Fox Corporation

Latest Fox Corporation News and Updates

The World Series Has Its First New Announcer in 25 Years — Where Is Joe Buck Now?

What happened to Joe Buck on FOX? The NFL commentator described how longtime colleague Troy Aikman’s move to ESPN triggered his own.

Where Is Joy Taylor? Rumors Suggest She Could Be Leaving ‘The Herd’

Although Fox Sports has yet to confirm any of the details we’re about to dish out, sources are claiming that Joy Taylor may be joining Emmanuel Acho to host an FS1 show in the afternoon.

Fox Nation Doesn't Care About Subscriber Acquisition, According to CEO

Fox News' streaming service Fox Nation is still live unlike its competitor CNN+. So, how many subscribers does it have and where can you watch Fox Nation?

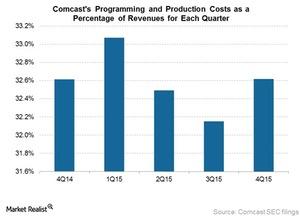

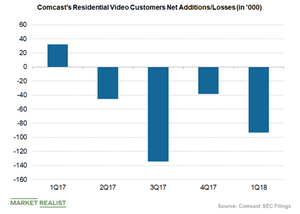

Why Does Comcast Expect Programming Costs to Rise in Fiscal 2016?

On March 8, 2016, the Wall Street Journal reported that Comcast and the YES Network were locked in a dispute regarding the carriage fee for the YES Network.

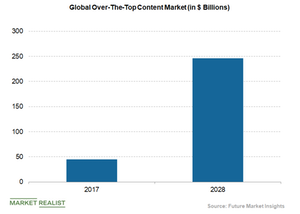

FOXA’s Views on Streaming Platforms: Advertising Opportunity?

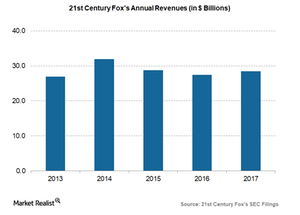

Due to the coverage of the US presidential elections this year, 21st Century Fox (FOXA) expects substantial advertising revenue from Fox News.

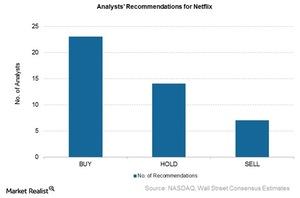

Trading at a Discount, Netflix Has Mixed Recommendations

Of the 44 analysts covering Netflix, 23 have given it a “buy” recommendation, seven have given it a “sell” recommendation, and 14 have given it a “hold” recommendation.

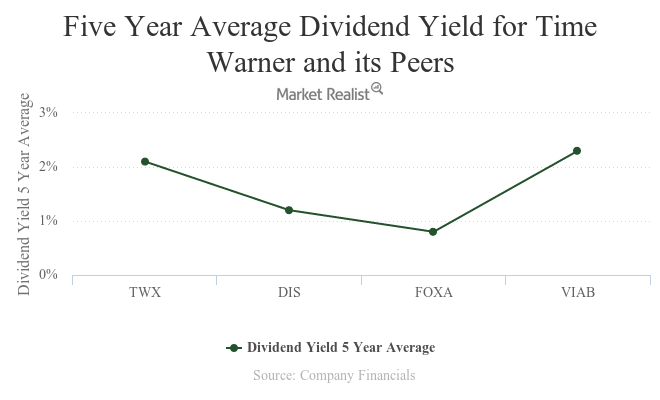

A Look at Time Warner’s Key Metrics

In fiscal 1Q16, Time Warner bought back $700 million worth of shares. Including dividends, it has returned around $1.3 billion to its shareholders year-to-date.

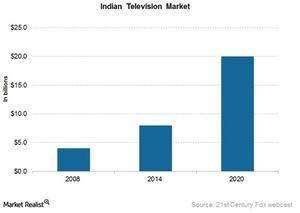

21st Century Fox’s Rising STAR in India

21st Century Fox owns STAR India, India’s largest media network. STAR India develops, broadcasts, and produces programming for 51 channels in its portfolio.Technology & Communications An assessment: Viacom versus its media peers

Viacom, despite being undervalued by analysts, is expected to see growth from its media networks segment especially with its digital partnership deals.

