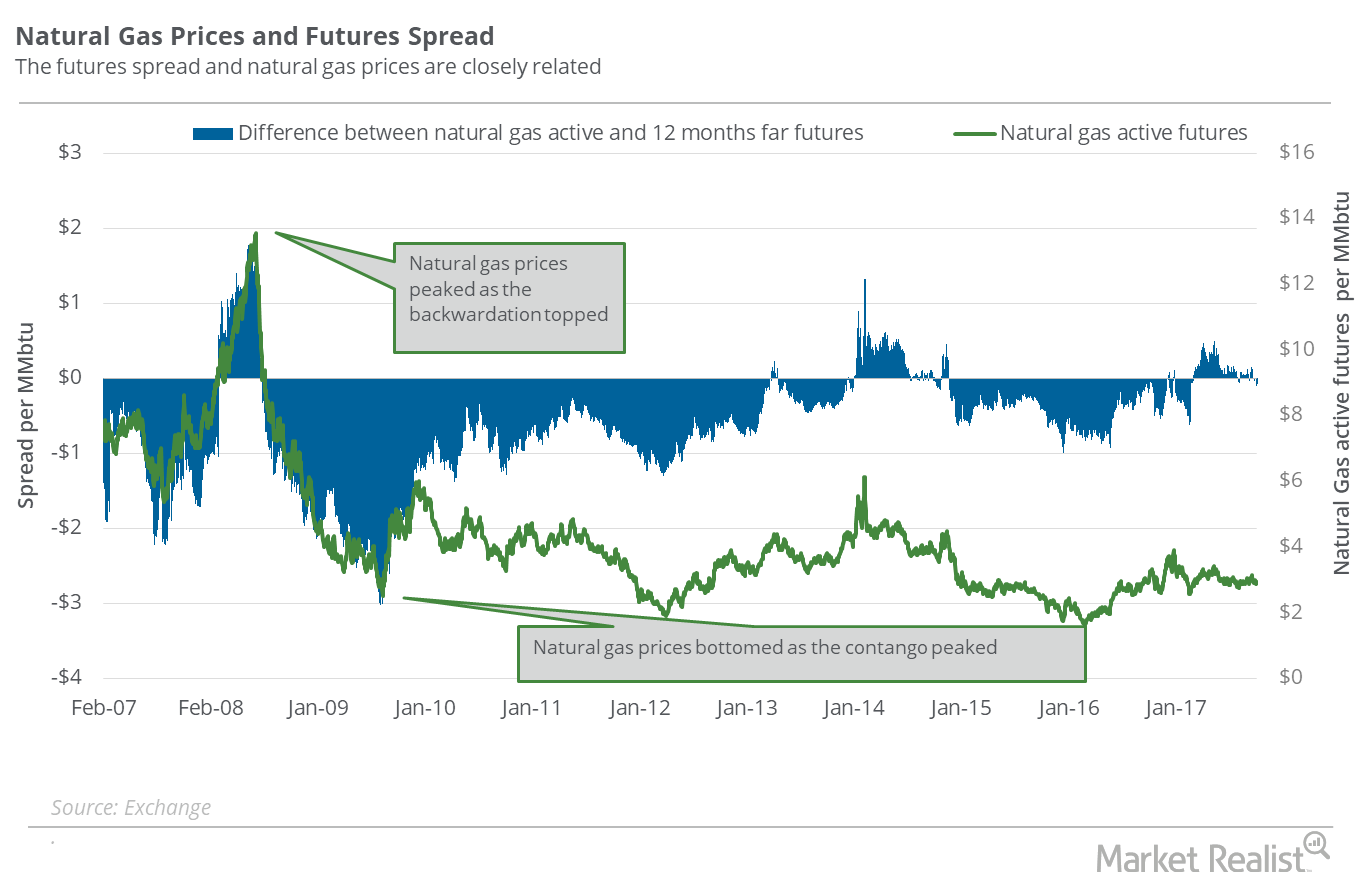

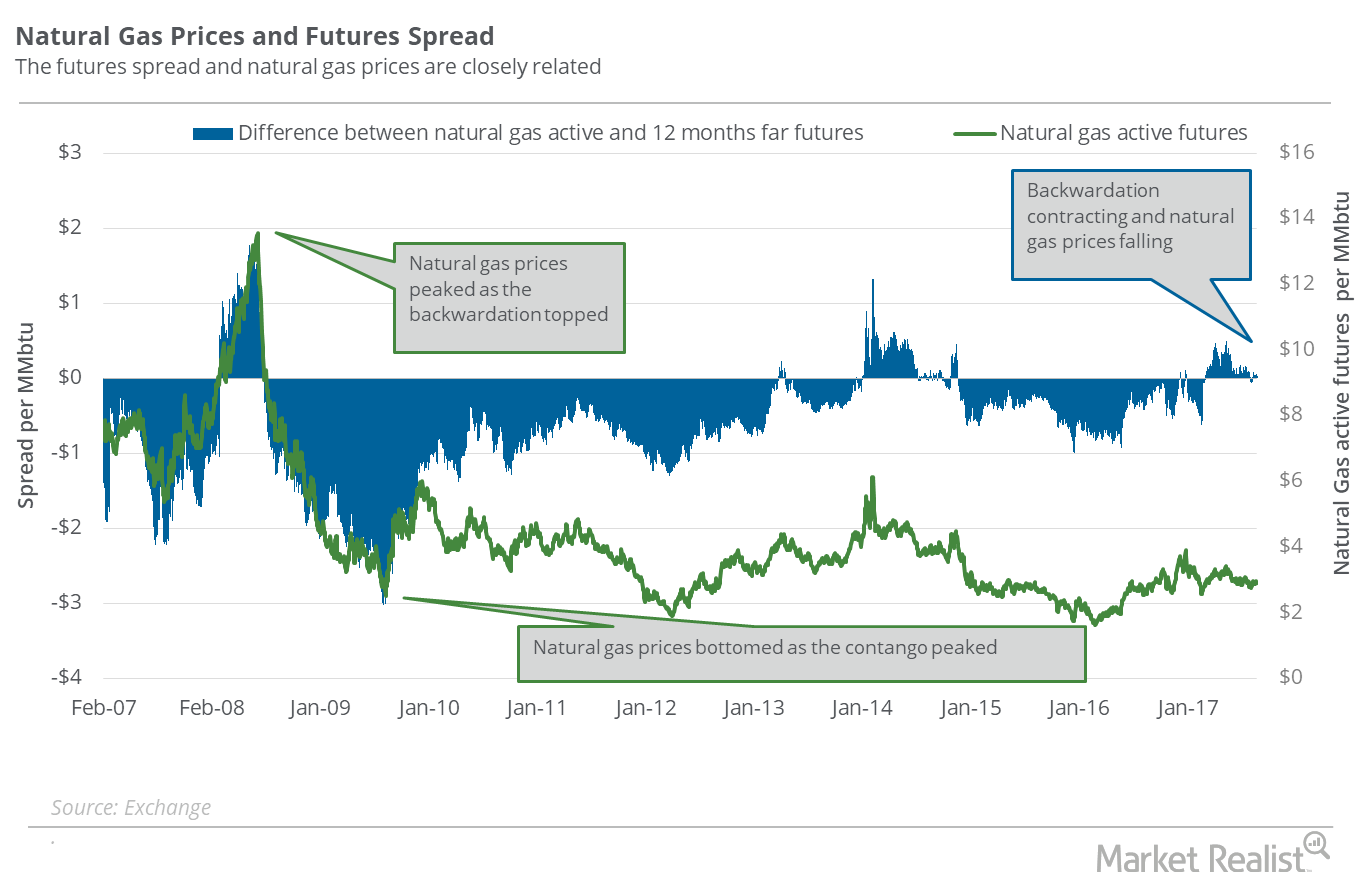

On December 6, natural gas (UNG)(BOIL) January 2018 futures traded at a discount of ~$0.24 to January 2019 futures. This price difference between January 2018 futures and January 2019 futures is called the “futures spread.”

