Total SA

Latest Total SA News and Updates

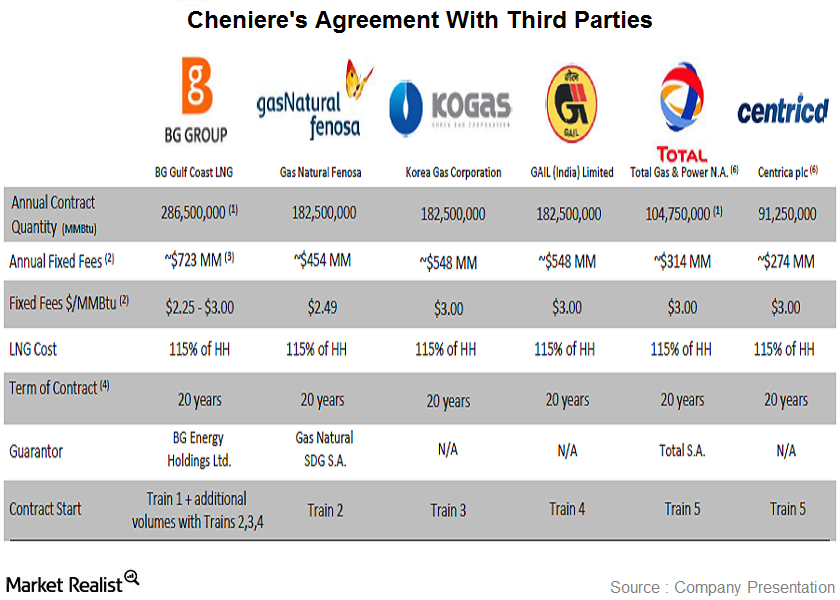

Overview of Cheniere’s sale and purchase contracts

Cheniere Energy, Inc.’s MLP company’s Sabine Pass liquefaction project has already secured four fixed-price, 20-year sales and purchase agreements with third parties.

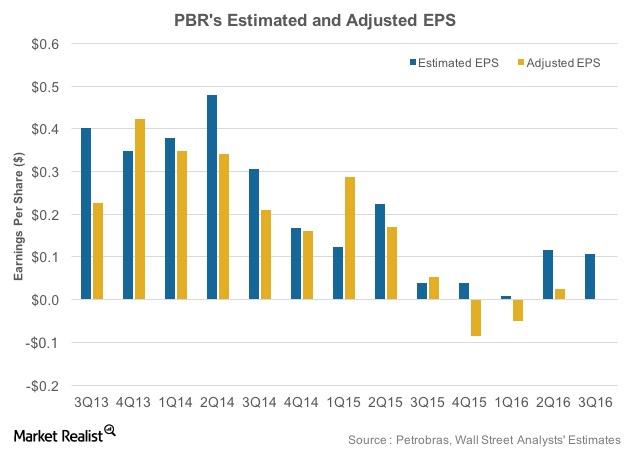

Petrobras’s Upcoming 3Q16 Results: Where Are Earnings Headed?

Petrobras (PBR) is expected to post its 3Q16 results on November 10, 2016. In 2Q16, it had adjusted EPS of $0.03 compared to analysts’ estimates of $0.12.

