iShares North American Natural Resources

Latest iShares North American Natural Resources News and Updates

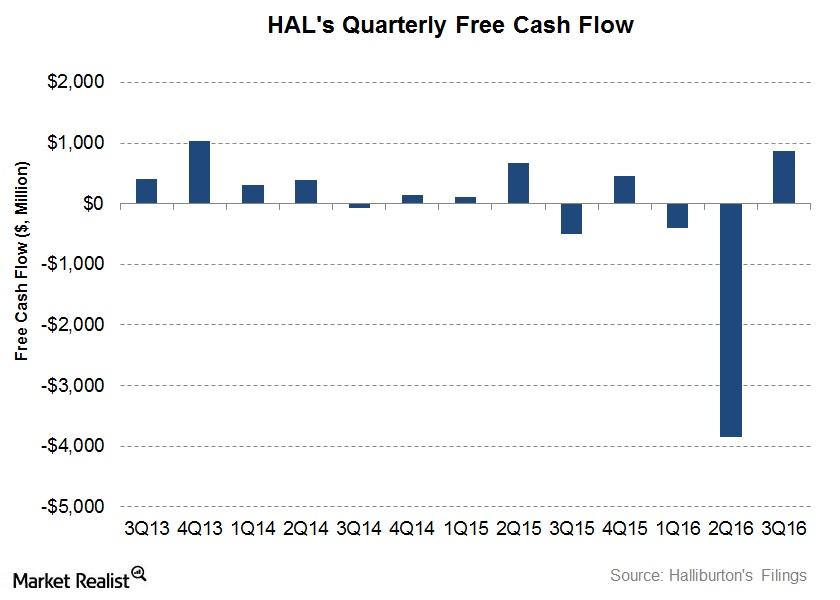

Why Did Halliburton’s Free Cash Flow Improve?

Halliburton’s cash from operating activities (or CFO) turned positive in 3Q16.

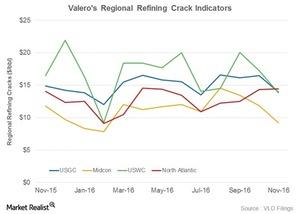

Analyzing Cracks to Predict Valero’s Refining Margin in 4Q16

Now, let’s analyze the refining margin indicators published by Valero Energy (VLO). These indicators point toward VLO’s likely margin trend in 4Q16.

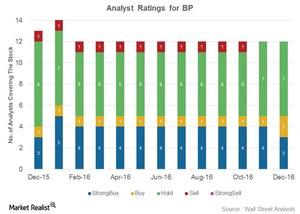

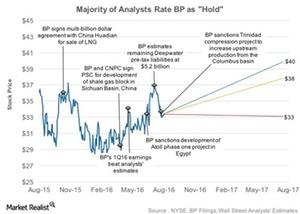

Why Do a Majority of Analysts Rate BP as a ‘Hold’?

BP (BP) plans to rebalance its sources and uses of cash by 2017 at an oil price level of $50–$55 per barrel.

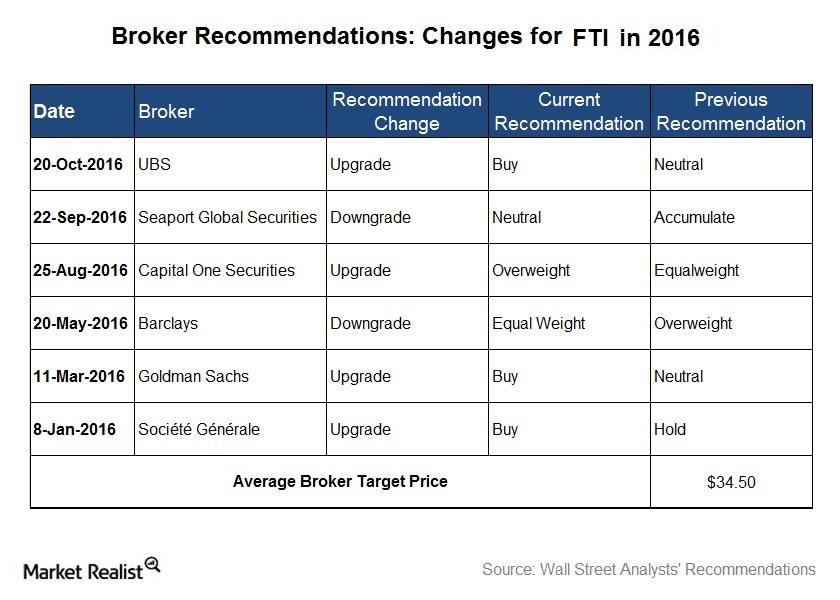

What Do Analysts Recommend for FMC Technologies?

In November, 34% of the analysts tracking FMC Technologies rated it a “buy,” ~55% rated it a “hold,” and only 3% of the analysts rated it a “sell.”