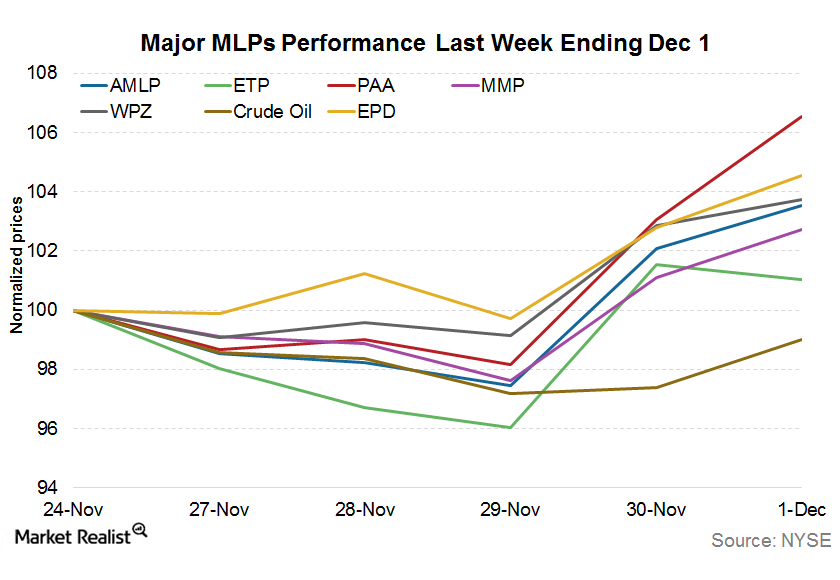

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

Are Oversupply Concerns Gripping Natural Gas Prices?

On November 22, natural gas (UNG)(BOIL) January 2018 futures closed at a discount of ~$0.2 to January 2019 futures.

