Exxon Mobil Corporation

Latest Exxon Mobil Corporation News and Updates

President Biden Threatens a Windfall Tax on Oil Companies — Here's How It Works

President Biden has urged Congress to approve a windfall profits tax on oil companies that reported record profits recently. Would a windfall tax help bring down gas prices?

Darren Woods: What's the ExxonMobil CEO's Current Net Worth?

Darren Woods has worked at ExxonMobil for decades and has been the CEO since 2017. He has a significant net worth after five years at the helm of the oil giant.

How Do Oil Companies Become Carbon Neutral?

ExxonMobil says that it wants to reach net zero carbon emissions by 2050. How do oil companies become carbon neutral? Here's the complete process.

Certain Stocks Jumped Post-Katrina, Influenced by Economic Factors

Hurricane Katrina decimated New Orleans in 2005. What stocks soared following the natural disaster? How did certain economic factors impact the stocks?

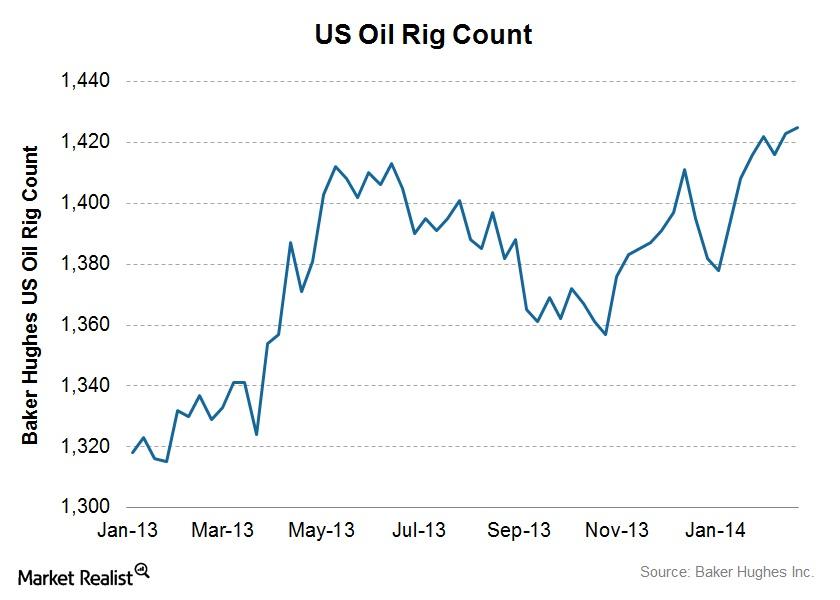

US oil rig counts continue to rally, reaching a year-to-date high

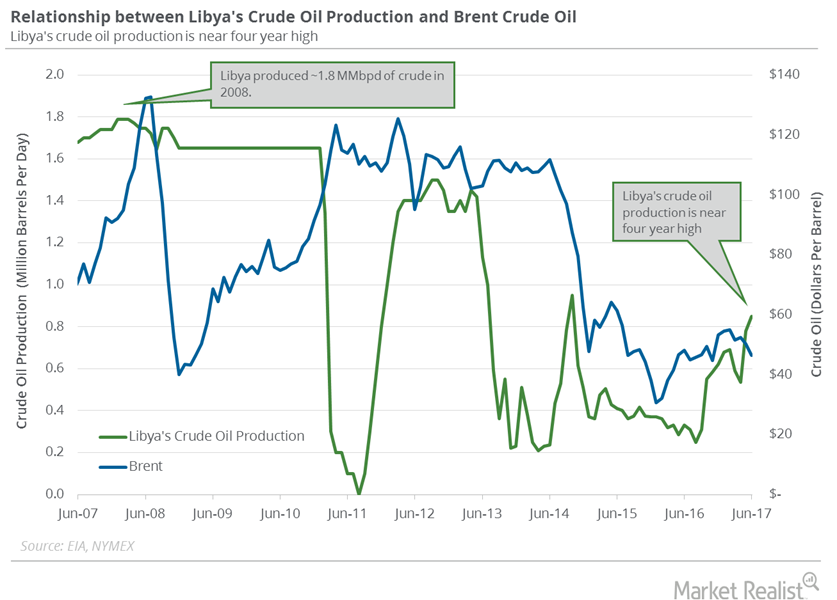

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began.Energy & Utilities Why improvement in Libya pushed down the crude price last week

For most of the last two years, WTI crude oil has been range-bound between ~$85 per barrel and ~$110 per barrel.

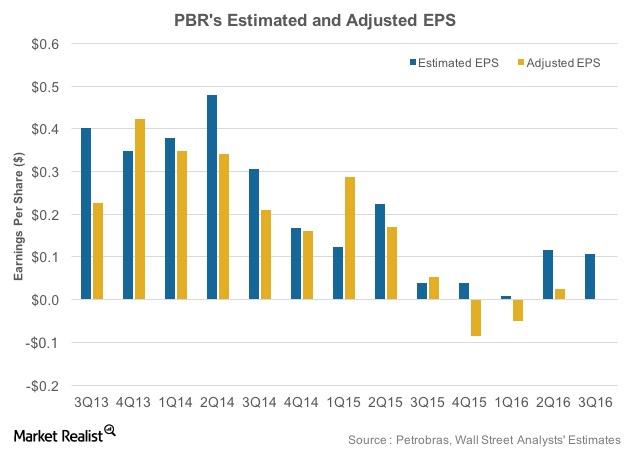

Petrobras’s Upcoming 3Q16 Results: Where Are Earnings Headed?

