iShares North American Natural Resources

Latest iShares North American Natural Resources News and Updates

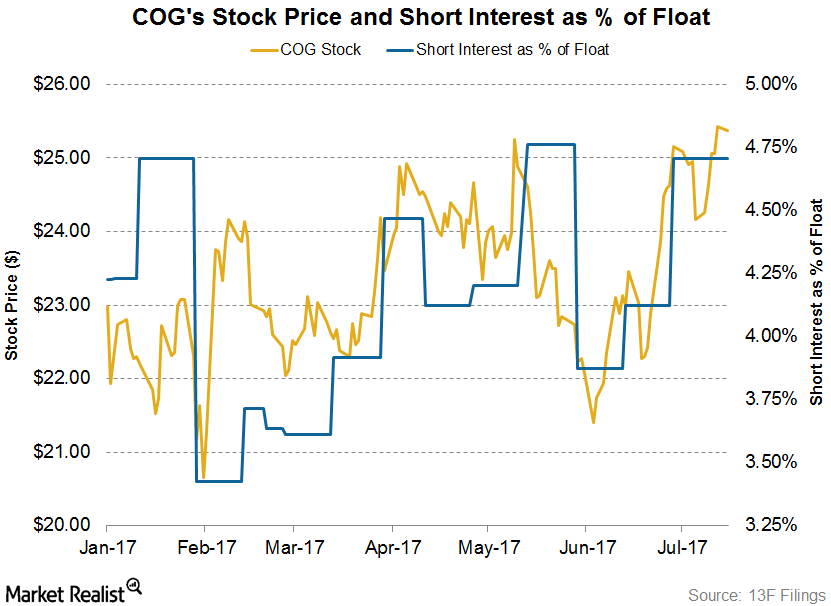

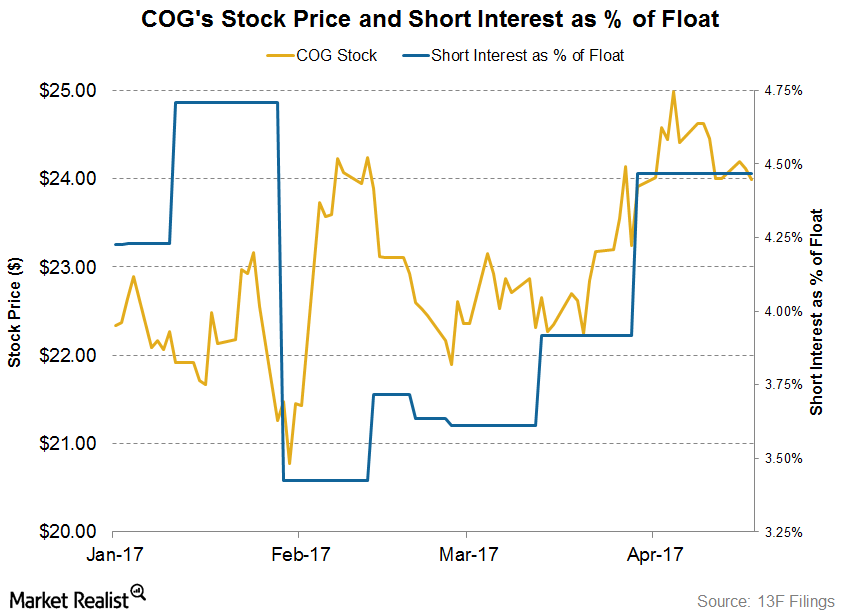

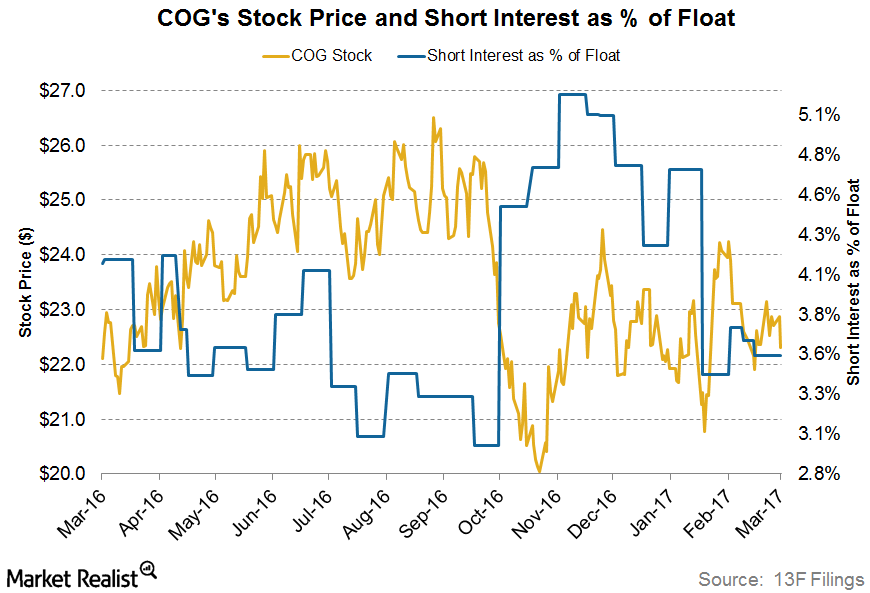

Cabot Oil & Gas: Short Interest Trends in Its Stock

On July 18, 2017, Cabot Oil & Gas’s (COG) short interest ratio was ~4.7%. At the beginning of the year, its short interest ratio was 4.2%.

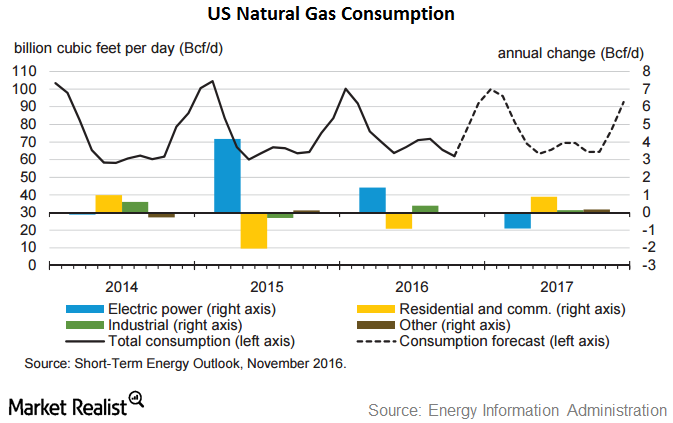

How Natural Gas Prices Have Supported Chesapeake Energy

2016 has been good for natural gas prices (UGAZ). Prices have risen ~34% year-over-year.

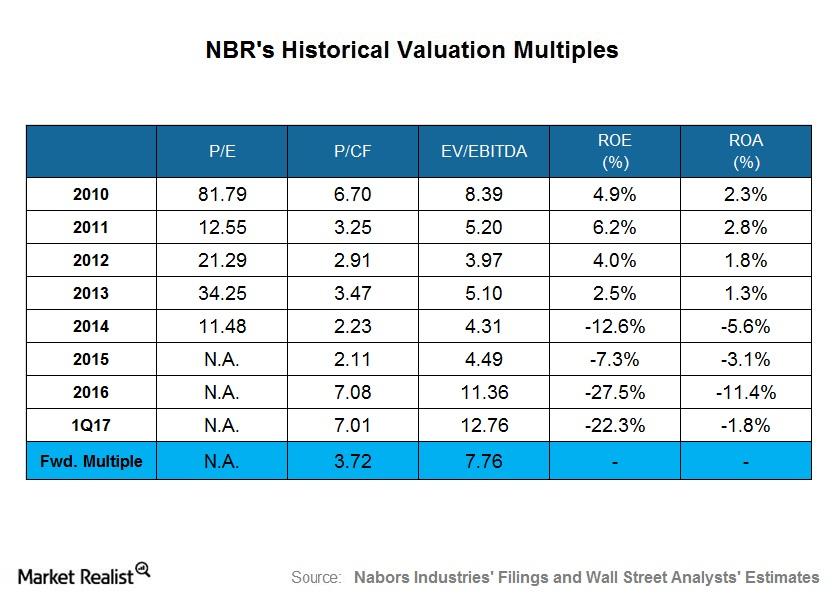

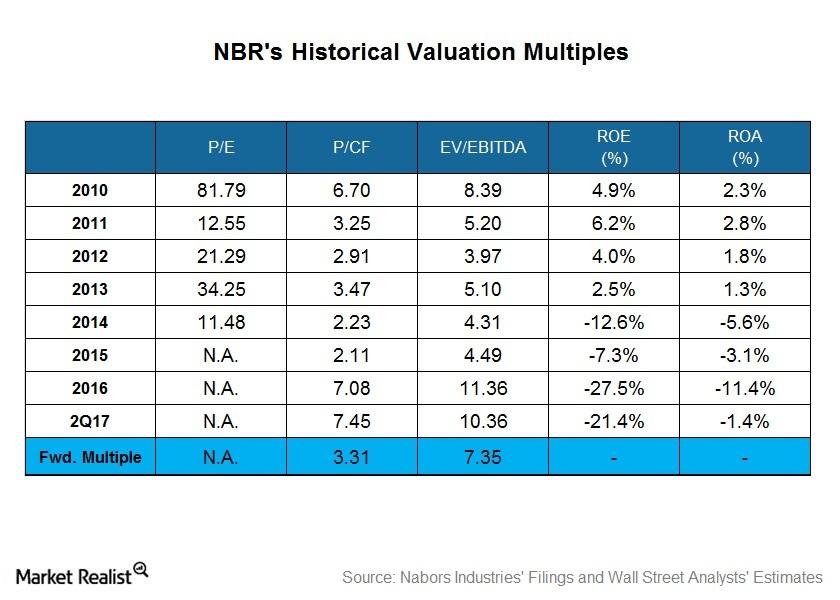

What Nabors Industries’ Historical Valuation Suggests

On March 31, 2017, Nabors Industries (NBR) stock was 20.0% lower than it was on December 30, 2016. In 1Q17, NBR’s adjusted earnings were negative.

