Boston Properties, Inc.

Latest Boston Properties, Inc. News and Updates

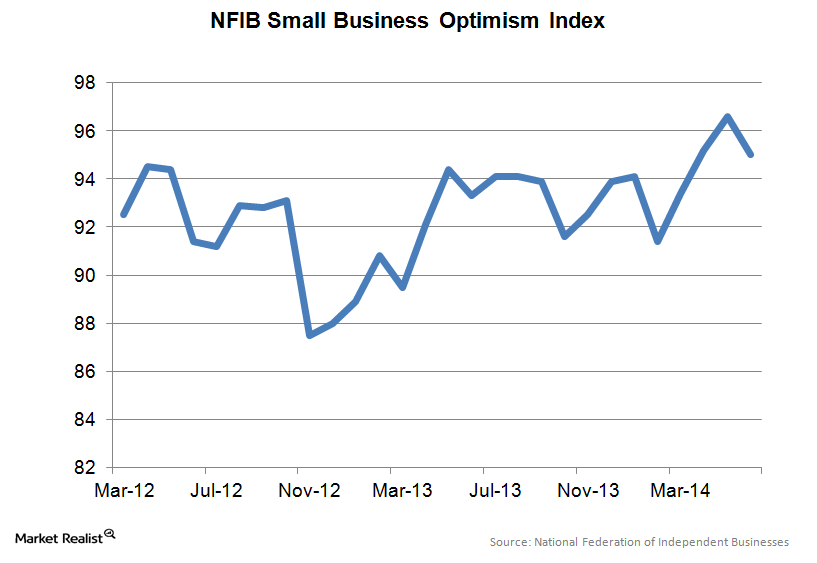

Why small business optimism continues to recover slowly

Small business accounts for roughly half of the U.S. gross domestic product (or GDP) and jobs.

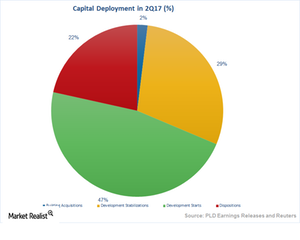

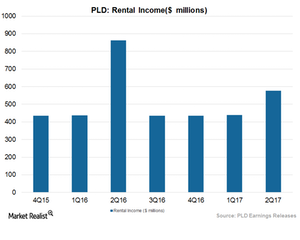

How Prologis Boosted Top-Line Growth in 2Q17

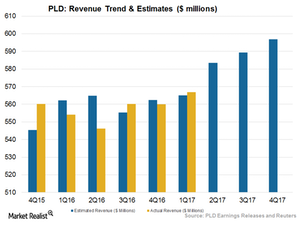

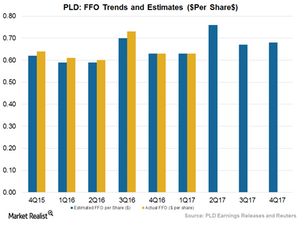

Prologis’s (PLD) upbeat top-line and bottom-line results in 2Q17 were driven by higher-than-expected rent growth and net operating income.