Petrobras (PBR) is expected to post its 3Q16 results on November 10, 2016. In 2Q16, it had adjusted EPS of $0.03 compared to analysts’ estimates of $0.12.

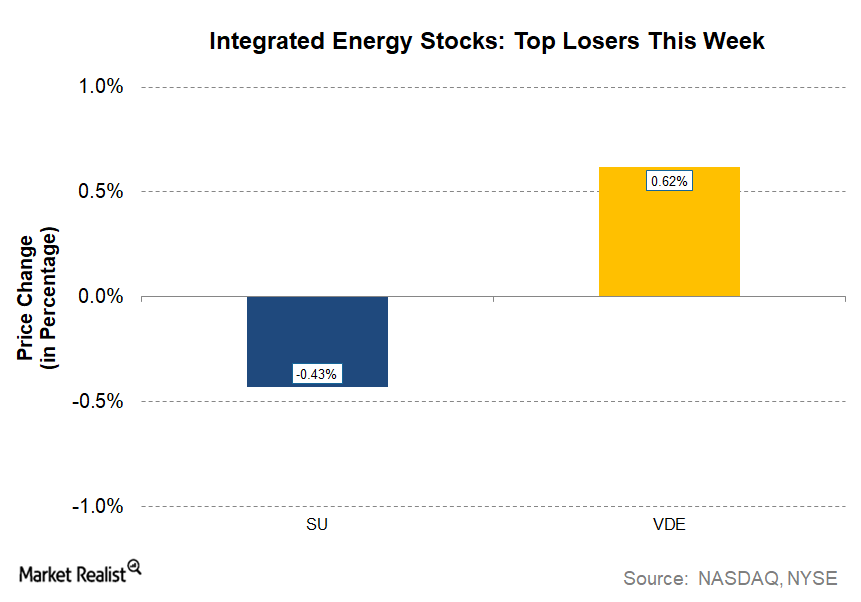

Suncor Energy: The Only Integrated Energy Loser This Week

Suncor Energy (SU) is the only losing stock in the current week from the integrated energy sector. It fell from last week’s close of $34.67 to $34.52 on October 11, 2017.

US Stock Indices Plunge after Oil Prices Rebound

The three US equity indices that we review in this weekly series fell from December 8 to December 15, 2015, after a rebound in oil prices.

