Why Do a Majority of Analysts Rate BP as a ‘Hold’?

BP (BP) plans to rebalance its sources and uses of cash by 2017 at an oil price level of $50–$55 per barrel.

Dec. 9 2016, Updated 11:06 a.m. ET

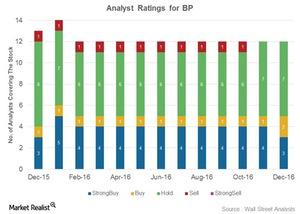

The majority of analysts rate BP as a “hold”

On December 4, 2016, BP (BP) was rated by 12 analysts, seven of whom assigned a “hold” recommendation to the stock.

These ratings have remained stable compared to November 2016, except for the change in its “strong buy” and “buy” ratings. However, these ratings have improved from the company’s October 2016 levels, where BP also had one “sell” rating. BP has also lived up to analysts’ expectations in its latest 3Q16 results, in which BP’s earnings have surpassed estimates.

BP’s peers ExxonMobil (XOM), Chevron (CVX), and Royal Dutch Shell (RDS.A) have been rated as a “buy” by 27%, 66%, and 100% of analysts, respectively. If you’re looking for exposure to integrated energy sector stocks, you can consider the iShares North American Natural Resources ETF (IGE). IGE has ~22% exposure to the industry.

BP strategies to equate its cash flows

BP plans to improve its liquidity position by equating its uses and sources of cash. The company plans to rebalance its sources and uses of cash by 2017 at an oil price level of $50–$55 per barrel. For this, BP plans to lower operating costs, optimize capex, and raise funds through divestments.

Considering operating costs first, by 2017, BP aims to reduce its annual cash costs by $7 billion over 2014. Plus, BP continues to restructure its portfolio by divesting non-strategic assets. BP plans to divest $3 billion–$5 billion of assets in 2016 to support its liquidity position. BP’s (BP) divestment proceeds for 9M16 stood at $2.3 billion, compared to $2.6 billion in 9M15. After 2016, BP expects $2 billion–$3 billion of asset sales per year.

Also, BP’s organic capex (or capital expenditure) for 3Q16 stood at $3.6 billion compared to $4.3 billion in 3Q15. BP expects 2016’s organic capex to be ~$16 billion, of which $11.5 billion was achieved in 9M16.

BP’s strategy of lowering costs, divesting non-strategic assets, and optimizing capex could work in its favor. Until concrete results are visible in terms of improving fundamentals, most analysts are likely to adopt a cautious approach, rating the stock a “hold.”

Move to the next part to learn more about BP’s dividend yield.