Exxon Mobil Corporation

Latest Exxon Mobil Corporation News and Updates

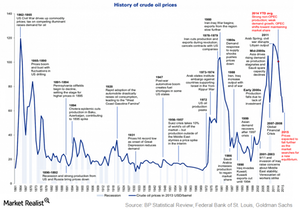

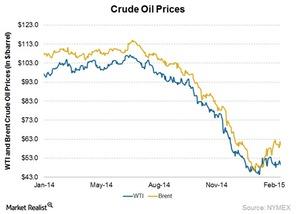

Why Roller Coaster Crude Oil Prices Are Nothing New

Crude oil prices like any other commodity are subject to changes based on the supply and demand dynamics.

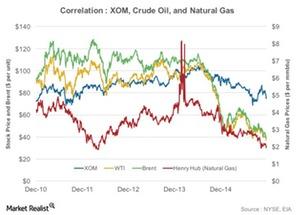

Correlation Analysis: ExxonMobil’s Crude Oil, Natural Gas prices

The correlation coefficients of ExxonMobil to Brent, West Texas Intermediate, and Henry Hub natural gas prices stand at 0.22, 0.35, and 0.36, respectively.

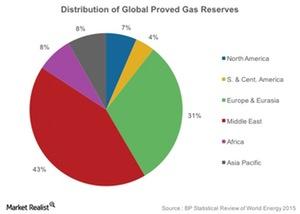

A Vital Resource: Which Region Has the Most Natural Gas Reserves?

Total global natural gas reserves stand at 6,606 trillion cubic feet, of which 43% are in the Middle East.

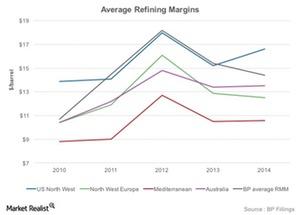

What Are the Key Indicators of Refining Profits?

Investors should track the GRM and crack spread of a region where a company’s refinery is located.

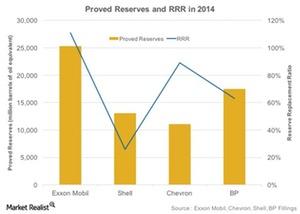

Why Is Reserve Replacement Ratio Important to the Upstream Sector?

RRR reflects how many barrels of oil equivalent the company adds to its reserves in replacement of ones that are produced.

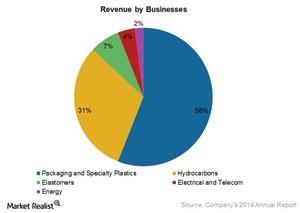

Understanding Dow’s Largest Segment, Performance Plastics

Dow’s Performance Plastics segment contributed 39% and 46% to Dow’s total revenue and EBITDA, respectively, in 2014.

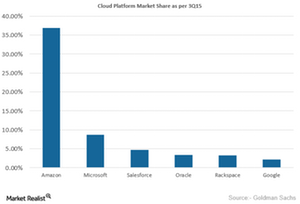

Can AWS and Microsoft Reach 50% Market Share in the Cloud?

Amazon has outperformed the big technology giants in cloud computing, whereas Microsoft is tightening its grip on the cloud market by leveraging Azure.

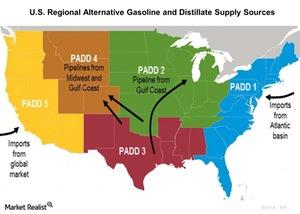

Can Outages Be Overcome by Alternate Sources of Gasoline Supply?

According to the EIA, since the Torrance outage, imported supplies of gasoline have been arriving in Southern California from all over the world.