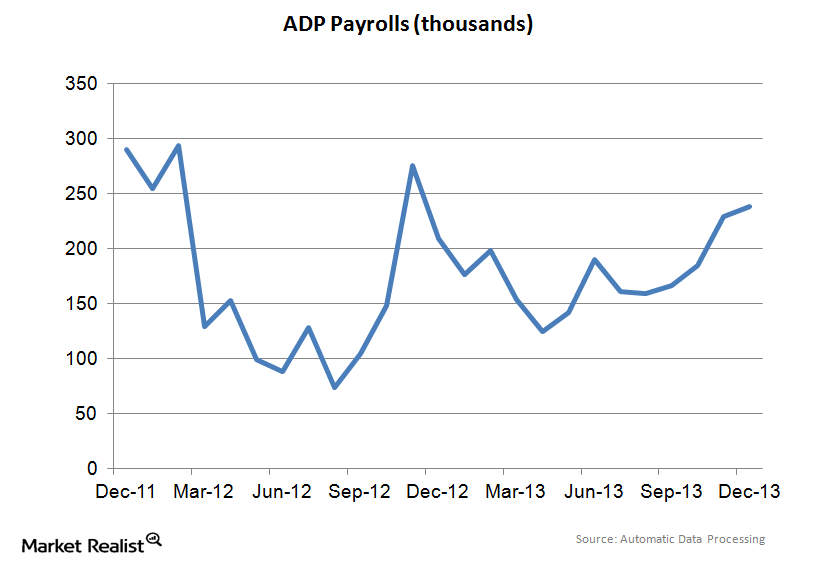

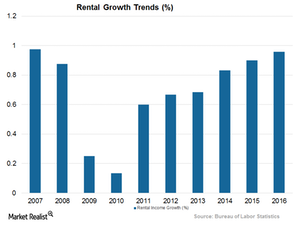

Jobs report shows hiring is picking up—good for commercial REITs

Private sector employment increased by 238,000 in December, while November’s numbers were revised upward from 215,000 to 229,000.

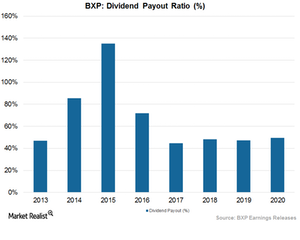

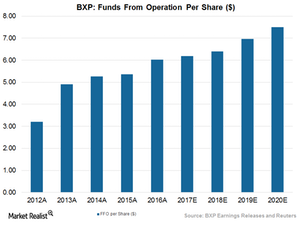

How Boston Properties Returns Value to Shareholders

In order to qualify as REITs (real estate investment trusts), companies usually have to pay 90% of their profits (excluding capital gains) as dividends.

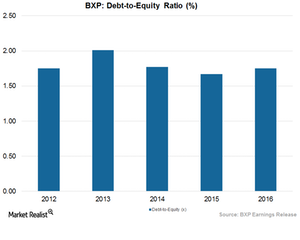

What’s Boston Properties’ Balance Sheet Position?

REITs depend on equity and debt for their working capital.

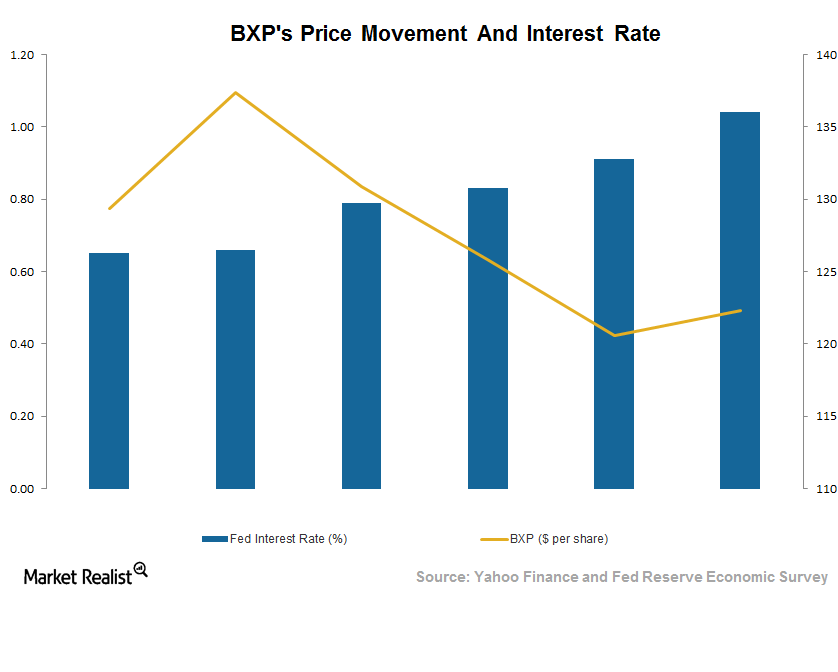

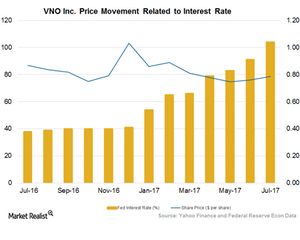

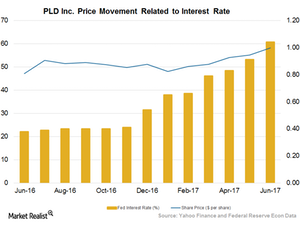

How Boston Property Is Flourishing despite Rising Interest Rates

Although it is a common belief that high interest rates are usually bad for REITs like Boston Properties (BXP), Simon Property (SPG), Prologis (PLD), and Vornado Realty Trust (VNO), we find that REITs have continued in their growth trajectory in the past few months.

