Can Outages Be Overcome by Alternate Sources of Gasoline Supply?

According to the EIA, since the Torrance outage, imported supplies of gasoline have been arriving in Southern California from all over the world.

Oct. 20 2015, Updated 7:08 p.m. ET

Gasoline supply and alternate sources

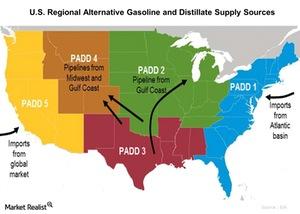

All the 5 PADDs (Petroleum Administration for Defense Districts) have two sources of alternative gasoline supply, and inventories and production from the other PADD region’s refineries are the first choice. However, these sources are insufficient to meet the demand, and next option is somewhat different for each region, as can be seen in the figure, as well as the detailed explanation given below.

Overview of alternate sources of gasoline supply

According to the EIA (US Energy Information Administration), since the outage in Torrance, imported supplies of gasoline have been arriving in Southern California from all over the world. Gasoline imports into PADD 5 as a whole were 79,000 barrels per day for the week ending October 9. The distance required for these imports requires long lead times and higher prices. The Rocky Mountain region, or PADD 4, has access via pipelines to refineries in the Gulf Coast and the southern half of PADD 2. The Rocky Mountain region relies on in-region refinery production and receipts from other regions in the event of an unplanned outage.

The Gulf Coast, or PADD 3, is home to half of the United States’ refining capacity and produces far more gasoline than the region consumes. Therefore, unplanned refinery outages in PADD 3 rarely have a large effect on wholesale and retail prices. PADD 2’s refineries produce significant amounts of gasoline and the region has become dependent on in-region production, but the region still requires additional supplies from the Gulf Coast, or PADD 3, to meet demand.

Gasoline demand on the East Coast far exceeds in-region refinery production. Additional supplies from the Gulf Coast arrive via pipeline and ship, but aren’t entirely sufficient to meet demand due to existing infrastructure and regulations.

PADD 3’s refiners gaining from exports to other PADDs

From the above explanation and figure, it’s clear that PADD 3 is exporting gasoline to PADD 2 and PADD 4. This could lead to a rise in the margins of refiners operating in the Gulf Coast region, or PADD 3, including Western Refining Inc (WNR), ExxonMobil’s (XOM) Beaumont Refinery, Phillips 66’s (PSX) Sweeny Refinery, and Chevron’s (CVX) Pascagoula Refinery. These four refiners account for 37.94% in Vanguard Energy ETF (VDE).