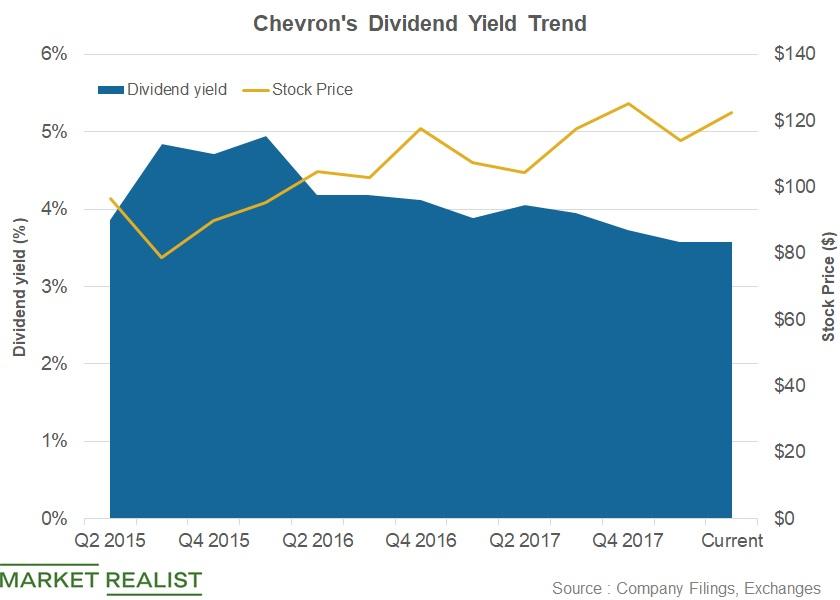

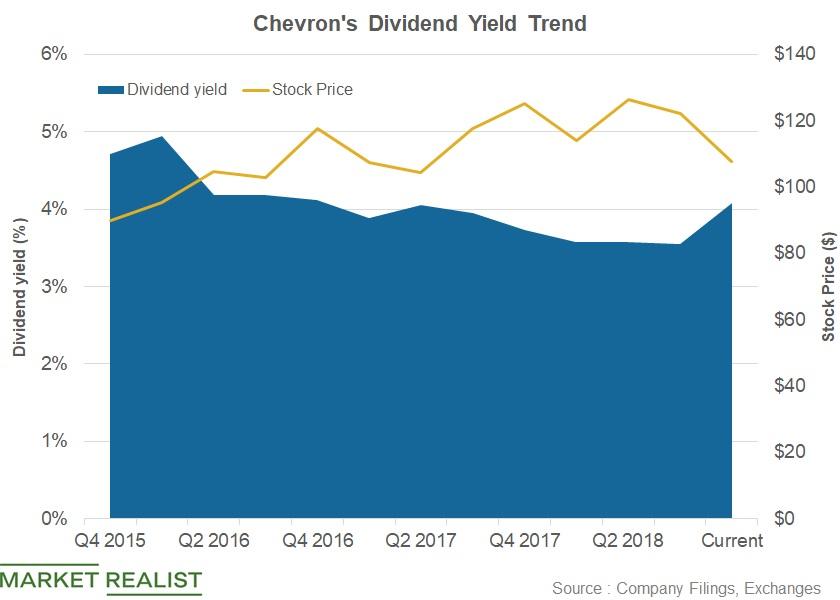

Chevron’s 3.6% Dividend Yield Ranks Sixth with High Valuations

Chevron (CVX) is the sixth stock on our list of the top eight dividend-yielding stocks.

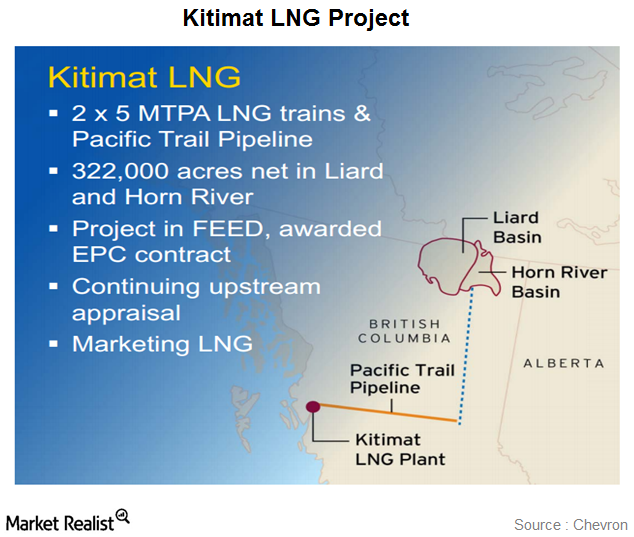

Why Chevron is cutting spending on some projects

Chevron has cut spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

Chevron Ranks Second-Last in Terms of Its Dividend Yield

In terms of its dividend yield, Chevron (CVX) is the fifth-best performer among the six stocks under review.

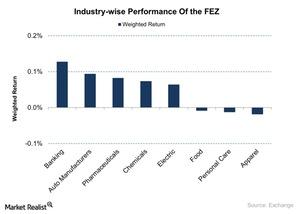

Positive Manufacturing Reports Drive the FEZ Up

The SPDR Euro Stoxx 50 ETF (FEZ) is a US exchange-traded ETF that tracks the performance of the 50 largest companies across the Eurozone.