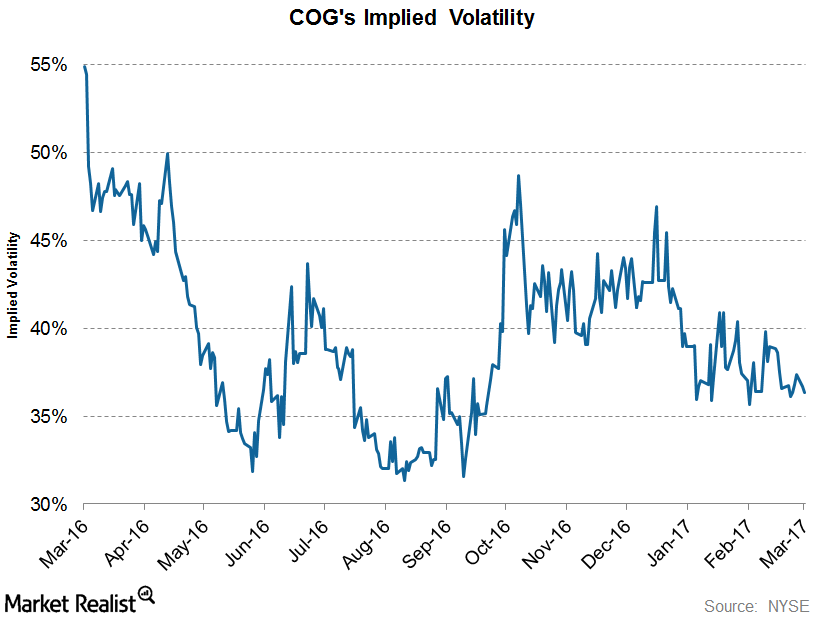

COG’s Implied Volatility Has Fallen Significantly since Early 2016

Cabot Oil and Gas’s (COG) current implied volatility is ~36.4%, ~3% lower than its 15-day average of 37.4%.

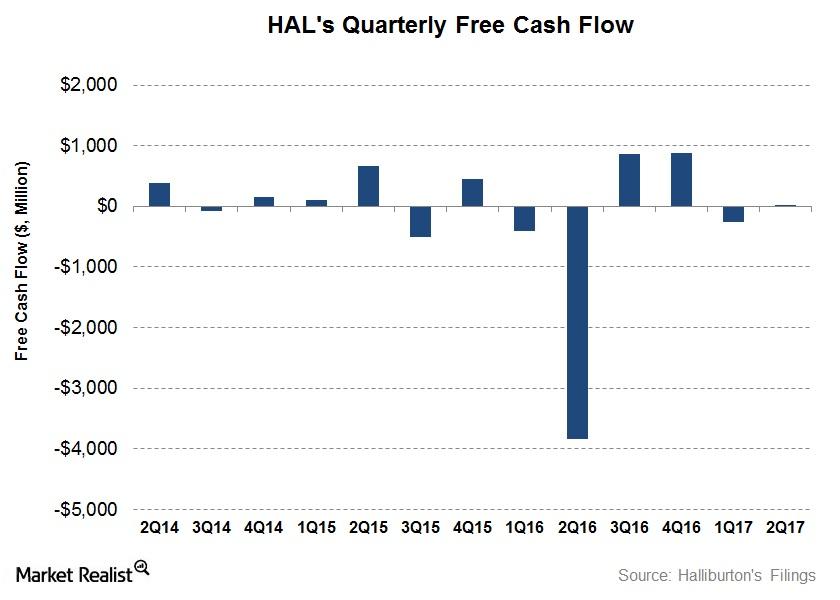

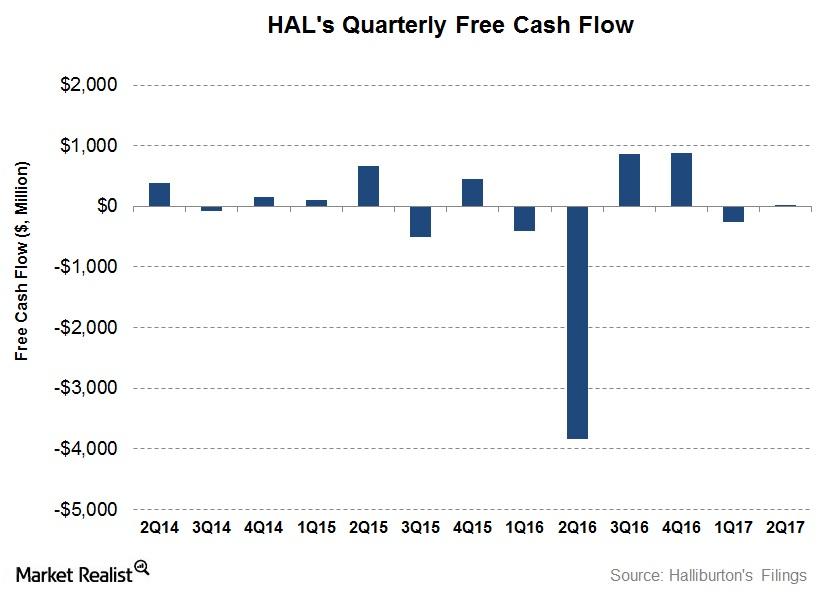

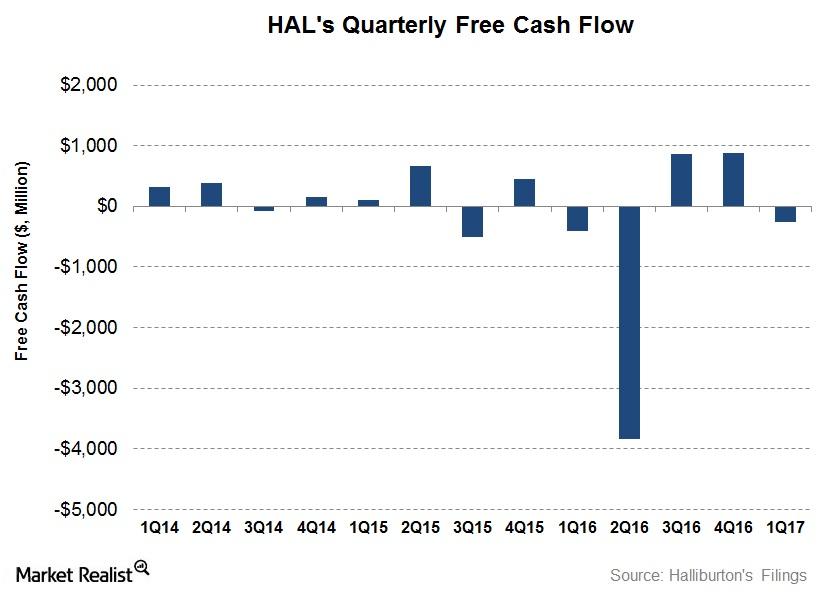

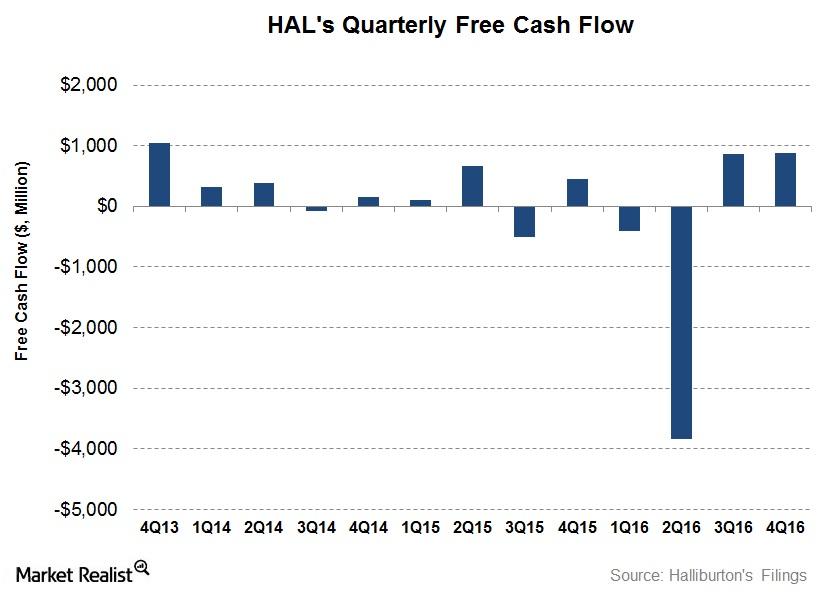

How Halliburton’s Free Cash Flow Turned Around in 2Q17

Halliburton’s (HAL) cash from operating activities (or CFO) in 2Q17 was a huge improvement over 2Q16 as well as an increase over 1Q17.