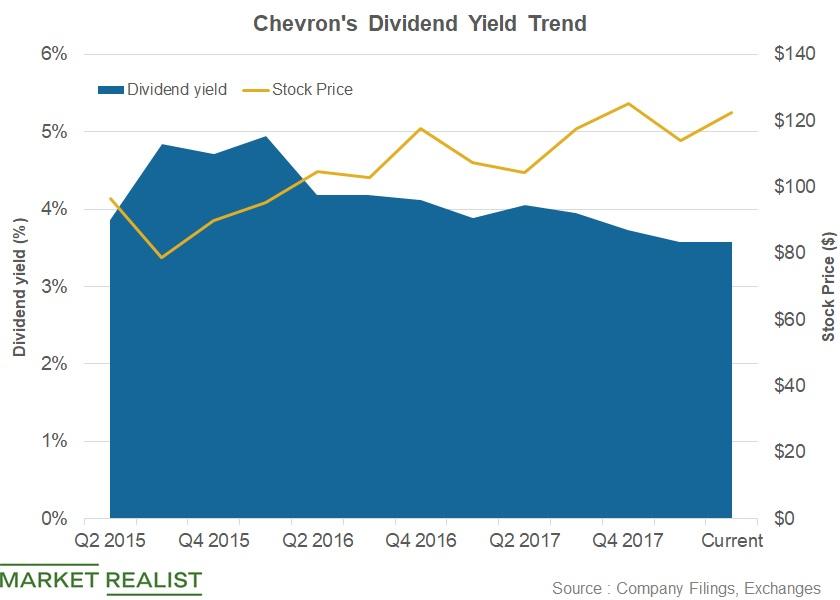

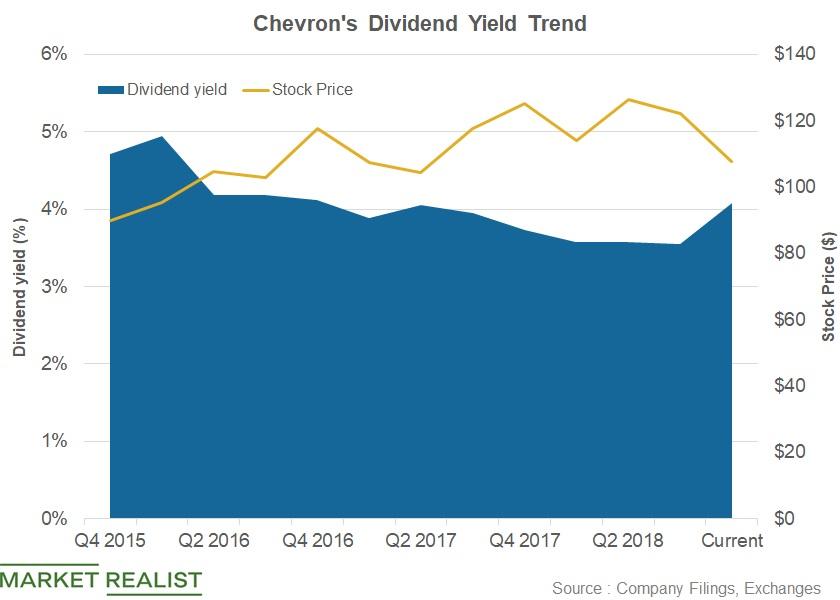

Chevron’s 3.6% Dividend Yield Ranks Sixth with High Valuations

Chevron (CVX) is the sixth stock on our list of the top eight dividend-yielding stocks.

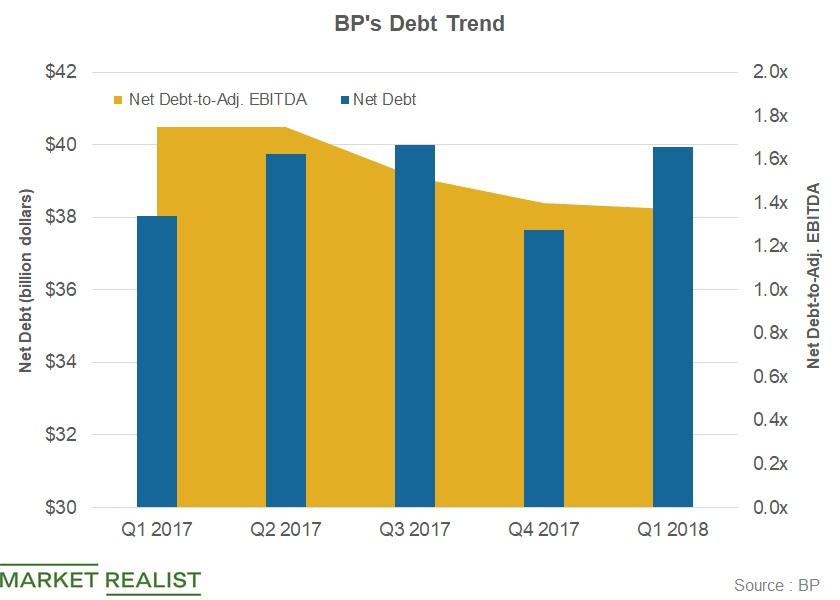

How BP’s Debt Position Compares

In this part, we’ll review whether BP’s (BP) debt position has improved. Let’s begin by comparing BP’s debt position with peers’.

