Analyzing Total’s Segmental Earnings in 3Q16

Total’s net adjusted operating earnings from the Upstream segment fell 21% from 3Q15 to $877 million in 3Q16 due to lower crude oil prices.

Nov. 1 2016, Updated 10:07 a.m. ET

Total’s Upstream earnings

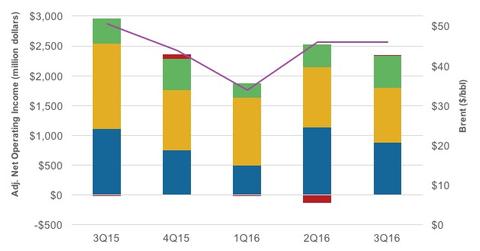

Changing oil prices impacted the dynamics within Total’s (TOT) segments. The Upstream segment’s earnings fell YoY (year-over-year) in 3Q16, but stayed positive during the quarter. In comparison, Total’s peer Suncor Energy (SU) saw its oil sand earnings turn positive in 3Q16.

Total’s net adjusted operating earnings from the Upstream segment fell 21% from 3Q15 to $877 million in 3Q16. The earnings fell due to lower crude oil prices. It was partially offset by increased hydrocarbon production and reduced operating costs. Brent prices, which averaged $51 per barrel in 3Q15, fell to $46 per barrel in 3Q16.

Total’s Downstream earnings

Total’s Downstream segment’s operating income fell 36% from 3Q15 to $917 million in 3Q16. The fall in Total’s Downstream earnings in 3Q16 was due to lower refining utilization rates and a fall in refining margins YoY.

Total’s refinery throughput reduced due to higher maintenance activities and the sale of the Schwedt refinery in 4Q15. Total’s European refining margin indicator fell 53% from 3Q15 to $25.5 per metric ton in 3Q16.

Total’s marketing and services net adjusted operating income rose 29% from 3Q15 to $545 million in 3Q16. It was led by a higher contribution from New Energies offsetting the impact of asset sales in the segment.

While Total’s overall net adjusted operating earnings fell from $2.9 billion in 3Q15 to $2.4 billion in 3Q16, all of the segments posted positive earnings. The iShares North American Natural Resources ETF (IGE) has ~22% exposure to integrated energy stocks.