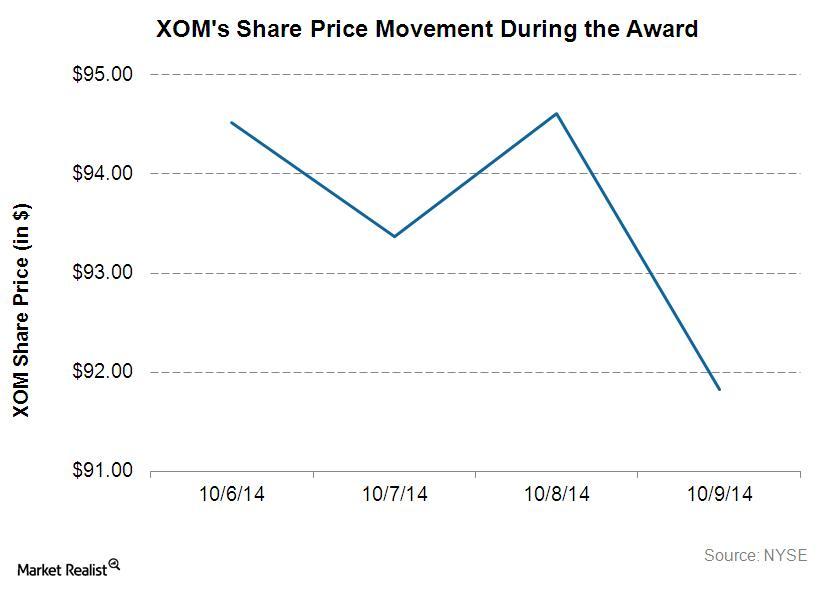

Exxon Mobil wins $1.6 billion in arbitration case against Venezuela

Exxon Mobil alleged that the Venezuelan government illegally expropriated its Venezuelan assets in 2007 and paid unfair compensation.

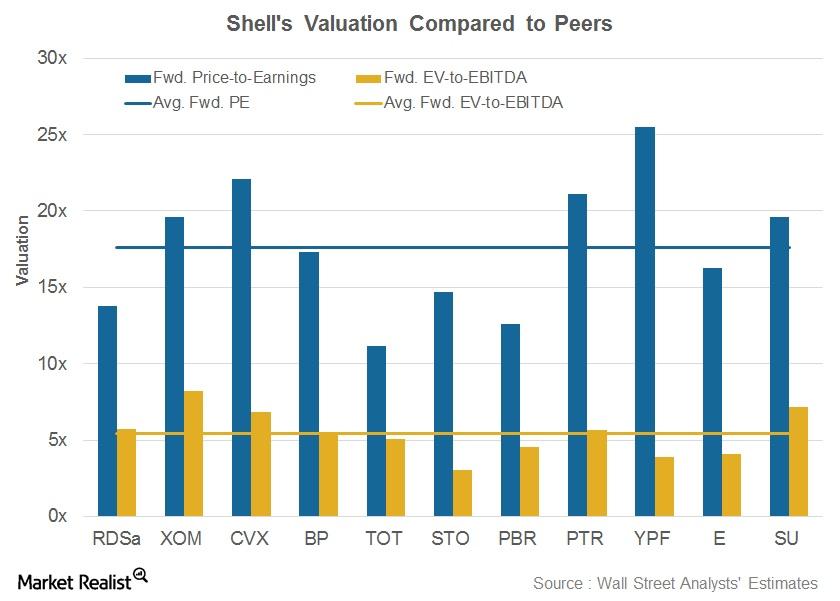

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

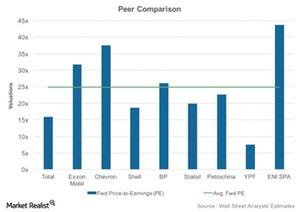

Total’s Forward Valuation: Peer Comparison

In the previous part of this series, we discussed Total’s historical valuation trends. Now we’ll compare its forward valuation with that of its peers.