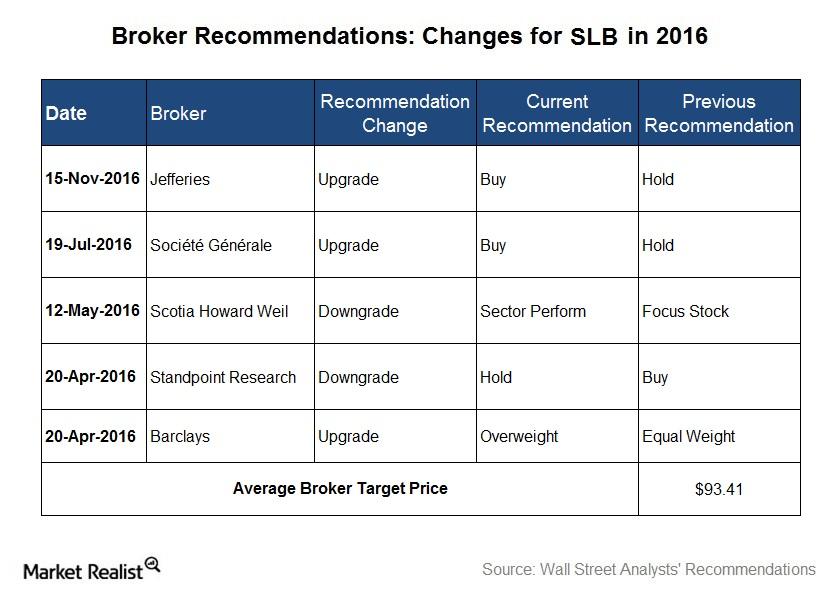

Wall Street Analysts’ Recommendations for Schlumberger

In November, 83% of the analysts tracking Schlumberger rated it a “buy” or some equivalent. The other 18% of the analysts recommended a “hold” or a “sell.”

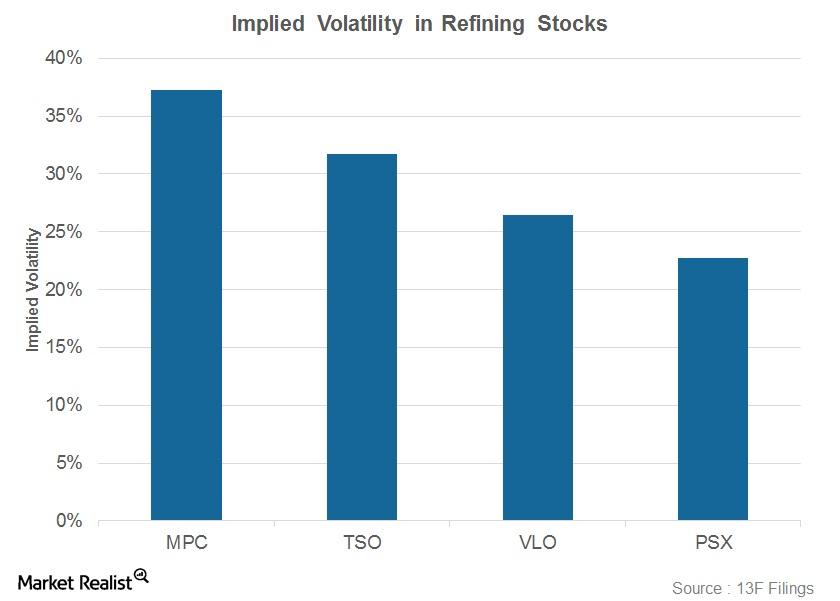

Where Are Refining Stocks’ Implied Volatilities Positioned?

Marathon Petroleum’s (MPC) implied volatility currently stands at 37%, the highest among its peers.

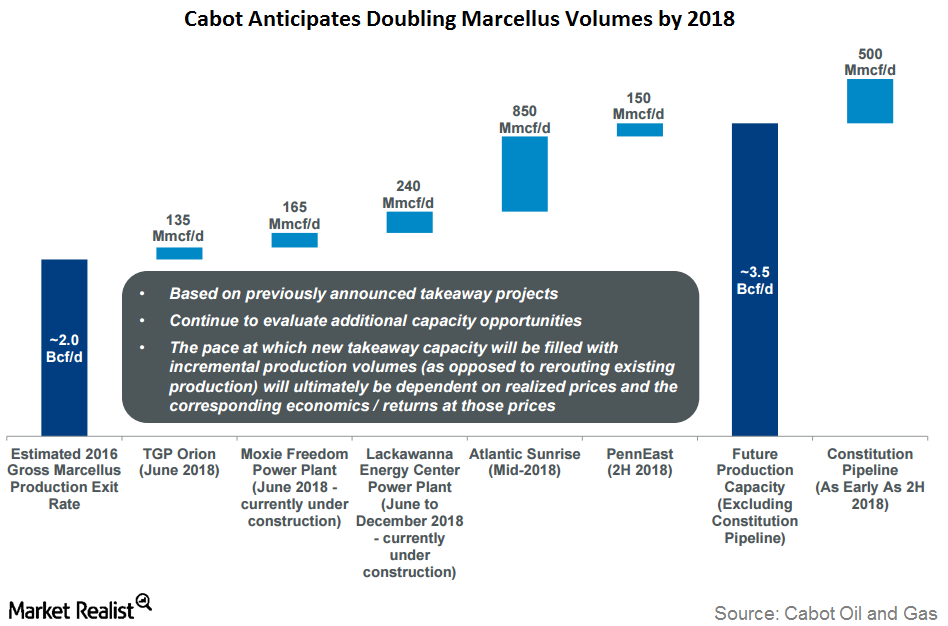

Why Cabot Awaits the Atlantic and Constitution Pipeline Projects

Cabot Oil & Gas’s stock price momentum has slowed, but its stock has recently been rising, mirroring natural gas prices.