US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

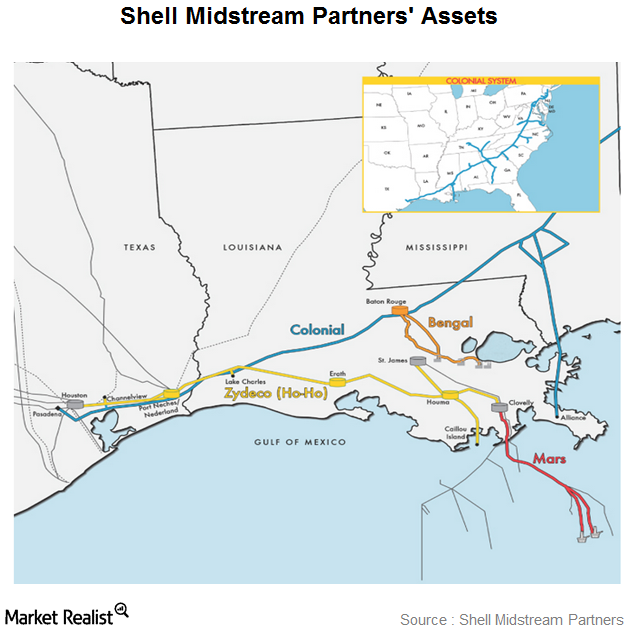

A Brief Overview of Shell Midstream Partners

Shell Midstream Partners (SHLX) is a MLP formed by Shell Pipeline Company, an affiliate of the international integrated energy giant, Royal Dutch Shell.

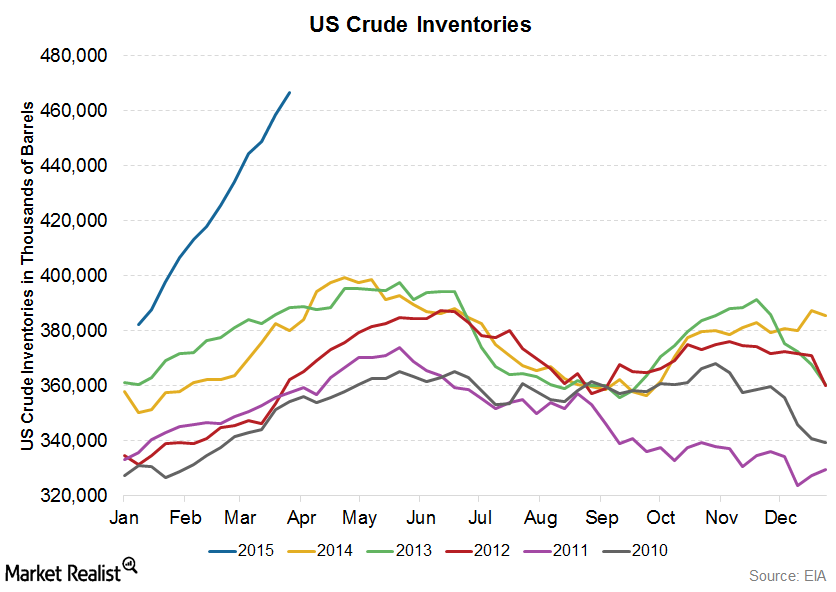

EIA Crude Oil Inventory Report: Essentials for Energy Investors

Crude oil inventory levels change based on demand and supply trends. Demand comes primarily from refineries that process this crude into refined products.

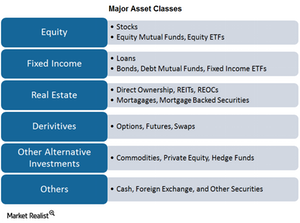

Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.

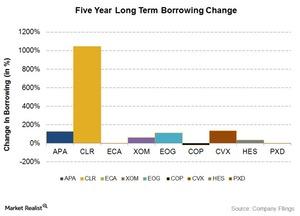

Why are some energy companies more leveraged than others?

In the past five years, many of the upstream and integrated energy companies have increased their debt. Some are more leveraged than others.

Why have energy companies increased their debt?

In 2010, US upstream energy companies aggregated $128 billion of total debt. As of 4Q14, this increased to $199 billion of combined debt, a jump of 55%.

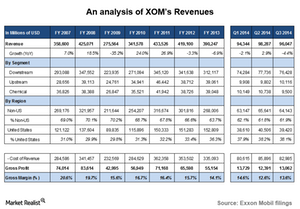

A key analysis of ExxonMobil’s revenues

ExxonMobil’s businesses and revenues depend on crude oil and natural gas’ price levels. In the first three quarters of 2014, ExxonMobil reported revenues of ~$290 billion.

