Are Natural Gas Supply Fears Rising?

On December 6, natural gas (UNG)(BOIL) January 2018 futures traded at a discount of ~$0.24 to January 2019 futures. This price difference between January 2018 futures and January 2019 futures is called the “futures spread.”

Dec. 8 2017, Updated 7:33 a.m. ET

Futures spread

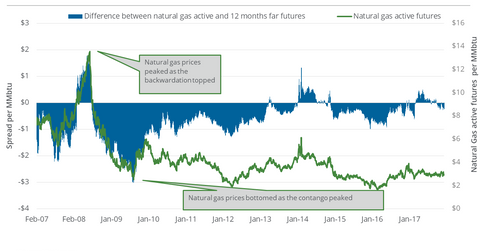

On December 6, natural gas (UNG)(BOIL) January 2018 futures traded at a discount of ~$0.24 to January 2019 futures. This price difference between January 2018 futures and January 2019 futures is called the “futures spread.” On November 29, the futures spread was at a discount of $0.08. Between November 29 and December 6, natural gas January futures fell 8.1%.

Discount versus premium

When the discount rises, it tends to increase the downside risk in natural gas prices, which happened on March 3, 2016. Natural gas futures saw a 17-year-low closing price, and the discount was $0.84. However, if the discount contracts, natural gas prices could see an upside.

Unlike a discount, when the spread is at a premium, it supports natural gas prices, which happened on May 12, 2017. Natural gas futures saw their 2017 high closing price, and the premium was $0.5. However, if the premium contracts, the downside risk in natural gas prices may rise.

In the trailing week, the discount tripled, and natural gas prices plunged 8.1%. The rise in the spread discount indicates that natural gas’s supply concerns are rising. We discussed the impact of oil and gas rig counts on natural gas supplies in Part 2 of this series, which could be adding to these concerns.

Energy sector

US natural gas producers’ (XOP)(DRIP)(IEO) hedging actions could depend on the natural gas futures forward curve. Strategically, this curve also influences midstream natural gas transportation, storage, and processing companies (AMLP).

On December 6, the price difference between natural gas February 2018 futures and January 2018 futures was $0.002. On the same day, natural gas February 2018 futures settled above January 2018 futures. This difference, particularly if it increases, may cause losses to ETFs that follow natural gas like the ProShares Ultra Bloomberg Natural Gas (BOIL) and the United States Natural Gas Fund LP (UNG).