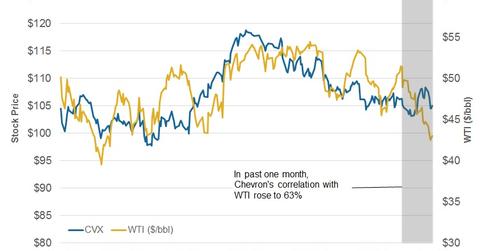

Correlation of Chevron Stock with WTI Crude Oil

The correlation coefficient of Chevron (CVX) versus WTI stood at 0.53 in the last one-year period.

July 3 2017, Updated 9:05 a.m. ET

What is the correlation coefficient?

In this series, we have evaluated Chevron’s (CVX) stock performance, moving averages, and seven-day price forecast based on its implied volatility. We also examined its analyst ratings, dividend expectations for the next quarter, valuations, and PEG ratio. We also reviewed the company’s short interest movements and changes in institutional holdings.

In this final part of the series, we’ll examine whether there is an increase in the correlation between Chevron’s stock price and crude oil prices in the past one-month period.

The correlation coefficient measures the association between two variables. A value between 0 and 1 indicates a positive correlation, a value of 1 indicates no correlation, and a value between -1 and 0 indicates a negative correlation.

We have considered the past 12-month and one-month price history of CVX and WTI (West Texas Intermediate) crude oil.

Correlation of Chevron stock with WTI

The correlation coefficient of Chevron (CVX) versus WTI stood at 0.53 in the last one-year period. The correlation value of Chevron stock and oil prices shows that Chevron’s stock price moved in line with WTI prices to an extent.

As a result, changes in oil prices could explain ~53% of the changes in Chevron’s stock price during the last one-year period. However, this rose to 63% in the past one-month period, indicating a further strengthening of this correlation.

Correlation analysis of Chevron’s peers

Chevron’s (CVX) peers also witnessed a rise in their correlation figures in the last one-month period. ExxonMobil (XOM), Royal Dutch Shell (RDS.A), and BP (BP) saw increased correlation readings of 0.11, 0.06, and 0.19, respectively, in the last one-month period. XOM, RDS.A, and BP have current one-month correlations with WTI of 0.62, 0.66, and 0.77, respectively.

Among the other global players, Suncor Energy (SU), Total (TOT), and ENI (E) also saw rising correlation readings of 0.89, 0.69, and 0.80, respectively, in the past one-month period.