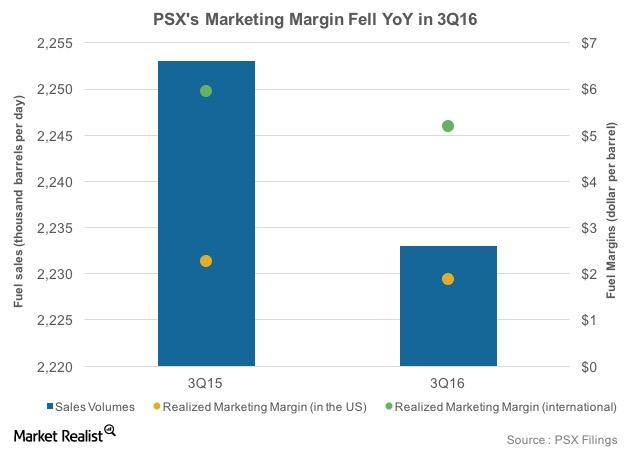

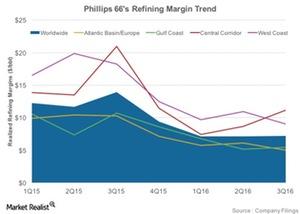

How Did Phillips 66’s Marketing Segment Perform in 3Q16?

Phillips 66’s adjusted EBITDA from its Marketing segment fell 22% from 3Q15 to $429 million in 3Q16 due to weaker marketing margins and lower volumes.

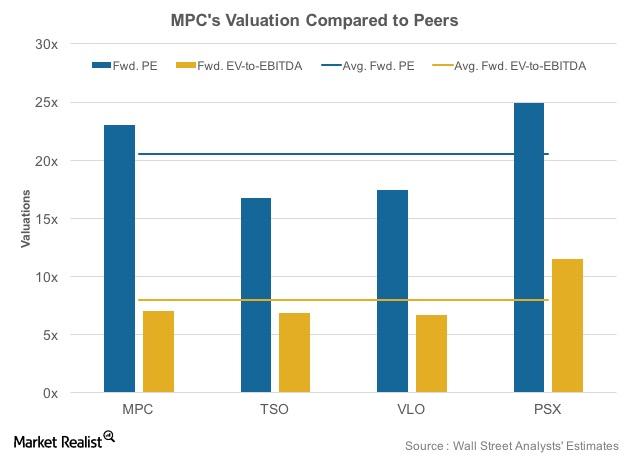

Elliott’s Recommendation: Where Does Marathon’s Valuation Stand?

After Elliott Management’s recommendations, Marathon Petroleum’s forward EV-to-EBITDA multiple stood at 23.1x.

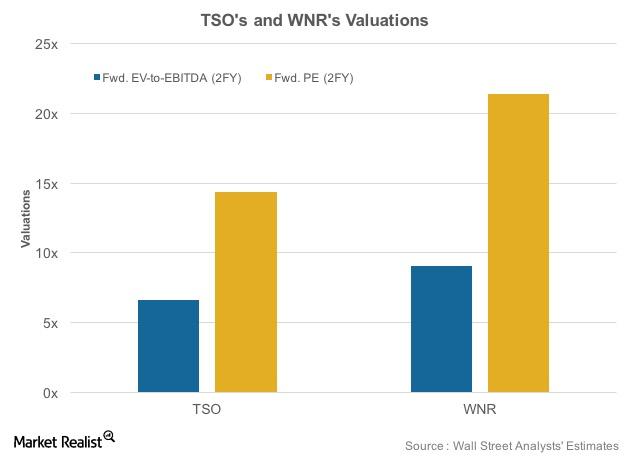

TSO to Acquire WNR: Where Do Their Valuations Stand?

In this article, we’ll look at Tesoro’s (TSO) and Western Refining’s (WNR) valuations following the news of TSO’s acquisition of WNR.

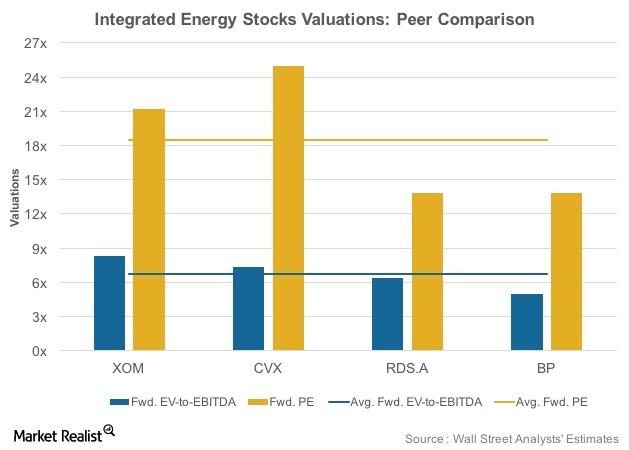

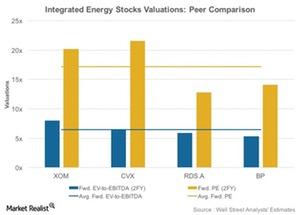

Integrated Energy Stocks’ Post-3Q16 Forward Valuations

XOM trades at 8.3x forward EV-to-EBITDA and 21.2x forward price-to-earnings, both above its peer averages.