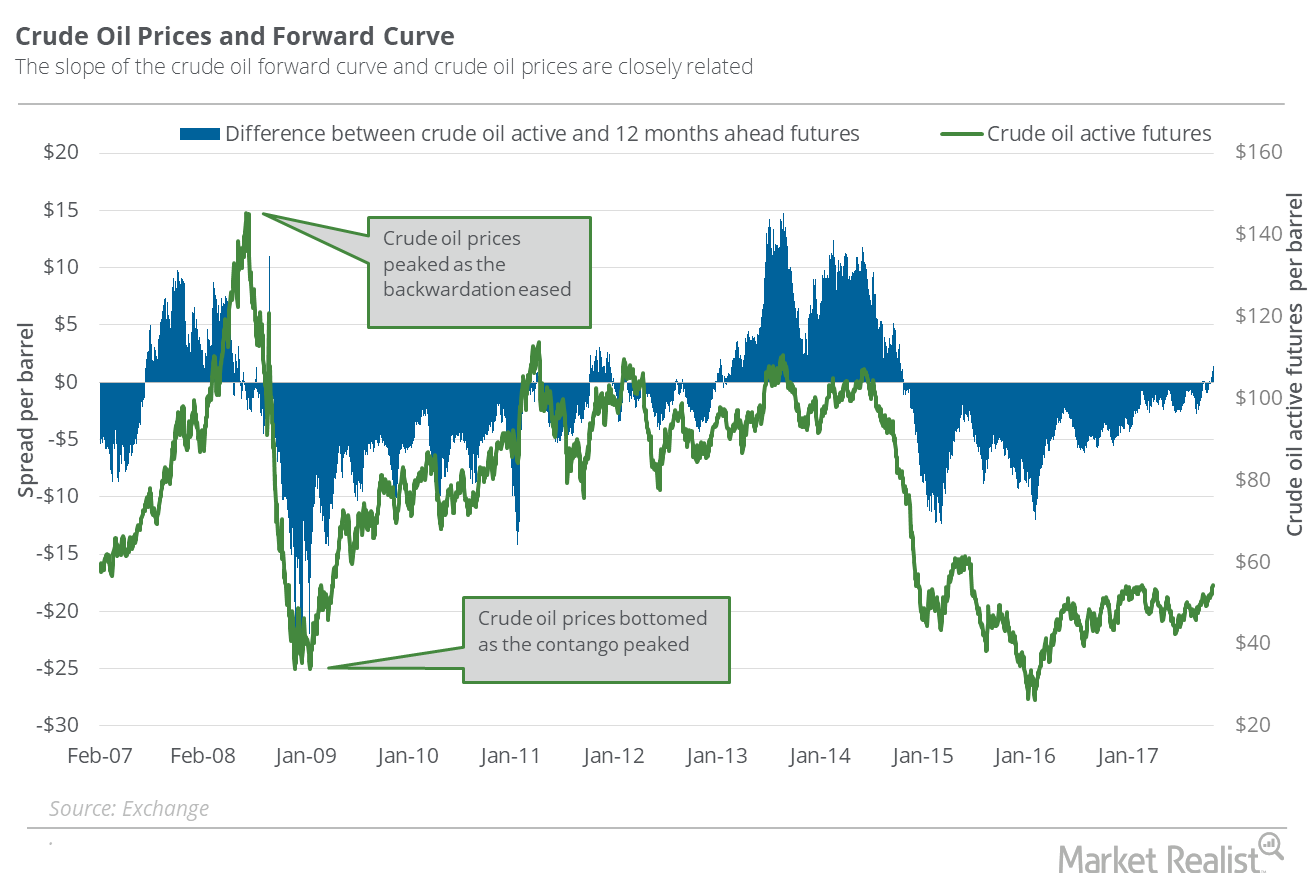

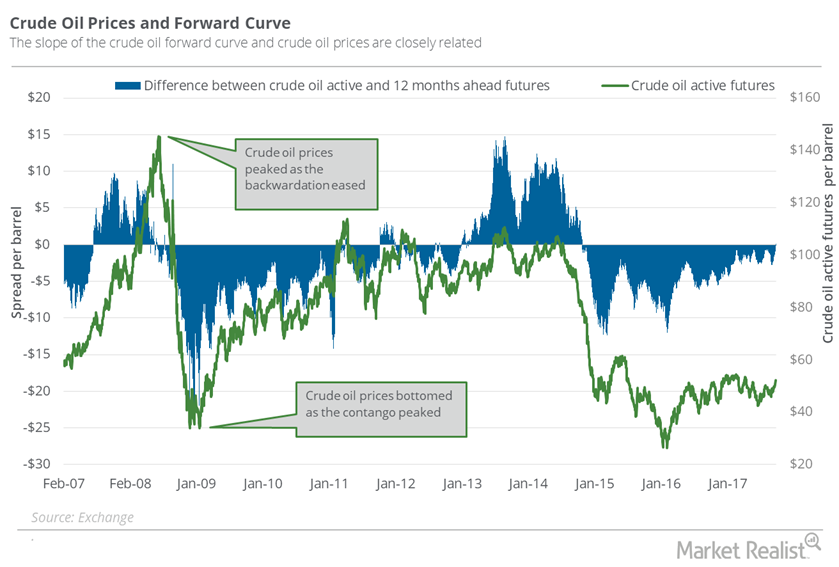

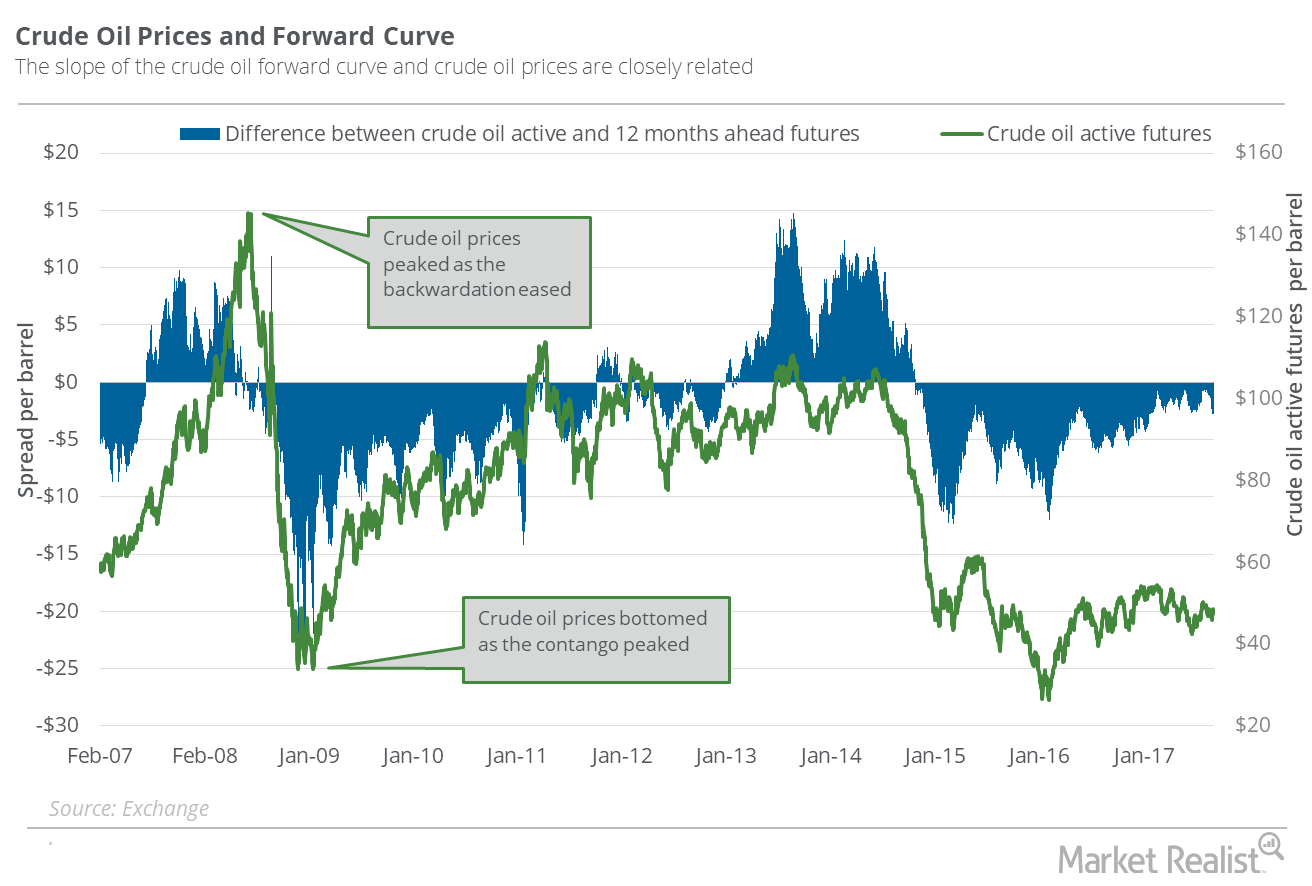