The Impact of the AT&T–Time Warner Merger

Analyst Craig Moffett believes that AT&T has an 80% chance of prevailing in court in its proposed merger with Time Warner.

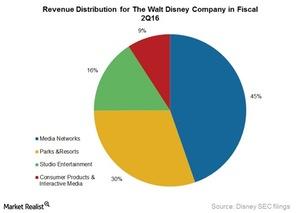

Why the Walt Disney Company Reorganized

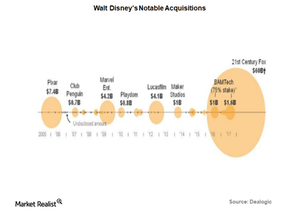

In 2017, Disney agreed to acquire the bulk of Fox assets for $52.4 billion, or $66.1 billion including debt.

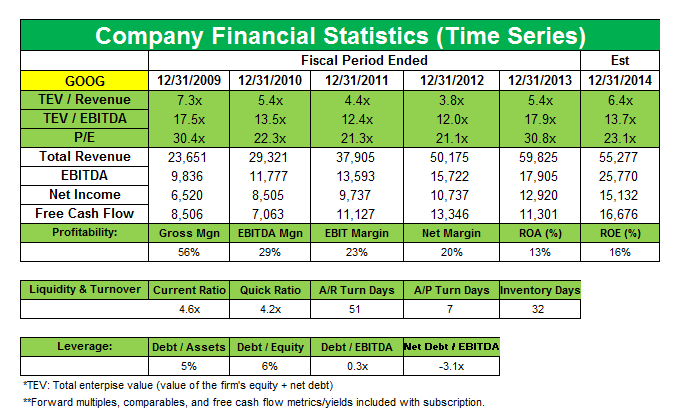

Steven A. Cohen increases SAC Capital’s position in Google

SAC Capital built up its stake in Google Inc. (GOOG) last quarter by 97,523 shares, to 193,550 shares. Google accounts for a 1.26% position in SAC’s portfolio.

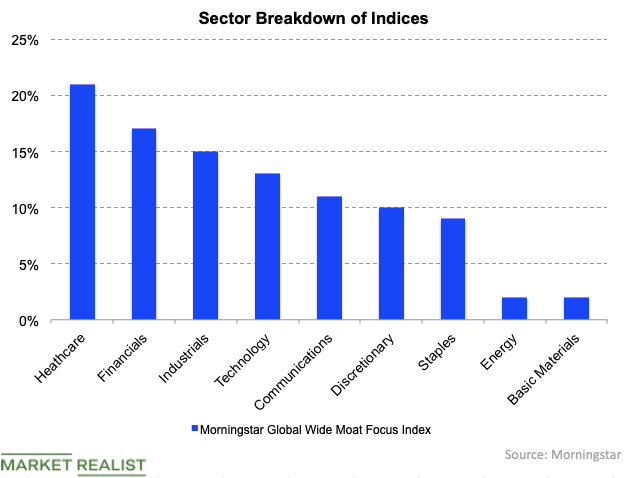

How to Invest in Global Wide Moat Stocks

The Morningstar Global Wide Moat Focus Index has global exposure, unlike the Morningstar International Moat Index (MOTI).

How Viacom and CBS Could Benefit from Potential Merger

Media players Viacom (VIAB) and CBS (CBS) are again talking about a merger.

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

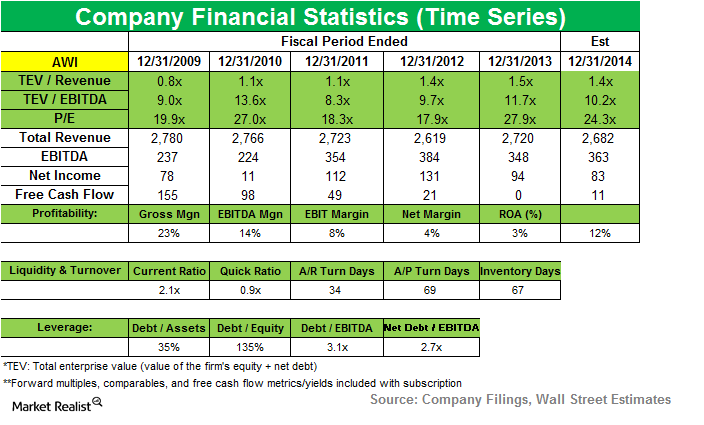

ValueAct gets seat on Armstrong World Industries’ board

While Armstrong’s 3Q14 results beat estimates, its consolidated net sales fell slightly compared to 3Q13, due to lower volumes in Europe and lower sales of resilient and wood flooring in the Americas.