How Refining Margins Are Key Indicators of Refining Profitability?

Refining margins are dependent on input crude oil cost, product slate, and prices of refined products and are indicators of overall profitability.

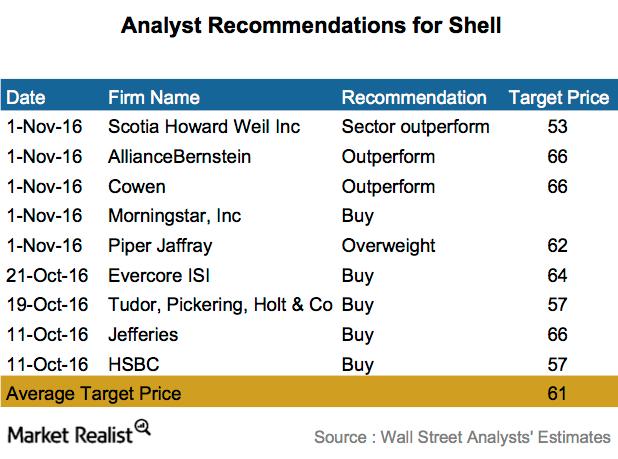

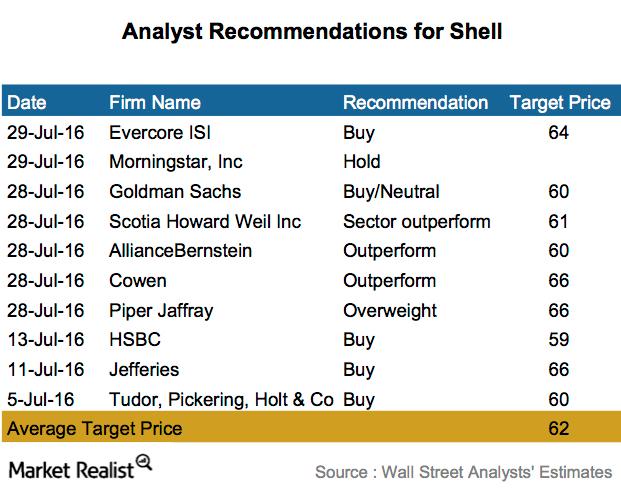

Analysts’ Recommendations for Shell: Most Say ‘Buy’

Shell’s highest and lowest 12-month price targets stand at $66 and $53. It indicates a 27% and 2% rise from its current levels, respectively.

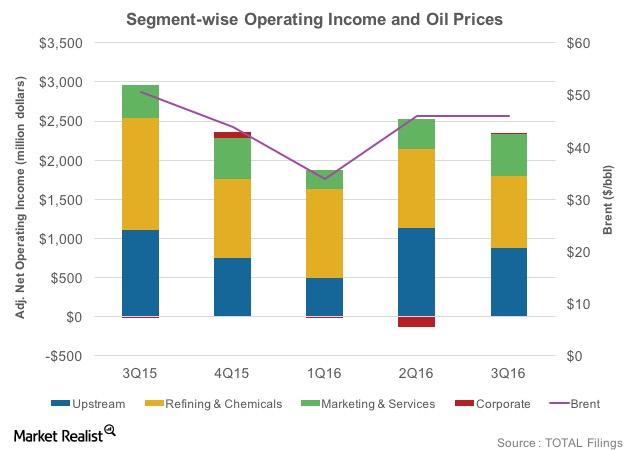

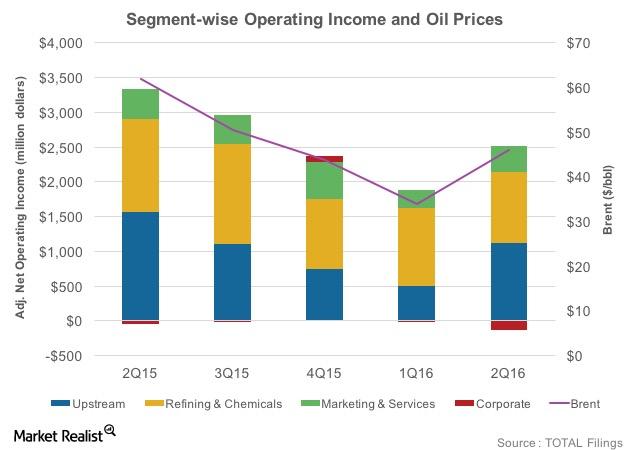

Analyzing Total’s Segmental Earnings in 3Q16

Total’s net adjusted operating earnings from the Upstream segment fell 21% from 3Q15 to $877 million in 3Q16 due to lower crude oil prices.