Can Boston Properties Flourish amid Higher Interest Rates?

REITs have flourished for a considerable period in a record-low-interest-rate environment because they depend on debt and equity for their working capital.

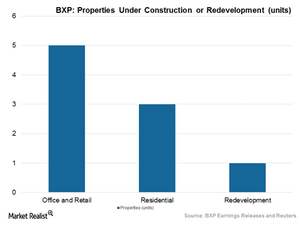

Boston Properties Maintained Profitability with Development Projects

BXP leased properties with a total area of 926,000 square feet in 2Q17.

Boston Properties Could Ride High on These Factors

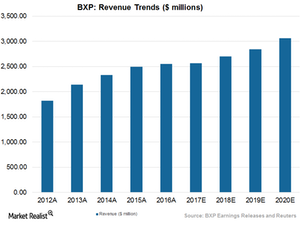

Boston Property (BXP) has strong business momentum and has been maintaining a decent growth trajectory for the past few years.

What Lies Ahead for Boston Properties in 2017?

Boston Properties raised its EPS (earnings per share) outlook for 2017 to a range of $2.72 to $2.77 per share.

How Did Boston Properties Fare in 1H17?

The growing economy has acted as a boon to REITs, and with the help of their strategic initiatives, these REITs have been able to take advantage of the opportunity and report higher revenue and profits.

Why Boston Properties Could Be Strong Enough to Combat Headwinds

Boston Properties’ recent upbeat results came on the back of higher leasing activity as well as strong occupancy levels, which led to revenue growth.

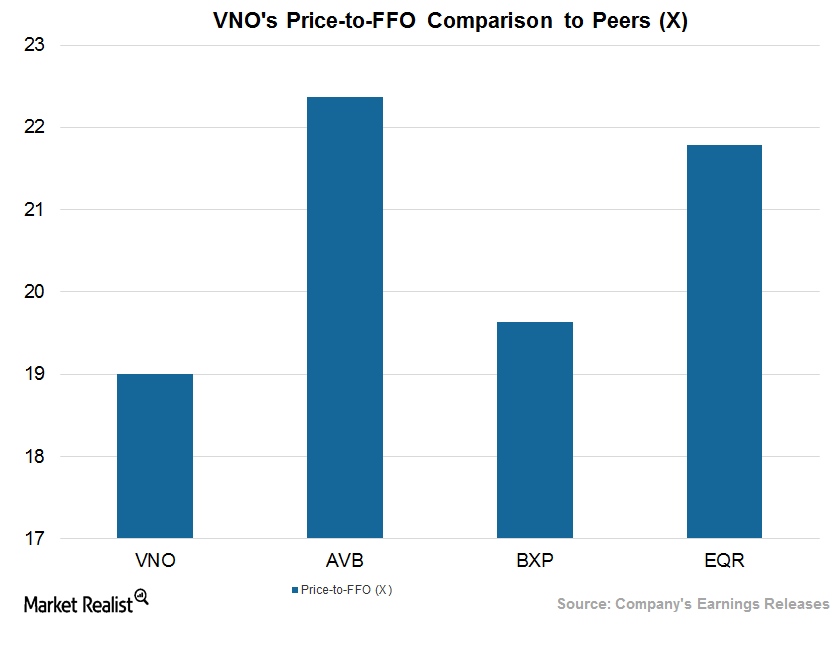

How Vornado Stacks Up against Peers

Vornado’s recent development and redevelopment activities have made investors optimistic about the stock.

Financing Helped Vornado Maintain Strong Balance Sheet in 2Q17

During 2Q17, Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results backed by growth in rent and occupancy level.

Did Vornado’s Cost Reduction Efforts Bear Fruit in 2Q17?

