BP’s Upstream Segment: Large Upcoming Gas Projects

BP has a strong pipeline of projects in its upstream portfolio. These projects are expected to result in 800,000 barrels per day of new production by 2020.

Dec. 4 2020, Updated 10:53 a.m. ET

BP’s upstream segment

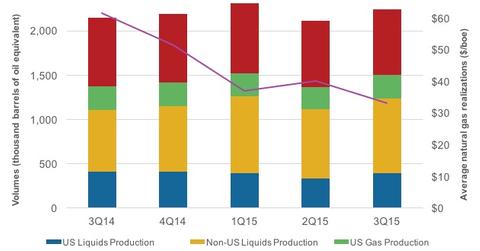

BP (BP) produced 2.2 MMbpd (million barrels of oil per day) in 3Q15 from its worldwide operations. It’s essential to consider that of the total production, 1.6 MMbpd, or 71%, is from non-US operations.

BP’s crude oil and natural gas realizations

Liquids account for 1.2 MMbpd, or 53%, of BP’s total production. Oil and natural gas prices have fallen sharply in the past few quarters. BP’s average liquid realizations fell to $44 per barrel in 3Q15 from $91 per barrel in 3Q14. Plus, BP’s natural gas average realizations fell 35% from 3Q14 to $3.5 per thousand cubic feet. Natural gas constitutes 47% of BP’s production mix.

Thus, BP’s total hydrocarbon average realizations fell by 46% over 3Q14 to $33.3 per barrel of oil equivalent. BP’s peers ExxonMobil (XOM), Chevron (CVX), and Royal Dutch Shell (RDS.A) have also witnessed the impacts of lower realizations.

BP’s upstream segment projects

BP has a strong pipeline of projects in its upstream portfolio. These projects are expected to result in 800,000 barrels per day of new production by 2020. According to BP, it has a balanced upstream portfolio in deep-water and gas fields with a bias toward gas over the next decade.

Around 500,000 barrels of oil equivalent per day are expected from seven projects, mainly holding gas reserves. Oman Khazzan, Trinidad, West Nile Delta, and Shah Deniz Phase 2 are some of the larger gas projects expected to deliver by 2020. Beyond 2020, BP expects growth to come from the huge hydrocarbon reserves that it holds.

If you are looking for exposure to the oil and gas exploration sector, you can consider the iShares US Oil & Gas Exploration & Production ETF (IEO). The ETF has ~67% exposure to the sector.