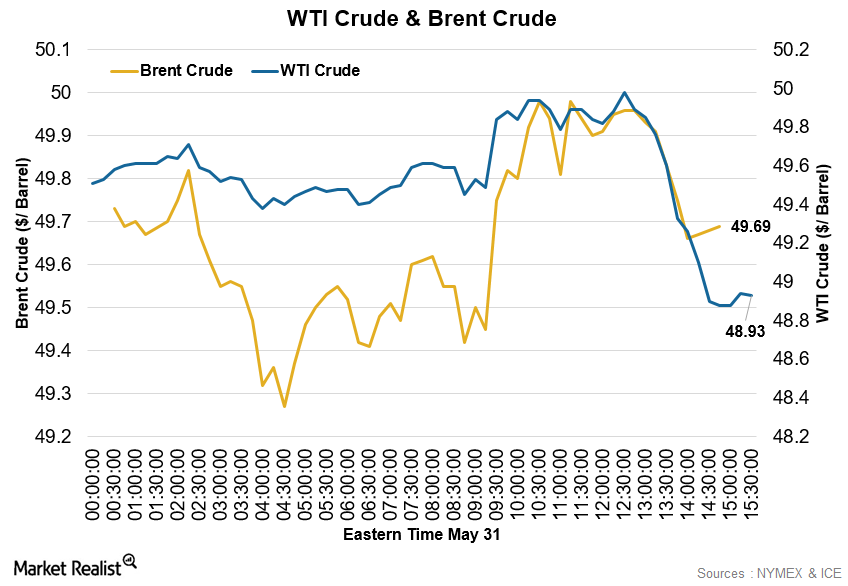

How Did Crude Oil Perform on Tuesday, May 31?

Crude oil had a volatile trading day on Tuesday, May 31, 2016. At 1:40 PM EDT, WTI crude for July delivery traded at $49.67 per barrel, a gain of 0.67%.

Chevron: Is It a Good Time to Invest in the Stock?

Currently, Chevron stock trades at 18.5x its 2019 forward EPS and at 17.2x its 2020 forward EPS. The stock is higher than most of its peers.

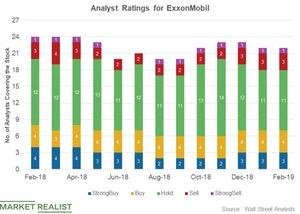

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

Total SA Stock Fell Marginally After Q2 Earnings

Total SA stock fell 0.9% on Thursday—its earnings release day. The stock was impacted by a 20% YoY fall in its earnings.

ExxonMobil: Analysts’ Recommendations

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

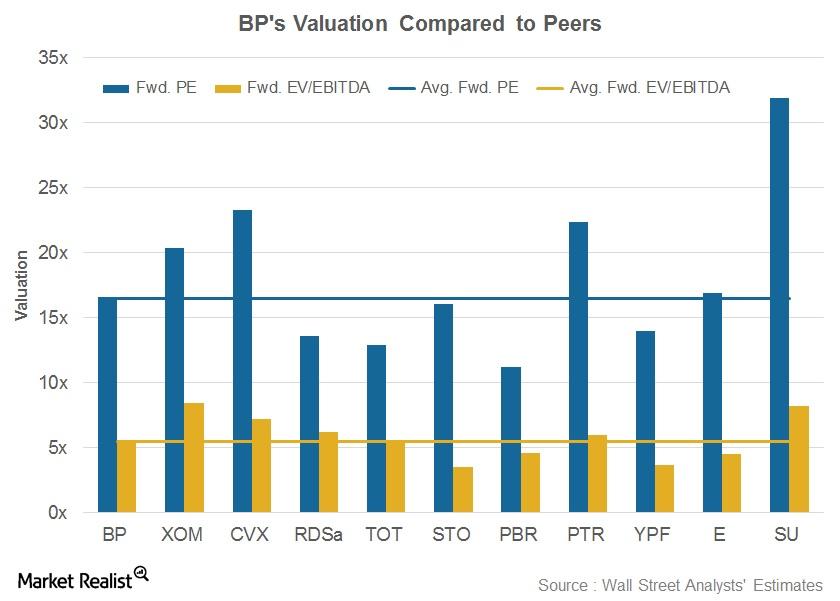

What’s BP’s Valuation?

BP (BP) is now trading at a forward PE (price-to-earnings ratio) of 16.6x, above its peer average of 16.5x.