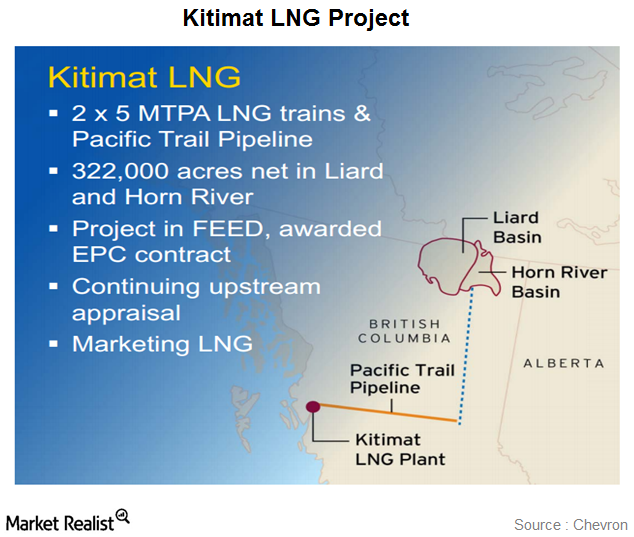

Why Chevron is cutting spending on some projects

Chevron has cut spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

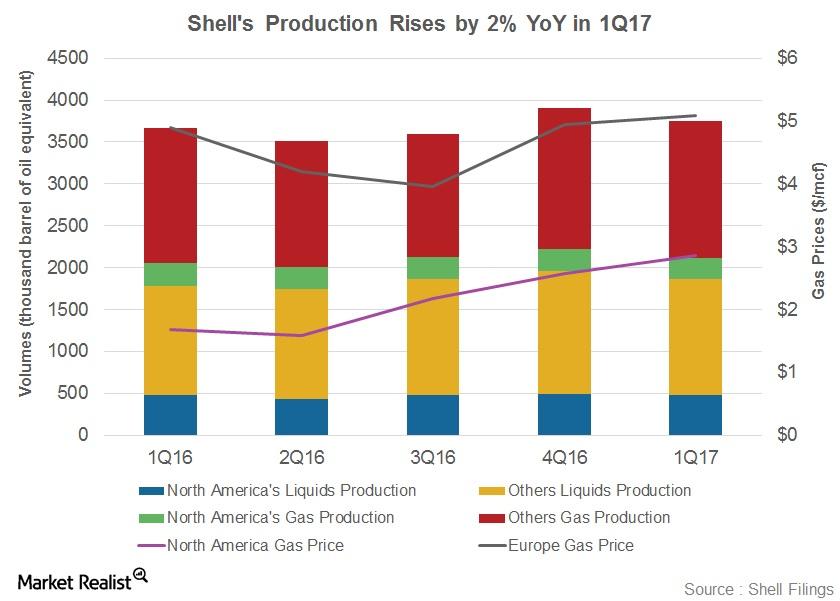

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

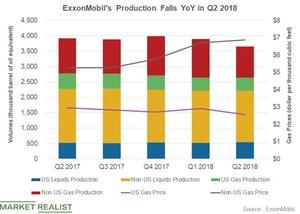

How Was ExxonMobil’s Upstream Performance in Q2 2018?

ExxonMobil (XOM) produced 3.7 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in the second quarter.

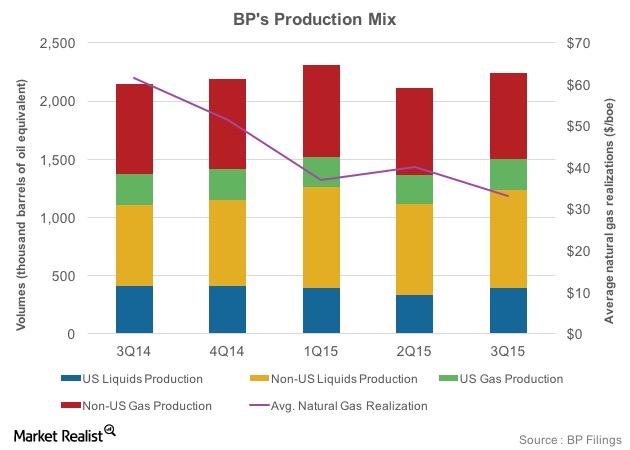

BP’s Upstream Segment: Large Upcoming Gas Projects

BP has a strong pipeline of projects in its upstream portfolio. These projects are expected to result in 800,000 barrels per day of new production by 2020.

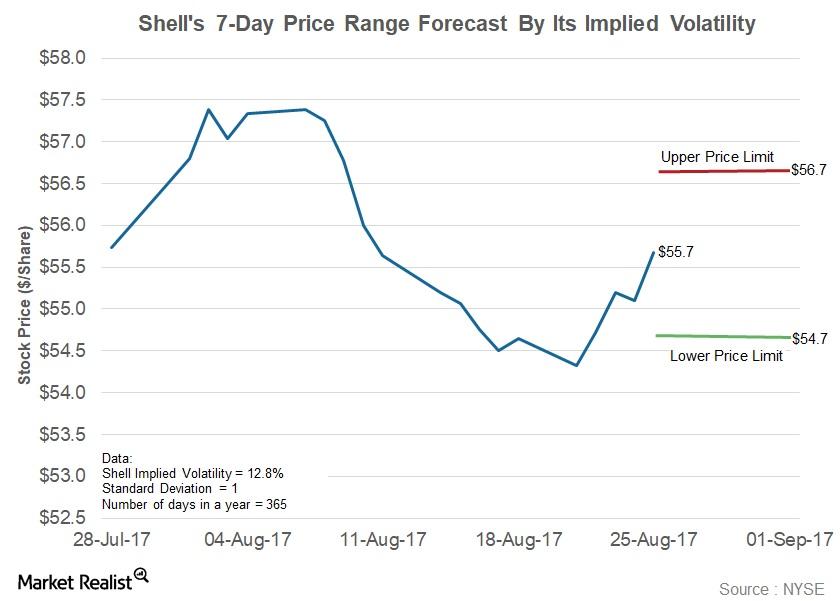

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.

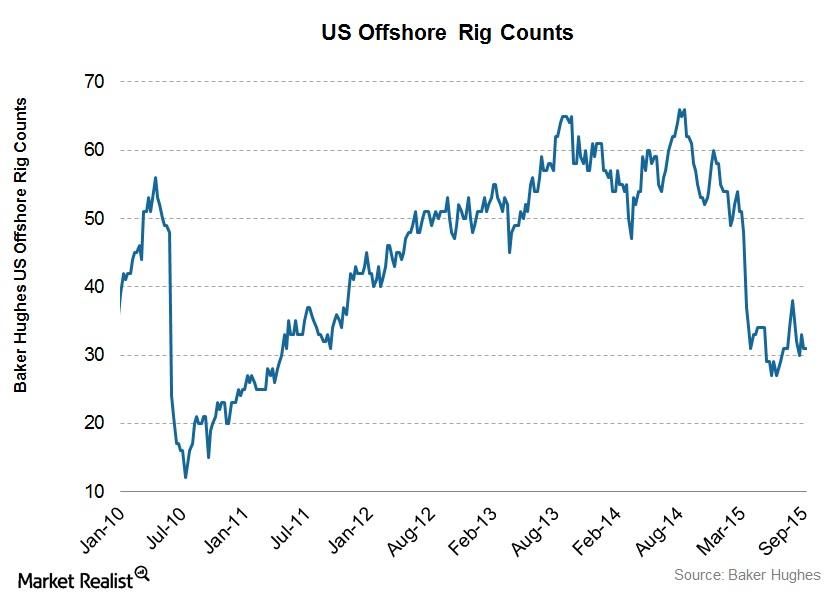

US Offshore Rig Count Was Steady in the September 18 Week

In the week ending September 18, 2015, the US offshore rig count didn’t change. The offshore rig counts have averaged 33 over the past eight weeks.