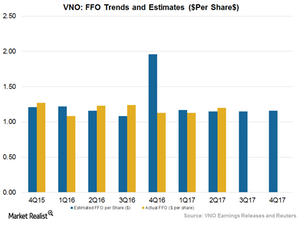

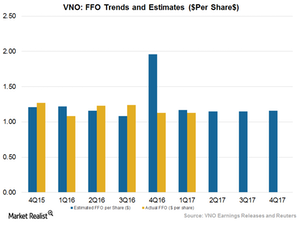

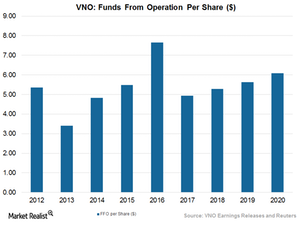

Vornado Realty Trust reported adjusted FFO (funds from operation) of $1.35 per share, which beat Wall Street estimates of $1.20 per share.

How Recent Disposition Activities Helped Vornado in 2Q17

Vornado Trust’s (VNO) top-line and bottom-line results improved year-over-year backed by higher rent growth and lower operational costs.

Project Development Spurred Vornado’s Growth in 2Q17

Vornado Realty Trust (VNO) reported decent results in 2Q17. Its top line and bottom line surpassed results from 2Q16 backed by higher rent and new lease activities.

Where Does Vornado Stand after 2Q17 Earnings?

Vornado Realty Trust (VNO) reported core funds from operation (or FFO) of $1.35 per share in 2Q17, which surpassed Wall Street estimates of $1.20 per share.

How Vornado’s New York Office Segment Performed in 2Q17

Vornado Realty Trust (VNO) reported higher year-over-year top-line and bottom-line results during 2Q17 backed by higher rent growth, lower costs, and new leases during the quarter.

Vornado’s New Leases Drove Revenue in 2Q17

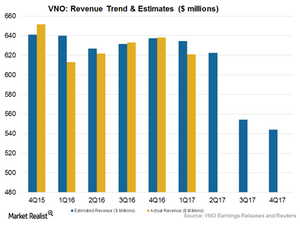

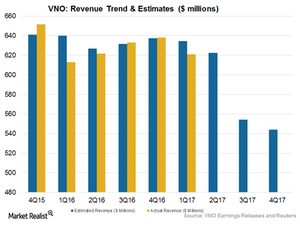

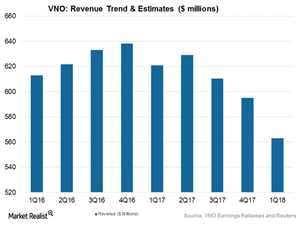

VNO posted rental revenue of $626 million in 2Q17, missing Wall Street’s estimates of $633.2 million.

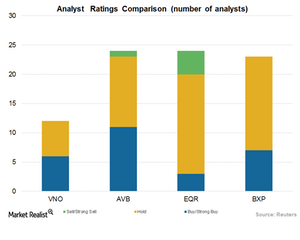

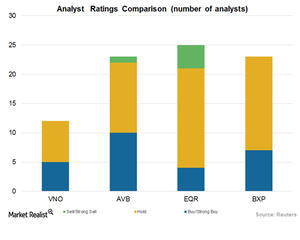

How Wall Street Analysts Rate Vornado

Analysts assigned VNO a mean price target of $89.52, 13.8% higher than its current price level.

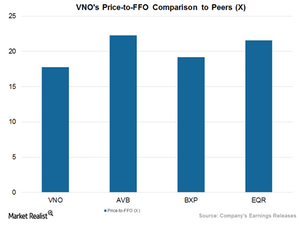

How Vornado Stacks Up against Other Industry Players

VNO’s current price-to-FFO multiple is 17.77x. The company has been able to return value to its shareholders consistently in the form of dividends and share repurchases.

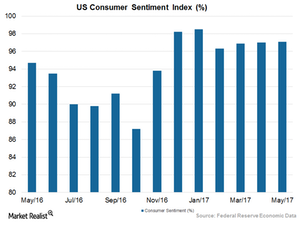

Will Vornado Benefit from a Growing Economy in 2Q17?

Although Vornado Realty Trust (VNO) may witness lower margins during a higher interest rate environment, it may see significant growth in the near future.

How Macro Issues Could Affect Vornado in 2Q17

Wall Street expects Vornado Realty Trust (VNO) to post flat year-over-year top-line and bottom-line results in 2Q17.