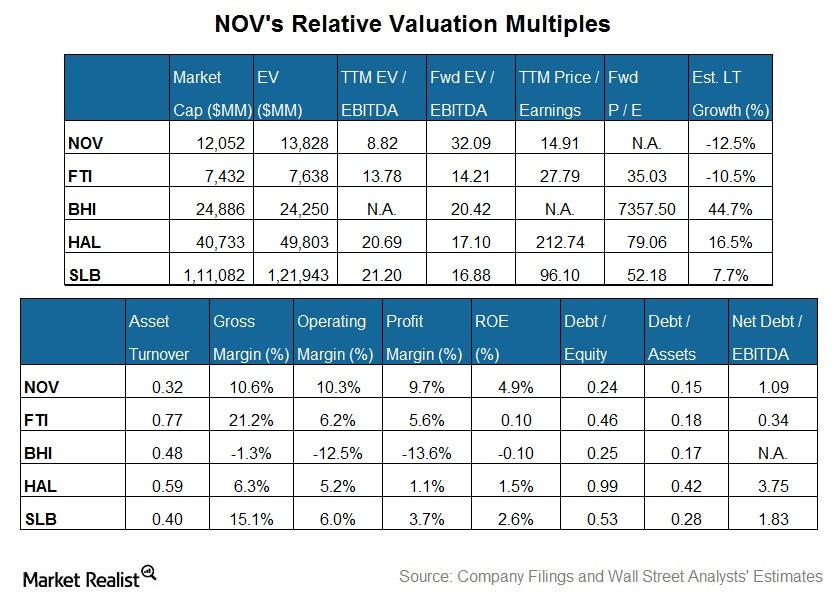

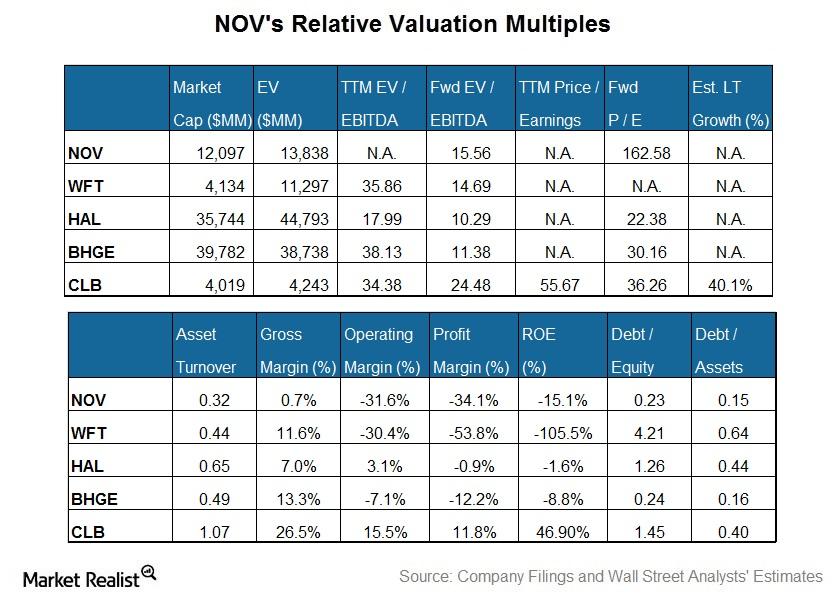

How National Oilwell Varco’s Valuation Stacks Up with Peers

National Oilwell Varco’s TTM PE (price-to-earnings) multiple of ~15x is lower than its peer average in the group.

What Do Analysts Recommend for Halliburton?

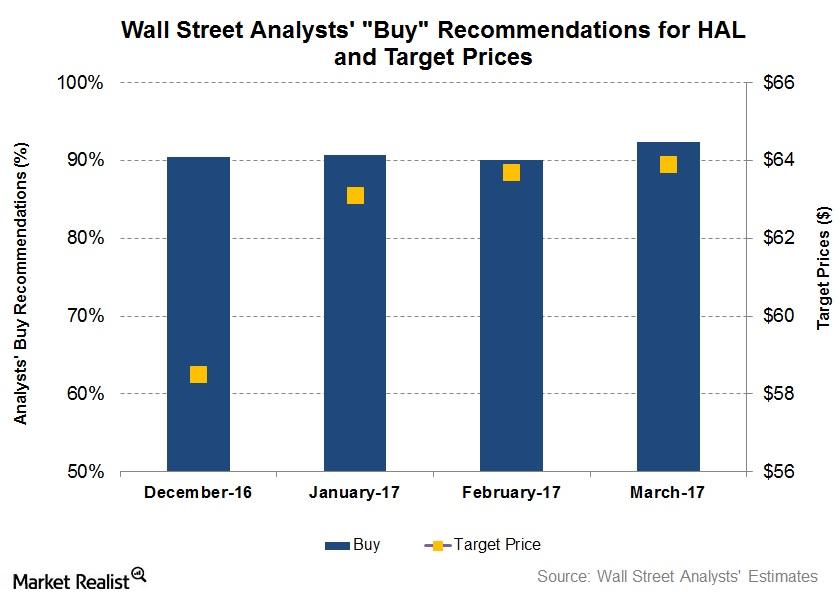

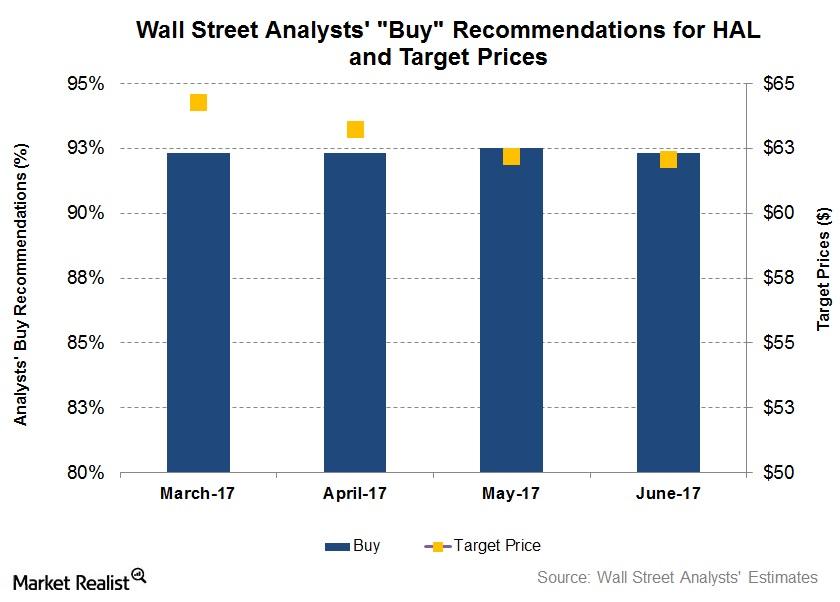

On March 24, 92% of the analysts tracking Halliburton rated it as a “buy,” ~5% rated it as a “hold,” and 3% rated it as a “sell.”

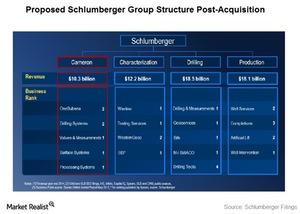

Schlumberger and Cameron International: a Complementary Team

Schlumberger and Cameron are contemplating a merger because their drilling and production systems would be integrated from “pore to pipeline.”

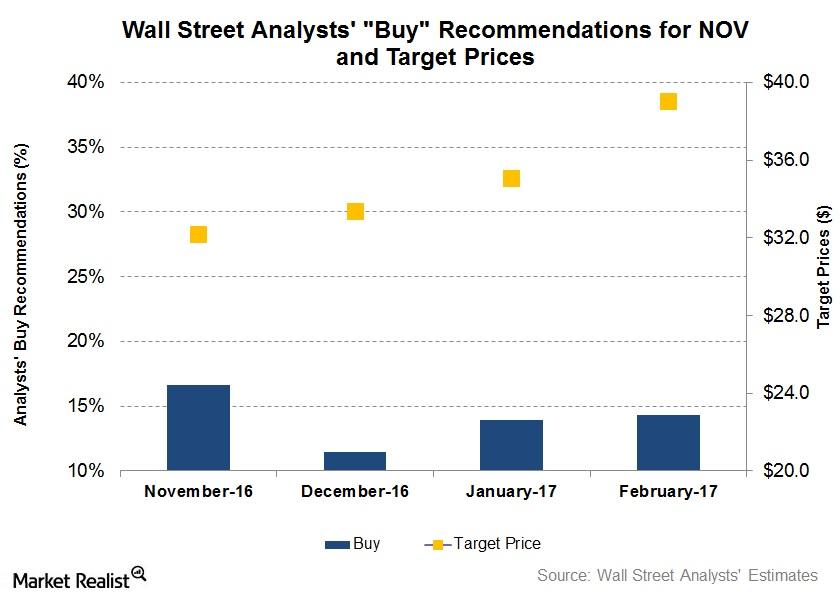

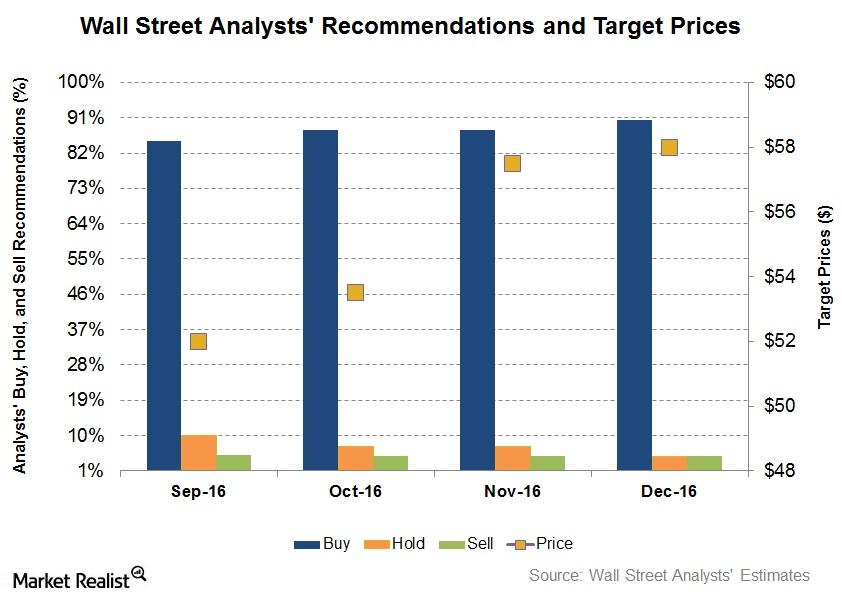

Wall Street Analysts’ Forecasts for National Oilwell Varco

On February 24, ~14% of the analysts tracking National Oilwell Varco rated it as a “buy,” ~74% rated it as a “hold,” and 12% rated it as a “sell.”

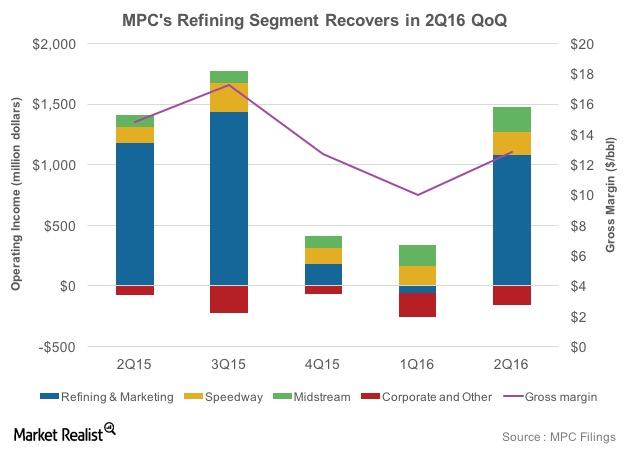

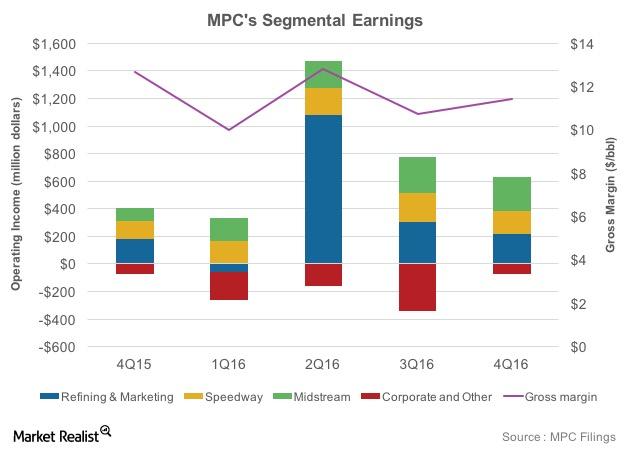

How Will Marathon Petroleum’s Refining Earnings Fare in 3Q16?