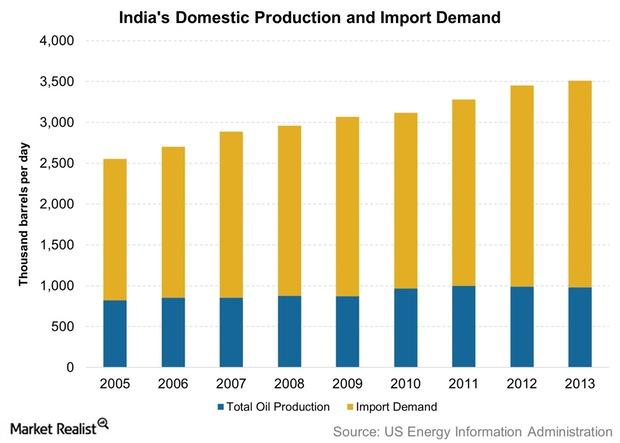

What amount of crude oil does India produce?

India produces a little under a quarter of its crude oil demand. The EIA estimates that India had close to 5.7 billion barrels of proven oil reserves at the beginning of 2014.

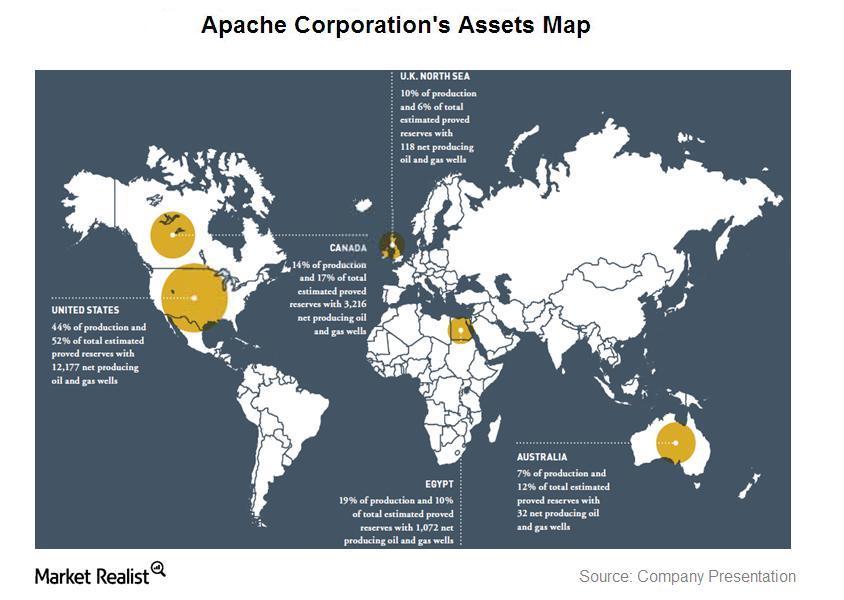

An overview of Apache Corporation’s oil and gas asset sales

Apache Corporation is planning asset sales of certain of its oil and gas operations. The company is focused on building onshore acreage instead.

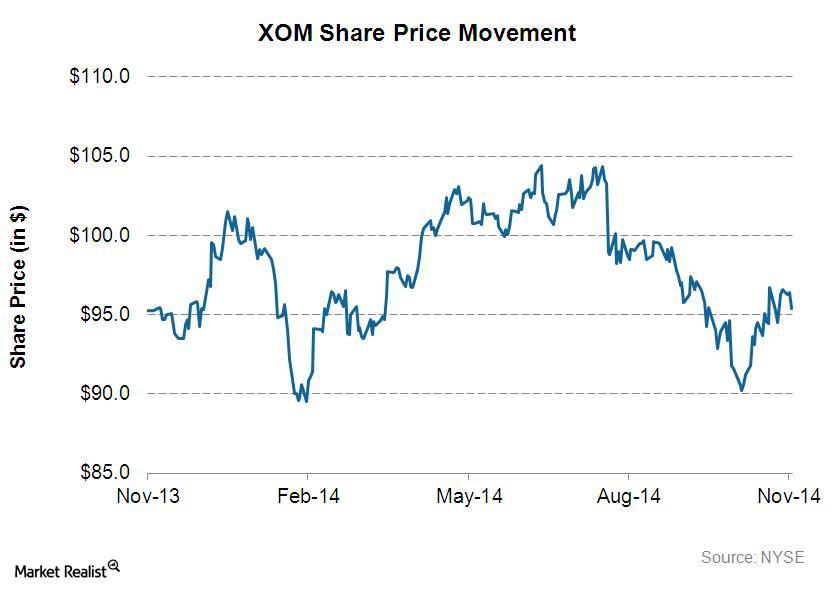

An overview of ExxonMobil

Exxon Mobil’s (XOM) stock price went up 2.4%, to $96.71, on October 31, 2014. Starting in November 2013, Exxon Mobil’s share price went up by 1.5%.Energy & Utilities Why the Bureau of Labor and Statistics jobs report is important

The employment situation is the primary monthly indicator of aggregate economic activity because it encompasses all major sectors of the economy.

