Alerian MLP ETF

Latest Alerian MLP ETF News and Updates

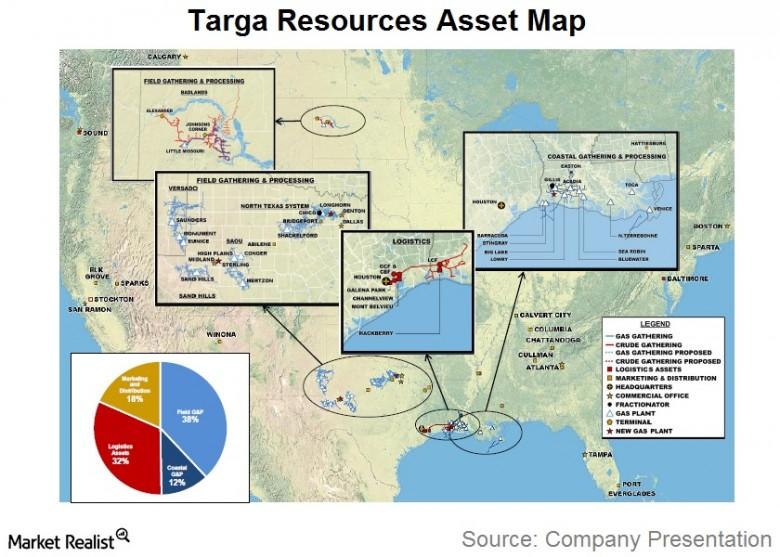

Targa Resources: A Midstream Energy MLP

Targa Resources Partners is a midstream energy MLP formed in 2006. The company is expanding its operations into gathering crude oil and transporting petroleum products.

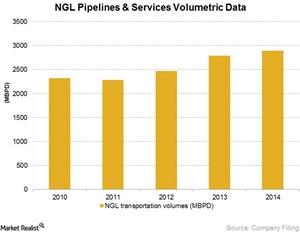

EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.

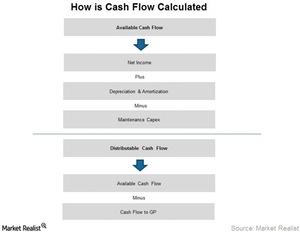

The Importance of the Distribution Coverage Ratio

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.

The Advantages and Disadvantages of Investing in MLPs

MLPs clearly stand out when compared to other asset classes because of their structure, yields as compared to other asset classes, and stability of cash distribution.

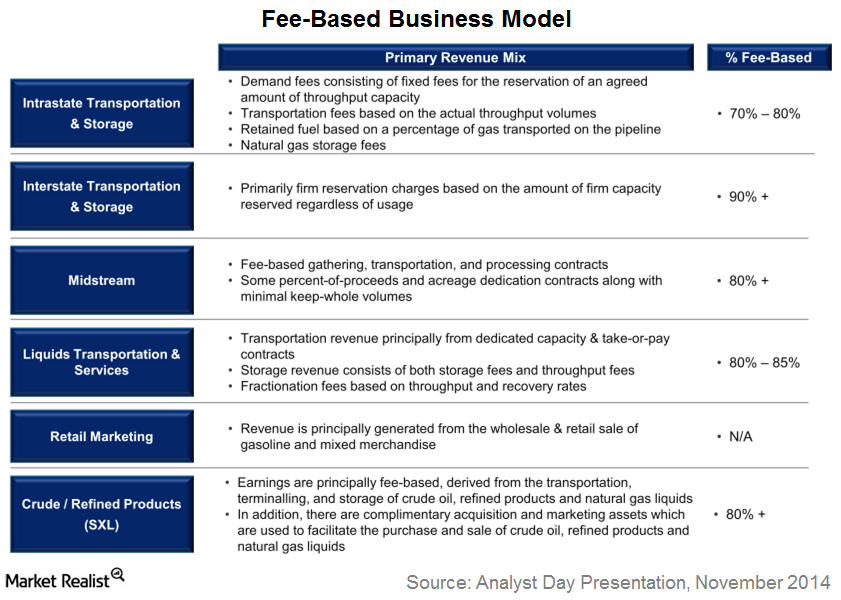

Energy Transfer Partners’ Fee-Based Model Drives Performance

Considering the rock solid performance of ETP during the slump in energy prices, it is clear that ETP has more fee-based contracts.