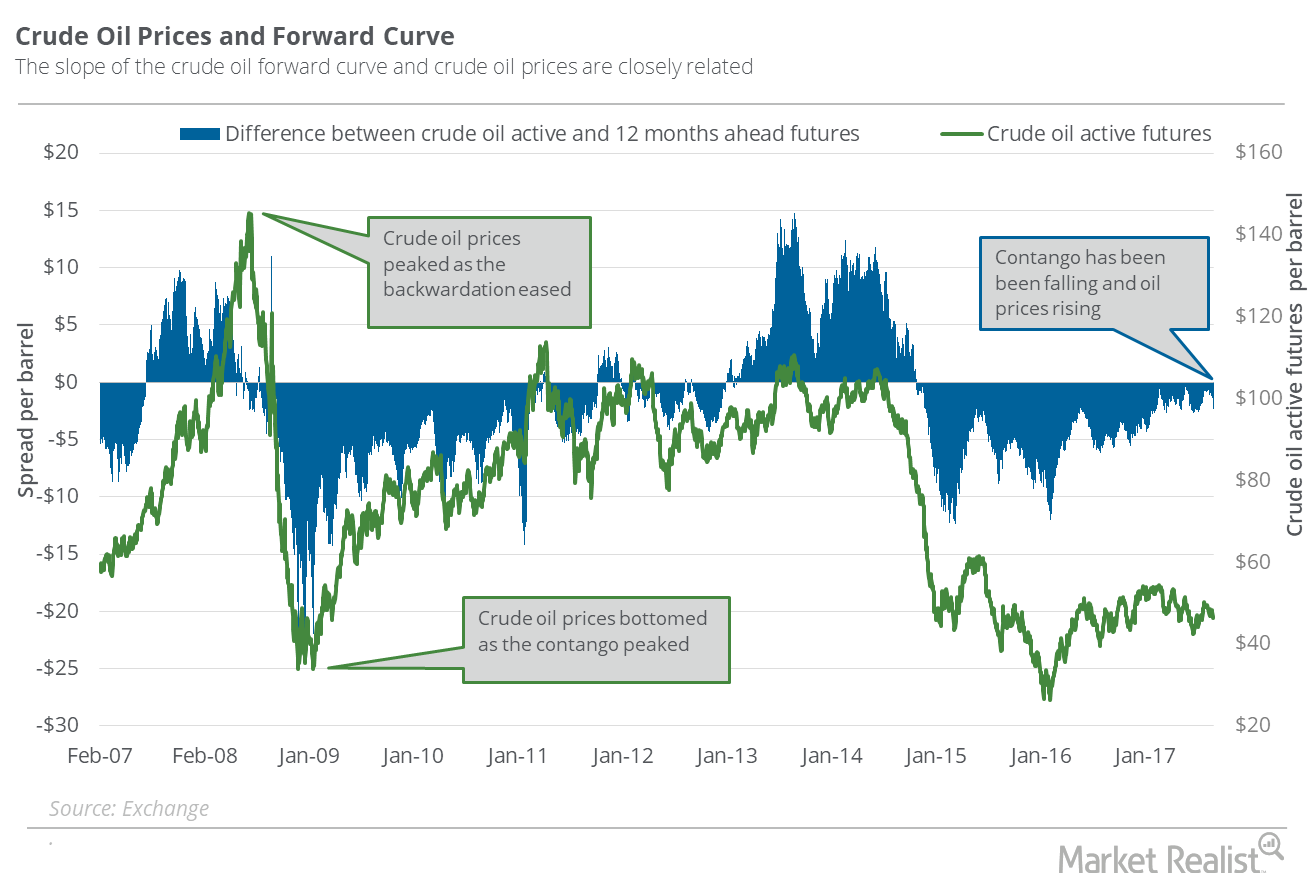

Futures Spread: Is the Oil Market Tightening?