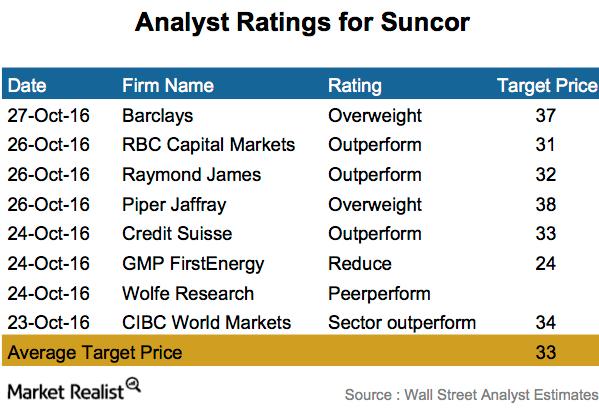

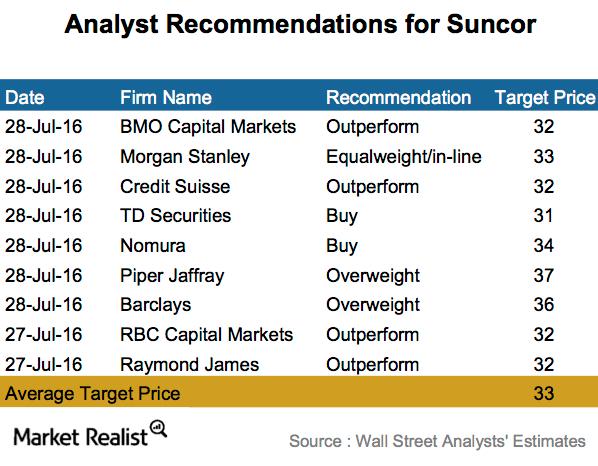

Suncor: How Analysts Are Rating the Stock after Earnings

An analyst survey shows that six out of eight companies surveyed rated Suncor Energy (SU) an “overweight” or “outperform.”

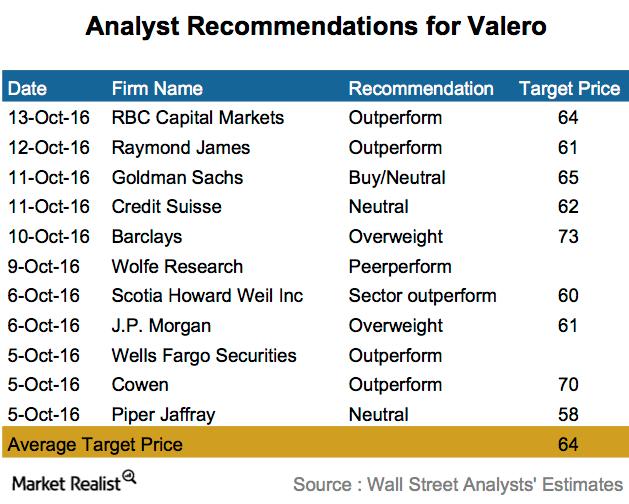

How Analysts Are Rating Valero ahead of Its 3Q16 Earnings

Eight of the 11 firms rated Valero as a “buy,” “overweight,” or “outperform,” with a high 12-month price target of $73, indicating a potential 35% gain.

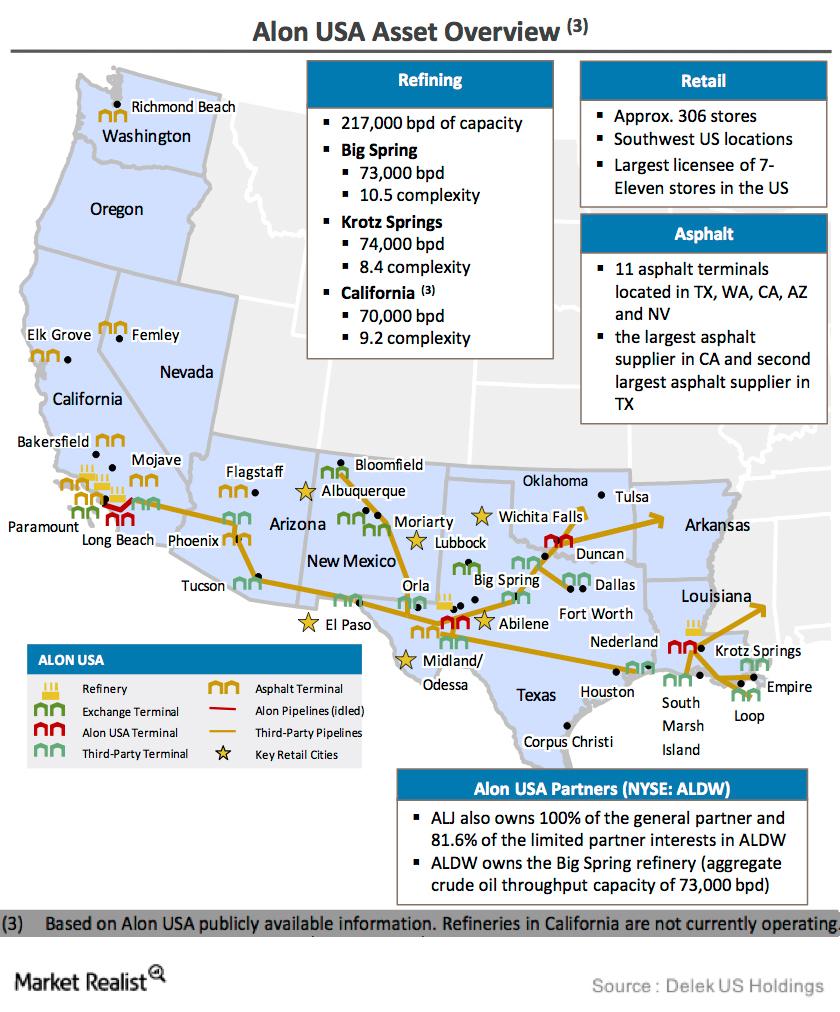

Can Delek US Fully Acquire Alon USA?