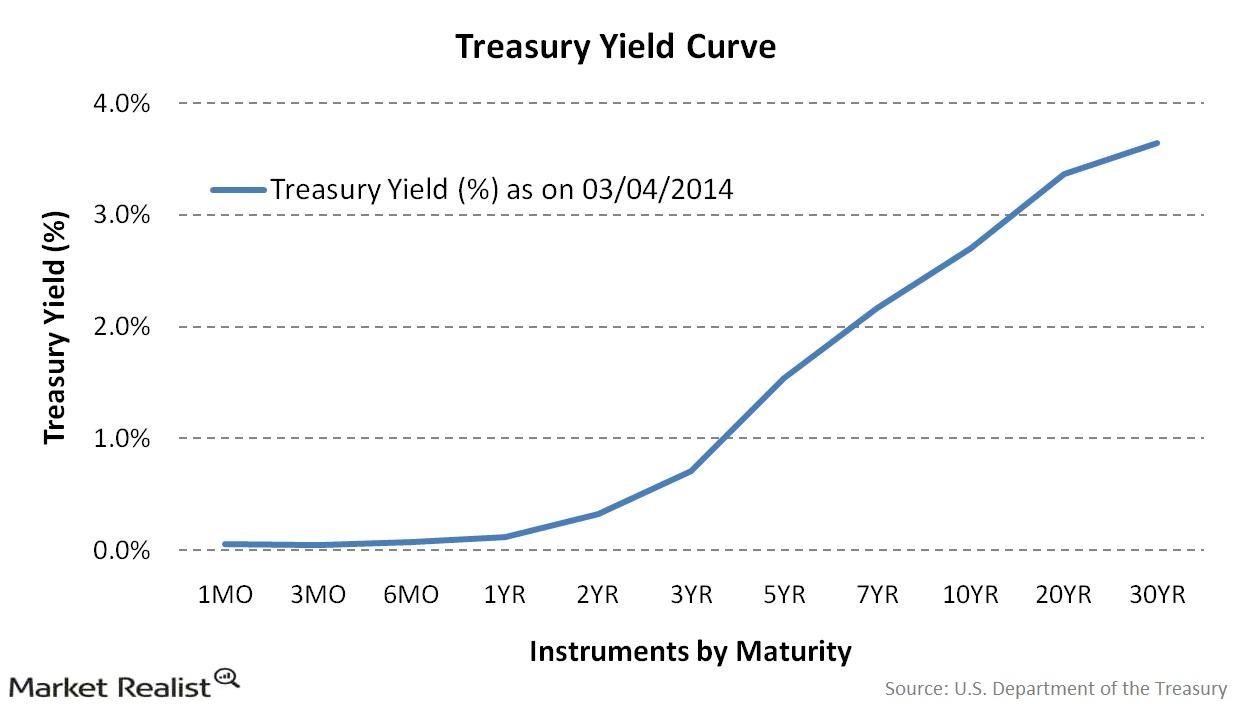

The yield curve: An indicator of the monetary policy implications

Intelligent investors have an opportunity to earn profits and avoid losses, if they understand how the yield curve may move when the Fed acts.

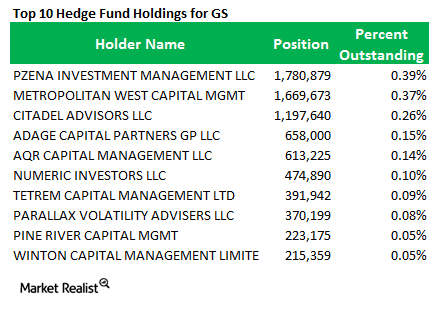

Berkshire Hathaway reveals a new position in Goldman Sachs

Berkshire Hathaway opened a brand new position in Goldman Sachs that accounts for 2.14% of the investment company’s $104 billion portfolio.