On November 7, 2017, US crude oil (OIIL) December 2018 futures settled $2.08 below the December 2017 futures.

Understanding the Natural Gas Futures Spread: Are Oversupply Concerns Rising?

On November 1, natural gas December 2018 futures settled $0.22 above December 2017 futures. On October 25, the futures spread was at a premium of $0.11.

Is the Oil Market Balancing?

On October 31, 2017, US crude oil (USO) December 2018 futures settled $1.4 below December 2017 futures.

Understanding the Natural Gas Futures Spread—And What It Means for Prices

On October 25, 2017, natural gas December 2018 futures closed $0.11 above the December 2017 futures.

Reading the Natural Gas Futures Spread: Rising Oversupply Concerns

On October 11, 2017, the futures spread was at a premium of $0.13. Between then and October 18, natural gas November futures fell 1.2%.

Why the Natural Gas Futures Spread Is Concerning Markets

When the futures spread is at a premium, or the premium rises, it could hamper the rise in natural gas prices.

Futures Spread: A Look at Natural Gas Supply–Demand Concerns

On October 4, 2017, natural gas (UNG) (GASL) November 2018 futures traded $0.08 above the November 2017 futures.

Understanding the Oil Futures’ Forward Curve

On September 26, 2017, US crude oil November 2017 futures traded just $0.14 below the November 2018 futures.

Have Oil Supply Glut Concerns Relaxed since Harvey?

On September 5, US crude oil October 2018 futures traded at a premium of $1.94 to October 2017 futures. On August 29, the premium was at $2.37.

Natural Gas: Analyzing the Futures Spread

On August 30, 2017, natural gas October 2018 futures traded at a discount of ~$0.03 to October 2017 futures.

Oil’s Futures Spread: Have Supply Glut Concerns Increased?

On August 29, 2017, US crude oil (USL) October 2018 futures traded at a premium of $2.37 to October 2017 futures.

Natural Gas Futures Spread: Analyzing Supply-Glut Concerns

On August 23, 2017, natural gas September 2018 futures traded at a discount of $0.03 to September 2017 futures.

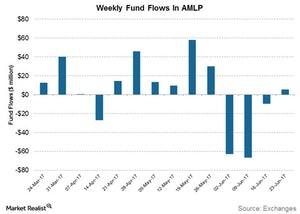

Take a Look at Fund Flows in MLP ETFs Last Week

After three weeks of negative flows, the Alerian MLP ETF (AMLP) witnessed a net inflow of $5.6 million for the week ended June 23, 2017.