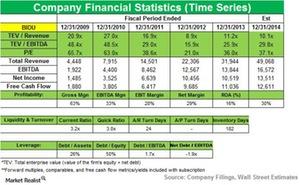

Maverick Capital lowers position in Baidu, Inc.

Maverick Capital lowered its position in Baidu, Inc. in 3Q14. The position accounts for 0.36% of the fund’s total portfolio in the third quarter.

Get Real: Misunderstood and Undervalued?

In today’s Get Real, we focused on Bill Ackman’s Berkshire Hathaway comments, Mexico’s major cannabis milestone, earnings season, and much more.

Understanding the Details of the Disney-Fox Deal

Yesterday, Walt Disney (DIS) gained control over most of 21st Century Fox’s (or 21CF’s) media and entertainment assets, including its film production and TV businesses, Hulu, and Star India.

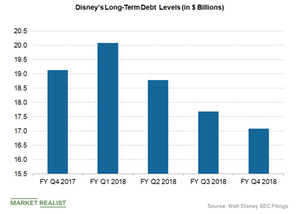

Why Did S&P Downgrade Disney’s Rating?

On March 12, S&P Global Ratings reportedly downgraded the Walt Disney Company (DIS) to an A from an A+.

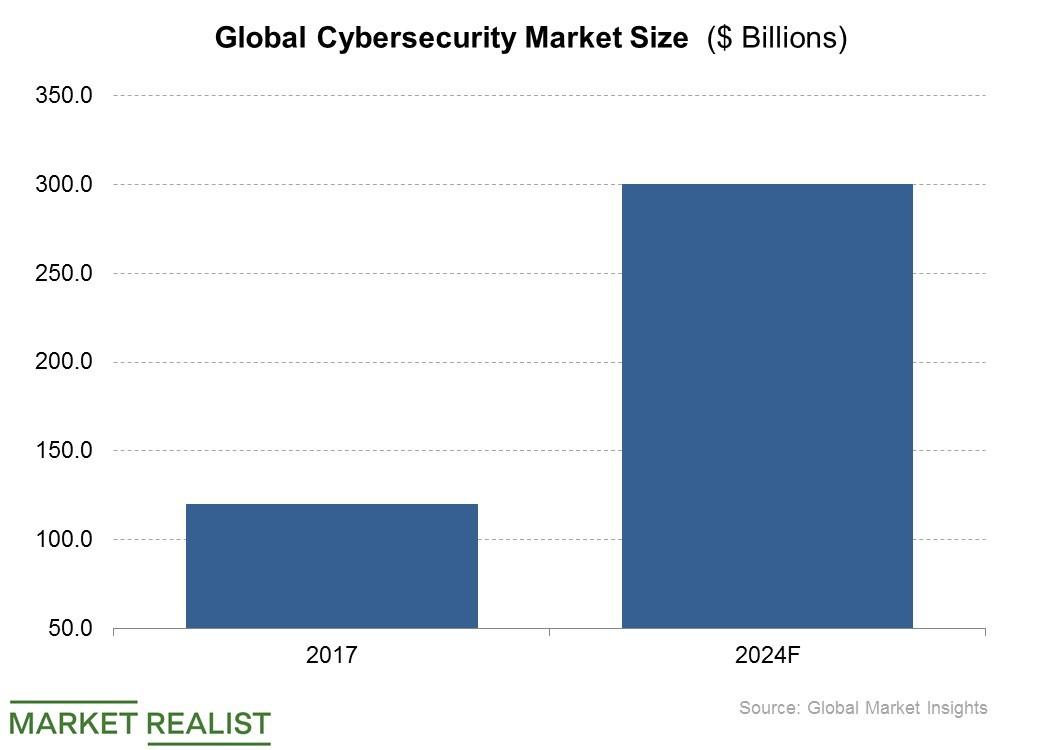

Where Does BluVector Fit in Comcast’s Strategy?