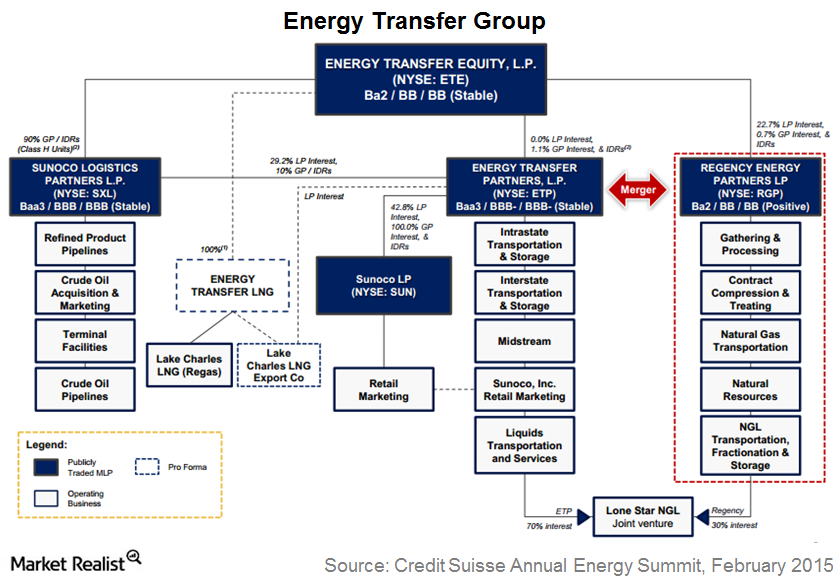

A Must-Know Overview of Energy Transfer Partners

Energy Transfer Partners (ETP) is one of the largest publicly traded master limited partnerships in the US in terms of equity market capitalization.

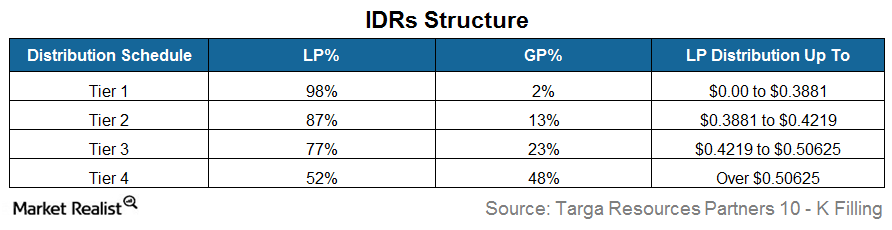

IDRs: How Do They Impact MLPs?

IDRs entitle the GP to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP unitholders.

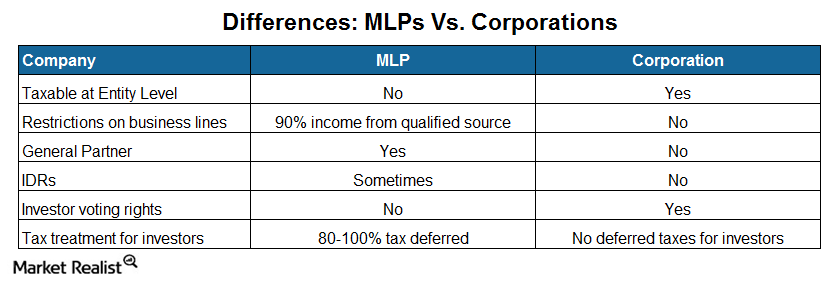

Analyzing the Differences: MLPs versus C Corporations

MLPs’ tax structure is the major difference that separates them from C Corps. MLPs’ earnings aren’t taxed at the partnership level. The taxes are passed to the unitholders.

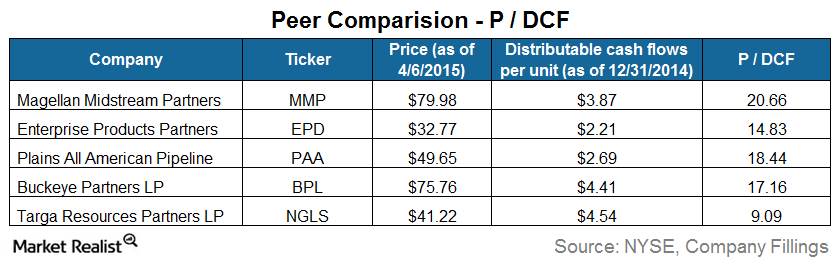

Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.