According to MPC, a dollar-per-barrel change in the blended LLS 6-3-2-1 crack spread affects its annual net income by $450 million.

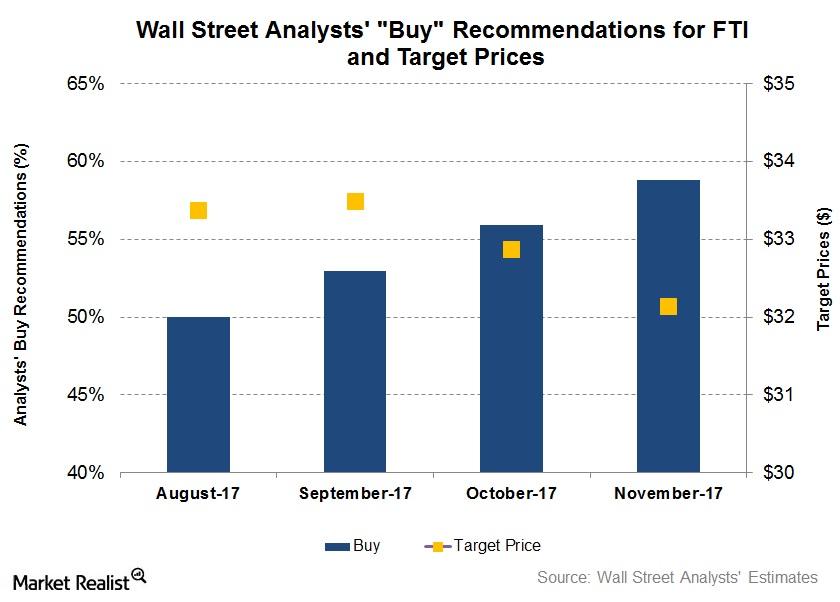

Wall Street Analysts’ Recommendations for TechnipFMC

In this article, we’ll look at Wall Street analysts’ recommendations for TechnipFMC (FTI) on November 9.

National Oilwell Varco’s Valuation Compared to Its Peers

National Oilwell’s valuation, expressed as the TTM PE (price-to-earnings) multiple, isn’t available due to its negative adjusted earnings.

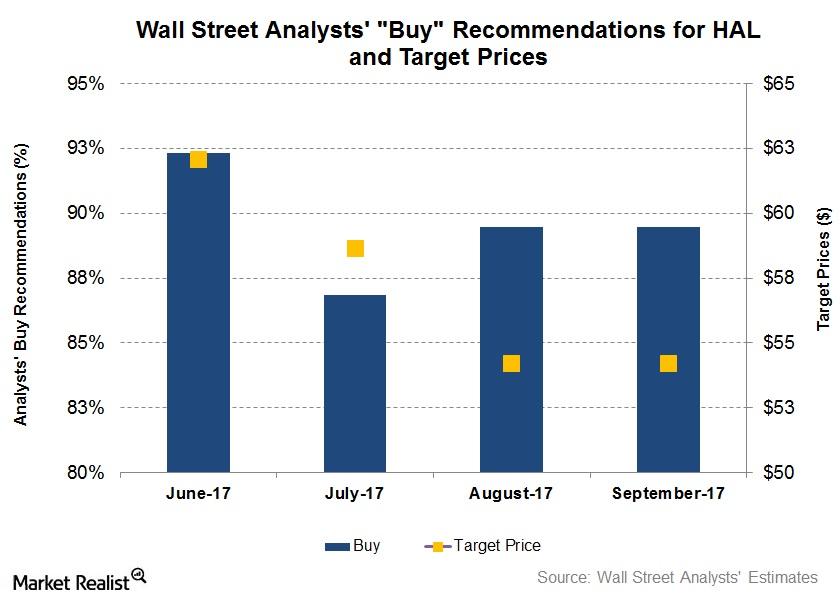

What Wall Street Analysts Are Recommending for Halliburton

On September 5, 2017, 89.0% of Wall Street analysts who are tracking Halliburton stock rated it a “buy” or some equivalent.

Behind Halliburton’s Free Cash Flow, Capex, and Acquisition Strategies

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17.

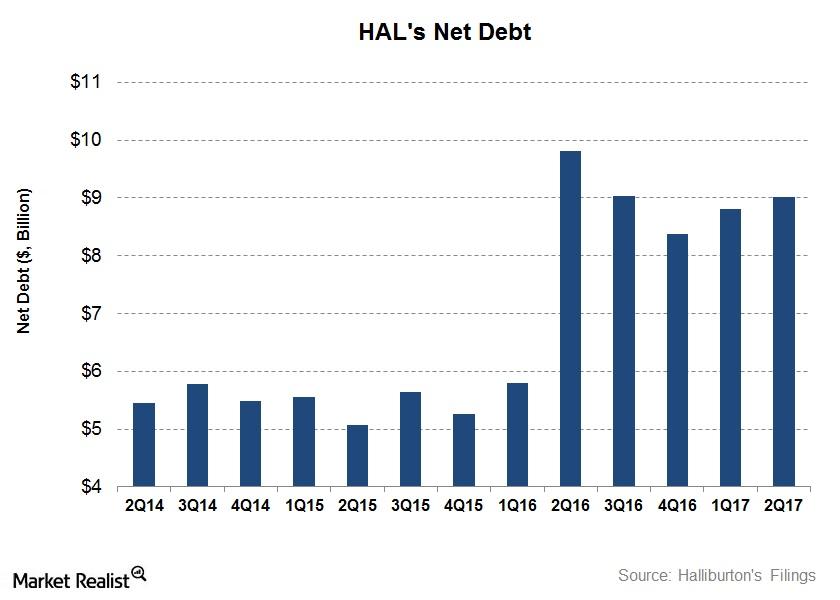

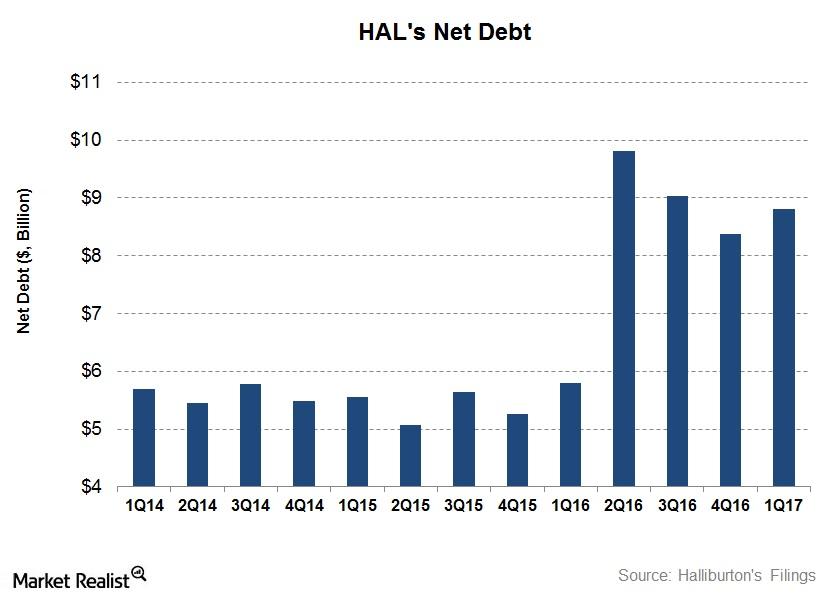

Understanding Halliburton’s Net Debt after 2Q17

In 2Q17, Halliburton’s (HAL) total debt fell 14% from 2Q16, while its cash and marketable securities fell 31%.

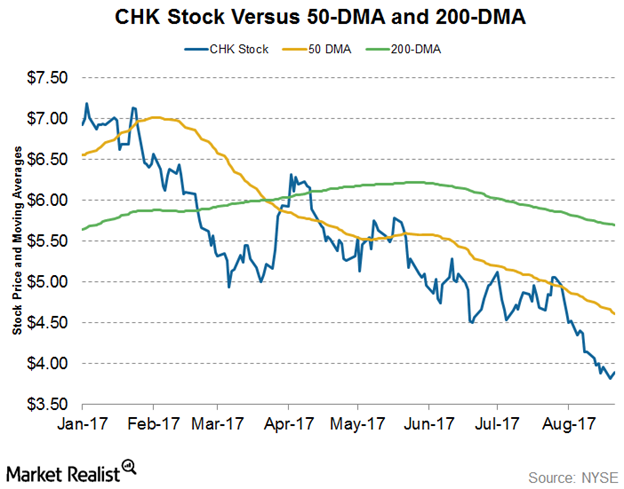

Can Chesapeake Energy Stock Rise from the Doldrums?

Chesapeake Energy stock (CHK) has fallen for most of this year. It picked up slightly in April but wasn’t able to hold those levels.

What Does Nabors Industries’ Historical Valuation Suggest?

Nabors Industries’ PE multiple was not meaningful in 2015 and 2016 as a result of negative adjusted earnings during this period.