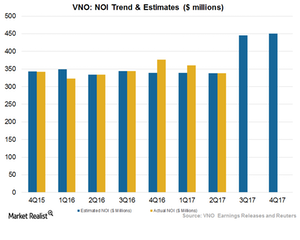

Will Vornado’s Project Streamlining Drive Net Operating Income?

Wall Street analysts expect Vornado Realty Trust (VNO) to report net operating income of $338.1 million in 2Q17.

How Vornado’s Revenue Could Benefit from Strategic Initiatives

Analysts expect Vornado Realty Trust (VNO) to report revenues of $622.3 million for 2Q17 when it releases its earnings on July 31, 2017.

What’s in Store for Vornado’s 2Q17 Earnings?

Vornado Realty Trust (VNO) is scheduled to report its 2Q17 earnings on July 31, 2017.

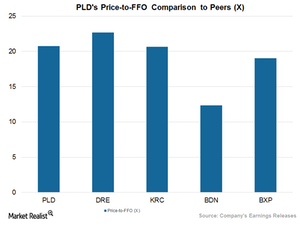

How Prologis Stacks Up against Peers after 2Q17 Earnings

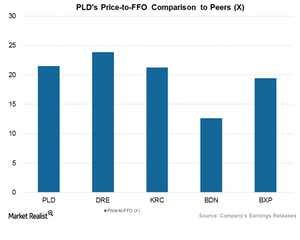

The price-to-FFO multiple is the best way to evaluate Prologis (PLD).

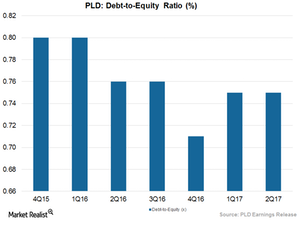

How Prologis Improved Its Balance Sheet

Prologis maintained a debt-to-equity ratio of 0.75x for 2Q17, which was lower than the industrial mean of 1.07x.

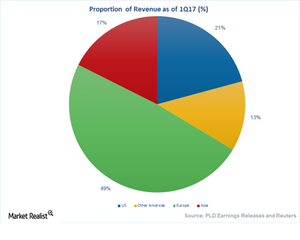

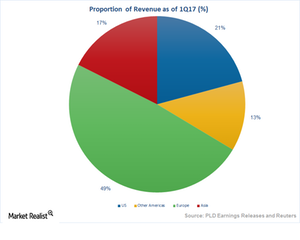

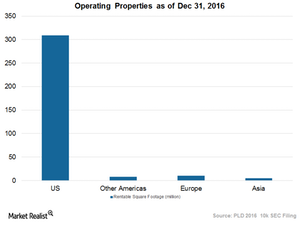

Robust US Business Growth Helped Prologis in 2Q17

Prologis’s (PLD) properties are spread across the globe. This geographical diversity ensures that the company gets the optimum value from the retail and supply chains in different parts of the world.

Prologis’s Strong 2Q17 Results Backed by Rent Growth

Prologis (PLD) reported better-than-expected 2Q17 top-line and bottom-line results.

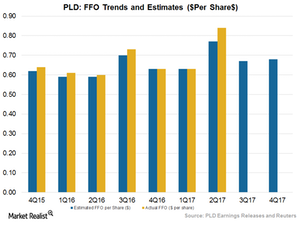

Where Does Prologis Stand after 2Q Earnings?

Prologis (PLD) reported core funds from operation (or FFO) of $0.84 per share in 2Q17, which surpassed Wall Street’s estimates of $0.77 by a remarkable 9.1%.

Where Does Prologis Stand among Its Peers?

In terms of price-to-FFO multiple, PLD trades at par with most of its peers except Brandywine Realty Trust (BDN).

Will Prologis Be Able to Turn Macro Issues to Its Advantage?

In addition to Prologis’s strategic initiatives such as acquisitions, dispositions, and project development activities, several macroeconomic factors also impact performance.

The Factors behind Prologis’s Expected 2Q17 Upbeat Results

Wall Street expects Prologis to report adjusted FFO (funds from operations) of $0.76, a 27.3% rise year-over-year.