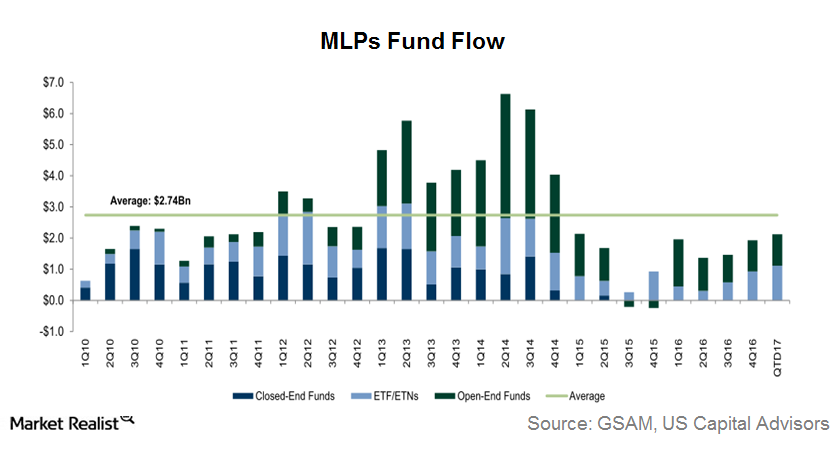

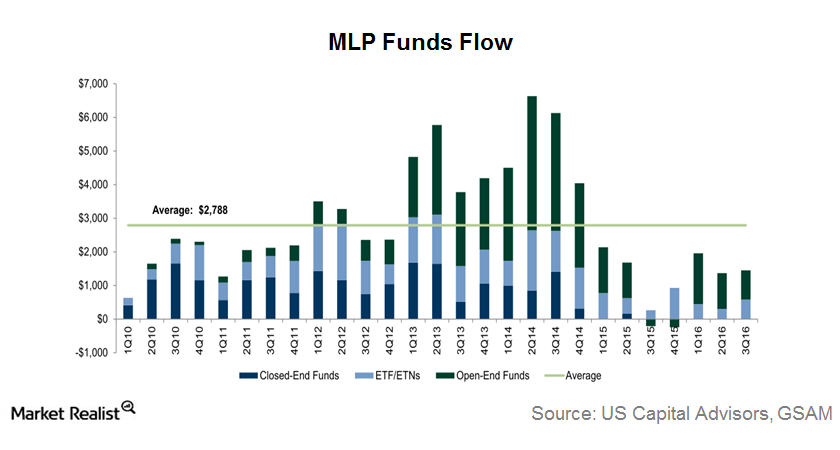

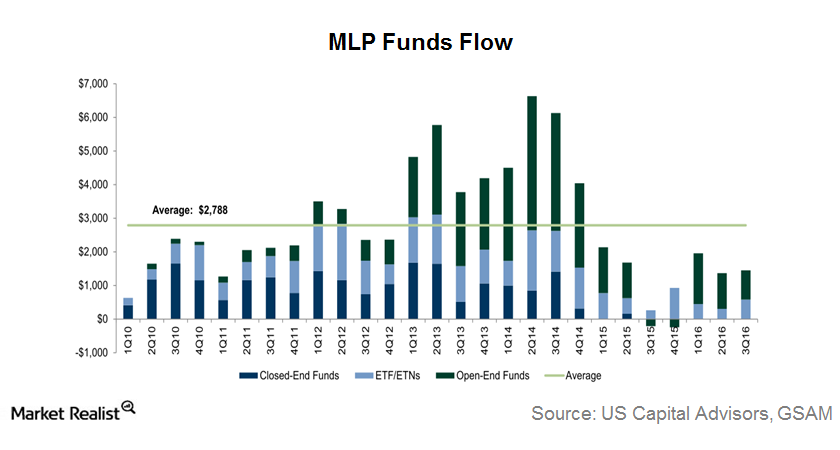

How MLP Funds’ Capital Inflow Improved in 1Q17

MLP funds’ capital inflow has recovered slightly in recent quarters compared to the second half of 2015.