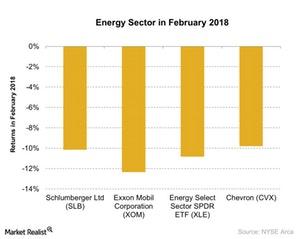

What Put Pressure on the Energy Sector in February 2018?

The US energy sector was badly affected by the recent market sell-off in February 2018.

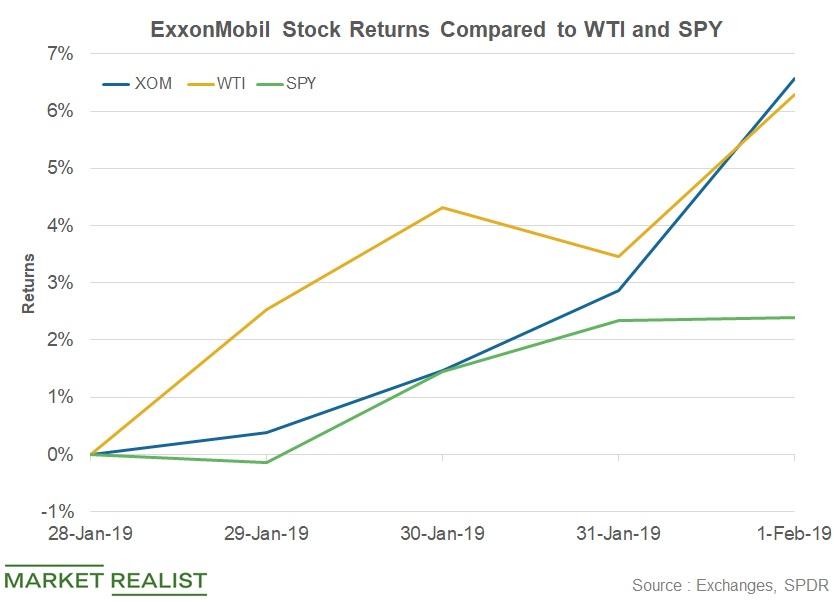

ExxonMobil Stock Rose 4% after Its Q4 Earnings

ExxonMobil (XOM) announced its fourth-quarter earnings on February 1. ExxonMobil stock opened at $74.9 per share on February 1.

Chevron Ranks Second-Last in Terms of Its Dividend Yield

In terms of its dividend yield, Chevron (CVX) is the fifth-best performer among the six stocks under review.

Why oil prices spiked on tensions in Gaza and Ukraine

Early last week, WTI crude oil had eased to close to $99 following Libya’s restarting exports from major ports and abating fears over supply disruptions in Iraq.

How Is ExxonMobil’s Upstream Portfolio Positioned?

Before we review ExxonMobil’s key growth assets, let’s briefly look at the company’s production expectations for the current year.

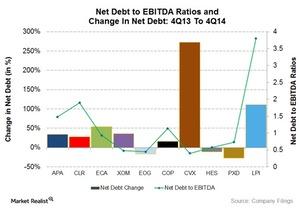

Who’s the energy company achiever, and who are the laggards?

Let’s see which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios and which ones are laggards.

Why ExxonMobil and Chevron Should Merge

ExxonMobil and Chevron have both faced harsh business conditions in 2020. Should ExxonMobil and Chevron merge during the downturn?

Is ExxonMobil Stock a Good Buy at These Prices?

So far this year, ExxonMobil stock has fallen over 41 percent. Is XOM stock a buy or sell at these prices?

Must-Know: World’s Top Oil Companies by Production

The US, Saudi Arabia, and Russia are the world’s top three crude oil producers. Let’s take a look at the world’s top oil players by production volumes.

XOM, CVX, RDS.A, BP: Are They Underperforming the S&P 500?

So far in 1Q18, Chevron (CVX) stock fell 13.9%, the highest among its peers ExxonMobil (XOM), BP (BP), and Royal Dutch Shell (RDS.A).

An Overview of US LNG Production and Exports

Investors may be seeing a lot of reports about rising US LNG (liquefied natural gas) exports. Let’s review the basics of LNG.

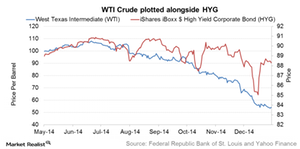

Crude Oil Prices Rally Due to Short Covering

WTI (West Texas Intermediate) crude oil futures contracts for January delivery rose slightly by 0.4% and closed at $43.04 per barrel on Wednesday.

