Petroleo Brasileiro SA Petrobras

Latest Petroleo Brasileiro SA Petrobras News and Updates

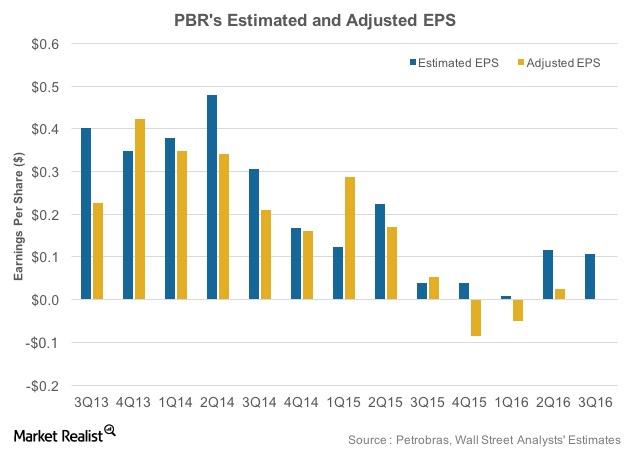

Petrobras’s Upcoming 3Q16 Results: Where Are Earnings Headed?

Petrobras (PBR) is expected to post its 3Q16 results on November 10, 2016. In 2Q16, it had adjusted EPS of $0.03 compared to analysts’ estimates of $0.12.

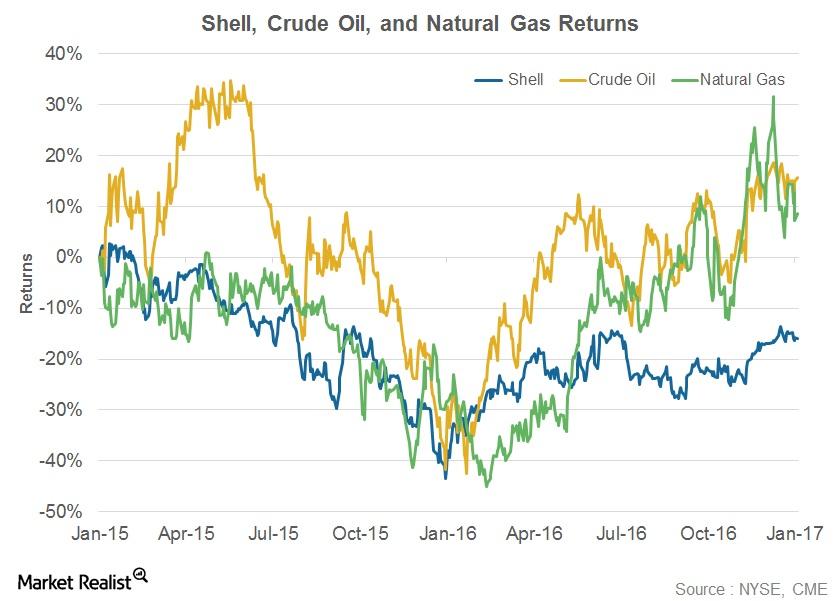

How Has Shell’s Stock Performed ahead of Its 4Q16 Earnings?

On January 20, 2016, Shell began recuperating from the falls it had experienced in the previous year. Shell has risen 49% since January 20, 2016.

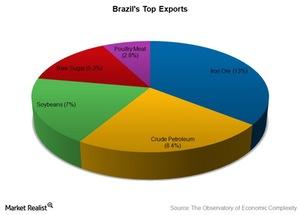

Are Commodities a Boon or a Bane for Brazil?

Brazil (EWZ) is rich in commodities. It’s among the top producers and exporters of iron ore, crude petroleum, soybeans, sugar, and meat.