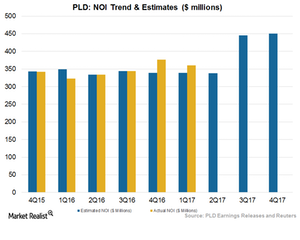

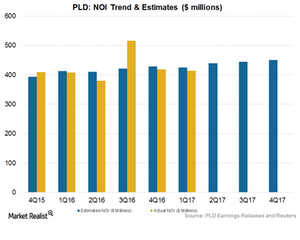

Can Prologis’s Cost Reductions Drive Net Operating Income Higher?

According to Wall Street analysts, Prologis (PLD) is expected to report NOI (net operating income) of $440.2 million in 2Q17.

Prologis’s Main Revenue Drivers in 2Q17

Prologis (PLD) is expected to see higher revenue growth as well as higher margins for 2Q17.

Will Prologis Ride High on Its Top Line in 2Q17?

Analysts expect Prologis (PLD) to report revenue of $583.5 million for 2Q17 when it releases its earnings on July 18, 2017.

What’s in Store for Prologis in 2Q17?

Prologis (PLD) is scheduled to report its fiscal 2Q17 earnings on July 18. 2017. Analysts expect it to report adjusted FFO (funds from operations) of $0.76.

How Wall Street Analysts Rate Vornado Realty Trust

Analysts assigned VNO a mean price target of $108.18, which is 12.9% higher than its current price level.

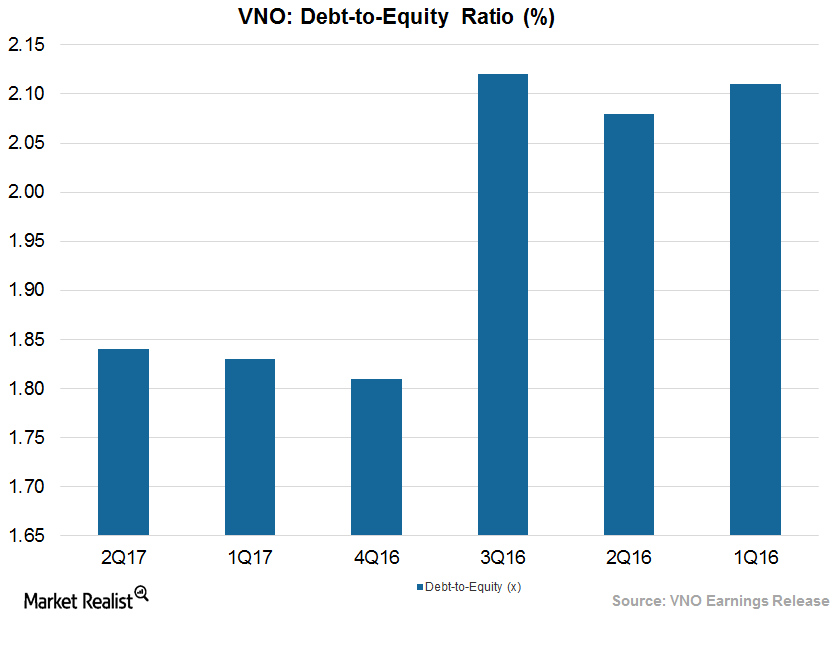

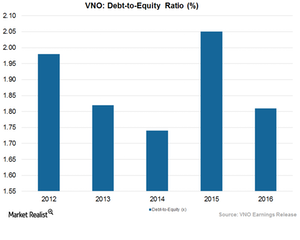

How Well Does Vornado Leverage Its Balance Sheet?

Vornado Realty Trust’s (VNO) total debt-to-total-equity ratio was 153.8%.

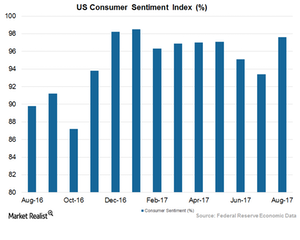

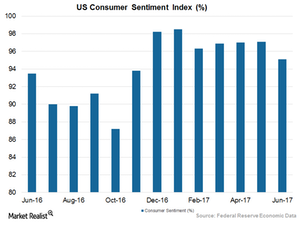

Vornado amid the Economic Transition under President Trump

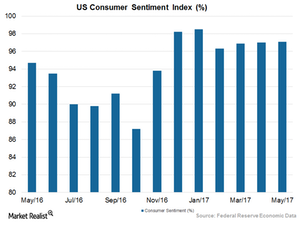

According to the University of Michigan, the June 2017 consumer sentiment index gained 1.7% year-over-year, standing at 95.1%.

