How Netflix’s Profitability Ratio Stacks Up with Peers

Netflix’s (NFLX) TTM (trailing-12-month) gross margin stands at 33.79% compared to the industry and sector average of 42.06% and 40.92%, respectively.

Dec. 14 2018, Updated 3:45 p.m. ET

Profitability ratio

Netflix’s (NFLX) TTM (trailing-12-month) gross margin stands at 33.79% compared to the industry and sector average of 42.06% and 40.92%, respectively. Netflix’s five-year gross margin is 30.78%. Netflix’s TTM operating margin is 6.33%, whereas the industry and sector averages are 10.62% and 15.94%, respectively.

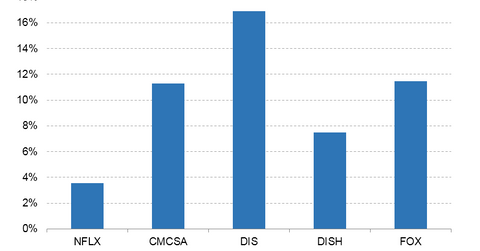

Netflix’s TTM net profit margin sits at 3.55% compared to industry average and sector average of 3.16% and 12.52%, respectively. Peers Comcast (CMCSA), Walt Disney (DIS), DISH Network (DISH), and 21st Century Fox (FOX) have TTM net profit margins of 11.28%, 16.92%, 7.47%, and 11.47%, respectively.

Its TTM EBITDA margin stands at 60.76%, while the five-year average is 56.92% compared to the industry average of 36.15%. The pre-tax margin for the trailing 12 months came in at 4% compared to the industry average of 11.04%. The five-year average margin stands at 3.28% compared to the industry average of 29.46%. Netflix’s TTM effective tax rate totals 11.07% compared to the industry average of 28.99%. The five-year average, on the other hand, is 25.98%.

Growth rates

In its most recent quarter, Netflix’s sales rose 32.31% YoY, while the industry’s sales grew 18.59% YoY and the sector’s grew 19.78% YoY. Netflix’s sales have grown 22.47% over the past five years, and the industry’s and sector’s have grown 19.59% and 4.97%, respectively. Netflix’s EPS grew 58.03% YoY, and its five-year EPS growth rate is -6.46%.

Efficiency

Netflix’s TTM revenue-to-employee ratio is 2,264,406x, and the industry and sector averages are 31,320,030x and 5,734,234x, respectively. Meanwhile, its TTM net-income-to-employee ratio is 80,464x, and the industry and sector averages are 5,784,142x and 611,296x. Netflix’s TTM asset turnover ratio is 0.72x.

Management’s effectiveness

Netflix’s TTM ROA (return-on-assets) ratio is 2.58x, while the industry and sector averages are 11.38x and 10.71x, respectively. Its five-year ROA ratio is 2.02x, and the industry’s and sector’s are 12.27x and 9.78x, respectively.

Netflix’s TTM ROI (return-on-investment) ratio is 3.82x, and its five-year average is 3.20x. Its TTM return-on-equity ratio is 13.10x.