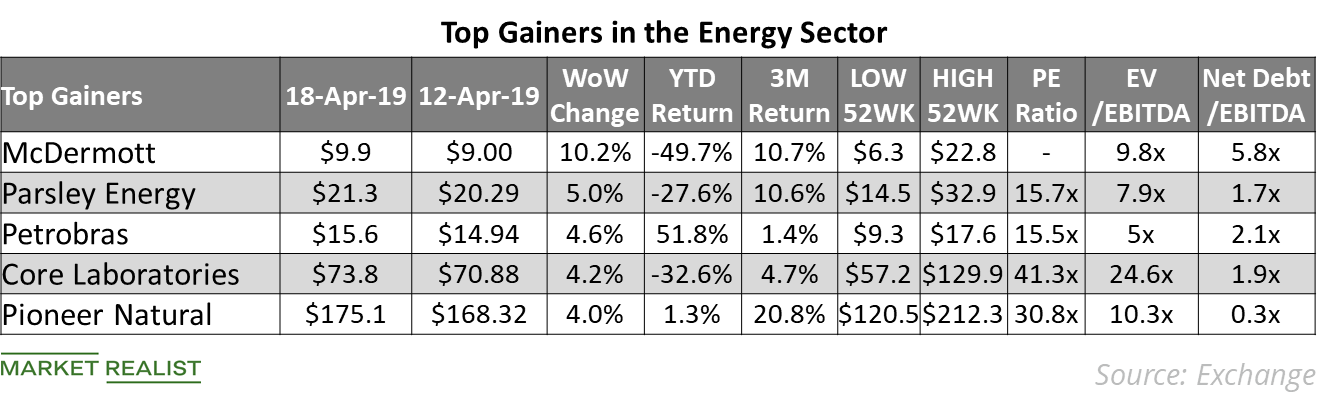

Top Energy Gains Last Week

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29.

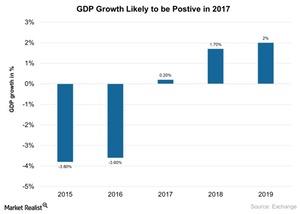

Why IMF Slashed Brazil’s Economic Growth Outlook in 2017

Economic activity in Brazil (EWZ) has been slow as it tries to emerge from its deep recession in 2016. But consumer and business confidence is improving.

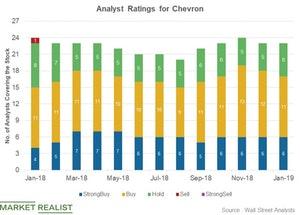

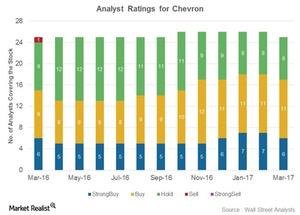

Chevron: Analysts’ Recommendations

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy.”

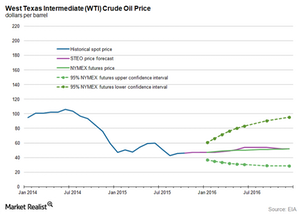

Crude Oil Bear Market: Worst Case Scenarios for 2016

Goldman Sachs (GS) suggests crude oil prices could test $20 per barrel in a worst case scenario in 2016.

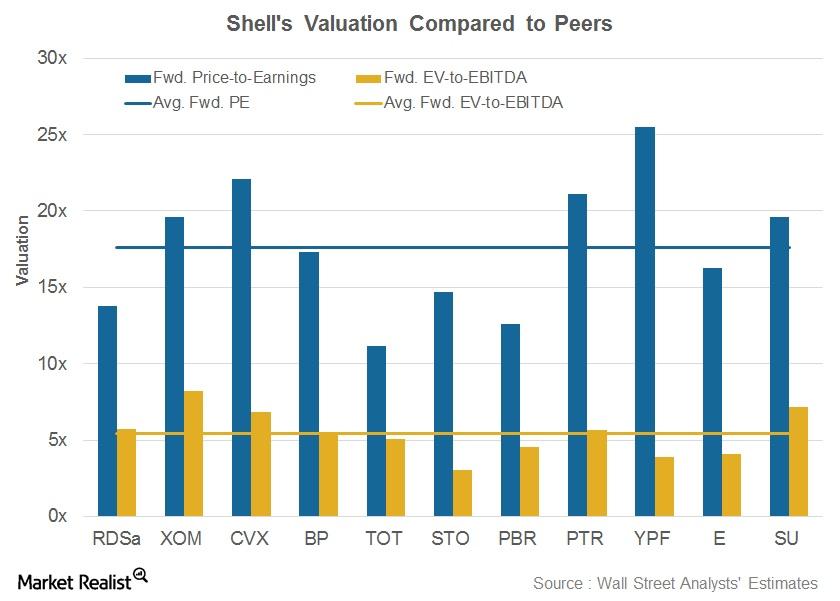

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.Financials Why Brazil seeks diversification