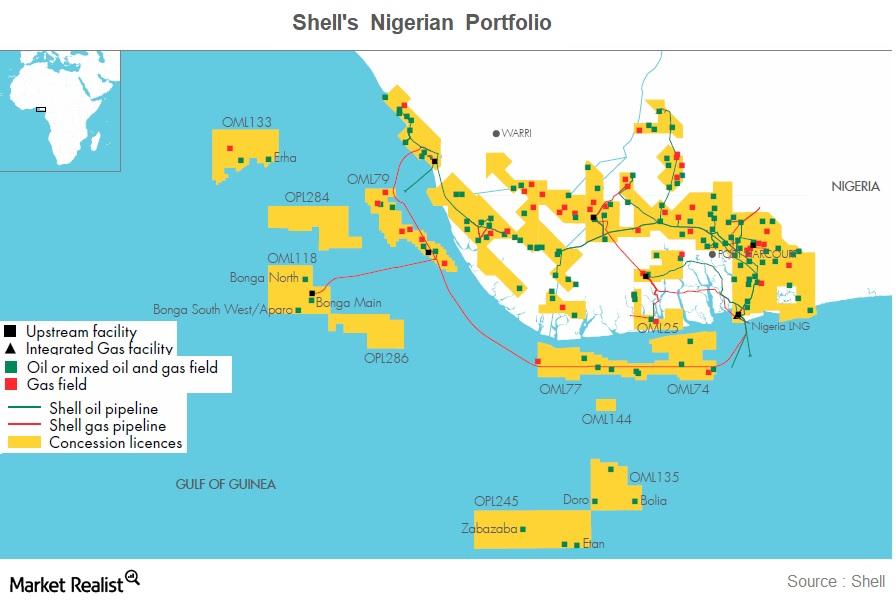

Why Shell’s Gbaran-Ubie Project Is Vital to Upstream Portfolio

In this series, we’ll look at Shell’s overall performance, its robust upstream portfolio, its changing downstream portfolio, and the company’s overall strategy.

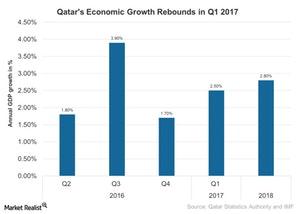

Understanding Qatar’s Resilience amid Sanctions

Qatar’s (QAT) economy continued to grow in 1Q17 amid improved oil prices since 2Q16. But more recently, oil prices have hit a downtrend.

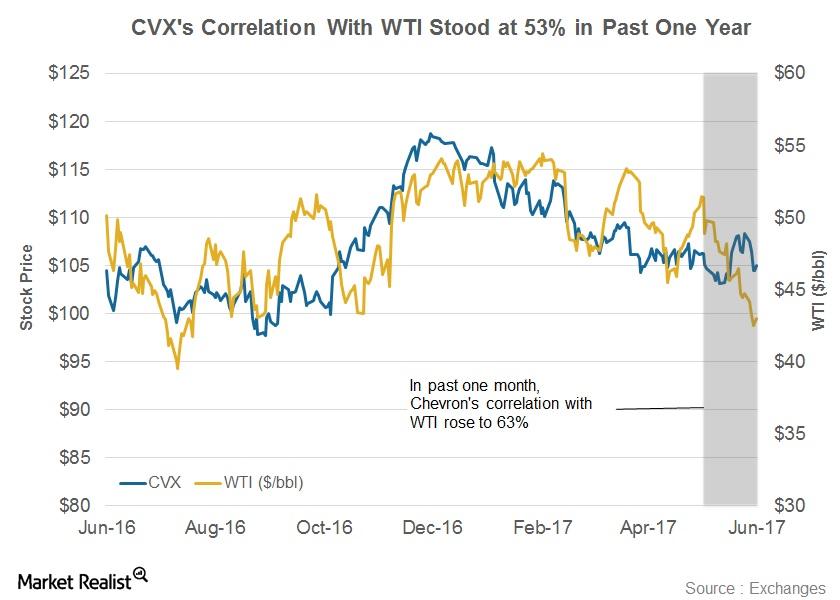

Correlation of Chevron Stock with WTI Crude Oil

The correlation coefficient of Chevron (CVX) versus WTI stood at 0.53 in the last one-year period.

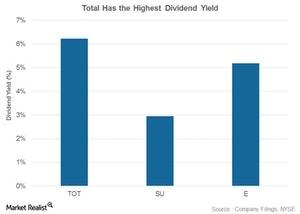

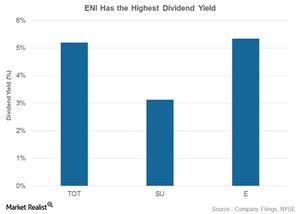

TOT, SU, E, and PBR: Comparing Their Dividend Yields

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have provided steady returns to their shareholders in the form of dividends.

TOT, SU, E, PBR: Who Has Highest Dividend Yield?