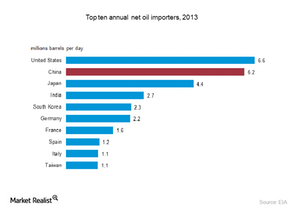

Who will drive crude oil consumption?

Current lower oil prices and growth from China, India, the United States and Asia Pacific countries will drive crude oil consumption in the long term.

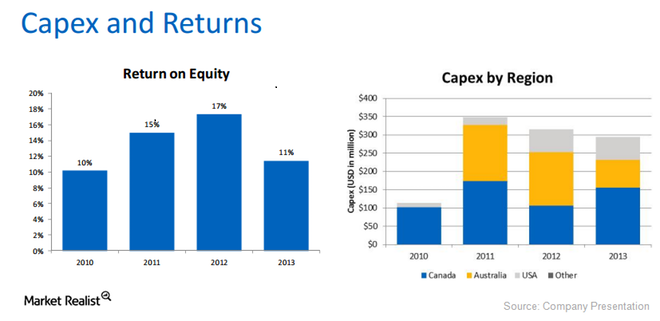

Civeo impacted by customers’ plans to trim capital spending

Civeo said the demand for its services depends on its customers’ capital spending programs. As a result, it’s one of the first to suffer losses when oil drillers pare back exploration.

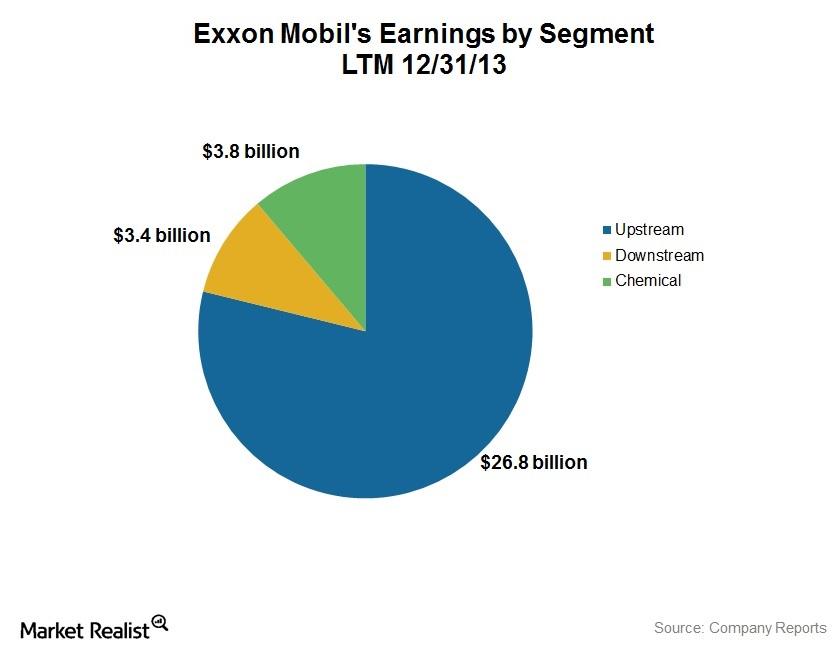

An essential guide to Exxon Mobil: XOM’s major areas of operation

Exxon Mobil has three major business segments: Upstream, Downstream, and Chemical. Upstream contributes the most to XOM’s earnings.

Exxon Mobil wins $1.6 billion in arbitration case against Venezuela

Exxon Mobil alleged that the Venezuelan government illegally expropriated its Venezuelan assets in 2007 and paid unfair compensation.

China’s Economic Data Might Drag Oil Prices

On December 14, China reported the November industrial output growth at 5.4% on a year-over-year basis—the lowest growth since early 2016.

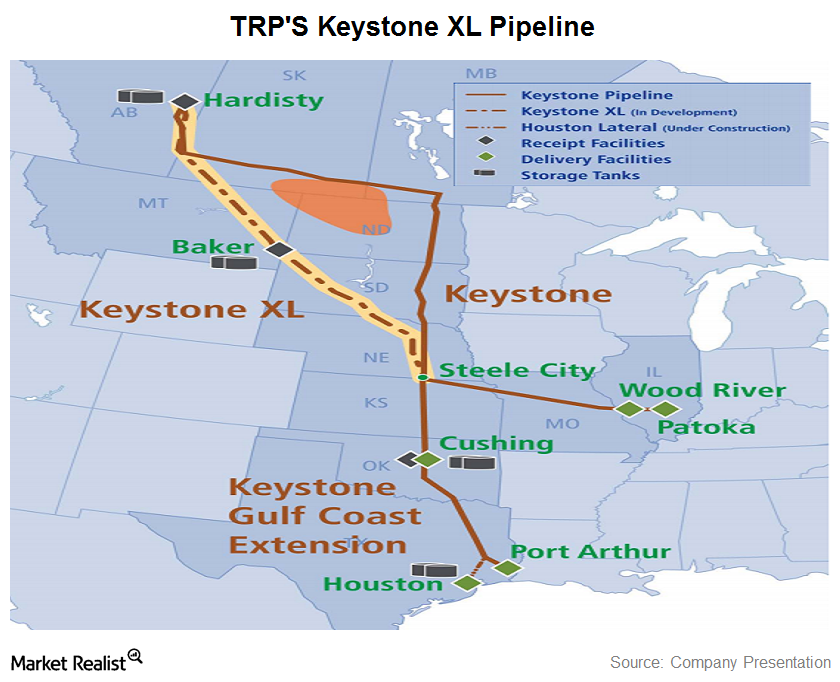

TransCanada’s controversial Keystone XL Pipeline project

The Keystone XL Pipeline project is a proposed 1,179-mile pipeline. It begins in Alberta, Canada and extends south to join the existing Keystone Pipeline in Steele City, Nebraska.