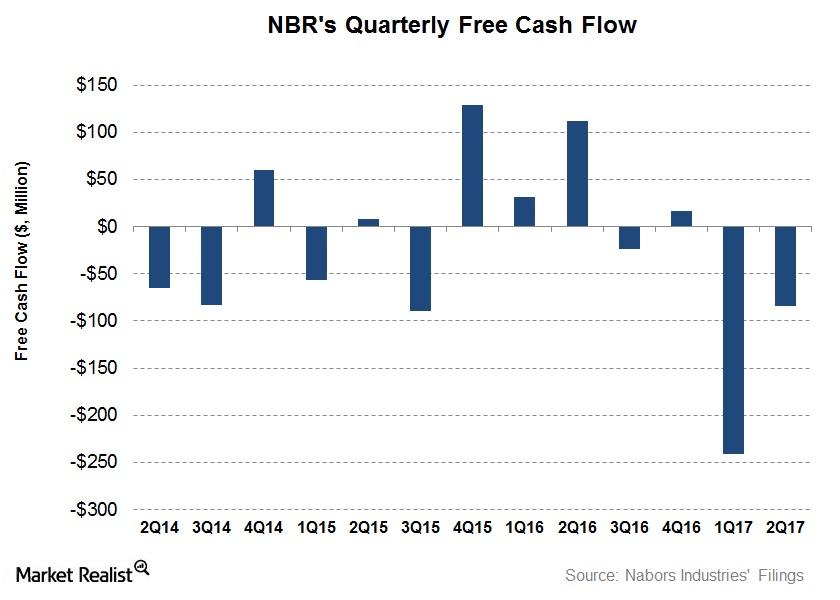

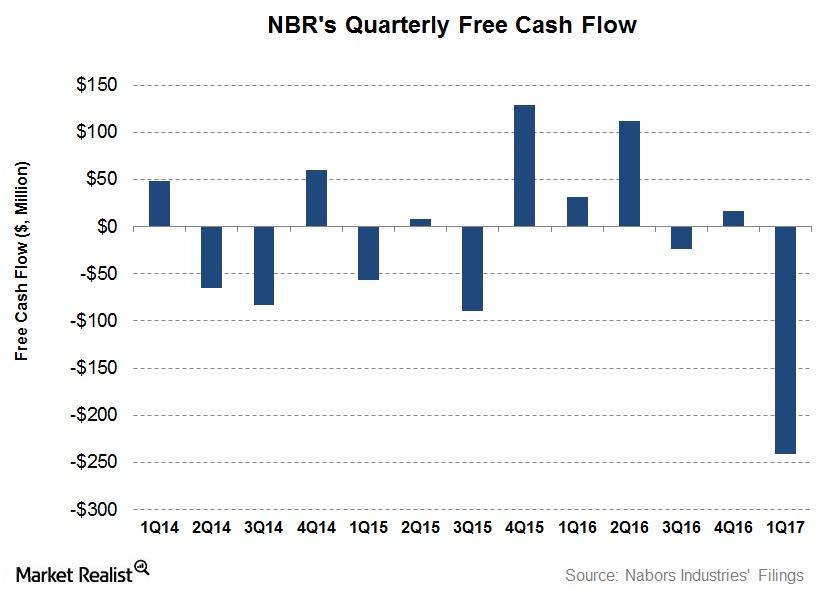

How Nabors Could Use Its Free Cash Flow This Year

Nabors Industries’ (NBR) CFO (cash from operating activities) turned positive in 2Q17, compared with its negative CFO in 1Q17.

What Are Nabors Industries’ Capex Plans for 2017?

Nabors Industries’ (NBR) cash from operating activities (or CFO) turned negative in 1Q17, compared to its positive CFO a year earlier.

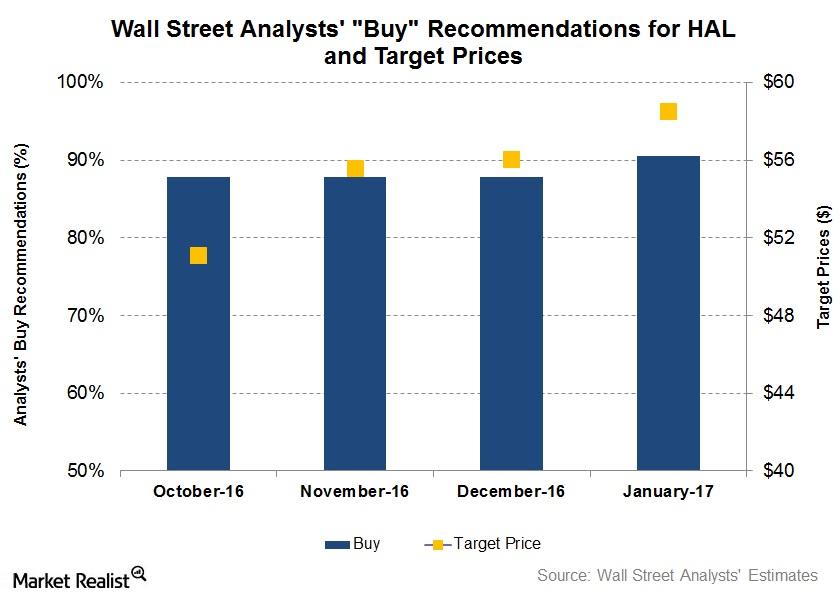

Analysts’ Recommendations for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy,” ~3% of the analysts rated it as a “sell,” and the other 5% rated it as a “hold.”

Analyzing Halliburton’s Free Cash Flow and Capex Plans

Halliburton’s cash from operating activities (or CFO) in 1Q17 was an improvement over 1Q16, although it was a steep deterioration compared to 4Q16.

What’s Happening to Halliburton’s Net Debt?

In 1Q17, Halliburton’s (HAL) total debt fell 29% compared to a year earlier, while its cash and marketable securities fell 78%.

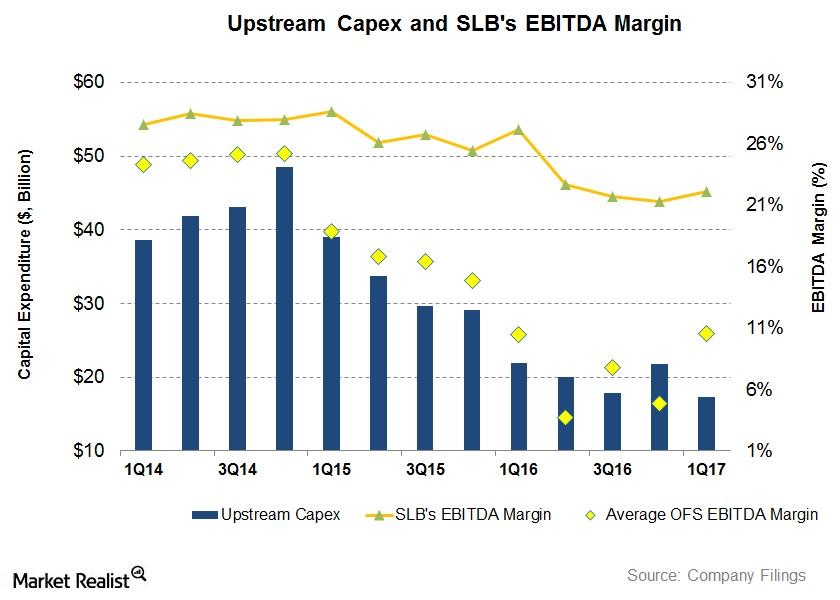

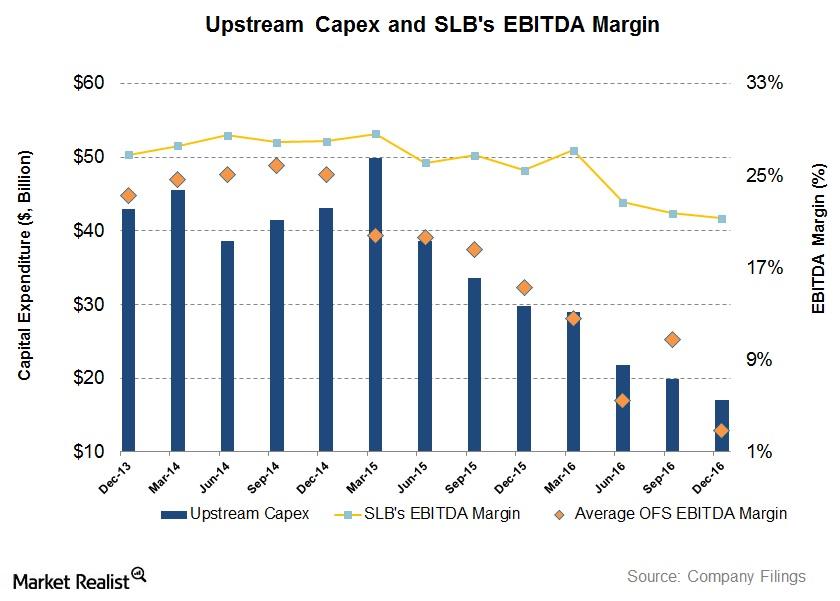

Upstream Operators’ Capex Could Impact Schlumberger’s Margin

Schlumberger’s EBITDA margin was impacted negatively as upstream companies slashed their budgets. From 1Q16 to 1Q17, Schlumberger’s EBITDA margin fell.