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have consistently given returns to shareholders in the form of dividends.

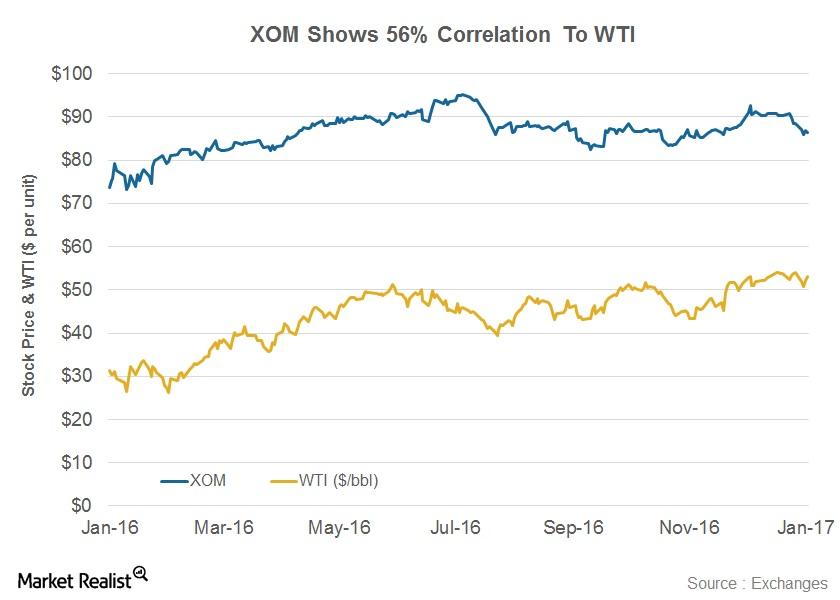

What’s the Correlation Between XOM and WTI?

Integrated energy companies such as ExxonMobil are affected to varying degrees by volatility in crude oil prices. XOM’s correlation coefficient with WTI stands at 0.56.

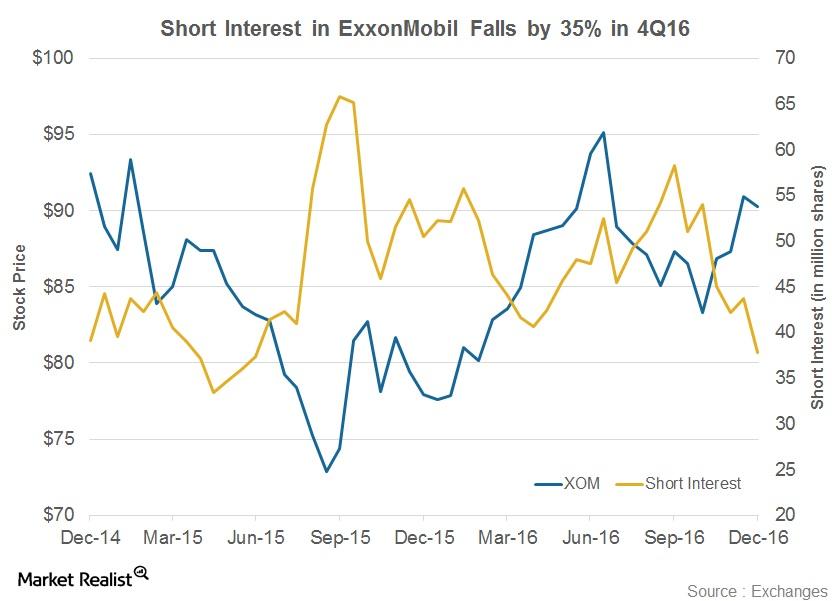

Has Short Interest in ExxonMobil Fallen?

ExxonMobil (XOM) has witnessed a 35% fall in its short interest volumes since September’s end 2016.