Delek US Holdings will be transformed if it succeeds in the acquisition of the remaining stake in Alon USA Energy.

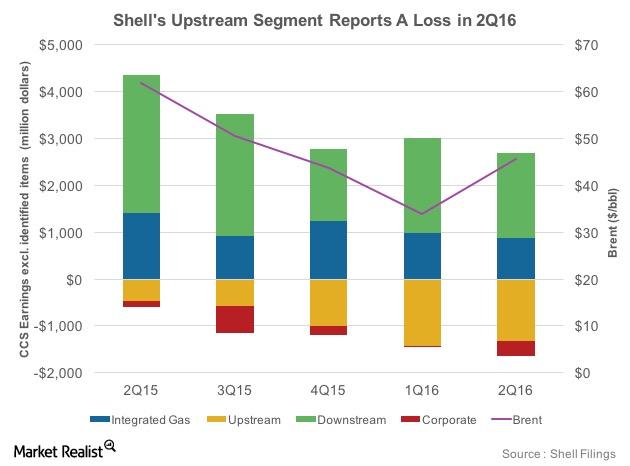

Shell’s Segments: Upstream Continues to Report Losses

Falling crude oil prices have changed the segmental dynamics within integrated energy companies such as Royal Dutch Shell (RDS.A).

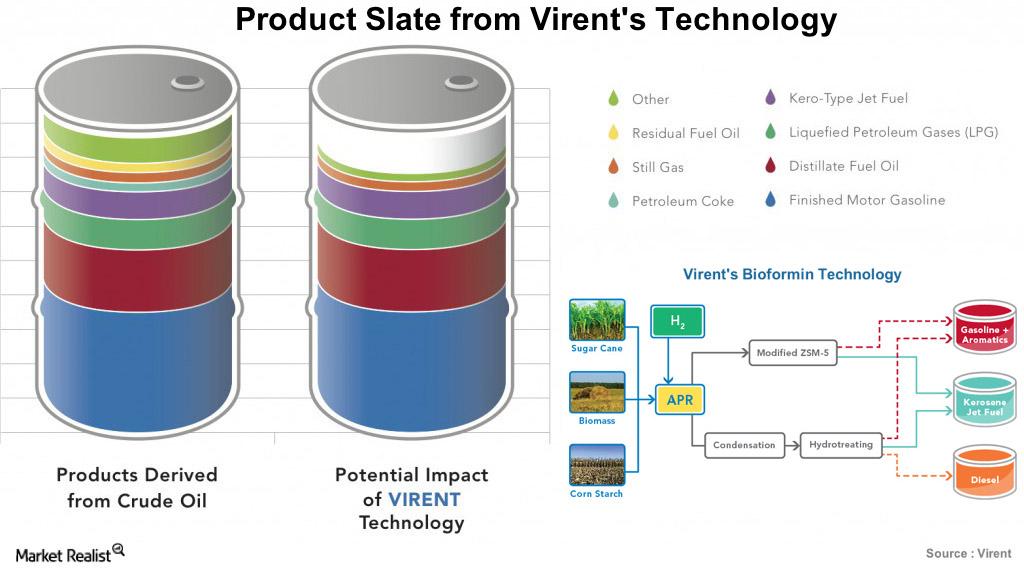

Tesoro’s Acquisition of Virent Helps It Focus on Biofuels

In a bid to foster its biofuels business, Tesoro (TSO) has agreed to acquire Virent. The company is expected to operate as Tesoro’s wholly owned subsidiary.

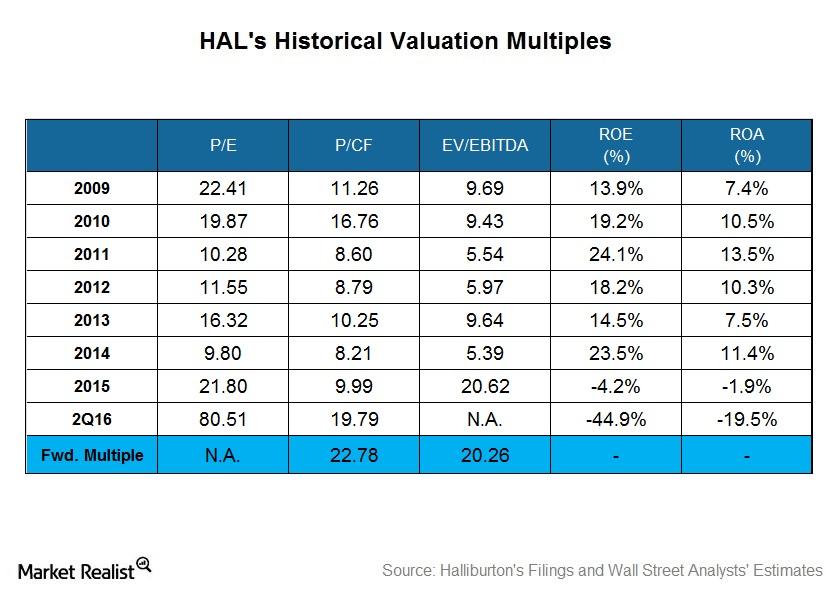

Explaining Halliburton’s Historical Valuation

A steeper earnings decline compared to the decline in its share price caused Halliburton’s (HAL) PE multiple to expand in 2015.