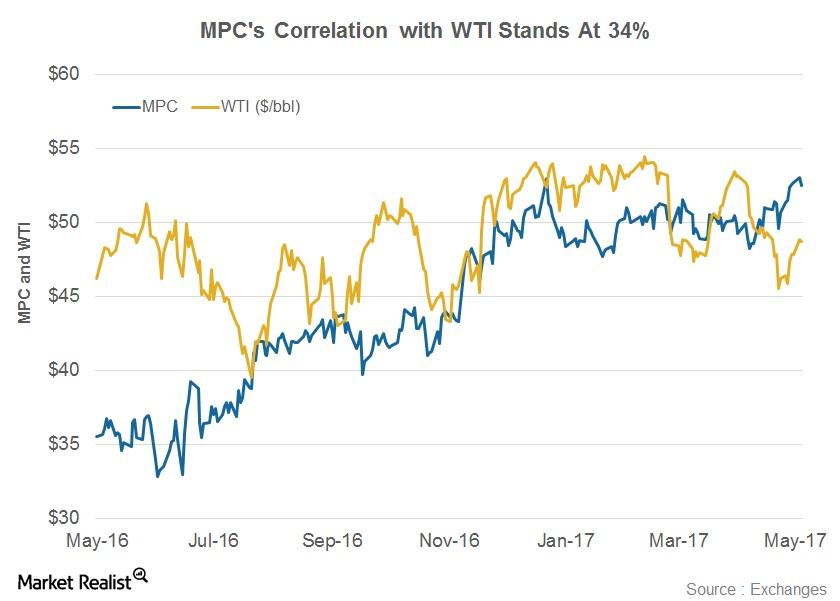

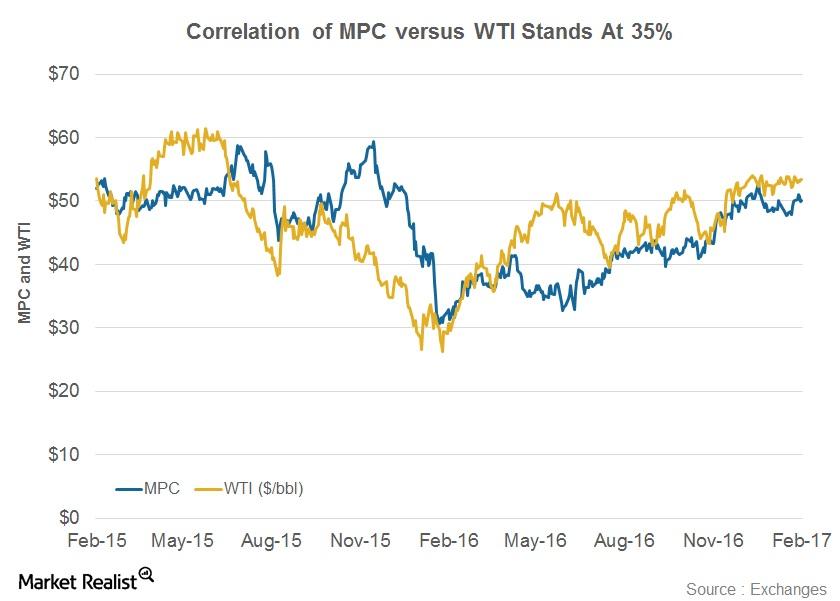

How Does MPC Stock Correlate with WTI?

Marathon Petroleum’s correlation with WTI stands at 0.34. This value shows that the two have a positive but relatively weak correlation.

Short Interest Trends in Cabot Oil & Gas Stock

On April 19, Cabot Oil and Gas’s short interest as a percentage of its float was ~4.5%. At the beginning of the year, its short interest ratio was 4.2%.

Which Way Will MPC’s Refining Earnings Swing in 1Q17?

MPC’s operating income rose 64% YoY to $553 million in 4Q16. The Refining segment’s operating income rose to $219 million in 4Q16 from $179 million in 4Q15.

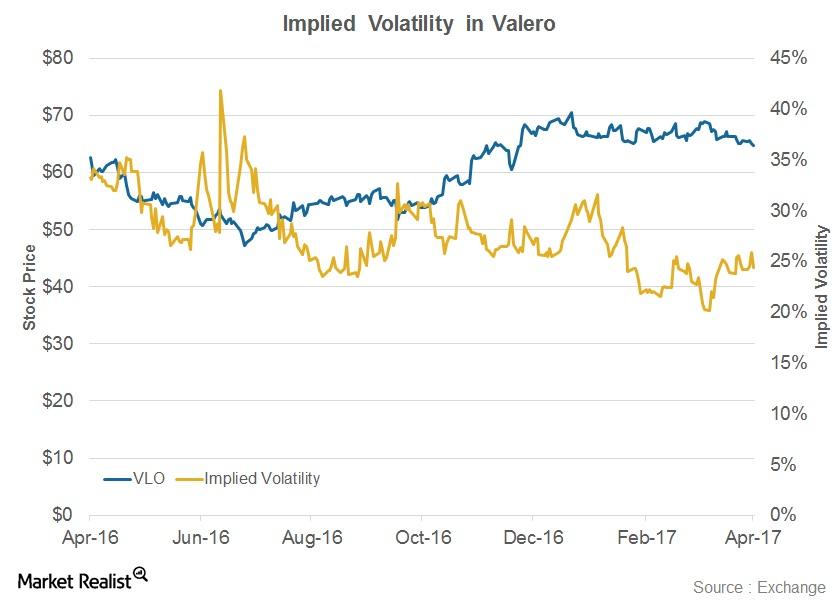

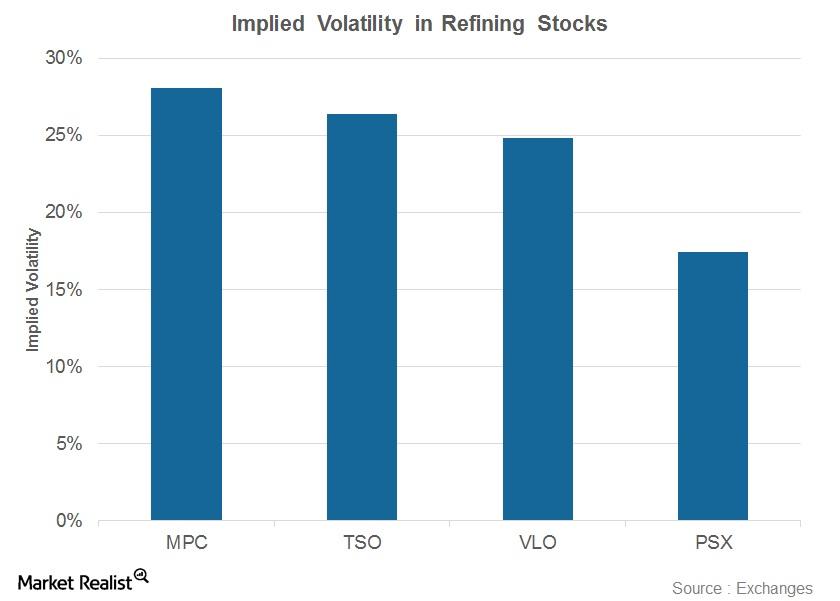

Behind Valero’s Implied Volatility ahead of the 1Q17 Results

The implied volatility of Valero Energy (VLO) stock now stands at 24%. This level is equal to VLO’s 30-day average implied volatility.

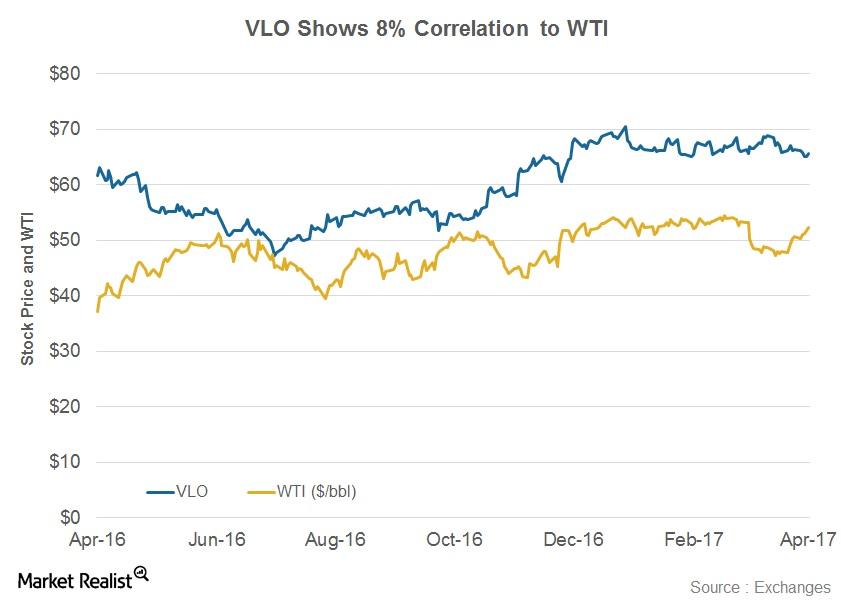

What Is the Relationship between VLO and WTI?

The correlation coefficient between VLO and WTI stands at 0.08.

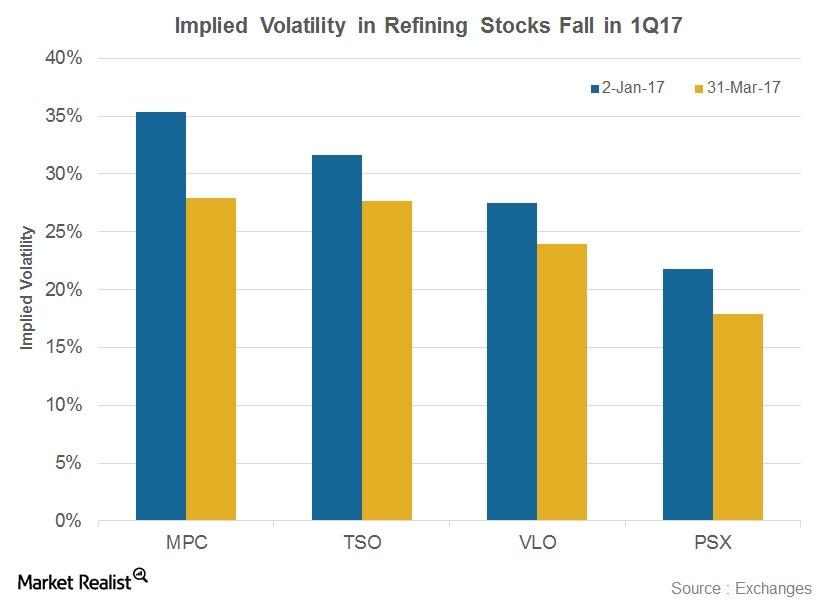

Refining Stocks’ Implied Volatilities Tumbled in 1Q17

Refining stocks’ implied volatilities have witnessed falls in 1Q17. Marathon Petroleum’s (MPC) implied volatility fell 7% to 27.9% from January 2 to March 31, 2017.

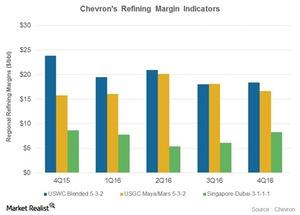

A Look at Chevron’s Refining Margin Trends

Chevron’s refining capacity Before we analyze Chevron’s (CVX) refining margin trends, le’s quickly look at its refining capacity. Chevron’s total refining capacity stands at 1.8 MMbpd (million barrels per day). Most of Chevron’s capacity, around ~1 MMbpd, is in the United States. In the international arena, Chevron has combined refining capacity of 0.3 MMbpd in South […]

How Short Interest in COG Stock Has Been Trending

On March 14, 2017, Cabot Oil and Gas’s (COG) short interest as a percentage of its float (or its short interest ratio) was ~3.5%.