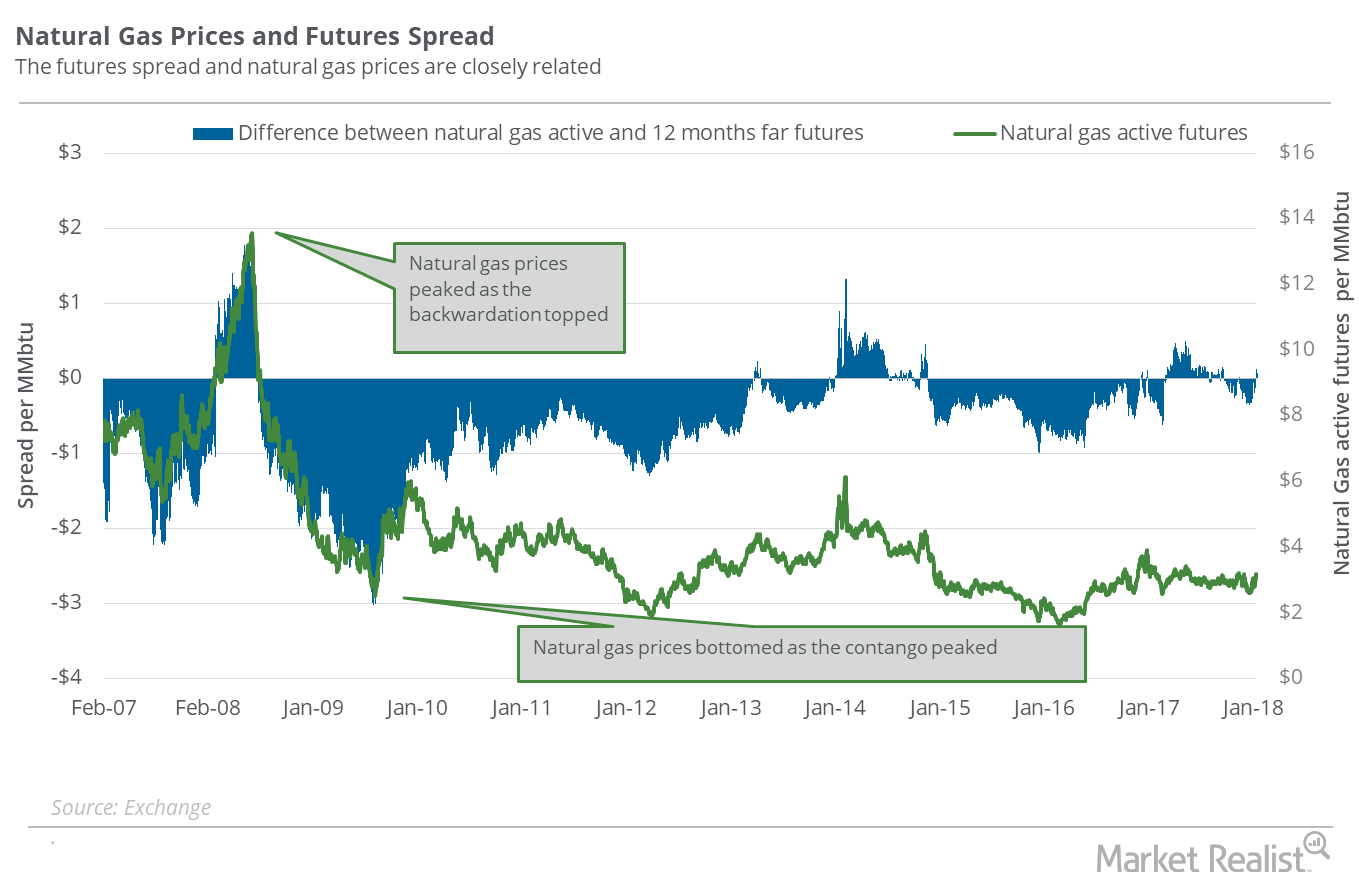

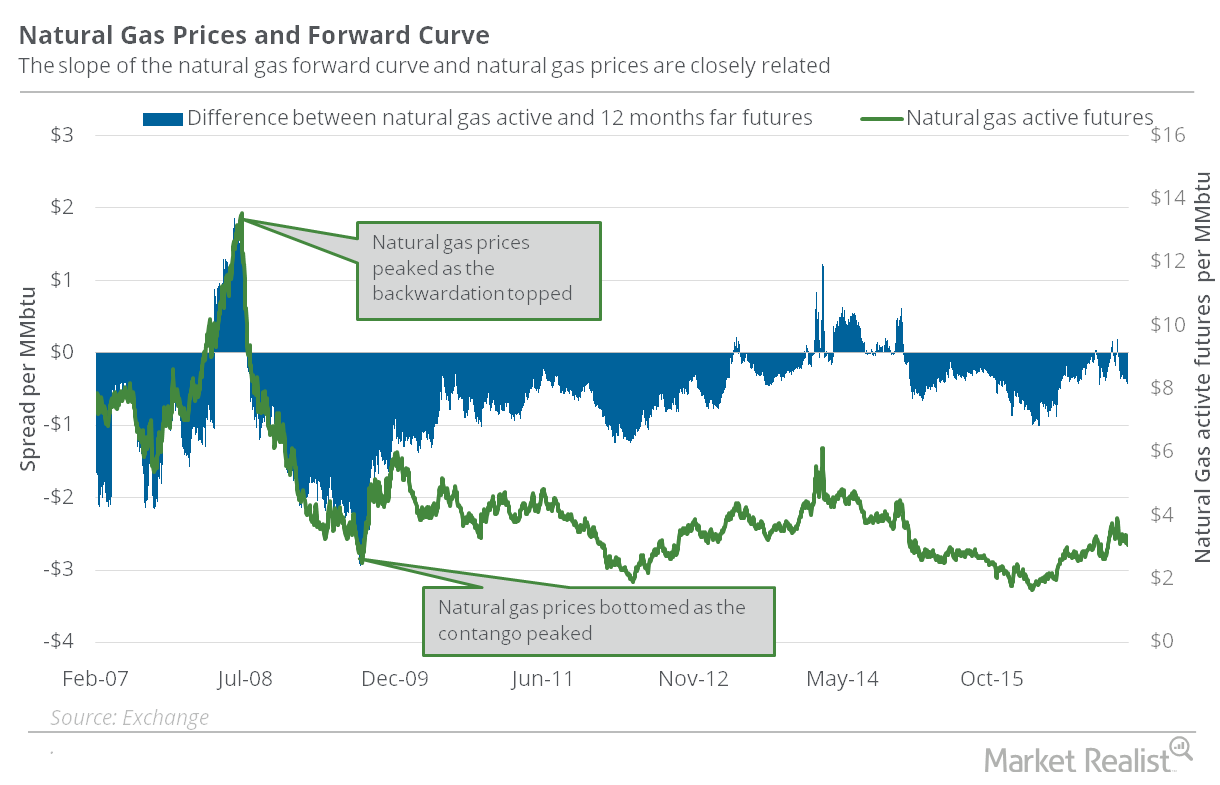

What Contango Could Mean for Natural Gas Traders

Active natural gas futures are currently trading at a discount of $0.56 to the futures contracts 12 months ahead. The situation is called “contango.”

Why Institutional Investors Seem Bullish on MLPs in 2017

MLP funds’ capital inflow recovered slightly in 2016 compared to their levels during the second half of 2015.

What Does the MLP Funds Market Look Like?

MLP funds’ capital inflows have recovered slightly in 2016 compared to 2H15. However, their overall capital inflow is still lower than their seven-year average.

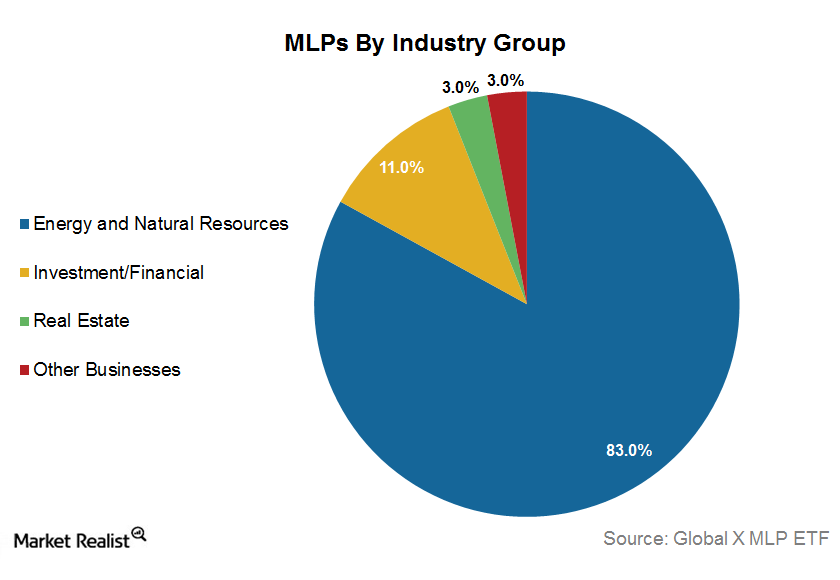

What You Should Know about Master Limited Partnerships

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

How Much Have MLP Fund Inflows Improved in 2016?

MLP funds’ capital inflows have recovered in 2016 from levels in 2H15. But overall capital inflows are lower than the seven-year average of $2.8 billion.