Looking 2 Years Out, Energy Stocks Trade at Respectable PEs

ExxonMobil (XOM) trades at an 8.1x EV-to-EBITDA multiple and a 20.2x price-to-earnings ratio, both above its peers’ averages.

Why Most Analysts Recommend ‘Holds’ on BP

Analysts’ ratings for BP (BP) show that 31% of those covering the stock rate it as a “buy,” and 61% rate it as a “hold.”

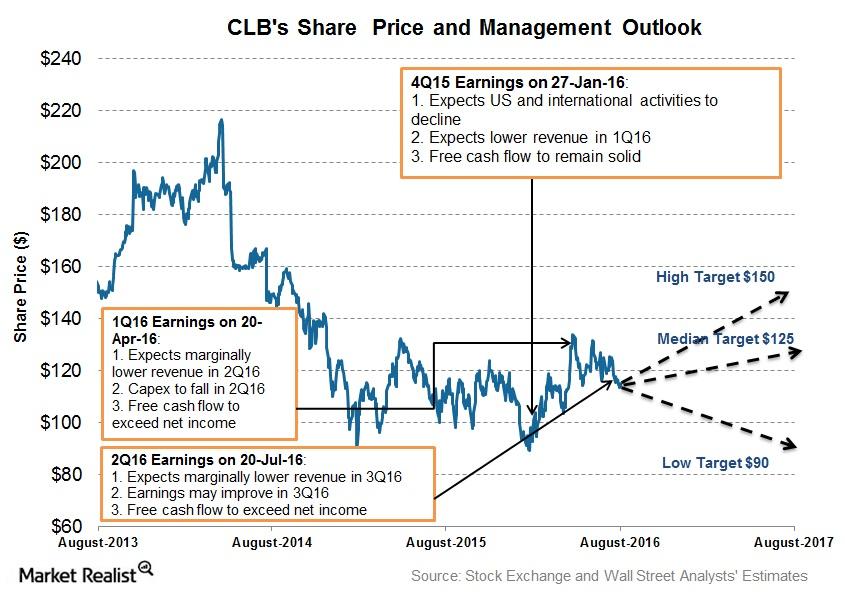

Inside Core Laboratories’ Management Projections for 3Q16

Core Laboratories expects onshore energy production to fall by the end of 2016 and net production of legacy deepwater projects to offset onshore declines.

Majority of Analysts Rate Shell as a ‘Buy’ Post-2Q16 Earnings

Nine out of the ten companies surveyed rated Royal Dutch Shell (RDS.A) a “buy,” “overweight,” or “outperform.”

Majority of Analysts Rate Suncor a ‘Buy’ after 2Q16 Earnings

Analyst surveys show that eight of the nine analysts surveyed rated Suncor (SU) a “buy,” “overweight,” or “outperform.”

Total’s Segments: Upstream Earnings Plunge but Stay Positive

Changing oil prices have changed the dynamics for Total’s segments. Although upstream earnings have declined in 2Q16 YoY, they stayed positive in the quarter.

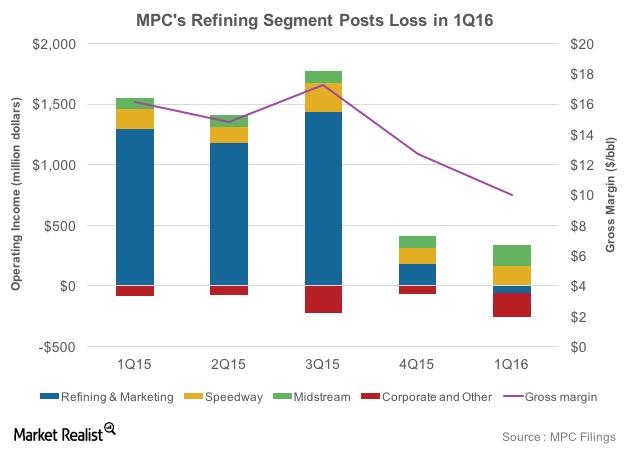

How Will Marathon Petroleum’s Refining Earnings Shape Up in 2Q16?

Marathon Petroleum’s (MPC) refining segment’s operating income plunged to -$62 million in 1Q16 due to a fall in its gross refining and marketing margin.

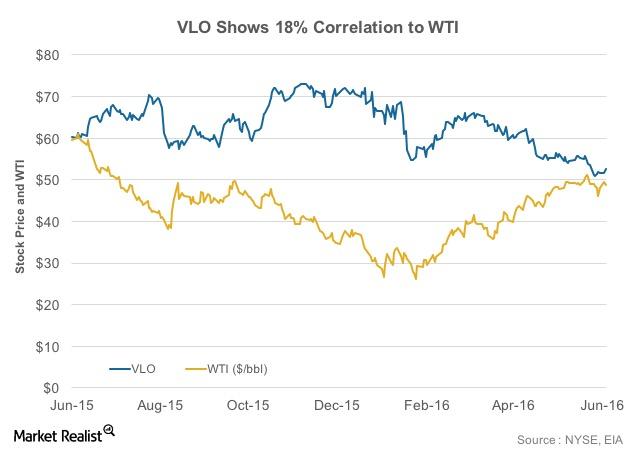

What’s the Correlation between Valero Stock and Oil Prices?