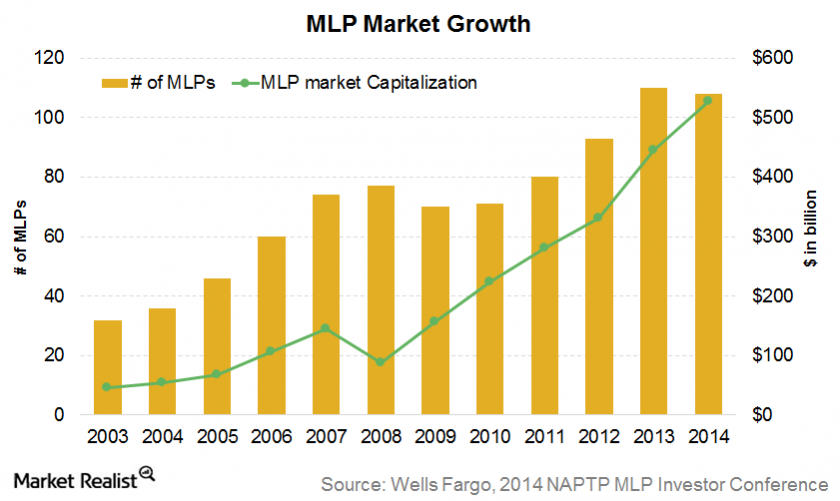

What Investors Need to Know about MLPs

MLPs are engaged in the production, transportation, storage, and processing of natural resources like oil, natural gas, and NGLs. They’re public companies.

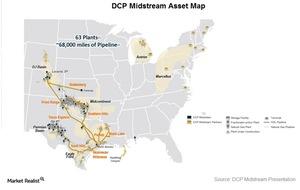

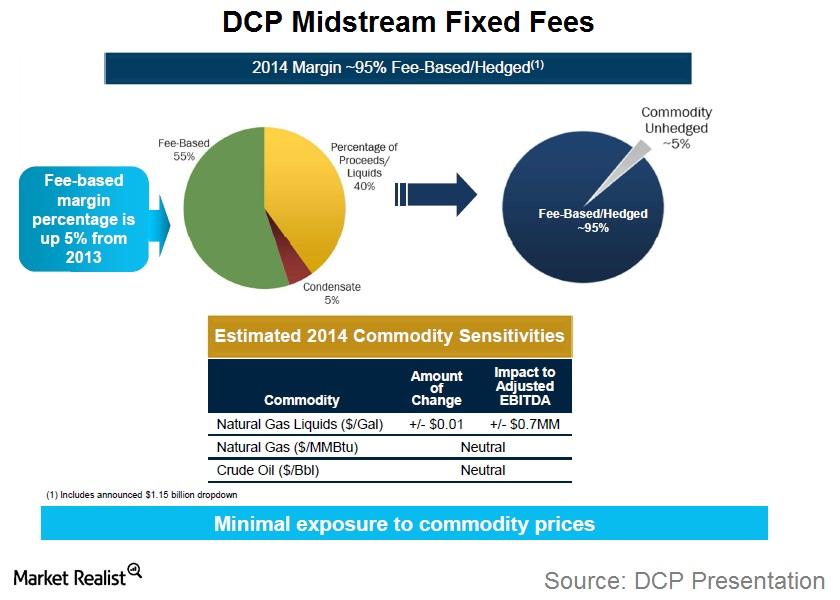

DCP Midstream Partners and Its Three Operating Segments

Unit price for DCP Midstream decreased 24% in the past year. The fall is particularly sharp since the end of October when its unit price crashed 32%.

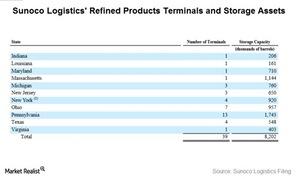

An Overview of Sunoco’s Terminals Facilities

Sunoco’s terminals facilities business operates crude oil, refined products, and natural gas liquids (or NGL) terminals.

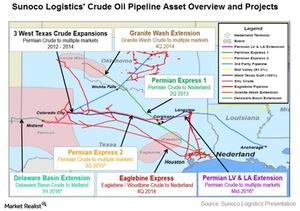

Crude Oil Pipeline Is a Major Segment for Sunoco Logistics

In the crude oil pipeline segment, Sunoco Logistics (SXL) runs 5,800 miles of crude oil pipelines and approximately 500 miles of crude oil gathering lines.