Analyzing Halliburton’s Free Cash Flow and Capex Plan

In this article, we’ll analyze how Halliburton’s (HAL) operating cash flows have trended over the past few quarters. We’ll also discuss its free cash flow (or FCF).

ExxonMobil’s Robust Upstream Portfolio: Poised for Growth

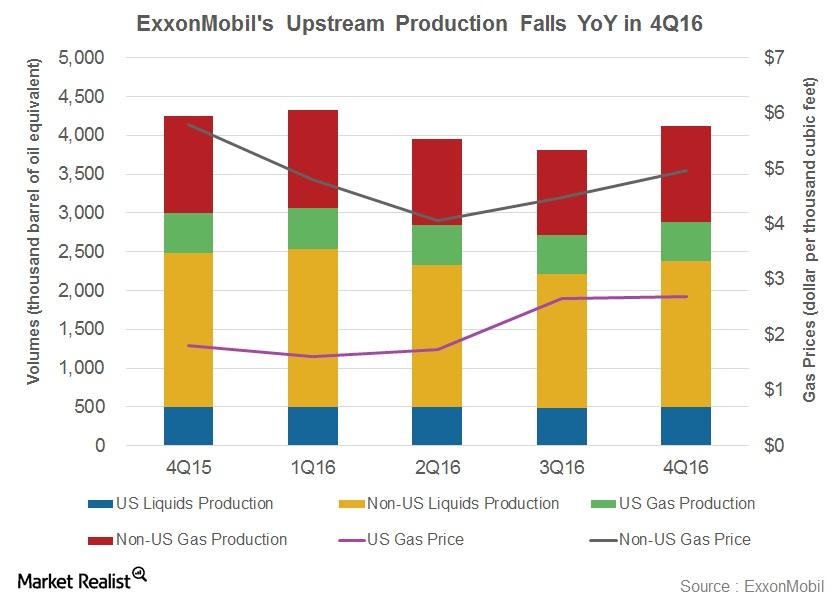

ExxonMobil (XOM) produced 4.1 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 4Q16.

Understanding the Latest Implied Volatility in Refining Stocks

Marathon Petroleum’s implied volatility currently stands at 28%—the highest level among peers Valero, Tesoro, and Phillips 66.

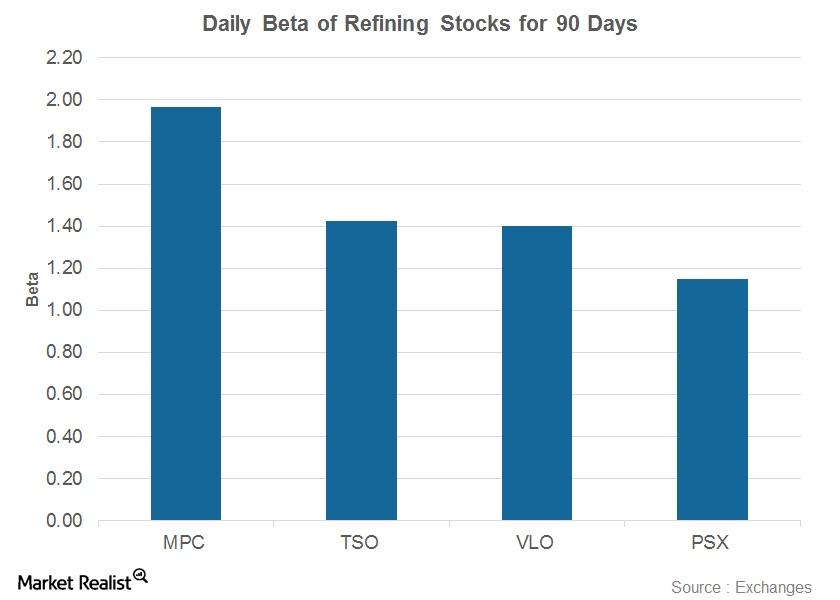

Refining Stock Betas: Who Could Pop?

On March 2, 2017, Marathon Petroleum’s 90-day beta stood at 2.0—the highest among peers Valero, Tesoro, and Phillips 66.

Understanding the Correlation between MPC’s Stock and Oil Prices

The correlation coefficient of Marathon Petroleum and WTI stands at 0.35—a positive but feeble correlation.

Will Upstream Operators’ Capexes Affect SLB’s 1Q17 Margin?

In the past couple of years, some major US upstream and integrated companies have reduced their capital expenditures (capex) following crude oil’s sharp fall.

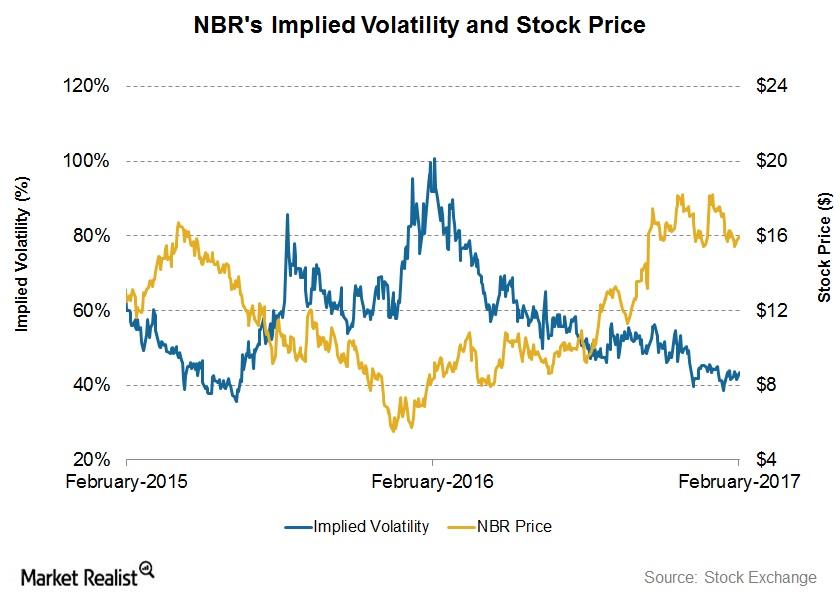

What Nabors Industries’ Implied Volatility Suggests

On February 13, 2017, Nabors Industries (NBR) had an implied volatility of 43%.

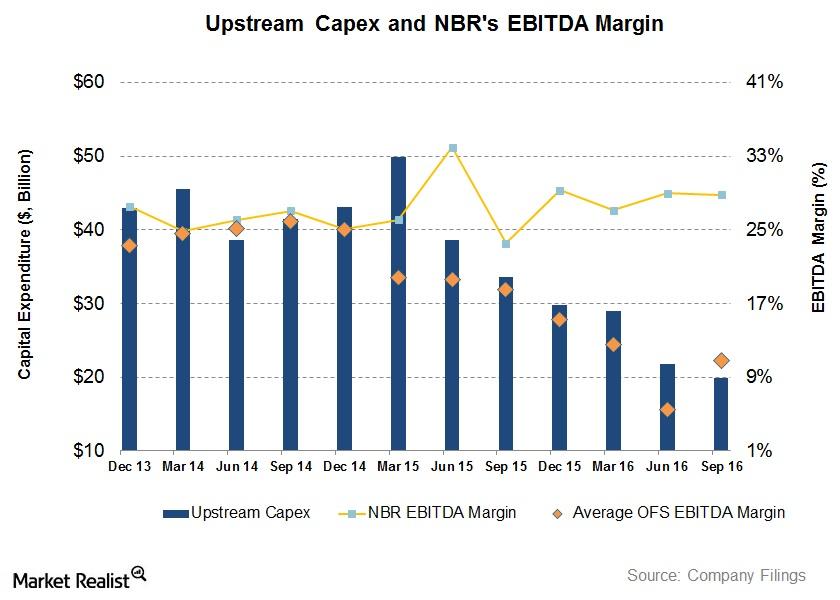

Will Upstream Operators’ Capex Affect Nabors’ 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure following crude oil prices’ sharp decline.

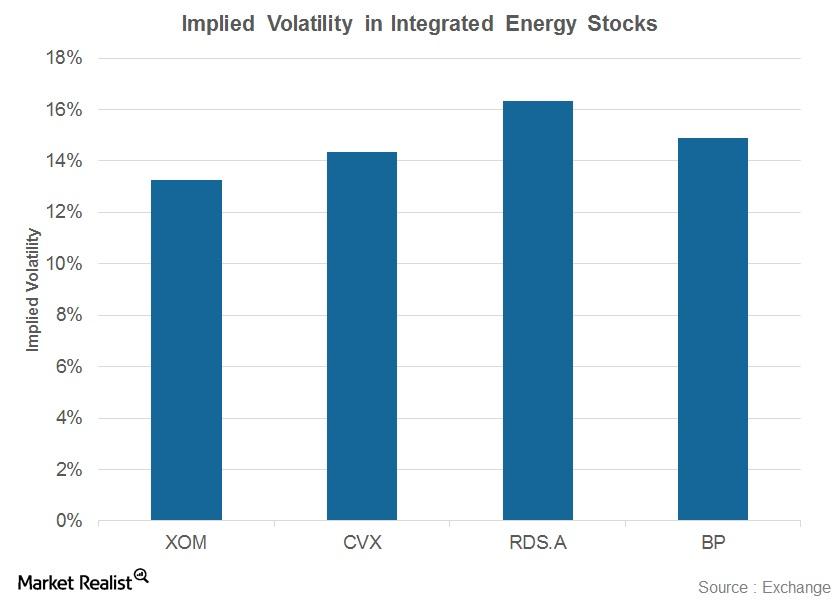

Where Do Implied Volatilities in Integrated Energy Stocks Stand?

Implied volatility in Royal Dutch Shell (RDS.A) currently stands at 16%, which is the highest compared to peers ExxonMobil (XOM), Chevron (CVX), and BP (BP).

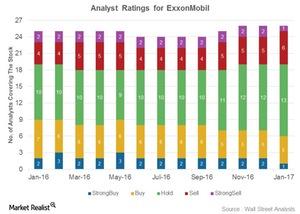

Analysts’ Ratings for ExxonMobil after Its Earnings

Six analysts gave ExxonMobil a “buy” rating, 13 analysts gave it a “hold” rating, and seven analysts gave it a “sell” rating after its 4Q16 earnings.