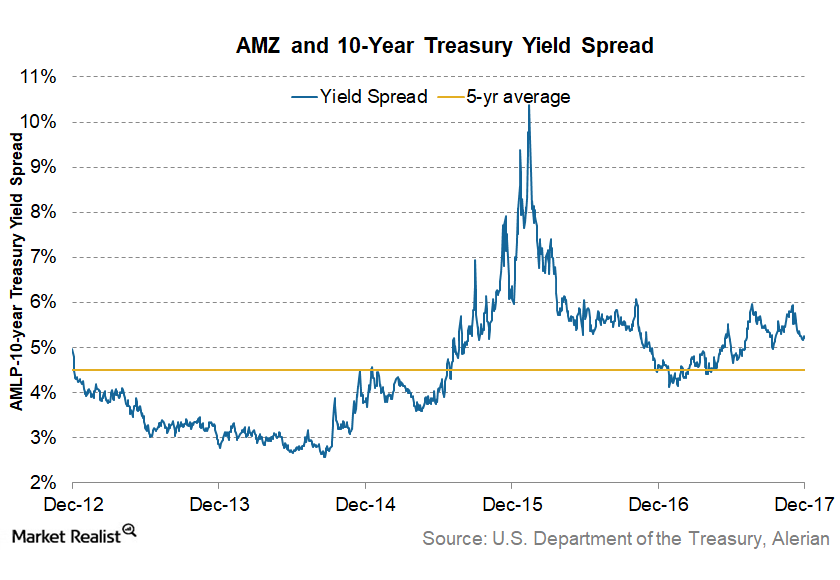

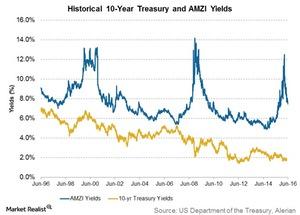

Analyzing the 10-Year Treasury and MLP Yields Spread

Generally, MLP yields move in the same direction as Treasury yields in the long term. MLP yields trade at a spread over Treasuries.

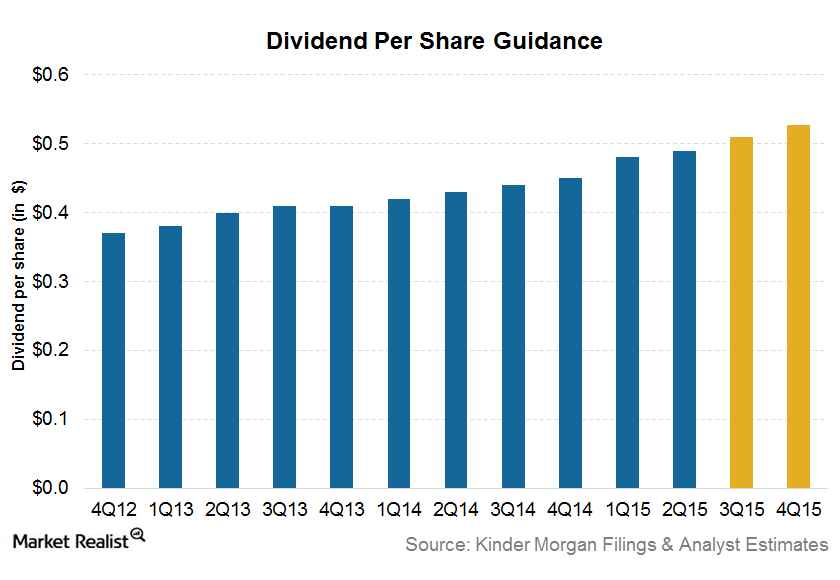

Kinder Morgan’s Outlook for the Rest of 2015

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

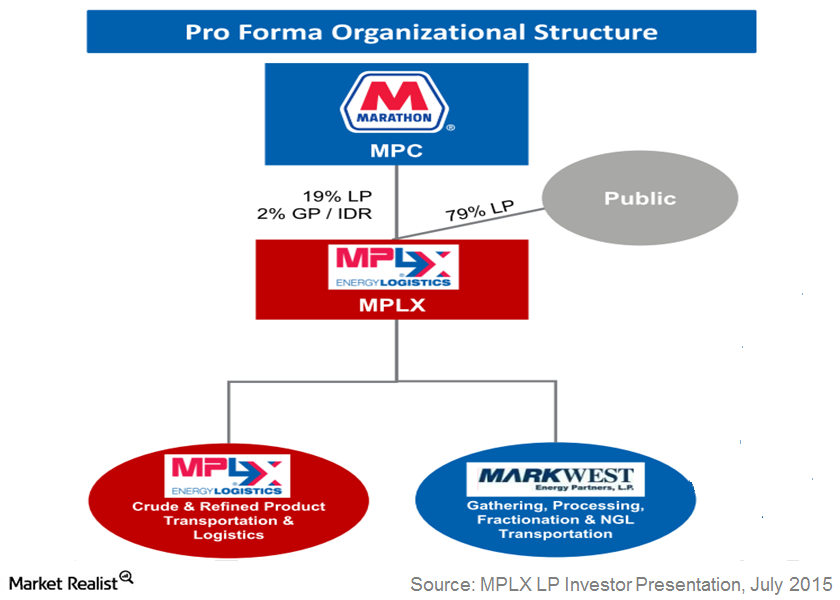

MarkWest-MPLX Merger: Big News for the Midstream Energy Sector

In a press release published on July 13, 2015, MarkWest Energy Partners (MWE) and MPLX LP (MPLX) announced that the two MLPs have agreed to merge.

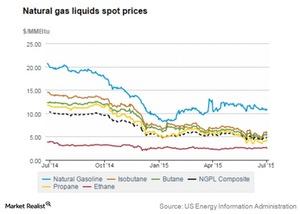

Why the Natural Gas-NGL Price Spread Impacts Energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas.

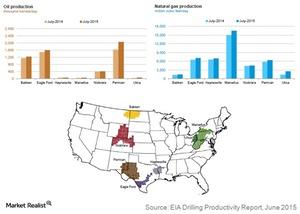

Must-Know: The 7 Regions for Oil and Gas Production in the US

The EIA (Energy Information Administration) monitors seven key tight oil and gas regions in the US.