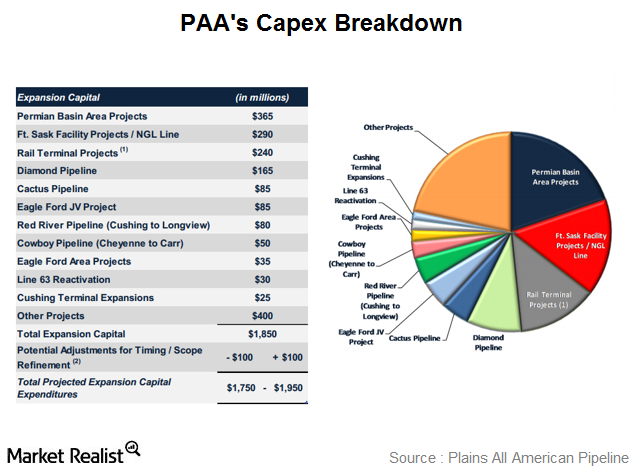

Plains All American Pipeline’s capex plan for 2015

Plains All American Pipeline expects to spend $1.85 in capex in 2015, highlighted by several projects in multiple geographic regions or resource plays.

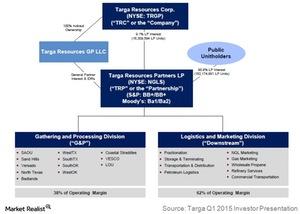

Must-know business overview: Targa Resources Partners

Targa Resources Partners LP (NGLS) is a master limited partnership operating in the midstream energy space. Targa Resources Corp. (TRGP) is the general partner of NGLS.

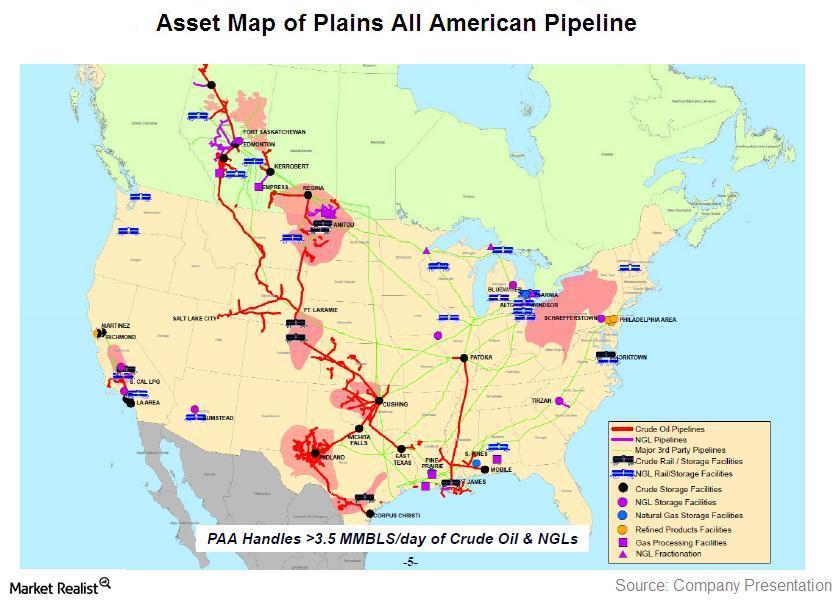

Overview: Plains All American Pipeline’s gas storage facilities

Currently, there are three major publicly traded independent storage firms, Plains All American Pipeline’s (PAA) natural gas storage subsidiary (PAA Natural Gas Storage), Niska Gas Storage Partners (NKA), and Crestwood Equity Partners (CEQP). PAA is part of the Alerian MLP (or master limited partnership) ETF (AMLP), while CEQP is part of the Global X MLP ETF (MLPA).

Must-know: An introduction to Plains All American Pipeline

Plains All American Pipeline L.P. (PAA) is a master limited partnership that operates in the midstream energy business.