Given the declining competitiveness of its commodity exports, Brazil’s economy is attempting to diversify away from its economic model.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

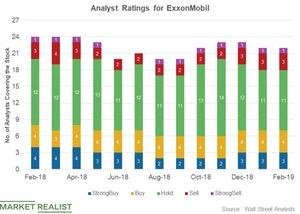

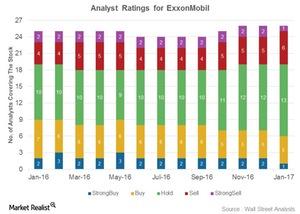

ExxonMobil: Analysts’ Recommendations

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model.

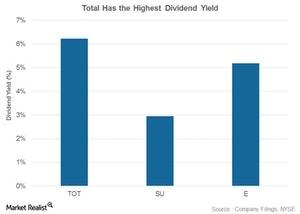

TOT, SU, E, and PBR: Comparing Their Dividend Yields

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have provided steady returns to their shareholders in the form of dividends.

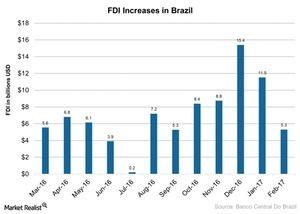

Will Rising FDI in Brazil Help 2017 Market Performance?

FDI (foreign direct investments) in Brazil picked up in the second half of 2016 in spite of a slow economy, impeachment of the president, political crises, and corruption scandals.

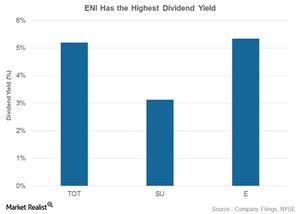

TOT, SU, E, PBR: Who Has Highest Dividend Yield?

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have consistently given returns to shareholders in the form of dividends.

Why Most Analysts Rate Chevron a ‘Buy’

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

Analysts’ Ratings for ExxonMobil after Its Earnings

Six analysts gave ExxonMobil a “buy” rating, 13 analysts gave it a “hold” rating, and seven analysts gave it a “sell” rating after its 4Q16 earnings.

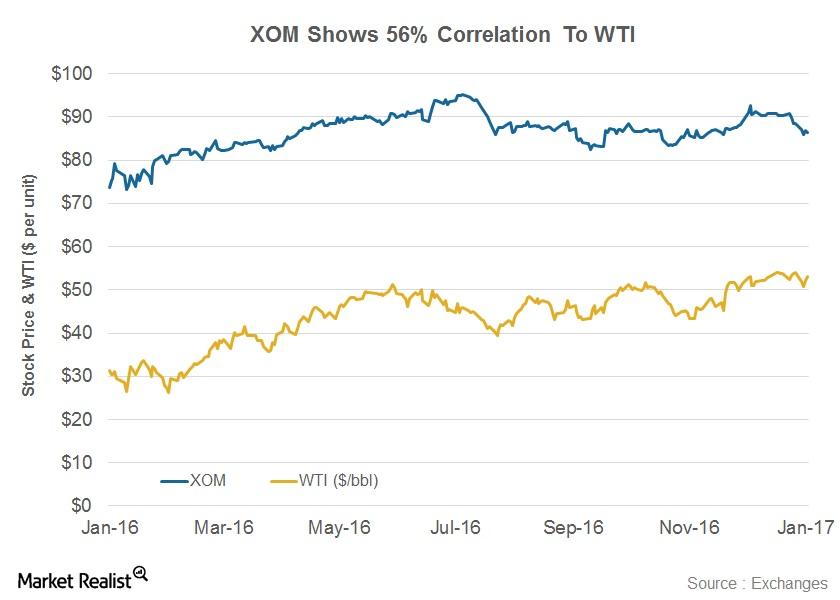

What’s the Correlation Between XOM and WTI?

Integrated energy companies such as ExxonMobil are affected to varying degrees by volatility in crude oil prices. XOM’s correlation coefficient with WTI stands at 0.56.