Comcast’s (CMCSA) recent purchase of cybersecurity company BluVector for an undisclosed amount looks like a promising opportunity for Comcast.

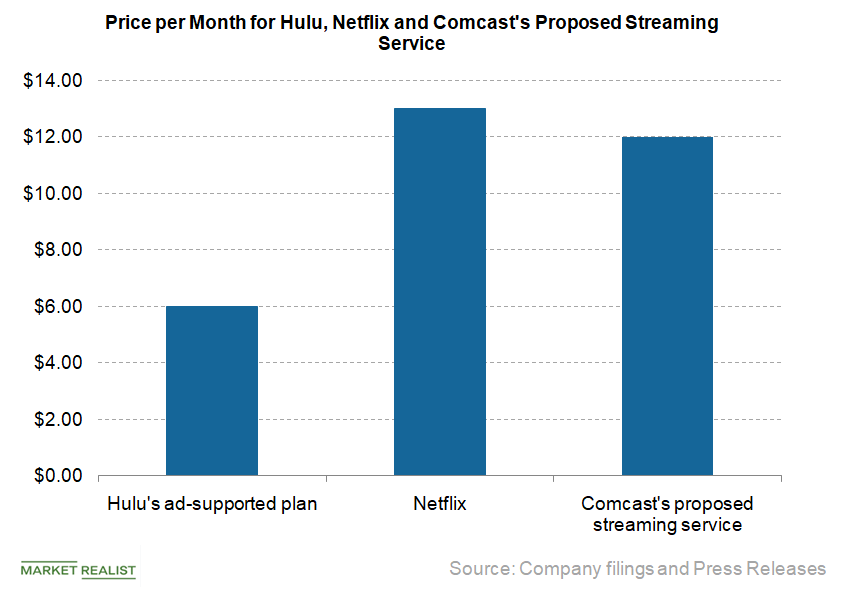

Why Hulu Changed Its Pricing Strategy

According to a Variety report from January 23, Hulu lowered the price of its ad-supported streaming plan from $7.99 per month to $5.99 per month.

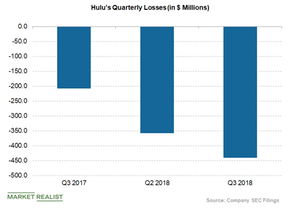

Why Is Hulu Posting Losses despite Its Strong Ad Revenue Growth?

According to Hulu, its 2018 advertising revenue rose 45%. Hulu is also adding subscribers and investing in original content and licensed series.

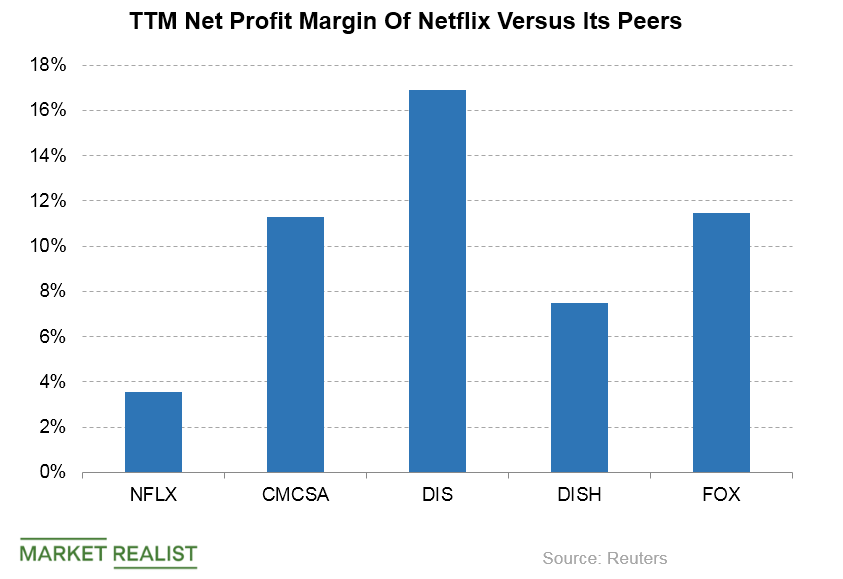

How Netflix’s Profitability Ratio Stacks Up with Peers

Netflix’s (NFLX) TTM (trailing-12-month) gross margin stands at 33.79% compared to the industry and sector average of 42.06% and 40.92%, respectively.