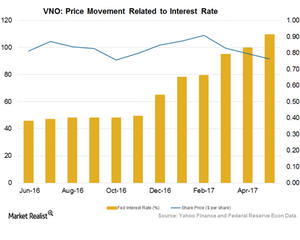

The Fed’s Interest Rate Hike—A Challenge for Vornado Realty Trust

After increasing interest rates in December 2016, the Fed hiked rates in March and June 2017 by 0.25%.

Vornado Realty Trust—Development, Redevelopment, and Occupancy

Vornado Realty Trust (VNO) invested in developing a high-demand office property in Highline at 512 West 22nd Street in Manhattan, which covers 173,000 square feet.

Vornado Realty Trust Works to Streamline Its Operations

Vornado Realty Trust (VNO) disposed of its 32.7% stake in Toys “R” Us and Urban Edge Properties as part of its strategy to concentrate on its core business.

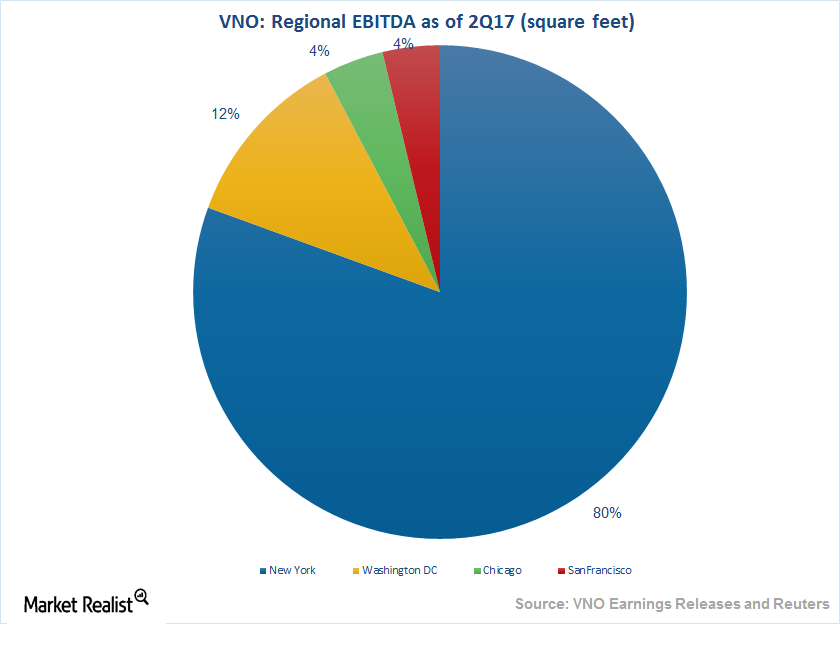

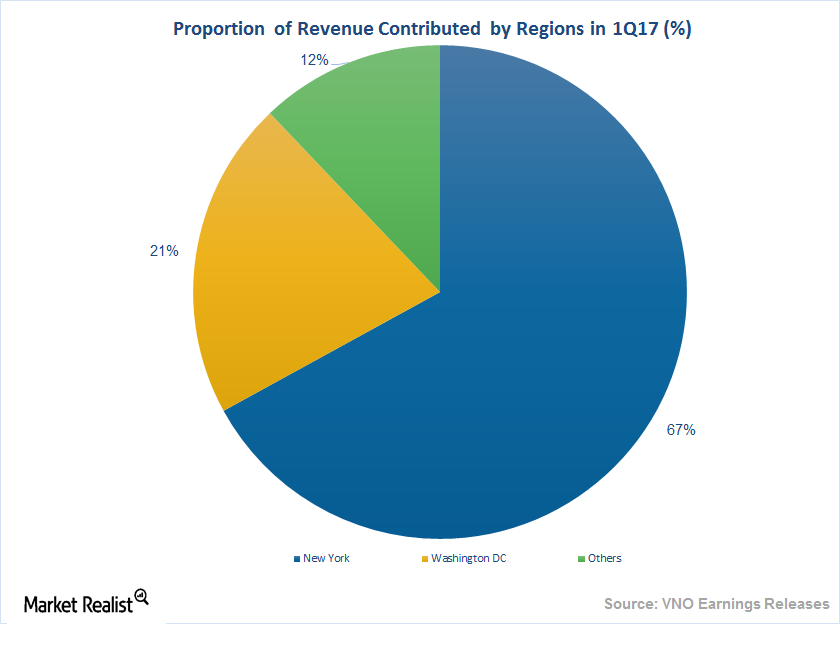

A Look at Vornado’s Top-Line Performance

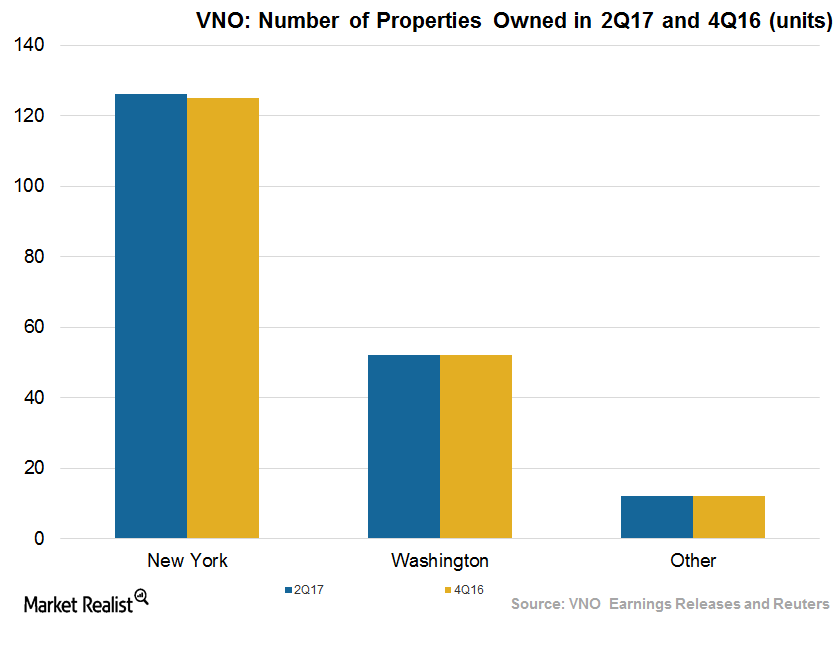

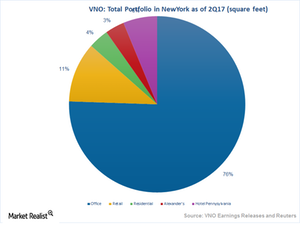

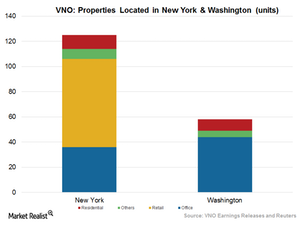

Vornado Realty Trust (VNO) is in talks to finalize the tax-free spinoff of its business in Washington, D.C. VNO expects to concentrate solely on its New York business after the spinoff.

