Petrobras’s Upcoming 3Q16 Results: Where Are Earnings Headed?

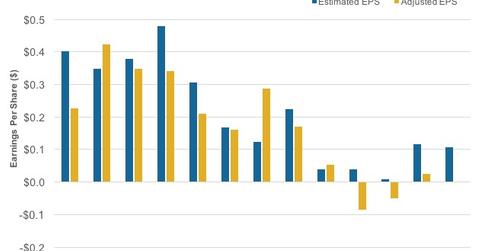

Petrobras (PBR) is expected to post its 3Q16 results on November 10, 2016. In 2Q16, it had adjusted EPS of $0.03 compared to analysts’ estimates of $0.12.

Dec. 4 2020, Updated 10:53 a.m. ET

2Q16 estimated and actual performance

Petrobras (PBR) is expected to post its 3Q16 results on November 10, 2016. Before we look at 3Q16 estimates, let’s recap PBR’s 2Q16 performance compared to the estimates.

In 2Q16, Petrobras posted adjusted EPS (earnings per share) of $0.03 compared to analysts’ estimates of $0.12. The company’s EPS for the first half of 2016 was -$0.02 compared to estimated EPS of $0.13.

The half-year lower-than-expected EPS was the result of a steep fall in earnings for PBR’s exploration and production segment compared to the first half of 2015.

In 2Q16, Petrobras’s (PBR) earnings attributable to its shareholders stood at $106.0 million compared to $171.0 million in 2Q15. This was due to a fall in crude oil and natural gas prices, which impacted its upstream earnings. This was partially offset by a rise in total crude oil and natural gas production volumes of 7.0% YoY (year-over-year).

Petrobras’s 3Q16 estimates

In 3Q16, Wall Street analysts expect Petrobras to post EPS of $0.11. Earnings from the upstream segment are likely to fall due to lower oil prices in 3Q16 compared to 3Q15. The downstream segment will likely see a subdued performance due to a narrowing of refining cracks in 3Q16 over 3Q15. However, net earnings might improve due to cost-saving initiatives and a probable reduction in interest expenses.

PBR’s peer Total (TOT) also saw a fall in its net adjusted earnings from 25.0% in 3Q15 to $2.1 billion in 3Q16. ExxonMobil’s (XOM) and Chevron’s (CVX) earnings fell 38.0% and 55.0%, respectively, in 3Q16 over 3Q15. However, Suncor Energy (SU) turned positive in 3Q16 compared to a loss in 3Q15. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has a ~6.0% exposure to integrated energy sector stocks.

In the next part, let’s do a segmental analysis of Petrobras before it reports its 3Q16 earnings.