The correlation value for Valero stock and the price of oil shows they have a positive but feeble correlation. Valero stock moves in line with WTI prices only to a certain extent.

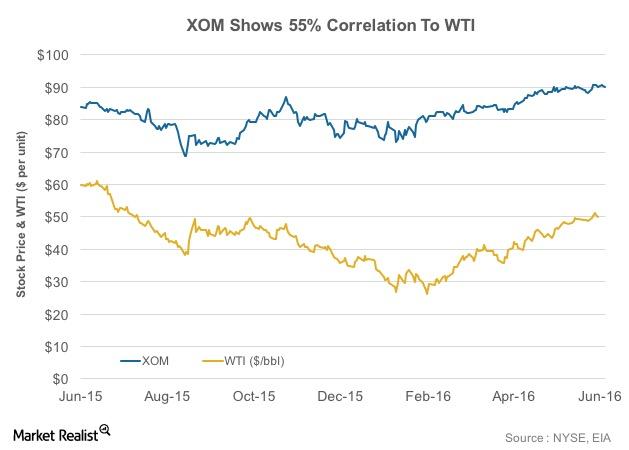

What’s the Correlation between XOM’s Stock and Crude Oil?

Integrated energy companies such as ExxonMobil (XOM) are affected by volatility in crude oil prices. To what degree? This varies from company to company.

What Does a Fall in Shell’s Short Interest Mean?

Shell has witnessed a 49% fall in its short interest volumes since February 10, 2016. This indicates that the bearish sentiment for the stock is weakening.

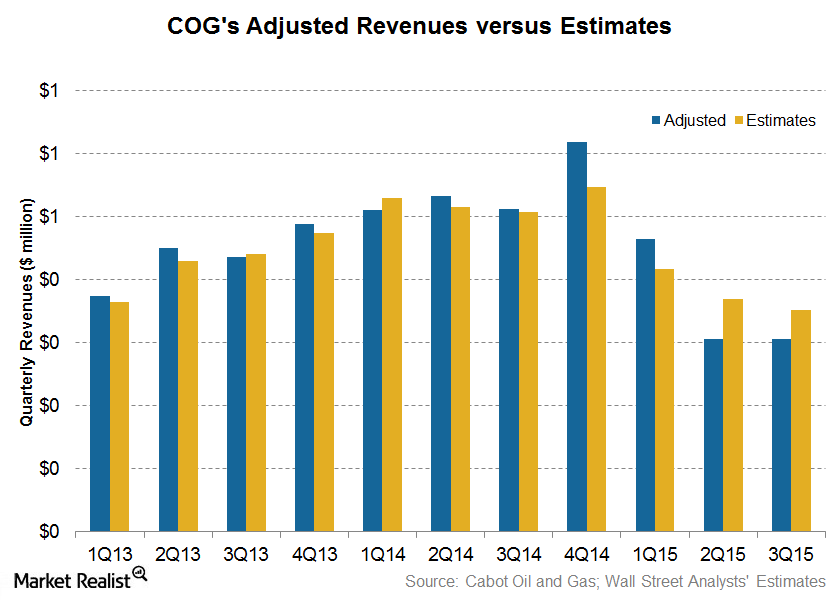

3Q15 Earnings: Cabot Oil and Gas’s Revenue Missed Estimates

Wall Street analysts’ estimate for Cabot Oil and Gas’s revenue was ~$352 million for 3Q15. The company announced adjusted revenue of ~$305 million.

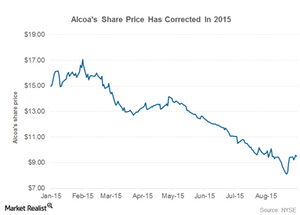

A Comparative Analysis of the Aluminum Industry

Aluminum is the second most widely used metal after steel. Investors have a special liking for aluminum. There are several ways to play the industry.

Short-Term Outlook: Freeport-McMoRan, Copper Could Drift Lower

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX).

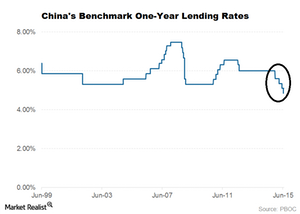

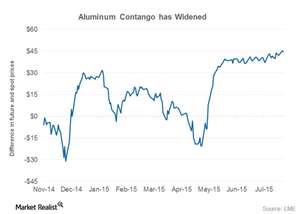

Aluminum Contango Widens as Market Expects Prices to Recover

A wider contango is generally associated with a short-term oversupply in the market. Aluminum market dynamics took a beating as China’s aluminum exports are reaching alarming levels.

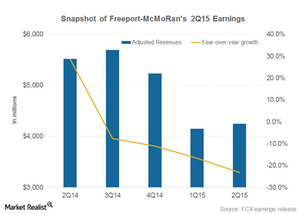

Lower Commodity Prices Take a Toll on Freeport’s 2Q15 Profits

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

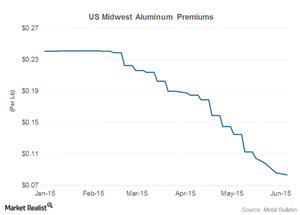

US Midwest Aluminum Premiums Are Still Caught in a Downtrend

Year-to-date, aluminum prices have lost ~9%, while physical aluminum premiums in the US have lost almost 60%.