What Are the Key Indicators of Refining Profits?

Investors should track the GRM and crack spread of a region where a company’s refinery is located.

Dec. 12 2015, Updated 10:05 a.m. ET

Indicators of refining profitability

In earlier parts of the series, we looked at refining capacities, throughputs, complexities, product slates, prices, and operating margins. In this part, we will discuss how GRMs (gross refining margins) and crack spreads help gauge the profitability of refining operations.

What is GRM and crack spread?

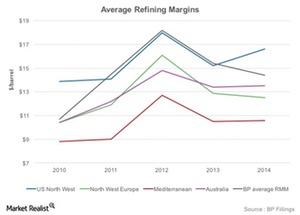

The chart above represents the refining margins for various regions and the weighted average refining margin for BP (BP) between 2010 and 2014. The average GRM (gross refining margin) for BP (BP) stood at $14.4 per barrel in 2014 down by a dollar per barrel in 2013.

GRM for a company is derived by subtracting crude oil cost from the total value of refined products. Thus, refining margins are dependent on input crude oil cost, product slate, and prices of refined products. Thus, refining margin is an indicator of the overall profitability of refining operations. But, the crack spread is used to determine the profitability of refining an individual product.

The crack spread is arrived at by deducting crude oil cost from the value of each refined product. Thus, tracking GRMs and crack spreads can point towards the future profitability of refining operations.

Tracking GRMs and crack spreads

Investors should track GRM and crack spread of a region where a company’s refinery is located. For example, Exxon Mobil (XOM) has most of its refining capacity in the US Gulf Coast. So, tracking the US Gulf Coast GRM can give an indication of the near-term profitability of XOM.

Investors can also consider benchmarks like the 3:2:1 crack spread. According to the EIA (U.S. Energy Information Administration), the 3:2:1 crack spread is derived by subtracting the cost of three barrels of crude oil from the combined value of two barrels of gasoline and one barrel of distillate.

The iShares Global Energy ETF (IXC) has a ~23% exposure to Chevron (CVX) and Royal Dutch Shell (RDS.A). The ETF’s combined exposure to BP, XOM, CVX, and RDS.A stands at ~35%.