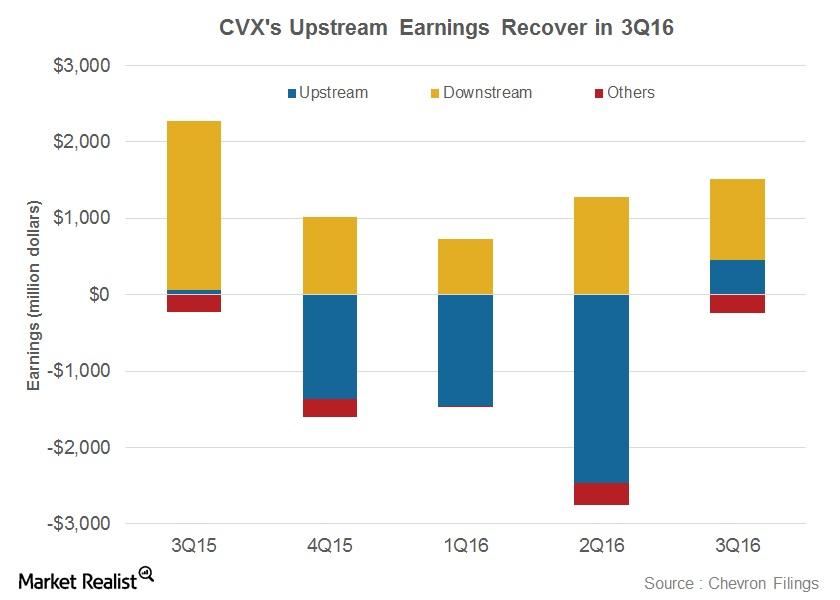

Chevron’s 4Q16 Segmental Outlook: Is It Positive?

Chevron’s (CVX) Downstream segment saw its earnings fall 52% YoY to ~$1.1 billion in 3Q16.

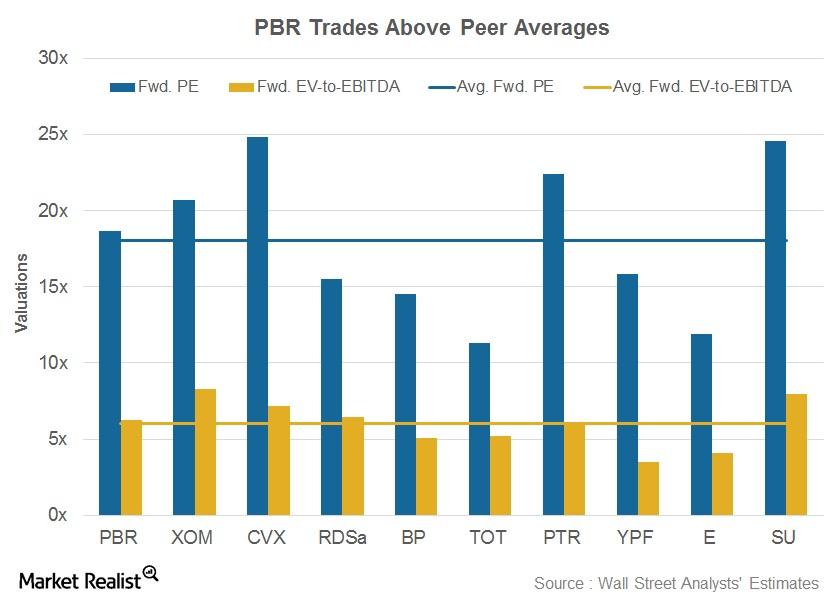

Why Is Petrobras’s Valuation Higher Than Peer Average?

After its production update news, Petrobas’s forward PE and EV-to-EBITDA stood at 18.7x and 6.3x, respectively.

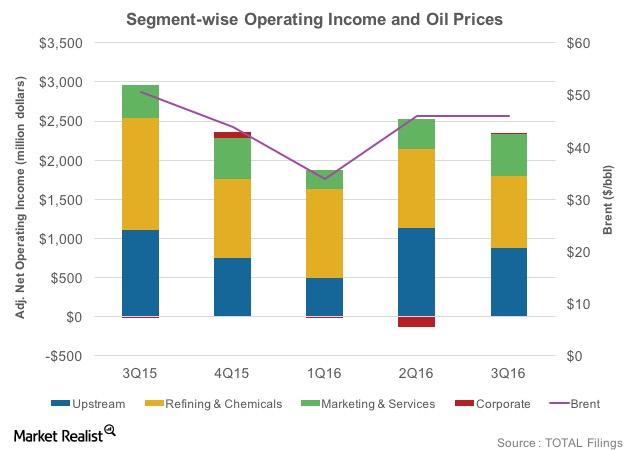

Analyzing Total’s Segmental Earnings in 3Q16

Total’s net adjusted operating earnings from the Upstream segment fell 21% from 3Q15 to $877 million in 3Q16 due to lower crude oil prices.