Looking at Disney’s Debt Load amid Fox Assets Acquisition

In June, the Walt Disney Company agreed to buy the media and entertainment assets of Rupert Murdoch–owned 21st Century Fox.

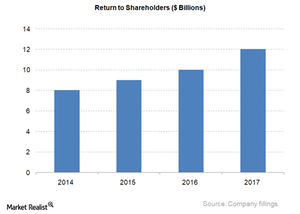

Why Disney Had to Discontinue Its Share Repurchase Program

Disney announced that it would not continue its share repurchase program until it completed its proposed acquisition of media assets from 21st Century Fox.

Take a Look at Netflix’s Competitive Landscape

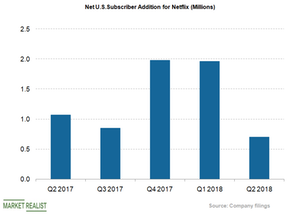

All the competition is hurting Netflix’s membership growth. In fiscal Q2 2018, it missed its subscriber guidance for the first time.

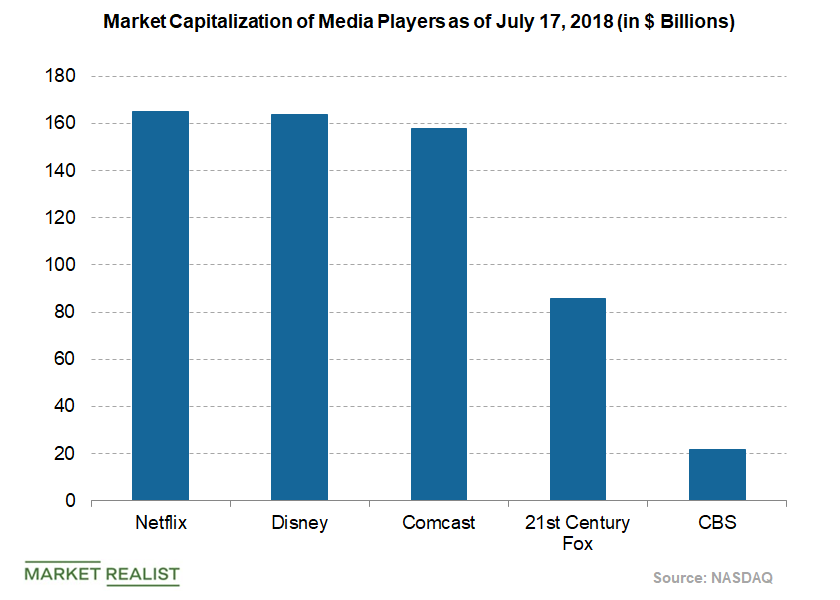

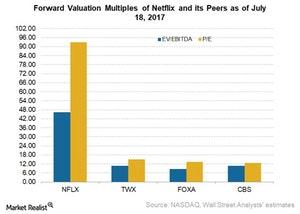

Where Netflix’s Valuation Stands among Its Peers

Netflix is now trading at a PE (price-to-earnings) multiple of 239.61x.