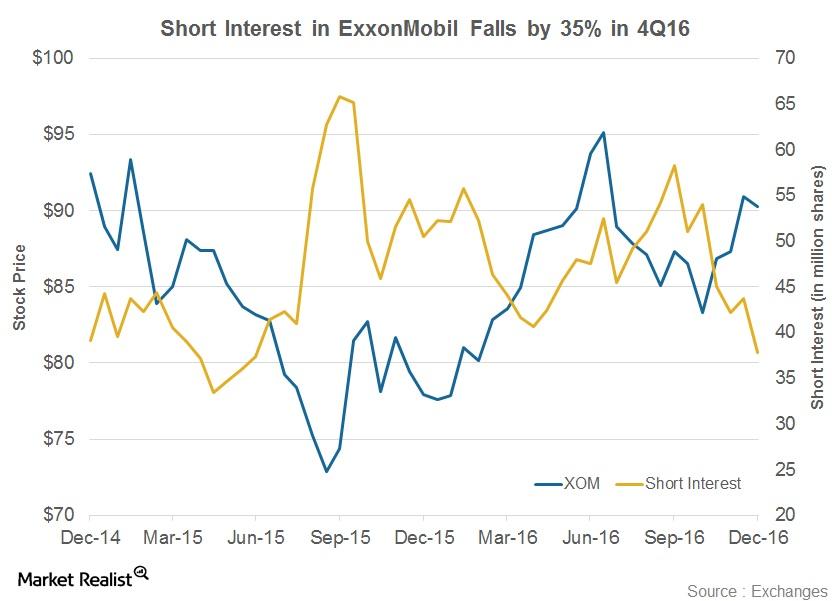

Has Short Interest in ExxonMobil Fallen?

ExxonMobil (XOM) has witnessed a 35% fall in its short interest volumes since September’s end 2016.

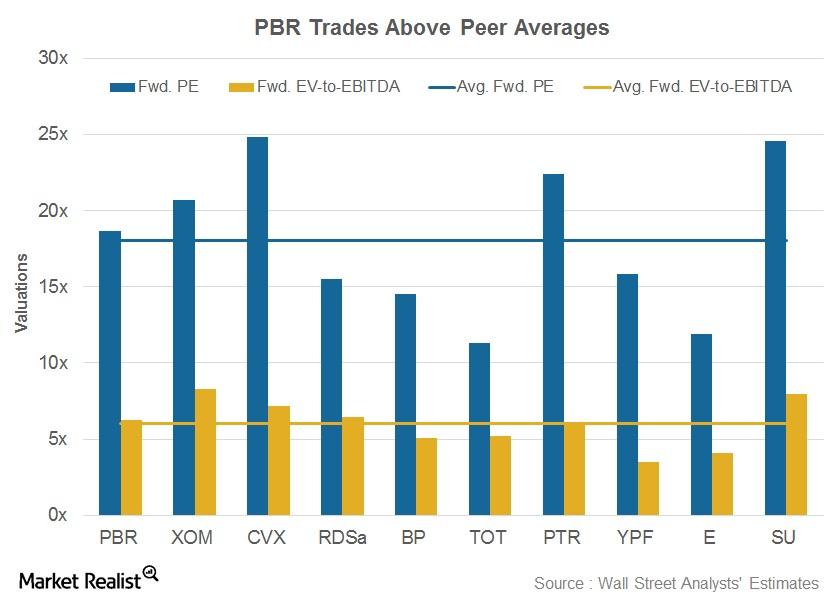

Why Is Petrobras’s Valuation Higher Than Peer Average?

After its production update news, Petrobas’s forward PE and EV-to-EBITDA stood at 18.7x and 6.3x, respectively.

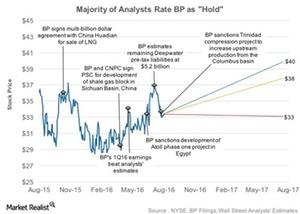

Why Most Analysts Recommend ‘Holds’ on BP

Analysts’ ratings for BP (BP) show that 31% of those covering the stock rate it as a “buy,” and 61% rate it as a “hold.”