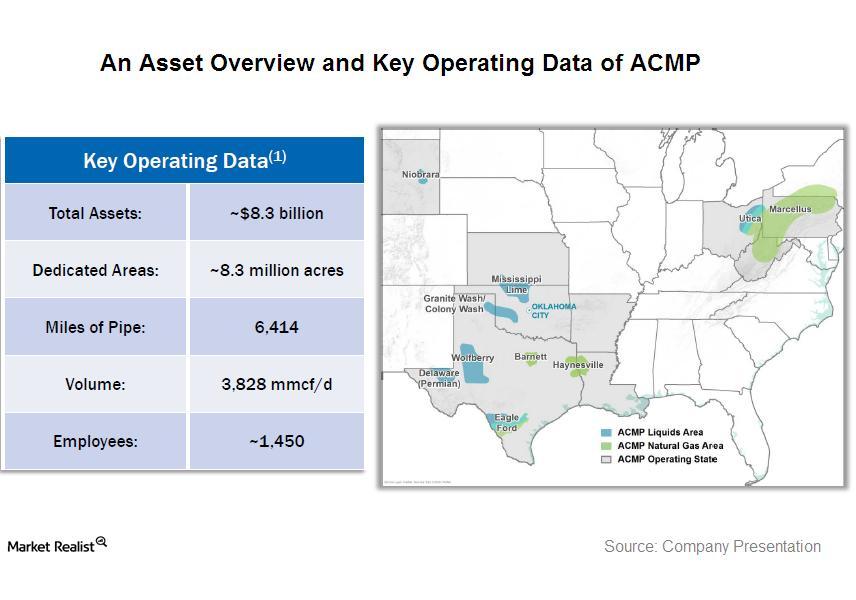

An introduction to Access Midstream Partners’ business and assets

Access Midstream Partners is a master limited partnership, which owns, operates, develops and acquires natural gas, NGLs, and oil gathering systems and other midstream energy assets.

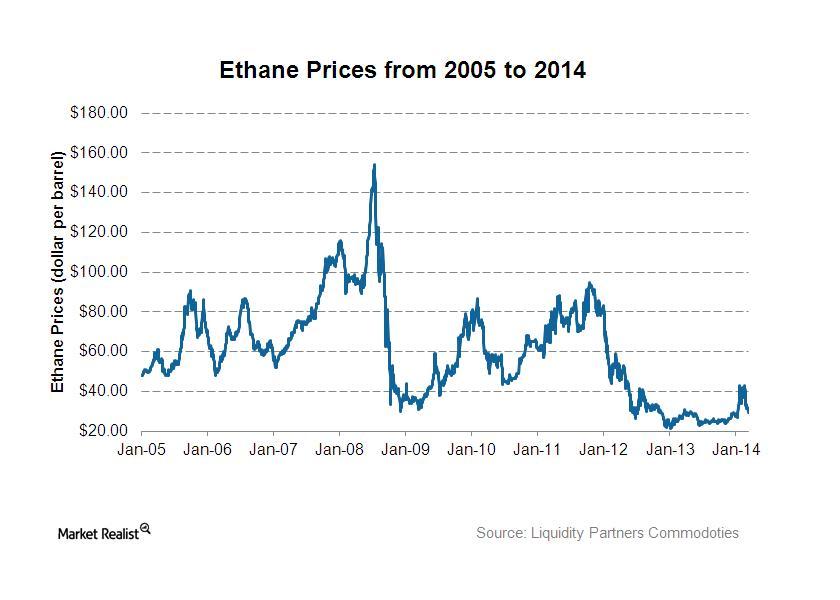

Ethane production and its effects on natural gas processors

With attractive NGL pricing relative to naphtha refinery streams, the feedstock percentage of NGLs has been increasing, with ethane taking a disproportionate share of the total.

How MLPs profit from natural gas gathering and processing

Natural gas gathering and processing are a significant part of the operations of many midstream master limited partnerships.

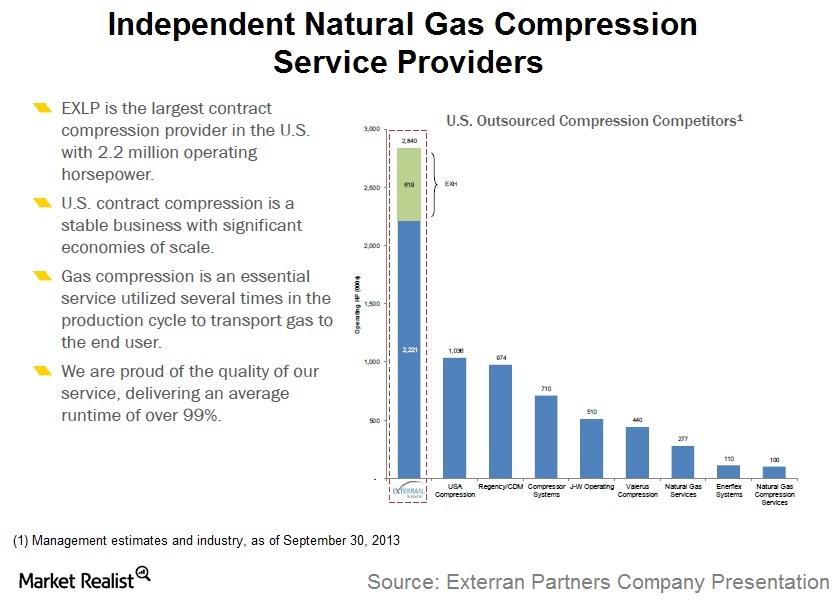

An overview of natural gas compression companies like Exterran

Natural gas compression services are used to transport natural gas. Compression is often used to get natural gas from low-pressure wells to gathering systems, and to maintain production as reservoir pressure declines.