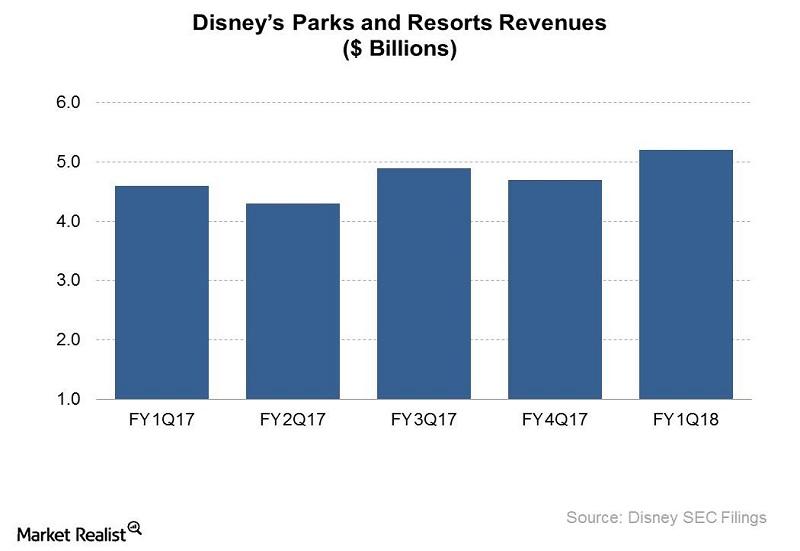

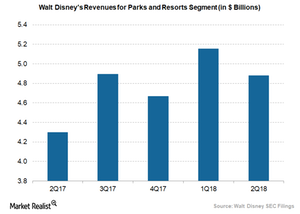

Why Disney Is Investing in Theme Parks

In fiscal 2Q18, Disney’s Parks and Resorts segment reported revenues of $4.9 billion.

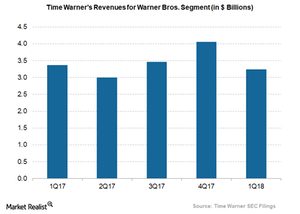

Understanding Time Warner’s Warner Bros. Revenue Trends

Time Warner’s (TWX) studio segment, Warner Bros., had a weak 1Q18, with both its revenue and operating income falling.

How Will the New Fox Look after the Disney Deal?

21st Century Fox (FOXA) will be left with news and sports assets after selling most of its assets to the Walt Disney Company (DIS) in a $52.4 billion deal.

How Will Disney Benefit from Its 21st Century Fox Acquisition?

Media behemoth the Walt Disney Company (DIS) has announced the purchase of another media company, 21st Century Fox (FOXA).

Understanding Walt Disney’s Deal with 21st Century Fox

In December 2017, the Walt Disney Company (DIS) announced its plans to buy some of the assets of 21st Century Fox (FOXA) for an equity value of ~$52.4 billion.

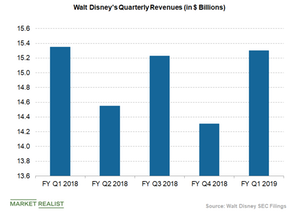

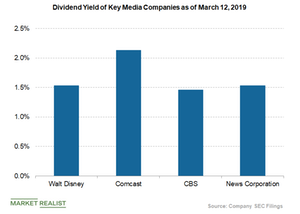

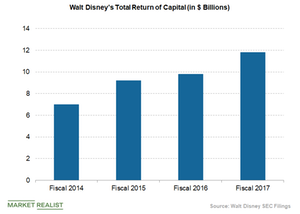

Disney’s Capital Return Policy Looks Attractive

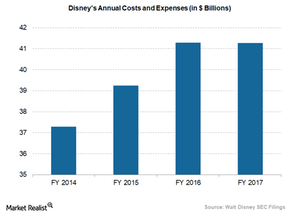

Capital return trends Leading media mogul The Walt Disney Company (DIS) has continued to improve its capital return policy, driven by attractive dividend payments and strong share repurchase programs. In fiscal 2017, the media giant returned ~$11.8 billion to shareholders via buybacks and dividend payments, compared with $9.8 billion in fiscal 2016. In fiscal 2018, the […]

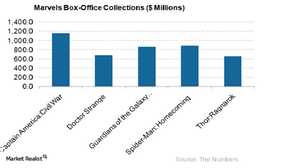

How the Marvel Acquisition Is Working out for Disney

Marvel acquisition helping film business The Walt Disney Company’s (DIS) acquisition of Marvel has worked out well for Disney, earning money for its Studio Entertainment segment. The latest flick, Thor: Ragnarok, has already collected more than $600 million worldwide. Blockbuster movie releases and other license fees have driven the company’s business and created a strong brand. The […]

Comparing Netflix’s Valuation Metrics with Its Peers

Netflix’s stock price closed at $183.60 on July 18. The company had a market capitalization of $79.4 billion on July 18 with an enterprise value of $81.8 billion.

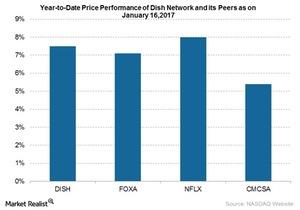

What Affects Dish Network’s Stock Price?