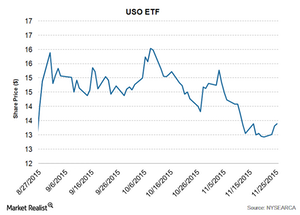

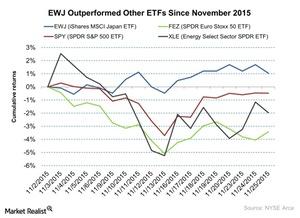

Overall Snapshot of the Market on November 25

On November 25, the SPDR S&P 500 ETF closed on a flat note ahead of the holiday. It closed at $209.3. The Energy Select Sector SPDR ETF fell by 0.81% on the day.

Crude Oil Prices Rally despite the Iran Nuclear Accord

NYMEX-traded WTI (West Texas Intermediate) crude oil futures contracts for August delivery rose by 1.10% and settled at $53.04 per barrel on July 14, 2015.

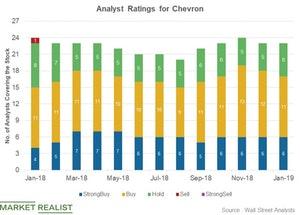

Goldman Sachs Favors Chevron Compared to ExxonMobil

Chevron and ExxonMobil stocks have provided almost flat returns in the current quarter. As a result, Goldman Sachs favors Chevron over ExxonMobil.

Stocks versus ETFs: Which Should Investors Choose?

Every investor faces some tough choices. Should you turn to stocks, exchange-traded funds (ETFs), index funds, mutual funds, or bonds?

Natural Gas Prices: What Could Happen on January 24?

On January 24, at 5:39 AM EST, natural gas prices have risen 1.7% from the last closing level.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).

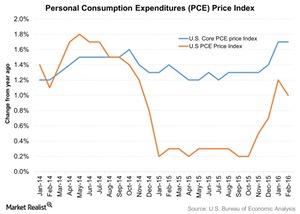

What Do the PCE Price Index and Break-Even Inflation Indicate?

The PCE price index is the Federal Reserve’s preferred measure of inflation because it covers the broadest set of goods and services.

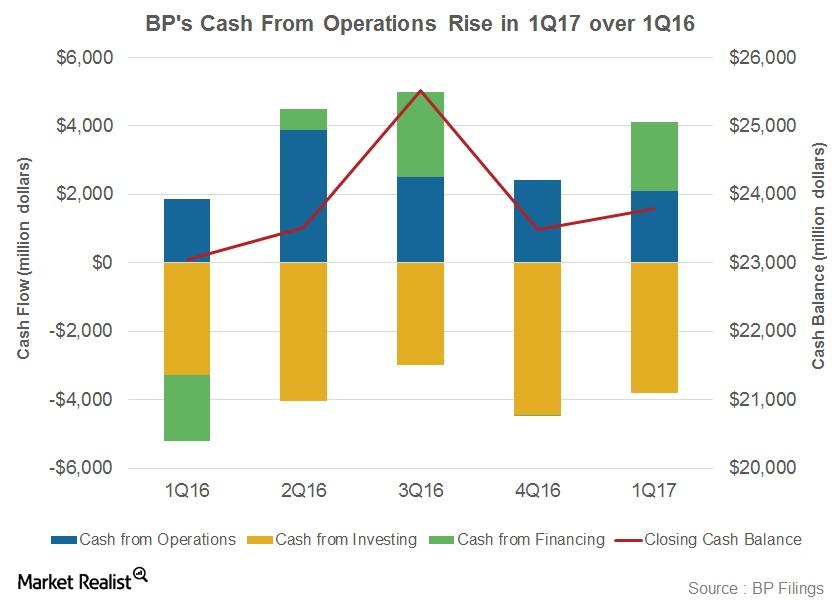

Is BP’s Cash Flow Slated for Growth?

Rising oil prices have given BP some hope that its cash flows could improve. The robust upstream project pipeline is also likely to result in higher production.