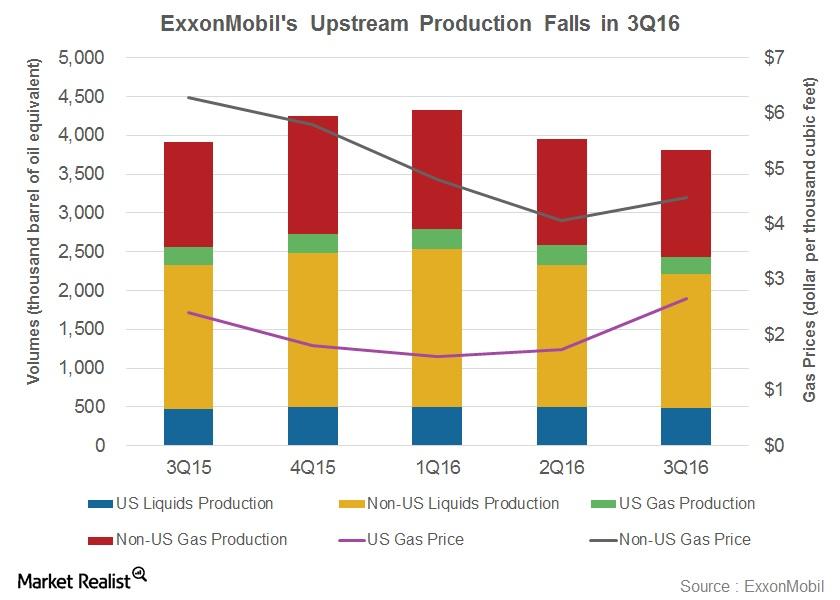

How Has ExxonMobil’s Upstream Production Trended?

ExxonMobil (XOM) produced 3.8 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 3Q16.

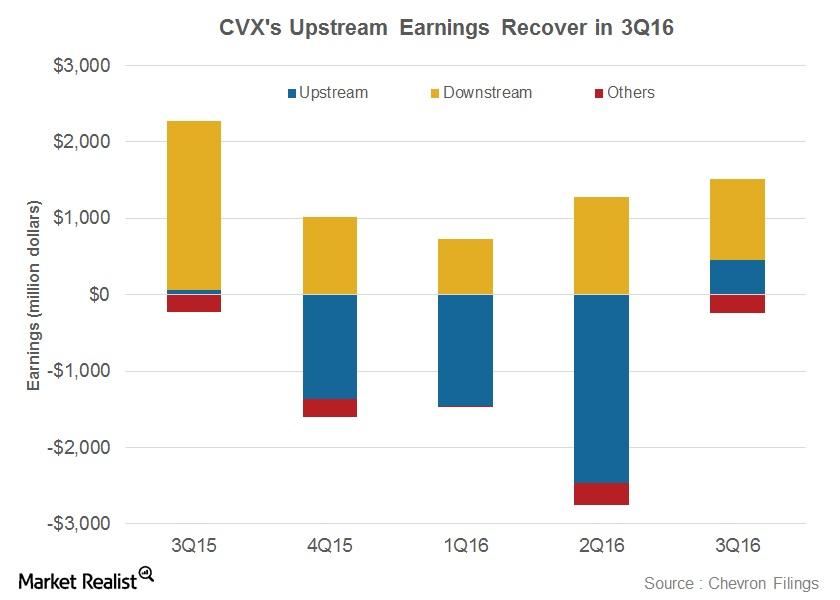

Chevron’s 4Q16 Segmental Outlook: Is It Positive?

Chevron’s (CVX) Downstream segment saw its earnings fall 52% YoY to ~$1.1 billion in 3Q16.

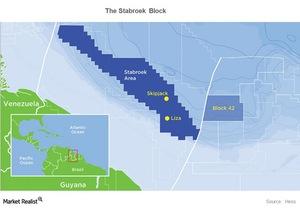

Once Again, ExxonMobil Discovers Oil in Guyana

ExxonMobil (XOM) has found oil in the Payara-1 Well in the Stabroek Block, positioned 120 miles offshore Guyana. This is the company’s second discovery in the block.

What’s the Correlation between Valero Stock and WTI?

The correlation coefficient of Valero (VLO) and WTI stands at 0.15. The correlation value for Valero’s stock and oil price show that they have a positive but feeble correlation.

How Have Superior Energy’s Recommendations Changed before the 4Q16 Earnings?

On January 6, 2017, ~70% of the analysts tracking SPN recommended a “buy” or some equivalent for the stock, while ~30% of the analysts issued a “hold.”

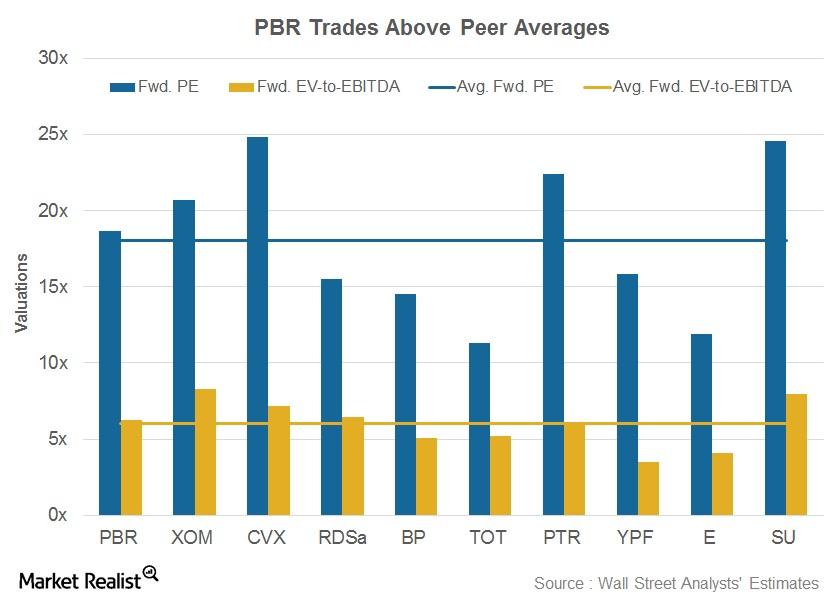

Why Is Petrobras’s Valuation Higher Than Peer Average?

After its production update news, Petrobas’s forward PE and EV-to-EBITDA stood at 18.7x and 6.3x, respectively.

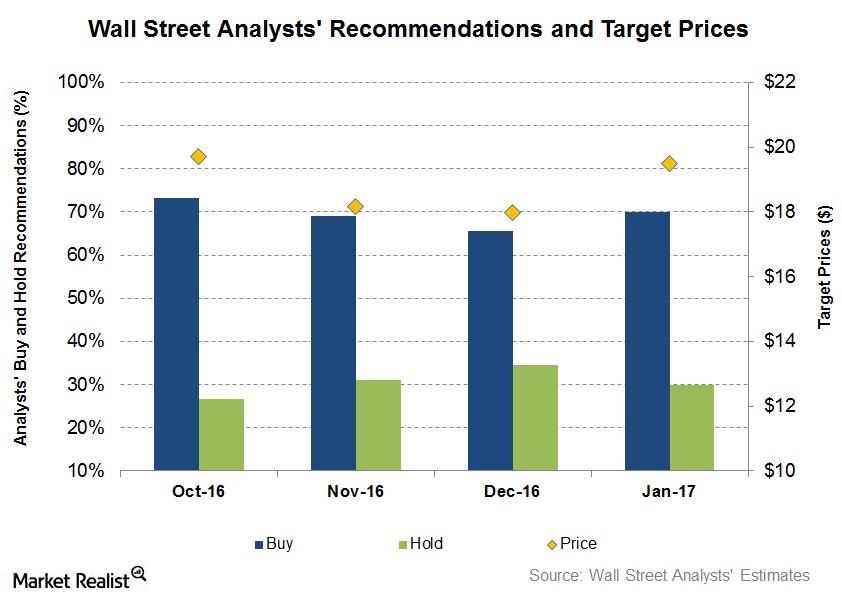

Wall Street’s Forecasts for Halliburton before Its 4Q16 Earnings

On January 3, 2017, 90% of the analysts tracking Halliburton (HAL) rated it a “buy” or some equivalent.

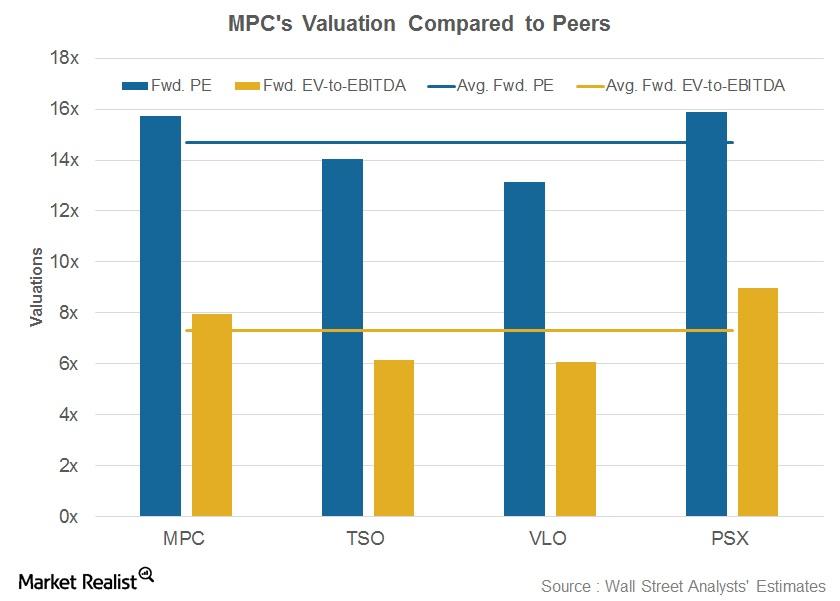

MPC’s Dropdown Plans: Where Do Its Valuations Stand?

After MPC proposed the dropdown plan, MPC’s forward price-to-earnings (or PE) and EV-to-EBITDA stood at 15.7x and 8x, respectively.

Are Analysts Changing Recommendations for Halliburton?

In December so far, 90% of the analysts tracking Halliburton rated it a “buy” or some equivalent.