Vornado Realty: A Commercial REIT Thriving amid a Retail Crisis

Vornado Realty Trust (VNO) is selling off its non-performing assets and focusing on its core business in a move to improve its profitability. Analysts are encouraged by Vornado’s strategy of optimizing its profits.

Why Prologis’s Business Model Promises Consistent Profitability

Prologis is expected to achieve a growth rate of 6%, 5.8%, 9.1% and 8.7%, respectively, in AFFO (adjusted funds from operations) over the next four quarters.

Kilroy Realty Corporation: What Does it Do?

Kilroy Realty Corporation (KRC) was founded in 1996 by John B. Kilroy Jr.

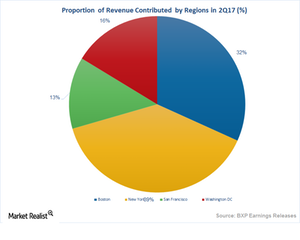

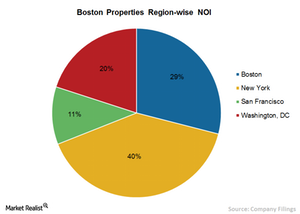

Making Sense of Boston Properties’ Geographically Concentrated Portfolio

Boston Properties concentrates on some of the highest-growth markets in the US, including Boston, New York, San Francisco, and Washington, D.C.