Looking at Disney’s Debt Load amid Fox Assets Acquisition

In June, the Walt Disney Company agreed to buy the media and entertainment assets of Rupert Murdoch–owned 21st Century Fox.

Nov. 16 2018, Updated 10:30 a.m. ET

Disney’s acquisition of Fox’s assets

In June, the Walt Disney Company (DIS) agreed to buy the media and entertainment assets of Rupert Murdoch–owned 21st Century Fox (FOXA), including a 39% stake in London-based Sky Plc, for $71.3 billion. However, after Comcast (CMCSA) won the bid against Fox for a 61% stake in Sky, Disney and Fox decided to sell the remaining 39% stake in the European broadcaster to Comcast.

Disney now remains on track to purchase Fox’s film and TV assets, its cable networks such as FX Networks and Fox regional sports networks, its Fox Networks Group unit, and its stakes in National Geographic Partners, Indian satellite TV group Star India, Hulu, and others.

Disney’s debt load

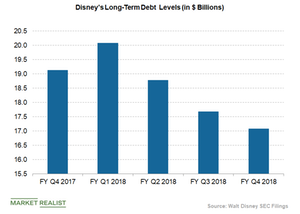

Disney’s debt load is high, as it’s buying Fox’s assets in a half-cash, half-stock transaction. Its cash-to-debt ratio is 0.20 as of September 30. Usually, a company can pay off its debt using cash in hand if the ratio is higher than 1. Disney’s cash and cash equivalents total $4.2 billion, whereas its long-term debt is ~$17.1 billion.

The company has terminated its share buyback program temporarily to utilize the amount for the acquisition of Fox’s media assets. Disney expects to resume share repurchases after it improves its cash-to-debt ratio and its credit rating.

The sale proceeds of a 39% stake in Sky should help Disney reduce its debt load and invest in its Disney+ direct-to-consumer offering. Fox and Disney have agreed to sell a 39% stake in Sky for ~11.6 billion pounds ($15.3 billion). Disney is also required to divest Fox’s regional sports networks, which could further reduce its debt.