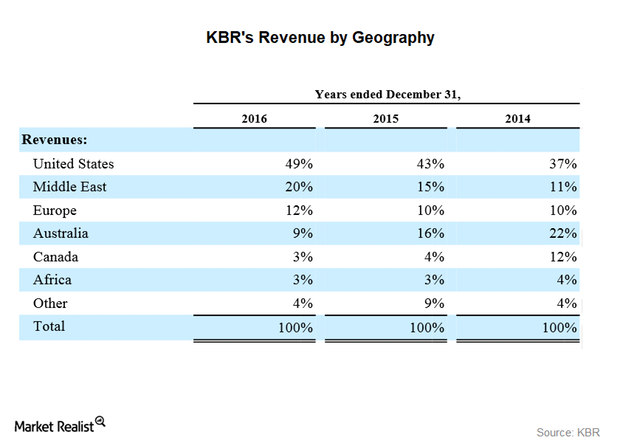

More about KBR’s Major Clients

Clients and their sectors KBR (KBR) has a diverse customer base. According to KBR, its customers are “domestic and foreign governments, international and national oil and gas companies, independent refiners, petrochemical producers, fertilizer producers and manufacturers.” Revenue from overseas operations represented 63%, 57%, and 51% of KBR’s total revenue in 2014, 2015, and 2016, respectively. In this part, we’ll look at […]

Graphical Representation of General Electric’s Business Model

General Electric’s industrials and finance services are its two broader divisions, contributing 91% and 9%, respectively, to its consolidated 2015 earnings.

Credit Default Swaps as Insurance against Junk Bond Market Crash

Carl Icahn mentions the use of credit default swaps as a form of protection against credit events. He implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

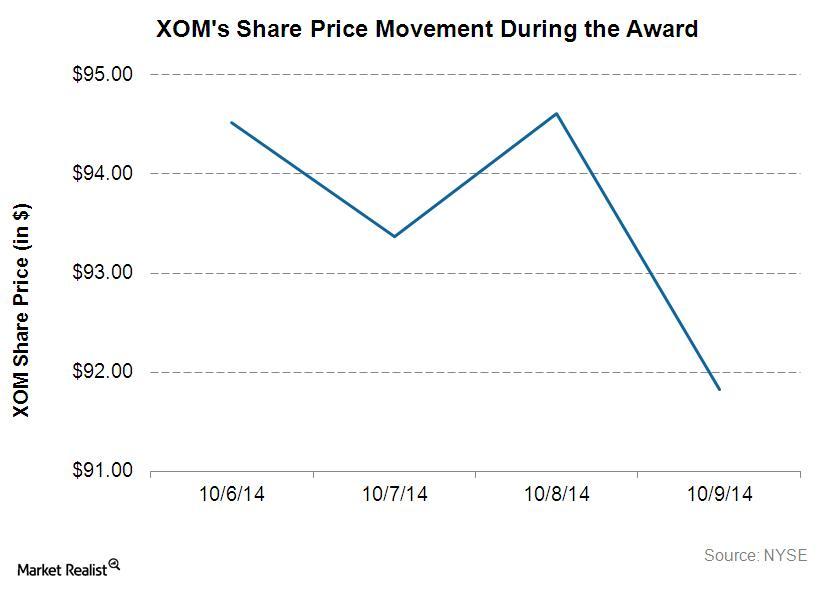

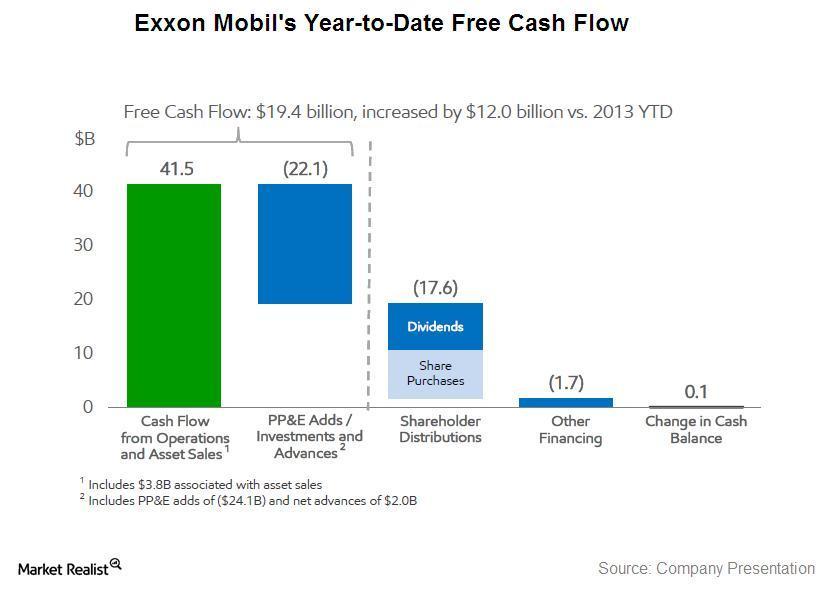

Positive and negative effects on ExxonMobil’s returns

Currently, the biggest concern affecting Exxon Mobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.

Libya’s Crude Oil Production Nears 4-Year High: What’s Next?

Libya is an OPEC member but was exempt from the production cut deal due to political and economic instability.

Chevron: Analysts’ Recommendations

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy.”

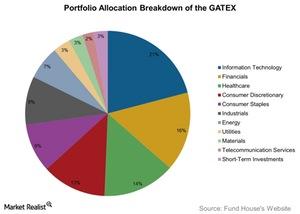

GATEX: A Sectorial Portfolio Breakdown

The Gateway Fund – Class A (GATEX) seeks to attain capital appreciation through its equity market investments. It has less risk compared to equity markets.