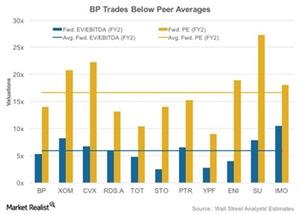

BP’s Forward Valuations: A Peer Comparison

In this article, we’ll consider BP’s forward valuations compared to those of its peers. BP’s market cap stands at ~$105 billion.

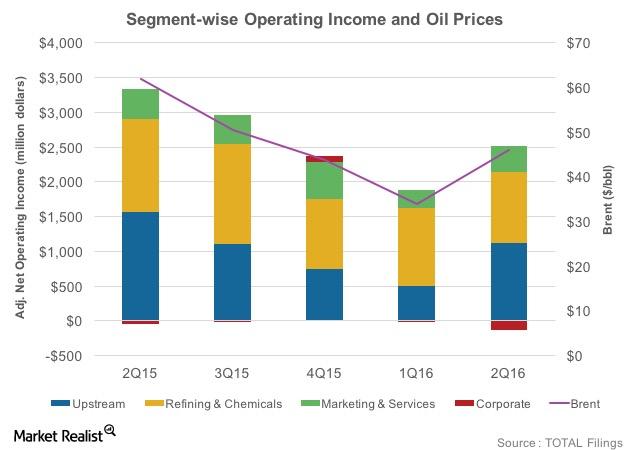

Total’s Segments: Upstream Earnings Plunge but Stay Positive

Changing oil prices have changed the dynamics for Total’s segments. Although upstream earnings have declined in 2Q16 YoY, they stayed positive in the quarter.

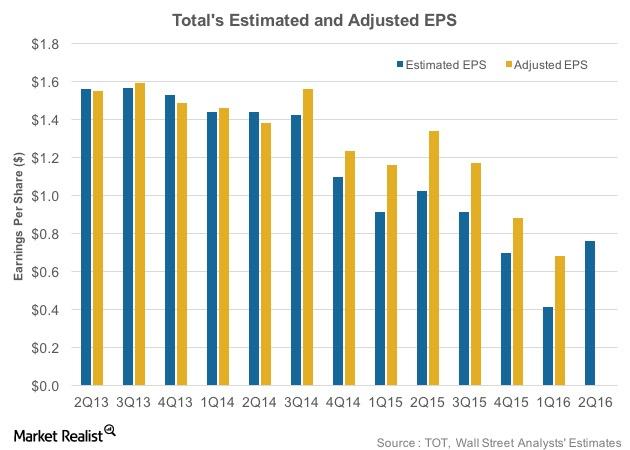

Total’s 2Q16 Earnings Outlook: Will It Beat Estimates?

Total SA (TOT) is expected to post its 2Q16 results on July 28, 2016. In 1Q16, TOT’s revenues of $27.5 billion surpassed Wall Street estimates.

A Forward Valuation Comparison of BP’s Competitors

BP’s market cap stands at ~$100 billion. Among the company’s peers, ExxonMobil (XOM) has the highest market cap of ~$371 billion.

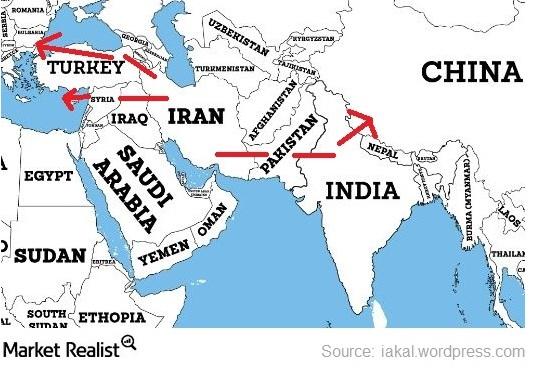

Could Iran Become a Big Gas Supplier to Europe and Asia?

Geographically, Iran is between the Europe and Asia’s gas markets. Iran could be a potential supplier to China (FXI) through Pakistan and India (INDY).

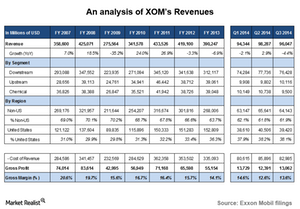

A key analysis of ExxonMobil’s revenues

ExxonMobil’s businesses and revenues depend on crude oil and natural gas’ price levels. In the first three quarters of 2014, ExxonMobil reported revenues of ~$290 billion.