On January 13, 2017, Dish Network’s (DISH) stock closed at $62.27. In this series, we’ll explore Dish Network’s spectrum holdings and the broadcast spectrum auction.

What Is Netflix’s Content Licensing Strategy?

Content licensing is usually for a fixed number of years, and Netflix (NFLX) pays for an exclusive subscription video-on-demand (or SVOD) license for a given title.

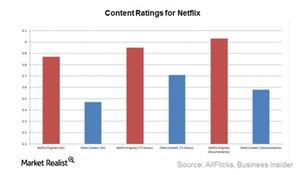

Netflix’s View: Original Content versus Content Licensing?

Original programming Netflix (NFLX) expects to spend ~$5 billion on content acquisition in 2016 and $6 billion on content in 2017. Currently, 10% of its content spending is on original content. The company would like to raise that amount to 50%. Netflix believes original content will strengthen its brand and drive up viewing hours. Netflix […]

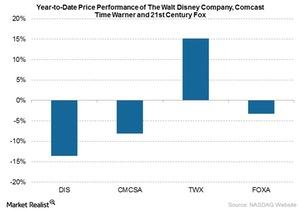

What Factors Could Be Impacting Disney’s Stock?

On November 2, 2016, The Walt Disney Company’s (DIS) stock closed at $92.39. The company’s stock price has fallen 13.6% year-to-date (or YTD) and 3.3% in the past three months.

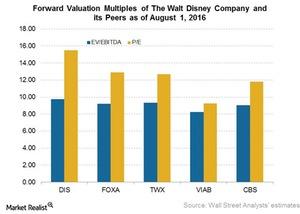

How Disney Is Managing Its Valuation Metrics

Disney stands out from its competitors in the media industry due to its large amount of intellectual property.

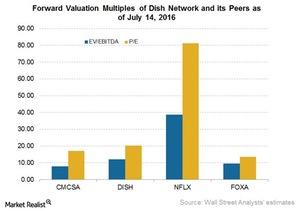

What are the Valuation metrics for Dish?

Valuation metrics In this part of the series, we’ll look at some key metrics investors can use to compare the values of media companies. Specifically, we’ll look at media valuation multiples. Some valuation metrics include the PE (price-to-earnings), EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization), PCF (price-to-cash flow), and PFCF (price-to-free […]

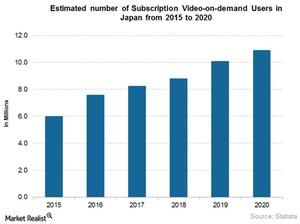

How Is Disney’s Acquisition Strategy Reaping Rewards?

On May 20, The Walt Disney Company announced that Marvel’s Captain America: Civil War was set to surpass $1 billion in earnings at the global box office.

How Could Foreign Regulations Impact Netflix?

Netflix and Amazon’s Prime Instant Video service could be forced to ensure that 20% of their content catalogs consist of European content.

What Is Disney’s Core Strategy for Its US Theme Parks Business?

The Walt Disney Company’s (DIS) theme parks and resorts business is doing extremely well in the United States.

Key Valuation Metrics for Disney: How Do They Compare?

Disney stands out from its competitors in the media industry because of its vast intellectual property.

Low Theatrical Revenues Pull Down Warner Bros. Revenue

Time Warner’s (TWX) Warner Bros. had revenues of $13 billion in fiscal 2015, up by 4% year-over-year. However, Warner Bros. had a 13% year-over-year decrease in revenues in fiscal 4Q15.Technology & Communications Must-know factors that could drive future growth at Disney

Disney considers itself a creative content company, and creative excellence is the key to its success. It expects to continue to invest both organically and inorganically.

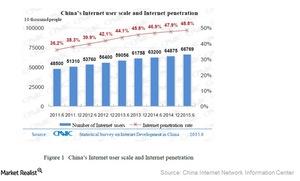

How Is Netflix Performing in Japan?

Netflix considers Japan to be a brand-sensitive market. Once it establishes its brand, it expects its connection with the Japanese audience to be long term.

Why Is Hulu Shying Away from International Markets?

Hulu CEO Mike Hopkins said at an industry conference in Cannes, France, that Hulu was not looking to expand into international markets any time soon.