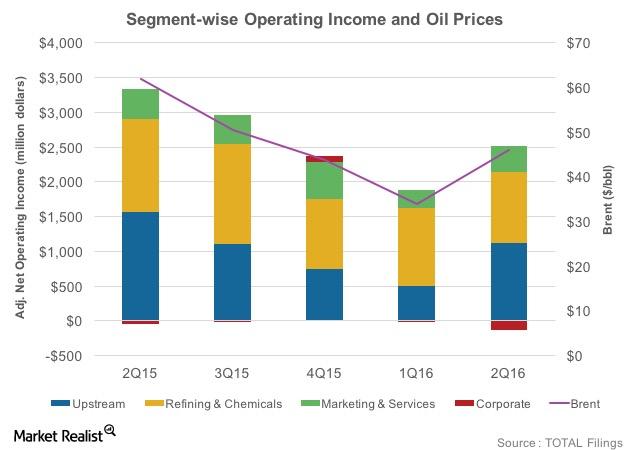

Total’s Segments: Upstream Earnings Plunge but Stay Positive

Changing oil prices have changed the dynamics for Total’s segments. Although upstream earnings have declined in 2Q16 YoY, they stayed positive in the quarter.

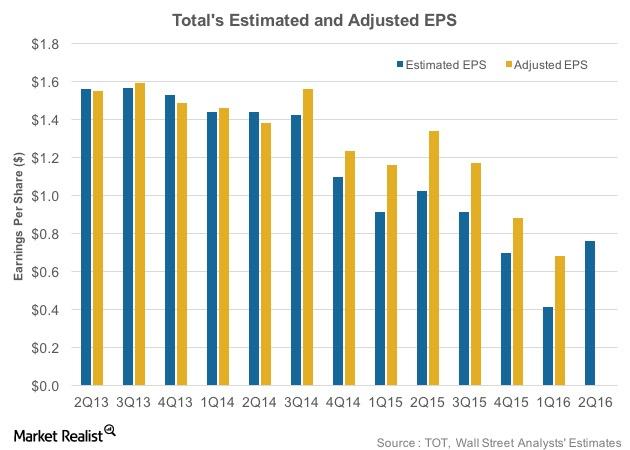

Total’s 2Q16 Earnings Outlook: Will It Beat Estimates?

Total SA (TOT) is expected to post its 2Q16 results on July 28, 2016. In 1Q16, TOT’s revenues of $27.5 billion surpassed Wall Street estimates.

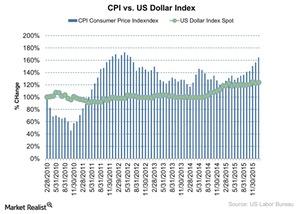

Why Inflation Is a Double-Edged Sword for the Financial Market

Core inflation could impact the market positively as well as negatively. Higher core inflation data will depreciate the US dollar (UUP).

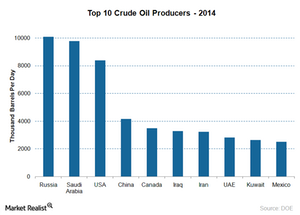

How Top Crude Oil Producers Impact the Crude Oil Market

The world’s largest producer of crude oil is Russia. It is also among the largest crude oil exporters.

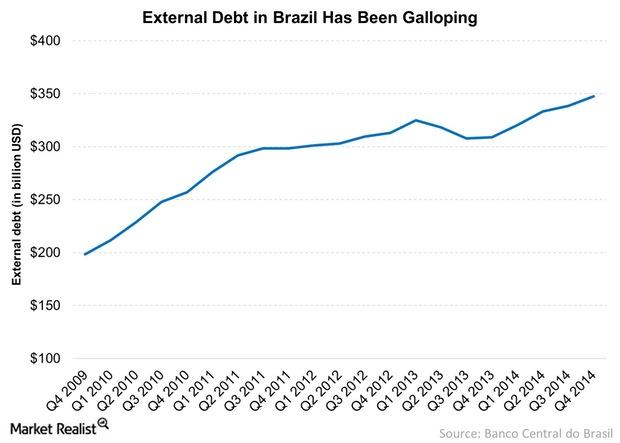

Why the Brazilian Government’s Debt Has Surged over the Years

The Brazilian government’s debt has surged over the last five years. The country’s internal debt has also increased.

A summary of Caxton Associates’ key 4Q14 holdings

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14.